New base special 10 june 2014

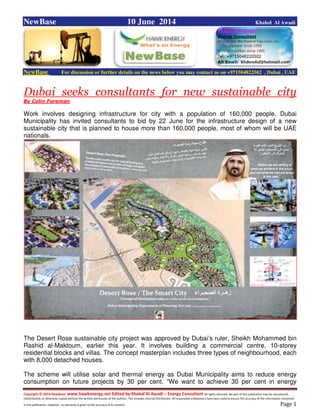

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 10 June 2014 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Dubai seeks consultants for new sustainable city By Colin Foreman Work involves designing infrastructure for city with a population of 160,000 people. Dubai Municipality has invited consultants to bid by 22 June for the infrastructure design of a new sustainable city that is planned to house more than 160,000 people, most of whom will be UAE nationals. The Desert Rose sustainable city project was approved by Dubai’s ruler, Sheikh Mohammed bin Rashid al-Maktoum, earlier this year. It involves building a commercial centre, 10-storey residential blocks and villas. The concept masterplan includes three types of neighbourhood, each with 8,000 detached houses. The scheme will utilise solar and thermal energy as Dubai Municipality aims to reduce energy consumption on future projects by 30 per cent. “We want to achieve 30 per cent in energy

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 efficiency by 2030,” said Abdullah Rafia, assistant director-general of planning and engineering at Dubai Municipality, at MEED’s Dubai Real Estate 2020 event held in Dubai on 9 June. Desert Rose will be built in the Ruwayyah area of Dubai, off Emirates Road (formerly known as the Bypass Road) and close to the Nad al-Sheba area. The site will also be connected to the proposed extension of the Dubai Metro’s Green Line and the Etihad Rail line, which will connect the seven emirates of the UAE. The consultancy role involves pre-design work and preparing designs for the roads and landscaping. Sustainability is a key focus for new projects in Dubai. Other sustainable schemes that are planned include the Frame building in Zabeel Park and the Dubai Safari project, which is being developed in the Al-Awir area. The local/German Al-Rostamani Pegel is the contractor for the Frame building. Malaysia’s Eversendai is constructing the steel structure for the building. The Project :- The project which will be called Desert Rose is expected to accommodate 20,000 plots for Emiratis and will be located near Emirates Road between Al Ruwaya and Al Aweer and will cover a total area of 14,000 hectares. The project will take the shape of a desert flower in different colours which is in line with the desert environment and as a representation of local sustainability. The project whose design and concept is currently under study will be carried out in several stages, and is expected to be completed in time for Expo 2020. Dawood Al Hajiri, director of the Planning Department at Dubai Municipality said, “Desert Rose is an Emirati housing project that will have recreational and sustainable features, where the roofs of homes and buildings will be covered with solar panels that will provide 200 megawatts of electricity. The city will also recycle over 40,000 cubic metres of waste water. The pedestrian path will be designed in an eco-friendly way that will be air-conditioned only during the hot season, and will have a green belt equipped with environmental and economical benefits that will be used for agricultural purposes.” He also stated that the city will include an electronic train track connected with Dubai Metro. Hussain Nasser Lootah, Director-General of Dubai Municipality said, “The project will incorporate the entire requirements of citizens under one roof of the proposed city. The city will take into account the geographical nature of the location and will include the reduction of dependence on private transportation, providing housing along the Metro line and stations, waste recycling, and the reduction of carbon footprint.”

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Saudi petrochemical sector to remain volatile due to lack of catalysts Source Al Rajhi Capital The Saudi petrochemical sector is currently trading at a discount due to near-term headwinds, Al Rajhi Capital said in its recent report on “Saudi Petrochemical Sector.” It expects the performance of the petrochemical sector to remain volatile over the next couple of months due to lack of catalysts. However, the report remains positive over the medium-term as “we expect industrial activities in the key markets to improve. At the stock levels, we remain Overweight on SABIC, SAFCO and NIC. We have raised our target price for SABIC to SR137.5 as we expect earnings to improve with many of its plants coming online over the medium-term.” With the adjournment of the merger, the report expects Sipchem and SPC to remain under pressure, and continue with our Neutral rating on these stocks. Most of the Saudi petrochemical companies have large projects under development and we believe these will provide earnings accretion over the next couple of years. These projects, which include NIC’s titanium & SAPCO projects, SABIC’s elastomer plant, SAFCO’s fifth unit SAFCO-V among others, will commence production over the next few quarters. These projects will add to the volumes, thus boosting the earnings performance of these companies over the coming quarters. Petrochemical prices generally witness a roller-coaster ride with prices climbing up in Q1 on account of shutdowns in various parts of the world and moving down in Q2, when most plants restart post turnaround. Prices of basic olefins – ethylene and propylene – were up 13.8 percent q-o-q and 10.7 percent in Q1 2013.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 However, the Q1 2014 was different as prices either declined or rose lower-than-expected affecting revenues (e.g. ethylene prices declined 0.3 percent while propylene prices were up 6.8 percent). Price pressure remained on polyolefins – polyethylene and polypropylene – as well. In addition to these, prices of many intermediaries and derivatives declined or did not rise as much as it did in the first quarter of 2013 on account of lower shutdowns globally and this hurt Saudi producers’ performance. Traditionally, Saudi petrochemical producers have witnessed a weak quarter in Q2 and we do not expect this trend to change this year, especially with manufacturing in China remaining bleak. However, Al Rajhi expects product prices to gather momentum in the second half of 2014 as industrial activities improve and developed countries show more consistent growth in consumption. Moreover, with naphtha prices remaining at higher levels due to higher crude prices, Saudi petrochemical players will continue to reap healthy margins as compared to the global peers. The severe weather in the US and downcast industrial condition hurt the Saudi-based producers, and this was reflected in their stock performance as well. The export-oriented petrochemical sector remained a laggard on the Tadawul and returned just over 4 percent YTD underperforming the TASI, which has yielded over 15 percent over the same period. This situation is comparable to that of the one in 2013 (over similar period), when the sector index’s performance (5.8 percent) was sub-par as compared to the TASI (11.9 percent) as economic uncertainties engulfed the global markets. However, as positive changes unfolded in the second half of 2013, the sector index posted a robust rally returning 28.8 percent and beating TASI’s 25.5 percent yield for the entire year. “We expect this to continue as improvement in developed markets will bolster demand improving Saudi producers’ bottom-line performances. We anticipate H2 to be a sentiment-booster for the petrochemical sector, with the broader market sentiment remaining positive,” the report noted. Moreover, with naphtha prices remaining at elevated levels due to higher crude prices, Saudi petrochemical players will continue to reap healthy margins as compared to the global peers. petrochemical producers continue to face near-term headwinds. Weaker product prices coupled with planned & unplanned shutdowns and lower ramp-up after resumption hit Saudi producers’ Q1 earnings performance. The companies under our coverage reported a 4 percent decline in y-o-y earnings. This was also reflected in their stock price performances as the sector index gained a meager 4 percent YTD compared to TASI’s 15 percent gain. As product prices continue to remain under pressure in Q2, the report expects flat earnings growth for the quarter. The developed markets, especially the US, are showing decent signs of economic revival. Although the US GDP declined 1 percent (seasonally adjusted annual rate) in Q1 2014, the decline on a q-o-q basis was primarily due to severe weather conditions. Another key reason was a sharp decline in exports as sluggish economic recovery in many parts of Europe and Asian markets led to poor demand growth. However, the industrial growth remained positive as the Purchasing Managers’ Index (PMI) rose consistently m-o-m in the last four months. Moreover, consumer confidence remained at relatively higher levels as people continue to remain optimistic about the business and labor market conditions. The US economic growth seems to be gathering pace, and hence the US Fed has decided to continue tapering its bond-buying program. We believe a rise in industrial growth and positive consumer sentiment are an indicator of an upbeat economic scenario in the country. Bloomberg consensus estimates 3.5 percent growth in Q2 and 3 percent in the H2-2014. On the other hand, growth in many parts of the Eurozone remains fragile. The GDP of the 18- nation bloc grew at a low 0.2 percent (q-o-q, source: Eurostat) in Q1 2014, lower than 0.4 percent growth forecast, indicating muted business growth. Given this scenario, the ECB is mulling monetary stimulus at its June meeting. Nevertheless, the economic indicators in some major economies remain positive and the economists anticipate GDP growth to steadily accelerate in the coming quarters.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Circle Oil spuds its first offshore well (Tunisia) Press Release Circle Oil Plc has started drilling of the well EMD-1 on the offshore Mahdia Permit using the drillship PetroSaudi Discoverer. The well is located within the vicinity of many producing fields, including the Tazerka, Birsa, Oudna, and Halk El Menzel oil fields, and the Maamoura gas field. The well is planned to test the play potential of the El Mediouni prospect, including the primary Birsa Sands target and the secondary fractured carbonates of the Ketatna Formation. The Birsa Sands alone have a management pre-drill P50 estimate of 185 MMbo STOOIP. The primary target, the Birsa Sands, is expected at 1,260 metres MD with the Ketatna Carbonates at 1,460 metres MD. The management view on the recoverable prospective resources estimate for the El Medouini prospect is 46 MMbo for the Birsa Sands objective alone. This is substantially larger than the recoverable commercial threshold for the area which stands at approximately 10 MMbo. Depending on progress rates the well is expected to take approximately 5-7 weeks to drill. Commenting on the spudding of EMD-1, Prof. Chris Green, CEO, said: “We are very pleased to be drilling what is our first offshore well and to be working with PetroSaudi and other experienced service companies on this project. It marks the start of another stage in our busy 2014 operational work programme.”

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 Nissan launches new all-electric car EVs the way forward AFP/Tokyo Nissan yesterday unveiled its second all-electric vehicle, the Japanese automaker’s latest push into the eco-friendly car sector despite disappointing sales. The company said its e-NV200, a zero-emission commercial van, can drive 190 kilometres (120 miles) on a full charge, and doubles as an onboard power source to supply emergency lighting or power to an outside unit. Nissan was the first in the world to sell a mass-production electric passenger vehicle, the LEAF, in 2010. The newest vehicle, which comes with either five or seven seats, is to go on sale in some European countries before its October Japan launch with prices starting at ¥3.88mn ($37,900), Nissan said. Retail prices could be lower after accounting for government subsidies on green-vehicle sales, it added. The van can be fully recharged in eight hours or to 80% of its battery capacity in half an hour using a separate quick-charging system. Nissan said it hoped to log monthly sales of 200 units in Japan for its electric van, a modest target after LEAF sold just 115,000 units globally since its launch nearly four years ago. Andy Palmer, executive vice president of Nissan, poses with the company’s e- NV200 electric light commercial vehicle at the launch in Yokohama, Japan, yesterday.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 Libya arrives for OPEC with exports at a trickle Source: Reuters Libya's attendance at Wednesday's OPEC meeting will be an oddity for historians of the oil exporters club - a member with virtually no oil for sale. As it struggles with its worst crisis since the 2011 war that toppled Muammar Gaddafi, early talk of a swift resumption of output have given way to pessimism, leaving OPEC with a longer lasting hole of over one million barrels per day in its supply. Production is below 200,000 barrels per day, Oil Minister Omar Shakmak said on arrival in Vienna on Monday for the meeting, a fraction of the 1.6 million bpd Libya pumped before the 2011 conflict. "Until the government gets control it cannot export on a normal basis... It is unlikely Libyan oil production will increase significantly in the next six months," said Charles Gurdon, managing director of Menas Consulting. The near absence of Libyan oil from international markets has helped anchor prices in a narrow range around $110 a barrel. That is a comfortable level for OPEC and few expect the cartel to change its output target for the rest of the year. Rebels have blocked Libya's major ports and fields since last summer, slashing output. With a renegade general launching war on Islamists, successive prime ministers struggling for legitimacy and a lack of oil revenues, the caretaker government could be forced to divert what barrels were destined for export to domestic refineries to supply gasoline to the capital. Foreign oil companies have pulled out staff and frozen exploration activities, while Libya's hungry European customers have turned elsewhere for more steady supplies. Monday's court ruling resolving a standoff between rival governments was welcomed by rebels holding some of Libya's largest oil terminals at Es Sider and Ras Lanuf and raises hopes that a deal to restore key export facilities could be reached soon. But even if a deal to reopen all the ports and fields is made, industry insiders and officials from Libya's National Oil Corp (NOC) say it is hard to tell how much damage the closures have already caused to its precious oil infrastructure or how long it would take to return to prewar capacity. Libya's western El Sharara oilfield may take months to reach its full output of 340,000 bpd, for instance, because at least 20 damaged well pumps need to be replaced. Once output can build up, the damage is

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 taking its toll on the country's production capacity. The International Energy Agency, the West's energy watchdog, in May cut its estimate of Libya's sustainable output capacity to 1 million bpd. Fires on pipelines elsewhere and lack of maintenance could make resumption of exports a long and costly process. Technically, Libya can still pump upwards of 1 million bpd but the new NOC chairman Mustafa Sanallah said it would only ramp up exports gradually - and in cooperation with OPEC. That would help avert a sudden slide in oil prices. "From a technical point of view, our facilities are ready ...and our people can resume production very soon," Sanallah told a Libyan oil conference in London last month. "But in order to resume production, we have to agree with our rivals, partners and with OPEC. We have still high storage of oil... So we have to export our oil gradually and by good cooperation between Libya and OPEC." At a London conference last month on on Libya's energy sector presentations focused on plans for a new oil law, enhanced oil recovery and even pipeline upgrades, skirting around the fact that the state could not even guarantee the flow of oil. "It is a very difficult market to predict," said Eric Oudenot, of Boston Consulting Group. "Nobody is really able to craft a strategy for Libya as it is too unstable." Year 2011

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 Four gas discoveries for SapuraKencana Energy Press Release, SapuraKencana Energy (SKE) today announced four significant gas discoveries in the SK408 Production Sharing Contract (PSC) area, offshore Sarawak, Malaysia. All four wells have discovered non-associated natural gas within the primary target Late Miocene Carbonate reservoirs. The first well, Teja-1, located southeast of the Cili Padi gas field encountered 219 metres of gross column whilst the Gorek-1 discovery, southeast from F23 gas field encountered a gross gas column of 235 metres. The third well, Legundi-1, located south of F23 gas field was drilled in a down-flank location and encountered a 139 metres gross gas column, and the fourth well, Larak- 1, located south of F6 gas field, also drilled in a down-flank location encountered a gross gas column of 333 metres. In line with the partnership philosophy of fast track, low-cost development, all four discovery wells have been suspended with the intention of completing as gas production wells in the future. “The excellent results of the drilling campaign further confirms the exploration model developed by the team at SK Energy and, is a true testimony to the capability of the team in realising the full potential of the SK408 block,” said Tan Sri Dato’ Seri Shahril Shamsuddin, President & Group CEO of SapuraKencana Petroleum Berhad. “The four SKE discoveries from the first four exploration wells clearly reflect the quality of the assets acquired,” he added. SKE via SapuraKencana Energy Sarawak Inc. is the operator with a (40%) working interest with partners PETRONAS Carigali Sdn. Bhd. (30%) and Sarawak Shell Bhd. (30%) and holding the remaining interest. SK408 Block is located in shallow waters, approximately 120 kilometres offshore Sarawak covering an area of approximately 4,480 sq. km in the prolific Central Luconia Gas Province. These are the first four wells of a 10-well commitment in the SK408 PSC.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 New Vietnam Oilfield Output Seen Below Peak At Start by Reuter Vietnam has begun pumping around 8,000 barrels of oil per day from a new offshore oilfield, Thang Long, while production is expected to start at another nearby field late this month, state oil and gas Petrovietnam said on Tuesday. Production began on June 6 at six wells at Thang Long field in the 01- 02/97 blocks, 160 km (100 miles) east of Vietnam's Vung Tau city, Petrovietnam Exploration Production Corporation (PVEP), the production arm of Petrovietnam, said in a statement. Dong Do field in the same area is expected to be tapped from late June by the field operator, Lam Son Joint Operating Co, an equally-owned venture between Petronas Carigali Overseas Sdn Bhd and PVEP. Production at the Thang Long and Dong Do fields is expected to peak at 12,000-15,000 bpd, sources said. Vietnam's state oil marketer PV Oil has sold its first cargo of Thang Long low-sulphur crude via a tender to BP. Lam Son plans to use two wellhead platforms and a floating production, storage and offloading unit at the Thang Long and Dong Do fields, PVEP said in the statement. Petrovietnam said it expects to produce 16.83 million tonnes, or 338,000 bpd of crude this year, a slight increase from its 2013 output and ahead of a government target.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Niger awards production sharing contract to Savannah Petroleum for two blocks . Source: Reuters Niger has awarded a production-sharing contract to UK-based company Savannah Petroleum as it seeks to attract a broader range of investors into its nascent oil industry. Niger, one of Africa's newest oil producers, began pumping oil in 2011 as part of a $5 billion deal with China National Petroleum Corp (CNPC) to develop the Agadem block. The country exports around 80,000 barrels per day via a pipeline through neighbouring Chad and Cameroon. 'In a cabinet meeting on Friday, a decree was adopted approving the production-sharing contract between Niger and Savannah Petroleum for Blocks R1 and R2,' said a government statement issued late on Friday. 'These two blocks represent 50 percent of the Agadem block, for which CNPC was given exclusive oil exploration rights in 2007,' it added. It did not say if the award of the production contract would affect the earlier exploration deal. Sources close to the oil ministry said the new contract was part of a broader policy to promote the sector and denied there were any problems with CNPC. In 2012, Niger awarded nine production-sharing contracts to five firms based in Nigeria, Australia and Bermuda.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Indian Oil to add polypropylene unit at Paradip Refinery in India The state-owned Indian Oil Corporation Limited (IOC) company received the board approval for the construction of greenfield world class polypropylene (PP) production unit at the Paradip Refinery and Petrochemical complex currently in construction on the east coast of India. India counts not less than 22 refineries out of which 10 belongs to IOC. With the Paradip Refinery, IOC will add the eleventh refinery in its portfolio. Located 120 kilometers east of Bhudaneswar in the State of Odisha, IOC Paradip Refinery has been designed with a capacity of 300,000 barrels per day of crude oil. To build the Paradip Refinery and integrated Petrochemical complex, IOC reserved 3344 acres in the industrial area of the Port of Paradip. Strategically located on the east coast of India, the Paradip Refinery has been designed to treat heavy crude oil with high sulfur content coming from Middle-East, Asia and Americas such as Mexico or Venezuela. This sulfur loaded heavy crude oil requires complex processes for pre-treatment before entering the normal refining process that may nearly double the cost of the refinery. But this additional capital expenditure is well balanced by the much lower price of the heavy crude compared with the light crude. Considering that more than 50% of the global crude trading is now on heavy crude, this decision gives IOC a much wider choice of sources of supply for its Paradip Refinery. Since IOC is integrating a petrochemical complex in the Paradip Refinery, the cost of the feedstock will impact the whole value chain from the naphtha to the polyolefins and all hydrocarbon products to be transformed in the Paradip complex. On the downstream side the Paradip Refinery will deliver: - 3.5 million tonnes per year (t/y) of liquid petroleum gas (LPG), gasoline, diesel, jet fuel - 200,000 t/y of propylene. Kuwait Petroleum Corporation (KPC) and IOC are currently in negotiation to open 26% stake to the Paradip Refinery. In the deal KPC is willing to secure the biggest share of the Paradip Refinery crude oil supply while IOC is looking for sourcing flexibility. Foster Wheeler is planning the commissioning of IOC Paradip Refinery at the end of 2014. Cracked from LPG, the propylene output will be exported in the meantime of the polypropylene production unit construction. In respect with industrial development in India, the domestic market for hydrocarbon products is increasing to a level motivating Indian Authorities to deliver IOC approval to start the construction of the petrochemical complex with the polypropylene unit. Paradip Polypropylene project should have a capacity of 700,000 t/y and should require 39 months for completion. In parallel, IOC is already studying the feasibility of the ethylene cracker and other polyolefins units in the Paradip Petreochemical complex for an estimated budget of $1 billion including: - 600,000 t/y polyvinyl chloride (PVC) - 400,000 t/y monoethylene glycol (MEG) With an investment of $800 million capital expenditure, IOC is expecting the Paradip Polypropylene project to come on stream on early 2018 with the other polyolefins units to follow by 2020.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Britain readies 'last resort' measures to keep the lights on National Grid to begin recruiting businesses who will be paid to switch off if needed to protect consumer supplies as a "last resort" Britain may be forced to use “last resort” measures to avert blackouts in coming winters, Ed Davey, the energy secretary, will say on Tuesday. Factories will be paid to switch off at times of peak demand in order to keep households’ lights on, if Britain’s dwindling power plants are unable to provide enough electricity, under the backstop measures from National Grid. The Grid is expected to announce that it will begin recruiting businesses that will be paid tens of thousands of pounds each simply to agree to take part in its scheme. They will receive further payments if they are called upon to stop drawing power from the grid. It is also expected to press ahead with plans to pay mothballed gas power plants to ready themselves to be fired up when needed. “Both the new demand and supply balancing services will be used only as a last resort – and are a safety net to protect households in difficult circumstances, such as a hard winter or very high surges in demand,” Mr Davey will say. Critics have suggested the measures, which were first mooted last summer, would represent a return to 1970s-style power rationing. But Mr Davey will refute this, saying: “It is entirely voluntary. Nobody will get cut off. No economic activity will be curtailed.” Mr Davey is on Tuesday also expected to publish a new gas “risk assessment” in response to the Ukraine crisis. He said this would show Britain could “comfortably” withstand extreme cold weather or the loss of key supplies. Energy regulator Ofgem warned last summer that Britain’s spare power capacity margin – the difference between peak demand and supply – could fall as low as 2pc in winter 2015-16 as old power plants close and new ones are not yet built. The risk of blackouts could be as high as one in four unless consumers cut demand, it said. An updated assessment in coming weeks is likely to show that the margin in 2015-16 will remain tight as feared. But it is also expected to show that the risk of the situation resulting in blackouts for consumers has reduced, due to National Grid’s measures. "Broad indications suggest that with the new balancing services in place the risk of supply disruptions for winter 2014-15 and 2015-16 has improved because National Grid now has new tools to help it manage lower margins," an Ofgem spokesman said. Mr Davey said: “The lights are going to stay on." By: Emily Gosden , The Telegraph

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 He told the Telegraph businesses were “delighted” to get paid to reduce demand. Some would not actually “switch off” and would instead fire up their own on-site generators to replace grid supplies. Others, such as large-scale refrigeration firms, could temporarily cut power without any negative effects. He insisted the plans were good value for consumers as they were “cheaper than building new power stations”. National Grid estimated in December that its measures could cost £75m but said this would be less than £1 per household. The Grid is expected to say that the scheme for businesses to reduce demand will be used over the next two years, but mothballed plants will not be asked to fire up until winter 2015-16. Mr Davey will say the capacity situation for this winter is now better than feared, and will be similar to last winter, even before National Grid’s measures, thanks in part to energy efficiency cutting demand. "The good news is that we may be looking at an improved picture for 2014/15, compared to last year’s expectations... but the outlook for the year after next - 2015/16 – will still require one of the significant new interventions we have long been planning for."

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 Only a fraction of big gas export projects will be built - Shell Reuters - UK Focus , By Henning Gloystein Only a fraction of the natural gas export projects being developed around the globe will become reality as high costs and weakening gas prices torpedo those that until recently promised huge returns on investment. Large natural gas field discoveries on and offshore have prompted several countries to plan liquefied natural gas (LNG) export projects, including in North America, Australia, East Africa and the east Mediterranean. But high development costs and low profit margins in the gas sector mean most of the projects will fail, Royal Dutch Shell director of projects and technology told Reuters in an interview. "There is always so much talk about these big LNG projects around the world, but only a small fraction of them will get built," said Matthias Bichsel, who is also a member of Shell Executive Committee. "Costs in the oil and gas sector are still on the rise and outpacing inflation, and gas projects are extremely price-sensitive because the margins are so thin," he added. European forward gas prices, which are used to make investment decisions for big pipeline and gas field projects, have dropped more than 15 percent since the beginning of the year. They are close to five-year lows, and most analysts expect further declines as new producers flood markets with gas. Analysts have said many new gas projects will struggle to make the return on investment necessary to receive the required financing. In Asia, where 70 percent of global LNG trading takes place, spot LNG prices have fallen more than 35 percent this year to their lowest since late 2012. STRUGGLING PROJECTS In the east Mediterranean, where Israel and Cyprus have discovered large offshore gas fields, Australia's Woodside Petroleum last month pulled out of an agreement to take a stake worth up to $2.7 billion in Israel's flagship Leviathan gas project. Woodside is a specialist LNG developer and was targeting sales in Asia with its involvement in Israel. "After many months of negotiations it is time to acknowledge we will not get there under the current proposal," Woodside CEO Peter Coleman said at the time. In Central Asia, France's Total pulled out of Azerbaijan's huge Shah Deniz II gas project, which is expected to produce 16 billion cubic metres (bcm) of gas for export to Turkey and Europe towards the end of this decade. Norway's Statoil had reduced its stake in the project in May. In North America, several LNG export terminals are also beginning to have trouble attracting buyers.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 In East Africa, where impoverished Mozambique and Tanzania hope recent offshore gas discoveries can bring future wealth, analysts have said developers will struggle to find necessary financing and that costly production delays are likely. "I believe the speed with which the East African projects have been promised is somewhat ambitious since all infrastructure there has to be built from scratch," Shell's Bichsel said. Mozambique and Tanzania hope to export their first cargoes around the turn of the decade. In Asia, uncertainty over future pricing of LNG has led consumers to hold off signing 20-year deals amid expectations that prices will soon enter a period of decline. As a result, final investment decisions on new projects have come to a virtual standstill, while cost blowouts in Australia are further deterring investors from signing up. Bichsel said that in Australia, which hopes to overtake Qatar as the world's biggest LNG exporter, high labour costs had caused problems for developers. Shell is building the world's first floating liquefied natural gas (FLNG) project in Australia, named Prelude, which will be the biggest maritime vessel ever constructed. LONG-TERM GROWTH Despite the troubled perspective for many gas projects, Bichsel said the outlook for the sector was positive. "We're quite excited about gas, there is a lot it can be used for, for instance gas to liquids, gas for transport or gas to chemicals, and there's also a lot of work being done to bring down the production costs of LNG," he said. "In oil, it's more maintaining production but in the long term, we're talking decades ahead, we see a decrease in oil demand and gas will take a more prominent role, including from shale gas. But it'll take time."

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 Power sector CO2 emissions sensitive to policy changes and natural gas supply Source: U.S. Energy Information Administration, In 2012, almost 40% of total energy-related CO2 emissions resulted from electricity generation. About three-fourths of those power sector emissions occurred from burning coal, the most carbon-intensive fuel. Policies to reduce CO2 emissions could result in less consumption of coal in favor of natural gas, which emits about 40% as much CO2 per kilowatthour as typical coal-fired generation when used in a combined- cycle plant, as well as increases in other low- or zero-carbon power generating technologies such as renewables and nuclear. Earlier this week, the Environmental Protection Agency (EPA) issued a proposed rule that would require reductions in CO2 emissions from existing fossil-fueled electric power plants. The EPA proposal includes emission rate targets for each state, measured as pounds of CO2 emissions per megawatthour of covered generation, as well as guidelines for the development, submission, and implementation of state plans. The emission rate targets vary significantly across individual states, reflecting the application of a series of common building blocks to states with widely different starting points in their respective electricity markets. The Annual Energy Outlook 2014 (AEO2014) Reference case, which assumes current laws and regulations, does not include the EPA proposal. Currently there are two regional programs in the Northeast and California (the Regional Greenhouse Gas Initiative and Assembly Bill 32, known as RGGI and AB32, respectively) that include control policies for greenhouse gases (GHGs) from the power industry, which are also included in the AEO2014 Reference case. All existing final environmental rules, including the Mercury and Air Toxics Standard, are also included in the projections. After taking these existing environmental regulations into account, the projections for electricity generation and its resulting emissions are primarily determined by the relative operating costs of the different technologies. The AEO2014 Reference case projections show several CO2-related trends, including: • CO2 emissions from the electric power sector increase from 2,035 million metric tons in 2012 to 2,271 million metric tons in 2040, an increase of 12% • The share of power sector CO2 emissions from natural gas increases from 24% to 27%, as natural gas-fired plants account for most of the capacity that is added to meet increases in demand and to replace retiring plants

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 • Few new coal plants are added, as uncertainty about future carbon regulations influences capacity decisions While EIA does not assume the final structure of any proposed regulations, in order to represent policies that explicitly or implicitly place a value on GHG emissions, the AEO2014 includes alternative cases that impose a fee on energy-related CO2 emissions. These side cases incorporate an initial CO2 value of $10 (GHG10 case) and $25 (GHG25 case) per metric ton in 2015, rising by 5% per year. The GHG10 case is also combined with High Oil and Gas Resources, which results in lower gas prices and encourages greater natural gas use. In these side cases, EIA projects the following results as compared with the AEO2014 Reference case: • 2025 power sector CO2 emissions are 16% and 49% lower in the GHG10 and GHG25 cases with fees, respectively, and 23% lower when the GHG10 case is combined with the High Oil and Gas Resource case • 2040 power sector CO2 emissions reductions range from 36% to 82% across the three side cases, which is greater than the corresponding changes in other sectors and indicates that the electric power industry is typically the most cost effective sector to achieve reductions in response to economy-wide CO2 fees • Natural gas-fired generation increases sharply beginning when CO2 fees are assumed to be introduced in 2015, followed by more nuclear and renewable plant additions as the fees increase • Natural gas-fired generation levels off around 2030 in the GHG10 case, and it begins to decline after 2025 in the GHG25 case • In the High Oil and Gas Resource case without CO2 fees, lower natural gas prices result in higher gas-fired generation and CO2 emissions in the power sector as more new natural gas plants are built instead of nuclear and renewable capacity • Natural gas-fired generation continues to increase through 2040 when the fees for the GHG10 case are combined with the lower gas prices from the High Oil and Gas Resource case Source: U.S. Energy Information Administration, Monthly Energy Review, September 2013, and the Annual Energy Outlook 2014

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 Oil Prices on the rise US crude rose by nearly $2 on Monday as strong Chinese and US data pointed to healthy economic growth and higher demand for oil from the world's top two consumers. China's exports beat forecasts in May on firmer global demand, rising 7% from a year earlier and quickening from April's increase of 0.9%, Reuters reported. The strong gains overshadowed an unexpected fall in imports that could signal weaker domestic demand, the news wire said. US oil rose by $1.75 a barrel to settle at $104.41. Market watchers said US crude's outperformance, in the absence of any clear change in the fundamental picture, could not be sufficiently explained by the Chinese data. "Don't let anyone tell you it's China, or US payrolls," Stephen Schork, editor of The Schork Report in Villanova, Pennsylvania, told the news wire. "Something's happening and we don't know what it is." Brent rose by $1.38 a barrel to settle at $109.99, after settling down 18 cents and declining 0.7% last week. The spread between the two benchmarks settled at $5.58, after swinging between $5.25 and $6.15 during Monday's session. The positive data boosted an oil market already bolstered by the loss of crude exports from Libya, where violence and civil turmoil have cut oil output by more than 1 million barrels per day from pre-unrest levels. The Chinese data followed US figures from Friday showing employment returning to its pre-recession peak, confirming steady improvement in the world's top economy. Opec meets in Vienna this week and is likely to keep an output target of 30 million bpd. Members of the group, which pumps a third of the world's oil, are happy with oil prices and producing enough to cover most of their budget needs.

- 20. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Energy Services & Consultants Mobile : +97150-4822502 khalid_malallah@emarat.ae khdmohd@hotmail.com Khaled Al Awadi is a UAE National withKhaled Al Awadi is a UAE National withKhaled Al Awadi is a UAE National withKhaled Al Awadi is a UAE National with a total of 24 yearsa total of 24 yearsa total of 24 yearsa total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. Currently working asOil & Gas sector. Currently working asOil & Gas sector. Currently working asOil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forTechnical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forTechnical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation forTechnical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAEthe GCC area via Hawk Energy Service as a UAEthe GCC area via Hawk Energy Service as a UAEthe GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operationsoperations base , Most of the experience were spent as the Gas Operationsoperations base , Most of the experience were spent as the Gas Operationsoperations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , heManager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , heManager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , heManager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developedhas developedhas developedhas developed great experiences in the designing & congreat experiences in the designing & congreat experiences in the designing & congreat experiences in the designing & constructingstructingstructingstructing of gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supplyof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many Mroutes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs forOUs forOUs forOUs for the local authorities. Hethe local authorities. Hethe local authorities. Hethe local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andhas become a reference for many of the Oil & Gas Conferences held in the UAE andhas become a reference for many of the Oil & Gas Conferences held in the UAE andhas become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcastedEnergy program broadcastedEnergy program broadcastedEnergy program broadcasted internationally , via GCC leading satelliteinternationally , via GCC leading satelliteinternationally , via GCC leading satelliteinternationally , via GCC leading satellite ChannelsChannelsChannelsChannels .... NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase June 2014 K. Al Awadi