859B energy projects planned in MENA

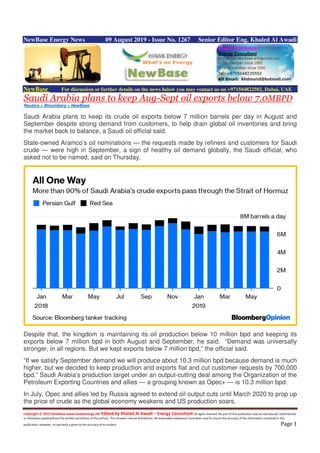

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 09 August 2019 - Issue No. 1267 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi Arabia plans to keep Aug-Sept oil exports below 7.0MBPD Reuters + Bloomberg + NewBase Saudi Arabia plans to keep its crude oil exports below 7 million barrels per day in August and September despite strong demand from customers, to help drain global oil inventories and bring the market back to balance, a Saudi oil official said. State-owned Aramco’s oil nominations — the requests made by refiners and customers for Saudi crude — were high in September, a sign of healthy oil demand globally, the Saudi official, who asked not to be named, said on Thursday. Despite that, the kingdom is maintaining its oil production below 10 million bpd and keeping its exports below 7 million bpd in both August and September, he said. “Demand was universally stronger, in all regions. But we kept exports below 7 million bpd,” the official said. “If we satisfy September demand we will produce about 10.3 million bpd because demand is much higher, but we decided to keep production and exports flat and cut customer requests by 700,000 bpd.” Saudi Arabia’s production target under an output-cutting deal among the Organization of the Petroleum Exporting Countries and allies — a grouping known as Opec+ — is 10.3 million bpd. In July, Opec and allies led by Russia agreed to extend oil output cuts until March 2020 to prop up the price of crude as the global economy weakens and US production soars.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 “Saudi Arabia is committed to do whatever it takes to keep the market balanced next year,” the official said. “We believe, based on close communication with key Opec+ countries, that they will do the same.” “The (oil market) fundamentals are good, especially on the supply side, due to a combination of strong Opec+ over-compliance, and a lower than previously expected US outlook,” the official said. Oil is poised for a second weekly loss as investors weigh the deteriorating U.S.-China trade dispute against the latest steps from Saudi Arabia to stabilize the market. While futures edged higher in New York early Friday, oil is still down more than 5% this week. A deepening spat between Beijing and Washington and a surprise gain in U.S. crude stockpiles helped to drive prices to the lowest level in almost seven months on Wednesday. Saudi Arabia has responded to the rout with a plan to constrain exports and output in September after signaling it wouldn’t tolerate a continued slump in prices. The U.S. benchmark has lost about 10% this month, while Brent has dropped into a bear market as growing fears the trade spat will expand into a currency war overshadowed the risk of supply disruptions in the Middle East. Saudi Arabia plans to keep oil exports below 7 million barrels a day next month as the top producer in the Organization of Petroleum Exporting Countries allocates less crude than customers demand, according to the kingdom’s officials. “No matter how hard Saudi Arabia tries, the kingdom alone cannot support the framework of OPEC+ cuts,” said Satoru Yoshida, a commodities analyst at Rakuten Securities Inc. in Tokyo. “You need both deeper cuts and the settlement of the U.S.-China conflict” to prop up crude prices, he said. West Texas Intermediate oil for September delivery added 7 cents to $52.61 a barrel on the New York Mercantile Exchange as of 11 a.m. in Singapore. The contract rose $1.45 to $52.54 on Thursday, snapping three days of losses and rebounding from the lowest level since January.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Brent for October settlement fell 4 cents to $57.34 on the ICE Futures Europe Exchange. The contract is down 7.3% this week, set for a second weekly loss. The global benchmark traded at a $4.81 premium to WTI for the same month. State-run Saudi Aramco will curb customer allocations across all regions by a total of 700,000 barrels a day next month, the officials said, asking not to be identified because the information isn’t public. For North American buyers, the kingdom will send about 300,000 barrels a day less than they nominated for oil scheduled to load in September, according to a person familiar with the matter. Oil market fundamentals are good and prices are undergoing a “temporary over-reaction,” driven by speculation, Suhail Al-Mazrouei, the energy minister for the United Arab Emirates, said on Twitter. “I am confident that OPEC+ will continue” its strong compliance with agreed production levels, he said. The EIA on Tuesday lowered its domestic oil growth forecasts for the year after Hurricane Barry disrupted Gulf of Mexico output in July. Production is set to rise by 1.28 million bpd to 12.27 million bpd this year, slightly lower than previous growth forecast of 1.40 million bpd.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 MENA: $B 859 energy, petrochemical projects on the way,planed WAM + NewBase + By Staff Writer, TradeArabia Oil, gas and petrochemical projects, valued at more than $859 billion, are either underway or planned in the Middle East and North Africa (Mena), a report revealed. Saudi Aramco is the largest single spender in the region’s oil and gas sector, with more than $31bln worth of contracts under execution Of these, $283 billion worth of projects are being implemented as the region gets ready to meet the forecast increases in demand for energy over the next two decades. According to industry forecasts global oil demand will increase by at least 10 million barrels per day by 2040, while natural gas demand is set to grow by 40 per cent and petrochemicals by 60 per cent. The expansion in demand for petroleum and petrochemicals in particular is driving downstream investment across the Mena region, says dmg, organiser of Abu Dhabi International Petroleum Exhibition (Adipec). What is creating the demand for energy? Christopher Hudson, president – dmg::events, said: “Breakthrough technologies, the growing global population and rising consumer spending are all combining to create new demand for energy, much of which will continue to be met by the oil and gas industry up to and beyond 2040. “While producers in the Middle East continue to maximise value from existing fields, there is heightened interest in developing new resources, both offshore and onshore, as well as investing in upgrading and diversifying both infrastructure and products downstream to create new products lines and revenue streams.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 “Adipec 2019 will be a catalyst for future growth and prosperity in the oil and gas industry, not only providing companies across the hydrocarbons value chain with a forum to gather first-hand knowledge of the dynamic changes taking place in regional oil and gas investment decisions but also enabling them to make the connections necessary to forge new partnerships and tap into the emerging commercial opportunities those investments are creating,” Hudson added. Aramco is the largest spender According to research conducted by Meed, a business intelligence and analytics specialist, Saudi Aramco is the largest single spender in the region’s oil and gas sector, with more than $31 billion worth of contracts under execution. The next three highest spenders are Kuwait’s three largest oil and gas companies with a combined $42.2 billion worth of projects underway.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Meanwhile, Meed says, the Abu Dhabi National Oil Company (Adnoc) has projects with a combined contract value of $16.7 billion under execution across both its onshore and offshore upstream businesses. Outside the GCC, Iraq’s State Company for Oil Project and Algeria’s Sonatrach have $13.7 billion worth of projects in progress. Leading the way in terms of pre execution contract values is Iraq’s Ministry of Oil with projects worth $19.5 billion in the pipeline, $13.7 billion of which is in the bidding phase, according to a list of top oil and gas projects under execution, compiled by Meed. Egypt’s Ministry of Petroleum has plans for $12.3 billion worth of projects; the Kuwait Oil Company has a $12.3 billion project pipeline and Algeria’s Sonatrach has announced plans to go ahead with $10.8 billion-worth of projects, including a $2.5 billion contract for the Hassi Messaoud refinery. India leads projects in Asia Away from the Mena region, Asia is forecast to see 130 new crude and natural gas projects starting operations over the next eight years, contributing around 518,000 barrels per day and close to 11.5 billion cubic feet per day of gas production. According to GlobalData, a leading data analytics and consulting company, 76 of the new developments fall under an early-stage category, while 54 of the new projects have progressed to well-defined development plans. India will lead the way with 62 projects, followed by China with 20 and Indonesia with 19. Malaysia will drive natural gas production. Taking place from November 11 to 14 at the Abu Dhabi National Exhibition Centre (Adnec), Adipec 2019 will once again be a platform for the global oil and gas industry to engage in dialogue, conduct business, and source the creative solutions and strategies that will shape the industry in the years ahead as well as identify the commercial opportunities from the Mena and Asia regions. In common with previous years, Adipec’s conference and technical sessions continue to evolve to reflect the changes taking place in the energy sector.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Why you should attend the conference Oil & Gas 4.0, the strategic conference at Adipec 2019 will feature conference sessions that will explore the nexus of technology and energy. Other sessions will examine the agile business models and new partnership eco-systems that are at the core of the global energy conversation. Since its inauguration in 1984, Adipec has continued to grow, gaining worldwide recognition as the premier oil and gas industry exhibition and conference. The exhibition brings together over 2,200 international exhibiting companies across 155,000 gross sq m, with 29 country pavilions, attracting over 145,000 global attendees and 42 national and international oil companies. The conference hosts over 980 strategic and technical speakers across more than 160 sessions, covering the full energy value chain and attracting over 10,400 delegates. Adipec is held under the patronage of His Highness Sheikh Khalifa Bin Zayed Al Nahyan, President of the UAE, hosted by Adnoc and supported by the UAE Ministry of Energy, the Abu Dhabi Chamber, and the Abu Dhabi Tourism and Culture Authority

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 IEA says oil demand growth at lowest since 2008 Reuters - Noah Browning Mounting signs of an economic slowdown and a ratcheting up of the U.S.-China trade war have caused global oil demand to grow at its slowest pace since the financial crisis of 2008, the International Energy Agency (IEA) said on Friday. “The situation is becoming even more uncertain ... global oil demand growth has been very sluggish in the first half of 2019,” the IEA said in its monthly report. The Paris-based agency said that compared with the same month in 2018, global demand fell by 160,000 barrels per day (bpd) in May - the second year-on-year fall of 2019. From January to May, oil demand increased by 520,000 bpd, marking the lowest rise for that period since 2008. “The prospects for a political agreement between China and the United States on trade have worsened. This could lead to reduced trade activity and less oil demand growth,” the IEA said. Lowering its global demand growth forecasts for 2019 and 2020 to 1.1 million and 1.3 million bpd, respectively, the IEA cited China as the only major source of growth at 500,000 bpd for the first half of this year. Demand growth in the United States and India was just 100,000 bpd from January to June, it said. “The outlook is fragile with a greater likelihood of a downward revision than an upward one,” the report said. Supply curbs by the Organization of the Petroleum Exporting Countries and its allies, meanwhile, had tightened the oil market, helped by slower non-OPEC production.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 But the IEA said that balance would be temporary as it forecast robust non-OPEC production growth in 2020 at 2.2 million bpd, predicting the global oil market would be “well supplied”. The IEA said economic concerns were overshadowing geopolitics, but the oil market continued to watch closely the tensions between the United States and Iran in the Gulf. U.S. sanctions drove down Tehran’s July exports of crude oil by 130,000 bpd to 400,000 bpd, the lowest since the 1980s.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 09 August 2019 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil edges up despite IEA report showing demand growth at decade low Reuters + Bloomberg + NewBase Oil prices inched higher on Friday supported by expectations of more OPEC production cuts despite the International Energy Agency (IEA) reporting demand growth at its lowest level since the financial crisis of 2008. Brent crude futures were at $58.21 a barrel by 01148 GMT, up 83 cents from their previous settlement. West Texas Intermediate (WTI) futures were at $53.380 per barrel, up 84 cents. “Despite a further cut in oil demand growth by the IEA, oil prices are trading marginally higher, as the demand growth cut was already announced previously by the head of the IEA and the agency still expects larger inventory draws for 2H19,” UBS analyst Giovanni Staunovo said. The IEA said global oil demand in the first half of 2019 grew at its slowest pace since 2008 hurt by mounting signs of an economic slowdown and a ramping up of the U.S.-China trade war. Oil prices have lost more than 20% from peaks reached in April, putting them in bear territory. Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Rystad Energy said the oil market was going “from gloomy to gloomier”, calling into question the consultancy’s own bullish view for the first part of 2020. “Economic recession risk and further escalation of the U.S.-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” said Bjørnar Tonhaugen, head of oil market analysis at Rystad Energy. The Organization of the Petroleum Exporting Countries, Russia and other producers, an alliance known as OPEC+, agreed in July to extend their supply cuts until March 2020 to boost oil prices. Saudi Arabia, de facto leader of the OPEC, plans to maintain its crude oil exports below 7 million barrels per day in August and September to bring the market back to balance and help absorb global oil inventories, a Saudi oil official said on Wednesday. “Market focus in oil has clearly shifted. It is squarely on future demand, rather than on supply,” said Harry Tchilinguirian, global oil strategist at BNP Paribas in London. The United Arab Emirates also will continue to support actions to balance the oil market, energy minister Suhail al-Mazrouei said in a tweet on Thursday. The minister said the OPEC and non- OPEC ministerial monitoring committee would meet in Abu Dhabi on Sept. 12 to review the oil market. The week end Oil is poised for a second weekly loss as investors weigh the deteriorating U.S.-China trade dispute against the latest steps from Saudi Arabia to stabilize the market. While futures edged higher in New York early Friday, oil is still down more than 5% this week. A deepening spat between Beijing and Washington and a surprise gain in U.S. crude stockpiles helped to drive prices to the lowest level in almost seven months on Wednesday. Saudi Arabia has responded to the rout with a plan to constrain exports and output in September after signaling it wouldn’t tolerate a continued slump in prices.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The U.S. benchmark has lost about 10% this month, while Brent has dropped into a bear market as growing fears the trade spat will expand into a currency war overshadowed the risk of supply disruptions in the Middle East. Saudi Arabia plans to keep oil exports below 7 million barrels a day next month as the top producer in the Organization of Petroleum Exporting Countries allocates less crude than customers demand, according to the kingdom’s officials. “No matter how hard Saudi Arabia tries, the kingdom alone cannot support the framework of OPEC+ cuts,” said Satoru Yoshida, a commodities analyst at Rakuten Securities Inc. in Tokyo. “You need both deeper cuts and the settlement of the U.S.-China conflict” to prop up crude prices, he said. West Texas Intermediate oil for September delivery added 7 cents to $52.61 a barrel on the New York Mercantile Exchange as of 11 a.m. in Singapore. The contract rose $1.45 to $52.54 on Thursday, snapping three days of losses and rebounding from the lowest level since January. Brent for October settlement fell 4 cents to $57.34 on the ICE Futures Europe Exchange. The contract is down 7.3% this week, set for a second weekly loss. The global benchmark traded at a $4.81 premium to WTI for the same month. State-run Saudi Aramco will curb customer allocations across all regions by a total of 700,000 barrels a day next month, the officials said, asking not to be identified because the information isn’t public. For North American buyers, the kingdom will send about 300,000 barrels a day less than they nominated for oil scheduled to load in September, according to a person familiar with the matter. Oil market fundamentals are good and prices are undergoing a “temporary over-reaction,” driven by speculation, Suhail Al-Mazrouei, the energy minister for the United Arab Emirates, said on Twitter. “I am confident that OPEC+ will continue” its strong compliance with agreed production levels, he said.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase Special Coverage News Agencies News Release 09 August 2019 Pakistan’s Milewide Open Air Mine Shows Why Coal Won’t Go Away Bloomberg + Newbase As wealthy nations wean themselves from the world’s No. 1 source of CO2, poorer ones are burning more and more of it. As this vast mine in Pakistan’s Thar Desert attests, the world’s No. 1 cause of carbon emissions will be a major source of electricity for decades, despite the outcry against it. In the flat scrubland of Pakistan’s scorching Thar Desert, hundreds of workers have been toiling for two years in the vast open pit of the Sindh Engro Coal Mining Co. Taking three-hour breaks during the hottest part of the day and living in a makeshift village of shipping containers, they’re digging for fuel to sustain a $3.5 billion power project. So far they’ve scraped away about 500 feet of Aeolian sand, dirt, and coal to create a milewide hole. Seven hundred miles to the north, in the Cholistan Desert, lie the skeletal beginnings of a solar farm that’s supposed to expand to eight times the size of New York’s Central Park. It’s the largest solar project in Pakistan, where the government has recently announced an ambitious plan to generate 60% of its power from renewable sources such as sun, wind, and water in about a decade. If these grand developments in the desert suggest that coal and solar are in a close-run contest, they’re not. Before 2016, Pakistan had a single coal-fired plant. It now has nine, supplying 15% of the nation’s electricity, with another four under construction. Solar power provides about 1% of energy needs and is getting a tiny sliver of investment compared with what’s going into coal. Solar and other renewables may someday eliminate Pakistan’s dependence on coal, but that day is probably decades away.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 And that’s fine as far as Akhtar Mohammad is concerned. “Coal is good. It’s cheap,” he says at his roadside kiosk in Port Qasim on the outskirts of Karachi, where air pollution is “among the most severe in the world,” according to the nongovernmental Pakistan Air Quality Initiative. He sells sweets, sachets of Head & Shoulders shampoo, and other basics in the shadow of transmission lines that carry power from a new electricity plant that burns imported coal. What about carbon emissions? He shrugs. “This is a small problem,” he says. “There is a lot of smoke and bad air already. We need electricity—any fuel, it doesn’t matter.” Mohammad’s pragmatism sums up the planet’s quandary. “Coal is the absolute No. 1 cause of carbon emissions globally and the leading driver of climate change,” says Tim Buckley, Sydney- based director of energy finance studies at the Institute for Energy Economics & Financial Analysis. But though wealthy nations may be able to afford to wean themselves off the combustible carbon that’s one of the biggest contributors of greenhouse gases, in countries where electricity is scarce, unreliable, or unaffordable, local politics often takes precedence over economics: Coal remains the cheap fallback. Especially in Asia, dozens of coal plants have come on line in recent years or are in the planning stages—with a normal lifetime of almost a half-century. In South and Southeast Asia, coal burning is expected to increase about 3.5% a year for the next two decades, according to the International Energy Agency. Globally, the IEA predicts, coal demand won’t peak until 2040. And that may be optimistic. Forecasts such as the IEA’s often assume governments will choose the cheapest option based on optimum efficiency while factoring in environmental constraints and the falling cost of solar and wind power. The world grew up on coal. People in China burned it to smelt copper 3,000 years ago. Britain used it to power the boilers of the Industrial Revolution in the 1700s. In the 19th century,

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Americans shoveled it into locomotives to connect the country. When Thomas Edison built the first power station for his electric lightbulbs in 1882, it was fired by coal. “Governments wanting to be elected want people to have electricity. That’s why coal has momentum” And now? Coal consumption won’t decline as significantly as people think, says Shirley Zhang, Wood Mackenzie Ltd.’s principal Asia-Pacific coal analyst. On the one hand, annual global seaborne coal trade probably peaked last year at 980 million tons. On the other hand, from now to 2040, it will decline by only 20 million tons, she says. Despite the rise of renewables, the roll call of governments adding coal-fired plants includes four of the world’s five most populous nations: China, India, Indonesia, and Pakistan. In 2018, when global carbon emissions rose 2.9%—the biggest jump in seven years—China, India, and the U.S. accounted for two-thirds of the increase, according to BP Plc’s 2019 Statistical Review of World Energy. As developed nations retired coal plants producing 17 gigawatts of power, consumption and production of coal advanced in Asia at the fastest rate in five years. (Michael R. Bloomberg, founder and majority owner of Bloomberg LP, in June launched an effort to phase out every U.S. coal-fired power plant by 2030.) Which brings us back to Pakistan. On paper, it could be one of Asia’s top economies. Twice the size of California, Pakistan is home to more than 200 million people between the icebound peaks of the Karakorum and the shores of the Arabian Sea, most of them in the fertile valleys of the Indus River and its tributaries that run down the center of the country. But it’s hobbled by corruption, political turmoil, terrorism, and poverty. In July, shortly after the country got its 22nd bailout from the International Monetary Fund, the central bank raised its base rate to an eight-year high of 13.25% amid soaring inflation. Add to Pakistan’s woes a crippling shortage of energy. Although the government has made progress in tackling the power deficit, blackouts are a way of life. Tens of millions of people aren’t connected to the grid. In 2015 inefficiencies in the power sector cost the economy $18 billion, or 6.5% of gross domestic product, according to a World Bank report. When it comes to power, says James Stevenson, Sydney-based senior director for global coal research at IHS Markit Ltd., “it’s having it or not that matters, not where it comes from. Governments wanting to be elected want people to have electricity. That’s why coal has momentum.” The sights and sounds at the Sindh Engro mine in the Thar tell you a lot. The coal being scooped out of the ever-deepening hole is soft, brown, and crumbly—lignite, one of the biggest producers of greenhouse gases. Lignite and hard black anthracite generate about twice the level of carbon dioxide as natural gas; gasoline and heating oils fall about halfway between the two.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 The workers digging in the mine, where temperatures can reach 50C (122F), are Pakistani and Chinese. In total, China will provide financing—from 50% to 90% of total costs—for $60 billion in projects to upgrade Pakistan’s transport and energy infrastructure, making the South Asian country a standout partner of Beijing’s “Belt and Road” initiative. Of the 10 biggest BRI power projects by capacity, eight are in Pakistan, and five of those are coal-fired. China is a vivid example of the rich-poor quandary when it comes to weaning the world off coal. Like many developing nations, it has taken measures to curb climate change, shutting some of its most-polluting steel mills and power plants and relying increasingly on alternative sources. It added more renewable energy last year than all of the 36 member countries of the Organization for Economic Cooperation and Development combined, according to the BP report. But at the same time, China is the world’s largest producer and user of coal. It’s helping to pay for and build power plants in at least a dozen countries, and though many are solar, wind, natural gas, and hydro projects, the bulk of the Chinese investment is in coal. That doesn’t bode well for the 2016 Paris Agreement on climate change, in which almost 200 nations, including China, pledged to take steps to limit the increase in global average temperature to well below 2C. That commitment basically requires the phasing out of coal: Since the Industrial Revolution, the Earth has warmed by 1 degree and is predicted to at least double that by the end of the century, the fastest pace since the end of the last Ice Age. It’s not as if Pakistan doesn’t have alternatives to coal. The country’s current natural gas fields are dwindling, but the IEA estimates its shale reserves could contain more than 9 billion barrels of recoverable oil and 105 trillion cubic feet of gas, enough to meet the nation’s needs for decades. It has five nuclear reactors, fed with locally mined uranium, and plans to build two more with Chinese help. Pakistan is also a regional leader in hydropower. About 29% of its electricity comes from harnessing water, including the massive 4.9GW Tarbela Dam on the Indus River, the largest

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 earth-and-rock-filled dam in the world. Such big structures have come under increasing criticism from environmentalists because of their impact on local ecosystems and populations, but Pakistan plans to build more. Another problem with hydropower infrastructure is the heavy cost of construction, which is hard to pay for without international support. Pakistan’s proposed $10 billion-plus Diamer-Bhasha Dam, upstream of Tarbela, has held at least five groundbreaking ceremonies over the decades without ever scoring enough financing to proceed. Meanwhile, Pakistan is pursuing renewable options that require less startup capital. The government of Prime Minister Imran Khan has set a 2030 target to generate 30% of the nation’s energy from large hydro plants and another 30% from other renewable sources that currently supply only about 4%, including arrays of wind turbines springing up along the coast in Jhimpir. At the forefront of that plan is the Quaid-e-Azam Solar Park in the Cholistan Desert. Originally envisioned as a 1GW plant, it is also backed by Chinese money and technology. The first 100MW started flowing to the grid in 2015, and a contract for the remaining 900MW was awarded to a unit of Chinese telecommunications giant ZTE Corp. with the aim of completing the project by 2016. But the park has been dogged by controversy—over the award of the contract, allegations of misappropriation of funds, and questions about its efficiency. So far, ZTE’s Zonergy Co. has added only 300MW after the government reduced the price it agreed to pay for the power. Syed Faizan Ali Shah, Zonergy’s deputy general manager for marketing and technical sales, says expansion stalled because the government changed the way it sets prices, which have fallen from 14¢ per kWh to about 6¢ since 2015. Scrutiny of past deals increased after the Khan government came to power last year, including an investigation by the National Accountability Bureau, which also probed two coal-power projects. Like all solar plants, the one at Quaid-e-Azam is at the mercy of environmental whims, such as variations in sunlight. It faces particular challenges as well, including the frequent dust storms off

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 the Cholistan: If the panels aren’t regularly cleaned, the accumulation of dust can drastically slash the plant’s average power output. According to local media reports, doing the job could require up to 10 million liters of water a year—enough to meet the annual needs of 9,000 people. Shah says the panels only need to be cleaned about twice a month to meet company benchmarks. In contrast to the stuttering start of Pakistan’s renewable ambitions, the view of the future from the Thar coal mine is one of confidence. “When people talk about coal plants getting shut down or people moving away from coal, they don’t understand what’s happening,” says Ahsan Zafar Syed, chief executive officer of Engro Energy Ltd., the Pakistani company leading the project. “Coal plants that are getting shut down have outlived their useful life. As I speak, there are 26 countries in the world where coal power plants are being constructed. They are everywhere.”

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21