Axis bank sanction letter

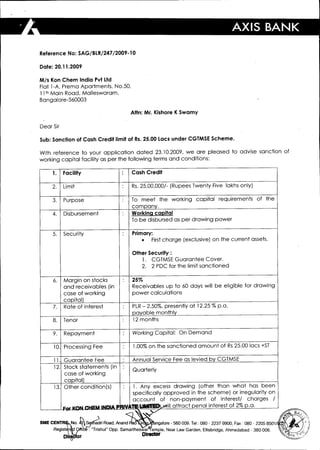

- 1. ~ AXIS BANK Reference No: SAG/BLR/247 /2009-10 Date: 20.11.2009 M/s Kon Chern India Pvt Ltd Flat 1-A, Prema Apartments, NO.50, 11th Main Road, Malleswaram, Bangalore-560003 Attn: Mr. Kishore K Swamy Dear Sir Sub: Sanction of Cash Credit limit of Rs.25.00 Lacs under CGTMSE Scheme. With reference to your application dated 23.10.2009, we are pleased to advise sanction of working capital facility as per the following terms and conditions: l. Facility 2. Limit 3. Purpose 4. Disbursement 5. Security Cash Credit Rs.25,00,0001- (Rupees Twenty Five lakhs only) To meet the working capital requirements of the com an . Working capital To be disbursed as per drawing power Primary: • Firstcharge (exclusive) on the current assets. other Security : 1. CGTMSE Guarantee Cover. 2. 2 PDC for the limit sanctioned 6. Margin on stocks and receivables (in case of working ca ital 7. Rate of interest 8. Tenor 9. Repayment 10. Processing Fee 25% Receivables up to 60 days will be eligible for drawing power calculations PLR- 2.50%, presently at 12.25 % p.a. a able monthl 12 months Working Capital: On Demand 1.00% on the sanctioned amount of Rs25.00 lacs +ST Annual Service Fee as levied b CGTMSE Quarterly 11. Guarantee Fee 12. Stock statements (in case of working ca ital 13. Other condition(s) 1. Any excess drawing (other than what has been specifically approved in the scheme) or irregularity on account of non-payment of interestl charges 1 ~ ill attract penal interest of 2% .a. . tB~.t." ~_ SME CENTR NO.:1 adri Road, Anand i~ angalore- 560009. Tel: 080 - 22379900, Fax: 080 - 2205 85011 '..,~' Regist~~h"" Cpp.samorthe,w" ,empie,Ne" UowG"deo, Em,b"dge,Ahmed.b.d - 380006. "' .../J01 e or Director " Ire ,??>"y~/

- 2. 14. Validity of sanction General Covenants 2. The security charged to the Bank including stock, fixed assets,etc. should be comprehensively insured with BankClause and the policy document/a copy of the policy document to be submitted for Bank's record. 3. The working capital limits are sanctioned for a period of 12 months, Le. till 18th November 2010. The borrower should note to submit the requisite data for renewal of limits atleast 45 days before the expiry. Continuation of limits on a lapsed sanction would attract Denal interest of 2%. The sanction shall be valid for acceptance upto 3 months, during which time, the terms of the facility would have to be accepted by the Borrower a) The Bank will have the right to examine the books of accounts of the firm/concern/company and to have the retail outlets/god owns inspected from time to time by officers of the Bank and/or outside consultants. Any expensesincurred by the Bank in thisregard will be borne by the firm/concern/company. b) The Bank may at its sole discretion disclose such information to such institution(s) in connection with the credit facilities granted to the firm/concern/company. c) The Bank shall have the right to listthe defaulted borrowers' names and particulars on the Website of CGTSI. d) During the currency of the Bank's credit facilities, the firm/concern/company shall not, without the prior approval of the Bankin writing: - i) Effect any major change in itscapital structure. ii) Formulate any scheme of amalgamation/ reconstruction. iii) Invest by way of share capital in or lend or advance funds to or place deposits with any other concern. Normal trade credit or security deposits in the usual course of businessor advances to employees, etc., are, however, not covered by thiscovenant. iv) Undertake guarantee obligations on behalf of another firm/concern/company, subsidiary. v) Declare dividends (in case of companies) for any year except out of the profits relating to that year. vi) Grant loans to promoters/partners. e) The firm/concern/company shall provide ancillary businesswherever possible to the Bank such as CMS,SalaryAccounts, credit card acquisition business,etc. f) The firm/concern/company should not make any drastic changes in its management set up without the Bank's permission Far KONCHEM INDIA PRIV~ D''kV _

- 3. g) The firm/concern/company will keep the Bank informed of the happening of any event, likely to have a substantial effect on their production, sales, profits, etc., such as labour problem. power cut, etc., and the remedial steps proposed to be taken by it. h) The firm/concern/company will keep the Bank advised of any circumstances adversely affecting the financial position of its subsidiaries/sisterconcerns (if any) including any action, taken by any creditor against any of the subsidiaries. i) The firm/concern/company should furnishto the Bank, every year, two copies of audited financial statements immediately on being published/signed by the auditors. j) Theborrower shall furnishan affidavit that it isa SSI. k) The funds from the above-mentioned credit facilities. shall not be used for adjustment/payment of any debt deemed bad or doubtful for recovery. I) The above-mentioned credit facilities shall not be covered under scheme operated/administered by DICGC or RBI. Govt, General insurer, any person or AOP carrying on the business of insurance, guarantee, indemnity, other than the Credit Guarantee Scheme of CGTSI. m) Theborrower shall not avail any credit facilities from any other bank / lending institution. n) The primary security charged for the above-mentioned credit facilities shall not be shared with any other credit facility. 0) The credit facilities shall not be transferred/assigned by the borrower to any other entity without permission of the bank. In case there is any transfer/assignment the loan shall be recalled at the sole discretion of the bank. p) TheSSIstatus of the borrower shall continue throughout the tenure of the loan. In case the SSIstatusisextinguished the loan shall be recalled at the sole discretion of the bank. q) TheBank'sSchedule of Charges for variousservicesisenclosed. r) The Borrower(s) shall be deemed to have given their express consent to the Bank to disclose the information and data furnished by them to the Bank and also those regarding the credit facility/ies to the Credit Information Bureau (India) Ltd. ("CIBIL").upon signing the copy of the sanction letter. The Borrower(s)and Guarantor(s) shall further execute such additional documents as may be necessary for this purpose. You are requested to return duplicate copy of this letter duly signed by you/the authorized signatory(s) of the company and guarantors on all the pages as token of acceptance of the terms and conditions of sanction and arrange for execution of loan/security documents at an early date. Yoursfaithfully, For KON CHEM INDIA PRIVATE u~ D~~ ~ 3

- 4. .. Acknowledgement I/We have read the offer letter ref. no. SAG/BLR/247/2009-10 dtd. 20.11.2009 and accept the same and agree to the terms and conditions. Borrower Date and Signature For KON CHEM INDIA PRIV~ M/s Kon Chern India Pvt Ltd 4