031111 federal reserve 50m

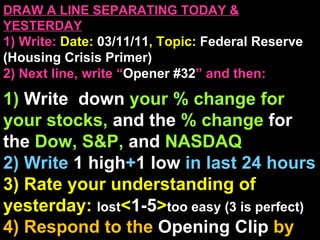

- 1. DRAW A LINE SEPARATING TODAY & YESTERDAY 1) Write: Date: 03/11/11 , Topic: Federal Reserve (Housing Crisis Primer) 2) Next line, write “ Opener #32 ” and then: 1) Write down your % change for your stocks, and the % change for the Dow, S&P, and NASDAQ 2) Write 1 high + 1 low in last 24 hours 3) Rate your understanding of yesterday: lost < 1-5 > too easy (3 is perfect) 4) Respond to the Opening Clip by writing at least 1 sentences about : Your opinions/thoughts OR/AND Questions sparked by the clip OR/AND Summary of the clip OR/AND Announcements: None

- 2. Agenda 1) Federal Reserve End Goal, you will be able to… 1) How is money made? Reminder 1) Study guide on Monday for Investing Test on Friday

- 3. Review : 1) Americans buy things not on how much money they have, but how much they can borrow cheaply. 2) If there is more money “out there” then interest rates drop (cheap loans) 3) If there is less money “out there” then interest rates increase (pricier loans)

- 4. Review 4) Housing Crisis : a) Traditional Bank Profit Model: Loan, make money off interest % , bank owns mortgage b) Liquidity: Amount banks have to lend (trad. based on what’s in saving accts) c) Subprime Loan: Loans to low credit borrowers (banks used to avoid these) BANKING MODEL: Banks attract savers by paying % Use savers money to loan, getting % The margin between % is their profit

- 5. Review: How Bank Makes Profits 4) Loan Interest Rate: 5% Bank: Profit Margin Saving Interest Rate: 0.2%

- 6. Notes #32a , Title: “ Federal Reserve ” 1) Federal Reserve : Gov regulatory agency that controls US money supply ( monetary policy ). Fed Board serve 14 yrs to protect from politics. Led by Chairman Ben Bernanke . Federal Reserve called “the Fed” or the “banker’s bank.”

- 7. Notes #32a , Title: “ Federal Reserve ” 1) Federal Reserve : a) Preserve the US dollar (fight inflation + deflation) b) Reduce unemployment (controversial goal)

- 8. Federal Reserve System 1) 1) US Gov Needs Money, Issues US Bonds (iou) 2) Private Investors buy bonds 3) Federal Reserve can SELL bonds to investors (open market) 4) Investors buys more bonds, gives money over to Federal Reserve Less money in the economy

- 9. Federal Reserve System 1) 1) US Gov in Debt, Needs Money, Issues US Bonds (iou) 2) Investors buy bonds 3) Federal Reserve can BUY bonds from investors (open market) 4) Investors get “new” money from Federal Reserve for the investors' bonds Fed buys from open market, b/c its mission is NOT to bail out US gov

- 11. US Bureau of Engraving and Printing prints money for the Federal Reserve.

- 12. Federal Reserve Bank Letter/Number Boston A New York B 2 Philadelphia C 3 Cleveland D 4 Richmond E 5 Atlanta F 6 Chicago G 7 St Louis H 8 Minneapolis I 9 Kansas City J 10 Dallas K 11 San Francisco L 12

- 13. Most of the Feds money these days is just electronically created.

- 14. Fed is defends money, so it won’t just print money , it uses more delicate tools

- 17. Fed Independence : a) 7 openings, 14 year terms , picked by the President, confirmed by the Senate b) 1 of the 7 picked to be Chairman for 4 years by the Pres, confirmed by Senate: Chairman Ben Bernanke c) Politicians have pressure to create short term boost in election years, Fed fights for stable growth

- 18. Alan Greenspan : Appointed 1987 Former Chairman

- 19. Ben Bernanke : Appointed 2006 Current Chairman

- 20. Notes #32a , Title: “ Federal Reserve ” 2) Economy Growing Too Fast (inflationary bubble): Too many ppl want to buy things, prices go up ( inflation ). High prices get biz too excited, and too much is produced. (Biz then face losses, leading to recession.)

- 21. Notes #32a , Title: “ Federal Reserve ” 3) Slowing Economy (recession): People have less money OR fear bad times ahead, no one wants to buy things, prices go down . Jobs lost as less is produced ( unemployment ).

- 22. Notes #32a , Title: “ Federal Reserve ” 4) Economy Growing Too Fast (inflation): Reduce money, make it more expensive to borrow. Less money supply increases price of borrowing/higher interest rates (banks increase interest rates to attract more money to lend out) 5) Slowing Economy (unemployment): Increase money, make it easier to borrow. More money available (banks can give lower interest rates, since extra money)

- 23. Journ #32a , “ Federal Reserve Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Fed should help the economy during a recession (jobs) 1) What’s the point of stable money value, if no one has a job? 2) The Fed can act more quickly and powerfully than Congress. PRO: Fed should just focus on stable money (prevent inflation) 1) Stable money is the backbone to any economy, the Fed should focus on this alone. 2)Too attractive for gov to have Fed just print money

- 24. Notes #32b , Title: “ Federal Reserve ” 6) Federal Funds Rate Target : Funds rate is the interest rate banks loan to each other. All other interest rates follow this. Fed can’t force private interest rates, but they use the 3 tools to try to pressure banks to hit target. Currently: 0.25%

- 25. Notes #32b , Title: “ Federal Reserve ” 7) 3 Tools of the Federal Reserve : i) Change banks Reserve Requirements : % of money banks must hold on to, can’t loan out ($ it keeps at the Fed). ii) Change the Discount Rate : Interest rate Fed charges banks for short term loans. 0.50% (disc rate always higher than Fed Fund Rate) iii) Sell US Bonds (bonds previously bought) OR buy US Bonds (with “new” money).

- 26. Notes #33a , Title: “ Federal Reserve ” Federal Reserve Tools 1) 1) Federal Reserve uses 3 tools to increase money supply 2) Banks less needy for money, lower savings rates 3) Banks lower loan rates, since saving rates are lower 4) People buy more since loans are more cheaper Fighting recession

- 27. Federal Reserve Tools 1) 1) Federal Reserve uses 3 tools to reduce money supply 2) Banks more desperate for money, raise savings rates 3) Banks increase loan rates to cover higher saving rates 4) People buy less since loans are more expensive Fighting inflation

- 28. Notes #33a , Title: “ Federal Reserve ” 2) Federal Open Market Committee (FOMC) : Federal Reserve Committee of 12 : 7 Fed Board members and 5 of the 12 district bank presidents Journ with Bernanke to make monetary decisions.

- 30. If the USA just printed money to speed things up, inflation could get out of control.

- 31. Journ #33a , Title “ Partner Questions ” Read and then respond to these questions with a partner ( include their name at the end ) : Changing the Daily Reserve Requirement Federal reserve sets daily percentage of money must be kept at the Fed , and rest can be lent out as loans . Banks will keep only what the Fed reserve says it has to (NO profits on reserve money, res req approx: 15%). 1) Lowering to 10% will fight inflation or unemployment?

- 32. Notes #33b , Title: “ Lecture Notes ” 2) Money Multiplier: Fed Reserve requirement + new bank loans grow the money supply 1) You put money in bank, bank hold Reserve, lend rest. 2) Borrower puts money in his/her bank, bank hold Resv, lend rest 3) Borrower puts money in his/her bank, bank hold Resv, lend rest 4) Borrower puts money in his/her bank, bank hold Resv, lend rest

- 33. M1 - Physical US dollars M2 - Physical US dollars + Dollar amount held in average savings accounts M3 - Physical US dollar + Dollar amount held in large saving accounts + Dollars held overseas

- 34. Journ #33b , Title “ Partner Questions ” Read and then respond to these questions with a partner ( include their name at the end ) : Changing the Discount Rate Federal reserve makes short term loans to banks currently: 0.50%. These loans are to cover any shortages in a banks reserve requirement with the Federal Reserve (Fed is lender of last resort). 1) If the Fed increase the Discount Rate to 9.50%, reduce inflation or unemployment?

- 37. Journ #33c , Title “ Partner Questions ” Read and then respond to these questions with a partner ( include their name at the end ) : Making Open Market Operations on Bonds When the US Gov needs to borrow money, it issues US bonds, These bonds are sold to private investors, the Fed can then buy US bonds from private investors. The Fed does not buy directly from the US gov, b/c its goal is to control money supply, not help the gov with its debt. 1) Fed buys US bonds reduces inflation or unemployment?

- 38. Journ # , Title “ Marketplace: 3/04 ” Pre-Sale 1a-b-c) a- List items b- est cost c- sell prices Post-Sale 2) Record your sales $ at the end of the round 3) Reflect on what can be done better to increase business next time, focus on what products are in demand (not mean you can or want to supply it) and how marketing can be improved next time (branding+advertising). -Remember you can pay with checks -If your salary is higher, you should feel obliged to spend more + pay more -Norm our market, treat as real $ (think of your cost) -Cleaners

- 39. Journ # , Title “ Closer Shareout ” Pick the 1 most important thing you learned today to share with your partner. 1) Write down a brief summary of what your partner said ( include their name ). 2) Rate 1-10 (1: confused, 10: too easy) how well you well you mastered today’s lesson. 3) Summarize Mr. Chiang’s feedback.

- 40. Homework: 1) Study Guide Monday, Test on Friday Test will cover investing, Federal Reserve, Financial Crisis (Mon, Tu) Workbook Check: If your name is called, drop off your Journbook with Mr. Chiang ( if requested, points lost if your Journbook is not turned in )