Weitere ähnliche Inhalte Ähnlich wie Bnm analisis financiero comparativo - bnm vs sistema bca comercial nov 2000 (20) Mehr von gonzaloromani (20) Kürzlich hochgeladen (20) 1. Fuente: EVOLUCION BNM vs BANCA COMERCIAL ESTADOS FINANCIEROS COMPARATIVOS

Superintendencia de Banca y Seguros del Perú

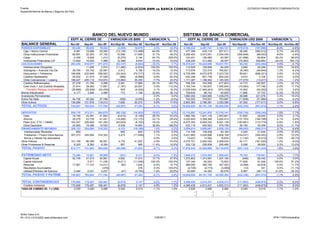

BANCO DEL NUEVO MUNDO SISTEMA DE BANCA COMERCIAL

EEFF AL CIERRE DE VARIACION US $000 VARIACION % EEFF AL CIERRE DE VARIACION USD $000 VARIACION %

BALANCE GENERAL Nov-00 Sep-00 Dec-99 Nov/Sep-00 Nov/Dec-99 Nov/Sep-00 Nov/Dec-99 Nov-00 Sep-00 Dec-99 Nov/Sep-00 Nov/Dec-99 Nov/Sep-00 Nov/Dec-99

FONDOS DISPONIBLES 93,430 96,635 76,452 (3,205) 16,978 -3.3% 22.2% 4,106,224 4,481,741 4,304,121 (375,518) (197,898) -8.4% -4.6%

Caja + Banco Central 6,561 18,696 20,060 (12,135) (13,499) -64.9% -67.3% 477,399 439,119 857,911 38,280 (380,512) 8.7% -44.4%

Otras Instituciones Financieras 68,891 52,293 47,192 16,598 21,699 31.7% 46.0% 3,266,403 3,573,051 3,354,455 (306,648) (88,053) -8.6% -2.6%

Canje 4,356 9,626 1,212 (5,270) 3,144 -54.7% 259.4% 124,201 156,089 63,397 (31,888) 60,804 -20.4% 95.9%

Inversiones Financieras C/P 13,622 16,020 7,988 (2,398) 5,634 -15.0% 70.5% 238,220 313,482 28,357 (75,262) 209,863 -24.0% 740.1%

COLOCACIONES 463,430 516,577 471,472 (53,147) (8,042) -10.3% -1.7% 10,478,247 10,422,009 10,931,701 56,238 (453,454) 0.5% -4.1%

Interbancarias Otorgadas - 11,490 2,874 (11,490) (2,874) -100.0% -100.0% 112,505 109,665 84,206 2,840 28,299 2.6% 33.6%

Sobregiros + Avances Cta.Cte 28,765 24,752 25,567 4,012 3,198 16.2% 12.5% 713,976 723,316 760,821 (9,340) (46,844) -1.3% -6.2%

Descuentos + Préstamos 188,606 222,648 258,923 (34,042) (70,317) -15.3% -27.2% 6,735,499 6,675,878 7,423,720 59,621 (688,221) 0.9% -9.3%

Créditos Hipotecarios 20,532 21,519 27,528 (988) (6,996) -4.6% -25.4% 832,346 827,736 829,220 4,610 3,126 0.6% 0.4%

Otras Colocaciones + Leasing 189,227 205,119 153,872 (15,892) 35,355 -7.7% 23.0% 1,171,387 1,188,462 1,185,305 (17,075) (13,917) -1.4% -1.2%

Créditos Refinanciados 27,276 21,795 9,286 5,481 17,989 25.1% 193.7% 758,330 743,558 617,823 14,772 140,507 2.0% 22.7%

Créd.Vcdo.+ Jud.(Cartera Atrasada) 37,914 39,082 17,857 (1,167) 20,057 -3.0% 112.3% 1,183,744 1,193,837 1,005,945 (10,093) 177,799 -0.8% 17.7%

- Provisión Riesgos Incobrabilidad (28,889) (29,828) (24,435) 939 (4,454) -3.1% 18.2% (1,029,540) (1,040,443) (975,338) 10,902 (54,202) -1.0% 5.6%

Bienes Adjudicados 4,177 3,465 3,069 712 1,108 20.6% 36.1% 108,632 96,742 60,929 11,890 47,703 12.3% 78.3%

Inversiones Permanentes - - - - - 0.0% 0.0% 1,660,352 1,620,665 1,439,276 39,686 221,076 2.4% 15.4%

Activo Fijo Neto 44,736 45,292 47,789 (556) (3,053) -1.2% -6.4% 722,003 733,631 753,987 (11,628) (31,984) -1.6% -4.2%

Otros Activos 139,284 131,676 119,012 7,609 20,272 5.8% 17.0% 2,853,363 2,796,361 3,030,380 57,002 (177,017) 2.0% -5.8%

TOTAL ACTIVOS 745,057 793,644 717,794 (48,587) 27,263 -6.1% 3.8% 19,928,820 20,151,150 20,520,394 (222,330) (591,574) -1.1% -2.9%

DEPOSITOS 254,176 312,311 264,678 (58,136) (10,502) -18.6% -4.0% 12,110,897 12,341,635 12,319,141 (230,738) (208,244) -1.9% -1.7%

Vista 16,745 23,361 21,853 (6,615) (5,108) -28.3% -23.4% 1,882,782 1,831,130 1,843,841 51,652 38,940 2.8% 2.1%

Ahorros 29,279 43,735 41,451 (14,456) (12,172) -33.1% -29.4% 3,220,645 3,358,348 3,405,413 (137,703) (184,768) -4.1% -5.4%

Plazo (Incl. CTS + CBME) 183,247 226,850 191,352 (43,603) (8,105) -19.2% -4.2% 6,475,353 6,659,234 6,591,128 (183,881) (115,775) -2.8% -1.8%

Otros Depósitos 24,905 18,366 10,022 6,539 14,883 35.6% 148.5% 532,118 492,923 478,759 39,195 53,359 8.0% 11.1%

FINANCIAMIENTO RECIBIDO 308,123 304,000 318,322 4,123 (10,199) 1.4% -3.2% 3,559,814 3,659,667 3,928,125 (99,853) (368,311) -2.7% -9.4%

Interbancarias Recibidas 850 - - 850 850 0.0% 0.0% 114,726 109,406 83,182 5,320 31,544 4.9% 37.9%

Préstamos + Financ.Otros Bancos 307,273 304,000 318,322 3,273 (11,049) 1.1% -3.5% 3,431,665 3,535,696 3,826,108 (104,031) (394,443) -2.9% -10.3%

Bonos y Valores hip adeudados - - - - - 0.0% 0.0% 13,423 14,564 18,835 (1,142) (5,412) -7.8% -28.7%

Otros Pasivos 101,159 96,389 59,501 4,770 41,657 4.9% 70.0% 2,076,701 2,052,530 2,258,222 24,171 (181,520) 1.2% -8.0%

Otras Provisiones & Reservas 9,320 8,362 8,324 957 995 11.4% 12.0% 232,132 226,836 205,482 5,296 26,650 2.3% 13.0%

TOTAL PASIVO 672,777 721,063 650,826 (48,286) 21,952 -6.7% 3.4% 17,979,545 18,280,668 18,710,970 (301,123) (731,425) -1.6% -3.9%

PATRIMONIO NETO 72,280 72,581 66,969 (301) 5,311 -0.4% 7.9% 1,949,275 1,870,483 1,809,424 78,793 139,851 4.2% 7.7%

Capital Social 52,735 47,915 35,661 4,820 17,073 10.1% 47.9% 1,372,602 1,373,091 1,307,160 (489) 65,442 0.0% 5.0%

Capital Adicional - 5,011 11,036 (5,011) (11,036) -100.0% -100.0% 137,349 65,524 75,803 71,826 61,546 109.6% 81.2%

Reservas 17,061 17,123 15,413 (62) 1,648 -0.4% 10.7% 388,092 390,190 347,453 (2,098) 40,638 -0.5% 11.7%

Resultados Acumulados - - (378) - 378 0.0% -100.0% (2,728) (2,715) (3,069) (13) 341 0.5% -11.1%

Utilidad/(Pérdida) del Ejercicio 2,484 2,531 5,237 (47) (2,753) -1.9% -52.6% 53,959 44,393 82,076 9,567 (28,117) 21.6% -34.3%

TOTAL PASIVO Y PATRIM. 745,057 793,644 717,794 (48,587) 27,263 -6.1% 3.8% 19,928,820 20,151,150 20,520,394 (222,330) (591,574) -1.1% -2.9%

TOTAL CONTINGENCIAS 170,608 179,487 168,461 (8,878) 2,147 -4.9% 1.3% 4,398,438 4,510,431 4,835,313 (111,993) (436,875) -2.5% -9.0%

Creditos Indirectos 170,608 179,487 168,461 (8,878) 2,147 -4.9% 1.3% 4,398,438 4,510,431 4,835,313 (111,993) (436,875) -2.5% -9.0%

TASA DE CAMBIO (S/. 1 x US$) 3.530 3.490 3.480 0.040 0.010 -1.1% -1.4% 3.530 3.490 3.480 0.040 0.010 -1.1% -1.4%

- - -

- - -

Strike Value S.A.

Ph +51(1) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100Comparative

2. Fuente: EVOLUCION BNM vs BANCA COMERCIAL ESTADOS FINANCIEROS COMPARATIVOS

Superintendencia de Banca y Seguros del Perú

PERDIDAS Y GANANCIAS Nov-00 Sep-00 Dec-99 Nov/Sep-00 Nov/Dec-99 Nov/Sep-00 Nov/Dec-99 Nov-00 Sep-00 Dec-99 Nov/Sep-00 Nov/Dec-99 Nov/Sep-00 Nov/Dec-99

INGRESOS FINANCIEROS 83,506 67,798 93,664 15,708 (10,158) 23.2% -10.8% 2,187,010 1,811,367 2,389,071 375,643 (202,061) 20.7% -8.5%

Ints.+Comisiones/Colocaciones 68,637 55,470 76,930 13,167 (8,293) 23.7% -10.8% 1,386,049 1,155,538 1,614,602 230,510 (228,553) 19.9% -14.2%

Ints.+Comisiones/Institut.Financieras 4,226 3,614 3,376 612 850 16.9% 25.2% 195,165 160,011 144,246 35,153 50,919 22.0% 35.3%

Ints./Interbancarias Otorgadas 261 213 278 48 (16) 22.5% -5.9% 18,127 15,675 28,793 2,452 (10,666) 15.6% -37.0%

Comm x Operac. Contingentes 6,431 5,212 7,075 1,219 (644) 23.4% -9.1% 298,074 239,623 292,503 58,451 5,571 24.4% 1.9%

Comm x Fideicomiso & Adm 214 182 - 32 214 17.7% #DIV/0! 1,191 999 817 192 374 19.3% 45.8%

Ganancia en Cambio 2,804 2,412 3,739 391 (936) 16.2% -25.0% 96,608 77,609 126,029 18,999 (29,421) 24.5% -23.3%

Renta de Valores en Cartera 849 630 2,175 219 (1,326) 34.8% -61.0% 180,865 152,913 172,627 27,952 8,238 18.3% 4.8%

Otros Ingresos Financieros 85 65 91 19 (6) 29.7% -6.4% 10,932 8,998 9,455 1,934 1,477 21.5% 15.6%

GASTOS FINANCIEROS (50,981) (42,647) (53,106) (8,333) 2,125 19.5% -4.0% (1,028,446) (853,751) (1,159,886) (174,695) 131,440 20.5% -11.3%

Ints./Depósitos (24,070) (20,311) (24,970) (3,759) 900 18.5% -3.6% (672,969) (561,607) (757,630) (111,361) 84,661 19.8% -11.2%

Ints./Interbancarias Recibidas - (218) (609) 218 609 -100.0% -100.0% - (11,833) (20,854) 11,833 20,854 -100.0% -100.0%

Ints.+Coms./Financiamiento Recibido (25,905) (21,323) (25,509) (4,581) (396) 21.5% 1.6% (298,842) (235,098) (311,235) (63,744) 12,393 27.1% -4.0%

Pérdidas en Cambio (99) (92) (1,324) (7) 1,225 7.8% -92.5% (8,635) (6,293) (11,618) (2,342) 2,983 37.2% -25.7%

Depósitos Reajustables - - - - - 0.0% 0.0% (4,195) (3,298) (2,061) (897) (2,134) 27.2% 103.5%

Fdo.Seg.Dep.+ Otros (907) (702) (695) (205) (212) 29.1% 30.6% (43,806) (35,622) (56,488) (8,184) 12,683 23.0% -22.5%

RESULTADO FINANCIERO 32,525 25,151 40,558 7,375 (8,033) 29.3% -19.8% 1,158,564 957,615 1,229,184 200,948 (70,621) 21.0% -5.7%

PROVISION COLOCACIONES (4,976) (3,976) (7,057) (1,000) 2,082 25.1% -29.5% (372,552) (320,587) (445,440) (51,964) 72,888 16.2% -16.4%

- Provisión/Créditos Directos (4,976) (3,976) (7,057) (1,000) 2,082 25.1% -29.5% (372,552) (320,587) (445,440) (51,964) 72,888 16.2% -16.4%

RESULT. FINANC NETO 27,550 21,174 33,501 6,375 (5,951) 30.1% -17.8% 786,012 637,028 783,745 148,984 2,267 23.4% 0.3%

OTROS INGRESOS 20,417 19,697 18,854 719 1,563 3.7% 8.3% 309,942 280,996 372,093 28,947 (62,150) 10.3% -16.7%

OTROS GASTOS (45,066) (38,103) (47,275) (6,963) 2,209 18.3% -4.7% (1,024,019) (855,375) (1,085,151) (168,643) 61,132 19.7% -5.6%

Gastos de Personal + Directorio (12,756) (10,180) (14,323) (2,576) 1,567 25.3% -10.9% (368,365) (307,918) (396,039) (60,447) 27,674 19.6% -7.0%

Gastos Generales (16,917) (14,151) (17,327) (2,765) 410 19.5% -2.4% (429,218) (356,107) (449,280) (73,110) 20,063 20.5% -4.5%

Depreciación + Amortización (7,045) (5,879) (4,830) (1,166) (2,215) 19.8% 45.9% (123,427) (101,858) (106,026) (21,569) (17,400) 21.2% 16.4%

Varios (8,349) (7,893) (10,796) (456) 2,447 5.8% -22.7% (103,010) (89,493) (133,806) (13,517) 30,796 15.1% -23.0%

UTIL.ANTES IMPTO RENTA 2,900 2,769 5,080 131 (2,180) 4.7% -42.9% 71,936 62,648 70,686 9,288 1,249 14.8% 1.8%

Impuesto a la Renta - - - - - 0.0% 0.0% (7,261) (7,130) (17,555) (131) 10,294 1.8% -58.6%

Resultado x Exposición Inflación-REI (416) (238) 157 (179) (573) 75.2% -364.8% (10,715) (11,126) 28,945 410 (39,660) -3.7% -137.0%

Ingr./(Cargas) Extraordinarias - - - - - 0.0% 0.0% - - - - - 0.0% 0.0%

UTIL/PDDA NETA 2,484 2,531 5,237 (47) (2,753) -1.9% -52.6% 53,959 44,393 82,076 9,567 (28,117) 21.6% -34.3%

UTIL/PDDA NETA (-) REI 2,484 2,531 5,080 (47) (2,596) -1.9% -51.1% 53,959 44,393 53,131 9,567 828 21.6% 1.6%

Strike Value S.A.

Ph +51(1) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100Comparative

3. Fuente: EVOLUCION BNM vs BANCA COMERCIAL ESTADOS FINANCIEROS COMPARATIVOS

Superintendencia de Banca y Seguros del Perú

ANALISIS FINANCIERO Nov-00 Sep-00 Dec-99 Nov-00 Sep-00 Dec-99

ESTRUCTURA PORCENTUAL

Fondos Disponibles/Activos 12.5% 12.2% 10.7% 20.6% 22.2% 21.0%

Invers.Financ.C/P/Activos 1.8% 2.0% 1.1% 1.2% 1.6% 0.1%

Colocaciones Netas/Activos 62.2% 65.1% 65.7% 52.6% 51.7% 53.3%

Colocaciones Brutas/Activos 66.1% 68.8% 69.1% 57.7% 56.9% 58.0%

Sobreg. + Av.Cta./Coloc.Brutas 5.8% 4.5% 5.2% 6.2% 6.3% 6.4%

Desc.+Préstamos/Coloc.Brutas 38.3% 40.7% 52.2% 58.5% 58.2% 62.3%

Activo Fijo/Activos 6.0% 5.7% 6.7% 3.6% 3.6% 3.7%

Depósitos/(Pasivo + Patrim) 34.1% 39.4% 36.9% 60.8% 61.2% 60.0%

Ahorros/Depósitos 11.5% 14.0% 15.7% 26.6% 27.2% 27.6%

Depósitos Plazo/Depósitos 72.1% 72.6% 72.3% 53.5% 54.0% 53.5%

Dep.Bcos.y Sist.Financ/Depósitos 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Financ.Recibido/Pasivo + Patrimonio 41.4% 38.3% 44.3% 17.9% 18.2% 19.1%

Valores en Circulac/Pasivos + Patrim. 0.0% 0.0% 0.0% 0.1% 0.1% 0.1%

Patrim.Neto/Pasivos + Patrim.Neto 9.7% 9.1% 9.3% 9.8% 9.3% 8.8%

COEFICIENTES OPERATIVOS Y DE RENTABILIDAD

Retorno Patrimonial (ROE) 3.4% 3.5% 7.6% 2.8% 2.4% 2.9%

Retorno sobre Activos (ROA) 0.3% 0.3% 0.7% 0.3% 0.2% 0.3%

Utilidad.(Pérdida)/TotalDepósitos 1.0% 0.8% 1.9% 0.4% 0.4% 0.4%

Ingr.Financieros/Activos Rentables 16.2% 11.8% 17.2% 14.4% 11.7% 15.0%

Retorno s/Activos en Riesgo RORA 0.4% 0.4% 0.8% 0.3% 0.3% 0.3%

Activos en Riesgo (US$ MM) $ 652 $ 697 $ 641 $ 15,823 $ 15,669 $ 16,216

Costo Operat./Rsltdo.Financ.Neto 133.3% 142.7% 108.9% 117.2% 120.2% 121.4%

Costo Operativo/TotalActivos 4.9% 3.8% 5.1% 4.6% 3.8% 4.6%

Gtos.Personal/TotalDepósitos 5.0% 3.3% 5.4% 3.0% 2.5% 3.2%

Gtos.Personal/TotalActivos 1.7% 1.3% 2.0% 1.8% 1.5% 1.9%

Costo Operativo/Activo Rentable 7.1% 5.3% 6.7% 6.1% 5.0% 6.0%

Participación Mercado Depósitos 2.1% 2.5% 2.1% 100.0% 100.0% 100.0%

Participación Mercado Colocaciones 4.4% 5.0% 4.3% 100.0% 100.0% 100.0%

CALIDAD DE ACTIVOS

CarteraAtrasada/Colocaciones Brutas 7.7% 7.2% 3.6% 10.3% 10.4% 8.4%

Cart.Atrasada + Refinanc/Coloc.Brutas 13.2% 11.1% 5.5% 16.9% 16.9% 13.6%

Prov.Incobrab./Cart.Atrasada + Rfncd. 44.3% 49.0% 90.0% 53.0% 53.7% 60.1%

Prov.Incobrab./Colocaciones Brutas 5.9% 5.5% 4.9% 8.9% 9.1% 8.2%

Prov.Incobrab./Colocaciones Netas 6.2% 5.8% 5.2% 9.8% 10.0% 8.9%

Activos Rentables-Pasivos Costosos $ (46,095) $ (43,773) $ (38,997) $ (462,624) $ (529,927) $ (283,995)

Activo Rentable Neto/ Total Activos (6.2%) (5.5%) (5.4%) (2.3%) (2.6%) (1.4%)

Colocaciones Brutas/TotalDepósitos 193.7% 175.0% 187.4% 95.0% 92.9% 96.7%

ActivoFijo/Patrimonio 61.9% 62.4% 71.4% 37.0% 39.2% 41.7%

LIQUIDEZ

ActivoLíquido/TotalDepósitos 36.8% 30.9% 28.9% 33.9% 36.3% 34.9%

Fncmto.Recibido/Colocac.Brutas (**) 62.6% 55.6% 64.2% 30.9% 31.9% 33.0%

DepósitosVista/TotalDepósitos 6.6% 7.5% 8.3% 15.5% 14.8% 15.0%

Interbanc.Recib./TotalDepósitos 121.2% 97.3% 120.3% 29.3% 29.5% 31.7%

Interbanc.Recib./TotalColocaciones 62.6% 55.6% 64.2% 30.8% 31.8% 32.8%

Interbanc.Otorg./TotalActivos 0.0% 1.4% 0.4% 0.6% 0.5% 0.4%

Interbanc.Otorg./Interbanc.Recibidas 8.4% 0.0% 0.0% 8.4% 100.2% 101.2%

CAPITALIZACION

Patrimonio/Total Activos 9.7% 9.1% 9.3% 9.8% 9.3% 8.8%

Patrimonio/Activos en Riesgo 11.1% 10.4% 10.4% 12.3% 11.9% 11.2%

Patrimonio/Colocaciones Brutas 14.7% 13.3% 13.5% 16.9% 16.3% 15.2%

Patrimonio/TotalDepósitos 28.4% 23.2% 25.3% 16.1% 15.2% 14.7%

Strike Value S.A.

Ph +51(1) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100Comparative