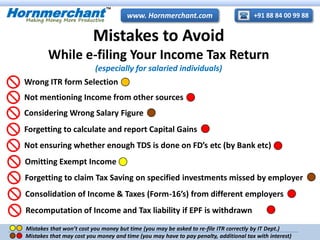

Mistakes to avoid while e filing your income tax return

- 1. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Mistakes to Avoid While e-filing Your Income Tax Return (especially for salaried individuals) Wrong ITR form Selection Considering Wrong Salary Figure Not mentioning Income from other sources Forgetting to calculate and report Capital Gains Not ensuring whether enough TDS is done on FD’s etc (by Bank etc) Omitting Exempt Income Forgetting to claim Tax Saving on specified investments missed by employer Consolidation of Income & Taxes (Form-16’s) from different employers Recomputation of Income and Tax liability if EPF is withdrawn Mistakes that won’t cost you money but time (you may be asked to re-file ITR correctly by IT Dept.) Mistakes that may cost you money and time (you may have to pay penalty, additional tax with interest)

- 2. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Wrong ITR form Selection Most of the salaried individuals select ITR Form-1 without thinking twice. Thanks to the fact that ITR Form-1 (and 4s) is made ‘web-based’ people tend to prefer this convenience. But as per the guidelines, Form-1 should not be used by a person having more than Rs. 5000/- exempt income (Agri Income, PPF interest, interest on tax-free bonds etc.) So, if you have any exempt income (i.e, the income on which you need not to pay tax) you should use ITR Form-2 . And also, this form should be used if you have any ‘Capital Gain’ income. Some times, few salaried individuals of private sector companies, Govt. doctors, semi-govt organisations’ engineers etc will have some income from their part time work (Ex: Agency Commission, Brokerage, Consultancy Fees etc). As per guidelines if a person has any income from Business or Profession, ITR Form-4 has to be used, immaterial how small is the income form such business / profession in comparison to his / her salary income. So, if you have any income from any business / profession (in addition to salary), you should use ITR Form-4

- 3. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Not mentioning Income from other sources Not mentioning all the incomes from all the sources (even unknowingly) may result in you becoming liable to pay higher taxes (with penalty and interest added). Many a times you might have forgotten few incomes you’ve earned from your Bank deposits and investments. If the TDS is done on such investments then most of the time they will show up in your Tax Credit Statement (Form 26 AS) • So, have a look at your Form 26 AS before you start filling the ITR form. Check whether there are any TDS / TCS entries; if so, add those payment credits to your total income for tax computation. • And also it is good to run through you Bank account transactions for the financial year to identify any income that you might have received and missed to consider for tax computation.

- 4. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Considering Wrong Salary Figure “Income from Salary” is nothing but what is given as “Income Chargeable Under the Head Salaries” in your Form-16 Further, in the ‘TDS’ tab, under the ‘Income Chargeable Under the Head Salaries’ column, there will be some figure appearing on itself. You may consider changing / matching it to actual figure as per Form-16 Many first time ITR filers get confused about the salary figure to be mentioned against “B1, Income from Salary”

- 5. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Forgetting to calculate and report Capital Gains Many a times people don’t realize that transactions like sale of assets like property, gold / silver, securities market investments etc attract ‘capital gain’ tax. There are two types of Capital Gain Taxes : Short Term and Long Term. Definition of Short and Long Term varies depending on the type of the asset These definitions and rate of taxes can be found easily on the internet or tax reference books. So, identify and report if you have any short term or long term capital gains. Again, don’t forget to use ITR Form-2 instead of ITR Form-1, if you have any Capital Gains.

- 6. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Not ensuring whether enough TDS is done on FD’s etc (by Bank etc) This is one of the frequent and most dangerous mistake done by many people. In fact many a times people have filed ‘Nil Tax Payable’, some times even claimed tax refund when actually they are suppose to pay additional 10% to 20% tax (balance tax after TDS). With the new ‘Web based’ ITR-1, it is much ‘easier’ to do this mistake. Though in the TDS tab, under the TDS 2, system automatically fills in the TDS on the income from non-salary income, it won’t consider the Income distributed and add it to the total income. You have to manually add this income received / credited to the total income. Then according to your tax slab, system calculates the correct tax liability. If required you should have to pay additional tax. For example, If you have a bank FD of Rs. 1 Lac, the interest income (@ 9%) Rs.9,000 is taxable and hence the bank should have deducted tax at the source (TDS). Most of the time TDS will be 10% and Rs. 900 should have been deducted. This TDS amount will, most of the times, automatically appear in the under TDS 2. But the interest income earned Rs. 9,000 will not be added automatically under “income from other sources”. But if you fall in a higher tax bracket, say 20%, you are suppose to pay total tax of Rs. 1,800 on this interest income. This will not be calculated unless you manually add the interest income under ‘income from other sources’.

- 7. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Omitting Exempt Income Exempt income have to be reported in the ITR, even though it is not going to be taxed. Further, if you (salaried) have exempt income more than Rs. 5,000/- then you should use ITR form-2 for filing the return instead of ITR-1 Forgetting to claim Tax Saving on specified investments missed by employer If by mistake your employer has missed considering your saving / investment eligible for tax exemption under section 80 C, or if you have made any tax saving investments after cut-off date for investment proof submission to the employer, you can very well claim the tax refund by reporting the amount invested under section 80 C.

- 8. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Consolidation of Income & Taxes (Form-16’s) from different employers If you have changed the jobs in the financial year, you will have one form-16 from each of the employer. You should pay attention to check whether double tax exemption is provided and / or sufficient TDS is done which will suffice the tax applicable to consolidated income. After consolidation, if any additional tax has to be paid, then pay it as ‘Self Assessment Tax’ and report the particulars under the ‘schedule IT’ (below TDS 2) in the TDS tab. Recomputation of Income and Tax Liability if EPF is withdrawn If you have withdrawn any EPF (Partially or Fully) before serving 5 years (single or multiple employers), then such withdrawal not only will be considered as income earned in the year of withdrawal (hence attracts Income Tax) but also, the tax exemption claimed in the present and previous years for EPF contribution, under section 80 C, will also be considered as salary income and will be taxed. That means, you are liable to pay tax on: • Withdrawn amount plus • Tax exemption claimed on PF contribution

- 9. +91 88 84 00 99 88www. Hornmerchant.comHornmerchant TM Making Money More Productive Last and Important Points: • Don’t forget to send (by ordinary post) the ITR V to CPC. • After you send it, ensure it is received by CPC (You will receive an e-mail confirming the receipt in few days of posting it. You can track the status on the e-filing portal or by calling CPC). • Watch out for an e-mail from CPC, Income Tax Dept. acknowledging the acceptance of your ITR filing. Even in case any discrepancy is found, CPC will send communication regarding the same by e-mail or post. • Check whether you have received tax refund, if any in to your account, maximum by end of October month. • In case you receive / have received any e-mail or letter communication asking for any discrepancy / clarification / rectification or Notice or Demand Note (to pay additional tax) from CPC, then consult a Tax Professional.