Excel Model for Valuation of Natural Gas Firm

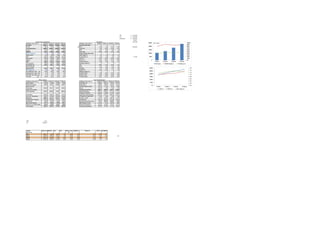

- 1. P/B 3 152.6448 P/E 11 158.0882 EV/EBITDA 6 12564.05 10404.7 138.7298 Y/E March, Fig in Rs. Cr FY2010 FY2011e FY2012e FY2013e Y/E March, Fig in Rs. Cr FY2010 FY2011e FY2012e FY2013e Net Sales 10649.1 13065.5 18026.6 23587.9 Per Share Data (Rs) % Chg. 26.3 22.7 38.0 30.9 100 EPS 5.4 7.8 10.4 14.4 149.8209 Total Expenditure 9802.6 11858.7 16458.6 21493.9 Cash EPS 7.5 10.2 12.9 17.5 % Chg. 30.2 21.0 38.8 30.6 DPS 3.2 3.0 3.0 3.0 EBIDTA 846.5 1206.8 1568.0 2094.0 Book Value 29.8 34.8 41.6 50.9 EBIDTA Margin % 7.9 9.2 8.7 8.9 Capital, Liquidity, Returns Ratio Other Income 97.8 53.5 55.9 97.8 Debt / Equity (x) 1.1 1.3 1.3 1.2 EBIT 944.3 1260.3 1623.8 2191.8 Current Ratio (x) 1.4 1.4 1.4 1.4 15.55% Depreciation 160.9 185.6 194.8 237.8 ROE (%) 18.1 22.3 24.9 28.2 Interest 184.0 200.0 264.1 335.5 ROCE (%) 18.7 20.2 21.3 24.9 PBT 599.5 874.6 1164.9 1618.4 Dividend Yield (%) 2.5 2.3 2.3 2.3 Tax Provisions 195.0 292.6 388.5 540.6 Valuation Ratio (x) Profit After Tax 404.5 582.1 776.4 1077.9 P/E 24.5 17.0 12.8 9.2 Minority Interest - - - - P/BV 4.4 3.8 3.2 2.6 Reported PAT 404.5 582.1 776.4 1077.9 EV/Sales 1.1 0.9 0.7 0.5 PAT Margin (%) 3.8 4.5 4.3 4.6 EV/EBIDTA 14.3 10.0 7.7 5.8 Raw Materials / Sales (%) 90.8 89.5 90.0 89.9 Efficiency Ratio (x) Employee Exp / Sales (%) 0.2 0.2 0.2 0.2 Inventory (days) 8.4 15.0 15.0 15.0 Other Mfr. Exp / Sales (%) 0.1 0.1 0.1 0.1 Debtors (days) 17.3 18.0 18.0 18.0 Tax Rate (%) 32.5 33.4 33.4 33.4 Creditors (days) 22.8 23.0 23.0 23.0 Y/E March, Fig in Rs. Cr FY2010 FY2011e FY2012e FY2013e Y/E March, Fig in Rs. Cr FY2010 FY2011e FY2012e FY2013e Share Capital 750.0 750.0 750.0 750.0 Profit After Tax 404.5 582.1 776.4 1077.9 Reserves & Surplus 1484.9 1862.7 2366.6 3066.1 Depreciation 160.9 185.6 194.8 237.8 Minority Interest - - - - Working Capital Changes 225.1 -171.2 -63.2 -66.9 Total Loans 2499.8 3301.7 4194.1 4665.6 Others 107.6 0.0 0.0 0.0 Deferred Tax Liability - - - - Operating Cash Flow 898.1 596.6 907.9 1248.8 Total Liabilities 4734.7 5914.4 7310.7 8481.8 Capital Expenditure -1046.1 -1064.2 -1271.4 -1117.7 Change in Investment -234.4 -96.0 -114.0 -135.5 Gross Block 3549.5 4363.7 6589.7 7437.5 Cash Flow from Investing -1280.4 -1160.1 -1385.4 -1253.2 Less: Acc. Depreciation 666.7 852.3 1047.0 1284.9 Proceeds from equity issue 0.0 0.0 0.0 0.0 Net Block 2882.9 3511.4 5542.7 6152.6 Inc/(Dec) in Debt 218.1 801.9 892.4 471.5 Capital Work in Progress 1318.4 1568.4 613.7 883.7 Dividend Paid -153.1 -204.3 -272.5 -378.3 Investments 538.6 634.6 748.6 884.0 Cash Flow from Financing 65.1 597.6 619.9 93.2 Net Current Assets 321.1 526.3 732.0 887.7 Net Change in Cash -317.3 34.1 142.5 88.8 Deferred Tax Assets/Liability -326.2 -326.2 -326.2 -326.2 Opening Cash Balance 657.8 340.5 374.5 517.0 Total Assets 4734.7 5914.4 7310.7 8481.8 Closing Cash Balance 340.5 374.5 517.0 605.8 CMP 132.1 EV 12066.82 Net RevenueEBITDA PAT EPS 2010 10649.1 846.5 404.5 5.4 -28.2 18.1 18.7 24.5 14.3 2011E 13065.5 1206.8 582.1 7.8 43.9 22.3 20.2 17.0 10.0 100 2012E 18026.6 1568.0 776.4 10.4 33.4 24.9 21.3 12.8 7.7 2013E 23587.9 2094.0 1077.9 14.4 38.8 28.2 24.9 9.2 5.8 EV/ EBITDA(X) Key Ratios Cash Flow Statement Profit and Loss Statement Balance Sheet Y/E Mar (Rs Crore) EPS Growth (%) RONW (%) ROCE (%) P/E (X) 0% 100% 200% 300% 400% 500% 600% 700% 800% 900% 1000% 0 5000 10000 15000 20000 25000 FY2010 FY2011e FY2012e FY2013e Net Sales EBIDTA Margin % PAT Margin (%) Rs crores 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 0% 500% 1000% 1500% 2000% 2500% 3000% FY2010 FY2011e FY2012e FY2013e ROE (%) ROCE (%) Debt / Equity (x)

- 2. Petronet LNG Ltd. Balance Sheet - Standalone - Actual - Schedules- [INR-Crore] DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 SOURCES OF FUNDS: Share Capital 750.00 750.00 750.00 750.00 750.00 750.00 750.00 750 750.00 Face Value 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 Share Warrants & Outstandings 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Total Reserves 127.02 321.95 525.52 868.55 1233.43 1484.88 1862.66 2366.564 3066.12 Shareholder's Funds 877.02 1071.95 1275.52 1618.55 1983.43 2234.88 2612.66 3116.564 3816.12 Secured Loans 1259.89 1259.89 1383.20 1577.62 2281.70 2299.77 3101.70 3994.10 4465.61 Unsecured Loans 200.04 200.04 200.04 200.04 Total Debts 1259.89 1259.89 1383.20 1577.62 2281.70 2499.81 3301.74 4194.14 4665.65 Total Liabilities 2136.91 2331.84 2658.71 3196.17 4265.13 4734.69 5914.40 7310.705 8481.77 1.44 1.18 1.08 0.97 1.15 1.12 1.26 1.35 1.22 APPLICATION OF FUNDS : Gross Block 1908.83 1942.10 1945.53 1971.80 1974.82 3549.51 4363.67 6589.75 7437.47 Less: Accumulated Depreciation 98.96 199.70 301.66 403.83 506.20 666.65 852.28 1047.03 1284.88 Net Block 1809.87 1742.39 1643.87 1567.97 1468.62 2882.86 3511.39 5542.714 6152.59 Capital Work in Progress 80.39 120.35 483.39 1061.36 1846.98 1318.36 1568.36 613.67 883.67 Investments 17.89 156.90 278.01 547.32 304.26 538.62 634.58 748.57 884.05 Long Term Investment 0.00 0.00 0.01 21.20 32.06 117.60 129.36 142.29 156.52 Currents Investments 17.89 156.90 278.00 526.12 272.21 421.02 505.23 606.27 727.53 Current Assets, Loans & Advances Inventories 126.66 103.90 209.93 90.95 385.58 222.26 480.44 666.92 871.15 Sundry Debtors 119.65 127.75 331.29 332.99 671.15 503.48 644.33 888.98 1163.24 Cash and Bank 297.98 250.60 340.47 358.56 657.79 340.50 374.55 517.00 605.80 Other Current Assets 8.58 4.35 6.60 8.07 25.75 12.16 20.28 29.49 40.65 As a % of Net sales 0.44% 0.11% 0.12% 0.12% 0.31% 0.11% 0.16% 0.16% 0.17% Loans and Advances 20.37 58.57 200.02 356.99 69.40 143.20 195.98 270.40 353.82 As a % of Net sales 1.05% 1.53% 3.63% 5.45% 0.82% 1.34% 1.50% 1.50% 1.50% Total Current Assets 573.23 545.17 1088.31 1147.56 1809.67 1221.60 1715.57 2372.79 3034.65 Less: Current Liabilities and Provisions Current Liabilities 357.31 146.06 398.11 428.75 736.52 744.87 993.33 1370.44 1793.17 Sundry Creditors 350.55 136.85 312.52 338.79 571.51 604.26 823.30 1135.92 1486.36 Other Deposits 0.12 0.11 0.10 0.16 0.17 0.16 0.17 0.17 0.17 Other Liabilities 6.64 9.10 85.49 89.80 164.85 140.45 169.85 234.35 306.64 As a % of Net sales 0.3% 0.2% 1.6% 1.4% 2.0% 1.3% 1.30% 1.30% 1.30% Provisions 1.16 26.42 189.56 430.09 155.69 155.68 195.98 270.40 353.82 As a % of Net sales 0.06% 0.69% 3.44% 6.56% 1.85% 1.46% 1.50% 1.50% 1.50% Total Current Liabilities 358.47 172.47 587.67 858.84 892.21 900.55 1189.31 1640.84 2146.99 Net Current Assets 214.76 372.70 500.64 288.73 917.46 321.05 526.27 731.95 887.66 Deferred Tax Assets / Liabilities 14.00 -60.50 -247.20 -269.20 -272.20 -326.20 -326.20 -326.20 -326.20 Total Assets 2136.91 2331.84 2658.71 3196.17 4265.13 4734.69 5914.40 7310.71 8481.77 Contingent Liabilities 582.93 702.90 981.14 1270.80 1504.15 1334.28 Book Value 11.69 14.29 17.01 21.58 26.45 29.80 34.84 41.55 50.88 Adjusted Book Value 11.69 14.29 17.01 21.58 26.45 29.80 34.84 41.55 50.88 Cash Flow Statement Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 PAT -28.45 194.93 313.25 474.65 518.44 404.50 582.09 776.41 1077.87 Dep 96.80 100.96 102.03 102.18 102.52 160.86 185.63 194.75 237.85 Others 148.79 373.33 43.99 5.86 107.59 Operating profit before WC Changes 68.36 444.67 788.61 620.82 626.82 672.95 767.71 971.16 1315.72 Change in Current Assets -19.31 -453.28 -41.15 -362.88 270.77 -459.92 -514.76 -573.06 Change in Current Liabilities -211.25 252.06 30.63 307.78 8.35 248.46 377.11 422.73 Provisions 25.26 163.15 240.53 -274.41 -0.01 40.30 74.42 83.42 Deferred Tax Liability -74.50 -186.70 -22.00 -3.00 -54.00 0.00 0.00 0.00 Net Cash from Operating Activities 164.87 563.84 828.83 294.31 898.06 596.55 907.93 1248.81 Purchase Fixed Asset -33.27 -3.44 -26.26 -3.03 -1574.69 -814.15 -2226.08 -847.72 CWIP -39.96 -363.04 -577.97 -785.63 528.63 -250.00 954.69 -270.00 Purchase/Sale of investments -139.01 -121.11 -269.31 243.06 -234.36 -95.96 -113.98 -135.48 Cash from Investing Activities -212.24 -487.59 -873.54 -545.60 -1280.42 -1160.12 -1385.37 -1253.20 Change in Minority Interest This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 3. Issue of capital 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Debt borowed 0.00 123.30 194.43 704.07 218.12 801.92 892.41 471.51 Premium on Issue of Capital Repayment of Debt Dividend Paid and DDT Tax 0.00 -109.68 -131.62 -153.56 -153.05 -204.30 -272.51 -378.32 Cash From Financing Activities 0.00 13.62 62.81 550.52 65.06 597.62 619.90 93.19 Foreign currency translation Cash from all the activities -47.37 89.87 18.10 299.23 -317.30 34.05 142.45 88.80 Opening balance of Cash 297.98 250.60 340.47 358.56 657.79 340.50 374.55 517.00 Closing balance of Cash 250.60 340.47 358.56 657.79 340.50 374.55 517.00 605.80 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 4. Petronet LNG Ltd. Profit And Loss - Standalone - Actual - Schedules- [INR-Crore] DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 FY10 FY11e FY12e FY13e No of Months INCOME : Net Sales 1945.26 3837.17 5508.95 6555.31 8428.70 10649.09 13065.49 18026.6 23587.87 30.4% Revenue growth rate (%) 97.3% 43.6% 19.0% 28.6% 26.3% 22.7% 38.0% 30.9% EXPENDITURE : Raw Material Consumed 1613.41 3092.57 4746.47 5566.42 7375.63 9664.76 11690.66 16228.45 21197.92 As a % of Net Sales 82.9% 80.6% 86.2% 84.9% 87.5% 90.8% 89.5% 90.0% 89.9% Power & Fuel Cost 31.08 38.08 42.90 44.40 37.54 48.00 58.45 81.14 105.99 As a % of Net Sales 1.9% 1.2% 0.9% 0.8% 0.5% 0.5% 0.5% 0.5% 0.5% Employee Cost 8.12 10.17 11.32 19.29 17.95 19.01 24.48 31.60 36.25 As a % of Net Sales 0.4% 0.3% 0.2% 0.3% 0.2% 0.2% 0.2% 0.2% 0.2% Other Manufacturing Expenses 8.86 5.63 14.16 9.38 11.84 12.59 17.19 23.72 31.04 As a % of Net Sales 0.5% 0.2% 0.3% 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% General and Administration Expenses 124.50 192.12 45.59 48.18 50.32 56.63 65.33 90.13 117.94 As a % of Net Sales 6.4% 5.0% 0.8% 0.7% 0.6% 0.5% 0.5% 0.5% 0.5% Miscellaneous Expenses 8.82 10.43 0.43 2.30 33.59 1.61 2.61 3.61 4.72 As a % of Net Sales 0.5% 0.3% 0.0% 0.0% 0.4% 0.0% 0.0% 0.0% 0.0% Total Expenditure 1794.79 3349.01 4860.88 5689.96 7526.86 9802.60 11858.73 16458.65 21493.86 As a % growth 86.6% 45.1% 17.1% 32.3% 30.2% 21.0% 38.8% 30.6% As a % of Net Sales 92.3% 87.3% 88.2% 86.8% 89.3% 92.1% 90.8% 91.3% 91.1% Operating Profit (Excl OI) 150.48 488.16 648.07 865.35 901.84 846.49 1206.76 1567.96 2094.01 EBITDA Margin (%) 7.7% 12.7% 11.8% 13.2% 10.7% 7.9% 9.2% 8.7% 8.9% Other Income 13.27 19.44 36.59 54.38 76.50 97.83 53.49 55.88 97.80 Operating Profit 163.75 507.60 684.66 919.73 978.34 944.32 1260.25 1623.84 2191.81 Interest 109.39 111.61 107.05 102.38 101.78 183.97 199.99 264.14 335.53 As a % of Debt 8.7% 8.9% 7.7% 6.5% 4.5% 7.4% 6.1% 6.3% 7.2% PBDT 54.36 395.99 577.61 817.35 876.56 760.36 1060.27 1359.70 1856.28 Depreciation 96.80 100.96 102.03 102.18 102.52 160.86 185.63 194.75 237.85 As a % of Gross Fixed Assets 5.1% 5.2% 5.2% 5.2% 5.2% 4.5% 5.1% 5.1% 5.1% Profit Before Taxation -42.45 295.04 475.58 715.17 774.04 599.50 874.64 1164.94 1618.43 Provision for Tax -14.00 100.11 162.33 240.52 255.60 195.00 292.56 388.53 540.56 Tax rate 33.9% 34.1% 33.6% 33.0% 32.5% 33.4% 33.4% 33.4% Profit After Tax -28.45 194.93 313.25 474.65 518.44 404.50 582.09 776.41 1077.87 38.6% PAT growth rate (%) -22.0% 43.9% 33.4% 38.8% Proposed Equity Dividend 93.75 112.50 131.25 131.25 174.63 232.92 323.36 As a % of PAT 29.9% 23.7% 25.3% 32.4% 30.00% 30.00% 30.00% Corporate Dividend Tax 15.93 19.12 22.31 21.80 29.68 39.59 54.96 17% 17% 17% 17% 17% 17% 17% Earnings Per Share -0.38 2.60 4.18 6.33 6.91 5.39 7.76 10.35 14.37 Adjusted EPS -0.38 2.60 4.18 6.33 6.91 5.39 7.76 10.35 14.37 -30% -20% -10% 0% 10% 20% 30% 40% 50% 0 5000 10000 15000 20000 25000 FY10 FY11e FY12e FY13e Net Sales Profit After Tax Revenue growth rate (%) PAT growth rate (%) Rs crores In (%) This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 5. Loan Book DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Secured Loans Term Loans - Banks 1050.89 1050.89 1183.60 1390.57 1432.04 1292.07 1992.07 2832.07 3588.07 Debt Repayment 100.00 300.00 900.00 Short Term Loan Secured Short Term Loans - Banks 0.00 0.00 0.00 0.00 200.00 200.00 200.00 200.00 Other Secured 209.00 209.00 199.60 187.06 849.65 807.70 1009.62 1262.03 1577.54 Total Secured Loans 1259.89 1259.89 1383.20 1577.62 2281.70 2299.77 3101.70 3994.10 4465.61 Unsecured Loans 200.04 Unsec. Short Term - Others 200.04 200.04 200.04 200.04 Total Debts 1259.89 1259.89 1383.20 1577.62 2281.70 2499.81 3301.74 4194.14 4665.65 Interest % 8.68% 8.86% 7.74% 6.49% 4.46% 7.36% 8.0% 8.0% 8.0% Interest 109.39 111.61 107.05 102.38 101.78 183.97 264.14 335.53 373.25 Interest to be capitalized 64.15 71.39 37.72 Interest 199.99 264.14 335.53 Capital Expenditure Particulars Dahej Terminal Kochi Terminal 2nd Berth at Dahej Equity 250.00 250.00 60.00 Debt 550.00 600.00 120.00 Total 800.00 850.00 180.00 Completion Q1FY14 Q4FY12 Q1FY12 Particulars FY11E FY12E FY13E Capital Expenditure---- 1000.00 1200.00 1080.00 Net block 750.00 900.00 810.00 CWIP 250.00 300.00 270.00 Debt Undertaken 700.00 840.00 756.00 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 6. EMPLOYEE COST DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Salaries, Wages & Bonus 6.79 8.79 9.88 17.11 15.84 16.21 21.08 27.4 31.5 % growth 29.49% 12.36% 73.20% -7.46% 2.39% 30.00% 30.00% 15.00% Contributions to EPF & Pension Funds 0.96 0.93 1.18 1.87 1.89 1.97 2.53 3.3 3.8 As a % of Salaries, Wages & Bonus 14.2% 10.5% 11.9% 10.9% 11.9% 12.1% 12.0% 12.0% 12.0% Workmen and Staff Welfare Expenses 0.37 0.45 0.26 0.31 0.22 0.83 0.87 0.91 0.96 As a % of Salaries, Wages & Bonus 5.4% 5.1% 2.7% 1.8% 1.4% 5.1% 4.1% 3.3% 3.0% TOTAL 8.12 10.17 11.32 19.29 17.95 19.01 24.48 31.60 36.25 MANUFACTURING EXPENSES DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Sub-contracted / Outsourced services Processing Charges 5.76 0.88 0.83 1.52 1.26 1.77 2.61 3.61 4.72 As a % of Net Sales 0.30% 0.02% 0.02% 0.02% 0.01% 0.02% 0.02% 0.02% 0.02% Repairs and Maintenance 2.52 2.73 9.68 3.32 4.73 4.26 6.53 9.01 11.79 As a % of Net Sales 0.13% 0.07% 0.18% 0.05% 0.06% 0.04% 0.05% 0.05% 0.05% Stores, spare parts and tools consumed 0.58 2.02 3.65 4.54 5.84 6.56 8.05 11.10 14.52 As a % of Net Sales 0.0% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% TOTAL 8.86 5.63 14.16 9.38 11.84 12.59 17.19 23.72 31.04 General Adminstration Expenses DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Rent, Rates & Taxes 86.57 169.48 7.64 5.60 6.44 7.44 Insurance 13.58 12.68 13.39 12.15 10.79 15.09 Repairs & Maintenance - Others Printing and stationery Professional and legal fees 7.86 4.37 6.47 7.25 11.10 10.44 Traveling and conveyance 4.18 4.67 5.65 6.16 5.87 5.99 Payment to Auditors 0.06 0.06 0.07 0.10 0.15 0.26 Hire Charges - Admin 11.53 Packing expenses Communication Expenses Training Expenses Wealth Tax 0.01 0.02 0.01 0.01 Director's remuneration 0.72 0.86 0.79 4.83 3.24 1.54 Other Administration 11.56 12.09 12.72 15.88 Administration Expenses Capitalised MISCELLANEOUS EXPENSES DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Deferred Revenue Expenditure Written Off 1.28 Bad debts/advances written off Provision for doubtful debts 0.80 Loss on disposal of fixed assets (net) 0.04 0.07 0.08 0.06 0.57 Loss on foreign exchange fluctuations 2.06 0.29 1.23 33.26 Loss on sale of non-trade current investments Diminution in the value of Long Term Investments Provisions & write off 1.96 0.80 Loss on Future and Options Donations 0.01 0.06 0.22 0.33 1.04 Other Miscellaneous Expenses 4.73 8.31 Miscellaneous Expenses Capitalised OTHER INCOME DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Interest Received 7.76 13.63 17.46 23.50 42.61 28.49 32.83 39.06 45.28 Interest on Deposits 7.76 13.63 17.46 22.81 39.63 25.62 29.96 36.19 42.41 As a % cash 2.6% 5.4% 5.1% 6.4% 6.0% 7.5% 8.00% 7.00% 7.00% Interest on Investments 2.20 2.20 2.20 2.20 Interest on Others 0.69 2.98 0.67 0.67 0.67 0.67 Dividend Received 2.41 18.63 29.86 16.68 22.21 26.20 30.94 As a % of Investment 13.45% 3.40% 9.82% 3.10% 3.50% 3.50% 3.50% Commission Received Export Incentives Discounts Profit on sale of Fixed Assets 0.50 Profits on sale of Investments 2.66 4.76 15.16 8.68 3.12 0.44 Income from mutual Funds Income from other investments Diminution in carrying cost of investments Sale of Scrap - Other Income Service Fee Gain on Forward Contracts/Forex Foreign Exchange Gains 0.35 51.88 Lease / Rental Income Grants from Government Transfer from capital reserve / Capital grants Bad debts recovered Provision Written Back 2.65 0.92 0.29 0.03 Claims Received 0.80 Others 0.09 1.05 1.33 1.85 0.12 0.31 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 7. Total 13.27 19.44 36.59 54.38 76.50 97.83 55.04 65.26 76.22 INVENTORY DESCRIPTION Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Raw Materials 88.48 56.12 161.09 41.68 369.38 137.76 0.0 Stores and Spare 2.86 11.59 13.88 16.71 16.20 17.32 Goods in transit 35.33 36.18 34.96 32.56 0.00 67.18 Total 126.66 103.90 209.93 90.95 385.58 222.26 480.44 666.92 871.15 Inventory Turnover 12.7 29.8 22.6 61.2 19.1 43.5 Inventory Holding Days (In days) 28.65 12.26 16.14 5.96 19.08 8.39 15 15 15 Volume SUNDRY DEBTORS Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Sundry Debtors 119.65 127.75 331.29 332.99 671.15 503.48 644.33 888.98 1163.24 DEBTORS TURNOVER 16.26 30.04 16.63 19.69 12.56 21.15 Debtors turnover days 22.45 12.15 21.95 18.54 29.06 17.26 18 18 18 SUNDRY CREDITORS Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Sundry Creditors 350.55 136.85 312.52 338.79 571.51 604.26 823.30 1135.92 1486.36 Creditors turnover 4.60 22.60 15.19 16.43 12.91 15.99 Creditors Holding period 79.30 16.15 24.03 22.21 28.28 22.82 23 23 23 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 8. Petronet LNG Ltd. Quarterly-Y-O-Y(%)-Standalone- [INR-Crore] DESCRIPTION Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 9M FY11 Gross Sales 2654.88 2612.38 3406.66 2213.00 2385.46 2525.96 3057.72 3600.45 9184.13 Less: Excise Duty 0.00 0.00 0.00 Net Sales 2654.88 2612.38 3406.66 2213.00 2385.46 2525.96 3057.72 3600.45 9184.13 Other operating income 0.00 0.00 31.60 0.00 27.19 27.19 Net Sales & Other Operating Income 2654.88 2612.38 3406.66 2244.59 2385.46 2525.96 3057.72 3627.64 9211.32 Total Expenditure 2313.16 2430.61 3152.93 2035.84 2183.25 2278.23 2786.09 3282.03 8346.35 (Increase) / Decrease In Stocks 0.00 0.00 0.00 Purchase of Finished Goods 0.00 0.00 0.00 Cost of Services & Raw Materials 2253.27 2401.97 3118.95 2002.60 2141.25 2233.27 2754.73 3238.91 8226.91 84.9% 91.9% 91.6% 90.5% 89.8% 88.4% 90.1% 90.0% 89.6% Excise Duty 0.00 0.00 0.00 Operating & Manufacturing Expenses 51.45 24.55 29.90 29.12 33.86 37.63 26.07 37.39 101.09 Electricity, Power & Fuel Cost 0.00 0.00 0.00 Employee Cost 8.44 4.09 4.08 4.12 8.14 7.34 5.29 5.73 18.36 General Administration Expenses 0.00 0.00 0.00 Selling & Distribution Expenses 0.00 0.00 0.00 Loss on Foreign Exchange 0.00 0.00 0.00 Loss on Foreign Exchange Loan 0.00 0.00 0.00 Miscellaneous Expenses 0.00 0.00 0.00 PBIDT (Excl OI) 341.72 181.77 253.73 208.75 202.20 247.72 271.63 345.61 864.96 Other Income 19.92 28.84 19.08 16.73 33.18 12.59 18.59 5.41 36.59 Operating Profit 361.64 210.62 272.81 225.48 235.38 260.32 290.22 351.02 901.56 Interest 26.54 28.35 51.08 53.40 51.10 49.81 49.48 50.70 149.99 0.00 Exceptional Items 0.00 0.00 0.00 PBDT 335.11 182.27 221.73 172.08 184.28 210.51 240.74 300.32 751.57 Depreciation 25.30 25.61 43.05 46.56 45.64 46.13 46.61 46.48 139.22 PBT 309.80 156.66 178.68 125.51 138.64 164.37 194.12 253.84 612.33 Tax 105.45 53.35 58.00 42.30 41.35 53.00 63.00 83.00 199.00 Profit After Tax 204.35 103.31 120.68 83.21 97.29 111.37 131.12 170.84 413.33 Extraordinary Items 0.00 0.00 0.00 Prior Period Expenses 0.00 0.00 0.00 Other Adjustments 0.00 0.00 0.00 Net Profit (after Extraordinary Items) 204.35 103.31 120.68 83.21 97.29 111.37 131.12 170.84 413.33 0.00 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 9. Equity Capital 750.00 750.00 750.00 750.00 750.00 750.00 750.00 750.00 2250.00 Face Value (In Rs) 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 30.00 Reserves 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Basic EPS before Extraordinary Items 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Basic EPS after Extraordinary Items 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Calculated EPS (Unit.Curr.) 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Calculated EPS Annualised (Unit.Curr.) 10.90 5.51 6.44 4.44 5.19 5.94 6.99 9.11 22.04 Adj Calculated EPS (Unit.Curr.) 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Adj Calculated EPS Annualised (Unit.Curr.) 10.90 5.51 6.44 4.44 5.19 5.94 6.99 9.11 22.04 Diluted EPS before Extraordinary Items 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Diluted EPS after Extraordinary Items 2.72 1.38 1.61 1.11 1.30 1.48 1.75 2.28 5.51 Number of Public Share Holding ######### ######## ######## ######## ######## ######## ######## ######## % of Public Share Holding 50.00 50.00 50.00 50.00 50.00 50.00 50.00 50.00 PBIDTM% (Excl OI) 12.87 6.96 7.45 9.30 8.48 9.81 8.88 9.53 PBIDTM% 13.62 8.06 8.01 10.05 9.87 10.31 9.49 9.68 PBDTM% 12.62 6.98 6.51 7.67 7.73 8.33 7.87 8.28 PBTM% 11.67 6.00 5.24 5.59 5.81 6.51 6.35 7.00 PATM% 7.70 3.95 3.54 3.71 4.08 4.41 4.29 4.71 Promoters No of Shares 0.00 0.00 Pledged / Encumbered Encumbered No of Shares 0.00 0.00 Encumbered % of Promoter Holdings Encumbered % of Share Capital Non Encumbered 0.00 0.00 Non Encumbered No of Shares ######### ######## ######## ######## ######## ######## ######## ######## Non Encumbered % of Promoter Holdings 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 Non Encumbered % of Share Capital 50.00 650.00 50.00 50.00 50.00 50.00 50.00 50.00 Type Reported Reported Reported Reported Reported Reported Reported Reported Notes Notes Notes Notes Notes Notes Notes Notes This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 10. Forecasted Reported Mar-11 FY11 9MFY10 3854.2 13038.3 8232.04 0.00 Y/E March, Fig in Rs. Cr Q3FY11 Q3FY10 YoY (%) 9MFY11 9MFY10 YoY (%) FY10 3854.2 13038.3 8232.04 Net Sales 3627.6 2244.6 61.6% 9211.3 8263.6 11.5% 10649.1 31.60 Total Expenditure 3282.0 2035.8 61.2% 8346.4 7619.4 9.5% 9802.6 3854.2 13065.5 8263.63 EBDITA 345.6 208.8 65.6% 865.0 644.3 34.3% 846.5 7619.38 EBDITA Margin 9.5% 9.3% 9.4% 7.8% 7.9% 0.00 Other Income 5.4 16.7 -67.7% 36.6 64.7 -43.4% 97.8 0.00 PBDIT 351.0 225.5 55.7% 901.6 708.9 27.2% 944.3 3463.75 11690.66 7523.52 Depreciation 46.5 46.6 -0.2% 139.2 115.2 20.8% 160.9 89.9% 2.74 Interest 50.7 53.4 -5.1% 150.0 115.2 30.2% 184.0 0 0.00 PBT 253.8 125.5 102.2% 612.3 478.5 28.0% 599.5 83.57 Tax Provisions 83.0 42.3 96.2% 199.0 153.7 29.5% 195.0 0.00 Reported PAT 170.8 83.2 105.3% 413.3 324.8 27.3% 404.5 6 12.29 PAT Margin 4.7% 3.7% 4.5% 3.9% 3.8% 0.00 0.00 0.00 0.00 0.00 644.25 64.65 708.91 132.83 0.00 0.00 576.08 185.6266667 115.22 460.85 153.65 307.20 0.00 0.00 0.00 307.20 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 11. Domestic Natural Gas Particulars (MMSCMD) 2010-11 2011-12 2012-13 2013-14 2014-15 Demand 178.9 253.4 306.4 341.1 381 Supply 146 155 191.6 198.4 202.9 BP Statistical Review Global (BCM) Particulars 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Supply 2332 2412.6 2477.5 2520.2 2617.2 2694 2779.5 2880.2 2954.7 3060.8 2987 Demand 2321.3 2410.8 2455.3 2516.5 2600.9 2681.4 2767.5 2829.5 2937.1 3010.8 2940.4 India (BCM) Particulars 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Supply 25.1 26.4 26.4 27.6 29.5 29.2 29.6 29.3 30.1 30.5 39.3 Demand 25.1 26.4 26.4 27.6 29.5 31.9 35.7 37.3 40.1 41.3 51.9 0 50 100 150 200 250 300 350 400 450 2010-11 2011-12 2012-13 2013-14 2014-15 Demand Supply 2000 2100 2200 2300 2400 2500 2600 2700 2800 2900 3000 3100 3200 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Supply Demand In BCM 50 60 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 12. Another View Particulars 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011e 2012e 2013e 2014e Supply 70.28 73.92 73.92 77.28 82.6 81.76 82.88 82.04 84.28 85.4 110.04 146 155 191.6 198.4 202.9 Demand 70.28 73.92 73.92 77.28 82.6 89.32 99.96 104.44 112.28 115.64 145.32 178.9 253.4 306.4 341.1 381 Demand- Supply Gap 0 0 0 0 0 7.56 17.08 22.4 28 30.24 35.28 32.9 98.4 114.8 142.7 178.1 Demand growth rate 5.2% 0.0% 4.5% 6.9% -1.0% 1.4% -1.0% 2.7% 1.3% 28.9% 32.7% 6.2% 23.6% 3.5% 2.3% Supply growth rate 5.2% 0.0% 4.5% 6.9% -1.0% 1.4% -1.0% 2.7% 1.3% 28.9% 32.7% 6.2% 23.6% 3.5% 2.3% 0.401824 Year Coal Oil Gas Hydel Nuclear 1997-98 55 35 7 2 1 2001-02 50 32 15 2 1 2006-07 50 32 15 2 1 2010-11 53 30 14 2 1 2024-25 50 25 20 2 3 0 10 20 30 40 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Supply Demand 0 50 100 150 200 250 300 350 400 450 Supply Demand Widening Demand Supply Gap In mmscmd 0 20 40 60 80 100 120 1997-98 2001-02 2006-07 2010-11 2024-25 Coal Oil Gas Hydel Nuclear In (%) -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 0 50 100 150 200 250 Supply Supply growth rate In mmscmd This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 13. Sector Wise demand break up in natural gas in India Sector 2009-10 2010-11e 2011-12e 2012-13e 2013-14e 2014-15e Power 66.6 68.8 74.6 87.1 96.8 104.8 3.3% 8.4% 16.8% 11.1% 8.3% Fertilizer 42.9 44.4 44.4 56 57.5 6 3.5% 0.0% 26.1% 2.7% -89.6% Captive Power 12.1 13.8 15.7 17.7 19.9 22.3 14.0% 13.8% 12.7% 12.4% 12.1% City gas distribution 10.1 14.4 16.8 21.3 25.8 31.8 42.6% 16.7% 26.8% 21.1% 23.3% Refinery 11.4 30 42 52 54 58 163.2% 40.0% 23.8% 3.8% 7.4% Petrochemicals 6.7 8.7 8.7 12.6 13.5 13.5 29.9% 0.0% 44.8% 7.1% 0.0% Sponge iron 6.3 7.1 7.4 7.5 7.5 7.6 12.7% 4.2% 1.4% 0.0% 1.3% 156.1 187.2 209.6 254.2 275 244 19.9% 12.0% 21.3% 8.2% -11.3% 0 50 100 150 200 250 300 2009-10 2010-11e 2011-12e 2012-13e 2013-14e 2014-15e Power Fertilizer Captive Power City gas distribution Refinery Petrochemicals Sponge iron In mmscmd -100.0% -75.0% -50.0% -25.0% 0.0% 25.0% 50.0% 2010-11e 2011-12e 2012-13e 2013-14e 2014-15e Power Fertilizer Captive Power City gas distribution This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 14. Date JCC prices (USD/bbl) LNG CIF Prices (USD/mmbtu) Price to customers 2/28/1999 11.46 2.70 23.6% 4.5 3/31/1999 11.23 2.76 24.6% 4.5 4/30/1999 12.91 2.78 21.5% 4.5 5/31/1999 15.52 2.76 17.8% 4.5 6/30/1999 16.34 2.75 16.8% 4.5 7/31/1999 16.67 2.86 17.2% 4.6 8/31/1999 18.51 3.09 16.7% 4.9 9/30/1999 20.21 3.27 16.2% 5.1 10/31/1999 22.54 3.44 15.3% 5.2 11/30/1999 23.12 3.61 15.6% 5.4 12/31/1999 24.66 3.9 15.8% 5.7 1/31/2000 25.69 4.13 16.1% 6.0 2/29/2000 25.9 4.33 16.7% 6.2 3/31/2000 26.82 4.5 16.8% 6.4 4/30/2000 27.23 4.67 17.2% 6.6 5/31/2000 25.12 4.77 19.0% 6.7 6/30/2000 27.38 4.83 17.6% 6.7 7/31/2000 29.28 4.82 16.5% 6.7 8/31/2000 29.03 4.76 16.4% 6.7 9/30/2000 29.26 4.75 16.2% 6.6 10/31/2000 31.58 4.82 15.3% 6.7 11/30/2000 32.36 4.9 15.1% 6.8 12/31/2000 31.93 4.95 15.5% 6.9 Correlation 1/31/2001 25.59 5.03 19.7% 6.9 0.84 2/28/2001 25.14 5.08 20.2% 7.0 3/31/2001 26.07 4.95 19.0% 6.9 4/30/2001 25.91 4.65 17.9% 6.5 5/31/2001 26.19 4.53 17.3% 6.4 6/30/2001 27.62 4.49 16.3% 6.4 7/31/2001 27.69 4.51 16.3% 6.4 8/31/2001 25.98 4.41 17.0% 6.3 9/30/2001 26.08 4.44 17.0% 6.3 10/31/2001 25.71 4.5 17.5% 6.4 11/30/2001 22.31 4.55 20.4% 6.4 12/31/2001 19.64 4.45 22.7% 6.3 1/31/2002 19.28 4.45 23.1% 6.3 2/28/2002 19.88 4.23 21.3% 6.1 3/31/2002 20.42 3.88 19.0% 5.7 4/30/2002 23.2 3.8 16.4% 5.6 5/31/2002 25.57 3.8 14.9% 5.6 6/30/2002 26.21 4 15.3% 5.8 7/31/2002 25.86 4.21 16.3% 6.1 8/31/2002 26.19 4.44 17.0% 6.3 Average JCC Prices USD/bbl 9/30/2002 26.74 4.5 16.8% 6.4 2000 17.6 USD/mmbtu 10/31/2002 28 4.52 16.1% 6.4 2001 28.5 Fixed Component 2.53 11/30/2002 28.13 4.53 16.1% 6.4 2002 25.3 12/31/2002 26.05 4.59 17.6% 6.5 2003 24.6 1/31/2003 28.25 4.58 16.2% 6.5 2004 29.1 2/28/2003 30.59 4.59 15.0% 6.5 2005 36.4 3/31/2003 32.61 4.6 14.1% 6.5 2006 51.0 4/30/2003 30.86 4.65 15.1% 6.5 2007 64.1 5/31/2003 27.43 4.78 17.4% 6.7 2008 69.0 6/30/2003 27.08 4.87 18.0% 6.8 2009 102.4 7/31/2003 27.58 4.81 17.4% 6.7 2010 60.6 8/31/2003 28.38 4.64 16.3% 6.5 2011 79.2 9/30/2003 29.19 4.62 15.8% 6.5 2012 85.0 10/31/2003 27.93 4.61 16.5% 6.5 2013 85.0 11/30/2003 29.49 4.67 15.8% 6.6 Price at which LNG is procured 12/31/2003 30.23 4.68 15.5% 6.6 Month 2010 2011 2012 2013 1/31/2004 30.89 4.7 15.2% 6.6 Jan 3.29 4.78 6.21 7.41 2/29/2004 31.9 4.71 14.8% 6.6 Feb 3.35 4.87 6.31 7.51 3/31/2004 31.55 4.78 15.2% 6.7 March 3.41 4.96 6.41 7.60 4/30/2004 33.48 4.85 14.5% 6.8 April 3.47 5.05 6.51 7.70 5/31/2004 34.39 4.91 14.3% 6.8 May 3.53 5.14 6.61 7.80 6/30/2004 37.12 4.9 13.2% 6.8 June 3.59 5.23 6.71 7.90 7/31/2004 36.7 4.96 13.5% 6.9 July 3.65 5.31 6.81 8.00 8/31/2004 37.67 5.12 13.6% 7.0 August 3.71 5.40 6.91 8.10 9/30/2004 41.3 5.18 12.5% 7.1 September 3.77 5.49 7.01 8.20 10/31/2004 39.91 5.23 13.1% 7.2 October 3.82 5.58 7.11 8.30 11/30/2004 41.9 5.29 12.6% 7.2 November 3.88 5.67 7.21 8.40 12/31/2004 39.89 5.49 13.8% 7.4 December 3.94 5.76 7.31 8.50 1/31/2005 38.42 5.48 14.3% 7.4 2/28/2005 41.11 5.48 13.3% 7.4 3/31/2005 42.57 5.43 12.8% 7.4 Landed Price 4/30/2005 48.5 5.43 11.2% 7.4 Month 2010 2011 2012 2013 5/31/2005 51.19 5.46 10.7% 7.4 Jan 3.7 5.3 6.8 8.1 USD/mmbtu LNG prices are determined by JCC crude price and bear a relationship similar to LNG Price = A* JCC+ B 0 20 40 60 80 100 120 140 160 2/1/1999 8/1/1999 2/1/2000 8/1/2000 2/1/2001 8/1/2001 2/1/2002 8/1/2002 2/1/2003 8/1/2003 2/1/2004 8/1/2004 2/1/2005 8/1/2005 2/1/2006 8/1/2006 2/1/2007 8/1/2007 2/1/2008 8/1/2008 2/1/2009 8/1/2009 2/1/2010 8/1/2010 LNG CIF Prices (USD/mmbtu) JCC prices (USD/bbl) 0.0 5.0 10.0 15.0 20.0 25.0 LNG Prices Price to customers LNG Cost This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 15. 6/30/2005 49.44 5.67 11.5% 7.6 Feb 3.8 5.4 6.9 8.2 7/31/2005 53.28 5.86 11.0% 7.8 March 3.9 5.5 7.0 8.3 8/31/2005 55.51 6.03 10.9% 8.0 April 3.9 5.6 7.1 8.4 9/30/2005 59.38 6.3 10.6% 8.3 May 4.0 5.7 7.2 8.5 10/31/2005 59.89 6.29 10.5% 8.3 June 4.0 5.8 7.3 8.6 11/30/2005 57.58 6.47 11.2% 8.5 July 4.1 5.9 7.4 8.7 12/31/2005 54.73 6.63 12.1% 8.7 August 4.2 6.0 7.5 8.8 1/31/2006 56.39 6.67 11.8% 8.7 September 4.2 6.1 7.6 8.9 2/28/2006 61.08 7.91 13.0% 10.0 October 4.3 6.1 7.7 9.0 3/31/2006 61.03 6.94 11.4% 9.0 November 4.4 6.2 7.9 9.1 4/30/2006 61.3 7 11.4% 9.1 December 4.4 6.3 8.0 9.2 5/31/2006 66.53 7.63 11.5% 9.7 Dahej Terminal 6/30/2006 67.81 7.96 11.7% 10.1 Regasification Margin FY10 FY11E FY12E FY13E FY14E 7/31/2006 67.96 7.33 10.8% 9.4 Price to the customers-----Dahej USD/mmbtu 0.71 0.75 0.78 0.82 0.86 8/31/2006 71.84 8.18 11.4% 10.3 Month 2010 2011 2012 2013 Rs/mmbtu 32.0 33.5 35.2 37.0 9/30/2006 72.06 8.36 11.6% 10.5 Jan 5.1 7.5 8.6 10.1 45 10/31/2006 64.44 8.18 12.7% 10.3 Feb 5.2 7.6 8.8 10.2 11/30/2006 59.87 7.44 12.4% 9.5 March 5.3 7.7 8.9 10.3 Marketing Margin Q4FY11 FY11E FY12E FY13E FY14E 12/31/2006 58.54 7.7 13.2% 9.8 April 5.3 7.3 9.0 10.5 USD/mmbtu 0.60 0.10 0.10 0.10 0.10 1/31/2007 60.43 7.66 12.7% 9.8 May 5.4 7.4 9.2 10.6 Rs/mmbtu 27.0 4.5 4.5 4.5 4.5 2/28/2007 55.08 7.29 13.2% 9.4 June 5.5 7.5 9.3 10.7 45 3/31/2007 57.05 7.59 13.3% 9.7 July 5.5 7.6 9.4 10.9 4/30/2007 60.85 7.76 12.8% 9.9 August 5.6 7.7 9.5 11.0 Kochi Terminal 5/31/2007 65.66 7.93 12.1% 10.1 September 5.7 7.8 9.6 11.1 Regasification Margin FY10 FY11E FY12E FY13E FY14E 6/30/2007 67.49 7.78 11.5% 9.9 October 5.7 7.9 9.8 11.2 USD/mmbtu 0.00 1.15 1.21 1.27 7/31/2007 69.38 8.04 11.6% 10.2 November 5.8 8.0 9.9 11.3 Rs/mmbtu 0.0 51.8 54.3 57.1 8/31/2007 72.24 8.28 11.5% 10.4 December 5.9 8.1 10.0 11.4 9/30/2007 71.12 8.81 12.4% 11.0 10/31/2007 76.24 8.27 10.8% 10.4 Spot Volumes FY11 FY12 FY13 11/30/2007 81.25 8.45 10.4% 10.6 SP 8 9.00 10 12/31/2007 90.84 9.51 10.5% 11.8 Cost 7 7.50 8 1/31/2008 91.15 9.63 10.6% 11.9 2/29/2008 92.85 10.28 11.1% 12.6 Price to the customers-----KOCHI 3/31/2008 95.39 10.58 11.1% 12.9 Month 2010 2011 2012 2013 4/30/2008 100.97 12.14 12.0% 14.6 Jan 5.1 6.9 9.1 10.5 5/31/2008 107.88 12.41 11.5% 14.9 Feb 5.2 7.0 9.2 10.7 6/30/2008 121.9 12.6 10.3% 15.1 March 5.3 7.1 9.4 10.8 7/31/2008 131.67 13.05 9.9% 15.6 April 5.3 7.3 9.5 10.5 8/31/2008 135.19 14.13 10.5% 16.7 May 5.4 7.4 9.6 10.6 9/30/2008 120.61 15.56 12.9% 18.2 June 5.5 7.5 9.7 10.7 10/31/2008 102.56 15.66 15.3% 18.4 July 5.5 7.6 9.8 10.8 11/30/2008 73.72 16.21 22.0% 18.9 August 5.6 7.7 10.0 10.9 12/31/2008 54.87 16.5 30.1% 19.3 September 5.7 7.2 10.1 11.0 1/31/2009 43.17 15.59 36.1% 18.3 October 5.7 7.3 10.8 11.8 2/28/2009 45.31 14.41 31.8% 17.0 November 5.8 8.0 10.3 11.3 3/31/2009 44.39 12.39 27.9% 14.8 December 5.9 8.1 10.4 11.4 4/30/2009 47.43 10.85 22.9% 13.2 5/31/2009 52.25 8.52 16.3% 10.7 7.98 6/30/2009 59.36 7.99 13.5% 10.1 7/31/2009 69.91 8.37 12.0% 10.5 LNG Prices ( in $/mmbtu) Jan-11 Jan-12 Jan-13 Jan-14 JCC @ USD 85/bbl Fixed Component 1.5 1.0 0.5 0.0 Variable Component 3.3 5.2 7.0 8.5 LNG Price 4.8 6.2 7.4 8.5 JCC @ USD 100/bbl 8/31/2009 68 8.99 13.2% 11.2 Fixed Component 1.5 1.0 0.5 0.0 9/30/2009 73.01 10.39 14.2% 12.7 Variable Component 4.2 6.2 8.2 10.0 10/31/2009 70.18 11.11 15.8% 13.5 LNG Price 5.6 7.1 8.6 10.0 11/30/2009 74.76 11.42 15.3% 13.8 JCC @ USD 115/bbl 12/31/2009 79.43 11.65 14.7% 14.0 Fixed Component 1.5 1.0 0.5 0.0 1/31/2010 77.68 11.98 15.4% 14.4 Variable Component 4.8 7.1 9.4 11.5 2/28/2010 78.89 12.52 15.9% 15.0 LNG Price 6.3 8.1 9.9 11.5 3/31/2010 76.34 12.45 16.3% 14.9 4/30/2010 79.87 12.78 16.0% 15.3 5/31/2010 85 12.94 15.2% 15.4 6/30/2010 79.9 12.33 15.4% 14.8 SPOT VOLUMES FY11 FY12 7/31/2010 76.33 12.53 16.4% 15.0 Price 11.5 12 8/31/2010 74.7 13.18 17.6% 15.7 Landed Cost 12.4 12.89139 9/30/2010 76.01 12.34 16.2% 14.8 Regasification Charges 0.78 0.82 10/31/2010 77.25 11.91 15.4% 14.3 Marketing margin 0.5 0.5 11/30/2010 82.24 11.62 14.1% 14.0 LNG Price Post Charges 13.6 14.2 12/31/2010 85.91 0.0% CST @ 2% 0.27 0.28 1/31/2011 91.78 12.14 13.2% LNG post CST 13.92 14.50 Transmission Charges 0.6 0.65 Service charge 0.06 0.07 LNG Selling price 14.58 15.21 Insurance & Freight - $ 0.26/mmbtu Import Duty 5.15% Landed Cost Landed Cost + Regasification margin Marketing Margin CST@ 2% Transmission Charges @ 0.60/mmbtu Service Tax @ 10.30% This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 16. In tonnes Date Qatar Algeria Australia Egypt Malaysia Norway Yemen Oman Total In BCM In mmscmd In MMTPA LNG Price (USD/mmbtu) 1/31/2004 60000 60000 0.05 0.14 0.06 4.7 3/31/2004 120000 120000 0.10 0.28 0.12 4.71 Total LNG Volumes (in tonnes) 4/30/2004 60000 60000 0.05 0.14 0.06 4.78 5/31/2004 182000 182000 0.15 0.42 0.18 4.85 6/30/2004 182000 182000 0.15 0.42 0.18 4.91 7/31/2004 182000 182000 0.15 0.42 0.18 4.9 8/31/2004 182000 182000 0.15 0.42 0.18 4.96 9/30/2004 182000 182000 0.15 0.42 0.18 5.12 10/31/2004 242000 242000 0.20 0.56 0.24 5.18 11/30/2004 242000 242000 0.20 0.56 0.24 5.23 12/31/2004 121000 121000 0.10 0.28 0.12 5.29 1/31/2005 242000 242000 0.20 0.56 0.24 5.49 2/28/2005 182000 182000 0.15 0.42 0.18 5.48 3/31/2005 363000 59000 422000 0.35 0.98 0.42 5.48 4/30/2005 60000 60000 0.05 0.14 0.06 5.43 5/31/2005 420000 55000 475000 0.39 1.10 0.48 5.43 6/30/2005 420000 420000 0.35 0.98 0.42 5.46 7/31/2005 360000 360000 0.30 0.84 0.36 5.67 8/31/2005 360000 360000 0.30 0.84 0.36 5.86 9/30/2005 420000 420000 0.35 0.98 0.42 6.03 10/31/2005 250000 50000 300000 0.25 0.70 0.30 6.3 11/30/2005 420000 420000 0.35 0.98 0.42 6.29 12/31/2005 420000 420000 0.35 0.98 0.42 6.47 1/31/2006 420000 420000 0.35 0.98 0.42 6.63 2/28/2006 360000 360000 0.30 0.84 0.36 6.67 3/31/2006 244000 244000 0.20 0.57 0.24 7.91 4/30/2006 363036 363036 0.30 0.84 0.36 6.94 5/31/2006 433026 62865 64895 560786 0.47 1.30 0.56 7 6/30/2006 433026 60000 493026 0.41 1.15 0.49 7.63 7/31/2006 441000 122300 66200 629500 0.52 1.46 0.63 7.96 8/31/2006 378000 378000 0.31 0.88 0.38 7.33 9/30/2006 441000 63000 62500 63000 629500 0.52 1.46 0.63 8.18 10/31/2006 570200 122800 59800 752800 0.62 1.75 0.75 8.36 11/30/2006 573400 573400 0.48 1.33 0.57 8.18 12/31/2006 504000 63000 63000 630000 0.52 1.46 0.63 7.44 1/31/2007 364290 63945 428235 0.36 1.00 0.43 7.7 2/28/2007 492994 60000 63945 616939 0.51 1.43 0.62 7.66 3/31/2007 604617 62000 64000 730617 0.61 1.70 0.73 7.29 4/30/2007 432212 127890 560102 0.46 1.30 0.56 7.59 5/31/2007 732858 732858 0.61 1.70 0.73 7.76 6/30/2007 682159 122638 804797 0.67 1.87 0.80 7.93 7/31/2007 551000 61000 612000 0.51 1.42 0.61 7.78 8/31/2007 679000 679000 0.56 1.58 0.68 8.04 9/30/2007 616000 616000 0.51 1.43 0.62 8.28 10/31/2007 617000 617000 0.51 1.43 0.62 8.81 11/30/2007 551093 551093 0.46 1.28 0.55 8.27 12/31/2007 551000 62000 613000 0.51 1.42 0.61 8.45 1/31/2008 550809 64254 63945 679008 0.56 1.58 0.68 9.51 2/29/2008 553984 63945 617929 0.51 1.44 0.62 9.63 3/31/2008 614842 60402 68134 743378 0.62 1.73 0.74 10.28 4/30/2008 617841 60402 678243 0.56 1.58 0.68 10.58 5/31/2008 621855 60402 682257 0.57 1.59 0.68 12.14 6/30/2008 371540 55623 427163 0.35 0.99 0.43 12.41 7/31/2008 555420 61000 63945 680365 0.56 1.58 0.68 12.6 8/31/2008 492994 60858 63945 617797 0.51 1.44 0.62 13.05 9/30/2008 492971 61000 553971 0.46 1.29 0.55 14.13 10/31/2008 492969 62925 65805 63945 685644 0.57 1.59 0.69 15.56 11/30/2008 426094 63945 490039 0.41 1.14 0.49 15.66 12/31/2008 491513 60402 551915 0.46 1.28 0.55 16.21 1/31/2009 304290 64254 368544 0.31 0.86 0.37 16.5 2/28/2009 490205 490205 0.41 1.14 0.49 15.59 3/31/2009 717918 63945 119520 901383 0.75 2.09 0.90 14.41 4/30/2009 465427 123775 589202 0.49 1.37 0.59 12.39 5/31/2009 566068 566068 0.47 1.32 0.57 10.85 6/30/2009 374254 248656 622910 0.52 1.45 0.62 8.52 7/31/2009 657750 122402 780152 0.65 1.81 0.78 7.99 8/31/2009 745789 180745 59609 986143 0.82 2.29 0.99 8.37 9/30/2009 750000 57000 62000 869000 0.72 2.02 0.87 8.99 10/31/2009 488000 191000 679000 0.56 1.58 0.68 10.39 11/30/2009 428000 64000 492000 0.41 1.14 0.49 11.11 12/31/2009 580000 580000 0.48 1.35 0.58 11.42 1/31/2010 737000 737000 0.61 1.71 0.74 11.65 2/28/2010 580000 580000 0.48 1.35 0.58 11.98 3/31/2010 700000 700000 0.58 1.63 0.70 12.52 4/30/2010 502310 73000 575310 0.48 1.34 0.58 12.45 5/31/2010 570000 570000 0.47 1.32 0.57 12.78 6/30/2010 663000 663000 0.55 1.54 0.66 12.94 7/31/2010 636683 636683 0.53 1.48 0.64 12.33 8/31/2010 636683 70560 707243 0.59 1.64 0.71 12.53 9/30/2010 630000 630000 0.52 1.46 0.63 13.18 10/31/2010 785000 785000 0.65 1.82 0.79 12.34 11/30/2010 663000 663000 0.55 1.54 0.66 11.91 12/31/2010 631000 64000 695000 0.58 1.62 0.70 11.62 1/31/2011 722000 61000 783000 0.65 1.82 0.78 12.14 0 2 4 6 8 10 12 14 16 18 0 200000 400000 600000 800000 1000000 1200000 Total LNG Volumes (in tonnes) LNG Price (USD/mmbtu) This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 17. Product FY05 FY06 FY07 FY08 FY09 FY10 Capacity 5.0 5.0 5.0 5.0 5.0 10.0 Production 2.5 4.9 5.6 6.3 6.3 7.6 Capacity Utilization 49% 98% 112% 126% 126% 76% Sales 1945.3 3837.2 5500.6 6555.3 8428.7 10602.9 Realizations (Rs crore per MMTPA) 794.0 783.1 982.3 1040.5 1340.0 1404.4 Realizations (Rs per mmbtu) 283.6 279.7 350.8 371.6 478.6 501.6 DAHEJ LNG TERMINAL Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Capacity in MMTPA 10 10 10 10 10 10 10 10 10 Capacity Utilization (%) 100% 93% 93% 93% 93% 93% 93% 93% 93% Production in MMTPA 2.5 2.3 2.3 2.3 2.3 2.3 2.3 2.3 2.3 LNG price realization USD/mmbtu 7.68 7.78 8.02 8.26 8.83 9.37 9.64 9.90 10.17 2.7% Revenue 4394.7 4139.6 4460.7 4593.7 4907.9 5212.6 5359.9 5507.2 5654.5 KOCHI LNG TERMINAL Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Capacity in MMTPA 2.5 2.5 2.5 2.5 5 Capacity Utilization (%) 0% 30% 30% 30% 40% Production in MMTPA 0.2 0.2 0.2 0.5 LNG price realization 9.70 9.96 10.39 10.49 1.0% Revenue 435.0 446.8 466.1 1254.9 SPOT CARGOES FY12E FY13E No of spot cargoes 10 12 Volumes per cargo 0.066 0.066 Additional 10 depending on the demand Volumes transported 0.66 0.66 Spot Cargo Selling Price USD/mmbtu 14.58 15.21 Revenue 2201.7 2297.2 CST 41.2 42.9 Service tax 9.3 10.1 Net Revenue 2151.2 2244.2 Landed Cost 12.36564 12.89139 Raw Material Cost 1867.3 1946.7 Particulars Q4FY11 FY12 FY13 Gross Sales 4394.7 18101.9 24337.1 Sales tax 87.9 362.0 486.7 Service Tax 452.7 1864.5 2506.7 Net Sales 3854.2 18026.6 23587.9 Raw Material Required 1.89 1.74 1.76 1.77 1.80 1.99 2.01 2.02 2.04 DAHEJ LNG TERMINAL Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 LNG Procurement Price 5.79 6.04 6.27 6.49 7.03 7.38 7.63 7.88 8.13 3.2% Cost of Raw Materials 3463.8 3358.2 3484.3 3610.4 3908.3 4103.5 4243.2 4382.8 4522.5 Kochi Terminal Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Cost of Raw Materials 330.9 342.2 353.5 972.6 LNG Cost 8.05 8.21 8.38 8.54 8.71 8.89 9.07 9.25 9.43 9.62 9.81 10.01 10.21 10.41 LNG RATE 10.49 10.70 10.91 11.13 11.35 11.58 11.81 12.05 12.29 12.54 12.79 13.04 13.30 13.57 VOLUME 3.5 4.75 5 5 5 5 5 5 5 5 5 5 5 5 KOCHI TERMINAL Particulars FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 Revenue 2602.9 8782.2 12157.1 13052.9 13314.0 13580.2 13851.8 14128.9 14411.5 14699.7 14993.7 15293.6 15599.4 15911.4 16229.6 Tax 268.1 904.6 1252.2 1344.4 1371.3 1398.8 1426.7 1455.3 1484.4 1514.1 1544.3 1575.2 1606.7 1638.9 1671.7 Net revenue 2334.8 7877.7 10904.9 11708.5 11942.6 12181.5 12425.1 12673.6 12927.1 13185.6 13449.3 13718.3 13992.7 14272.5 14558.0 Cost of Raw Materials 1999.2 6739.5 9329.3 10016.8 10217.1 10421.4 10629.9 10842.5 11059.3 11280.5 11506.1 11736.2 11971.0 12210.4 12454.6 Other Costs 78.09 263.47 364.71 391.59 399.42 407.41 415.56 423.87 432.34 440.99 449.81 458.81 467.98 477.34 486.89 Interest 102.9 164.84 174.64 184.44 194.24 204.04 213.84 223.64 233.44 243.24 253.04 262.84 272.64 282.44 292.24 Depreciation 105 168.20 178.20 188.20 198.20 208.20 218.20 228.20 238.20 248.20 258.20 268.20 278.20 288.20 298.20 PBT 49.65 541.70 858.04 927.47 933.67 940.39 947.64 955.44 963.78 972.69 982.17 992.24 1002.91 1014.18 1026.08 Tax 16.58 180.93 286.59 309.77 311.84 314.09 316.51 319.12 321.90 324.88 328.05 331.41 334.97 338.74 342.71 PAT 33.06 360.77 571.46 617.69 621.82 626.30 631.13 636.32 641.88 647.81 654.13 660.83 667.93 675.44 683.37 PAT+ Dep 138.06 528.97 749.66 805.89 820.02 834.50 849.33 864.52 880.08 896.01 912.33 929.03 946.13 963.64 981.57 LNG Cost 8.05 8.21 8.38 8.54 8.71 8.89 9.065607 9.24692 9.431858 LNG RATE 10.17 10.37 10.58 10.79 11.01 11.23 11.45 11.68 11.91 VOLUME 9.6 11 11 11 11 11 12.5 12.5 12.5 DAHEJ TERMINAL Particulars FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 Revenue 21734.3 23347.6 27287.5 27833.3 28389.9 28957.7 29536.9 34235.9 34920.7 35619.1 Tax 2238.6 2404.8 2810.6 2866.8 2924.2 2982.6 3042.3 3526.3 3596.8 3668.8 Revenue 19495.6 20942.8 24476.9 24966.5 25465.8 25975.1 26494.6 30709.6 31323.8 31950.3 Cost of Raw Materials 17252.1 18485.4 21604.8 22036.9 22477.6 22927.2 23385.7 27106.2 27648.3 28201.3 Other Costs 1086.71 1167.38 1364.38 1391.66 1419.50 1447.89 1476.84 1711.80 1746.03 1780.95 Interest 190 199.50 209.48 219.95 230.95 242.49 254.62 267.35 280.72 294.75 Depreciation 216.75 234.75 245.25 255.75 266.25 276.75 287.25 297.75 -307.75 317.75 PBT 750.10 855.81 1053.03 1062.21 1071.47 1080.80 1090.17 1326.58 1956.55 1355.60 Tax 250.53 285.84 351.71 354.78 357.87 360.99 364.12 443.08 653.49 452.77 PAT 499.57 569.97 701.32 707.43 713.60 719.81 726.05 883.50 1303.06 902.83 PAT+ Dep 716.32 804.72 946.57 963.18 979.85 996.56 1013.30 1181.25 995.31 1220.58 Note: 0% 50% 100% 150% FY05 FY06 FY07 FY08 FY09 FY10 Capacity Utilization Capacity Utilization One LNG cargo tank of average capacity of 143384.6 cubic metres. can carry LNG and LNG equivalent of 67,000 tonnes. The Average Capacity of three LNG Carriers of Petronet LNG is 143384.6 cubic metres. LNG equivalent it can carry is 66071.3 tonnes This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 18. 1 tonne 52 mmbtu 1 MMTPA 52000000 mmmbto I bcm 2.8 mmscmd 1 mmbtu 26.8 cubic metres I mmscmd 35700 mmbtu 142800 TBTUS 112.13 90.78 13.62 0.97 MMBTUS 112130000 90780000 13620000 970000 MMTPA 2.156346154 1.745769231 0.261923077 0.018653846 2.418269231 1.764423077 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 19. PLL's Existing Contracts Supplier Duration (In Years) Period Qty. Contracted (In MMTPA) RasGas, Qatar 25 2004-29 5 RasGas, Qatar 25 2009-34 2.5 Gorgon LNG, Aus 20 2014-34 1.5-2.5 GAIL 60% 4.5 30% 0.45 IOC 30% 2.25 30% 0.45 BPCL 10% 0.75 40% 0.6 Total 100% 7.5 100% 1.5 417 353.6 0.056512 Dahej % Quantity (mmtpa) Kochi % Quantity (mmtpa)Company These contracts are back to back long term sales agreement on a take or pay basis for the sale of R LNG to the contracted off takers. This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 20. DAHEJ TERMINAL Initial Investment 1900 Starting 2003 Spread over of period 24 Completed in 2004 Expansion Capex 1400 Starting FY06 Spread over the period 36 Completed in FY09 Dahej- Planned Expansion 900 Starting FY11 36 Will be completed in FY14 Maintainence Capex Year Initial Investment PAT +DEP FCFF FY03 -950 -950.00 FY04 -950 -950.00 FY05 -95 68.36 -26.64 FY06 -420.00 295.88 295.88 IRR 16% FY07 -420.00 415.28 -4.72 FY08 -420.00 576.83 156.83 FY09 -165 565.36 400.36 FY10 -165 478.18 313.18 FY11 -150 767.71 617.71 FY12 -300 971.16 671.16 FY13 -300 716.3 416.32 FY14 -360 804.7 444.72 FY15 -210 946.6 736.57 FY16 -220.5 963.2 742.68 FY17 -221.03 979.8 758.82 FY18 -221.05 996.56 775.51 FY19 -221.05 1013.30 792.25 FY20 -221.05 1181.25 960.20 FY21 -221.05 995.31 774.26 FY22 -221.05 1220.58 999.53 Cost of Capital Calculation Cost of Equity 9.93 0.30 Cost of Debt 8.00 0.70 Cost of Capital 8.58 Kochi Terminal Particulars In Rs crore Initial Investment 2100 Starting FY08 Spread over a period of 60 Months Incremental Capex 1900 Starting Dec 2010 Spread over a period of 25 months Maintainnence Capex This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 21. Year Initial Investment PAT +DEP FCFF FY08 -420 -420 IRR 12% FY09 -420 -420 FY10 -420 -420 FY11 -192 -192 FY12 -1332 -1332 FY13 -380 138.1 -241.94 FY14 -200 529.0 328.97 FY15 -200 749.7 549.66 FY16 -200 805.9 605.89 FY17 -200 820.0 620.02 FY18 -200 834.5 634.50 FY19 -200 849.3 649.33 FY20 -200 864.5 664.52 FY21 -200 880.1 680.08 FY22 -200 896.0 696.01 FY23 -200 912.3 712.33 FY24 -200 929.0 729.03 FY25 -200 946.1 746.13 FY26 -200 963.6 763.64 FY27 -200 981.6 781.57 Cost of Capital Calculation Cost of Equity 9.93 0.30 Cost of Debt 8.00 0.70 Cost of Capital 8.58 Cost of Equity Calculation Beta 0.8928 Rf 7.6752 Rm 10.2 Cost of Equity 9.93 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 22. 2007 2008 2009 2010 2011 2012 2013 EPS 4.18 6.33 6.91 5.39 7.76 10.35 14.37 5.00 8.00 11.00 14.00 17.00 Date Close PE EPS CMP 5x 8x 11x 14x 17x x 4.18 Date Close (Unit Curr) Date 0.01 30-Mar-07 41.95 6.63 10.04 4.18 3/30/2007 41.95 20.88 33.41 45.94 58.47 71.00 02-Apr-07 41.25 6.52 9.86 4.19 4/2/2007 41.25 20.93 33.48 46.04 58.59 71.15 03-Apr-07 41.70 6.58 9.94 4.19 4/3/2007 41.70 20.97 33.55 46.13 58.71 71.30 04-Apr-07 42.05 6.64 10.01 4.20 4/4/2007 42.05 21.01 33.62 46.23 58.83 71.44 05-Apr-07 42.70 6.74 10.14 4.21 4/5/2007 42.70 21.06 33.69 46.32 58.95 71.59 09-Apr-07 45.35 7.15 10.75 4.22 4/9/2007 45.35 21.10 33.76 46.42 59.07 71.73 10-Apr-07 45.00 7.09 10.64 4.23 39,182.00 45.00 21.14 33.83 46.51 59.19 71.88 11-Apr-07 44.95 7.08 10.61 4.24 4/11/2007 44.95 21.18 33.89 46.60 59.31 72.02 12-Apr-07 44.75 7.05 10.54 4.25 4/12/2007 44.75 21.23 33.96 46.70 59.43 72.17 13-Apr-07 45.00 7.09 10.58 4.25 4/13/2007 45.00 21.27 34.03 46.79 59.55 72.32 16-Apr-07 46.45 7.31 10.90 4.26 4/16/2007 46.45 21.31 34.10 46.89 59.67 72.46 17-Apr-07 46.00 7.24 10.77 4.27 4/17/2007 46.00 21.36 34.17 46.98 59.79 72.61 18-Apr-07 45.85 7.21 10.71 4.28 4/18/2007 45.85 21.40 34.24 47.08 59.91 72.75 19-Apr-07 45.85 7.21 10.69 4.29 4/19/2007 45.85 21.44 34.31 47.17 60.03 72.90 20-Apr-07 45.60 7.17 10.61 4.30 4/20/2007 45.60 21.48 34.37 47.26 60.15 73.04 23-Apr-07 45.60 7.16 10.59 4.31 4/23/2007 45.60 21.53 34.44 47.36 60.27 73.19 24-Apr-07 45.90 7.21 10.64 4.31 4/24/2007 45.90 21.57 34.51 47.45 60.39 73.34 25-Apr-07 45.70 7.17 10.57 4.32 4/25/2007 45.70 21.61 34.58 47.55 60.51 73.48 26-Apr-07 45.40 7.12 10.48 4.33 4/26/2007 45.40 21.66 34.65 47.64 60.63 73.63 27-Apr-07 45.35 7.11 10.45 4.34 4/27/2007 45.35 21.70 34.72 47.74 60.75 73.77 30-Apr-07 45.35 7.11 10.43 4.35 4/30/2007 45.35 21.74 34.79 47.83 60.87 73.92 03-May-07 45.85 7.19 10.52 4.36 5/3/2007 45.85 21.78 34.85 47.92 60.99 74.06 04-May-07 45.90 7.19 10.51 4.37 5/4/2007 45.90 21.83 34.92 48.02 61.11 74.21 07-May-07 45.30 7.10 10.36 4.37 5/7/2007 45.30 21.87 34.99 48.11 61.23 74.36 08-May-07 44.80 7.01 10.22 4.38 5/8/2007 44.80 21.91 35.06 48.21 61.35 74.50 09-May-07 44.95 7.04 10.24 4.39 5/9/2007 44.95 21.96 35.13 48.30 61.47 74.65 10-May-07 45.80 7.17 10.41 4.40 5/10/2007 45.80 22.00 35.20 48.40 61.59 74.79 11-May-07 45.65 7.14 10.36 4.41 5/11/2007 45.65 22.04 35.27 48.49 61.71 74.94 14-May-07 47.05 7.36 10.65 4.42 5/14/2007 47.05 22.08 35.33 48.58 61.83 75.09 15-May-07 50.75 7.93 11.47 4.43 5/15/2007 50.75 22.13 35.40 48.68 61.95 75.23 16-May-07 51.75 8.08 11.67 4.43 5/16/2007 51.75 22.17 35.47 48.77 62.07 75.38 17-May-07 52.15 8.14 11.74 4.44 5/17/2007 52.15 22.21 35.54 48.87 62.19 75.52 18-May-07 51.85 8.09 11.65 4.45 5/18/2007 51.85 22.26 35.61 48.96 62.32 75.67 21-May-07 53.55 8.36 12.01 4.46 5/21/2007 53.55 22.30 35.68 49.06 62.44 75.81 22-May-07 52.85 8.24 11.83 4.47 5/22/2007 52.85 22.34 35.75 49.15 62.56 75.96 23-May-07 51.25 7.99 11.45 4.48 5/23/2007 51.25 22.38 35.81 49.24 62.68 76.11 24-May-07 50.85 7.93 11.34 4.49 5/24/2007 50.85 22.43 35.88 49.34 62.80 76.25 25-May-07 51.20 7.98 11.39 4.49 5/25/2007 51.20 22.47 35.95 49.43 62.92 76.40 28-May-07 51.95 8.09 11.54 4.50 5/28/2007 51.95 22.51 36.02 49.53 63.04 76.54 29-May-07 53.20 8.28 11.79 4.51 5/29/2007 53.20 22.56 36.09 49.62 63.16 76.69 30-May-07 52.35 8.15 11.58 4.52 5/30/2007 52.35 22.60 36.16 49.72 63.28 76.83 31-May-07 51.80 8.06 11.44 4.53 5/31/2007 51.80 22.64 36.23 49.81 63.40 76.98 01-Jun-07 55.75 8.67 12.29 4.54 6/1/2007 55.75 22.68 36.29 49.90 63.52 77.13 04-Jun-07 55.50 8.63 12.21 4.55 6/4/2007 55.50 22.73 36.36 50.00 63.64 77.27 05-Jun-07 57.60 8.95 12.65 4.55 6/5/2007 57.60 22.77 36.43 50.09 63.76 77.42 06-Jun-07 55.60 8.64 12.19 4.56 6/6/2007 55.60 22.81 36.50 50.19 63.88 77.56 07-Jun-07 55.20 8.57 12.08 4.57 6/7/2007 55.20 22.86 36.57 50.28 64.00 77.71 08-Jun-07 55.40 8.60 12.10 4.58 6/8/2007 55.40 22.90 36.64 50.38 64.12 77.85 11-Jun-07 54.40 8.44 11.86 4.59 6/11/2007 54.40 22.94 36.71 50.47 64.24 78.00 12-Jun-07 53.75 8.34 11.69 4.60 6/12/2007 53.75 22.98 36.77 50.57 64.36 78.15 13-Jun-07 53.55 8.30 11.63 4.61 6/13/2007 53.55 23.03 36.84 50.66 64.48 78.29 14-Jun-07 55.35 8.58 12.00 4.61 6/14/2007 55.35 23.07 36.91 50.75 64.60 78.44 15-Jun-07 54.55 8.45 11.80 4.62 6/15/2007 54.55 23.11 36.98 50.85 64.72 78.58 18-Jun-07 54.05 8.37 11.67 4.63 6/18/2007 54.05 23.16 37.05 50.94 64.84 78.73 19-Jun-07 54.90 8.50 11.83 4.64 6/19/2007 54.90 23.20 37.12 51.04 64.96 78.87 20-Jun-07 54.95 8.51 11.82 4.65 6/20/2007 54.95 23.24 37.19 51.13 65.08 79.02 21-Jun-07 54.45 8.42 11.69 4.66 6/21/2007 54.45 23.28 37.25 51.23 65.20 79.17 22-Jun-07 55.00 8.51 11.79 4.67 6/22/2007 55.00 23.33 37.32 51.32 65.32 79.31 25-Jun-07 56.10 8.67 12.00 4.67 6/25/2007 56.10 23.37 37.39 51.41 65.44 79.46 26-Jun-07 56.85 8.79 12.14 4.68 6/26/2007 56.85 23.41 37.46 51.51 65.56 79.60 27-Jun-07 55.55 8.58 11.84 4.69 6/27/2007 55.55 23.46 37.53 51.60 65.68 79.75 28-Jun-07 55.00 8.49 11.70 4.70 6/28/2007 55.00 23.50 37.60 51.70 65.80 79.90 29-Jun-07 56.20 8.68 11.94 4.71 6/29/2007 56.20 23.54 37.67 51.79 65.92 80.04 02-Jul-07 57.30 8.84 12.15 4.72 7/2/2007 57.30 23.58 37.73 51.89 66.04 80.19 03-Jul-07 58.65 9.05 12.41 4.73 7/3/2007 58.65 23.63 37.80 51.98 66.16 80.33 04-Jul-07 57.50 8.87 12.15 4.73 7/4/2007 57.50 23.67 37.87 52.07 66.28 80.48 05-Jul-07 56.65 8.73 11.94 4.74 7/5/2007 56.65 23.71 37.94 52.17 66.40 80.62 06-Jul-07 56.35 8.68 11.86 4.75 7/6/2007 56.35 23.76 38.01 52.26 66.52 80.77 09-Jul-07 57.60 8.87 12.10 4.76 7/9/2007 57.60 23.80 38.08 52.36 66.64 80.92 10-Jul-07 56.90 8.76 11.93 4.77 7/10/2007 56.90 23.84 38.15 52.45 66.76 81.06 11-Jul-07 58.10 8.94 12.16 4.78 7/11/2007 58.10 23.88 38.21 52.55 66.88 81.21 12-Jul-07 58.60 9.02 12.25 4.79 7/12/2007 58.60 23.93 38.28 52.64 67.00 81.35 13-Jul-07 61.35 9.44 12.80 4.79 7/13/2007 61.35 23.97 38.35 52.73 67.12 81.50 16-Jul-07 61.65 9.48 12.84 4.80 7/16/2007 61.65 24.01 38.42 52.83 67.24 81.64 17-Jul-07 60.50 9.30 12.57 4.81 7/17/2007 60.50 24.06 38.49 52.92 67.36 81.79 18-Jul-07 61.10 9.39 12.68 4.82 7/18/2007 61.10 24.10 38.56 53.02 67.48 81.94 19-Jul-07 62.20 9.55 12.88 4.83 7/19/2007 62.20 24.14 38.63 53.11 67.60 82.08 20-Jul-07 65.75 10.09 13.59 4.84 7/20/2007 65.75 24.18 38.70 53.21 67.72 82.23 23-Jul-07 66.80 10.25 13.79 4.85 7/23/2007 66.80 24.23 38.76 53.30 67.84 82.37 24-Jul-07 65.70 10.08 13.54 4.85 7/24/2007 65.70 24.27 38.83 53.39 67.96 82.52 25-Jul-07 65.25 10.01 13.42 4.86 7/25/2007 65.25 24.31 38.90 53.49 68.08 82.66 26-Jul-07 65.55 10.05 13.46 4.87 7/26/2007 65.55 24.36 38.97 53.58 68.20 82.81 27-Jul-07 63.00 9.65 12.91 4.88 7/27/2007 63.00 24.40 39.04 53.68 68.32 82.96 30-Jul-07 62.80 9.62 12.85 4.89 7/30/2007 62.80 24.44 39.11 53.77 68.44 83.10 31-Jul-07 63.25 9.69 12.92 4.90 7/31/2007 63.25 24.48 39.18 53.87 68.56 83.25 01-Aug-07 58.90 9.02 12.01 4.91 8/1/2007 58.90 24.53 39.24 53.96 68.68 83.39 02-Aug-07 59.50 9.10 12.11 4.91 8/2/2007 59.50 24.57 39.31 54.05 68.80 83.54 03-Aug-07 60.30 9.22 12.25 4.92 8/3/2007 60.30 24.61 39.38 54.15 68.92 83.68 06-Aug-07 60.15 9.20 12.20 4.93 8/6/2007 60.15 24.66 39.45 54.24 69.04 83.83 07-Aug-07 62.55 9.56 12.66 4.94 8/7/2007 62.55 24.70 39.52 54.34 69.16 83.98 08-Aug-07 64.00 9.78 12.93 4.95 8/8/2007 64.00 24.74 39.59 54.43 69.28 84.12 09-Aug-07 62.70 9.58 12.65 4.96 8/9/2007 62.70 24.78 39.66 54.53 69.40 84.27 10-Aug-07 62.80 9.59 12.65 4.97 8/10/2007 62.80 24.83 39.72 54.62 69.52 84.41 13-Aug-07 63.35 9.67 12.74 4.97 8/13/2007 63.35 24.87 39.79 54.71 69.64 84.56 14-Aug-07 64.25 9.80 12.89 4.98 8/14/2007 64.25 24.91 39.86 54.81 69.76 84.70 16-Aug-07 62.55 9.54 12.53 4.99 8/16/2007 62.55 24.96 39.93 54.90 69.88 84.85 17-Aug-07 61.10 9.31 12.22 5.00 8/17/2007 61.10 25.00 40.00 55.00 70.00 85.00 20-Aug-07 62.10 9.46 12.40 5.01 8/20/2007 62.10 25.04 40.07 55.09 70.12 85.14 21-Aug-07 59.20 9.02 11.80 5.02 8/21/2007 59.20 25.08 40.14 55.19 70.24 85.29 22-Aug-07 59.10 9.00 11.76 5.03 8/22/2007 59.10 25.13 40.20 55.28 70.36 85.43 23-Aug-07 58.05 8.84 11.53 5.03 8/23/2007 58.05 25.17 40.27 55.37 70.48 85.58 24-Aug-07 58.90 8.96 11.68 5.04 8/24/2007 58.90 25.21 40.34 55.47 70.60 85.73 27-Aug-07 60.05 9.13 11.89 5.05 8/27/2007 60.05 25.26 40.41 55.56 70.72 85.87 28-Aug-07 59.80 9.09 11.82 5.06 8/28/2007 59.80 25.30 40.48 55.66 70.84 86.02 29-Aug-07 59.90 9.11 11.82 5.07 8/29/2007 59.90 25.34 40.55 55.75 70.96 86.16 30-Aug-07 60.45 9.19 11.91 5.08 8/30/2007 60.45 25.38 40.62 55.85 71.08 86.31 31-Aug-07 61.60 9.36 12.11 5.09 8/31/2007 61.60 25.43 40.68 55.94 71.20 86.45 03-Sep-07 62.55 9.50 12.28 5.09 9/3/2007 62.55 25.47 40.75 56.04 71.32 86.60 04-Sep-07 62.75 9.52 12.30 5.10 9/4/2007 62.75 25.51 40.82 56.13 71.44 86.75 05-Sep-07 62.15 9.43 12.16 5.11 9/5/2007 62.15 25.56 40.89 56.22 71.56 86.89 06-Sep-07 62.80 9.53 12.27 5.12 9/6/2007 62.80 25.60 40.96 56.32 71.68 87.04 07-Sep-07 64.35 9.76 12.55 5.13 9/7/2007 64.35 25.64 41.03 56.41 71.80 87.18 10-Sep-07 66.75 10.12 12.99 5.14 9/10/2007 66.75 25.68 41.10 56.51 71.92 87.33 11-Sep-07 67.20 10.18 13.06 5.15 9/11/2007 67.20 25.73 41.16 56.60 72.04 87.47 12-Sep-07 67.00 10.15 13.00 5.15 9/12/2007 67.00 25.77 41.23 56.70 72.16 87.62 13-Sep-07 66.20 10.02 12.82 5.16 9/13/2007 66.20 25.81 41.30 56.79 72.28 87.77 14-Sep-07 64.55 9.77 12.48 5.17 9/14/2007 64.55 25.86 41.37 56.88 72.40 87.91 17-Sep-07 64.35 9.74 12.42 5.18 9/17/2007 64.35 25.90 41.44 56.98 72.52 88.06 18-Sep-07 65.35 9.88 12.60 5.19 9/18/2007 65.35 25.94 41.51 57.07 72.64 88.20 19-Sep-07 66.25 10.02 12.75 5.20 9/19/2007 66.25 25.98 41.58 57.17 72.76 88.35 20-Sep-07 68.65 10.37 13.19 5.21 9/20/2007 68.65 26.03 41.64 57.26 72.88 88.49 21-Sep-07 72.15 10.90 13.84 5.21 9/21/2007 72.15 26.07 41.71 57.36 73.00 88.64 24-Sep-07 77.70 11.73 14.88 5.22 9/24/2007 77.70 26.11 41.78 57.45 73.12 88.79 25-Sep-07 86.30 13.03 16.50 5.23 9/25/2007 86.30 26.16 41.85 57.54 73.24 88.93 26-Sep-07 83.95 12.67 16.02 5.24 9/26/2007 83.95 26.20 41.92 57.64 73.36 89.08 27-Sep-07 80.20 12.10 15.28 5.25 9/27/2007 80.20 26.24 41.99 57.73 73.48 89.22 28-Sep-07 80.50 12.14 15.31 5.26 9/28/2007 80.50 26.29 42.06 57.83 73.60 89.37 01-Oct-07 82.60 12.45 15.69 5.27 10/1/2007 82.60 26.33 42.12 57.92 73.72 89.51 03-Oct-07 80.20 12.09 15.21 5.27 10/3/2007 80.20 26.37 42.19 58.02 73.84 89.66 04-Oct-07 81.15 12.22 15.36 5.28 10/4/2007 81.15 26.41 42.26 58.11 73.96 89.81 05-Oct-07 79.70 12.00 15.06 5.29 10/5/2007 79.70 26.46 42.33 58.20 74.08 89.95 08-Oct-07 72.70 10.94 13.72 5.30 10/8/2007 72.70 26.50 42.40 58.30 74.20 90.10 09-Oct-07 76.30 11.48 14.37 5.31 10/9/2007 76.30 26.54 42.47 58.39 74.32 90.24 10-Oct-07 76.90 11.57 14.46 5.32 10/10/2007 76.90 26.59 42.54 58.49 74.44 90.39 0 20 40 60 80 100 120 140 160 180 200 Date 8/22/2007 1/14/2008 6/11/2008 11/5/2008 4/9/2009 9/2/2009 2/2/2010 6/28/2010 11/16/2010 4/1/2011 7/10/2011 10/18/2011 1/26/2012 5/5/2012 8/13/2012 11/21/2012 3/1/2013 CMP 5x 8x 11x 14x 17x This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138

- 23. 11-Oct-07 77.10 11.59 14.48 5.33 10/11/2007 77.10 26.63 42.60 58.58 74.56 90.54 12-Oct-07 76.65 11.52 14.37 5.33 10/12/2007 76.65 26.67 42.67 58.68 74.68 90.68 15-Oct-07 78.45 11.79 14.68 5.34 10/15/2007 78.45 26.71 42.74 58.77 74.80 90.83 16-Oct-07 77.60 11.66 14.50 5.35 10/16/2007 77.60 26.76 42.81 58.86 74.92 90.97 17-Oct-07 74.85 11.24 13.96 5.36 10/17/2007 74.85 26.80 42.88 58.96 75.04 91.12 18-Oct-07 73.65 11.05 13.72 5.37 10/18/2007 73.65 26.84 42.95 59.05 75.16 91.26 19-Oct-07 73.20 10.98 13.61 5.38 10/19/2007 73.20 26.89 43.02 59.15 75.28 91.41 22-Oct-07 72.15 10.82 13.40 5.39 10/22/2007 72.15 26.93 43.08 59.24 75.40 91.56 23-Oct-07 75.00 11.24 13.90 5.39 10/23/2007 75.00 26.97 43.15 59.34 75.52 91.70 24-Oct-07 76.25 11.43 14.11 5.40 10/24/2007 76.25 27.01 43.22 59.43 75.64 91.85 25-Oct-07 81.15 12.16 15.00 5.41 10/25/2007 81.15 27.06 43.29 59.52 75.76 91.99 26-Oct-07 82.40 12.34 15.20 5.42 10/26/2007 82.40 27.10 43.36 59.62 75.88 92.14 29-Oct-07 83.55 12.51 15.39 5.43 10/29/2007 83.55 27.14 43.43 59.71 76.00 92.28 30-Oct-07 84.20 12.60 15.49 5.44 10/30/2007 84.20 27.19 43.50 59.81 76.12 92.43 31-Oct-07 87.75 13.13 16.11 5.45 10/31/2007 87.75 27.23 43.56 59.90 76.24 92.58 01-Nov-07 87.05 13.02 15.96 5.45 11/1/2007 87.05 27.27 43.63 60.00 76.36 92.72 02-Nov-07 89.55 13.39 16.39 5.46 11/2/2007 89.55 27.31 43.70 60.09 76.48 92.87 05-Nov-07 93.70 14.00 17.13 5.47 11/5/2007 93.70 27.36 43.77 60.18 76.60 93.01 06-Nov-07 92.50 13.82 16.88 5.48 11/6/2007 92.50 27.40 43.84 60.28 76.72 93.16 07-Nov-07 91.20 13.62 16.62 5.49 11/7/2007 91.20 27.44 43.91 60.37 76.84 93.30 08-Nov-07 90.45 13.50 16.45 5.50 11/8/2007 90.45 27.49 43.98 60.47 76.96 93.45 09-Nov-07 90.00 13.43 16.35 5.51 11/9/2007 90.00 27.53 44.05 60.56 77.08 93.60 12-Nov-07 92.40 13.78 16.76 5.51 11/12/2007 92.40 27.57 44.11 60.66 77.20 93.74 13-Nov-07 98.65 14.71 17.86 5.52 11/13/2007 98.65 27.61 44.18 60.75 77.32 93.89 14-Nov-07 102.10 15.22 18.46 5.53 11/14/2007 102.10 27.66 44.25 60.84 77.44 94.03 15-Nov-07 112.80 16.81 20.36 5.54 11/15/2007 112.80 27.70 44.32 60.94 77.56 94.18 16-Nov-07 108.40 16.15 19.54 5.55 11/16/2007 108.40 27.74 44.39 61.03 77.68 94.32 19-Nov-07 110.85 16.51 19.95 5.56 11/19/2007 110.85 27.79 44.46 61.13 77.80 94.47 20-Nov-07 107.55 16.01 19.32 5.57 11/20/2007 107.55 27.83 44.53 61.22 77.92 94.62 21-Nov-07 98.70 14.69 17.71 5.57 11/21/2007 98.70 27.87 44.59 61.32 78.04 94.76 22-Nov-07 92.40 13.74 16.55 5.58 11/22/2007 92.40 27.91 44.66 61.41 78.16 94.91 23-Nov-07 96.50 14.35 17.26 5.59 11/23/2007 96.50 27.96 44.73 61.51 78.28 95.05 26-Nov-07 99.75 14.83 17.81 5.60 11/26/2007 99.75 28.00 44.80 61.60 78.40 95.20 27-Nov-07 105.30 15.65 18.78 5.61 11/27/2007 105.30 28.04 44.87 61.69 78.52 95.34 28-Nov-07 102.05 15.16 18.17 5.62 11/28/2007 102.05 28.09 44.94 61.79 78.64 95.49 29-Nov-07 100.30 14.89 17.83 5.63 11/29/2007 100.30 28.13 45.01 61.88 78.76 95.64 30-Nov-07 103.60 15.38 18.39 5.63 11/30/2007 103.60 28.17 45.07 61.98 78.88 95.78 03-Dec-07 108.30 16.07 19.19 5.64 12/3/2007 108.30 28.21 45.14 62.07 79.00 95.93 04-Dec-07 109.65 16.26 19.40 5.65 12/4/2007 109.65 28.26 45.21 62.17 79.12 96.07 05-Dec-07 113.85 16.88 20.11 5.66 12/5/2007 113.85 28.30 45.28 62.26 79.24 96.22 06-Dec-07 110.30 16.35 19.46 5.67 12/6/2007 110.30 28.34 45.35 62.35 79.36 96.37 07-Dec-07 109.15 16.17 19.23 5.68 12/7/2007 109.15 28.39 45.42 62.45 79.48 96.51 10-Dec-07 111.60 16.53 19.63 5.69 12/10/2007 111.60 28.43 45.49 62.54 79.60 96.66 11-Dec-07 110.25 16.32 19.36 5.69 12/11/2007 110.25 28.47 45.55 62.64 79.72 96.80 12-Dec-07 110.40 16.34 19.36 5.70 12/12/2007 110.40 28.51 45.62 62.73 79.84 96.95 13-Dec-07 109.60 16.22 19.19 5.71 12/13/2007 109.60 28.56 45.69 62.83 79.96 97.09 14-Dec-07 109.95 16.26 19.22 5.72 12/14/2007 109.95 28.60 45.76 62.92 80.08 97.24 17-Dec-07 103.20 15.26 18.02 5.73 12/17/2007 103.20 28.64 45.83 63.01 80.20 97.39 18-Dec-07 103.60 15.31 18.06 5.74 12/18/2007 103.60 28.69 45.90 63.11 80.32 97.53 19-Dec-07 103.55 15.30 18.02 5.75 12/19/2007 103.55 28.73 45.97 63.20 80.44 97.68 20-Dec-07 101.50 14.99 17.64 5.75 12/20/2007 101.50 28.77 46.03 63.30 80.56 97.82 24-Dec-07 103.40 15.27 17.94 5.76 12/24/2007 103.40 28.81 46.10 63.39 80.68 97.97 26-Dec-07 105.10 15.51 18.21 5.77 12/26/2007 105.10 28.86 46.17 63.49 80.80 98.11 27-Dec-07 103.85 15.32 17.97 5.78 12/27/2007 103.85 28.90 46.24 63.58 80.92 98.26 28-Dec-07 105.30 15.53 18.19 5.79 12/28/2007 105.30 28.94 46.31 63.67 81.04 98.41 31-Dec-07 107.30 15.82 18.51 5.80 12/31/2007 107.30 28.99 46.38 63.77 81.16 98.55 01-Jan-08 110.50 16.29 19.03 5.81 1/1/2008 110.50 29.03 46.45 63.86 81.28 98.70 02-Jan-08 112.60 16.59 19.37 5.81 1/2/2008 112.60 29.07 46.51 63.96 81.40 98.84 03-Jan-08 118.30 17.42 20.32 5.82 1/3/2008 118.30 29.11 46.58 64.05 81.52 98.99 04-Jan-08 117.20 17.25 20.10 5.83 1/4/2008 117.20 29.16 46.65 64.15 81.64 99.13 07-Jan-08 119.15 17.54 20.40 5.84 1/7/2008 119.15 29.20 46.72 64.24 81.76 99.28 08-Jan-08 114.90 16.90 19.65 5.85 1/8/2008 114.90 29.24 46.79 64.33 81.88 99.43 09-Jan-08 111.70 16.43 19.07 5.86 1/9/2008 111.70 29.29 46.86 64.43 82.00 99.57 10-Jan-08 106.55 15.66 18.16 5.87 1/10/2008 106.55 29.33 46.93 64.52 82.12 99.72 11-Jan-08 106.90 15.71 18.20 5.87 1/11/2008 106.90 29.37 46.99 64.62 82.24 99.86 14-Jan-08 112.05 16.46 19.05 5.88 1/14/2008 112.05 29.41 47.06 64.71 82.36 100.01 15-Jan-08 110.05 16.16 18.68 5.89 1/15/2008 110.05 29.46 47.13 64.81 82.48 100.15 16-Jan-08 107.30 15.75 18.19 5.90 1/16/2008 107.30 29.50 47.20 64.90 82.60 100.30 17-Jan-08 108.55 15.93 18.37 5.91 1/17/2008 108.55 29.54 47.27 64.99 82.72 100.45 18-Jan-08 101.70 14.92 17.19 5.92 1/18/2008 101.70 29.59 47.34 65.09 82.84 100.59 21-Jan-08 79.15 11.61 13.36 5.93 1/21/2008 79.15 29.63 47.41 65.18 82.96 100.74 22-Jan-08 64.25 9.42 10.83 5.93 1/22/2008 64.25 29.67 47.47 65.28 83.08 100.88 23-Jan-08 73.90 10.83 12.44 5.94 1/23/2008 73.90 29.71 47.54 65.37 83.20 101.03 24-Jan-08 70.80 10.37 11.90 5.95 1/24/2008 70.80 29.76 47.61 65.47 83.32 101.17 25-Jan-08 77.25 11.31 12.96 5.96 1/25/2008 77.25 29.80 47.68 65.56 83.44 101.32 28-Jan-08 77.20 11.30 12.93 5.97 1/28/2008 77.20 29.84 47.75 65.65 83.56 101.47 29-Jan-08 77.15 11.29 12.91 5.98 1/29/2008 77.15 29.89 47.82 65.75 83.68 101.61 30-Jan-08 72.15 10.55 12.05 5.99 1/30/2008 72.15 29.93 47.89 65.84 83.80 101.76 31-Jan-08 72.45 10.60 12.09 5.99 1/31/2008 72.45 29.97 47.95 65.94 83.92 101.90 01-Feb-08 73.95 10.81 12.32 6.00 2/1/2008 73.95 30.01 48.02 66.03 84.04 102.05 04-Feb-08 77.15 11.27 12.83 6.01 2/4/2008 77.15 30.06 48.09 66.13 84.16 102.20 05-Feb-08 79.20 11.57 13.16 6.02 2/5/2008 79.20 30.10 48.16 66.22 84.28 102.34 06-Feb-08 80.00 11.68 13.27 6.03 2/6/2008 80.00 30.14 48.23 66.31 84.40 102.49 07-Feb-08 75.65 11.04 12.53 6.04 2/7/2008 75.65 30.19 48.30 66.41 84.52 102.63 08-Feb-08 74.50 10.87 12.32 6.05 2/8/2008 74.50 30.23 48.37 66.50 84.64 102.78 11-Feb-08 69.10 10.08 11.41 6.05 2/11/2008 69.10 30.27 48.43 66.60 84.76 102.92 12-Feb-08 68.20 9.95 11.25 6.06 2/12/2008 68.20 30.31 48.50 66.69 84.88 103.07 13-Feb-08 66.90 9.75 11.02 6.07 2/13/2008 66.90 30.36 48.57 66.79 85.00 103.22 14-Feb-08 74.05 10.79 12.18 6.08 2/14/2008 74.05 30.40 48.64 66.88 85.12 103.36 15-Feb-08 75.35 10.98 12.38 6.09 2/15/2008 75.35 30.44 48.71 66.98 85.24 103.51 18-Feb-08 76.20 11.10 12.50 6.10 2/18/2008 76.20 30.49 48.78 67.07 85.36 103.65 19-Feb-08 75.15 10.94 12.31 6.11 2/19/2008 75.15 30.53 48.85 67.16 85.48 103.80 20-Feb-08 73.85 10.75 12.08 6.11 2/20/2008 73.85 30.57 48.91 67.26 85.60 103.94 21-Feb-08 74.85 10.89 12.22 6.12 2/21/2008 74.85 30.61 48.98 67.35 85.72 104.09 22-Feb-08 73.40 10.67 11.97 6.13 2/22/2008 73.40 30.66 49.05 67.45 85.84 104.24 25-Feb-08 73.40 10.67 11.95 6.14 2/25/2008 73.40 30.70 49.12 67.54 85.96 104.38 26-Feb-08 74.60 10.84 12.13 6.15 2/26/2008 74.60 30.74 49.19 67.64 86.08 104.53 27-Feb-08 75.50 10.97 12.26 6.16 2/27/2008 75.50 30.79 49.26 67.73 86.20 104.67 28-Feb-08 74.35 10.80 12.06 6.17 2/28/2008 74.35 30.83 49.33 67.82 86.32 104.82 29-Feb-08 73.85 10.72 11.96 6.17 2/29/2008 73.85 30.87 49.40 67.92 86.44 104.96 03-Mar-08 70.05 10.17 11.33 6.18 3/3/2008 70.05 30.91 49.46 68.01 86.56 105.11 04-Mar-08 69.40 10.07 11.21 6.19 3/4/2008 69.40 30.96 49.53 68.11 86.68 105.26 05-Mar-08 69.05 10.01 11.14 6.20 3/5/2008 69.05 31.00 49.60 68.20 86.80 105.40 07-Mar-08 65.75 9.53 10.59 6.21 3/7/2008 65.75 31.04 49.67 68.30 86.92 105.55 10-Mar-08 65.70 9.52 10.57 6.22 3/10/2008 65.70 31.09 49.74 68.39 87.04 105.69 11-Mar-08 69.40 10.05 11.15 6.23 3/11/2008 69.40 31.13 49.81 68.48 87.16 105.84 12-Mar-08 69.05 10.00 11.08 6.23 3/12/2008 69.05 31.17 49.88 68.58 87.28 105.98 13-Mar-08 68.20 9.87 10.92 6.24 3/13/2008 68.20 31.21 49.94 68.67 87.40 106.13 14-Mar-08 70.10 10.14 11.21 6.25 3/14/2008 70.10 31.26 50.01 68.77 87.52 106.28 17-Mar-08 65.70 9.50 10.50 6.26 3/17/2008 65.70 31.30 50.08 68.86 87.64 106.42 18-Mar-08 66.60 9.64 10.62 6.27 3/18/2008 66.60 31.34 50.15 68.96 87.76 106.57 19-Mar-08 63.75 9.24 10.16 6.28 3/19/2008 63.75 31.39 50.22 69.05 87.88 106.71 24-Mar-08 61.90 8.98 9.85 6.29 3/24/2008 61.90 31.43 50.29 69.14 88.00 106.86 25-Mar-08 65.30 9.48 10.37 6.29 3/25/2008 65.30 31.47 50.36 69.24 88.12 107.01 26-Mar-08 65.45 9.51 10.38 6.30 3/26/2008 65.45 31.51 50.42 69.33 88.24 107.15 27-Mar-08 65.05 9.46 10.31 6.31 3/27/2008 65.05 31.56 50.49 69.43 88.36 107.30 28-Mar-08 70.15 10.21 11.10 6.32 3/28/2008 70.15 31.60 50.56 69.52 88.48 107.44 6.33 31-Mar-08 70.30 10.24 11.11 6.33 3/31/2008 70.30 31.64 50.63 69.62 88.60 107.59 0.00 01-Apr-08 72.15 10.52 11.40 6.33 4/1/2008 72.15 31.66 50.65 69.64 88.64 107.63 02-Apr-08 71.35 10.42 11.27 6.33 4/2/2008 71.35 31.67 50.67 69.67 88.67 107.67 03-Apr-08 71.55 10.45 11.29 6.34 4/3/2008 71.55 31.68 50.69 69.70 88.70 107.71 04-Apr-08 69.85 10.22 11.02 6.34 4/4/2008 69.85 31.69 50.71 69.72 88.74 107.75 07-Apr-08 72.60 10.63 11.45 6.34 4/7/2008 72.60 31.70 50.73 69.75 88.77 107.79 08-Apr-08 73.85 10.82 11.64 6.34 4/8/2008 73.85 31.72 50.75 69.77 88.80 107.83 09-Apr-08 74.70 10.95 11.77 6.35 4/9/2008 74.70 31.73 50.76 69.80 88.84 107.87 10-Apr-08 75.30 11.05 11.86 6.35 4/10/2008 75.30 31.74 50.78 69.83 88.87 107.91 11-Apr-08 75.90 11.15 11.95 6.35 4/11/2008 75.90 31.75 50.80 69.85 88.90 107.96 15-Apr-08 77.45 11.39 12.19 6.35 4/15/2008 77.45 31.76 50.82 69.88 88.94 108.00 16-Apr-08 76.80 11.30 12.08 6.36 4/16/2008 76.80 31.78 50.84 69.91 88.97 108.04 17-Apr-08 79.60 11.73 12.52 6.36 4/17/2008 79.60 31.79 50.86 69.93 89.01 108.08 21-Apr-08 80.65 11.89 12.68 6.36 4/21/2008 80.65 31.80 50.88 69.96 89.04 108.12 22-Apr-08 81.15 11.98 12.75 6.36 4/22/2008 81.15 31.81 50.90 69.99 89.07 108.16 23-Apr-08 83.55 12.34 13.13 6.36 4/23/2008 83.55 31.82 50.92 70.01 89.11 108.20 24-Apr-08 79.35 11.73 12.46 6.37 4/24/2008 79.35 31.84 50.94 70.04 89.14 108.24 25-Apr-08 79.90 11.82 12.54 6.37 4/25/2008 79.90 31.85 50.96 70.07 89.17 108.28 28-Apr-08 79.85 11.83 12.53 6.37 4/28/2008 79.85 31.86 50.98 70.09 89.21 108.32 29-Apr-08 80.40 11.92 12.61 6.37 4/29/2008 80.40 31.87 50.99 70.12 89.24 108.36 30-Apr-08 80.20 11.90 12.58 6.38 4/30/2008 80.20 31.88 51.01 70.14 89.27 108.41 02-May-08 82.95 12.32 13.00 6.38 5/2/2008 82.95 31.90 51.03 70.17 89.31 108.45 This document is a partial preview. Full document download can be found on Flevy: http://flevy.com/browse/document/excel-model-for-valuation-of-natural-gas-firm-1138