The Impact of the Global Financial and Economic Crisis on Botswana

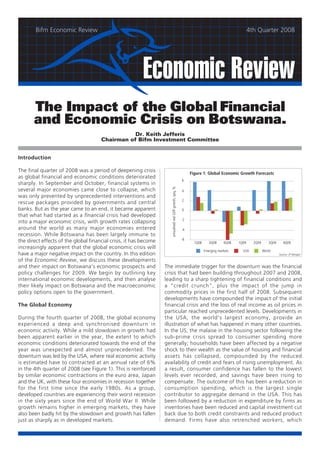

- 1. Bifm Economic Review 4th Quarter 2008 Economic Review The Impact of the Global Financial and Economic Crisis on Botswana. Dr. Keith Jefferis Chairman of Bifm Investment Committee Introduction The final quarter of 2008 was a period of deepening crisis Figure 1: Global Economic Growth Forecasts as global financial and economic conditions deteriorated 6 sharply. In September and October, financial systems in annualised real GDP growth, qoq, % several major economies came close to collapse, which 4 was only prevented by unprecedented interventions and 2 rescue packages provided by governments and central banks. But as the year came to an end, it became apparent 0 that what had started as a financial crisis had developed -2 into a major economic crisis, with growth rates collapsing around the world as many major economies entered -4 recession. While Botswana has been largely immune to -6 the direct effects of the global financial crisis, it has become 1Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 increasingly apparent that the global economic crisis will Emerging markets USA World have a major negative impact on the country. In this edition Source: JP Morgan of the Economic Review, we discuss these developments and their impact on Botswana's economic prospects and The immediate trigger for the downturn was the financial policy challenges for 2009. We begin by outlining key crisis that had been building throughout 2007 and 2008, international economic developments, and then analyse leading to a sharp tightening of financial conditions and their likely impact on Botswana and the macroeconomic a "credit crunch", plus the impact of the jump in policy options open to the government. commodity prices in the first half of 2008. Subsequent developments have compounded the impact of the initial The Global Economy financial crisis and the loss of real income as oil prices in particular reached unprecedented levels. Developments in During the fourth quarter of 2008, the global economy the USA, the world's largest economy, provide an experienced a deep and synchronised downturn in illustration of what has happened in many other countries. economic activity. While a mild slowdown in growth had In the US, the malaise in the housing sector following the been apparent earlier in the year, the extent to which sub-prime crisis spread to consumer spending more economic conditions deteriorated towards the end of the generally; households have been affected by a negative year was unexpected and almost unprecedented. The shock to their wealth as the value of housing and financial downturn was led by the USA, where real economic activity assets has collapsed, compounded by the reduced is estimated have to contracted at an annual rate of 6% availability of credit and fears of rising unemployment. As in the 4th quarter of 2008 (see Figure 1). This is reinforced a result, consumer confidence has fallen to the lowest by similar economic contractions in the euro area, Japan levels ever recorded, and savings have been rising to and the UK, with these four economies in recession together compensate. The outcome of this has been a reduction in for the first time since the early 1980s. As a group, consumption spending, which is the largest single developed countries are experiencing their worst recession contributor to aggregate demand in the USA. This has in the sixty years since the end of World War II. While been followed by a reduction in expenditure by firms as growth remains higher in emerging markets, they have inventories have been reduced and capital investment cut also been badly hit by the slowdown and growth has fallen back due to both credit constraints and reduced product just as sharply as in developed markets. demand. Firms have also retrenched workers, which

- 2. 2 Economic Review compounds the problem of weak consumer spending. The years have been predominantly V-shaped, whereas of third major component of demand, net exports, has also course the 1930s depression was L-shaped. fallen as the global economy has slowed. Hence all major It is likely that the key to global economic recovery will contributors to growth, with the exception of government be the resumption of growth in US consumer spending; spending , have weakened. This leaves governments not just as the ultimate guarantors (and sometimes owners) Figure 2: US GDP growth of the financial system, but also as "spenders of last 8% resort", as shown by the reliance on fiscal spending packages in the recovery plans of many countries. 6% 4% While there are many similarities and general trends, the impact of the economic slowdown varies across economic 2% sectors and countries. In the USA, the industries that have been most severely affected - in addition to the financial 0% sector - are those involving large consumer spending -2% commitments and dependence on access to credit, such as housing and automobiles; spending on new homes and -4% Recessions cars has dropped by between one-third and one-half on 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 in 2008. Also badly affected are industries providing capital goods, as corporate investment spending has in many cases been drastically cut back. A third area of vulnerability this would boost growth in the US which will in turn help is industries providing luxury goods (such as jewellery) or to stimulate growth in the rest of the world. The pre- discretionary spending (such as tourism), where expenditure requisites for recovery in US consumer spending include: can easily be postponed, while consumer necessities such as food and clothing have held up much better. - The resumption of credit flows; - A macroeconomic stimulus from fiscal tax and/or While many emerging markets have not directly experienced spending packages and looser monetary policy; financial sector problems or housing market collapses, - Growth in real incomes; they have not escaped unscathed. Most emerging markets - A reduction in uncertainty and improved consumer are highly dependent upon exports, so economic slowdown confidence. in developed economies has reduced demand as the growth of world trade has slowed. There have also been sharp The unblocking of credit markets is essential for recovery reductions in commodity prices as the earlier bubble has in the housing and motor vehicle markets as well as for burst. While this will play an important part in boosting companies. There are some signs of an easing of credit real incomes and restoring demand and growth in much conditions and resumption of credit flows to consumers of the developed world, the reliance of many emerging and businesses, but the process is very slow. While many markets, especially in Africa, on commodity exports will banks have received capital injections from governments is already causing problems for many countries as export and shareholders, this is not in itself sufficient to get credit earnings decline. The credit crunch, combined with flowing again, as in many cases financial institutions have increased risk aversion, has made finance more difficult suffered such large losses - and may still face further losses to come by for countries dependent upon inflows of short- - that their priority is to recapitalise and rebuild their term capital or foreign direct investment, especially for balance sheets rather than rapidly increase lending. This mining projects as lower commodity prices have project problem is compounded by fear, and a desire to avoid economics unfavourable. unnecessary risks. International Prospects for 2009 Much emphasis is being placed on the impact of fiscal stimulus packages, comprising additional public spending As the crisis has deepened, many analysts have become and/or tax reductions, most notably in the US but also in more pessimistic about how deep and prolonged the many other developed and developing economies. In most recession will be. We can distinguish between a "V-shaped" developed economies these packages are likely to be recession - which is deep and painful but short-lived and equivalent to 1-2% of GDP in 2009, rising to an estimated followed by a robust recovery - or an "L-shaped" recession, 5-7% in India and China. These can potentially make a which is prolonged with weak and slow recovery. As Figure significant contribution to recovery, although they are not 2 shows, previous US recessions over the past three decades without problems. Increasing public spending in a hurry

- 3. 3 Economic Review runs the risk of poor project selection and management, Implications for Botswana leading to waste and inefficiency, although tax cuts may simply result in increased saving by households rather than While almost all countries of the world will be negatively spending; while additional saving makes sense from an affected by the crisis, the type and scale of impact will individual point of view, especially when household assets vary. In most developed countries, as discussed above, the have fallen in value, it does nothing to help pull an economy crisis originated in a combination of financial sector distress, out of a recession (Keynes' famous "paradox of thrift"). the credit crunch, and rising oil prices. These factors have Expansionary fiscal policy also leads to increased public been less important in most emerging markets, where the debt levels and/or monetary expansion, both of which main impact has come from the slowdown in international store up future problems. trade as developed countries enter recession. Like many other developing countries, Botswana is highly trade- However, fiscal expansion will help to boost real household dependent, integrated into the regional and world incomes which should ultimately lead to increased spending, economies, and the reduction in global trade and economic even if not by the full amount. The income effect will also growth is already having a negative impact on demand be supported by lower commodity prices, especially lower for Botswana's exports. oil and fuel prices; recent declines have already reversed some of the negative effects experienced last year as higher While exports have become more diversified in recent oil prices reduced spending power in oil-importing nations. years, this does not enable the country to escape the Nevertheless, this will be offset to some degree by the impact of a widespread downturn in global demand. The negative impact of further falls in house prices, and until global recession will affect demand for exports across the these bottom out it is unlikely that spending will rise board, including all three of the country's major exports significantly. - diamonds, copper-nickel, and tourism. Diamond exports have already suffered through reduced export quantities The final component of the recovery is increased consumer towards the end of 2008, while the prices received for confidence. So far there is little sign of any improvement, copper and nickel have fallen by 70% - 80% from their with confidence surveys showing readings at rock-bottom peaks. Tourism is yet to seriously feel the pinch, given that levels. Consumer spending over the important Christmas much of the industry works on quite a long booking cycle, season fell in most major economies, and with a steady but will inevitably do so during 2009. All three industries flow of corporate bankruptcies and retrenchments, will suffer reduced earnings, and are likely to retrench unemployment is expected to continue rising for several staff. more months. Continued negative sentiment will mean that any recovery in consumer spending, even with a fiscal While the impact on exports may be broad-based, the boost behind it, is likely to be weak and sluggish through 2009. main concern is what the consequences will be of a downturn in the demand for diamonds. This is because More generally, there is little sign that the deterioration diamonds remain Botswana's largest export, accounting in economic conditions is bottoming out. The flow of for over half of total earnings from exports of goods and economic and financial news remains almost uniformly services, and account for nearly 40% of government bad and below expectations, which as a result continue revenues. As a result, problems with diamond exports to be revised downwards. Only once economic and financial developments start exceeding expectations will confidence affect not just the industry but have macroeconomic return. consequences, which may in turn call for macroeconomic policy responses. Over the past three months, general views on the likely depth and duration of the recession have shifted towards Diamonds "bad for long". It is widely expected that recession - i.e. negative economic growth - in developed economies will The global economic and financial crisis has had a dramatic continue at least until the middle of 2009, with the first impact on the global diamond industry. After a buoyant quarter of the year being particularly bad. While there start to the year, the industry suffered severe problems in may be some recovery towards the end of the year, this the second half of 2008 as a result of the combination of is likely to be weak; taking 2009 as a whole, the world restricted credit availability and reduced demand economy is likely to experience negative growth, which for the industry's final product, diamond jewellery. would be the first time that this has happened-over a full year-for over 60 years. More robust recovery in world economic The global diamond industry takes the form of a pipeline growth is unlikely before 2010, and quite possibly 2011. whereby diamonds flow from mining companies, through

- 4. 4 Economic Review sales channels for rough diamonds, to cutters and polishers, Figure 4: World retail Diamond Demand 2006 wholesalers, jewellery manufacturers, and the retail market (see Figure 3). This value of diamond stocks in this pipeline Other Gulf 6% is extremely high, and is largely financed by short-term 5% bank credit. With weakness in the retail market in the China second half of 2008, the flow of diamonds through the 5% pipeline slowed, resulting in a build-up of stocks. At the same time, due to the credit crunch the banks became India less willing to provide credit, and furthermore were 8% concerned that with prices under pressure, the value of USA the diamonds held as collateral for short-term credit was 45% declining. The combination of reduced credit, rising stocks and falling demand meant that by the end of the year, the pipeline could not absorb any new supplies of rough Europe diamonds from mining companies such as Debswana. The 19% result was that global sales of rough diamonds collapsed in the 4th quarter of 2008, and Botswana's diamond exports fell to virtually zero. Japan Source: BMO Capital Markets 12% Figure 3: Diamond Pipeline fall of all reported retail categories. These figures would Mining Rough sales Cutting & polishing Wholesalers Retail put jewellery in the same category as new housing and automobile sales, which are down by similar amounts. With this starting point, what kind of recovery can be expected? As noted above, general economic recovery in the USA and other developed markets is likely to be slow Debswana DTC Sightholders Traders Consumers and weak, with healthy growth only taking place in 2010 or 2011. Beyond the general recovery, what is important This situation is likely to be temporary, and diamond sales for Botswana's diamond exports is the sequencing of will resume once stock levels have fallen. What is unclear, recovery in different sectors. In contrast to some of the however, is at what level sales will resume, but with other hard-hit sectors, jewellery purchases are less reduced credit availability, lower retail demand and de- dependent on credit finance, so the sector is much less stocking in the diamond pipeline, exports will undoubtedly dependent - at least directly - upon improvements in credit be lower than in recent years, and in 2009, exports are availability than is, say, the motor industry. However, when likely to be particularly weak. times are hard, purchases of luxuries can easily be postponed, and it is quite plausible that jewellery sales The world market for cut and polished diamonds is will only really recover once economic recovery is well dominated by the USA and by developed country markets under way. It is quite plausible that the recovery of spending more generally; while emerging markets such as China on jewellery and other luxuries will only follow the recovery and India are growing rapidly, they still account for less of spending on other big-ticket items such as housing and than a quarter of final demand at present. Hence the automobiles. In the meantime, it is likely that world retail prospects for diamonds depend crucially on economic diamond demand will be 10-15% lower for the foreseeable developments in major developed markets [see Figure 4]. future, which it has been estimated will translate to 50% lower demand for rough diamonds in the short run as the In the USA, short-term prospects are not good. Diamond industry de-stocks and adjusts to credit constraints. As sales during the all-important Christmas season, which Figure 5 shows, in the previous similar recession of the accounts for a large proportion of annual turnover, appear early 1980s, it took seven years before rough diamond to have been poor. Several jewellery store chains reported sales recovered to pre-crisis levels. The likelihood is that sales declines in the region of 15-25% compared to 2007. Botswana's diamond exports will face market weakness According to Mastercard, total retail sales in the US over - resulting in lower prices and reduced volumes - not just the period from November 1 to December 24 were down in the short-term but into the medium-term. 2-4% compared to a year earlier, but sales of luxury items - which includes jewellery - were down 34% - the largest

- 5. 5 Economic Review Box: The 1981 Recession and Diamond Crisis The last occasion that Botswana experienced a serious The adjustment measures included: macroeconomic crisis was in 1981-82, when circumstances (i) the devaluation of the Pula, by 10% were similar to the present: an international recession, (ii) a freeze on public sector wages and salaries (which, coupled with a dramatic reduction in diamond sales. As given the policy in place at the time, effectively Figure 2 shows, US GDP contracted by 2% in 1982, similar meant an economy-wide wage freeze); to the current forecast for 2009. The international diamond (iii) tighter monetary policy (the Bank Rate rose from market was hard hit: sales through De Beers Central Selling 8.5% to 12%); Organisation (CSO), which at that time dominated the (iv) direct controls by BoB on credit extension by the world market, fell by more than 50%, from $2.7 billion commercial banks; in 1980 to only $1.3 billion in 1982. The demand for large, (v) the introduction of a sales tax; valuable stones for the upper end of the jewellery market (vi) restrained growth in government spending. was particularly weak. Former President Masire described the principles that were Figure 5: CSO diamond sales, 1976 - 1987 followed in implementing these adjustment measures in 1 3.5 his biography . 3 (i) spread the burden of adjustment as fairly as possible; 2.5 (ii) be transparent and consult widely if difficult decisions have to be taken, so that the facts are known and US$ billion 2 the reasons understood; 1.5 (iii) use accumulated reserves as a buffer; 1 (iv) do not delay or avoid adjustments if they are necessary. 0.5 In adopting these principles, the government had learned 0 from the experience of other countries which had hoped that their problems would go away, when delays in taking 76 77 78 79 80 81 82 83 84 85 86 87 action actually created more problems and ultimately the 19 19 19 19 19 19 19 19 19 19 19 19 need for more severe measures. Source: Bank of Botswana Botswana's diamond exports were hard hit; there were The outcome of the crisis was, in the end, not as bad as no diamond exports at all for several months in late 1981 had been initially feared. This was largely because in 1982 and early 1982, and there was a sharp reduction in the cavalry arrived, in the form of the opening of the government revenues from diamonds. De Beers reduced Jwaneng mine, and despite the weakness of the sales offtake quotas for producers selling through the international market, Botswana was permitted to increase CSO, and many producers, including Debswana, were its diamond sales through the CSO. Hence the reduction forced to stockpile part of their production. in diamond exports and government revenues was fairly short-lived, and by 1983 both were growing at a healthy As the crisis unfolded it was not at all clear how long it rate. GDP growth was not affected, because even during would last, and the Botswana Government introduced a the crisis diamond production was not reduced, and surplus package of adjustment measures aimed at maintaining stones were simply stockpiled, and when Jwaneng opened macroeconomic stability in an environment where national output rose sharply. income (represented by export earnings) and government resources (derived from taxation of minerals) had been Because the opening of Jwaneng transformed the situation, sharply reduced. Essentially these measures aimed at it is difficult to say how much the adjustment package curbing national consumption to maintain a balance with contributed towards maintaining macroeconomic stability, (reduced) income, and ensuring that neither the although it undoubtedly played a positive role. Without government nor the country incurred unsustainable deficits. the contribution of Jwaneng, the impact of the crisis on Botswana woul undoubtedly have been much more severe.

- 6. 6 Economic Review It took seven years for the international diamond market duration of the international recession is likely to be to recover; only in 1987 did CSO sales pass the level that greater. On the positive side, however, Botswana has achieved in 1980, and it was only at this time that used the intervening period to build up a sizeable cushion Botswana's accumulated stockpile of diamonds could be of financial resources (in the form of the foreign exchange finally sold off. reserves and government's savings at BoB) that can be used as a buffer to support the adjustment process. In The current situation has some similarities with 1981-2, terms of possible adjustment measures, the range of but some important differences. Most obviously, there is policies available to government is somewhat reduced no Jwaneng waiting in the wings to rescue the situation; compared to 1982, when the economy was much smaller whereas in 1981-2 the reduction in diamond exports and and the government had more direct controls; for instance, mineral revenues was fairly short-lived, this time it is likely credit controls and a wage freeze are no longer part of to last for several years, especially as the depth and the policy armoury. 1 Q K J Masire, "Very Brave or Very Foolish", (edited by S R Lewis Jr) Macroeconomic Implications The immediate impact of the halting of diamond exports Figure 6: Projected Budget Balance and Trade Balance is that approximately P1.5 - 2 billion has to be drawn from 10% the foreign exchange reserves each month to maintain import levels. With total reserves of around P70 billion 5% this is not a problem in the short term. Government is % of GDP 0% losing around P1 billion a month in mineral revenues, but with accumulated savings of some P30 billion, this too -5% can be accommodated in the short term. -10% Diamond exports will eventually resume, but are unlikely to return to pre-crisis levels in the near future. While -15% 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 forecasts are still hedged with a great deal of uncertainty, Budget Trade Source: Econsult we estimate that taking account of lower prices and reduced export volumes, diamond export earnings will fall significantly, by one-third to one-half, in 2009/10. GDP growth is likely to fall sharply and could well be Furthermore, we estimate that it will take five years for negative, although this primarily depends on the degree diamond exports to fully recover. Lower diamond exports to which production is cut back at the diamond mines, or will be compounded by declines in exports of other major how much production is maintained and any surplus is commodities such as copper-nickel. This reduction in stockpiled. If sales do fall by 30-40% in 2009 (or perhaps exports is equivalent to around 10-15% of GDP. In the even more), it is likely that Debswana will have to cut back meantime, unless measures are taken to restrain imports, on production in order to contain costs. There has already the country will experience substantial balance of trade been discussion of closing two of the smaller mines, and deficits, which will have to be financed by drawing this would be a prudent strategy; while in principle all the down the foreign exchange reserves (see figure 6). mines could be kept open and production maintained at recent levels, and the surplus stockpiled, this would cause The above figures would also translate into a decline of government mineral revenues to fall even further. While 15-20% in total government revenues. Lower mineral keeping all of the Debswana mines open would benefit revenues are likely to be compounded by slower growth Debswana employees and suppliers, it would disadvantage in other important revenue sources. SACU revenues are other citizens, and would thus be inconsistent the principle likely to decline as South African import growth slows; of equitable burden-sharing. earnings from the foreign exchange reserves will fall due to both declining returns in international markets and the The credit rating agencies, Moody's and Standard & Poors drawdown of reserves; and other revenue sources (such both released their 2008 reviews of Botswana in December, as VAT and income tax) will be hit as economic growth slows. and included forecasts of real GDP growth for 2008/9 and Depending on how government spending is adjusted, large 2009/10, taking account of the impact of the global crisis. budget deficits are likely (see Figure 6). Moody's are slightly more optimistic, seeing growth fall sharply, but remaining positive. S&P consider that the

- 7. 7 Economic Review growth shock will be greater, and that there will be two and polishing operations will be adversely affected due to years of negative growth, before a modest recovery in the drop in demand for their products, and it has already 2010/11. been announced by De Beers that the transfer of diamond aggregation operations from London to Gaborone has Table 1: Economic Growth Forecasts been postponed. Outside of mining, it is likely that tourism will be adversely affected, as well as perhaps other important export industries such as textiles. Domestically, construction is Undoubtedly there will be a reduction in GDP growth from likely to be impacted by reduced government spending the 3.3% recorded in 2007/08. Our own projections are on development projects. As for employment, there have more in line with the S&P forecasts, i.e. that Botswana is already been redundancies announced in the mining sector; likely to experience negative economic growth through more are likely, as are retrenchments in the other sectors to 2010. Furthermore, the main risks are to the downside, mentioned above, although quantifying the likely negative i.e. that growth will be lower than the figures indicated effect on employment is very difficult. here. Compared with trend GDP growth of 4-5%, this means that the negative impact of the crisis on the economy There has been much speculation regarding how will be equivalent to some 10% of GDP (see Figure 7). Botswana's foreign exchange reserves have been or may While this may seem large, it is similar to the fall in GDP be affected by the crisis. There is no evidence that financial growth rates being experienced by many other countries. assets making up the reserves were negatively affected by the turmoil in global financial markets in September and Figure 7:Real GDP - Trend & Forecast October. However, the likelihood of sharp falls in export 125 earnings, it will be necessary to draw down on accumulated reserves. Forecasts of the likely declines are inevitably 120 speculative, and depend on the government's policy 115 response, which is discussed further below. However, on Index, 2007/08 = 100 Forecast 110 the basis of a projected 40% decline in diamond exports, Trend and a modest restraint in fiscal policy, we project that the 105 foreign exchange reserves could fall by more than half 100 over the next five years. Net government savings balances 95 are also likely to decline by a similar amount. 90 While most of the economic news is bad, there are two 8 9 0 1 2 /0 /0 /1 /1 /1 07 08 09 10 11 positive outcomes of the crisis. The first is that inflationary 20 20 20 20 20 Source: calculations based on data from Bank of Botswana pressures are abating rapidly, both globally and domestically; inflation is likely to fall sharply during the There has been much public discussion regarding which first half of 2009, and could be within the Bank of sectors of the economy are likely to be hardest hit by the Botswana's 3-6% inflation objective by the middle of the crisis. As noted above, mining has already been badly year, driven by declining fuel prices. This should enable affected, with sharp falls in the volume of diamond exports further reductions in interest rates. Second, reduced and in revenues from copper-nickel. All of Botswana's economic growth in the southern African region will ease mining companies are negatively affected, with the pressure on power supplies, and the precarious situation exception of Mupane gold mine, as gold has been the one in Botswana will be eased by the closure of one or more mineral that has benefitted from the crisis due to its "safe of Debswana's mines. haven" status. The most vulnerable mines are the new small mines run by African Copper and Diamonex, which Policy Responses have been hit by lower prices just as they were scaling up production. Elsewhere in the mining sector, it is likely that As noted in the Box, the macroeconomic policy response prospecting and exploration work will be scaled back, and to the 1982-2 crisis involved fiscal, monetary and exchange projects that were considered likely to lead to new mines rate policy, as well as direct controls on credit and wages. in the new few years - such as Discovery's copper project The economic policy environment is quite different now, and A-Cap's uranium project, as well as two new diamond however. Government no longer has the power to mines - are likely to be deferred due to low prices and implement wage and credit controls. Monetary and funding constraints. Newly-established diamond-cutting exchange rate policy have also changed. The adoption of the crawling peg exchange rate regime appears to have

- 8. 8 Economic Review ruled out step devaluations, and although a reduction in to lower income levels is required. the value of the pula would be appropriate in present circumstances - primarily to restrain imports in line with With this in mind, using fiscal policy to stimulate the reduced exports - this is more likely to be done through economy, or even maintaining a "business as usual" an acceleration in the rate of crawl rather than a devaluation approach, runs the risk of large budget deficits and balance as in 2004 and 2005. As for monetary policy, this is now of payments deficits for a number of years, which would much more closely focused on controlling inflation rather lead to a rapid depletion of the foreign exchange reserves. than influencing the level of economic activity; given the diminished inflation risk in the recession, it is more likely At this point we should note that government savings and that interest rates will be reduced, rather than increased the foreign exchange reserves have two purposes: to act as in 1981-2. as a buffer against short-term fluctuations in economic activity and earnings, and as a "fund for future Much of the burden of macroeconomic adjustment in generations", a financial asset intended to compensate response to the current crisis will therefore fall on fiscal for the depletion of mineral assets and generate income policy. In doing so, the policy response has to accommodate for the future. It is important not to use all of the reserves two, possibly conflicting, objectives. First, policy can attempt for the first purpose, leaving nothing for the second. to reduce the adverse impact of the crisis on the economy, though a combination of using accumulated reserves as This does not mean that Botswana is gaining no benefit a buffer and using fiscal policy to stimulate the economy, from the reserves. The do provide room for manoeuvre. in a similar fashion to policy packages being undertaken For instance, even if export earnings and government in other countries. Second, policy should focus on revenues fall sharply in 2009, it will not be necessary to maintaining macroeconomic stability, which means ensuring cut back on imports or government spending by the same that domestic and external balances (the government amount, because of the cushion provided by the reserves, budget balance and the balance of payments) are which can certainly be partially drawn down to finance sustainable. The two objectives may be in conflict because, deficits. However, this does not mean that the reserves for instance, providing a fiscal boost to the economy could can be fully depleted in order to indefinitely finance lead to an unsustainable budget deficit, depletion of consumption levels far in excess of the country's income- reserves, accumulation of debt or future inflation. Achieving earning ability. an appropriate balance between buffering and adjustment is the key. While a fiscal stimulus is likely to be unsustainable, government should as far as possible try to avoid making If the crisis were expected to be short-lived, the focus drastic cuts in spending that would destabilise the economy could be primarily on "buffering" and using accumulated still further. But some spending cuts are likely: our reserves to counter the negative impact of the recession. projections suggest that with government spending However, it would be risky to assume that the crisis is growing at "pre-crisis" rates, the budget deficit would going to be over within, say 12-18 months, which is the quickly surpass 10% of GDP, which is very large and quite period for which a "business as usual" scenario could be possibly unsustainable. Modest cuts, to keep the easily maintained. It is much more likely that it will be a deficit within say 6% of GDP, should be targeted. multi-year affair, with diamond exports taking perhaps five years to recover to early 2008 levels in real terms The level of spending cuts that will be necessary to maintain (reflecting stuttering recovery in the world economy, and fiscal sustainability depends very much on the degree of the diamond sector lagging behind recovery in other the downturn in diamond exports and mineral revenues. sectors. If the decline in exports is limited to, say, 35% for two years, with recovery beginning in late 2010, then it should Botswana could, in principle, undertake a fiscal stimulus be possible to manage with some fairly modest cuts in package financed by accumulated government savings or government spending. The danger is that the decline in by additional government borrowing; after all, the economy earnings is larger, say more than 50%, in which case is awash with liquidity and the private sector is undoubtedly deeper cuts would be necessary. willing to hold more government bonds. However, budget Controlling the government budget will be the key to data suggest that there is little scope to do this in a maintaining macroeconomic stability during the crisis. sustainable manner. Such a policy would lead to large The following principles would be appropriate: budget deficits and sharp deterioration in government's financial position, which would be difficult, if not • Setting a firm ceiling on the government budget, which impossible, to restore. It would also lead to rapid drawdown is likely to involve modest spending cuts; of the foreign exchange reserves. The ability to borrow • Reviewing government policies and programmes and does not change the situation: government's net financial their expenditure implications position and the impact on the reserves is the same whether - weeding out unnecessary and unproductive expenditure is funded from savings or borrowing. To spending; maintain macroeconomic stability, some kind of adjustment - prioritisation of projects and programmes,

- 9. 9 Economic Review so that the focus can be on high priority items; It should also be noted that contrary to popular perceptions, - focusing government spending on economically much has been done to reduce Botswana's dependence productive projects which will help the economy upon diamonds over the past two decades. For instance, to withstand the recession and contribute to while mineral revenues accounted for well over 55% of economic diversification; total government revenues as recently as the late 1990s, • Postponing non-essential development programmes; the figure is now under 40%. Similarly, the balance of • Critically evaluating projects with a very high import payments is much less dependent upon diamond exports component; than it was: in the early 1990s, non-diamond exports • Freezing new posts in the public sector; managed to pay for less than 30% of Botswana's imports • A continued focus on improving productivity and of goods and services, whereas by 2007, the figure had efficiency in the public sector; risen to nearly 60% (see Figure 8). Hence the impact of • Preparing contingency plans to be implemented in the a dramatic downturn in diamond exports on the economy event that the international crisis proves deeper or is likely to be less at the current time than it would have more long-lasting than currently anticipated (especially been a decade ago. The severity of the impact reflects not with regards to diamond exports); so much a failure to diversify away from diamonds, but • Postponing the introduction of NDP10 until the the fact that several of the industries that have been longer-term implications of the crisis are clearer. instrumental in that diversification are also being badly affected by the global recession. Conclusion Figure 8: Proportion of imports covered by In the last edition of the Economic Review (2008Q3) we non-diamond exports (goods and services) argued that while "Botswana's financial sector has so far 60% been immune from the problems facing stock markets and 50% banking systems in other countries", the "main threat lies US$ billion in the potential impact of prolonged global economic 40% slowdown on the mining industry". We also noted that 30% "the next three to six months will be crucial in determining 20% how the impact of the global crisis on Botswana will play 10% out". In the event, developments over the past three months have been far worse than anticipated, and the 0% impact on Botswana - as in most countries of the world 07 06 92 93 94 95 96 97 98 99 00 01 02 03 04 05 20 20 19 19 19 19 19 19 19 19 20 20 20 20 20 20 - will be severe, with lower economic growth, reduced Source: Econsult exports and government revenues, and rising unemployment. While in many respects the economic prospects for 2009 are not good, the situation is not all bleak. The long-term While Botswana will undoubtedly be stressed in the current prospects for diamonds remain good, with falling world global economic climate, the dangers should not be diamond supplies providing support for prices once demand exaggerated, and Botswana is in a much stronger position recovers. As noted above, inflation is falling sharply, due than many other mineral-producing economies. Nigeria, in large part to the impact of the global recession, and Angola and Zambia are all likely to experience larger regional power shortages should become slightly less declines in export earnings than Botswana, and also have acute. In addition, government budget constraints will smaller reserves to help see them through the crisis. hopefully force some long-overdue pruning of waste in Botswana's accumulated foreign exchange reserves and government spending, along with the prioritisation of government assets provide a cushion that will enable a projects and programmes. The crisis also reinforces the gradual adjustment to these adverse circumstances, rather point made in earlier editions of this Review that in good than a panic response. The foreign exchange reserves times, government should be saving much more to put amount to some 24 months of import cover, whilst at the the economy in a stronger position when diamonds end of 1980, going into the previous crisis, reserve cover eventually run out, and should not be embarking on new was only around 6 months. spending programmes (or keeping old ones going) with unknown or insufficient economic or social benefits. Bifm Botswana Limited Asset Management, Property Management, Private Equity, Corporate Advisory Services. Dynamic Wealth Management Private Bag BR 185, Broadhurst, Botswana, Tel: +(267) 395 1564, Fax: +(267) 390 0358, www.bifm.co.bw