Bank Director Final Brochure

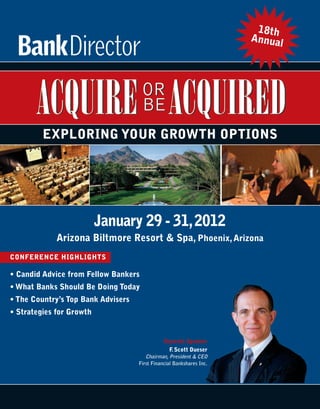

- 1. 18th Annual EXPLORING YOUR GROWTH OPTIONS January 29 - 31, 2012 Arizona Biltmore Resort & Spa, Phoenix, Arizona CONFERENCE HIGHLIGHTS • Candid Advice from Fellow Bankers • What Banks Should Be Doing Today • The Country’s Top Bank Advisers • Strategies for Growth Keynote Speaker F Scott Dueser . Chairman, President & CEO First Financial Bankshares Inc.

- 2. Why You Should Attend the Acquire The Premier Growth Conference for Financial Institutions For the past 17 years, bankers have attended Acquire or Be Acquired to gain the knowledge they need to make the right strategic decisions for their institutions. Beyond just M&A, obtain timely, practical insight on capital formation, deposit growth, private equity, alternatives for liquidity and more! Candid Advice from Experienced Bankers & Advisers Notable bankers outline their M&A and growth successes and lessons learned. An unparalleled line-up of respected industry advisers promises valuable guidance on industry trends and important information you won’t find anywhere else! FREE Bank Valuation Receive a FREE report estimating your bank’s worth in today’s market, courtesy of Sheshunoff & Co. Investment Banking. All attendees registered before January 15 will receive a customized report for their institution based upon recent activity in the industry. Hear Firsthand Advice From Other “Movers and Shakers” KEYNOTE: Merrill W. Sherman Kevin Lynch F Scott Dueser . President & CEO President & CEO, Oritani Bank Chairman, President & CEO Bancorp Rhode Island, Inc. Chairman, President & CEO First Financial Bankshares Inc. Oritani Financial Corp. Michael P Daly . Kenneth Neilson Norman H. Schulman, CPA President & CEO former President, Chairman & CEO Director Berkshire Bank Hudson United Bank and Hudson Herald National Bank United Bancorp

- 3. or Be Acquired Conference in 2012! Network with Peers from Across the Country Take advantage of unique networking opportunities throughout the event. Peer interaction is an important part of the conference learning experience. On Tuesday, enjoy a round of golf with fellow attendees. But hurry, while the golf tournament is free for paid attendees, it is limited to 85 golfers. Guest Program We want you and your guest to have a memorable trip. Your guest will have plenty of time to explore Phoenix and guests are invited to join you for the Sunday lunch, receptions each evening and the Monday gala dinner featuring special entertainment. Hotel Information Continuing Legal Education: State CLE accreditation for each conference is based on individual attendee requests. Credit hours may vary by state. Credit hours are not guaranteed. All CLE requests must be received prior to the event. Please contact Bank Director at (615) 777-8463 or mcotten@bankdirector.com. Many states have minimum deadlines for applications or credits may be denied, so requests should be submitted to us in a timely manner. Requests received at or following the event for states not previously submitted for credit may not be processed. You may, however, be eligible for credit hours by applying to your state on an individual basis where applicable. Please contact your state bar for more information. You may locate your state bar’s office or website at the following web address: www.abanet.org/cle/manstates.htm. Continuing Professional Education: Director Corps, Inc., the parent company ARIZONA BILTMORE RESORT & SPA of Bank Director, is registered with the National State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National 2400 East Missouri Avenue Registry of CPE Sponsors. Visit www.bankdirector.com for more information Phoenix, Arizona 85016 • (602) 955-6600 on CPE learning objectives, program levels, prerequisites, recommended credits www.arizonabiltmore.com and complaint resolutions. Since 1929, when the Frank Lloyd Wright-inspired Arizona Biltmore Payments: Conference registration includes admittance to all conference opened, Phoenix has grown up around the landmark, making it a activities and the conference notebook. Payment will be accepted by check, welcome retreat in the center of Phoenix and Scottsdale. Equipped American Express, Discover, Visa or MasterCard. If paying by check, please with two championship golf courses, a spa and athletic club, four make payable to DirectorCorps, Inc., include the attendees’ names and/or a swimming pools, designer shops and gourmet dining opportunities, copy of the registration form, and mail to: Conferences, DirectorCorps, Inc., the Biltmore offers something for everyone. These amenities, 201 Summit View Drive, Suite 350, Brentwood, Tennessee 37027. Payments combined with impeccable service, will provide an experience you must be received by January 16, 2012. won’t soon forget. Cancellations: Due to commitments and expenses, all cancellations after SPECIAL RATE December 16, 2011 will be subject to a $150 processing fee. We regret that no $359 per night. Specify the “Bank Director Acquire or Be refunds will be granted after January 16, 2012; however, substitute participants Acquired Conference” to ensure your discount. Rooms are are welcomed. DirectorCorps, Inc. assumes no liability for any nonrefundable limited. Hotel discount expires January 6, 2012. travel, hotel or related expenses incurred by registrants.

- 4. Sunday, January 29 Agenda subject to change due to market circumstances. 7:30 a.m. - 1:00 p.m. Registration 7:30 a.m - 8:30 a.m. Breakfast Sponsored by: 8:30 a.m. - 10:30 a.m. Workshops (select one) 1 M&A Simulation Kumi Baruffi, Partner, Graham & Dunn P.C. Brian D. Branson, Director, Investment Banking, Sterne Agee & Leach, Inc. Robert P Hutchinson, Head of Depository Institutions, Investment Banking, Sterne Agee & Leach, Inc. . Stephen M. Klein, Partner, Graham & Dunn P.C. Casey Nault, Partner, Graham & Dunn P.C. Robert J. Toma, CFA, Director, Investment Banking, Sterne Agee & Leach, Inc. To successfully negotiate a merger transaction, buyers and sellers must bridge the gap between a number of financial, legal, accounting and social challenges. Work side-by-side with industry experts in this interactive exercise where participants role-play as buyers and sellers in an attempt to negotiate a mutually beneficial merger transaction. The simulation replicates challenges that boards must overcome to facilitate a transaction in today’s tough environment. This session will be limited to 36 participants. 2 Strategic Alternatives for Banks Under $1 Billion in Assets Craig J. Mancinotti, Managing Director & Principal, Austin Associates LLC Richard F Maroney Jr., Managing Director & Principal, Austin Associates LLC . C. Robert Monroe, Chairman, Financial Services Division, Stinson Morrison Hecker LLP Recent legislation has further divided the industry into size classifications. While some experts have pronounced that banks must be one billion dollars in assets to survive, many smaller community banks are thriving. This session will present established strategies for growth, capital maintenance, profitability and other critical strategic initiatives. Case studies of successful community banks will be presented. 3 How Do You Make Your Bank Relevant in Today’s Consolidating Industry? Joseph M. Harenza, CEO & Senior Managing Director, Griffin Financial Group Mark R. McCollom, Senior Managing Director, Griffin Financial Group As the industry continues to consolidate and adapt to regulatory and competitive market forces, banks need to continually evaluate their strategic relevance to the markets they serve. This presentation will show banks what economic, financial and demographic factors are important and relevant to institutional investors, industry consolidators and your competitors. Staying one step ahead of your competition will be more important than ever, as increased regulation and a slow economic recovery have reduced new investor capital into the banking sector and those banks that remain financially and strategically relevant will increase their chances for success. 4 Director Liability Workshop: Exploring Board Liabilities Throughout the Deal Process Steven H. Anderson, Executive Managing Director, Beecher Carlson Henry M. Fields, Partner, Morrison & Foerster LLP John Hamel, Managing Director & Head of Financial Institutions Group, ROTH Capital Partners Board members have a fiduciary responsibility to grow shareholder value and act in the best interest of their constituents. With an uncertain market, many boards wrestling with fundamental questions like what are we worth today? And what is a fair price at which to sell? This workshop will address the individual responsibilities assumed during an M&A transaction, exploring liabilities inherent to the position. 10:30 a.m - 10:45 a.m. Refreshment Break Sponsored by: “If you only go to one conference per year, this is the one. It covers the broadest number of relevant issues for bankers and bank directors.” – John Sneed, Chief Executive Officer, First Morgan State Bank and 3-time Acquire or Be Acquired conference attendee

- 5. Sunday, January 29 10:45 a.m. - 11:45 a.m. Raising Capital For Banks: Elements Of A Successful Offering Kevin Lynch, President & CEO, Oritani Bank; Chairman, President & CEO, Oritani Financial Corp. Ben A. Plotkin, Executive Vice President, Stifel Nicolaus Weisel; Vice Chairman, Stifel Financial Corp. Find out how small-cap banks are successfully tapping the equity markets. An experienced investment banker and a public company CEO will discuss their recent experiences in preparing for and executing successful public offerings. Topics will include the “road show” experience, types of offerings and managing pricing expectations. Noon - 1:00 p.m. Lunch Sponsored by: 1:00 p.m. - 1:10 p.m. Welcome Al Dominick, Managing Director & Executive Vice President, Bank Director 1:10 p.m. - 2:00 p.m. Your Bank’s Worth–Today And Tomorrow Curtis Carpenter, Managing Director, Sheshunoff & Co. Investment Banking Gain a better understanding of how the market has changed, major value drivers, transaction trends and where your bank fits into the mix. 2:00 p.m. - 2:50 p.m. Banker’s Panel: The Who, What, When, Why And How Of Selling Your Bank Kenneth T. Neilson, former President, Chairman & CEO, Hudson United Bank and Hudson United Bancorp Norman H. Schulman, CPA, Director, Herald National Bank Merrill W. Sherman, President & CEO, Bancorp Rhode Island, Inc. Moderator: Ronald H. Janis, Esq., Partner, Day Pitney LLP To sell or not to sell – that is a debate for many bank boards. Many factors go into this strategic decision and it is essential for boards to weigh all the alternatives to make the best decision for shareholders. Hear from bank directors who have completed recent transactions and gain insight on everything from how to find the best deal to how to handle board dynamics during the process. 2:50 p.m. - 3:10 p.m. Refreshment Break Sponsored by: 3:10 p.m. - 4:00 p.m. Analyst Panel Frederick Cannon, Director of Research, Chief Equity Strategist and Executive Vice President, Keefe, Bruyette, & Woods, Inc. Mark Fitzgibbon, Principal and Director of Research, Sandler O'Neill + Partners Ken Usdin, Managing Director, Equity Research – U.S. Banks, Jefferies & Co., Inc. Moderator: Gary R. Bronstein, Partner, Kilpatrick Townsend & Stockton LLP Hear what top analysts look for when investing in a bank, what challenges they see for the industry and specific opportunities they are following for 2012.

- 6. Sunday, January 29 4:05 p.m. - 5:05 p.m. Breakouts (select one) 1 The Path to Recovery - Building Value in a Changing Environment James J. McAlpin Jr., Partner, Bryan Cave LLP Walter G. Moeling IV, Partner, Bryan Cave LLP This breakout will look at the evolving profitability trends in the banking industry and the drivers of those trends. Participants will also discuss the opportunities and challenges which bank management and boards of directors should be focusing on during the path to recovery of the industry. 2 Structuring a Deal in a Volatile Market and Ensuring Walk-Away Power Rick Childs, Director, Assurance & Financial Advisory Services, Crowe Horwath LLP Deal structure has never been trickier. What structures are working now and how do you structure your transaction to protect your shareholders? The market is volatile, and the economic outlook changes daily. What are the ways smart banks are doing deals in an uncertain environment? 3 M&A Best Practices - From Finding the Deal to Making it Real Nichole Jordan, National Banking & Securities Industry Leader, Grant Thornton LLP This session will take you on a tour of essential steps throughout the entire deal process. Learn what your institution can do to create an M&A strategy that fits with your institutions strengths; assess and analyze potential deals and their potential pitfalls; execute a thorough due diligence and merger integration process; and realize the benefits of a successful integration. 4 Banking M&A - Headwinds and Shifting Sands Clifford S. Stanford, Counsel, Alston & Bird LLP The changes wrought by the financial crisis and its aftermath continue to reverberate, and banking business models have yet to reach a "new normal." In an environment of continued slow growth and low interest rates, regulatory pressures and uncertainty, emerging technology paradigms and threats to the banking franchise from non-banks, and where traditional fee models have been changed forever, where are the opportunities emerging in the banking sector? 5:30 p.m. - 6:30 p.m. Welcome Reception Sponsored by:

- 7. Monday, January 30 7:00 a.m. - 8:00 a.m. Breakfast Sponsored by: 7:00 a.m. - 7:50 a.m. Regional Roundtables Take advantage of a unique opportunity to discuss issues and growth challenges specific to your region and network with other bankers from your area during these informal breakfast roundtables. There will be four sets: • Northeast, sponsored by FinPro, Inc. • Southeast, sponsored by FIG Partners LLC • Midwest, sponsored by McGladrey • West Coast, sponsored by Manatt Phelps & Phillips LLP 7:50 a.m. - 8:05 a.m. Opening Remarks Jack Milligan, Editor, Bank Director 8:05 a.m. - 8:55 a.m. State Of The Industry John G. Duffy, Chairman & CEO, Keefe, Bruyette & Woods Inc. An annual highlight! One of the financial services industry’s most well known advisers reviews the operating conditions for banks across the country to help you make more informed decisions on the strategic challenges ahead. 8:55 a.m. - 9:45 a.m. The New M&A Market: Can Buyers & Sellers Find The Perfect Balance For Constituencies? Michael P Daly, President & CEO, Berkshire Bank . William F Hickey, Principal, Sandler O’Neill + Partners, L.P. . Sellers must focus on valuation and liquidity of buyers. Buyers must realize opportunities that they bring to sellers. A well balanced deal should be a win-win. 9:45 a.m. - 10:00 a.m. Audience Response Survey Sponsored by: Nichole Jordan, National Banking & Securities Industry Leader, Grant Thornton LLP An audience favorite! We once again ask attendees to sort out the emerging trends in the banking industry. Don’t miss the chance to express your opinions through individual automated response keypads. 10:00 a.m. - 10:20 a.m. Refreshment Break Sponsored by: 10:15 a.m. - 12:05 p.m. M&A Simulation (This workshop runs concurrent to the 10:20 and 11:15 a.m. breakout sessions listed on the next page.) Kumi Baruffi, Partner, Graham & Dunn P.C. Richard D. Foggia, Managing Director, Financial Institutions Group, Commerce Street Capital LLC Stephen M. Klein, Partner, Graham & Dunn P.C. C.K. Lee, Managing Director, Financial Institutions Group, Commerce Street Capital LLC Casey Nault, Partner, Graham & Dunn P.C. Dory A. Wiley, President & CEO, Commerce Street Capital LLC To successfully negotiate a merger transaction, buyers and sellers must bridge the gap between a number of financial,legal, accounting and social challenges. Work side-by-side with industry experts in this interactive exercise where participants role-play as buyers and sellers in an attempt to negotiate a mutually beneficial merger transaction. The simulation replicates challenges that boards must overcome to facilitate a transaction in today’s tough environment. This session will be limited to 36 participants.

- 8. Monday, January 30 10:20 a.m. - 11:10 a.m. Breakouts I (select one) 1 What Bank Management and Boards Need to Know in 2012 John E. Freechack, Chair, Barack Ferrazzano Financial Institutions Group Allen G. Laufenberg, Managing Director, Investment Banking, Stifel Nicolaus Weisel This breakout continues the “Need to Know” series that has been a popular highlight at this conference for the past few years. Gain practical insight from two experienced bank advisers on what CEOs and directors will need to know to succeed in 2012 and beyond. From regulatory and legal matters to M&A and capital market trends, learn how to best position your organization to take advantage of changes. 2 Managing The M&A Process For Success In A Challenging Environment – A Practical Guide John J. Gorman, Partner, Luse Gorman Pomerenk & Schick, P.C. Eric Luse, Partner, Luse Gorman Pomerenk & Schick, P.C. This session will review board and management responsibilities in evaluating a deal. In addition, participants will analyze and discuss the impact of evolving regulatory standards of M&A transactions, the importance of due diligence, innovative deal structures and document drafting, strategies for achieving executive compensation objectives and new challenges with the SEC and in obtaining shareholder approval, including the new golden parachute vote. 3 ESOPs For Banks and Bank Holding Companies: The Tax-Exempt Stock Market Michael A. Coffey, Managing Vice President, Corporate Capital Resources LLC W. William Gust, J.D., LLM, President, Corporate Capital Resources, LLC The Internal Revenue Code treats ESOPs as tax-exempt single shareholders, which can purchase newly-issued or outstanding, bank or bank holding company shares using pre-tax plan contributions as well as untaxed dividends. An integrated strategy is the key to meeting board and shareholder objectives: the successful ESOP is one which coordinates the design with the long term business succession plan, key executive compensation, stock valuation and employee benefit goals. This session reviews ESOP regulations, features of plan designs for the banking sector, and most importantly, strategic and creative applications of these plans for buying in shares or capitalization with pre-tax dollars. 11:15 a.m. - 12:05 p.m. Breakouts II (select one) 1 The Movement to Redefine Compensation, Cost and Control in the Era of Consolidation William Flynt Gallagher, President, Meyer Chatfield Compensation Advisors How do you define senior management compensation in the face of rapid-change regulations? Harder still, what’s the right response to best practices in the midst of industry consolidation? This breakout session presents a practical review of what every chief executive and director must know and do to stay grounded and proactive. 2 Community Bank Valuation: Moving Past the Crisis Andrew K. Gibbs, SVP & Financial Institutions Group Leader, Mercer Capital As community banks’ performance continues to improve from the lows experienced during the financial crisis, this session will look at factors that are presently contributing or that may contribute in the future to the valuation of community banks. The breakout will also consider transactions, such as employee stock ownership plans or share repurchases, that may be advisable in the current environment for community banks. 3 Credit Considerations in Bank M&A: Analyzing Credit Risk and Dealing with Problem Loan Assets James J. Dougherty, Managing Director, Bayview Advisory Services, LLC Brett S. Evenson, Managing Director, Bayview Asset Management, LLC Today’s challenging markets require a comprehensive approach to evaluating the credit risk in loan portfolios and dynamic strategies to deal with the underperforming loans contained in most acquired portfolios. This discussion will cover various loss estimation approaches developed for FDIC-assisted and private M&A transactions, and various strategies to employ to best deal with troubled or non-performing assets. 12:05 p.m. - 1:25 p.m. Lunch Sponsored by:

- 9. Monday, January 30 1:25 p.m. - 2:15 p.m. The Evolution of Private Equity Participation in Bank Capitalization and Acquisitions John Eggemeyer, President, Castle Creek Capital LLC Kenneth P Slosser, Managing Director, FBR & Co. . Bryan E. Sullivan, Senior Vice President, PIMCO The field of private equity funds focusing on community banks has shrunk, creating a more competitive landscape. This panel will explore the state of private equity investment approaches today, including how the process has evolved, how the firms are setting their parameters for potential investments and where and what they are looking to invest in today’s market. 2:15 p.m. - 3:05 p.m. Keynote Address F Scott Dueser, Chairman, President & CEO, First Financial Bankshares Inc. . Having finished first in Bank Director’s 2010 Performance Scorecard and second in the 2011 report, Abilene, Texas-based First Financial Bankshares knows a thing or two about growing successfully. Hear how the bank’s management and board works together to focus its strategy and make effective decisions to achieve exemplary performance in a challenging environment. Take away practical and implementable “tricks of the trade” for your own institution. 3:05 p.m. - 3:25 p.m. Refreshment Break Sponsored by: 3:25 p.m. - 4:15 p.m. Point / Counterpoint Debate Steven D. Hovde, President & CEO; Director of Investment Banking Operations, The Hovde Group Ronald H. Janis, Esq., Partner, Day Pitney LLP Mark C. Kanaly, Partner, Alston & Bird LLP Michael T. Mayes, Managing Director, Raymond James & Associates Inc. One of the most popular highlights of past conferences! Top investment bankers square off against attorneys to debate the merits of recent banking trends and what lies ahead. 4:15 p.m. - 5:05 p.m. L. William Seidman Lecture Series Sponsored by: This session honors Bank Director magazine’s late publisher, L.William Seidman, whose wit and wisdom always entertained attendees. The third annual series will look at the state of capital and M&A from a regulatory perspective. 5:45 p.m. - 7:00 p.m. Cocktails Sponsored by: 7:00 p.m. - 8:30 p.m. Dinner Sponsored by: 8:30 p.m. - 9:30 p.m. Special Entertainment:The Evasons, renowned mentalist duo A high-speed, interactive presentation that will captivate the audience and get everyone involved. ESP, Mind over Matter, Super Memory, Telepathy, Prediction and Levitation – prepare to be amazed! “This conference provides management and bank boards with the information to understand growth and how to use those principles to achieve profitability. A very worthwhile investment of time.” – Michael Morris, Chairman of the Board, Heritage Oaks Bank and 2011 Acquire or Be Acquired conference attendee

- 10. Tuesday, January 31 7:00 a.m. - 8:00 a.m. Breakfast Sponsored by: 7:00 a.m. - 8:25 a.m. Discussion Groups Rise early for interactive discussion groups with banking experts and your banking peers. The discussion groups will be repeated two times so attendees can select two topics of interest. Topics will include: implementing a successful social media plan; finding profitable growth; overcoming buyer obstacles and more. Participants will receive a complete list of options at the event. 8:30 a.m. - 9:20 a.m. General Session: M&A Integration Challenges Rick Bennett, Managing Partner, Bank Integration Practice, PricewaterhouseCoopers LLP The session will focus on the unique operational, reporting and compliance issues associated with the acquisition of a bank. This will include examining the unique issues associated with acquiring a distressed bank as well as the data and operational challenges of merging two banking institutions. Main topics will include operations, credit, accounting and reporting, technology and compliance challenges. 9:20 a.m. - 10:10 a.m. Breakouts I (select one) 1 What Buyers Want–And How To Present Your Bank In The Most Favorable Light Joseph Berry Jr., Managing Director Co-Head Depositories Group, Keefe, Bruyette & Woods, Inc. Scott Anderson, Managing Director Co-Head Depositories Group, Keefe, Bruyette & Woods, Inc. What makes your bank attractive to acquirers? Beyond asset quality, what are the acquirers looking for? This session will talk about what a bank needs to have in order to sell at a premium. 2 FDIC-Assisted Deals: What Opportunities Remain? Matthew F Veneri, Principal, FIG Partners LLC .X. As the FDIC receivership process rolls on, what opportunities exist for those banks that are looking to enter this marketplace, and what modifications will those that have participated in the past need to make to be successful in the bid process? 3 Assessing Strategic Alternatives Donald J. Musso, President, FinPro, Inc. Which builds more shareholder value: raising capital, shrinking the balance sheet or selling? Would it be more beneficial to grow organically or acquire? Each financial institution is unique and has its own strategic issues, but the value propositions remain the same. Management and the board of directors must define specific critical issues and assess the impact of each strategic alternative to determine the most effective way to maximize value. This session will provide clarity to the analytical process via a decision tree methodology and framework. 10:10 a.m. - 10:30 a.m. Refreshment Break Sponsored by:

- 11. Tuesday, January 31 10:30 a.m. - 11:20 a.m. Breakouts II (select one) 1 D&O Liability: What You Need to Know Dennis Gustafson, SVP & Financial Institutions Practice Leader, AH&T Insurance This interactive breakout will provide a one-stop shop to help prepare you for your upcoming D&O renewal. The session will begin with a claim and litigation trends analysis focusing on exposures arising from M&A, regulatory actions, and even the recent U.S. credit downgrade and the resulting market drop. The focus will then transition to a data-centric approach to limits benchmarking to assist in the process of determining the appropriate D&O limits of liability. Lastly, participants will walk away with a top 10 list of coverage enhancements that you should be asking for. 2 What Should You Expect at Your Next Meeting? John Siemann, Partner, Phoenix Advisory Partners This session will offer a brief look at the new proxy and corporate governance arena and provide answers to such questions as: What does the Dodd-Frank Act mean for me? How can companies survive the new activism? What can directors do to protect their boards? 3 Can You Still Get Paid When You Walk Out the Door? Gordon M. Bava, Firm Co-Chair & Partner, Manatt Phelps & Phillips LLP Joshua A. Dean, Partner, Manatt Phelps & Phillips LLP Craig D. Miller, Partner & Co-Chair, Financial Services & Banking, Manatt Phelps & Phillips LLP Learn the latest on executive compensation exit packages while taking into account incentive compensation guidance, limitations on golden parachutes, clawbacks and shareholder feedback. 11:25 a.m. - 12:15 p.m. Breakouts III (select one) 1 The Post-Durbin Path to Profitable Checking Accounts Mike Branton, Partner, StrategyCorps Dave DeFazio, Partner, StrategyCorps Your bank has thousands of unprofitable consumer checking accounts (40%-50% of total accounts). Durbin, other regulations and “guidance” are increasing this number. Blanket fee increases or punitive account requirements, like a minimum balance, won’t increase profitability. Plus, it risks angering your super profitable accounts (representing 80%-100% of portfolio profitability). This session highlights how to generate significant new fee income from unprofitable checking accounts and improve the retention of super profits by at least 10%, adding significant and immediate profit and creating value for your bank. 2 M&A—Keys to Successful Banking Today Brett P Barragate, Partner, Jones Day . Ralph F MacDonald III, Partner, Jones Day . Successful banking depends more on M&A in the current economic and regulatory environment. This discussion will focus on why M&A is critical; how to develop and implement a successful M&A strategy programs; the building blocks for M&A success; avoiding regulatory and governmental road blocks; and enhancing shareholder value with appropriate capital. 3 Risks and Rewards of New Businesses Barak J. Sanford, Managing Director, Promontory Financial Group, LLC Faced with the unrelenting arithmetic of their income statements, an increasing number of community banks face the dilemma – “acquire or be acquired.” Yet some enterprising institutions are pursuing a third solution to the revenue puzzle by venturing into specialized lending, fee-based services and other new businesses. Done right, these businesses can provide the additional revenue and scale necessary to make continued independence viable. But the risks of such strategies are considerable, and many attempts end poorly, if not disastrously. This session will discuss the strategic, regulatory and financial risks and opportunities of pursuing this third option. 12:15 p.m. Boxed Lunches 1:00 p.m. Golf Tournament Golf Tournament & Closing Reception Enjoy the afternoon playing golf on one of the top courses in America. Remember, the golf tournament is limited to the first 85 registered players, so sign up early to reserve your spot! Sponsored by: 5:30 p.m. - 7:00 p.m. Closing Reception

- 12. Conference Sponsors AH&T Insurance was founded in 1921 and is Beecher Carlson is an insurance brokerage and Day Pitney LLP has approximately 350 FinPro, Inc. was established in 1987 as a recognized as one of the “100 Largest Brokers risk management consulting firm that strives attorneys located in nine offices in New Jersey, merger and acquisition and management of U.S. Business” as ranked by Business to develop new and better technologies that New York, Connecticut, Boston and Washington, consulting firm, specializing in the financial Insurance magazine. The firm is a full service support business requirements and drive D.C. The firm represents banks and bank holding institutions industry. The firm is nationally insurance brokerage, risk management, operational excellence. Beecher Carlson companies in bank regulatory matters, capital ranked in mergers and acquisitions and is a employee benefits, surety bond and retirement identifies and quantifies the factors bearing on raising, FDIC-assisted transactions and mergers proven leader in strategic planning, market planning services organization dedicated to how each decision will affect your business. The and acquisitions. Day Pitney assists clients in feasibility, de novo bank formation, asset/ providing innovative solutions globally for result is evidence-based information regarding M&A due diligence, including regulatory liability management, enterprise risk management businesses and individuals. AH&T is employee- the causes of risk within your organization and compliance and BSA/AML issues; employee and regulatory consulting. FinPro maintains owned and one of the largest independent for your executives. Beecher Carlson is a benefits and executive compensation; intellectual close contact with the bank regulatory agencies. insurance brokerages in the nation, with offices privately held company with its corporate office property; real estate and environmental issues; With a combination of its regulatory expertise in Virginia, D.C, Newark, New Jersey and in Atlanta, GA. Beecher Carlson also maintains securities law; and corporate fiduciary issues. and entrepreneurial solutions, FinPro provides Seattle, Washington. AH&T is a partner of the offices throughout the United States and in The firm serves as SEC and regulatory strategies to maximize value while working RiskProNet and TechAssure global broker Bermuda. compliance counsel to both banks and bank within the regulatory framework. FinPro principals networks. holding companies. It also serves as counsel to teach M&A classes at various banking schools audit committees and compensation committees. and are frequent speakers at financial institution and regulatory conferences. Alston & Bird is an international law firm with more than 800 attorneys providing a full range of services to domestic and international clients conducting business around the world. The Bryan Cave is an Am Law 100 law firm with industry knowledge and regulatory capacity of over 1,100 lawyers and other professionals Graham & Dunn PC is an industry-focused law its 250 corporate, regulatory and policy practicing in a wide range of disciplines from firm based in Seattle, with a primary focus on 29 offices around the world. The members of Being successful in today’s financial arena attorneys bring critical value to client means being flexible to the ever-changing the financial services industry. With a client list relationships. The BTI “Masters of the Deal” our financial institutions group have worked of more than 50 financial institutions in the with hundreds of banks, payment networks and demands and preferences of your account list, a survey of law firms’ corporate holders. With Deluxe Financial Services, West, the Graham & Dunn team offers breadth relationships, ranked Alston & Bird fifth among bank card issuers across the country for many and depth of industry knowledge, and a proven years, and offer clients a broad spectrum of you’ll find the programs and services you need U.S. law firms. Alston & Bird has been ranked to meet those demands, drive revenue, and track record representing financial institutions. on FORTUNE's “100 Best Companies to Work practical experience and legal knowledge From operations to acquisitions, regulatory relating to every aspect of the financial services create meaningful, long-lasting relationships For” list for 12 consecutive years, including with your customers. Deluxe provides financial enforcement and compliance, SEC compliance placement in the top 25 for seven consecutive industry. The group emphasizes hands-on and corporate governance, lending to litigation, experience, and includes numerous 25+ year institutions measurable solutions for increasing years. The recognition speaks to the culture of non-interest income, targeting customers, and formation to financing, Graham & Dunn the firm and the environment in which the firm veterans of banking law, former regulators, puts their knowledge, innovation, and credibility former bank officers, and CPAs who formerly acquiring and on-boarding accountholders, practices law. enhancing customer experiences, managing to work to ensure that your business makes the audited banks. The group has recently been most of its money. involved in significant private equity investments compliance and tracking success. To learn as well as open and closed bank M&A more visit www.deluxe.com/connect today. transactions. For many years, the group has been ranked among the leading deal-making Austin Associates, LLC is a leading provider of banking practices in the nation, as compiled by investment banking, financial management and SNL and American Banker. consulting services to community banks. Austin Grant Thornton LLP is the U.S. member firm Associates investment banking services include of Grant Thornton International, one of the six both buy-side and sell-side transactions, branch DLA Piper is a global law firm with 4,200 global accounting, tax and business advisory acquisitions/divestitures and FDIC-assisted lawyers in 30 countries and 76 offices organizations. Through its 52 offices in the transactions. Austin Associates has consistently throughout Asia Pacific, Europe, the Middle United States, its partners provide personalized ranked among the top investment banking firms Commerce Street Capital, LLC (“CSC”), is a East and United States. The firm’s practice attention and the highest quality service to to community banks. Austin Associates also private investment banking firm headquartered focuses on the core areas of corporate and public and private clients, including more than consults with financial institutions in strategic in Dallas, Texas. Founded in October 2007 and finance, litigation and arbitration, real estate 1,400 clients in the Financial Services industry. planning, capital planning, regulatory consulting, led by veterans of the banking industry, CSC and real estate capital markets, regulatory and Each spring, the firm publishes the Bank asset/liability management, profitability analysis specializes in investment banking services government affairs, intellectual property and Executive Survey. Its other Financial Services systems, loan pricing models, executive (mergers and acquisitions, valuations and technology, and tax. Its unmatched global industry publications include Currency, compensation programs, insurance and financial regulatory issue advising) and bank development presence enables the firm to meet the ongoing CorporateGovernor, Financial Bulletin, services, risk management, compliance and (onsite consulting and management of capital needs of its clients in the world’s key economic, SecuritiesAdviser and Regulatory Update. EDP/technology solutions. raising, market assessments, application technology, and governmental centers. development, board of director placement). The firm provides tailored solutions for all or part of a financial institution’s business lifecycle. Barack Ferrazzano is a law firm with a strong focus on the financial services industry, with experience addressing the entire spectrum of FBR & Co. (Nasdaq:FBCM) provides issues confronted by a financial institution. The investment banking, merger and acquisition Griffin Financial Group is an investment bank firm’s Financial Institutions Group has advisory, institutional brokerage, and which assists financial institutions in understanding represented over 250 financial institutions research services through its subsidiary FBR their strategic and financial alternatives in a across the country in recent years and has Corporate Capital Resources, LLC, is an independent national consultancy specializing in Capital Markets & Co. FBR focuses capital and rapidly changing environment, raising capital and consistently ranked as one of the top law firms financial expertise on the following industry in buying and selling banks and related businesses. in the nation in number of announced bank and business succession strategies for closely-held corporations with revenues of $10 M to $10 B. sectors: consumer; diversified industrials; energy Griffin understands a financial institution’s needs thrift merger and acquisition transactions. In & natural resources; financial institutions; from the perspective of bank executives and addition to our strong transactional practice, the The firm’s senior staff has an aggregate experience of over 60 years in the application insurance; real estate; and technology, media & board members. Many of the firm’s professionals Financial Institutions Group has national telecom. FBR Fund Advisers, Inc., a subsidiary are former senior executive officers of both large experience in regulatory and troubled bank issues, of Employee Stock Ownership Plans as a component of internal business continuity plans. of FBR, provides clients with a range of and small depository institutions with hands-on debt and equity financings, recapitalizations, investment choices through The FBR Funds, a governance, operating and transactional de novo bank formations, financial products and A hallmark of their designs is the coordination of ESOP tax favors with governance family of mutual funds. FBR is headquartered in experience. In addition, the firm’s in-house financial services, as well as an extensive executive the Washington, D.C. metropolitan area with accounting and tax capabilities are unique among compensation and employee benefits practice requirements, returns to shareholders, key executive compensation and estate plans for offices throughout the United States and in investment banks specializing in the financial with a focus on the unique needs of financial London. institutions sector. institutions. Our experience allows us to help senior shareholders. fashion creative solutions for our clients, with an emphasis on relationships, service and stability. The Hovde Group is a leading U.S. financial Crowe Horwath LLP is one of the largest public FIG Partners, LLC is an employee-owned advisory group that provides a full-service suite Bayview Asset Management LLC is a fully accounting and consulting firms in the United broker/ dealer specializing in bank and thrift integrated mortgage investment, special of investment banking, capital markets and States. Under its core purpose of “Building Value stocks. The firm’s mission is to generate superior financial advisory services focused exclusively servicing and advisory firm with expertise in with Values®,” Crowe assists public and private returns for both investors and community banks the analysis and management of distressed and on the banking & thrift industry. As a leading company clients in reaching their goals through through integrated Research, Market Making, specialist in the banking sector for over 25 performing mortgage assets. Bayview has been audit, tax, advisory, risk, and performance Capital Raising, Strategic Advisory, and Sales. engaged to assist banks and other institutions in years, The Hovde Group consistently ranks services. With 26 offices and 2,400 personnel, FIG Partners was formed in 2003, believing that among the top firms in mergers and acquisitions over 60 FDIC-assisted and open bank M&A Crowe is recognized by many organizations as an investment firm with independent research on transactions since 2009 ranging in size from and capital markets transactions for U.S.- one of the country's best places to work. Crowe banks and thrifts, coupled with focused sales, based bank and thrift institutions. The Firm’s $200 million to $45 billion. Services include serves clients worldwide as an independent market making, capital raising, and advisory expert valuation/advisory services, top-rated expertise extends to a wide range of strategic member of Crowe Horwath International, one could add value to the marketplace. The group’s M&A transactions, including asset purchases commercial and residential special servicing of the largest networks in the world, consisting collective experience in larger firms gives it including FDIC-loss share compliant asset and dispositions, restructurings, recapitalizations of more than 140 independent accounting and confidence that there is still a void for these and reorganizations, mergers, branch divestitures, management and reporting. Bayview also helps management consulting firms with offices in services. The firm believes in listening to clients banks strengthen their existing mortgage FDIC acquisitions, and other strategic more than 400 cities around the world. first, then advising them on the best course of affiliations and transactions. portfolios by offering quality performing assets action, offering a different level of sincerity for sale or exchange, and unique solutions for which it believes is often lost at large Wall non-performing loan problems including the Street firms. purchase of distressed mortgage portfolios.

- 13. Conference Sponsors Jones Day is a global law firm with 15 U.S. McGladrey's Depository Institutions Group Promontory is a leading strategy, risk Sheshunoff & Co. Investment Banking, a offices and 20 foreign offices. We represent offers deep understanding of the challenges and management and regulatory compliance premier community bank financial advisor, has financial institutions that are global to local in complexities financial institutions face. Our team consulting firm for the financial services acted as financial advisor in more than 250 size, including banks, holding companies, serves more than 2,000 financial institutions industry. Led by Eugene A. Ludwig, former transactions. Sheshunoff has helped institutions investment banks, PE and hedge funds, nationwide making this one of the largest U.S. Comptroller of the Currency, Promontory’s nationwide optimize shareholder wealth with institutional investors, broker-dealers and industries we serve as a firm.Our industry- professionals have deep and varied expertise merger and acquisition advisory services, investment advisors. Our services include specific expertise enables us to provide you gained through decades of experience as senior valuations, capital restructuring, and strategic capital raising securities and investments; M&A; bank wide operational reviews, loan reviews, leaders of regulatory bodies, financial options assessment for more than 30 years. Its corporate governance, regulatory and Dodd-Frank regulatory compliance, internal audits, institutions and Fortune 100 corporations. professionals are dedicated to providing integrity compliance and enforcement; litigation, including information technology solutions (including From 14 offices in North America, Europe, driven services. Sheshunoff knows community M&A, securities, derivatives and mortgages; and technology intrusions monitory and Asia, Australia and the Middle East, banking better than anyone. lending and commercial finance. infrastructure assessments), mergers and Promontory assists clients in more than 50 acquisitions, tax consulting, regulatory countries on six continents in meeting enforcement action assistance, valuations, and regulatory requirements; creating sound, compensation strategies that are unique to sustainable strategic plans and governance your bank.Whether you are considering an structures; strengthening credit and other risk acquisition, mitigating risk or enhancing controls; analyzing capital and liquidity needs; business performance, visit McGladrey at designing and implementing restructuring Keefe, Bruyette & Woods (KBW) is the largest www.mcgladrey.com/banks for more information. mechanisms; acquiring new bank charters; and full-service investment bank that specializes conducting investigations and forensic reviews. Sterne Agee & Leach, Inc. is a full-service exclusively in the financial services sector. Founded investment banking firm with offices located in in 1962, KBW is recognized as a leading authority 23 states across the country. The firm’s on financial services companies. KBW's focus investment banking group assists financial includes banking companies, insurance companies, Mercer Capital is one of the largest independent institutions with mergers and acquisitions, broker/ dealers, mortgage banks, asset business valuation and financial advisory financial advisory and capital raising. Additionally, management companies, and specialty finance services firms in the nation. Its ability to the firm provides fixed income and equity sales firms. The firm has established industry-leading understand and determine the value of a and trading, balance sheet management and PricewaterhouseCoopers provides industry- research services to financial institutions and positions in the areas of research, corporate financial institution is the cornerstone of the focused assurance, tax and advisory services finance, mergers and acquisitions, and sales and firm’s services and has been its core expertise their investors. Sterne Agee has been providing to build public trust and enhance value for its its clients with superior financial products, trading for financial services companies. since its founding. The firm’s financial clients and their stakeholders. More than institution valuation services include: Bank services and advice since its founding in 1901. 163,000 people in 151 countries across its As a privately-owned firm, Sterne Agee is able and Financial Institution Valuation; Bank ESOP network share their thinking, experience and Valuations; Valuation for Financial to offer its clients all the advantages of a full- solutions to develop fresh perspectives and service investment bank while maintaining a Reporting; Goodwill Impairment Testing; practical advice. “PricewaterhouseCoopers” Valuation for Tax Compliance; Transaction high level of flexibility, personal attention and and “PwC” refer to the network of member stability. Advisory Consulting; Loan Portfolio Valuation; firms of PricewaterhouseCoopers International and Capital Raising Consulting. Mercer Capital Limited (PwCIL). Each member firm is a has years of experience assisting financial separate legal entity and does not act as agent Kilpatrick Townsend & Stockton LLP is a full- institutions with significant corporate of PwCIL or any other member firm. service law firm with nearly 650 attorneys. The valuation, transactions, and other strategic lawyers in our financial services practice group decisions. Mercer Capital has provided hundreds represent banks and other financial institutions of sound, well-documented financial analyses and on a wide variety of matters. We offer a great valuation opinions for financial institutions large depth of knowledge and experience in the areas and small. In addition, the firm has a wealth of Stifel Nicolaus Weisel is the premier middle of employee benefits and director and executive transaction experience helping clients with over Raymond James & Associates, Inc. is one of market investment bank in the United States. compensation, mergers and acquisitions, 100 mergers, acquisitions, recapitalizations, and the nation’s largest full-service investment firms The firm’s Institutional Group provides top rated equity and debt offerings, holding company other substantial transactions. and operates nationwide through over 5,400 research, investment banking and other capital reorganizations, enforcement and director/ financial advisors. Client assets under markets services to banks and other middle officer liability matters, consumer law issues, management exceed $278 billion. The firm market companies. The Firm’s wealth financial privacy and electronic banking. Our makes active markets and provides equity management groups handle in excess of $110 lawyers understand the business impact of our research on over 1,000 publicly-traded billion in client assets. With over 5000 employees, clients' legal matters and work with them to Meyer-Chatfield, the leading BOLI resource companies. The Financial Services Group Stifel Nicolaus focuses on creative, idea-driven develop solution-oriented approaches. for America's financial institutions, has been specializes in serving banks, bank holding solutions tailored to meet each financial helping banks develop innovative and secure companies and thrift institutions in institution’s specific goals. Stifel Nicolaus’ BOLI investment strategies since 1992. The underwritten public offerings, private holding company, Stifel Financial, is publicly firm provides a wide array of services. With its placements, mergers and acquisitions, takeover traded on the New York Stock Exchange under own dedicated BOLI administration affiliate, defenses and fairness opinions. the symbol “SF.” Meyer-Chatfield can offer a truly integrated Luse Gorman is a Washington, D.C–based law approach that provides banks with unique firm specializing in representing community benefits. Meyer-Chatfield is the only BOLI banks, savings banks, and other financial provider that guarantees lifetime servicing of services providers. A significant part of its all its BOLI policies at no additional cost to the practice involves advising public and privately bank client. In addition, its in-house service held clients on mergers and acquisitions, capital representatives and consultants enable Meyer- raising transactions, corporate reorganizations, Chatfield to provide banks an unprecedented ROTH Capital Partners, LLC (ROTH), is a executive compensation and employee benefits, level of service and support. Meyer-Chatfield relationship-driven investment bank focused on and regulatory compliance and enforcement also has a dedicated compensation consulting identifying opportunities for institutional Stinson Morrison Hecker LLP is a 330- matters before the federal and state banking affiliate that focuses on helping bank clients investors in U.S.-listed equity securities of attorney law firm, focusing in many legal areas agencies. Luse Gorman is recognized as a attract, motivate and retain critical personnel, companies based in the U.S. and China. with an emphasis in representing financial national leader in advising community banks on primarily through the proper design and use Headquartered in Newport Beach, CA, with institutions. The firm maintains offices equity offerings and mergers and acquisitions, of performance based compensation plans. offices throughout the U.S., Hong Kong and a throughout the Midwest, as well as Phoenix, and the firm has consistently ranked in the Top Shanghai Representative Office, the employee- and Washington D.C. The firm has experience in 10 law firms nationally in representing banks, owned firm provides analytical research, many aspects of the financial services industry savings banks and their holding companies trading, capital raising, and business combination including acquisition of assets and deposits of on mergers and acquisitions and stock offerings. advisory services. ROTH seeks to implement failed banks, commercial lending, creditors' rights Morrison & Foerster is an international firm innovative financing strategies to efficiently and bankruptcy, mergers and acquisitions, and with more than 1,000 lawyers across 15 offices meet the liquidity and valuation requirements of regulatory enforcement actions, among others. in the U.S., Europe, and Asia. The firm is both its corporate and institutional investor dedicated to providing clients, which include clients. some of the largest financial institutions, Fortune 100 companies, and technology and life science companies, with legendary service. Manatt, Phelps & Phillips represents a wide Clients rely on Morrison & Foerster attorneys range of clients—from Fortune 1000 to for innovative and business-minded solutions. Sandler O’Neill + Partners, L.P is a leading . StrategyCorps works with hundreds of financial middle-market to emerging companies across a The firm has been included on The American investment banking firm and registered broker- institutions designing consumer checking line-ups range of practice areas and industry sectors. Lawyer's A-List for eight straight years, and dealer focused on the financial services sector. that are simpler and more profitable, and more Founded in 1965 to represent community Fortune named Morrison & Foerster one of The firm provides the full suite of investment relevant and appealing to their customers. The banks and savings and loans, Manatt has the "100 Best Companies to Work For." banking services, including advisory, capital firm’s CheckingScore® and MaxChecking® counseled more than 300 financial institutions markets, fixed income and equity trading and solutions are the best performing checking across the nation and abroad over the past sales, mortgage finance, balance sheet strategies in the marketplace. Combining precision several decades. With offices in California, management and research services to financial profit analysis with tailored, relationship-building New York, and Washington, D.C., Manatt is institutions and their investors. Sandler O’Neill accounts that generate $60-$100 of new fee recognized as one of the leading financial was founded in 1988 as an alternative to large income annually per account, your thousands of services law firms in the United States. Phoenix Advisory Partners is a corporate Wall Street firms, and today, about 330 unprofitable accounts will be cured and your governance consulting and proxy solicitation partners and employees work at the firm. profitable ones more protected. Plus your line-up firm. The firm provides year-round corporate Each year Sandler O’Neill is a leader in M&A will be simplified and upgraded to attract more governance consultation and advisory services advisory and capital raising for financial new customers. StrategyCorps is the go-to to all its clients, including full service companies. company for all things related to checking in a traditional proxy solicitation, bank and post-Durbin world. thrift conversion solicitations, mergers & acquisitions, tender offers, information agent services, shareholder activism advisory services, and proxy contests.

- 14. ACQUIRE OR BE ACQUIRED REGISTRATION FORM PHONE (800) 452-9875 E-MAIL conferences@bankdirector.com FAX (615) 309-3256 MAIL Bank Director WEB www.bankdirector.com/conferences 201 Summit View Drive, Suite 350 Brentwood, Tennessee 37027 NAME NICKNAME FOR BADGE COMPANY TITLE ADDRESS CITY STATE ZIP PHONE E-MAIL Registration Fees Individual Rate ❑ Early Rate $1,395 (Rate Expires November 30, 2011) ❑ Standard Rate $1,545 Group Rate (per person for groups of three or more) ❑ Early Rate $1,245 (Rate Expires November 30, 2011) ❑ Standard Rate $1,345 *Payment must be received by offer expiration date to get special rate. ❑ Non-Banker Rate $2,500 (This fee applies to attendees who are not officers or directors of a depository financial institution, such as investment bankers, attorneys, accounting firms, and other vendors and service providers.) ❑ Enroll me in Tuesday’s Golf Outing (FREE for the first 85 registered golfers) My Handicap: ❑ I need rental clubs. ❑ Right ❑ Left (Rental clubs are at attendee’s expense.) ❑ Enroll my guest in the Guest/Spouse Program • Guest/Spouse’s Name: $225 fee includes Sunday lunch, all receptions and Monday dinner. The Guest Program fee does not include participation in Tuesday’s golf tournament. Guests interested in playing with attendees in the golf tournament can sign up based on space availability. Green fee is $175. ❑ Enroll my guest in Tuesday’s Golf Outing (Additional $175) Guest’s Handicap: ❑ My guest needs rental clubs. ❑ Right ❑ Left (Rental clubs are at guest’s expense.) ❑ I am an attorney, and need Continuing Legal Education Credits for this event in the following states: State CLE Accreditation for each conference is based on individual attendee requests. Credit hours may vary by state. Credit hours are not guaranteed. All CLE requests must be received prior to the event. Please contact Misty Cotten at (615) 777-8463 or mcotten@bankdirector.com. ❑ I am an accountant, and need Continuing Professional Education Credits for this event. DirectorCorps, Inc., the parent company of Bank Director, is registered with the National State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. Visit our website for more information on CPE learning objectives, program levels, prerequisites, recommended credits, and complaint resolutions. Payment Information ❑ Visa ❑ MasterCard ❑ American Express ❑ Discover ❑ Bill me ❑ Check enclosed Make checks payable to DirectorCorps, Inc. CARD NUMBER EXP. DATE NAME ON CARD SECURITY CODE For more information, visit BankDirector.com