Weitere ähnliche Inhalte

Ähnlich wie Swifton CFOs - McCarter English - Fin Proj 100511

Ähnlich wie Swifton CFOs - McCarter English - Fin Proj 100511 (20)

Swifton CFOs - McCarter English - Fin Proj 100511

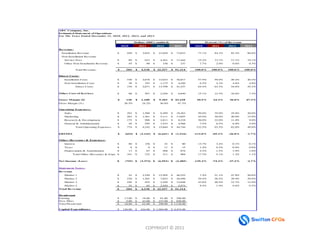

- 1. AB C Company, Inc.

Es timate d State me nt of Ope rations

For The Years Ended December 31, 2010. 2011, 2012, and 2013

Dollars (000's omitte d) Pe rce nt (%) of Re ve nue

2010 2011 2012 2013 2010 2011 2012 2013

Re ve nue :

Installation Revenue $ 450 $ 3,825 $ 21,038 $ 73,633 77.1% 84.3% 82.3% 80.6%

Non-Installation Revenue

Service Fees $ 89 $ 623 $ 4,361 $ 17,444 15.2% 13.7% 17.1% 19.1%

Other Non-Installation Revenue $ 45 $ 90 $ 158 $ 237 7.7% 2.0% 0.6% 0.3%

Total Revenue: $ 584 $ 4,538 $ 25,557 $ 91,314 100.0% 100.0% 100.0% 100.0%

Dire ct Cos ts:

Installation Costs $ 338 $ 2,678 $ 12,623 $ 36,817 57.9% 59.0% 49.4% 40.3%

Non-Installation Costs $ 38 $ 193 $ 1,175 $ 4,420 6.5% 4.3% 4.6% 4.8%

Direct Costs: $ 376 $ 2,871 $ 13,798 $ 41,237 64.4% 63.3% 54.0% 45.2%

Othe r Cos t of Se rvice s $ 88 $ 567 $ 2,556 $ 6,849 15.1% 12.5% 10.0% 7.5%

Gros s M argin ($) $ 120 $ 1,100 $ 9,203 $ 43,228 20.5% 24.2% 36.0% 47.3%

Gross Margin (%) 20.5% 24.2% 36.0% 47.3%

Ope rating Expe nse s:

Sales $ 292 $ 1,588 $ 6,389 $ 18,263 50.0% 35.0% 25.0% 20.0%

Marketing $ 263 $ 1,361 $ 5,111 $ 13,697 45.0% 30.0% 20.0% 15.0%

Research & Development $ 175 $ 998 $ 2,811 $ 8,218 30.0% 22.0% 11.0% 9.0%

General & Administration $ 44 $ 295 $ 1,533 $ 4,566 7.5% 6.5% 6.0% 5.0%

Total Operating Expenses: $ 774 $ 4,242 $ 15,844 $ 44,744 132.5% 93.5% 62.0% 49.0%

EBITDA $ (654) $ (3,142) $ (6,641) $ (1,516) -112.0% -69.2% -26.0% -1.7%

Othe r (Re ve nue ) & Expe ns e s :

Interest $ 80 $ 156 $ 32 $ 80 13.7% 3.4% 0.1% 0.1%

Taxes $ 8 $ 9 $ 11 $ 15 1.4% 0.2% 0.0% 0.0%

Depreciation & Amortization $ 13 $ 67 $ 268 $ 874 2.2% 1.5% 1.0% 1.0%

Total Other (Revenue) & Expenses

$ 101 $ 232 $ 311 $ 969 17.3% 5.1% 1.2% 1.1%

Ne t Income (Loss ) $ (755) $ (3,374) $ (6,952) $ (2,485) -129.3% -74.3% -27.2% -2.7%

State me nt Note s :

Re ve nue

Market 1 $ 43 $ 2,320 $ 12,205 $ 46,232 7.4% 51.1% 47.8% 50.6%

Market 2 $ 230 $ 1,201 $ 7,652 $ 26,450 39.4% 26.5% 29.9% 29.0%

Market 3 $ 256 $ 932 $ 3,250 $ 12,658 43.8% 20.5% 12.7% 13.9%

Market 4 $ 55 $ 85 $ 2,450 $ 5,974 9.4% 1.9% 9.6% 6.5%

Total Re ve nue $ 584 $ 4,538 $ 25,557 $ 91,314

He adcount

Existing $ 13.00 $ 18.00 $ 61.00 $ 298.00

New Hires $ 5.00 $ 43.00 $ 237.00 $ 830.00

Total Headcount $ 18.00 $ 61.00 $ 298.00 $ 1,128.00

Capital Expe nditure s $ 126.00 $ 424.00 $ 1,584.00 $ 4,474.00

COPYRIGHT © 2010

COPYRIGHT © 2011

- 2. Rule #1:

If you cannot read the

financial statement from two

feet away the font is

too small

(i.e. there are too many details)

COPYRIGHT © 2011

- 3. ABC Company, Inc.

Projected Statement of Operations

For The Years Ended December 31, 2010. 2011, 2012, and 2013

Dollars (000's omitted)

2010 2011 2012 2013

Revenue:

Market 1 $ 43.00 $ 2,320.00 $ 12,205.00 $ 46,232.00

Market 2 $ 230.00 $ 1,201.00 $ 7,652.00 $ 26,450.00

Market 3 $ 256.00 $ 932.00 $ 3,250.00 $ 12,658.00

Market 4 $ 55.00 $ 85.00 $ 2,450.00 $ 5,974.00

Total Revenue $ 584.00 $ 4,538.00 $ 25,557.00 $ 91,314.00

Gross Margin ($) $ 120.00 $ 1,100.00 $ 9,203.00 $ 43,228.00

Gross Margin (%) 20.5% 24.2% 36.0% 47.3%

Operating Expenses:

Sales & Marketing $ 555.00 $ 2,949.00 $ 11,500.00 $ 31,960.00

Research & Development $ 175.00 $ 998.00 $ 2,811.00 $ 8,218.00

General & Administration $ 44.00 $ 295.00 $ 1,533.00 $ 4,566.00

Total Operating Expenses: $ 774.00 $ 4,242.00 $ 15,844.00 $ 44,744.00

Other Expense/(Income) $ 101.00 $ 232.00 $ 311.00 $ 969.00

Net Income (Loss) $ (755.00) $ (3,374.00) $ (6,952.00) $ (2,485.00)

Stateme nt Notes:

Headcount

Existing $ 13.00 $ 18.00 $ 61.00 $ 298.00

New Hires $ 5.00 $ 43.00 $ 237.00 $ 830.00

Total Headcount $ 18.00 $ 61.00 $ 298.00 $ 1,128.00

Capital Expenditures $ 126.00 $ 424.00 $ 1,584.00 $ 4,474.00

COPYRIGHT © 2011

- 5. “Before you can sprint you

must learn how to crawl”

Usain Bolt

(Olympic Gold Medalist 100 meters)

COPYRIGHT © 2011

- 6. ABC Company, Inc.

Estimate d State ment of Operations

For The Years Ended December 31, 2010. 2011, 2012, and 2013

Dollars (000's omitte d)

2010 2011 2012 2013

Revenue:

Market 1 $ 43 $ 2,320 $ 12,205 $ 46,232

Market 2 $ 230 $ 1,201 $ 7,652 $ 26,450

Market 3 $ 256 $ 932 $ 3,250 $ 12,658

Market 4 $ 55 $ 85 $ 2,450 $ 5,974

Total Reve nue $ 584 $ 4,538 $ 25,557 $ 91,314

Gross Margin ($) $ 120 $ 1,100 $ 9,203 $ 43,228

Gross Margin (%) 20.5% 24.2% 36.0% 47.3%

Ope rating Expense s:

Sales & Marketing $ 555 $ 2,949 $ 11,500 $ 31,960

Research & Development $ 175 $ 998 $ 2,811 $ 8,218

General & Administration $ 44 $ 295 $ 1,533 $ 4,566

Total Operating Expenses: $ 774 $ 4,242 $ 15,844 $ 44,744

Other Expense/(Income) $ 101 $ 232 $ 311 $ 969

Net Income (Loss) $ (755) $ (3,374) $ (6,952) $ (2,485)

Statement Notes:

Headcount

Existing $ 13 $ 18 $ 61 $ 298

New Hires $ 5 $ 43 $ 237 $ 830

Total Headcount $ 18 $ 61 $ 298 $ 1,128

Capital Expe nditure s $ 126 $ 424 $ 1,584 $ 4,474

COPYRIGHT © 2011

- 7. Rule #3:

Use $ (dollar signs) on the

first and last row only.

Unless, of course, you are

mixing rows of $ and %, etc.

COPYRIGHT © 2011

- 9. ABC Company, Inc.

Projected Statement of Operations

For The Years Ended December 31, 2010 through 2013

Dollars

Revenue:

Market 1 $ 43 $ 2,320 $ 12,205 $ 46,232

Market 2 230 1201 7652 26450

Market 3 256 932 3250 12658

Market 4 55 85 2450 5974

Total Revenue 584 4538 25557 91314

Gross Margin ($) 120 1100 9203 43228

Gross Margin (%) 20.5% 24.2% 36.0% 47.3%

Operating Expenses:

Sales & Marketing 555 2949 11500 31960

Research & Development 175 998 2811 8218

General & Administration 44 295 1533 4566

Total Operating Expenses: 774 4242 15844 44744

Other Expense/(Income) 101 232 311 969

Net Income (Loss) $ (755) $ (3,374) $ (6,952) $ (2,485)

Statement Notes:

Headcount

Existing 13 18 61 298

New Hires 5 43 237 830

Total Headcount 18 61 298 1,128

Capital Expenditures $ 126 $ 424 $ 1,584 $ 4,474

COPYRIGHT © 2011

- 10. Rule #4:

Use column headings that

make sense

(and there are violators of this in the room)

COPYRIGHT © 2011

- 11. Rule #5:

Numbers with thousands or

millions must have commas

This: 54,556

Not this: 54556

COPYRIGHT © 2011

- 12. ABC Company, Inc.

Projecte d Statement of Operations

For The Years Ended December 31, 2010 through 2013

Dollars

2010 2011 2012 2013

Revenue:

Market 1 $ 43 $ 2,320 $ 12,205 $ 46,232

Market 2 230 1,201 7,652 26,450

Market 3 256 932 3,250 12,658

Market 4 55 85 2,450 5,974

Total Revenue 584 4,538 25,557 91,314

Gross Margin ($) 120 1,100 9,203 43,228

Gross Margin (%) 20.5% 24.2% 36.0% 47.3%

Operating Expense s:

Sales & Marketing 555 2,949 11,500 31,960

Research & Development 175 998 2,811 8,218

General & Administration 44 295 1,533 4,566

Total Operating Expenses: 774 4,242 15,844 44,744

Other Expense/(Income) 101 232 311 969

Net Income (Loss) $ (755) $ (3,374) $ (6,952) $ (2,485)

S t at em ent Not es:

Headcount

Exis t ing 13 18 61 298

New Hir es 5 43 237 830

Tot al Headc ount 18 61 298 1,128

Capital Expenditure s $ 126 $ 424 $ 1,584 $ 4,474

COPYRIGHT © 2011

- 13. Rule #6:

Don’t mix fonts

Or font size……

And do not use a silly font

COPYRIGHT © 2011

- 14. Rule #7:

Text is left justified

Numbers are right justified

Violators confuse the reader

COPYRIGHT © 2011

- 15. Rule #8:

Do not overdo color

and

Do not highlight in

Use Spot color!

COPYRIGHT © 2011

- 16. Rule #9:

Round your numbers to the

nearest thousand for

presentations

Thank you Joe Caruso for this suggestion

COPYRIGHT © 2011

- 17. Rule #10:

Spelle Check

And do not tell me you relied

on Microsoft…….

COPYRIGHT © 2011

- 19. • Provide cost-effective outsourced (part-time)

CFO support

• Clients range from pre-revenue startups to later

stage privately held companies

• Goal = provide strategic financial advice and

handle all accounting/ financial matters so the

entrepreneurs can focus on driving the business

COPYRIGHT © 2011

- 20. David Fogel, CPA

Serial entrepreneurial CFO

Principal of Swifton CFOs LLC (circa 2009)

Experience with high tech companies ranging from biotech

to telecom services to healthcare IT to social media to…

Adjunct Instructor of WPI MBA Program

Judge & Mentor:

Sponsor:

Associations:

COPYRIGHT © 2011

- 21. Developing The Financial Forecast

1. Defined

2. What about the assumptions?

3. Creating the sales forecast

4. Spreading the numbers

5. Creating the statements

COPYRIGHT © 2011

- 22. Ty Danco

Member, Mass Medical Angels

Member, North Country Angels

"I'll never believe your revenue numbers

anyway, but I sure want to scrutinize your

assumptions and expenses!"

COPYRIGHT © 2011

- 23. Developing The Financial Forecast

1.What are financial projections?

Collection of statements that present

your business in numbers (IS, BS, CF, Cap)

“Does the story make sense?”

“Does the story add up?”

COPYRIGHT © 2011

- 24. Set your goals from top down

but…..

Prepare the model from the bottom up

then….start over

with your top down goals

COPYRIGHT © 2011

- 25. Developing The Financial Forecast

2. What about the assumptions?

Document the source of each number you produce - Why?

- Knowledge of the assumptions proves that the

entrepreneur understands the business

- Prove it to yourself

Sources of assumptions

- Estimated or best guess (really try not to SWAG)

- Desired goal to be obtained

- Primary market research – surveys, vendor quotes

- Second market research – purchased or gov’t information

COPYRIGHT © 2011

- 26. Developing The Financial Forecast

2. What about the assumptions? (part 2)

Start-up costs (uses of $)

Financing (sources of $)

Capital expenditures (costs with >1 yr life)

Fixed expense (cost of being in business)

Variable expense (cost of doing business)

Projected sales (anticipated revenue earned)

Cash flow (anticipated $ received and spent)

COPYRIGHT © 2011

- 27. Start-up cost assumptions

• Expenses up to the point when you are open

for business…….which is when?

• List all the uses of money – describe exactly

how spent

• Two types: Fixed assets & Working Capital

• Examples?

Fixed Assets = Equipment, Furniture

Working Capital = Rental deposits, Insurance

COPYRIGHT © 2011

- 28. Financing assumptions

• Sources where $ will come from

• Where?

Entrepreneur and team

F&F

Bank loan (though not likely for start-ups)

Debt from owner or outside creditor

Non-dilutive financing (maybe )

Equity capital

• For loan – know amount, terms of repayment

(mos), and rate of interest or return

COPYRIGHT © 2011

- 29. Capital Expenditures

(aka Fixed Assets)

• Costs that have a “lifetime” greater than one year

AND an individual or collective cost greater than $2k

• Predict some fixed assets by headcount, some by

significant changes in sales volume, some by

changes in product lines, etc.

• Examples: Leasehold improvements, Furniture &

fixtures, Machinery

• Note: Probably expense the PCs & Macs & iPads

(but try to keep track of them anyway)

COPYRIGHT © 2011

- 30. Fixed cost assumptions

• Costs of being in business

• Do not vary by sales volume (i.e. day-to-day)

• But DO increase as the business scales

• Create fixed cost projections on monthly basis

• Research through correspondence with outside

vendors

• Record the source & amount from each

vendor……..

• Examples: Rent, Utilities, Salaries, Benefits,

Marketing expenses, Administrative expenses

COPYRIGHT © 2011

- 31. Variable cost assumptions

• Costs of doing business

• May vary directly with sales volume

• DO increase as the business scales

• Expenses incurred with the next “unit” of

product or service

• Research through correspondence with outside

vendors

• Examples: Materials, direct/indirect labor, and

shipping costs

COPYRIGHT © 2011

- 33. Cash flow assumptions

• Convert your business activity to cash activity

• When will cash be collected from customers?

May vary by product line and by customer

Generally assume 45 days---though currently

customers are extending to 60 days

• When do you pay your vendor’s invoices?

May vary by product line and by vendor

Generally assume 30-45 days

Need to create “referenceable” vendors

COPYRIGHT © 2011

- 35. Developing The Financial Forecast

3. Creating the sales forecast

BEST - Predict by customer as detailed as

possible

….but include customer turnover

BETTER – Predict by market

COPYRIGHT © 2011

- 36. Developing The Financial Forecast

3. Creating the sales forecast (part 2)

How do I start? Market research

• Gov’t resources

US Census Bureau

IRS Statistical Data

• Trade association

• Primary & secondary research

Select your geography

COPYRIGHT © 2011

- 37. Developing The Financial Forecast

3. Creating the sales forecast (part 2)

Predict by client (customer) types

• By market

• By size

Then ID certain characteristics

Small Medium Large

Client Client Client

Average Hours Per 4 Hours 8 Hours 16 Hours

Week

Average Contract $ $500 $1,250 $2,500

Per Week

COPYRIGHT © 2011

- 38. Developing The Financial Forecast

3. Creating the sales forecast (part 3)

Predict using Sales staff

• Assume lag time (3-6 mos.)

• Estimate the pipeline

• # of calls / meetings per staff

• # of sales per staff

• Remember: Not all staff start same date

• Spread out the volume by month – with

realistic goals

• ….Consider turnover of sales staff

COPYRIGHT © 2011

- 39. Forecast Trap:

Why they call them “Gross Sales”

• Returns

• Discounts

• Rebates

• Chargebacks

• Markdowns

COPYRIGHT © 2011

- 40. Forecast Trap:

Do not over-estimate

first year revenue

(what, we can’t sell millions in first month?)

COPYRIGHT © 2011

- 41. Developing The Financial Forecast

4. Spreading the Numbers

• Yes, you need to do it monthly -- for the entire period

• No flat numbers – consider the meaning – use %

increases or $ per some type of unit

• Think: As headcount increases rent increases (just

not variably)

• Start with revenue, then cost of services

COPYRIGHT © 2011

- 42. Tip:

Integration

Must use an integrated model

Headcount added

Payroll and benefits calculation

Summarized employee costs

Income Statement

Cash Flow

COPYRIGHT © 2011

- 43. Tip:

Use Rounding

Use the MS Excel “rounding

function” --- otherwise your

numbers may not add up

COPYRIGHT © 2011

- 45. Tip:

If you want to be taken seriously do

not use round numbers

This: 53,567

Not this: 50,000

COPYRIGHT © 2011

- 46. Tip:

Project payroll & benefits in detail

• Payroll & benefits are often the most costly

expense yet they are often neglected

• Project monthly to handle startdates correctly

• Match additions of people with milestones

COPYRIGHT © 2011

- 47. Tip:

Projection Numbers are not separate from

the Company Plans

Company Plans

Milestone Projects Responsible Revenue/ Dates

Cost

COPYRIGHT © 2011

- 48. Tip:

Be careful with Depreciation and

Interest expense

• Depreciation is a non-cash expense – do

not include in cash flow

(we’ll worry about how to calculate this when you come see me)

• Interest expense does not include the

principal portion of your payment

COPYRIGHT © 2011

- 49. Ben Littauer

Member, Boston Harbor Angels

"I like to see a business model spreadsheet with

the assumptions clearly called out as variables.

Then I can twiddle the knobs and see how

sensitive profits are to the assumptions."

COPYRIGHT © 2011

- 50. Multiple Model Trap:

One investor model,

Multiple options (triggers)

But…why not?

You will make fundamental changes in the

base model and then forget to make similar

changes on the “other scenario models”

COPYRIGHT © 2011

- 51. Tip:

Don’t forget the…..

Sales commissions – Direct connect them to your

sales staff’s (or sales rep) sales

Bonuses – Include with payroll

Recruiting expenses – Peg them to change in new

employees

Debt - Many forget to include Interest Expense on

the income statement even though the Company

has incurred Debt

COPYRIGHT © 2011

- 52. Presentation Suggestions

Steady, consistent evolution of the model

Revenue growth in $

Expenses over time in %

Know the % change for major components

(and be able to explain them)

Do not allocate G&A/Facilities expenses

Show depreciation separately (non-cash)

COPYRIGHT © 2011

- 53. Tip:

Reasonableness

1. Once you think you are done take the

smell test --- Do the numbers really make

sense (i.e. can you really increase revenue

w/o an increase in costs)?

2. Do the Like-Kind test. Compare your

“metrics” versus your competition

COPYRIGHT © 2011

- 54. Creating the Statements

1. Consider it a Marketing Effort

2. Present the Pro-Forma Financial

Statement

3. Graph the Revenues, Income, and Cash

4. Present the Headcount

COPYRIGHT © 2011

- 55. ABC Co.

($ 000's omitted)

2010 2011 2012 2013 2014 Income

Pro Forma Financial Statement

Revenue $ - $ 1,875 $ 44,953 $ 108,238 $ 180,161

Statement

Cost of Service - 1,162 12,739 5,369 -

Gross Margin - 712 32,214 102,868 180,161

38% 72% 95% 100%

Operating Expenses

Employee Costs 1,303 2,972 3,587 4,198 4,379

Professional Fees 253 637 1,780 1,230 1,135

Marketing & Travel 61 525 2,340 293 658

Administrative Expenses 60 55 232 41 47

Development & Pilot Manufacturing 409 819 262 965 1,733

Facility & Other 195 801 1,206 1,612 2,023

Total Expenses 2,282 5,807 9,407 8,340 9,976

Depreciation & Amortization 42 98 301 590 791

EBIT (2,324) (5,193) 22,507 93,939 169,394

Cash Flow

Net Income (2,639) (5,411) 16,893 55,530 100,603

0% -289% 38% 51% 56% Statement

Pro Forma Cash Flow

Cash from Operations (2,597) (5,313) 17,193 56,120 101,393

Cash from Working Capital (31) (936) (2,879) (2,754) (3,437)

Cash from Investments (57) (297) (1,052) (607) (600)

Cash from Financing 7,000 - 42,000 - -

Net Cash Flow 4,315 (6,545) 55,262 52,759 97,357

Ending Cash $ 6,644 $ 99 $ 55,360 $ 108,119 $ 205,476

COPYRIGHT © 2011

- 56. ABC Company – Financials by Year

($ 000’s omitted)

$225,000 Seeking $250k Investment

Milestone #1

Prototype

$175,000

Milestone #2

Pilots

Milestone #3

$125,000 Commercialization

Revenue

Income

Cash

$75,000

$25,000

2010 2011 2012 2013 2014

($25,000)

COPYRIGHT © 2011

- 57. ABC Co. Headcount Summary

2010 2011 2012 2013 2014

Manufacturing - 1 1 1 1

Sales & Marketing - - 1 4 4

Research 7 19 19 19 19

Executive/Admin 3 8 9 9 9

International - 1 2 3 4

Total 10 29 32 36 37

COPYRIGHT © 2011

- 58. ABC Co. Headcount Summary

2010 2011 2012 2013 2014 For your review

Manufacturing

Sales & Marketing

-

- -

1 1

1

1

4

1

4

only. Not for

Research 7 19 19 19 19

Executive/Admin 3 8 9 9 9 presentation

International - 1 2 3 4

Total 10 29 32 36 37

2010 Jan, 10 Fe b, 10 Mar, 10 Apr, 10 May, 10 Jun, 10 Jul, 10 Aug, 10 Sep, 10 Oct, 10 Nov, 10 De c, 10

Manufacturing - - - - - - - - - - - -

Sales & Marketing - - - - - - - - - - - -

Research 7 7 7 7 7 7 7 7 7 7 7 7

Executive/Admin 2 2 3 3 3 3 3 3 3 3 3 3

International - - - - - - - - - - - -

Total 9 9 10 10 10 10 10 10 10 10 10 10

2011 Jan, 11 Fe b, 11 Mar, 11 Apr, 11 May, 11 Jun, 11 Jul, 11 Aug, 11 Sep, 11 Oct, 11 Nov, 11 De c, 11

Manufacturing 1 1 1 1 1 1 1 1 1 1 1 1

Sales & Marketing - - - - - - - - - - - -

Research

Executive/Admin

19

4

19

4

19

4

19

4

19

4

19

5

19

7

19

7

19

7

19

8

19

8

19

8 Looking at the

International - - - - - 1 1 1 1 1 1 1

Total 24 24 24 24 24 26 28 28 28 29 29 29 monthly

2012

Manufacturing

Jan, 12

1

Fe b, 12

1

Mar, 12

1

Apr, 12

1

May, 12

1

Jun, 12

1

Jul, 12

1

Aug, 12

1

Sep, 12

1

Oct, 12

1

Nov, 12

1

De c, 12

1

headcount helps

Sales & Marketing

Research

-

19

-

19

-

19

-

19

-

19

-

19

-

19

-

19

-

19

-

19

1

19

1

19

you find obvious

Executive/Admin

International

9

1

9

1

9

1

9

1

9

1

9

2

9

2

9

2

9

2

9

2

9

2

9

2 discrepancies

Total 30 30 30 30 30 31 31 31 31 31 32 32

2013 Jan, 13 Fe b, 13 Mar, 13 Apr, 13 May, 13 Jun, 13 Jul, 13 Aug, 13 Sep, 13 Oct, 13 Nov, 13 De c, 13

Manufacturing 1 1 1 1 1 1 1 1 1 1 1 1

Sales & Marketing 1 1 2 2 3 3 4 4 4 4 4 4

Research 19 19 19 19 19 19 19 19 19 19 19 19

Executive/Admin 9 9 9 9 9 9 9 9 9 9 9 9

International 2 2 3 3 3 3 3 3 3 3 3 3

Total 32 32 34 34 35 35 36 36 36 36 36 36

2014 Jan, 14 Fe b, 14 Mar, 14 Apr, 14 May, 14 Jun, 14 Jul, 14 Aug, 14 Sep, 14 Oct, 14 Nov, 14 De c, 14

Manufacturing 1 1 1 1 1 1 1 1 1 1 1 1

Sales & Marketing 4 4 4 4 4 4 4 4 4 4 4 4

Research 19 19 19 19 19 19 19 19 19 19 19 19

Executive/Admin 9 9 9 9 9 9 9 9 9 9 9 9

International 4 4 4 4 4 4 4 4 4 4 4 4

Total 37 37 37 37 37 37 37 37 37 37 37 37

COPYRIGHT © 2011

- 59. More on charts and tables……

1. Explain the sales & distribution model

(…so about those 90% margins)

2. Key events to next funding round

3. Cash flow cycle

COPYRIGHT © 2011

- 60. Universal Truths:

1. Project monthly, Present annually

2. Projections constantly change,

let them. Not an annual exercise.

Develop as a monthly exercise.

3. Financials must be consistent with rest

of presentation

4. Do not need to be hung up with GAAP,

but….don’t go rogue

COPYRIGHT © 2011

- 61. Even More Universal Truths:

5. Be consistent – Don’t portray cost

categories (or individuals)

differently by year

6. Have “Checks”

7. P&L Income ≠ Cash Flow

(we know this right?)

COPYRIGHT © 2011