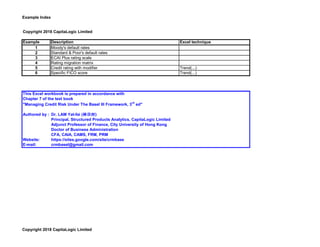

Weitere ähnliche Inhalte Ähnlich wie 07.3 credit ratings and fico scores (20) Kürzlich hochgeladen (20) 1. Example Index

Copyright 2018 CapitaLogic Limited

Example Description Excel technique

1 Moody's default rates

2 Standard & Poor's default rates

3 ECAI Plus rating scale

4 Rating migration matrix

5 Credit rating with modifier Trend(...)

6 Specific FICO score Trend(...)

This Excel workbook is prepared in accordance with

Chapter 7 of the text book

"Managing Credit Risk Under The Basel III Framework, 3

rd

ed"

Authored by : Dr. LAM Yat-fai (林日辉)

Principal, Structured Products Analytics, CapitaLogic Limited

Adjunct Professor of Finance, City University of Hong Kong

Doctor of Business Administration

CFA, CAIA, CAMS, FRM, PRM

Website: https://sites.google.com/site/crmbase

E-mail: crmbasel@gmail.com

Copyright 2018 CapitaLogic Limited

2. Example 1 Moody's default rates

Year AAA AA A BBB BB B CCC to C Investment

grade

High yield

grade

Overall

2016 0.0000% 0.0000% 0.0000% 0.0000% 0.1340% 1.5310% 9.1110% 0.0000% 4.4740% 2.1490%

2015 0.0000% 0.0000% 0.0000% 0.0000% 0.2910% 2.2390% 6.7650% 0.0000% 3.6260% 1.7320%

2014 0.0000% 0.0000% 0.0880% 0.0590% 0.1410% 0.4980% 4.5870% 0.0630% 1.9380% 0.9390%

2013 0.0000% 0.0000% 0.0890% 0.1200% 0.5820% 0.9060% 6.2330% 0.0960% 2.6250% 1.2320%

2012 0.0000% 0.0000% 0.0000% 0.0710% 0.1430% 0.5430% 7.7590% 0.0330% 2.7560% 1.2300%

2011 0.0000% 0.1930% 0.0000% 0.3550% 0.1590% 0.3430% 5.8520% 0.1870% 1.9820% 0.9060%

2010 0.0000% 0.0000% 0.1710% 0.0750% 0.0000% 0.3830% 8.5270% 0.0950% 3.0130% 1.2320%

2009 0.0000% 0.0000% 0.2400% 0.9300% 1.7650% 7.2150% 25.9330% 0.4280% 12.0600% 4.9960%

2008 0.0000% 0.5060% 0.4060% 1.0240% 2.3430% 3.9890% 10.6940% 0.6270% 5.4260% 2.5070%

2007 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 4.9530% 0.0000% 0.9450% 0.3490%

2006 0.0000% 0.0000% 0.0000% 0.0000% 0.1940% 1.0700% 5.8930% 0.0000% 1.6690% 0.5930%

2005 0.0000% 0.0000% 0.0000% 0.1630% 0.0000% 0.8150% 7.3240% 0.0610% 1.7210% 0.6470%

2004 0.0000% 0.0000% 0.0000% 0.0000% 0.3780% 0.7960% 11.8160% 0.0000% 2.4180% 0.8340%

2003 0.0000% 0.0000% 0.0000% 0.0000% 0.8790% 2.5810% 20.5760% 0.0000% 5.2780% 1.8280%

2002 0.0000% 0.0000% 0.1610% 1.0140% 1.4000% 4.5730% 27.0220% 0.4310% 7.6630% 2.9240%

2001 0.0000% 0.0000% 0.1550% 0.1800% 1.1590% 9.2400% 29.9600% 0.1240% 9.6340% 3.6790%

2000 0.0000% 0.0000% 0.0000% 0.3500% 1.2690% 5.7440% 17.9040% 0.1260% 6.0740% 2.4550%

1999 0.0000% 0.0000% 0.0000% 0.0930% 1.5030% 4.8950% 16.1820% 0.0320% 5.3610% 2.1230%

1998 0.0000% 0.0000% 0.0000% 0.1090% 0.8960% 3.8750% 8.3410% 0.0350% 3.0280% 1.1370%

1997 0.0000% 0.0000% 0.0000% 0.0000% 0.1750% 1.9980% 9.8230% 0.0000% 1.8890% 0.6160%

1996 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 1.5050% 10.3090% 0.0000% 1.6510% 0.5060%

1995 0.0000% 0.0000% 0.0000% 0.0000% 0.2670% 4.0150% 10.5460% 0.0000% 3.0630% 0.8990%

1994 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 4.1910% 5.3860% 0.0000% 2.3410% 0.6510%

1993 0.0000% 0.0000% 0.0000% 0.0000% 0.6220% 4.3760% 13.5310% 0.0000% 3.4040% 0.8990%

1992 0.0000% 0.0000% 0.0000% 0.0000% 0.3370% 7.3450% 16.4940% 0.0000% 4.9330% 1.3370%

1991 0.0000% 0.0000% 0.0000% 0.2490% 3.8480% 13.1990% 15.3450% 0.0590% 9.0960% 2.8030%

1990 0.0000% 0.0000% 0.0000% 0.2650% 3.7660% 13.7070% 43.9100% 0.0600% 10.5270% 3.5720%

1989 0.0000% 0.4990% 0.0000% 0.5290% 2.9570% 7.5490% 20.3340% 0.2540% 5.9010% 2.2260%

1988 0.0000% 0.0000% 0.0000% 0.0000% 1.3530% 5.9340% 12.5000% 0.0000% 3.8500% 1.3930%

1987 0.0000% 0.0000% 0.0000% 0.0000% 3.0240% 5.4370% 9.8230% 0.0000% 4.2990% 1.4230%

Mean 0.0000% 0.0399% 0.0437% 0.1862% 0.9862% 4.0164% 13.4478% 0.0904% 4.4215% 1.6606%

S.D. 0.0000% 0.1306% 0.0947% 0.3034% 1.1474% 3.6068% 8.9076% 0.1536% 2.8663% 1.1022%

Minimum 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 4.5870% 0.0000% 0.9450% 0.3490%

Maximum 0.0000% 0.5060% 0.4060% 1.0240% 3.8480% 13.7070% 43.9100% 0.6270% 12.0600% 4.9960%

Median 0.0000% 0.0000% 0.0000% 0.0650% 0.4800% 3.9320% 10.4275% 0.0325% 3.5150% 1.2845%

Copyright 2018 CapitaLogic Limited

3. Example 2 S&P's default rates

Year AAA AA A BBB BB B CCC to C

2016 0.0000% 0.0000% 0.0000% 0.0000% 0.4700% 3.6800% 32.6700%

2015 0.0000% 0.0000% 0.0000% 0.0000% 0.1600% 2.3900% 25.8800%

2014 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 0.7800% 17.1300%

2013 0.0000% 0.0000% 0.0000% 0.0000% 0.1000% 1.6300% 24.3400%

2012 0.0000% 0.0000% 0.0000% 0.0000% 0.3000% 1.5600% 27.5200%

2011 0.0000% 0.0000% 0.0000% 0.0700% 0.0000% 1.6700% 16.3000%

2010 0.0000% 0.0000% 0.0000% 0.0000% 0.5800% 0.8600% 22.6200%

2009 0.0000% 0.0000% 0.2200% 0.5500% 0.7500% 10.9200% 49.4600%

2008 0.0000% 0.3800% 0.3900% 0.4900% 0.8100% 4.0800% 27.2700%

2007 0.0000% 0.0000% 0.0000% 0.0000% 0.2000% 0.2500% 15.2400%

2006 0.0000% 0.0000% 0.0000% 0.0000% 0.3000% 0.8200% 13.3300%

2005 0.0000% 0.0000% 0.0000% 0.0700% 0.3100% 1.7400% 9.0900%

2004 0.0000% 0.0000% 0.0800% 0.0000% 0.4400% 1.4500% 16.1800%

2003 0.0000% 0.0000% 0.0000% 0.2300% 0.5800% 4.0700% 32.7300%

2002 0.0000% 0.0000% 0.0000% 1.0100% 2.8900% 8.2100% 44.4400%

2001 0.0000% 0.0000% 0.2700% 0.3400% 2.9600% 11.5300% 45.4500%

2000 0.0000% 0.0000% 0.2700% 0.3700% 1.1600% 7.7000% 35.9600%

1999 0.0000% 0.1700% 0.1800% 0.2000% 0.9500% 7.2900% 33.3300%

1998 0.0000% 0.0000% 0.0000% 0.4100% 0.8200% 4.6300% 42.8600%

1997 0.0000% 0.0000% 0.0000% 0.2500% 0.1900% 3.5100% 12.0000%

1996 0.0000% 0.0000% 0.0000% 0.0000% 0.4500% 2.9100% 8.0000%

1995 0.0000% 0.0000% 0.0000% 0.1700% 0.9900% 4.5800% 28.0000%

1994 0.0000% 0.0000% 0.1400% 0.0000% 0.2800% 3.0800% 16.6700%

1993 0.0000% 0.0000% 0.0000% 0.0000% 0.7000% 2.6200% 13.3300%

1992 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 6.9900% 30.1900%

1991 0.0000% 0.0000% 0.0000% 0.5500% 1.6900% 13.8400% 33.8700%

1990 0.0000% 0.0000% 0.0000% 0.5800% 3.5700% 8.5600% 31.2500%

1989 0.0000% 0.0000% 0.1800% 0.6000% 0.7200% 3.3800% 33.3300%

1988 0.0000% 0.0000% 0.0000% 0.0000% 1.0500% 3.6300% 20.3700%

1987 0.0000% 0.0000% 0.0000% 0.0000% 0.3800% 3.0800% 12.2800%

Mean 0.0000% 0.0183% 0.0577% 0.1963% 0.7933% 4.3813% 25.7030%

S.D. 0.0000% 0.0750% 0.1079% 0.2639% 0.8899% 3.4791% 11.4393%

Minimum 0.0000% 0.0000% 0.0000% 0.0000% 0.0000% 0.2500% 8.0000%

Maximum 0.0000% 0.3800% 0.3900% 1.0100% 3.5700% 13.8400% 49.4600%

Median 0.0000% 0.0000% 0.0000% 0.0350% 0.5250% 3.4450% 26.5750%

Copyright 2018 CapitaLogic Limited

4. Example 3 ECAI Plus rating scale

Rating 3-year DR PD

AAA 0.03% 0.0100%

AA 0.10% 0.0333%

A 0.25% 0.0834%

BBB 1.00% 0.3345%

BB 7.50% 2.5652%

B 20.00% 7.1682%

CCC 40.00% 15.6567%

CC 65.00% 29.5270%

C 95.00% 63.1597%

Copyright 2018 CapitaLogic Limited

5. Example 4 Rating migration matrix

From/To AAA AA A BBB BB B CCC to C Default No rating

AAA 87.05% 9.03% 0.53% 0.05% 0.08% 0.03% 0.05% 0.00% 3.17%

AA 0.52% 86.82% 8.00% 0.51% 0.05% 0.07% 0.02% 0.02% 3.99%

A 0.03% 1.77% 87.79% 5.33% 0.32% 0.13% 0.02% 0.06% 4.55%

BBB 0.01% 0.10% 3.51% 85.56% 3.79% 0.51% 0.12% 0.18% 6.23%

BB 0.01% 0.03% 0.12% 4.97% 76.98% 6.92% 0.61% 0.72% 9.63%

B 0.00% 0.03% 0.09% 0.19% 5.15% 74.26% 4.46% 3.76% 12.06%

CCC to C 0.00% 0.00% 0.13% 0.19% 0.63% 12.91% 43.97% 26.78% 15.39%

From/To AAA AA A BBB BB B CCC to C Default No rating

AAA 87.05% 96.08% 96.61% 96.66% 96.74% 96.77% 96.82% 96.82% 100%

AA 0.52% 87.34% 95.34% 95.85% 95.90% 95.97% 95.99% 96.01% 100%

A 0.03% 1.80% 89.59% 94.92% 95.24% 95.37% 95.39% 95.45% 100%

BBB 0.01% 0.11% 3.62% 89.18% 92.97% 93.48% 93.60% 93.78% 100%

BB 0.01% 0.04% 0.16% 5.13% 82.11% 89.03% 89.64% 90.36% 100%

B 0.00% 0.03% 0.12% 0.31% 5.46% 79.72% 84.18% 87.94% 100%

CCC to C 0.00% 0.00% 0.13% 0.32% 0.95% 13.86% 57.83% 84.61% 100%

Copyright 2018 CapitaLogic Limited

6. Example 5 Credit rating with modifier

Rating 3-year DR Order Probit

AAA 0.03% 1 -3.4316 1 4

AA 0.10% 4 -3.0902 1 4 7 10

A 0.25% 7 -2.8070 4 7 10 13

BBB 1.00% 10 -2.3263 7 10 13 16

BB 7.50% 13 -1.4395 10 13 16 19

B 20.00% 16 -0.8416 13 16 19 22

CCC 40.00% 19 -0.2533 16 19 22 25

CC 65.00% 22 0.3853 22 25

C 95.00% 25 1.6449

Rating Order Probit 3-year DR PD

AAA 1 1 4 -3.43161 -3.09023 -3.43161 0.0300% 0.0100%

AAA- 2 1 4 -3.43161 -3.09023 -3.31782 0.0454% 0.0151%

AA+ 3 1 4 -3.43161 -3.09023 -3.20403 0.0678% 0.0226%

AA 4 1 4 7 10 -3.43161 -3.09023 -2.80703 -2.32635 -3.09023 0.1000% 0.0333%

AA- 5 1 4 7 10 -3.43161 -3.09023 -2.80703 -2.32635 -3.00199 0.1341% 0.0447%

A+ 6 1 4 7 10 -3.43161 -3.09023 -2.80703 -2.32635 -2.91075 0.1803% 0.0601%

A 7 4 7 10 13 -3.09023 -2.80703 -2.32635 -1.43953 -2.80703 0.2500% 0.0834%

A- 8 4 7 10 13 -3.09023 -2.80703 -2.32635 -1.43953 -2.67905 0.3692% 0.1232%

BBB+ 9 4 7 10 13 -3.09023 -2.80703 -2.32635 -1.43953 -2.5214 0.5844% 0.1952%

BBB 10 7 10 13 16 -2.80703 -2.32635 -1.43953 -0.84162 -2.32635 1.0000% 0.3345%

BBB- 11 7 10 13 16 -2.80703 -2.32635 -1.43953 -0.84162 -2.04155 2.0598% 0.6914%

BB+ 12 7 10 13 16 -2.80703 -2.32635 -1.43953 -0.84162 -1.73736 4.1162% 1.3913%

BB 13 10 13 16 19 -2.32635 -1.43953 -0.84162 -0.25335 -1.43953 7.5000% 2.5652%

BB- 14 10 13 16 19 -2.32635 -1.43953 -0.84162 -0.25335 -1.22192 11.0869% 3.8413%

B+ 15 10 13 16 19 -2.32635 -1.43953 -0.84162 -0.25335 -1.02606 15.2431% 5.3636%

B 16 13 16 19 22 -1.43953 -0.84162 -0.25335 0.38532 -0.84162 20.0000% 7.1682%

B- 17 13 16 19 22 -1.43953 -0.84162 -0.25335 0.38532 -0.64742 25.8679% 9.4958%

CCC+ 18 13 16 19 22 -1.43953 -0.84162 -0.25335 0.38532 -0.45207 32.5608% 12.3058%

CCC 19 16 19 22 25 -0.84162 -0.25335 0.38532 1.644854 -0.25335 40.0000% 15.6567%

CCC- 20 16 19 22 25 -0.84162 -0.25335 0.38532 1.644854 -0.07423 47.0414% 19.0944%

CC+ 21 16 19 22 25 -0.84162 -0.25335 0.38532 1.644854 0.131618 55.2357% 23.5031%

CC 22 22 25 0.38532 1.644854 0.38532 65.0000% 29.5270%

CC- 23 22 25 0.38532 1.644854 0.805165 78.9638% 40.5266%

C+ 24 22 25 0.38532 1.644854 1.225009 88.9714% 52.0443%

C 25 22 25 0.38532 1.644854 1.644854 95.0000% 63.1597%

Order range Probit range

Order range

Copyright 2018 CapitaLogic Limited

7. Example 6 Specific FICO score

From To Annual DR Middle Probit

350 549 33.8% 450 -0.41793 450 585

550 619 17.0% 585 -0.95417 450 585 650 710

620 679 7.5% 650 -1.43953 585 650 710 795

680 739 2.8% 710 -1.91104 710 795

740 850 0.4% 795 -2.65207

FICO Probit PD

620 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.20702 11.3713%

625 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.24503 10.6560%

630 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.2834 9.9676%

635 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.32207 9.3072%

640 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.36101 8.6755%

645 450 585 650 710 -0.41793 -0.95417 -1.43953 -1.91104 -1.40018 8.0730%

650 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.43953 7.5000%

655 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.47771 6.9743%

660 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.51605 6.4753%

665 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.55458 6.0024%

670 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.59329 5.5548%

675 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.6322 5.1318%

680 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.67133 4.7329%

685 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.71067 4.3571%

690 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.75024 4.0038%

695 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.79006 3.6722%

700 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.83012 3.3616%

705 585 650 710 795 -0.95417 -1.43953 -1.91104 -2.65207 -1.87044 3.0711%

710 710 795 0 0 -1.91104 -2.65207 -1.91104 2.8000%

FICO score range Probit range

FICO score range

Copyright 2018 CapitaLogic Limited