Gta office market statistics 2011 q2

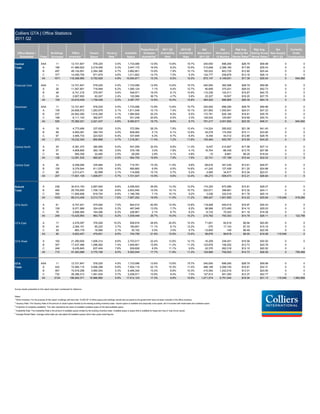

- 1. Colliers GTA | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Central AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 698,290 $28.79 $59.98 0 0 Total: A 186 41,969,922 2,218,458 5.3% 3,447,172 16.5% 8.2% 10.5% 313,848 2,398,160 $17.85 $35.43 0 0 B 497 49,124,691 2,284,366 4.7% 3,862,801 15.6% 7.9% 10.1% 193,522 843,725 $12.80 $25.44 0 0 C 377 14,490,705 671,879 4.6% 1,011,802 14.7% 7.0% 5.3% 124,777 208,876 $13.16 $26.14 0 0 All 1071 118,306,965 5,752,928 4.9% 10,054,871 15.3% 8.5% 10.2% 872,147 4,149,051 $17.39 $35.04 0 644,592 Financial Core AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 382,596 $28.79 $59.98 0 0 A 26 11,547,851 718,949 6.2% 1,085,124 7.1% 9.4% 12.7% 90,859 370,251 $26.03 $52.73 0 0 B 48 6,741,218 379,007 5.6% 546,971 18.0% 8.1% 10.9% 110,336 124,511 $19.87 $40.75 0 0 C 24 2,607,693 63,247 2.4% 122,566 36.7% 4.7% 5.8% 23,327 19,507 $18.20 $37.75 0 0 All 109 33,618,409 1,739,428 5.2% 3,487,757 12.6% 10.4% 12.8% 464,522 896,865 $26.30 $54.19 0 0 Downtown AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 698,290 $28.79 $59.98 0 0 A 109 24,606,972 1,263,978 5.1% 1,811,548 10.1% 7.4% 10.1% 251,893 1,550,061 $24.01 $47.23 0 0 B 237 24,942,260 1,016,358 4.1% 1,984,926 25.2% 8.0% 8.5% 172,781 628,184 $18.81 $35.76 0 0 C 168 8,111,142 362,877 4.5% 531,248 20.6% 6.5% 3.3% 126,542 125,067 $16.69 $30.74 0 0 All 525 70,382,021 3,221,437 4.6% 6,060,817 16.7% 8.6% 9.7% 791,217 3,001,602 $23.30 $46.31 0 644,592 Midtown A 18 4,773,486 237,630 5.0% 372,584 26.3% 7.8% 12.4% 114,524 285,922 $21.06 $41.40 0 0 B 98 9,993,081 394,745 4.0% 608,060 5.1% 6.1% 12.8% 45,278 174,554 $15.11 $33.85 0 0 C 97 3,465,733 223,523 6.4% 337,658 6.3% 9.7% 8.4% -6,340 40,312 $12.85 $28.76 0 0 All 213 18,232,300 855,898 4.7% 1,318,301 11.4% 7.2% 11.8% 153,463 500,787 $15.90 $34.25 0 0 Central North A 25 6,381,370 380,955 6.0% 547,259 32.4% 8.6% 11.3% 6,047 214,947 $17.58 $37.12 0 0 B 57 4,809,806 262,185 5.5% 379,156 3.0% 7.9% 4.1% 16,704 -86,439 $13.75 $27.96 0 0 C 44 900,359 22,480 2.5% 28,290 2.9% 3.1% 4.8% -10 8,681 $9.29 $18.04 0 0 All 126 12,091,535 665,621 5.5% 954,705 19.8% 7.9% 7.9% 22,741 137,189 $15.44 $32.03 0 0 Central East A 34 6,208,094 335,894 5.4% 715,781 15.3% 11.5% 9.8% -58,616 347,230 $13.61 $29.57 0 0 B 105 9,379,544 611,078 6.5% 890,660 6.9% 9.5% 14.6% -41,242 127,426 $11.20 $24.86 0 0 C 68 2,013,471 62,999 3.1% 114,606 15.1% 5.7% 9.2% 4,585 34,817 $12.04 $23.51 0 0 All 207 17,601,109 1,009,971 5.7% 1,721,047 10.9% 9.8% 12.4% -95,273 509,473 $12.21 $26.64 0 0 Suburb A 238 30,614,193 2,687,840 8.8% 4,056,943 26.8% 13.3% 12.5% 174,320 870,586 $15.81 $29.27 0 0 Total: B 460 25,793,605 1,706,138 6.6% 2,603,540 15.0% 10.1% 10.7% 222,071 398,891 $13.32 $24.11 0 0 C 355 11,905,608 819,754 6.9% 1,196,769 7.1% 10.1% 9.2% 3,036 332,516 $11.76 $20.14 0 0 All 1053 68,313,406 5,213,733 7.6% 7,857,252 19.9% 11.5% 11.2% 399,427 1,601,993 $14.22 $25.84 115,546 918,266 GTA North A 61 6,747,441 475,000 7.0% 844,510 40.9% 12.5% 12.8% 118,928 449,515 $16.97 $30.43 0 0 B 109 6,071,968 324,435 5.3% 467,948 13.0% 7.7% 8.2% 98,568 273,495 $14.10 $25.03 0 0 C 78 2,606,584 164,266 6.3% 226,991 2.1% 8.7% 8.2% -6,734 70,343 $11.16 $18.38 0 0 All 248 15,425,993 963,702 6.2% 1,539,449 26.7% 10.0% 10.2% 210,762 793,353 $14.79 $26.11 0 122,798 GTA East A 17 2,476,097 376,526 15.2% 508,916 26.8% 20.6% 15.3% 71,651 82,619 $9.94 $20.80 0 0 B 44 2,284,151 85,220 3.7% 185,691 11.1% 8.1% 13.2% -375 17,143 $7.33 $15.16 0 0 C 29 863,179 18,085 2.1% 30,152 0.0% 3.5% 9.7% -12,600 -145 $6.48 $22.59 0 0 All 90 5,623,427 479,831 8.5% 724,759 21.6% 12.9% 13.5% 58,676 99,618 $9.00 $19.26 115,546 0 GTA West A 160 21,390,655 1,836,314 8.6% 2,703,517 22.4% 12.6% 12.1% -16,259 338,451 $16.58 $30.50 0 0 B 307 17,437,486 1,296,482 7.4% 1,949,901 15.8% 11.2% 11.3% 123,878 108,252 $13.73 $24.78 0 C 248 8,435,845 637,404 7.6% 939,626 8.5% 11.1% 9.5% 22,370 262,318 $12.10 $20.52 0 0 All 715 47,263,986 3,770,199 8.0% 5,593,044 17.7% 11.8% 11.3% 129,989 709,022 $14.73 $26.59 0 795,468 GTA AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 698,290 $28.79 $59.98 0 0 Total: A 424 72,584,115 4,906,298 6.8% 7,504,115 22.1% 10.3% 11.4% 488,168 3,268,745 $16.81 $32.31 0 0 B 957 74,918,296 3,990,504 5.3% 6,466,340 15.4% 8.6% 10.3% 415,594 1,242,616 $13.01 $24.90 0 0 C 732 26,396,313 1,491,634 5.7% 2,208,571 10.6% 8.4% 7.0% 127,813 541,392 $12.37 $22.77 0 0 All 2124 186,620,371 10,966,660 5.9% 17,912,123 17.3% 9.6% 10.6% 1,271,574 5,751,044 $16.04 $31.13 115,546 1,562,858 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of sublease availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 2. Colliers Downtown | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 Submarket Class Surveyed Inventory Space Rate Space Availability3 Rate Rate 2011 Q2 12 Months 5 Rental Rates Rental Rates 2011 Q2 Construction Financial Core AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 698,290 $28.79 $59.98 0 0 A 26 11,547,851 718,949 6.2% 1,085,124 7.1% 9.4% 12.7% 90,859 423,031 $26.03 $52.73 0 0 B 48 6,741,218 379,007 5.6% 546,971 18.0% 8.1% 10.9% 110,336 383,883 $19.87 $40.75 0 0 C 24 2,607,693 63,247 2.4% 122,566 36.7% 4.7% 5.8% 23,327 55,259 $18.20 $37.75 0 0 All 109 33,618,409 1,739,428 5.2% 3,487,757 12.6% 10.4% 12.8% 464,522 1,560,464 $26.30 $54.19 0 0 Downtown East A 22 1,101,378 46,978 4.3% 55,017 57.9% 5.0% 6.2% -557 37,870 $16.61 $35.53 0 0 B 52 1,907,970 123,983 6.5% 198,749 3.7% 10.4% 12.0% 52,984 88,888 $20.99 $31.82 0 0 C 36 915,464 92,904 10.1% 132,658 3.6% 14.5% 13.7% 46,316 75,508 $15.80 $24.13 0 0 All 110 3,924,812 263,865 6.7% 386,423 11.4% 9.8% 10.7% 98,743 202,265 $18.76 $29.20 0 0 Downtown North A 13 5,641,211 233,573 4.1% 269,685 9.1% 4.8% 6.1% 31,003 150,599 $23.00 $43.02 0 0 B 28 6,481,619 132,605 2.0% 217,186 24.2% 3.4% 3.7% 22,835 21,583 $16.49 $36.16 0 0 C 33 2,595,629 83,631 3.2% 107,135 0.0% 4.1% 5.0% 5,800 -57,068 $16.87 $35.88 0 0 All 74 14,718,459 449,809 3.1% 594,006 13.0% 4.0% 4.8% 59,639 115,114 $19.65 $39.35 0 0 Downtown South A 6 2,270,654 34,581 1.5% 44,192 29.3% 1.9% 5.9% 35,908 722,014 $31.00 $53.90 0 0 B 5 1,271,110 97,966 7.7% 175,289 77.2% 13.8% 12.1% 17,718 -47,644 $15.00 $29.31 0 0 C 7 273,699 56,840 20.8% 56,840 100.0% 20.8% 1.7% 11,900 -56,840 $13.25 $18.82 0 0 All 18 3,815,463 189,387 5.0% 276,321 74.2% 7.2% 7.9% 65,526 617,530 $22.02 $40.09 0 644,952 Downtown West A 42 4,045,878 229,897 5.7% 357,530 10.2% 8.8% 11.3% 94,681 216,547 $18.28 $33.38 0 0 B 104 8,540,343 282,796 3.3% 846,732 24.3% 9.9% 9.2% -31,092 181,474 $18.24 $33.75 0 0 C 68 1,718,657 66,255 3.9% 112,049 2.6% 6.5% 7.1% 39,199 108,208 $16.47 $28.48 0 0 All 214 14,304,878 578,948 4.0% 1,316,310 18.6% 9.2% 9.6% 102,788 506,229 $18.07 $33.10 0 0 Downtown AAA 11 12,721,647 578,225 4.5% 1,733,096 12.6% 13.6% 15.7% 240,000 698,290 $28.79 $59.98 0 0 Total: A 109 24,606,972 1,263,978 5.1% 1,811,548 10.1% 7.4% 10.1% 251,893 1,550,061 $24.01 $47.23 0 0 B 237 24,942,260 1,016,358 4.1% 1,984,926 25.2% 8.0% 8.5% 172,781 628,184 $18.81 $35.76 0 0 C 168 8,111,142 362,877 4.5% 531,248 20.6% 6.5% 6.5% 126,542 125,067 $16.69 $30.74 0 0 All 525 70,382,021 3,221,437 4.6% 6,060,817 16.7% 8.6% 10.1% 791,217 3,001,602 $23.30 $46.31 0 644,952 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 3. Colliers Midtown | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Yonge-Bloor A 8 2,656,355 157,728 5.9% 230,973 17.7% 8.7% 10.6% 43,245 78,144 $22.83 $42.83 0 0 B 37 5,583,452 114,206 2.0% 166,260 2.4% 3.0% 3.5% 2,174 109,698 $15.56 $36.20 0 0 C 29 1,393,195 110,742 7.9% 198,713 10.7% 14.3% 11.2% -4,450 16,234 $12.97 $30.59 0 0 All 74 9,633,002 382,676 4.0% 595,946 11.1% 6.2% 6.6% 40,969 204,077 $17.51 $36.90 0 0 Yonge-St.Clair A 4 798,771 4,131 0.5% 32,691 35.7% 4.1% 10.0% 27,778 68,443 $19.17 $41.91 0 0 B 19 1,586,172 102,060 6.4% 134,966 1.9% 8.5% 9.4% 22,593 -32,767 $15.68 $33.05 0 0 C 13 234,401 1,523 0.6% 3,843 0.0% 1.6% 1.6% 1,523 1,523 $16.09 $32.74 0 0 All 36 2,619,344 107,714 4.1% 171,500 8.3% 6.5% 7.9% 51,894 37,198 $16.35 $34.73 0 0 Yonge-Eglinton A 6 1,318,360 75,770 5.7% 108,919 41.6% 8.3% 17.0% 43,501 139,334 $16.38 $36.97 0 0 B 28 2,535,072 153,794 6.1% 282,149 8.8% 11.1% 9.3% 9,451 75,837 $14.55 $32.94 0 0 C 24 893,279 78,516 8.8% 98,235 0.0% 11.0% 11.3% -2,557 -4,142 $12.99 $27.36 0 0 All 58 4,746,711 308,080 6.5% 489,304 14.3% 10.3% 12.0% 50,395 211,029 $14.64 $32.72 0 0 Toronto West A 0 0 0 0.0% 0 0.0% 0.0% 0.0% 0 0 $0.00 $0.00 0 0 B 14 288,385 24,685 8.6% 24,685 0.0% 8.6% 243.9% 11,060 21,786 $15.00 $32.09 0 0 C 31 944,858 32,743 3.5% 36,866 0.0% 3.9% 6.1% -855 26,696 $11.54 $23.29 0 0 All 45 1,233,243 57,428 4.7% 61,551 0.0% 5.0% 59.6% 10,205 48,483 $12.93 $26.82 0 0 Midtown A 18 4,773,486 237,629 5.0% 372,584 26.3% 7.8% 12.4% 114,524 285,922 $21.06 $41.40 0 0 Total: B 98 9,993,081 394,745 4.0% 608,060 5.1% 6.1% 12.8% 45,278 174,554 $15.11 $33.85 0 0 C 97 3,465,733 223,523 6.4% 337,658 6.3% 9.7% 8.4% -6,340 40,312 $12.85 $28.76 0 0 All 213 18,232,300 855,898 4.7% 1,318,301 11.4% 7.2% 11.8% 153,463 500,787 $15.90 $34.25 0 0 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 4. Colliers Central East | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Don Mills - Eglinton A 6 1,082,940 19,959 1.8% 45,717 0.0% 4.2% 2.6% 0 78,605 $12.56 $29.06 0 0 B 38 3,788,141 258,380 6.8% 319,637 2.2% 8.4% 19.2% -33,426 -67,532 $11.32 $26.02 0 0 C 25 558,322 0 0.0% 26,340 0.0% 4.7% 4.7% 5,970 23,623 $11.00 $25.02 0 0 All 69 5,429,403 278,339 5.1% 391,694 1.8% 7.2% 14.6% -27,456 34,696 $11.44 $26.31 0 0 Duncan Mill A 3 528,307 9,917 1.9% 20,504 49.6% 3.9% 7.0% -3,520 245,610 $14.00 $28.46 0 0 B 20 1,405,763 92,187 6.6% 123,386 34.2% 8.8% 4.4% 0 42,143 $8.71 $22.90 0 0 C 15 374,146 1,560 0.4% 26,827 64.4% 7.2% 21.0% -8,860 -413 $11.43 $26.12 0 0 All 38 2,308,216 103,664 4.5% 170,716 40.8% 7.4% 7.2% -12,380 287,340 $9.77 $24.07 0 0 Consumer Road A 6 1,302,553 94,114 7.2% 219,665 7.5% 16.9% 16.8% -15,679 -1,359 $13.96 $31.41 0 0 B 16 1,972,881 183,941 9.3% 325,039 3.6% 16.5% 20.1% -12,541 31,553 $11.91 $26.33 0 0 C 8 473,993 48,789 10.3% 48,789 0.0% 10.3% 12.7% -475 3,657 $13.86 $23.07 0 0 All 30 3,749,427 326,844 8.7% 593,494 4.8% 15.8% 18.1% -28,695 33,851 $12.83 $27.94 0 0 Woodbine Steeles A 16 3,028,644 211,905 7.0% 429,895 19.3% 14.2% 10.8% -39,418 24,374 $13.52 $28.59 0 0 B 19 1,340,827 71,137 5.3% 87,166 0.0% 6.5% 11.6% 4,726 89,600 $10.12 $20.30 0 0 C 15 391,131 5,600 1.4% 5,600 0.0% 1.4% 0.8% 0 0 $8.50 $19.40 0 0 All 50 4,749,602 288,642 6.1% 522,661 15.9% 11.0% 10.3% -34,692 113,974 $12.90 $27.11 0 0 Toronto East A 3 265,650 0 0.0% 0 0.0% 0.0% 0.0% 0 0 $0.00 $0.00 0 0 B 12 871,932 5,433 0.6% 35,433 0.0% 4.1% 3.5% 0 31,662 $12.35 $17.44 0 0 C 5 215,879 7,050 3.3% 7,050 0.0% 3.3% 10.3% 7,950 7,950 $7.00 $20.70 0 0 All 20 1,353,461 12,483 0.9% 42,483 0.0% 3.1% 3.5% 7,950 39,612 $11.46 $17.98 0 0 Central East A 34 6,208,094 335,894 5.4% 715,781 15.3% 11.5% 9.8% -58,616 347,230 $13.61 $29.57 0 0 Area B 105 9,379,544 611,078 6.5% 890,660 6.9% 9.5% 14.6% -41,242 127,426 $11.20 $24.86 0 0 Total: C 68 2,002,471 62,999 3.1% 114,606 15.1% 5.7% 9.2% 4,585 34,817 $12.04 $23.51 0 0 All 207 17,590,109 1,009,971 5.7% 1,721,047 10.9% 9.8% 12.4% -95,273 509,473 $12.21 $26.64 0 0 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 5. Colliers Central North | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Yorkdale A 2 317,281 0 0.0% 0 0.0% 0.0% 0.5% 0 13,560 $0.00 $0.00 0 0 B 13 1,163,783 9,950 0.9% 20,929 0.0% 1.8% 2.2% 5,200 15,000 $9.00 $25.37 0 0 C 13 306,220 17,800 5.8% 23,610 3.4% 7.7% 13.1% 1,000 20,800 $9.00 $17.08 0 0 All 28 1,787,284 27,750 1.6% 44,539 1.8% 2.5% 3.7% 6,200 49,360 $9.00 $20.98 0 0 Dufferin Finch A 0 0 0 0.0% 0 0.0% 0.0% 0.0% 0 0 $0.00 $0.00 0 0 B 17 1,109,157 192,511 17.4% 208,338 0.0% 18.8% 1.8% 788 -165,552 $12.25 $23.94 0 0 C 15 301,078 3,400 1.1% 3,400 0.0% 1.1% 1.0% -2,200 6,505 $7.95 $18.13 0 0 All 32 1,410,235 195,911 13.9% 211,738 0.0% 15.0% 1.6% -1,412 -159,047 $12.18 $23.85 0 0 North Yonge A 23 6,064,089 380,955 6.3% 547,259 32.4% 9.0% 11.9% 6,047 201,387 $17.58 $37.12 0 0 Corridor B 27 2,536,866 59,725 2.4% 149,888 7.5% 5.9% 5.9% 10,716 64,113 $16.72 $34.40 0 0 C 16 293,061 1,280 0.4% 1,280 0.0% 0.4% 0.0% 1,190 -18,624 $18.00 $35.00 0 0 All 66 8,894,016 441,960 5.0% 698,428 27.0% 7.9% 9.8% 17,953 246,876 $17.40 $36.53 0 0 Central North A 25 6,381,370 380,955 6.0% 547,259 32.4% 8.6% 11.3% 6,047 214947 $17.58 $37.12 0 0 Area B 57 4,809,806 262,185 5.5% 379,156 3.0% 7.9% 4.1% 16,704 -86439 $13.75 $27.96 0 0 Total: C 44 900,359 22,480 2.5% 28,290 2.9% 3.1% 4.8% -10 8681 $9.29 $18.04 0 0 All 126 12,091,535 665,621 5.5% 954,705 19.8% 7.9% 7.9% 22,741 137189 $15.44 $32.03 0 0 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 6. Colliers GTA East | Office Statistics 2011 Q2 Proportion 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available of Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Scarborough A 6 1,488,002 278,497 18.7% 409,187 33.3% 27.5% 20.1% 0 20,568 $14.20 $30.73 0 0 Town Centre B 30 1,765,570 81,641 4.6% 158,620 6.9% 9.0% 13.8% -375 9,751 $12.94 $27.35 0 0 C 23 676,559 18,085 2.7% 30,152 0.0% 4.5% 12.1% -12,600 12,455 $6.48 $22.59 0 0 All 59 3,930,131 378,223 9.6% 597,959 24.6% 15.2% 15.8% -12,975 30,175 $13.48 $29.42 0 0 Pickering Oshawa A 11 988,095 98,029 9.9% 99,729 0.0% 10.1% 0.0% 71,651 62,051 $15.54 $29.77 0 0 B 14 518,581 3,580 0.7% 27,071 35.5% 5.2% 0.0% 0 7,392 $14.51 $25.02 0 0 C 6 186,620 0 0.0% 0 0.0% 0.0% 0.0% 0 0 $0.00 $0.00 0 0 All 31 1,693,296 101,609 6.0% 126,800 7.6% 7.5% 7.6% 71,651 69,443 $15.32 $28.75 115,546 0 GTA East A 17 2,476,097 376,526 15.2% 508,916 26.8% 20.6% 15.3% 71,651 82,619 $9.94 $20.80 0 0 Area B 44 2,284,151 85,220 3.7% 185,691 11.1% 8.1% 13.2% -375 17,143 $7.33 $15.16 0 0 Total: C 29 863,179 18,085 2.1% 30,152 0.0% 3.5% 9.7% -12,600 12,455 $6.48 $22.59 0 0 All 90 5,623,427 479,831 8.5% 724,759 21.6% 12.9% 13.5% 58,676 99,618 $9.13 $19.43 115,546 0 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 7. Colliers GTA North | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Vaughan A 14 778,564 3,969 0.5% 3,969 0.0% 0.5% 0.0% 0 132,861 $18.00 $25.42 0 0 B 31 1,449,195 23,559 1.6% 87,937 21.4% 6.1% 5.0% 44,031 62,136 $14.40 $24.58 0 0 C 15 530,069 11,440 2.2% 30,266 0.0% 5.7% 5.1% 0 -5,200 $15.96 $25.30 0 0 All 60 2,757,828 38,968 1.4% 122,171 15.4% 4.4% 5.9% 44,031 189,797 $14.99 $24.82 0 63,515 Richmond Hill A 3 462,205 0 0.0% 0 0.0% 0.0% 0.0% 0 9,982 $0.00 $0.00 0 0 B 7 235,022 6,852 2.9% 9,036 0.0% 3.8% 0.0% 904 5,407 $12.85 $24.62 0 0 C 2 40,000 0 0.0% 0 0.0% 0.0% 0.0% 0 0 $0.00 $0.00 0 0 All 12 737,227 6,852 0.9% 9,036 0.0% 1.2% 0.6% 904 15,389 $12.85 $24.62 0 59,283 Hwy404-Hwy407 A 33 4,220,288 336,763 8.0% 635,517 39.8% 15.1% 0.0% 119,656 310,341 $17.95 $31.91 0 0 B 47 2,602,315 238,922 9.2% 256,757 0.5% 9.9% 12.8% 33,409 152,320 $14.55 $26.04 0 0 C 46 1,624,301 76,315 4.7% 117,963 4.1% 7.3% 7.0% -9,359 65,763 $10.91 $18.29 0 0 All 126 8,446,904 651,999 7.7% 1,010,237 25.7% 12.0% 13.2% 143,706 528,423 $15.73 $27.86 0 0 Markham A 11 1,286,384 134,269 10.4% 205,025 45.0% 15.9% 11.0% -728 -3,669 $13.59 $25.56 0 0 Town Centre B 24 1,785,436 55,103 3.1% 114,218 35.7% 6.4% 5.2% 20,225 53,633 $12.40 $22.02 0 0 C 15 412,214 76,512 18.6% 78,762 0.0% 19.1% 17.2% 2,625 9,780 $9.67 $15.84 0 0 All 50 3,484,034 265,883 7.6% 398,004 33.4% 11.4% 8.8% 22,122 59,744 $12.09 $21.69 0 0 GTA North A 61 6,747,441 475,000 7.0% 844,510 40.9% 12.5% 12.8% 118,928 449,515 $16.97 $30.43 0 0 Total: B 109 6,071,968 324,435 5.3% 467,948 13.0% 7.7% 8.2% 98,568 273,495 $14.10 $25.03 0 0 C 78 2,606,584 164,266 6.3% 226,991 2.1% 8.7% 8.2% -6,734 70,343 $11.16 $18.38 0 0 All 248 15,425,993 963,702 6.2% 1,539,449 26.7% 10.0% 10.3% 210,762 793,353 $14.79 $26.11 0 122,798 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.

- 8. Colliers GTA West | Office Statistics 2011 Q2 Proportion of 2011 Q2 2010 Q2 Net Net Wgt Avg. Wgt Avg. Net Currently Office Market / Buildings Office Vacant Vacancy Available Sublease Availability Availability Absorption Absorption Asking Net Asking Gross New Supply Under 1 2 3 5 Submarket Class Surveyed Inventory Space Rate Space Availability Rate Rate 2011 Q2 12 Months Rental Rates Rental Rates 2011 Q2 Construction Airport A 21 2,513,567 491,570 19.6% 594,159 23.9% 23.6% 25.8% 103,745 287,880 $18.60 $32.01 0 0 Corporate Centre B 27 1,863,486 191,287 10.3% 293,222 43.5% 15.7% 8.5% 16,617 -66,668 $14.54 $28.10 0 0 C 31 1,383,218 226,860 16.4% 318,462 14.5% 23.0% 2.4% -6,938 -15,520 $14.59 $23.22 0 0 All 79 5,760,271 909,717 15.8% 1,205,843 26.2% 20.9% 14.7% 113,424 205,692 $16.56 $28.74 0 0 Airport East A 8 957,966 123,495 12.9% 266,411 16.1% 27.8% 27.3% 29,230 63,728 $15.08 $29.93 0 0 B 34 2,221,265 363,603 16.4% 534,325 15.2% 24.1% 26.4% 134,068 171,574 $12.45 $24.43 0 0 C 27 985,197 68,748 7.0% 80,839 10.1% 8.2% 12.5% 3,970 35,000 $9.98 $18.57 0 0 All 69 4,164,428 555,845 13.3% 881,575 15.0% 21.2% 23.4% 167,268 270,302 $13.02 $25.56 0 0 Airport West A 21 2,613,606 49,783 1.9% 87,267 15.3% 3.3% 3.3% 0 23,808 $13.07 $24.80 0 0 B 27 1,458,228 30,836 2.1% 54,736 0.0% 3.8% 2.0% 1,170 4,171 $11.93 $21.88 0 0 C 11 339,719 18,624 5.5% 26,964 0.0% 7.9% 16.3% 32,891 98,261 $7.81 $16.38 0 0 All 59 4,411,553 99,243 2.2% 168,968 7.9% 3.8% 4.5% 34,061 126,241 $11.86 $22.51 0 0 Brampton A 13 742,916 73,473 9.9% 107,810 30.1% 14.5% 4.1% 1,831 36,780 $16.92 $28.10 0 0 B 13 1,658,846 32,806 2.0% 92,806 0.0% 5.6% 0.2% 0 0 $12.70 $18.80 0 0 C 5 107,426 13,365 12.4% 13,365 0.0% 12.4% 49.2% 16,214 16,709 $12.00 $23.75 0 0 All 31 2,509,188 119,644 4.8% 213,981 15.1% 8.5% 3.5% 18,045 53,489 $14.78 $23.80 0 0 Burlington A 19 1,754,171 149,400 8.5% 225,814 27.2% 12.9% 16.3% -2,058 47,543 $17.42 $28.55 0 0 B 36 1,499,965 84,509 5.6% 117,584 12.1% 7.8% 8.9% 36,325 11,431 $13.55 $22.01 0 0 C 29 1,048,162 50,735 4.8% 104,556 4.9% 10.0% 8.8% 9,105 31,401 $11.23 $17.00 0 0 All 84 4,302,298 284,644 6.6% 447,954 18.0% 10.4% 12.0% 43,372 90,375 $14.96 $24.14 0 0 Cooksville A 5 664,087 9,356 1.4% 20,156 27.8% 3.0% 3.2% 3,726 7,992 $15.58 $29.31 0 0 B 19 831,027 57,642 6.9% 57,642 6.4% 6.9% 6.2% 0 12,058 $15.48 $26.01 0 0 C 13 323,292 29,652 9.2% 29,652 0.0% 9.2% 10.1% 3,776 10,240 $7.00 $18.00 0 0 All 37 1,818,406 96,650 5.3% 107,450 8.7% 5.9% 5.8% 7,502 30,291 $13.16 $24.42 0 0 Hwy401 A 9 1,763,830 132,265 7.5% 239,696 24.9% 13.6% 15.6% -54,781 -78,583 $13.21 $25.29 0 0 Hurontario B 12 743,944 32,597 4.4% 42,350 0.0% 5.7% 7.3% 4,876 -11,136 $11.62 $22.71 0 0 C 17 756,939 8,320 1.1% 27,036 24.7% 3.6% 4.4% -8,320 12,127 $10.18 $19.87 0 0 All 38 3,264,713 173,182 5.3% 309,082 21.5% 9.5% 11.1% -58,225 -77,592 $12.73 $24.46 0 0 Hwy427 A 14 2,361,188 259,659 11.0% 306,785 10.0% 13.0% 8.1% -155,302 -283,525 $14.58 $30.95 0 0 Bloor-Islington B 34 1,555,926 121,154 7.8% 135,570 0.0% 8.7% 11.8% -127,198 -102,086 $10.72 $23.99 0 0 C 25 638,776 11,867 1.9% 50,905 0.0% 8.0% 3.5% -2,696 46,202 $8.54 $20.91 0 0 All 73 4,555,890 392,680 8.6% 493,260 6.2% 10.8% 8.7% -285,197 -339,409 $12.89 $28.00 0 0 Mississauga A 14 3,002,934 232,663 7.7% 449,339 16.5% 15.0% 10.6% 34,438 95,481 $16.92 $33.02 0 0 City Centre B 9 530,735 7,561 1.4% 13,691 44.8% 2.6% 4.0% 5,302 22,770 $13.50 $23.09 0 0 C 13 225,898 0 0.0% 4,581 0.0% 2.0% 0.0% 1,456 -456 $14.00 $23.49 0 0 All 36 3,759,567 240,224 6.4% 467,611 17.1% 12.4% 9.0% 41,196 117,795 $16.79 $32.63 0 0 Meadowvale A 18 3,221,780 132,352 4.1% 211,352 60.8% 6.6% 5.1% 35,435 78,065 $18.17 $33.06 0 0 B 41 2,433,725 288,065 11.8% 386,009 17.4% 15.9% 16.6% 15,836 -16,697 $15.48 $26.31 0 0 C 41 1,609,387 164,107 10.2% 200,084 6.3% 12.4% 15.2% -13,641 35,133 $11.88 $18.34 0 0 All 100 7,264,892 584,524 8.0% 797,445 26.1% 11.0% 11.4% 37,630 96,501 $15.29 $26.10 0 375,000 Sheridan Winston A 4 347,676 0 0.0% 0 0.0% 0.0% 14.7% 0 73,679 $0.00 $0.00 0 0 B 21 1,254,260 15,180 1.2% 21,480 0.0% 1.7% 7.1% 13,810 18,032 $11.50 $22.06 0 0 C 13 439,916 2,562 0.6% 7,627 0.0% 1.7% 10.7% -6,475 -2562 $11.25 $16.22 0 0 All 38 2,041,852 17,742 0.9% 29,107 0.0% 1.4% 9.1% 7,335 89149 $11.43 $20.53 0 0 Oakville A 14 1,446,934 182,297 12.6% 194,728 7.4% 13.5% 15.5% -12,521 -14,398 $18.96 $30.74 0 0 B 34 1,386,079 71,244 5.1% 200,487 4.0% 14.5% 17.0% 23,072 64,803 $16.59 $26.43 0 0 C 23 577,915 42,563 7.4% 75,554 1.5% 13.1% 8.9% -6,973 -4216 $13.34 $24.80 0 0 All 71 3,410,928 296,104 8.7% 470,769 5.0% 13.8% 15.0% 3,578 46189 $17.05 $27.95 0 420,468 GTA West A 160 21,390,655 1,836,314 8.6% 2,703,517 22.4% 12.6% 12.1% -16,259 338,451 $16.58 $30.50 0 0 Total: B 307 17,437,486 1,296,482 7.4% 1,949,901 15.8% 11.2% 11.3% 123,878 108,252 $13.73 $24.78 0 0 C 248 8,435,845 637,404 7.6% 939,626 8.5% 11.1% 9.5% 22,370 262,318 $12.10 $20.52 0 0 All 715 47,263,986 3,770,199 8.0% 5,593,044 17.7% 11.8% 11.3% 129,989 709,021 $14.73 $26.59 0 795,468 Survey results presented on this report have been condensed for reference. Notes: 1 Office Inventory: For the purpose of this report, buildings with less than 10,000 SF of office space and buildings owned and occupied by the government have not been included in the office inventory. 2 Vacancy Rate: The Vacancy Rate is the amount of vacant space divided by the existing building inventory base. Vacant space is available and physically unoccupied, and it includes both head lease and sublease space. 3 Proportion of Sublease Availability: This ratio represents the share of available sublease space of the total available space. 4 Availability Rate: The Availability Rate is the amount of available space divided by the building inventory base. Available space is space that is available for lease and may or may not be vacant. 5 Average Rental Rates: Average rental rates are calculated off available spaces which also quote rental figures.