Commercial Real Estate: Industrial Sector 2001-2009

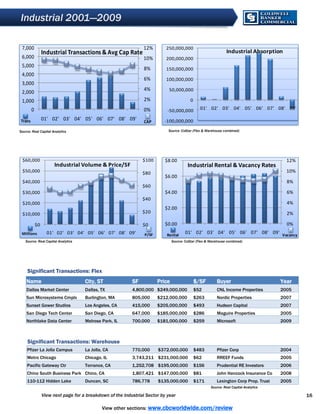

- 1. Industrial 2001—2009 7,000 12% 250,000,000 Industrial Transactions & Avg Cap Rate Industrial Absorption 6,000 10% 200,000,000 5,000 8% 150,000,000 4,000 6% 100,000,000 3,000 4% 50,000,000 2,000 1,000 2% 0 0 0% 01' 02' 03' 04' 05' 06' 07' 08' 09' -50,000,000 Trans 01' 02' 03' 04' 05' 06' 07' 08' 09' CAP -100,000,000 Source: Real Capital Analytics Source: CoStar (Flex & Warehouse combined) $60,000 $100 $8.00 12% Industrial Volume & Price/SF Industrial Rental & Vacancy Rates $50,000 $80 10% $6.00 $40,000 8% $60 $30,000 $4.00 6% $40 $20,000 4% $2.00 $10,000 $20 2% $0 $0 $0.00 0% Millions 01' 02' 03' 04' 05' 06' 07' 08' 09' P/SF Rental 01' 02' 03' 04' 05' 06' 07' 08' 09' Vacancy Source: Real Capital Analytics Source: CoStar (Flex & Warehouse combined) Significant Transactions: Flex Name City, ST SF Price $/SF Buyer Year Dallas Market Center Dallas, TX 4,800,000 $249,000,000 $52 CNL Income Properties 2005 Sun Microsystems Cmplx Burlington, MA 805,000 $212,000,000 $263 Nordic Properties 2007 Sunset Gower Studios Los Angeles, CA 415,000 $205,000,000 $493 Hudson Capital 2007 San Diego Tech Center San Diego, CA 647,000 $185,000,000 $286 Maguire Properties 2005 Northlake Data Center Melrose Park, IL 700,000 $181,000,000 $259 Microsoft 2009 Significant Transactions: Warehouse Pfizer La Jolla Campus La Jolla, CA 770,000 $372,000,000 $483 Pfizer Corp 2004 Metro Chicago Chicago, IL 3,743,211 $231,000,000 $62 RREEF Funds 2005 Pacific Gateway Ctr Torrance, CA 1,252,708 $195,000,000 $156 Prudential RE Investors 2006 Chino South Business Park Chino, CA 1,807,421 $147,000,000 $81 John Hancock Insurance Co 2008 110-112 Hidden Lake Duncan, SC 786,778 $135,000,000 $171 Lexington Corp Prop. Trust 2005 Source: Real Capital Analytics View next page for a breakdown of the Industrial Sector by year 16 View other sections: www.cbcworldwide.com/review

- 2. Industrial Breakdown 17 View other sections: www.cbcworldwide.com/review