Health Care Reform Developments Week of February 10 2014(1)

•

0 gefällt mir•312 views

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

News Flash February 12 2014 Final Regulations on Employer Pay or Play Provis...

News Flash February 12 2014 Final Regulations on Employer Pay or Play Provis...Annette Wright, GBA, GBDS

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

News Flash November 1 2013 Two Developments Plans May Permit Participants t...Annette Wright, GBA, GBDS

Empfohlen

News Flash February 12 2014 Final Regulations on Employer Pay or Play Provis...

News Flash February 12 2014 Final Regulations on Employer Pay or Play Provis...Annette Wright, GBA, GBDS

News Flash November 1 2013 Two Developments Plans May Permit Participants t...

News Flash November 1 2013 Two Developments Plans May Permit Participants t...Annette Wright, GBA, GBDS

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...Annette Wright, GBA, GBDS

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...Annette Wright, GBA, GBDS

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (10)

Getting Ready for 2016 Changes in Health Care Reform

Getting Ready for 2016 Changes in Health Care Reform

Briefing Regarding Revisions to the California Family Rights Act

Briefing Regarding Revisions to the California Family Rights Act

Andere mochten auch

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...Annette Wright, GBA, GBDS

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...Annette Wright, GBA, GBDS

Andere mochten auch (9)

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...

News Flash June 30 2014 Supreme Court Rejects Contraceptive Coverage Mandate...

You Ought To Know: September 20, 2013 – HIPAA Privacy FAQs

You Ought To Know: September 20, 2013 – HIPAA Privacy FAQs

Health Care Reform Developments Week of June 1, 2015[1]![Health Care Reform Developments Week of June 1, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of June 1, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of June 1, 2015[1]

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...

News Flash February 21 2014 - Final Regulations on PPACA 90-Day Waiting Peri...

Health Care Reform Developments Week of November 9, 2015

Health Care Reform Developments Week of November 9, 2015

Ähnlich wie Health Care Reform Developments Week of February 10 2014(1)

Linklaters Alert Dutch government and social partners announce changes to emp...

Linklaters Alert Dutch government and social partners announce changes to emp...Martijn van Broeckhuijsen

Ähnlich wie Health Care Reform Developments Week of February 10 2014(1) (20)

Health Reform Bulletin: Exploring Shared Responsibility Regulations

Health Reform Bulletin: Exploring Shared Responsibility Regulations

Exploring the Final Employer Shared Responsibility Regulations

Exploring the Final Employer Shared Responsibility Regulations

The Affordable Care Act: Update on the Employer Mandate Final Rule

The Affordable Care Act: Update on the Employer Mandate Final Rule

The Affordable Care Act – Compliance Challenges for Employers

The Affordable Care Act – Compliance Challenges for Employers

Health Care Reform Developments Week of October 13 20141

Health Care Reform Developments Week of October 13 20141

IRS Delays Key Provision Of The Affordable Care Act

IRS Delays Key Provision Of The Affordable Care Act

6 Facts/Updates You Must Know About the Employer Mandate

6 Facts/Updates You Must Know About the Employer Mandate

Are You Ready for the Next Wave of Health Care Reform?

Are You Ready for the Next Wave of Health Care Reform?

Linklaters Alert Dutch government and social partners announce changes to emp...

Linklaters Alert Dutch government and social partners announce changes to emp...

Mehr von Annette Wright, GBA, GBDS

FEDERAL AGENCIES PROVIDE CLARIFICATION AND LIMITED RELIEF REGARDING PREMIUM REIMBURSEMENT ARRANGEMENTSNews Flash February 25 2015 - Federal Agencies Provide Clarification and Limi...

News Flash February 25 2015 - Federal Agencies Provide Clarification and Limi...Annette Wright, GBA, GBDS

The following article describes a new employee benefits development (Supreme Court decision could make it easier for employers to reduce union retiree health benefits).News Flash January 27 2015 - Settled Law Changing _ Retiree Medical Benefits...

News Flash January 27 2015 - Settled Law Changing _ Retiree Medical Benefits...Annette Wright, GBA, GBDS

On January 16, 2015, the Supreme Court of the United States announced that it will take up the issue whether persons of the same gender have the right to marry under the U.S. Constitution.News Flash January 20 2015 - Supreme Court Agrees to Address Same Sex Marriage

News Flash January 20 2015 - Supreme Court Agrees to Address Same Sex MarriageAnnette Wright, GBA, GBDS

Mehr von Annette Wright, GBA, GBDS (20)

News Flash October 21 2015 - IRS Inflation Adjustments for 2016

News Flash October 21 2015 - IRS Inflation Adjustments for 2016

Health Care Reform Developments Week of August 3, 2015

Health Care Reform Developments Week of August 3, 2015

Health Care Reform Developments Week of July 6, 2015

Health Care Reform Developments Week of July 6, 2015

Health Care Reform Developments week of June 8, 2015

Health Care Reform Developments week of June 8, 2015

Health Care Reform Developments Week of May 25, 2015[1]![Health Care Reform Developments Week of May 25, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of May 25, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of May 25, 2015[1]

Health Care Reform Developments Week of May 4, 2015

Health Care Reform Developments Week of May 4, 2015

News Flash April 16 2015 - EEOC Issues Proposed Wellness Rules

News Flash April 16 2015 - EEOC Issues Proposed Wellness Rules

Health Care Reform Developments Week of April 13, 2015

Health Care Reform Developments Week of April 13, 2015

Health Care Reform Developments Week of March 30, 2015[1]![Health Care Reform Developments Week of March 30, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of March 30, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of March 30, 2015[1]

Health Care Reform Developments Week of March 23, 2015[1]![Health Care Reform Developments Week of March 23, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of March 23, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of March 23, 2015[1]

Health Care Reform Developments Week of March 9, 2015[1]![Health Care Reform Developments Week of March 9, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of March 9, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of March 9, 2015[1]

News Flash February 25 2015 - Federal Agencies Provide Clarification and Limi...

News Flash February 25 2015 - Federal Agencies Provide Clarification and Limi...

Health Care Reform Developments Week of March 2, 2015[1]![Health Care Reform Developments Week of March 2, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of March 2, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of March 2, 2015[1]

Health Care Reform Developments Week of February 16, 2015[1]![Health Care Reform Developments Week of February 16, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of February 16, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of February 16, 2015[1]

Health Care Reform Developments Week of February 9, 2015[1]![Health Care Reform Developments Week of February 9, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Health Care Reform Developments Week of February 9, 2015[1]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Health Care Reform Developments Week of February 9, 2015[1]

News Flash January 27 2015 - Settled Law Changing _ Retiree Medical Benefits...

News Flash January 27 2015 - Settled Law Changing _ Retiree Medical Benefits...

News Flash January 20 2015 - Supreme Court Agrees to Address Same Sex Marriage

News Flash January 20 2015 - Supreme Court Agrees to Address Same Sex Marriage

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Test bank for advanced assessment interpreting findings and formulating diffe...

Test bank for advanced assessment interpreting findings and formulating diffe...

+971565801893>>SAFE ORIGINAL ABORTION PILLS FOR SALE IN DUBAI,RAK CITY,ABUDHA...

+971565801893>>SAFE ORIGINAL ABORTION PILLS FOR SALE IN DUBAI,RAK CITY,ABUDHA...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

NO1 Verified Online Love Vashikaran Specialist Kala Jadu Expert Specialist In...

NO1 Verified Online Love Vashikaran Specialist Kala Jadu Expert Specialist In...

Health Care Reform Developments Week of February 10 2014(1)

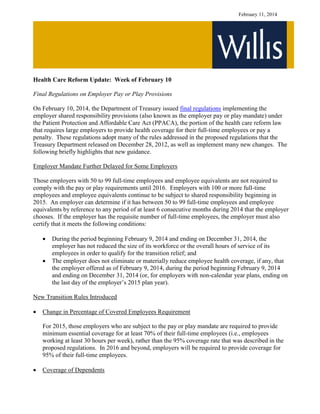

- 1. February 11, 2014 Health Care Reform Update: Week of February 10 Final Regulations on Employer Pay or Play Provisions On February 10, 2014, the Department of Treasury issued final regulations implementing the employer shared responsibility provisions (also known as the employer pay or play mandate) under the Patient Protection and Affordable Care Act (PPACA), the portion of the health care reform law that requires large employers to provide health coverage for their full-time employees or pay a penalty. These regulations adopt many of the rules addressed in the proposed regulations that the Treasury Department released on December 28, 2012, as well as implement many new changes. The following briefly highlights that new guidance. Employer Mandate Further Delayed for Some Employers Those employers with 50 to 99 full-time employees and employee equivalents are not required to comply with the pay or play requirements until 2016. Employers with 100 or more full-time employees and employee equivalents continue to be subject to shared responsibility beginning in 2015. An employer can determine if it has between 50 to 99 full-time employees and employee equivalents by reference to any period of at least 6 consecutive months during 2014 that the employer chooses. If the employer has the requisite number of full-time employees, the employer must also certify that it meets the following conditions: During the period beginning February 9, 2014 and ending on December 31, 2014, the employer has not reduced the size of its workforce or the overall hours of service of its employees in order to qualify for the transition relief; and The employer does not eliminate or materially reduce employee health coverage, if any, that the employer offered as of February 9, 2014, during the period beginning February 9, 2014 and ending on December 31, 2014 (or, for employers with non-calendar year plans, ending on the last day of the employer’s 2015 plan year). New Transition Rules Introduced Change in Percentage of Covered Employees Requirement For 2015, those employers who are subject to the pay or play mandate are required to provide minimum essential coverage for at least 70% of their full-time employees (i.e., employees working at least 30 hours per week), rather than the 95% coverage rate that was described in the proposed regulations. In 2016 and beyond, employers will be required to provide coverage for 95% of their full-time employees. Coverage of Dependents

- 2. February 11, 2014 In 2015 employers who are obligated to comply with the pay or play mandate are not required to cover dependents, as previously stated in the proposed regulations. The obligation under shared responsibility to cover all dependents will not begin until 2016. Please note that this transition rule applies to employers who do not offer dependent coverage, offer dependent coverage that does not constitute minimum essential coverage, or offer dependent coverage to some but not all dependents. Transition relief is not available to the extent the employer offered dependent coverage during either the 2013 or the 2014 plan year and subsequently dropped that coverage. This relief applies only for dependents who were without an offer of coverage from the employer in both the 2013 and 2014 plan years and if the employer takes steps during the 2014 and 2015 plan year (or both) to extend coverage under the plan to dependents not offered coverage during the 2013 or 2014 plan year (or both). There has been no change in the law regarding coverage of spouses, and there continues to be no obligation under shared responsibility for employers to provide coverage for spouses. Prior Transition Rules Retained Effective Date for Non-Calendar Year Plans Employers with non-calendar year health plans and 100 or more full-time employees and employee equivalents become subject to the pay or play rules as of the first day of their 2015 plan year, rather than the January 1, 2015 effective date that applies to calendar year plans. The final regulations continue the transition rule that was identified in the proposed regulations, including certain requirements that must be met in order for an employer to apply this transition rule, plus some additional requirements that have been imposed. Look-Back Measurement Period An employer who is subject to the pay or play mandate in 2015 and has variable hour employees may determine those employees’ full-time employee status based on a look-back measurement period of 6 months, even though the employer’s applicable stability period (i.e., the period during which the employee’s status quo, coverage or non-coverage, is maintained prior to the next measurement period) is up to 12 months. While the ongoing shared responsibility rules will require that the stability period be the longer of 6 months or the length of the measurement period, for the first year that pay-or-play originally was in effect the proposed regulations allowed an employer to use a measurement period of at least 6 months but less than 12 months even if the employer’s stability period was 12 months. That optional transition rule was continued in the final regulations for 2015.

- 3. February 11, 2014 Determination of Full-Time Status for Certain Employee Categories The final regulations provide guidance for the following occupations and employee categories in determining whether an individual is considered a full-time employee: Volunteers—bona fide volunteers for a government or tax-exempt entity (e.g., volunteer firefighters and emergency responders) are not considered full-time employees. Educational Employees—teachers and other educational employees are not treated as part-time for the year based solely on the school being closed or operating on a limited schedule during the summer. Seasonal Employees—positions for which the customary annual employment is 6 months or less are generally not considered to be full-time. Student Work-Study Programs—service performed by students under federal or state-sponsored work-study programs is not counted towards determining whether the students are full-time employees. Adjunct Faculty—employers can credit an adjunct faculty member with 2 ¼ hours of service per week for each hour of teaching or classroom time as a reasonable method for determining whether the adjunct faculty member is a full-time employee, as well as any other method of crediting hours of service for those employees that is reasonable under the circumstances and consistent with the employer shared responsibility provisions. Please note that even though these regulations are final, they continue to be a work in progress. Some of the transition rules and other guidance incorporate provisions that promise additional guidance and leave numerous terms undefined. Willis’ National Legal & Research Group will continue to review and provide timely updates on these and other related changes in Health Care Reform that affect employers. This information is not intended to represent legal or tax advice and has been prepared solely for informational purposes. You may wish to consult your attorney or tax adviser regarding issues raised in this publication.