Question 1 (1 point)The following trial balance of Flip Corp.docx

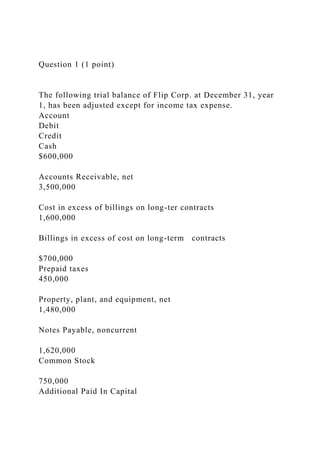

- 1. Question 1 (1 point) The following trial balance of Flip Corp. at December 31, year 1, has been adjusted except for income tax expense. Account Debit Credit Cash $600,000 Accounts Receivable, net 3,500,000 Cost in excess of billings on long-ter contracts 1,600,000 Billings in excess of cost on long-term contracts $700,000 Prepaid taxes 450,000 Property, plant, and equipment, net 1,480,000 Notes Payable, noncurrent 1,620,000 Common Stock 750,000 Additional Paid In Capital

- 2. 2000,000 Retained Earnings - unappropriated 900,000 Retained Earnings - restricted for Notes Payable 160,000 Earning from long-term contracts 6,680,000 Cost and Expenses 5,180,000 ________ Totals $12,810,000 $12,810,000 Other financial data for the year ended December 31, year 1, are Flip uses the percentage-of-completion method to account for long-term construction contracts for financial statement and income tax purposes. All receivables on these contracts are considered to be collectible within twelve months. During year 1, estimated tax payments of $450,000 were charged to prepaid taxes. Flip has not recorded income tax expense. There were no temporary or permanent differences, and Flip's tax rate is 30%. In Flip's December 31, year 1 balance sheet, what amount should be reported as total noncurrent liabilities? Question 1 options: $2,480,000 $1,780,000

- 3. $1,620,000 $2,320,000 Save Question 2 (1 point) The following trial balance of Flip Corp. at December 31, year 1, has been adjusted except for income tax expense. Account Debit Credit Cash $600,000 Accounts Receivable, net 3,500,000 Cost in excess of billings on long-ter contracts 1,600,000 Billings in excess of cost on long-term contracts $700,000 Prepaid taxes 450,000 Property, plant, and equipment, net 1,480,000 Notes Payable, noncurrent 1,620,000 Common Stock

- 4. 750,000 Additional Paid In Capital 2000,000 Retained Earnings - unappropriated 900,000 Retained Earnings - restricted for Notes Payable 160,000 Earning from long-term contracts 6,680,000 Cost and Expenses 5,180,000 ________ Totals $12,810,000 $12,810,000 Other financial data for the year ended December 31, year 1, are Flip uses the percentage-of-completion method to account for long-term construction contracts for financial statement and income tax purposes. All receivables on these contracts are considered to be collectible within twelve months. During year 1, estimated tax payments of $450,000 were charged to prepaid taxes. Flip has not recorded income tax expense. There were no temporary or permanent differences, and Flip's tax rate is 30%. In Flip's December 31, year 1 balance sheet, what amount should be reported as total current assets? Question 2 options:

- 5. $6,150,000 $5,700,000 $5,450,000 $5,000,000 Save Question 3 (1 point) Flip, Inc. was incorporated on January 1, year 1, with proceeds from the issuance of $750,000 in stock and borrowed funds of $110,000. During the first year of operations, revenues from sales and consulting amounted to $82,000, and operating costs and expenses totaled $64,000. On December 15, Flip declared a $3,000 cash dividend, payable to stockholders on January 15, year 2. No additional activities affected owners' equity in year 1. Flip's liabilities increased to $120,000 by December 31, year 1. On Flip's December 31, year 1 balance sheet, total assets should be reported at current assets? Question 3 options: $885,000 $882,000 $878,000 $875,000 Save Question 4 (1 point)

- 6. When preparing a draft of its year 1 balance sheet, Flip, Inc. reported net assets totaling $875,000. Included in the asset section of the balance sheet were the following: Treasury Stock of Flip, Inc at cost, which approximates market value on December 31 $24,000 Idle machinery 11,200 Sash surrender value o life insurance on corporate executives 13,700 Allowance for decline in market value of noncurrent equity investments 8,400 At what amount should Flip's net assets be reported in the December 31, year 1 balance sheet? Question 4 options: $850,100 $834,500 $851,000 $842,600 Save Question 5 (1 point) In analyzing a company's financial statements, which financial statement would a potential investor primarily use to assess the company's liquidity and financial flexibility? Question 5 options: Balance sheet

- 7. Income statement. Statement of cash flows. Statement of retained earnings. Save Question 6 (1 point) Flip Co. acquired 100% of Flop Corp. prior to year 2. During year 2, the individual companies included in their financial statements the following: Flip Flop Officers' salaries $ 75,000 $50,000 Officers' expenses 20,000 10,000 Loans to officers 125,000 50,000 Intercompany sales 150,000 -- What amount should be reported as related-party disclosures in the notes to Flip's year 2 consolidated financial statements Question 6 options: $330,000 $175,000

- 8. $150,000 $155,000 Save Question 7 (1 point) Flop Co. has entered into a joint venture with an affiliate to secure access to additional inventory. Under the joint venture agreement, Flop will purchase the output of the venture at prices negotiated on an arm's-length basis. Which of the following is(are) required to be disclosed about the related- party transaction? I. The amount due to the affiliate at the balance sheet date. II. The dollar amount of the purchases during the year. Question 7 options: I only. II only. Both I and II. Neither I nor II. Save Question 8 (1 point) What is the purpose of information presented in notes to the financial statements? Question 8 options: To correct improper presentation in the financial statements. To present management's responses to auditor comments.

- 9. To provide disclosures required by generally accepted accounting principles. To provide recognition of amounts not included in the totals of the financial statements. Save Question 9 (1 point) Which of the following information should be included in Flop, Inc.'s year 1 summary of significant accounting policies? Question 9 options: Business component year 1 sales are Alpha $1M, Beta $2M, and Charlie $3M. Property, plant, and equipment is recorded at cost with depreciation computed principally by the straight-line method. Future common share dividends are expected to approximate 60% of earnings. During year 1, the Delta component was sold. Save Question 10 (1 point) Which of the following information should be disclosed in the summary of significant accounting policies? Question 10 options: Guarantees of indebtedness of others. Criteria for determining which investments are treated as cash equivalents.

- 10. Refinancing of debt subsequent to the balance sheet date. Adequacy of pension plan assets relative to vested benefits. Save Question 11 (1 point) Flop Corp. prepares its financial statements for its fiscal year ending December 31, year 1. Flop estimates that its product warranty liability is $28,000 at December 31, year 1. On February 12, year 2, before the financial statements were issued, Flop received information about a product defect that will require a recall of all units sold in year 1. It is expected the product recall will cost an additional $40,000 in warranty repairs. What should Flop present in its December 31, year 1 financial statements? Question 11 options: A footnote disclosure listing the estimated amount of $40,000 in warranty repairs and an explanation of the recall. An estimated warranty liability of $68,000. No disclosure is necessary. A footnote disclosure explaining the product recall. Save Question 12 (1 point) Flop Corp. has a fiscal year-end of December 31, year 1. On that date, Flop reported total assets of $600,000. On February 1, year 2, before the year 1 financial statements were issued, Flop lost $250,000 of inventory due to a fire. The inventory was a total loss and was uninsured. How should Flop present this

- 11. information in its December 31, year 1 financial statements? Question 12 options: should disclose the loss in a footnote to its year 1 financial statements. Flop should report an allowance for lost inventory in its year 1 balance sheet. Flop should not report the loss. Flop should report an extraordinary loss in its year 1 income statement. Save Question 13 (1 point) The fair value of an asset should be based upon Question 13 options: The replacement cost of an asset. The price that would be received to sell the asset at the measurement date under current market conditions. The price that would be paid to acquire the asset. The original cost of the asset plus an adjustment for obsolescence. Save Question 14 (1 point) Which of the following describes a principal market for establishing fair value of an asset? Question 14 options:

- 12. The market that has the greatest volume and level of activity for the asset. Any broker or dealer market that buys or sells the asset. The market in which the amount received would be maximized. The most observable market in which the price of the asset is minimized. Save Question 15 (1 point) Which of the following is true for valuing an asset to fair value? Question 15 options: The price should be adjusted for transportation costs to transport the asset to its principal market. The fair value price is based upon an entry price to purchase the asset. The fair value of the asset should be adjusted for costs to sell. The price of the asset should be adjusted for transaction costs. Save Question 16 (1 point) Which of the following would meet the qualifications as market participants in determining fair value? Question 16 options: A subsidiary of the reporting unit interested in purchasing assets similar to those being valued.

- 13. An independent entity that is knowledgeable about the asset. A liquidation market in which sellers are compelled to sell. A broker or dealer that wishes to establish a new market for the asset. Save Question 17 (1 point) The fair value of an asset at initial recognition is Question 17 options: The price paid to transfer or sell the asset. The price paid to acquire the asset. The price paid to acquire the asset less transaction costs. The book value of the asset acquired. Save Question 18 (1 point) Which of the following is not a valuation technique used in fair value estimates? Question 18 options: Market approach. Cost approach. Residual value approach. Income approach.

- 14. Save Question 19 (1 point) The market approach valuation technique for measuring fair value requires which of the following? Question 19 options: The weighted-average of the present value of future cash flows. The price to replace the service capacity of the asset. Present value of future cash flows. Prices and other relevant information of transactions from identical or comparable assets. Save Question 20 (1 point) A change in valuation techniques used to measure fair value should be reported as Question 20 options: A change in accounting principle with retrospective restatement. An extraordinary item on the current year's income statement. . An error correction with restatement of the financial statements of previous periods. A change in accounting estimate reported on a prospective basis. Save Question 21 (1 point)

- 15. Which of the following are observable inputs used for fair value measurements? I. Bank prime rate. II. Default rates on loans. III. Financial forecasts. Question 21 options: I and III only. I, II and III. I only. I and II only. Save Question 22 (1 point) Which of the following best describes the content of the SEC Form 10-Q? Question 22 options: Quarterly audited financial information and other information about the company. Quarterly reviewed financial information and other information about the company. Annual audited financial information and nonfinancial information about the company. Disclosure of material events that affect the company. Save Question 23 (1 point)

- 16. A company is required to file quarterly financial statements with the United States Securities and Exchange Commission on form 10-Q. The company operates in an industry that is not subject to seasonal fluctuations that could have a significant impact on its financial condition. In addition to the most recent quarter-end, for which of the following periods is the company required to present balance sheets on Form 10-Q? Question 23 options: The end of the preceding fiscal year and the end of the prior two fiscal years. The end of the preceding fiscal year. The end of the corresponding fiscal quarter of the preceding fiscal year. The end of the preceding fiscal year and the end of the corresponding fiscal quarter of the preceding fiscal years. Save Question 24 (1 point) A company is an accelerated filer that is required to file Form 10-K with the United States Securities and Exchange Commission (SEC). What is the maximum number of days after the company's fiscal year-end that the company has to file Form 10-K with the SEC? Question 24 options: 75 days. 120 days.

- 17. 90 days. 60 days. Save Question 25 (1 point) Flop Inc is a publicly traded company. Recently, Flop entered into a material long-term lease agreement. Which SEC form discloses information about material events? Question 25 options: Form 8-K Form 10-K Form 10Q Form S-1 17 18 19 20 21 2 22 23