Analyzing Liquidity, Turnover and Profitability Ratios of Colgate-Palmolive

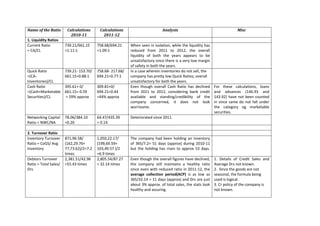

- 1. Name of the Ratio 1. Liquidity Ratios Current Ratio = CA/CL Calculations 2010-11 Calculations 2011-12 Analysis 739.21/661.15 =1.11:1 758.68/694.21 =1.09:1 Quick Ratio =(CAInventories)/CL Cash Ratio =(Cash+Marketable Securities)/CL 739.21- 153.70/ 661.15=0.88:1 758.68- 217.68/ 694.21=0.77:1 395.61+ 0/ 661.15= 0.59 = 59% approx 309.81+0/ 694.21=0.44 =44% approx Networking Capital Ratio = NWC/NA 78.06/384.10 =0.20 64.47/435.39 = 0.14 Deteriorated since 2011. 871,96.58/ (162,29.76+ 77,73.62)/2=7.2 times 2,381.51/42.96 =55.43 times 1,050,22.17/ (199,69.59+ 103,49.57 )/2 =6.9 times 2,805.54/87.27 = 32.14 times The company had been holding an inventory of 365/7.2= 51 days (approx) during 2010-11 but the holding has risen to approx 53 days. 2. Turnover Ratio Inventory Turnover Ratio = CoGS/ Avg Inventory Debtors Turnover Ratio = Total Sales/ Drs When seen in isolation, while the liquidity has reduced from 2011 to 2012, the overall liquidity of both the years appears to be unsatisfactory since there is a very low margin of safety in both the years. In a case wherein inventories do not sell, the company has pretty low Quick Ratios; overall unsatisfactory for both the years. Even though overall Cash Ratio has declined from 2011 to 2012, considering bank credit available and standing/credibility of the company concerned, it does not look worrisome. Misc Even though the overall figures have declined, the company still maintains a healthy ratio since even with reduced ratio in 2011-12, the average collection period(ACP) is as low as 365/32.14 = 11 days (approx) and Drs are just about 3% approx. of total sales, the stats look healthy and assuring. For these calculations, loans and advances (146.93 and 143.92) have not been counted in since same do not fall under the category og marketable securities. 1. Details of Credit Sales and Average Drs not known. 2. Since the goods are not seasonal, the formula being used is logical. 3. Cr policy of the company is not known.

- 2. Creditors Turnover Ratio 750,35.73 / 491.84= 152.5 Asset Turnover Ratio Net Assets Turnover Ratio = Sales/NA 2,381.51/ 384.10 = 6.2 times Total Assets Turnover Ratio =Sales/Total Assets Fixed Asset Turnover Ratio =Sales/NFA Current Asset Turnover Asset =Sales/CA 89527.09/ 586.96=152.5 There has been no change in the figures. It translates into an APP (average Payment Period) of less than three days! For every ₹of capital employed, company has been producing ₹ (approx) of sales 6 consistently over past two years. It means that the company is not under-utilising its assets. 2,381.51/ 2,805.54/(758.68 For every ₹of investment (NFA+CA) (739.21 + +254.42 )= 2.7 employed, company has been producing ₹ 2.5 255.04)=2.4 times (approx) of sales consistently over past two times years. This is significantly lower than Net Asset Turn Over Ratio figures. 2,381.51/255.04 2,805.54/254.42 FA are being turned over faster than CA. In =9.33 times =11.02 times other words, to generate a sale of ₹1, company needs to invest ₹0.9 in FA and ₹ 2,381.51/739.21 2,805.54/758.68 0.28 (approx). However, both these ratios are on an increase between two financial periods. =3.22 times =3.6 times 1. Details of Credit purchases and Average Drs not known. 2. Separate details of credit purchases are not available; being assumed from the figures given in the balance sheet. 2,805.54/ 435.39 = 6.4 times 3. Leverage Ratios Debt Ratio = TD/ (TD+NA) 0.05/.05+384.05 0.00/435.39 =0 =0.0001 Debt Equity Ratio = TD/NW 0.05/384.05 =0.0001 0 These ratios indicate that the company has been financed by the owners all by themselves since there are hardly any borrowings from lenders. --do---- 1.Total Assets= Net Fixed Assets+ Current Assets. 2. Figures of Net Block being taken as NFA here.

- 3. Capital Employed to Net Worth Ratio = CE or NA/NW Coverage Ratios Interest Coverage Ratio=EBIT/Interest 4. Profitability Ratios Gross Profit Margin =GP (or SalesCoGS)/Sales Net Profit Margin =PAT/Sales Return on Equity =PAT/NW (Equity) Return on Capital Employed= ROI =EBIT(1-Tax)/NA 5. Investment Ratios Dividend Per Share =Dividend/No of shares Earnings Per Share =PAT/No of shares Dividend Pay Out Ratio = DPS/EPS 384.10/384.05= 1.0001 435.39/435.39 =1 Follows the same trend as two other leverage ratios as also the thumb rule of 1+Debt-Equity ratio. 522.13/ 8.61 =60.64:1 588.97/1.51 =390.04:1 Very high ratios here indicate an ultraconservative approach towards usage of debt. However, since there is hardly any debt on the company, these figures look justified. 520.19/2,284.47 578.55/2,688.01 =0.22 = 22% =0.21 =21% 402.58/2,284.47 =0.17 = 17% 402.58/384.05 =1.04= 104% 522.13(1-0.24)/ 384.10= 1.03 = 103% 446.47/2,688.01 =0.16 = 16% 446.47/435.39 =1.02 or 102% 588.97(1-0.22)/ 435.39= 1.05 = 105% 299.18Crore/ 1359.93 lac =₹ 21.99 402.58 Crore/ 1359.93 lac =₹ 29.60 21.99/29.60 =74% 339.98Crore/ 1359.93 lac =₹ 24.99 446.47 Crore/ 1359.93 lac =₹ 32.83 24.99/32.83 =76% A bit of decline (1%) between the accounting periods indicates declining margins. --- do--------do----; however, returns look good when compared to market trends in general. With a uniform figure of 135%*, the company is doing well. An increase of approx. 14% (year on year) augurs well for the stock holders. An increase of approx. 10% is in line with industry averages. Translates into a situation wherein growth in equity is 26% approximately. This is in line *If tax component is ignored because same is not uniform, the ROCE will be 135% in both the years.

- 4. Dividend Yield Ratio = DPS/ Mkt value per share Price Earnings Ratio =Mkt value per share/EPS 21.99/1563 = 1.4% 24.99/1563 =1.5% 1563/29.60 =52.80 times 1563/32.83 =47.60 times with industry average and it has seen an increase of 2% between two accounting periods. These ratios are perfectly in sync with industry Mkt Value of one share worth averages (competitors like Godrej, P&G, Dabur FV of ₹ = ₹1563 as on 01 Jan 1 and so on). As a company, it is earning well for 2013 its investors while staying in meaningful competition in the market.

- 5. Appendix giving out details of the inputs used in the assignment Balance sheet - Colgate-Palmolive (India) Ltd. Particulars Mar'12 Mar'11 Liabilities 12 Months 12 Months Share Capital 13.60 13.60 Reserves & Surplus 421.79 370.45 Net Worth 435.39 384.05 Secured Loans 0.00 0.00 Unsecured Loans 0.00 0.05 TOTAL LIABILITIES 435.39 384.10 Gross Block 522.50 579.83 (-) Acc. Depreciation 268.08 324.79 Net Block 254.42 255.04 Capital Work in Progress. 69.38 12.26 Investments. 47.12 38.74 Inventories 217.68 153.70 Sundry Debtors 87.27 42.96 Cash And Bank 309.81 395.61 Loans And Advances 143.92 146.93 Total Current Assets 758.68 739.21 Current Liabilities 586.96 491.84 Provisions 107.25 169.31 Total Current Liabilities 694.21 661.15 NET CURRENT ASSETS 64.47 78.06 Misc. Expenses 0.00 0.00 TOTAL ASSETS (A+B+C+D+E) 435.39 384.10

- 6. Profit & Loss - Colgate-Palmolive (India) Ltd. Mar'12 Mar'11 12 Months 12 Months INCOME: Sales Turnover 2,805.54 2,381.51 Excise Duty 117.54 97.05 NET SALES 2,688.01 2,284.47 Other Income 0.00 0.00 TOTAL INCOME 2,737.74 2,320.66 EXPENDITURE: Manufacturing Expenses 172.09 139.33 Material Consumed 1,055.58 881.18 Personal Expenses 215.61 193.22 Selling Expenses 0.00 422.35 Administrative Expenses 666.18 128.21 Expenses Capitalised 0.00 0.00 Provisions Made 0.00 0.00 TOTAL EXPENDITURE 2,109.46 1,764.28 Operating Profit 578.55 520.19 EBITDA 628.28 556.38 Depreciation 39.31 34.25 Other Write-offs 0.00 0.00 EBIT 588.97 522.13 Interest 1.51 8.61 EBT 587.46 513.52 Taxes 141.92 117.37 Profit and Loss for the Year 445.54 396.15 Non Recurring Items 0.29 0.29 Other Non Cash Adjustments 0.64 6.14

- 7. Other Adjustments 0.00 0.00 REPORTED PAT 446.47 402.58 KEY ITEMS Preference Dividend 0.00 0.00 Equity Dividend 339.98 299.18 Equity Dividend (%) 2,499.99 2,199.99 Shares in Issue (Lakhs) 1,359.93 1,359.93 EPS - Annualised (Rs) 32.83 29.60 Capital Structure - Colgate-Palmolive (India) Ltd. Authorized Capital Issued Capital (Rs. cr) Period Instrument (Rs. cr) Shares (nos) Face Value Capital (Rs. Cr) -PAIDUP- From To 2011 2012 Equity Share 137.0 13.6 135992817 1.0 13.6 2010 2011 Equity Share 137.0 13.6 135992817 1.0 13.6 2009 2010 Equity Share 137.0 13.6 135992817 1.0 13.6 Statements of Cost of Goods Sold 2011(₹ in Lacs) 2012 (₹ in Lacs) Work-in-Process 6,08.33 10,36.30 Finished Goods 60,27.50 77,73.62 Add : Stock taken over on Amalgamation of a Subsidiary 14,55.51 23,05.20 particular Opening Stock 81,09.41 111,15.12 Raw and Packing Materials Consumed Opening Stock 23,89.52 47,87.99 Add : Stock taken over on Amalgamation of a Subsidiary 74.34 ------ Add : Purchases 750,35.73 89527.09 774,99.59 943,15.08 35,47.71 49,28.10 739,51.88 893,86.98 Less : Closing Stock 820,61.29 Purchased Finished Goods 100,502.10 162,29.76 199,69.59 Less : Closing Stock Work-in-Process 10,36.30 8,33.73 Finished Goods 77,73.62 103,49.57 Stock-in-trade 23,05.20 47,87.99 (-) 111,15.12 Excise Duty on Finished Goods Cost of goods sold 20.65 871,96.58 (-) 159,71.29 5,21.77 1,050,22.17

- 8. Era Business School, Dwarka ASSIGNMENT: CF Group Members NavdeepDahiya - 0121pg005 Manoj Kajla - 0121pg036 Col AK Raina, SM - 0121pg014

- 9. (P.S.: Ratios have been worked out based on the data that has been placed as appendix after the ratios)