Vishnu Bahadur cv

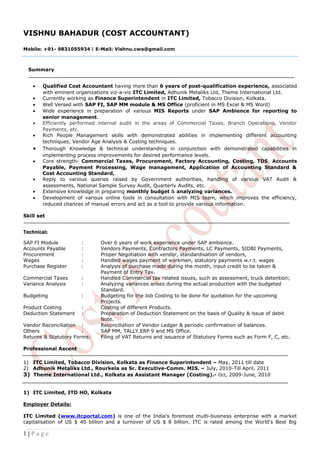

- 1. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com Summary • Qualified Cost Accountant having more than 6 years of post-qualification experience, associated with eminent organizations viz-a-viz ITC Limited, Adhunik Metaliks Ltd, Theme International Ltd. • Currently working as Finance Superintendent in ITC Limited, Tobacco Division, Kolkata. • Well Versed with SAP FI, SAP MM module & MS Office (proficient in MS Excel & MS Word) • Wide experience in preparation of various MIS Reports under SAP Ambience for reporting to senior management. • Efficiently performed internal audit in the areas of Commercial Taxes, Branch Operations, Vendor Payments, etc. • Rich People Management skills with demonstrated abilities in implementing different accounting techniques, Vendor Age Analysis & Costing techniques. • Thorough Knowledge & technical understanding in conjunction with demonstrated capabilities in implementing process improvements for desired performance levels. • Core strength- Commercial Taxes, Procurement, Factory Accounting, Costing, TDS, Accounts Payable, Payment Processing, Wage management, Application of Accounting Standard & Cost Accounting Standard, • Reply to various queries raised by Government authorities, handling of various VAT Audit & assessments, National Sample Survey Audit, Quarterly Audits, etc. • Extensive knowledge in preparing monthly budget & analyzing variances. • Development of various online tools in consultation with MIS team, which improves the efficiency, reduced chances of manual errors and act as a tool to provide various information. Skill set Technical: SAP FI Module : Over 6 years of work experience under SAP ambience. Accounts Payable : Vendors Payments, Contractors Payments, LC Payments, SIDBI Payments, Procurement : Proper Negotiation with vendor, standardisation of vendors, Wages : Handled wages payment of workmen, statutory payments w.r.t. wages Purchase Register : Analysis of purchase made during the month, input credit to be taken & Payment of Entry Tax. Commercial Taxes : Handled Commercial tax related issues, such as assessment, truck detention; Variance Analysis : Analyzing variances arises during the actual production with the budgeted Standard. Budgeting : Budgeting for the Job Costing to be done for quotation for the upcoming Projects. Product Costing : Costing of different Products. Deduction Statement : Preparation of Deduction Statement on the basis of Quality & issue of debit Note. Vendor Reconciliation : Reconciliation of Vendor Ledger & periodic confirmation of balances. Others : SAP MM, TALLY.ERP 9 and MS Office. Returns & Statutory Forms: Filing of VAT Returns and issuance of Statutory Forms such as Form F, C, etc. Professional Ascent 1) ITC Limited, Tobacco Division, Kolkata as Finance Superintendent – May, 2011 till date 2) Adhunik Metaliks Ltd., Rourkela as Sr. Executive-Comm. MIS. – July, 2010-Till April, 2011 3) Theme International Ltd., Kolkata as Assistant Manager (Costing).- Oct, 2009-June, 2010 1) ITC Limited, ITD HO, Kolkata Employer Details: ITC Limited (www.itcportal.com) is one of the India’s foremost multi-business enterprise with a market capitalisation of US $ 40 billion and a turnover of US $ 8 billion. ITC is rated among the World's Best Big 1 | P a g e

- 2. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com Companies, Asia's 'Fab 50' and the World's Most Reputable Companies by Forbes magazine and as 'India's Most Admired Company' in a survey conducted by Fortune India magazine and Hay Group. ITC also features as one of world's largest sustainable value creator in the consumer goods industry in a study by the Boston Consulting Group. ITC has been listed among India's Most Valuable Companies by Business Today magazine. The Company is among India's '10 Most Valuable (Company) Brands', according to a study conducted by Brand Finance and published by the Economic Times. ITC also ranks among Asia's 50 best performing companies compiled by Business Week. Duration : May 2011 till date Location : Kolkata Role : Finance Superintendent Roles and Responsibilities handled: Accounts Payable: ∼ Efficiently handled bill payments to all the vendors (purchases, Services & GTA) on time, for one of the biggest factory of ITC (i.e. Bangalore Cigarette Factory); ∼ Responsible for adherence of the companies policies in the areas of Accounts Payable; ∼ Improved the bill processing cycle time and achieved highest key performance indicator in the areas of Bill payment, achieved highest milestone across all units (payment of 99% bills before due dates); ∼ Negotiated with different vendors for cash discounts for early release of payments; and provided considerable savings – 1% cash discount of bill value, achieved savings of 20 to 25 lakhs per month. ∼ Checking of correctness and accuracy of the bills processed, checking of various details required under different statutes such as Service Tax, VAT, TDS, Excise, etc.; ∼ Ensured proper deduction of TDS and timely issuance of TDS certificate; ∼ Ensured proper and accurate taxes charged in the invoices and provided knowledge to the vendors for the changes / applicability of various statutes such as Service Tax, VAT, TDS, etc.; ∼ Checking of Eligibility for CENVAT/Service Tax/VAT Credit. If eligible for Cenvat Credit, checking of J1IEX entry for the same, as the SAP system will not allow voucher preparation till Cenvat Credit has been availed. ∼ Ensured proper accounting entry for availing various tax credits such as VAT credit, service tax credit and CENVAT credits; ∼ Checking of various indices while verifications of bills such as quantities and rates in the bill against PO/SO, In case any taxes are being charged in the bill, whether Vendor’s registration number/s for same under these acts are stated on the bill/invoice, viz., PAN, TIN, CST Registration No., ECC No., Service Tax Registration No., etc., Service tax classifications, tax rate and tax base are correct or not, etc.; ∼ Adjustment of advance / Claims / deductions due to quality or services, if any, that needs to be set off against the Bill /Invoice; ∼ Pioneered a unique platform where external vendor can get one stop solutions for all their queries, we named it as ‘Vendor Query Management System’ and it was very helpful and reduced lots of time and effort of our vendors; Wages Management: ∼ Timely and accurate process /payment of wages to the unionised workmen; ∼ Accurate deductions of TDS, PF and other statutory deductions; ∼ Timely payment of Bonus, Leave encashment, festival advances; ∼ Timely disbursement of PJPF pensions to all the retired employees; ∼ Active member of the workmen ‘grievance redressal team’ pioneered by our unit to provide prompt and satisfying reply to the queries raised; ∼ Ensured proper accounting entries in SAP pertaining to the various income and deductions w.r.t. wages payment and periodical review of various GLs; ∼ Timely remittance of Statutory dues relating to Wages and filing of Statutory Returns on time; ∼ Timely Clearance of Full & Final settlement of the exiting employees; ∼ Timely filing of various returns such as TDS quarterly return (Form 24Q), monthly PF return (Form 12A), Monthly Professional Tax return, etc.; ∼ Correct and timely issuance of Form 16 and income details to the workmen; 2 | P a g e

- 3. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com ∼ Initiated practice of making online payment to workmen for medicals, travelling expenses and other petty reimbursements; Commercial Taxes: ∼ Assisting every units in the matter of commercial tax issues such as Truck detentions, queries from different Government Authorities; ∼ Preparation of draft reply & liaising with our Corporate legal department for clearing various letters for submissions to Government Authority; ∼ Analysis of different provisions of the Laws in the areas of State Taxes and providing our views on the various clauses to our different units; ∼ Timely filing of VAT returns issuance of statutory forms such as Form F, Form C, etc. ∼ Assisting in timely completion of VAT Audit, VAT assessment, coordinating with VAT auditors and clarifications to different queries; ∼ Analysis of VAT rates applicable in various states for the different products and taking views from our Corporate legal / corporate I.Taxes team; ∼ Developed various online tools in the areas of commercial taxes to minimize manual interventions and mitigating the risk of manual errors; Other Roles: ∼ Also handled profile of procurement in-charge, which involves responsibility of negotiation with vendors, timely raising of purchase orders, timely review of work orders and proper negotiations with service providers; ∼ Scrap Sale, finalization of competitive rates for various scrap, timely clearance of the same and statutory compliance in the areas of scrap sale such as e-wastes; ∼ Assisted in completion of various audits such as EHS Audits, National Sample Survey Audits, Quarterly Limited reviews, physical verification of stocks, Canteen Audit, etc.; ∼ Got training for certified EHS Auditor and conducted various internal audits in the areas of EHS; 2) Adhunik Metaliks Ltd., Rourkela – Support Project Employer Details: Adhunik Metaliks Ltd., is a flagship company of Adhunik group of Industries (www.adhunikgroup.com). Adhunik Metaliks Ltd. has emerged as one of the fastest growing alloy, special and construction steel manufacturing companies in the country with significant presence in mining and power sectors through its subsidiaries. Duration : July 2010 to April 2011 Location : Rourkela, Orissa. Role : Sr. Executive (Comm. MIS) Roles and Responsibilities: Responsible for preparation & presentation of various MIS report under SAP Ambience. Timely review & Clearing Vendor Ledger for LC Acceptance on the basis of request raised by the party. Processing of LC payment, scrutinizing LC opening request on the basis of PO rate & the actual quantity received on the basis of GRN booked. Vendor Ledger reconciliation & timely confirmation of balances. SIDBI Payment processing, tracking of SIDBI payment since gate entry of material to discounting of bills. Calculation of interest payment, making of interest provision regarding outstanding creditors, making entry under SAP. Successfully handled periodic internal Audit for the LC Payments & SIDBI Payments. Preparation of quarterly consumption report for analyzing the correlation between payments made & quantity consumed. Preparation of deduction statement for acceptance under LC payment, special entry under MIRO & issue of debit note to the vendor. 3 | P a g e

- 4. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com Timely and accurate clearance of multiple GL accounts. Internal check of all documents such as P.O., GRN, C.S., Gate entry. Preparation of LC registers for tracking of LC Payment & clearing of Accounts. Responsible for preparing of Debit balances report of the Vendor & analyzing the reasons thereof. Preparation of purchase register, analyzing for input tax credit and preparation of annexures for filing of VAT returns. 3) Theme International Ltd., Kolkata Employer Details: Theme International (www.theme.org) is a S.M.E. which is furniture manufacturing concern has significant presence in eastern region. Theme produces furniture from solid wood & ply boards as well. It basically works under project of different clients such as IIT Kharagpur, PWD. Duration : October 2009 to June 2010. Location : Kolkata, West Bengal. Role : Assistant Manager (Costing & MIS). Roles and Responsibilities: ∼ Efficiently handled product costing for new projects and job orders by applying various costing techniques & analyzing the project feasibility. ∼ Preparation of Quotation for new project & product costing for the project. ∼ Scrutinizes the reports on closing stock, finished goods, WIP and its valuation for various MIS. ∼ Involved in Value engineering program in consultation with design department & analyzing the way to reduce the cost. ∼ Pivotal in analyzing wages cost analysis & there correlation with the production, cost impact for the same and finalizing contributions; ∼ Formulation of cost effective budgets for effective products pricing, so as to remain competitive in the market; ∼ Played instrumental role in successful implementation of Activity Based Costing & Overhead Absorption technique. ∼ Responsible to provide report against movement of stocks, Valuation of WIP & finished goods on periodic basis; ∼ Experience in Reconciliation of Cost Accounts with Financial Books. ∼ Responsible to provide report against the Day to day Production & there Value for Excise Purpose. ∼ Prepare variance analysis & degree of fluctuations with the budgeted estimates; ∼ Preparation of various MIS report for EVP Finance and VP Marketing; ∼ Coordinating with marketing and designing team for various valuable inputs in the areas of product costing; Academic Credentials 2009 Cost Accountant – I.C.W.A.I., Kolkata. Secured 52.68% (Aggregate) 2006 B.Com (H), University of Delhi, Delhi. Secured 59.11% (Aggregate) 2003 All India Senior School Certificate Examination, C.B.S.E., Bokaro. Secured 72% 2001 All India Secondary School Examination, C.B.S.E., Bokaro. Secured 65% Personal Dossier Date of Birth : 15th Feb, 1985 Fathers Name : Kul Bahadur Thapa Mothers Name : Moti Devi Nationality : Indian Languages Known : English, Hindi, Nepali & Bengali Permanent Address : WB47/192, Vivekanand Park, Natunhat, Maheshtala, Kolkata -700141 4 | P a g e

- 5. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com Present Address : WB47/192, Vivekanand Park, Natunhat, Maheshtala, Kolkata -700141 PAN Card : AYPPB6849K Passport No. : M9077496 I do hereby declare that the information given in this form is true to the best of my knowledge and belief. Vishnu Bahadur. 5 | P a g e

- 6. VISHNU BAHADUR (COST ACCOUNTANT) Mobile: +91- 9831055934 E-Mail: Vishnu.cwa@gmail.com Present Address : WB47/192, Vivekanand Park, Natunhat, Maheshtala, Kolkata -700141 PAN Card : AYPPB6849K Passport No. : M9077496 I do hereby declare that the information given in this form is true to the best of my knowledge and belief. Vishnu Bahadur. 5 | P a g e