Barron's presents the best of the best advisors 2014

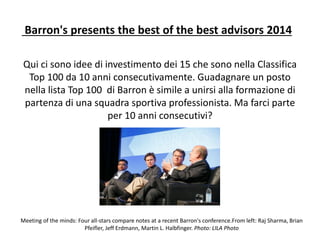

- 1. Barron's presents the best of the best advisors 2014 Qui ci sono idee di investimento dei 15 che sono nella Classifica Top 100 da 10 anni consecutivamente. Guadagnare un posto nella lista Top 100 di Barron è simile a unirsi alla formazione di partenza di una squadra sportiva professionista. Ma farci parte per 10 anni consecutivi? Meeting of the minds: Four all-stars compare notes at a recent Barron's conference.From left: Raj Sharma, Brian Pfeifler, Jeff Erdmann, Martin L. Halbfinger. Photo: LILA Photo

- 2. INTERVISTA ORIGINALE IN INGLESE Barron's presents the best of the best advisors: Here are investment ideas from 15 who made our Top 100 list for 10 straight years. STEVE GARMHAUSEN • The 15 advisors highlighted in these pages have streaks of excellence to rival those of Derek Jeter. Their businesses are strong and sustainable, their backgrounds spotless, and their track record of serving clients superb. Hailing from nine states, many of our advisors are affiliated with marquee Wall Street firms, but a significant number are from independent shops. Most have spent their entire careers at a single firm, even if it has been gobbled up by one or more acquirers over time. That stability has helped them build their businesses, fine-tune their services, and know their clients extremely well. Jeff Erdmann, for example, started with Merrill Lynch in 1984 as a college intern. “We're now in the third generation with some of our families,” he says. • Clients of our 15 all-stars are typically very wealthy, and they demand more than run-of-the-mill investment ideas. So when we asked the advisors to give us their top recommendations for the current environment, they responded with some rarefied advice. • The ideas range from illiquid fixed-income investments to overseas “dividend aristocrat” stocks to private-equity funds that invest in both equity and fixed income in emerging markets. On the following pages in this special report, we lay out the single best idea of each advisor. • Despite recent volatility in the market, the advisors are mostly upbeat about its long-term promise. “The market is an attractive place to be,” says Morgan Stanley's Alan Whitman, “and it will continue to be for a while.” If the five-year-old bull market manages to double its age, it, too, would be an all- star.

- 3. Ron Carson Carson Wealth Management • The housing crisis may be long gone from the front pages, but investment opportunities in its wake are still going strong, says Carson. • In January 2013, he and his team launched a fund to buy and rehab properties for rent in cities nationwide, including Minneapolis, Baltimore, and Dallas. That fund has done so well that they are putting together another one. • “New-home sales are up, but a lot of people are renting, and we're the beneficiaries,” he says, citing yields (rent revenue divided by the cost of the property) of 14%. Buying and rehabbing property currently costs 40% to 50% less than the cost of building, says Carson, whose team is partnering with a real estate firm for the endeavor. • “Even if all we ever do is collect rent, it's a very good investment in this low-interest-rate environment,” he says. Firm: Carson Wealth Management Location: Omaha, Neb. Team Assets: $4.3 billion Current Rank: 29 Career Path: Carson started his advisory career from a dorm room in 1983, and has been independent his entire career. Advice: “True wealth is all you have that money can't buy and that death can't take away.”

- 4. Louis J. Chiavacci Merrill Lynch Private Banking & Investment Group • With cash earning little or nothing these days, Chiavacci is pointing investors toward short- duration, high-yield muni bonds. “At today's top marginal tax rates, the spread of high-yield munis versus their taxable counterparts makes them absolutely dirt cheap and attractive,” he says. • Chiavacci likes short-term, high-yield munis (rated BB-plus or below) within well-diversified mutual funds. Well-managed funds with relatively low interest-rate risk were recently yielding roughly 3.5% tax-free, he notes. That's a tax-equivalent yield of 5.8% for investors in the 39.6% federal tax bracket. • Chiavacci declined to recommend specific funds for this article, but Nuveen's Short Duration High Yield Muni Bond fund appears to fit the bill. It sports a trailing 12-month yield of 3.43% and an average duration of a little under four years. Firm: Merrill Lynch PBIG Location: Coral Gables, Fla. Team Assets: $2.7 billion Current Rank: 69 Career Path: Chiavacci got his start with Goldman Sachs in 1986 in New York, and joined Merrill Lynch 11 years later. Advice: “Investors need a keen sense of their risk tolerance and a grasp of what losing money feels like.”

- 5. Mark T. Curtis Graystone Consulting • As Curtis sees it, now is the time to invest in Europe. • The advisor sees opportunity in buying bank assets as European financial institutions continue to deleverage following the debt crisis. And he believes that the region's stocks could rally broadly as the result of new stimulus measures. “We think there's really good value there,” says Curtis. • As Europe slowly recovers, governments and regulators have pressed banks to strengthen their balance sheets—and they've responded by putting billions of dollars worth of lower-quality loans up for sale. Curtis is buying those loans through investment funds with capital-call structures. Such funds require a commitment of capital that their managers can summon from investors as opportunities arise. Firm: Graystone Consulting (Morgan Stanley) Location: Palo Alto, Calif. Team Assets: $27 billion Current Rank: 3 Career Path: Curtis started at EF Hutton 33 years ago;three mergers later, he's with Morgan Stanley's Graystone Consulting unit. Advice: “In adding value in portfolio construction, taxes matter. Look for tax- managed strategies.”

- 6. Jeff Erdmann Merrill Lynch Private Banking & Investment Group • Big companies' healthy appetite for acquisitions is good news for small-cap and microcap companies—and for nimble investors, says Erdmann. • “Large-cap companies have done a great job building cash flow and fixing their balance sheets,” he says. “And they're often spending their cash on acquiring smaller companies.” • The buyout opportunities are plentiful in both the US and Europe, says Erdmann.He and his team play the acquisition theme using two mutual funds and a hedge fund, which he declined to name for compliance reasons. The funds take equity positions in small-cap and microcap buyout targets in the hopes of big gains when they're bought at a premium. • The fact that small-cap stocks are having a weak year—the Russell 2000 small-company index is down about 5% since January—only increases the opportunities, says Erdmann. Firm: Merrill Lynch PBIG Location: Greenwich, Conn. Team Assets: $6 billion Current Rank: 8 Career Path: Erdmann started with Merrill as a college intern in 1984 and has been there ever since. Advice: “Conversations about legacy and next-generation planning should start before and during wealth creation—not after.”

- 7. Martin L. Halbfinger UBS Financial Services • Halbfinger's best piece of investment advice is simple: Take a step back and have a fresh look at your portfolio.“When you get to this kind of juncture in the market,” he says, “it's important to make sure your portfolio is still aligned with your goals and objectives.” • That may sound elementary, but five years into the bull market, many investors have been swept up in the excitement and have allowed their portfolios to become too risky, he says.That's exactly what happened during the tech and real estate booms of the past 15 years. • Not that Halbfinger is expecting an imminent end to the bull market. “We're still very constructive on US markets and getting our long-awaited economic expansion,” he says. Firm: UBS Financial Services Location: New York Team Assets: $3.7 billion Current Rank: 43 Career Path: Born and bred in the Bronx, Halbfinger has been with UBS and its predecessors for 33 years. Advice: “Include the next generation in [investment] conversations so they're aware of strategies, goals, and risk tolerance.”

- 8. Marvin H. McIntyre Morgan Stanley Wealth Management • McIntyre sees plenty of investment fuel in what he characterizes as the “energy revolution in North America.” • Over the past seven years, US natural-gas production has surged 35%, and oil production is up nearly 70%. McIntyre and his colleagues like to play that with master limited partnerships. MLPs typically offer a combination of strong yield, growing distributions, and tax-advantaged income. • If you can't hack the tax-reporting headaches that MLPs can involve, McIntyre recommends exchange-traded funds. The more prominent ETFs in oil and gas include the Energy Select Sector SPDR and Vanguard Energy ETF. • McIntyre says the energy game is just getting started. “If I had to guess an inning,” he says, “I would say the second or third, with the possibility of extra innings.” Firm: Morgan Stanley Wealth Mgmt Location: Washington, DC Team Assets: $3.6 billion Current Rank: 16 Career Path: McIntyre started with Mason & Co. in 1968 and has remained with the business through multiple iterations. Advice: “We love rising dividends: They signal a strong company, and they provide a cushion in rising interest-rate environments.”

- 9. Joseph W. Montgomery Wells Fargo Advisors • Montgomery's advice: Stop diversifying like it's 2006. • Old-school diversification, with stocks, bonds, and cash, served to pare portfolio risk for many years. But it failed in the 2008 crash, as most assets swooned in tandem. Today's investors should diversify more widely, according to Montgomery. Specifically, investors should have a good chunk of “nontraditional” investments. • Those include commodities, real estate investment trusts, emerging-market debt, and so-called liquid alternatives—mutual funds and exchange-traded funds that mimic hedge funds but provide the escape hatch of daily liquidity. • Montgomery also likes low-volatility equity funds, which aim to smooth out market swings, even at the cost of potentially underperforming during bull markets. Firm: Wells Fargo Advisors Location: Williamsburg, Va. Team Assets: $15.8 billion Current Rank: 40 Career Path: The former pro football player has worked at Wells Fargo and its predecessors for 40 years. Advice: “Now more than ever, it's not what you make but what you keep that's important.”

- 10. John D. Olson Merrill Lynch Wealth Management • The market's recent weakness presents a perfect opportunity to stock up on high- dividend securities with a history of increasing their payouts, says Olson. • “When they come down with the market, their yield goes up and they become more attractive,” says Olson, who says these investments are yielding between 3.5% and 6.5%. • Olson's shopping list includes master limited partnerships in energy, selected real-estate investment trusts, and stocks in areas like health care and telecommunications. He has been using price declines to accumulate positions, he says. • To raise some of the cash for purchases, Olson has been trimming excess bond holdings and rotating clients out of utility stocks. Both asset types are sensitive to rising interest rates. Firm: Merrill Lynch Wealth Management Location: New York Team Assets: $2.3 billion Current Rank: 72 Career Path: A onetime accountant, Olson joined Merrill in 1980 and has been with the firm ever since. Advice: “ In times of euphoria and stress, it's important to keep emotion out of your investing decisions.”

- 11. Brian Pfeifler Morgan Stanley Private Wealth Management • Five years into the market recovery, mispriced asset classes have become far harder to find— but Pfeifler sees a glaring exception in certain illiquid fixed-income investments. “There is still a dramatic discrepancy between the potential for return on illiquid versus liquid investments,” he says. • Illiquid fixed-income investments can include loans to distressed borrowers or to small companies. But many of the best opportunities are in Europe, such as assets offloaded by banks seeking to bolster their balance sheets, says Pfeifler. • Private funds that target these assets can generate returns between 8% and 15%, he says. Taking the same level of risk in liquid, US- based investments might return just 5% or 6%, he says. • Yes, the investments can be tricky to exit. But, Pfeifler says, “There are times when illiquidity is an attractive thing to have in your portfolio.” Firm: Morgan Stanley PWM Location: New York Team Assets: $8.7 billion Current Rank: 2 Career Path: A 25-year Morgan Stanley veteran, Pfeifler worked as an analyst and bond trader before becoming an advisor. Advice: “I hate risk, but in a portfolio, there's a very large difference between risk and volatility.”

- 12. John W. Rafal Essex Financial Services • Domestic blue-chip stocks with growing dividends have gotten plenty of attention over the past few years, but it's their overseas counterparts that boast compelling values right now, says Rafal. Specifically, Rafal is positive on “international dividend aristocrats,” largely from Europe and Japan. Although he expects the US market as a whole to outperform other developed markets, many quality, dividend-paying companies abroad are significantly underpriced. Such companies' valuations have fallen as overseas investors, concerned about stagnation in foreign economies, have moved money to the US • Rafal points to two exchange-traded funds: PowerShares International Dividend Achievers, which recently had an SEC yield—which allows for fairer bond-fund comparisons—of 3.04%, and iShares International Select Dividend, yielding 4.24%. Firm: Essex Financial Services Location: Essex, Conn. Team Assets: $3.8 billion Current Rank: 12 Career Path: Rafal spent 14 years with Raymond James before forming Essex in 2003 to provide independent advice. Advice: “I want to become so close to a client that if something bad happens, they call me first.”

- 13. Raj Sharma Merrill Lynch Private Banking & Investment Group • Sharma takes a long-term view on emerging markets—and he loves what he sees. “The potential over the next decade and beyond is extremely compelling,” he says. “I think there is an enormous amount of money to be made in the emerging markets.” • The economic output of emerging-market countries, now about $30 trillion, should double in 10 to 12 years, he says.Countries like Mexico, India, and China are “creating deep stock and bond markets for investors, and that will lead to a lot of opportunities opening up.” • The best way to play emerging markets?Through private-equity funds, says Sharma. Such funds can scour the world for the best private and public opportunities, free from day-to-day performance pressure. “Patience,” he says, “is the key.” Firm: Merrill Lynch PBIG Location: Boston Team Assets: $10.4 billion Current Rank: 18 Career Path: Sharma tried out advertising and filmmaking before becoming an advisor. He has been with Merrill for 27 years. Advice: “Don't look at your money as one whole: Separating it into buckets for different objectives reduces anxiety.”

- 14. Robert M. Stulberg Merrill Lynch Wealth Management • Stulberg doesn't see any screaming values in either stocks or bonds, but he does like selected preferred stocks, which have characteristics of both. • He'sa fan of fixed-to-floating-rate preferred shares. These provide a set dividend yield for a certain period, then convert to a floating rate tied to market interest rates. That provides a measure of protection against interest-rate increases. • Stulberg likes to see a relatively high coupon. For example, he might buy an older preferred stock, with an 8% coupon, that is callable in two or three years. In such cases, Stulberg also requires the bond's yield to the call date to be above those of comparable bonds. Issuers typically call shares when cheaper financing is available.But even if interest rates shoot up and the preferred shares aren't called, Stulberg says he wouldn't be unhappy with an 8% yield. Firm: Merrill Lynch Wealth Management Location: Bloomfield Hills, Mich. Team Assets: $2.2 billion Current Rank: 88 Career Path: Stulberg started in real estate, then 31 years ago followed his father to Merrill Lynch. Advice: “I tell our clients that the only things they can't buy are health and time.” (Stulberg declined to be photographed.)

- 15. Gregory Vaughan Morgan Stanley Private Wealth Management • Europe's economies may be troubled, but investors shouldn't write off the big companies based there, says Vaughan. • The reason: Many European large-cap firms transcend the region's economies.“There's tons of skepticism around owning European companies,” says Vaughan, “when often, they're really global companies that just happen to be based in Europe.” • Europe's big companies, including its “powerhouse exporters,” are attractively priced versus their US counterparts, Vaughan says. At a given time, actively managed separate accounts, exchange- traded funds, or individual securities may perform best. Investors, he says, should consider combining all three approaches. In all, Vaughan and company recommend European equities for 5% to 10% of their typical client's total portfolio. Firm: Morgan Stanley PWM Location: Menlo Park, Calif. Team Assets: $14.6 billion Current Rank: 1 Career Path: Vaughan has been an advisor for 35 years, and joined Morgan Stanley Private Wealth Management in 1981. Advice: “ Complexity often does not lead to great results, whether that's in investing or in life.”

- 16. Alan Whitman Morgan Stanley Wealth Management • When it comes to giving investors what they want, it's hard to beat high-quality, dividend-paying stocks, says Whitman. • “People want return down the road, but they also want cash flow now,” he says.“I think that's going to cause a lot of these stocks to perform substantially better over time.” • Historically, dividends have accounted for half of the total return of the Standard & Poor's 500. That dropped to about 25% in the 1990s as investors fell in love with growing tech companies. Now, he says, “there's been a dramatic shift in the way people perceive investing and what they expect. They want to share in the success of the company right now, and the income stream gives them that ability.” • Whitman recommends pharmaceutical companies, consumer nondurables, and established tech companies. Firm: Morgan Stanley Wealth Mgmt Location: Pasadena, Calif. Team Assets: $2.3 billion Current Rank: 84 Career Path: Whitman started with Dean Witter—now part of Morgan Stanley—in 1971, “when dinosaurs roamed,” he says. Advice: Pay special attention to “great companies that have the ability to evolve and change with the world.”

- 17. Drew Zager Morgan Stanley Private Wealth Management • Zager, an expert in investment-grade bonds, says municipal bonds are a great value right now. • “Intermediate-to-long munis are cheap,” he says. Historically, longer-term munis yield around 90% of Treasuries with corresponding terms. But today, 20-year munis yield about 3.75%, more than the 2.8% yield for 20-year Treasuries. • The tax-equivalent yield can be eye- popping: Investors earning a 3% nominal yield—and paying close to 50% in federal and state taxes—enjoy the equivalent of 7%. What's more, muni prices should be bolstered by a shrinking supply of new issues, he says. From 2005 to 2010, issuance averaged about $400 billion. This year, Zager expects just $290 billion of muni issuance, compared with demand of $500 billion. • But, he says, avoid short-term munis. The Fed is likely to raise rates in the second quarter, which could deal them a blow. Firm: Morgan Stanley PWM Location: Los Angeles Team Assets: $8.7 billion Current Rank: 30 Career Path: Zager joined Morgan Stanley's Private Wealth Management Group in 1986 and has been there ever since. Advice: “People for the most part don't focus as much on after-tax [performance] as they should.”