Note on dspblk bond fund march 2018 1

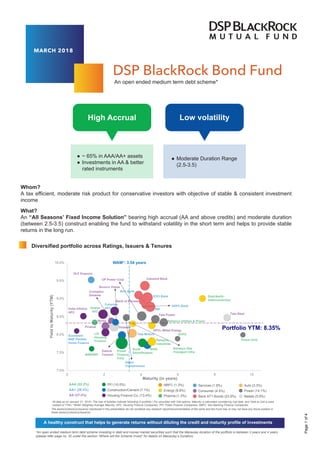

- 1. ● Moderate Duration Range (2.5-3.5) Page1of4 High Accrual Low volatility MARCH 2018 DSP BlackRock Bond Fund Whom? A tax efficient, moderate risk product for conservative investors with objective of stable & consistent investment income Diversified portfolio across Ratings, Issuers & Tenures 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 0186420 YieldtoMaturity(YTM) Maturity (in years) All data as on January 31, 2018 | The size of bubbles indicate %holding in portfolio | For securities with Call options: Maturity is calculated considering Call date, and Yield to Call is used instead of YTM | *WAM: Weighted Average Maturity, HFC: Housing Finance Companies, PFI: Public Finance Companies, NBFC: Non-Banking Finance Companies Adani Transmission Tata Motors NHAI Dewan HFC India Infoline HFC Dalmia Cement HPCL-Mittal Energy East-North Interconnection Piramal Axis Bank Bank of Baroda DLF Emporio Nirma HDFC Bank Crompton Greaves NABARD AAA (32.2%) AA+ (26.4%) AA (37.4%) PFI (10.5%) Construction/Cement (7.1%) Housing Finance Co. (13.4%) NBFC (1.3%) Energy (8.8%) Pharma (1.3%) Services (1.9%) Consumer (4.5%) Bank AT1 Bonds (23.9%) Portfolio YTM: 8.35% WAM*: 3.54 years SBI Power Finance Corp Sundaram BNP Paribas Home Finance Reliance Utilities & Power LIC Housing Finance Vedanta Reliance Gas Transport Infra Nuvoco Vistas Tata Steel Fullerton HFC Auto (3.3%) Power (14.1%) Metals (5.9%) UP Power Corp Rural Electrification NTPC Power GridReliance Industries IndusInd Bank ICICI Bank Tata Power A healthy construct that helps to generate returns without diluting the credit and maturity profile of investments The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). ● ~ 65% in AAA/AA+ assets ● Investments in AA & better rated instruments An open ended medium term debt scheme* What? An “All Seasons’ Fixed Income Solution” bearing high accrual (AA and above credits) and moderate duration (between 2.5-3.5) construct enabling the fund to withstand volatility in the short term and helps to provide stable returns in the long run. *An open ended medium term debt scheme investing in debt and money market securities such that the Macaulay duration of the portfolio is between 3 years and 4 years (please refer page no. 32 under the section “Where will the Scheme invest” for details on Macaulay’s Duration)

- 2. -1 1 3 5 7 9 11 13 15 CY03 CY04 CY05 CY06 CY07 CY08 CY09 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17 CYreturnsin% CRISIL Short Term Bond Fund Index CRISIL Composite Bond Fund Index Page2of4 How? The portfolio seeks to invest in short tenure corporate bonds rated AAA to AA. Low duration profile of the fund and NIL investments below AA minimizes the portfolio from both market and credit risk. Portfolio* Segment Allocation Yield Modified Duration Min Max 3.5 3.5Core 25% 9.1%Perpetual bonds of high quality banks/Higher accrual NBFCs -- 5Liquid 45% 8.2%AAA rated corporate bonds for liquidity budgeting/ portfolio re-balancing 2.5 3.5100%Total 2.5 313% 8.6%Housing Finance companies 2.5 317% 8.7%AA/AA+ rated corporates Why? Lower duration strategy has evidence of better Risk Adjusted Returns over a higher duration strategy 1 Return profile of lower duration strategy demonstrates resilience in times of rising interest rates (repo rate) 2 Advantage of Self-correcting mechanism3 Recommendation in the form of short term accrual strategies4 Lower duration strategy has evidence of better Risk Adjusted Returns over a higher duration strategy Source: MFIE; Returns considered from CY 2003 till CY 2017. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Evidence of better risk adjusted returns Parameters CRISIL Short Term Bond Fund Index CRISIL Composite Bond Fund Index Avg. 1 year rolling returns Annualized Std. Dev Return/Risk 7.42 2.19 2.39 7.23 3.65 1.98 *Data as on February 28, 2018

- 3. Page3of4 3% 4% 5% 6% 7% 8% 9% 10% 31-Mar-04 19-Mar-06 6-Mar-08 22-Feb-10 10-Feb-12 28-Jan-14 RepoRate Rising interest rate environment post 24-Jan-06 after ~2 years of 6-6.25% repo rate Interest rates fall momentarily post 02-Jan-09 bottoming out @4.75% and rising post 21-Apr-09 Potential to outperform in rising interest rate scenarios Source: Reserve Bank of India *CAGR Holding period returns of CRISIL Short Term Bond Fund Index in rising interest rate environment Source: MFIE; Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Return profile of lower duration strategy demonstrates resilience in times of rising interest rates (repo rate) Advantage of Self-correcting mechanism 8.74%* 9.58%* (13) (10) (7) (4) (1) 2 5 8 11 14 17 20 23 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 SimpleAnnualisedReturnsin% Average Returns Trend Line Monthly Returns - CRISIL Short Term Bond Fund Index • With the reversal in rate scenario on the anvil; bond funds will have increased exposure to low duration high accrual assets. • As evidence in the above chart, in phases of steep rise in interest rates (eg: 2010 and 2013), short duration fund performances have recovered soon enough from brief periods of underperformance (low/negative returns); and investors can recover from any dips by staying invested marginally longer • The short term index shows evidence of robust performance in rising interest rates environment: Between mid-July 13 to Dec-14, when repo rates rose from 7.25 to 8 and 10-year benchmark rose from ~7.5 to ~8 (also reaching ~9 levels in between), CRISIL Short Term Bond Fund Index had absolute returns of ~14%. (Source: MFIE) Only 3 instances of negative monthly returns over 9 yrs Quick recovery from dips

- 4. Recommendation and Outlook on the Fund With the repo rate at 6% and the money market rates close to 7.50%; markets are pricing in at least one rate hike at current levels. In case of reversal in rate scenario interest earned by bonds can overcome the price impact to deliver a positive return. Therefore, our view is short to intermediate-term high quality bonds are recommended at this time. This will not only help to self-correct the recent subpar performance for the existing investors but also provide an opportunity for the fresh investments to earn higher returns without diluting the credit as well as market risk profile of the investments. High money market yields coupled with high sovereign yields have pushed corporate bond yields closer to bank lending rates. Herein, high rated corporates having access to bank credit would switch from corporate bond markets to bank lending to raise resources. This will keep spreads between government securities and corporate bonds compressed as evidenced during the recent hardening of yields. With the fund investing close to 70% in AAA and AA+ assets we expect high accruals and low duration to provide a favorable risk reward despite lower spreads between government securities and corporate bonds. • An additional evidence of self-correction is presented in the below table. When short duration funds’ current YTM was in the range of 8 – 9% and last 1 Year returns were less than 8% (rising interest rate scenario), the short duration funds’ next 1 year returns were on an average greater than 8%: In this material DSP BlackRock Investment Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The data/statistics are given to explain general market trends in the securities market, it should not be construed as any research report/research recommendation. We have included statements / opinions/recommendations in this document, which contain words, or phrases such as "will", "expect", "should", "believe" and similar expressions or variations of such expressions that are "forward looking statements". Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. All figures and other data given in this document are dated and the same may or may not be relevant in future. The sector(s) / stock(s) / issuer(s) mentioned in this presentation do not constitute any research report / recommendation of the same and the Fund may or may not have any future position in the sesector(s) / stock(s) / issuer(s). The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors. This note indicates the strategy/Philosophy//investment approach currently followed by the Schemes and the same may change in future depending on market conditions and other factors. © CRISIL Limited 2016. All Rights Reserved. Each CRISIL Index (including, for the avoidance of doubt, its values and constituents) is the sole property of CRISIL Limited (CRISIL). No CRISIL Index may be copied, retransmitted or redistributed in any manner. While CRISIL uses reasonable care in computing the CRISIL Indices and bases its calculation on data that it considers reliable, CRISIL does not warrant that any CRISIL Index is error-free, complete, adequate or without faults. Anyone accessing and/or using any part of the CRISIL Indices does so subject to the condition that: (a) CRISIL is not responsible for any errors, omissions or faults with respect to any CRISIL Index or for the results obtained from the use of any CRISIL Index; (b) CRISIL does not accept any liability (and expressly excludes all liability) arising from or relating to their use of any part of CRISIL Indices. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. The scheme is suitable for investors who are seeking* • Income over a medium-term investment horizon • Investment in money market and debt securities the scheme is suitable for them PRODUCT LABELLING AND RISKOMETER 7 - 8% 6 - 7% 5 - 6% 4 - 5% 9.12% 8.86% 9.44% 8.12% Average returns in next 1 Year Current YTM ~8-9% & last 1 year returns were between Source: MFIE, information of Short Duration peers considered from Sep 2001 to Feb 2018. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.