West Region_Case 1

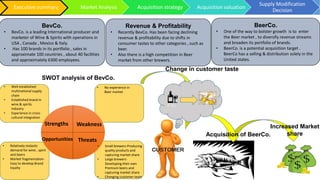

- 1. Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision • Relatively inelastic demand for wine , spirit and beers • Market fragmentation- Easy to develop Brand loyalty Strengths Weakness ThreatsOpportunities • Well established multinational supply chain • Established brand in wine & spirits industry • Experience in cross- cultural integration • No experience in Beer market • Small brewers-Producing quality products and capturing market share • Large brewers- Developing their own Premium beers and capturing market share • Changing customer taste SWOT analysis of BevCo. Change in customer taste Increased Market shareAcquisition of BeerCo. BevCo. • BevCo. is a leading International producer and marketer of Wine & Spirits with operations in USA , Canada , Mexico & Italy. • Has 100 brands in its portfolio , sales in approximate 100 countries , about 40 facilities and approximately 6300 employees. Revenue & Profitability • Recently BevCo. Has been facing declining revenue & profitability due to shifts in consumer tastes to other categories , such as beer. • Also there is a high competition in Beer market from other brewers. BeerCo. • One of the way to bolster growth is to enter the Beer market , to diversify revenue streams and broaden its portfolio of brands. • BeerCo. is a potential acquisition target . BeerCo has a selling & distribution solely in the United states.

- 2. US Beer market segmentation Segment Revenue in Million USD Average annual growth rate % 2014 2019 (E) Super Premium 2035.2 2162.4 6.3 Craft 3434.4 4960.8 44.4 Import 6455.4 7294.92 13.0 Premium 8115.36 7584.3 -6.5 Sub Premium 12589.62 11479.8 -8.8 Total Beer Market 32629.98 33482.22 2.6 BEER Expected US Alcoholic Beverage market in 2019 Super Premium Craft Import Premium Sub Premium Beer Market Segmentation -20% -10% 0% 10% 20% 30% 40% 50% Super Premium Craft Import Premium Sub Premium Average Annual growth rate of Beer segments 59.2 60.2 63 65 66.5 68.30 54 56 58 60 62 64 66 68 70 2014 2015 2016 2017 2018 2019 BillionUSD Year US Alcoholic Beverage Market In $Billion High Growth Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision values in Billion USD 2014 2019 (Exp) CAGR(%) Alcohol beverage industry 59.2 68.3 2.901 Wines 9.5 11.611 4.095 Spirits 17.2 23.222 6.186 Beer 32.6 33.428 0.498 Segment-wise Growth Rate of US Beverage industry

- 3. Company Financials in 2014($) In Billions of USD BeerCo Revenue 1.11B COGS 669M SG&A 201M EBITDA 260M Operating Income 235M Operating Margin % 21.17% Industry Craft Beer operating margin 20% Financial Information Breakdown All numbers in Millions (USD) Financial Information Lager Ale Stout 2013 2014 2015 2013 2014 2015 2013 2014 2015 Revenue 625 719 863 208 228 262 150 158 173 COGS 400 460 552 113 124 138 81 85 94 SG&A 125 150 195 30 30 33 23 21 23 Operating Income 100 109 116 65 75 92 46 51 57 Operating Margin% 16% 15% 13% 31% 33% 35% 31% 32% 33% Lager has higher Revenue Growth compared to Ale and Stout BUT 100 300 500 700 900 1100 1300 2015 2016 2017 RevenueinMillions(USD) Year Revenue Growth Lager Ale Stout 0% 5% 10% 15% 20% 25% 30% 35% 40% 2013 2014 2015 Operatingmargin Year Operating margin Lager Ale Stout Ale would prove to be profitable in the long run due to growing operating margin. Revenue growth needs to be improved with Higher Marketing and Cross selling Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision

- 4. Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision 1 2 3 4 1 2 3 4 2014 1 2 3 4 2019 Low market share & Low growth Low market share & High growth High market share & growth BeerCo acquisition proposal is based on the following factors- Growth Synergy Customer Taste •To address shifting customer tastes in US market towards craft brews and imports, BevCo should look towards expanding into the Beer market. Small brewers •Small brewers are focusing on quality to capture market shares, taking advantage of the fragmented markets compared to last decade • This could be countered by increasing the marketing and cross-selling between BevCo and BeerCo customers. Large brewers •Since large brewers could make premium brands and try to retain market shares, BeerCo acquisition would woo their customers using existing Craft brews and Premium Beer segment of BeerCo Customer Loyalty •Since market is fragmented and a rise in income is making people conscious of Brand, acquiring BeerCo with existing supply chain and customer base and marketing it heavily would lead to better brand consciousness. SOURCE: BCG Matrix

- 5. Based on Comparable Transaction analysis of Beer and craft Beer based acquisitions, we establish a price range from $1887 million to $7215 million. Which further validates the DCF pricing Based on Discounted Cash Flow (DCF), Acquisition price: $4223.06 Million (Excluding Synergy cost) Discounted Cash Flow Analysis- The future cash flows are discounted at the treasury bill rates to calculate the Net Present Value and then discounted at the present cost of capital. Pros: Revenue based so gives precise market capture potential Cons: T-Bill rate may vary and may lead to inconsistency. Comparable transaction method- Acquisitions in the similar industry are scrutinized and based on the Acquisition to Revenue multiple or Acquisition to EBITDA multiple ,the target company is valued. Pros: Reflects on market fluctuations Cons: Hidden costs and transaction using shares may not always disclose the true value of the company Multiples method- The profitability ratios are used for valuation , for example P/E ratio. Pros: Gives adequate information on company financials Cons: The hidden costs and auditing negligence may result in error e.g.: Satyam case Market valuation method- Demand and supply equilibrium established and valued accordingly. Pros: Gauges exact demand and supply dynamics of market. Cons: It would not work in certain markets like monopoly or in case of cartel formation Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision Company Financials in 2014($ Millions) BevCo BeerC o Synery Benefits Revenue 3350 1110 4683 COGS 2180 669 2564.1 SG&A 652.6 201 768.24 Operating Income 517.4 235 1350.66 Operating Synergy Based operating margin Factors Affecting Price other than Synergy Market Saturation Low cost base due to asset depreciation Efficient manufacturing facilities of target company Established Supply Chain Demand for the product line

- 6. 0 50 100 150 200 250 2013 2014 2015 2016 2017 2018 2019 2020 2021 SupplyCostin$USDinMillions Demand of cans in millions Production facility vs Supply Costs Supplier cost Supply through Production facility BREAK-EVEN POINT Production Facility Feasibility Study Assumptions: •Every expansion is finished & facility is operational within six months. •The deficit in facility capacity, would be met by taking supply of cans from supplier. •The supplier prices per unit and the variable costs per unit remain same across the time period. Based on the Break-even point the facility for production should be installed right away so that it becomes profitable by 2015 Operational Considerations before acquiring BeerCo Executive summary Market Analysis Acquisition strategy Acquisition valuation Supply Modification Decision Established Customer Base: BeerCo is larger by revenues compared to the recent acquisitions. Which implies it has a prominent customer base accounting for additional market share for BevCo Established Supply Chain: BeerCo has established Supply chain in US markets. BevCo would have a choice for continuing, modifying or creating redundancy. Synergistic benefits: Growth Synergy means entering into a larger market share. Beer Segment of the market is greater than the Wine and Spirits market with increasing popularities of Craft brews and imports Low Operational costs of BeerCo: BeerCo has higher operating margins compared to industry. Which speaks of the efficiency in operations and supply chain management. Market Demand Inelasticity: Relatively inelastic market demand means it can absorb any sudden price offsets due to inexperience of BeerCo operations by the BevCo management Change management: People need to be told about change in management else we may face irrational layoff fears from employees or decrease in productivity. Cultural indifference: The work culture differs from organization to organization and may hamper team work and communication flow across organization. Return On investment: Your profitable the growth synergy would be based on the synergy benefits forecasted by market research and how quickly would it start giving return on capital invested. Lower Overall Beer market: Compared to wine and spirits market, beer market has a lower CAGR which means it would depend on few Beer segments to capitalize on the invested capital Approval from Federal Trade Commission(FTC) & existing stakeholders: Rationalizing the decision to acquire should be explained to the shareholders. In case acquisition fails due to FTC interruptions the reputation of the BevCo CEO would have to suffer

- 7. US Beer market segmentation Segment Sales volume(Barrels in millions) Average price per bottle($) Revenue in Million USD Average annual growth rate % 2014 2019 (E) 2014 2019 (E) 2014 2019 (E) Super Premium 10 10 0.64 0.68 =0.64*318*10 =0.68*318*10 =((2162.4-2035.2)/2035.2)*100 Craft 9 12 1.2 1.3 =1.2*318*9 =1.3*318*12 =((4960-3434.4)/3434.4)*100 Import 29 31 0.7 0.74 =0.7*318*29 =0.74*318*31 =((7294.92-6455.4)/6455.4)*100 Premium 58 53 0.44 0.45 =0.44*318*58 =0.45*318*53 =((7584.3-8115.36)/8155.36)*100 Sub Premium 107 95 0.37 0.38 =0.37*318*107 =0.38*318*95 =((11479.8-12589.62)/12589.62)*100 Total 32629.98 33482.22 =((33482.22-32629.98)/32629.98)*100Assuming, given are the only segments in Beer market Appendix1-US Beer Market & Craft Beer growth calculation

- 8. Where Xt = The nth year revenues Xt-n = The base year revenues n = number of years CAGR= compound annual growth rate Assumptions: Given 2.9% as the CAGR we calculate the 2019 revenues In $Billion 2014 2019 (E) CAGR (%) Alcohol beverage industry 59.2 68.3 =(((68.3/59.2)^(1/5))-1)*100 Wines 9.5 =0.17*68.3 =(((11.611/9.5)^(1/5))-1)*100 Spirits 17.2 =0.34*68.3 =(((23.22/17.2)^(1/5))-1)*100 Beer 32.6 33.428 =(33.42/32.6)^(1/5)-1 *100 Appendix2-US Alcoholic beverage market revenues 𝑪𝑨𝑮𝑹 = ( 𝑿𝐭 𝑿𝒕−𝒏 ) 𝟏 𝒏-1

- 9. Company Financials in 2014($ Millions) BevCo BeerCo Total Synery Benefits Revenue 3350 1110 =3350+1110 =1.05*L14 COGS 2180 669 =2180+669 =0.9*L15 SG&A 652.6 201 =652.6+201 =0.9*853.6 Operating Income 517.4 235 =4460-2849-853.6 =4683-2564.1-768.24 Operating Margin % 0.154 =235/1110 =757.4/4460 =1350/4683 Assumptions: 5% Revenue Growth 10% Total Cost Reduction Company Financials in 2014($ Millions) Synery Benefits BevCo + BeerCo Discounted at Cost of capital Value of Synergy Revenue 4683 4407.83 275.17 Appendix3- Calculation of Synergy Benefits

- 10. Revenue Growth calculation 2015 2016 2017 Lager 863 =1.22*863 =1.23*1052.86 Ale 262 =1.1*262 =1.05*288.2 Stout 173 =1.08*173 =1.07*186.84 Revenue in % 2013 2014 2015 2016 2017 Lager 15 20 22 23 25 Ale 10 15 10 5 5 Stout 5 10 8 7 5 Appendix4-Revenue growth calculation

- 11. Appendix5-Valuation Calculation Revenue Growth calculation $USD Millions 2015 2016 2017 Lager 863 1052.86 1295.0178 Ale 262 288.2 302.61 Stout 173 186.84 199.9188 TOTAL 1298 1527.9 1797.5466 Discounting future revenues at T-Bill rate 2.04% 2015 2016 2017 1298 1527.9 1797.5466 NPV 4431.345899 NPV discounted at the cost of capital 4.70% Proposed Acquisition Price 4223.072642 BeerCo acquisition price based on Target Segment Target Transac multiple Target EBITDA multiple Revenue multiple EBITDA Craft Beer 1.9 12.3 2109 3198 Beer 6.5 25.9 7215 6734 Beer 1.7 8.7 1887 2262 Craft Beer 1.7 10.4 1887 2704

- 12. ($/unit) Figures in Millions 2014 2015 2016 2017 2018 2019 2020 2021 Supply 500 700 900 1100 1300 1500 1700 1900 Supply Production facility 500 625 750 875 1000 1125 1250 1375 Deficit in production 0 75 150 225 300 375 450 525 0.15Cost of Supply from supplier 75 105 135 165 195 225 255 285 0.05 Cost of Supply from production facility 125 67.5 85 102.5 120 137.5 155 172.5 Fixed Cost 100 25 25 25 25 25 25 25 Appendix6-Supply Calculation