Custody Survey Sep 2011

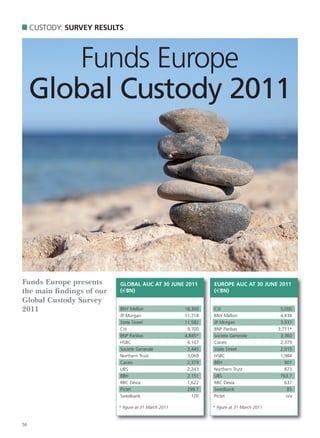

- 1. CUSTODY: SURVEY RESULTS Funds Europe Global Custody 2011 Funds Europe presents GLOBAL AUC AT 30 JUNE 2011 EUROPE AUC AT 30 JUNE 2011 the main findings of our (€BN) (€BN) Global Custody Survey 2011 BNY Mellon 18,360 Citi 5,000 JP Morgan 11,718 BNY Mellon 4,438 State Street 11,582 JP Morgan 3,937 Citi 9,700 BNP Paribas 3,711* BNP Paribas 4,845* Societe Generale 3,360 HSBC 4,107 Caceis 2,379 Societe Generale 3,445 State Street 2,015 Northern Trust 3,069 HSBC 1,984 Caceis 2,379 BBH 901 UBS 2,243 Northern Trust 873 BBH 2,151 UBS 763.7 RBC Dexia 1,622 RBC Dexia 637 Pictet 299.7 Swedbank 85 Swedbank 120 Pictet n/a * figure at 31 March 2011 * figure at 31 March 2011 56

- 2. TOP THREE NEW BUSINESS WINS 12 MONTHS TO 30 JUNE 2011 €bn AuC Client type Domicile BBH n/d n/d n/d BNP Paribas 13 Insurer France 5 Mutual France n/a Fund manager Australia BNY Mellon n/d Caceis n/d Citi 40 Bank Norway 5 Insurer/Fund manager UK 1.2 Bank/broker Denmark HSBC n/d JP Morgan 21 Pension fund provider Sweden 1.5 Asset manager Turkey 1.5 Pension fund provider UK Northern Trust 12.7 Corporate Emea 8.5 Insurer Emea 8 Government Americas Pictet n/d Third-party funds Europe n/d Third-party funds Europe n/d Pension funds Middle East RBC Dexia n/d Societe Generale 9 Asset manager Italy 6.1 Private bank Switzerland, Belgium, Guernsey 3 Asset manager France State Street 122 Asset manager UK 32 Bank Italy 12 Fund manager UK Swedbank 0.6 Asset manager Sweden 0.3 Asset manager Sweden 0.1 Fund manager Sweden UBS 5.2 Bank North America 3.3 Pension fund Switzerland 3.2 Pension fund Switzerland NET FLOW 12 MONTHS TO NEW CUSTODY WINS 30 JUNE 2011 (€BN) 12 MONTHS TO 30 JUNE 2011 Wins BNY Mellon + 3,141 State Street 357** JP Morgan + 1,444 Societe Generale > 200 HSBC 130 Northern Trust + 600 Citi > 100 Citi + 200 JP Morgan 96 Societe Generale + 150.5 Northern Trust 96 UBS + 52.6 UBS 22 Caceis + 50 Swedbank 15 Swedbank +1 BBH 10 BBH n/d BNP Paribas n/d BNP Paribas n/d BNY Mellon n/d State Street n/d Caceis n/d RBC Dexia n/d HSBC n/a Pictet n/a Pictet n/a RBC Dexia n/a ** includes 235 gained from Intesa Sanpaola acquisition 57

- 3. CUSTODY: DIRECTORY Funds Europe Custody Directory 2011 BBH Philippe Ricard (Pantin, Paris) Frankfurter Service Kapitalanlage-GmbH Brown Brothers Harriman PNC Global Investment Servicing (GIS) Philippe Kerdoncuff (Pantin, Paris) Head of asset and fund services 140 Broadway Representative offices (Europe) in: New York, NY Head of global custody Belgium, Denmark, France, Germany (2), 10005 Assets under custody at 31 March 2011 Ireland (3), Italy, Luxembourg (2), USA Global: €4,845bn Netherlands (2), Poland, Spain, Switzerland, tel: +1 212 483 1818 Europe: €3,711bn UK (11) web: www.bbh.com New wins (year to 30 June 2011): n/a Products/services showing greatest Country of origin: USA Top three new custody wins: €13bn / Insurer / France / Maif Group Increase in demand (last 12 months): Operating in Europe: 83 years Investment Manager Outsourcing €5bn / mutual / France / Malakoff Mederic ETFs €n/a / Fund Manager / Australia / Devon Derivatives processing Senior executives: Jeffrey Holland (London) Partner Fund Management Products/services launched or Geoffrey Cook (Luxembourg) Representative offices (Europe) in: France, UK, Germany, Luxembourg, developed in the past 12 months: Derivatives360 Belgium, Netherlands, Spain, Italy, Ireland, OnCore Investment Manager Solutions Partner Sean Pairceir (Dublin) Switzerland, Poland, Hungary, Portugal, Distribution Support Services Greece, Jersey, Guernsey, Isle of Man, Turkey Partner Daniel Genoud (Zurich) Market focus (year to 30 June 2011): Managing Director Germany BNY MELLON Ireland BNY Mellon Asset Servicing Assets under custody at 30 June 2011 Global: €2,151bn UK Europe: €901bn One Canada Square London Products/services for launch or Global custody as % of business: >80 % E14 5AL development in next 12 months: Net flow 12 months to 30 June 2011: n/d RDR UK UCITS IV New wins (year to 30 June 2011): 10 tel: +44 (0)20 7964 5447 web: www.bnymellon.com Market focus next 12 months: EMEA Representative offices (Europe) in: Dublin, London, Zurich, Luxembourg Country of origin: USA Operating in Europe: 43 years Market focus (year to 30 June 2011): UK CACEIS Switzerland CACEIS Investor Services Frank Froud (London) Senior executives: Germany 1-3, place Valhubert 75206 Paris Cedex 13 Ross Whitehill (London) Head of EMEA Asset Servicing France Market focus next 12 months: UK Switzerland tel: +33 1 57 78 00 00 Michelle Grundmann (Frankfurt) Business Manager, Asset Servicing EMEA Germany web: www.caceis.com Leonique van Houwelingen (Amsterdam) Country of origin: France Branch Manager BNP PARIBAS Operating in Europe: over 20 years BNP Paribas Securities Services Country Executive for The Netherlands and Senior executives: 9 rue du Débarcadère François Marion (Paris) Head of Relationship Management for 93500 Pantin Continental European Clients Chief Executive Officer France Jean-Pierre Michalowski (Paris) Assets under custody at 30 June 2011 Global: €18,360bn tel: +33 1 42 98 10 00 Europe: €4,438bn Deputy Chief Executive Officer fax: +33 1 42 98 04 33 Global custody as % of business: 34% Sylvie Philippot (Paris) Deputy Chief Executive Officer Pierre Cimino (Luxembourg) email: BP2S_Corporate_comms@bnpparibas.com Net flow (year to 30 June 2011): +€3,141bn web: http://securities.bnpparibas.com BNY Mellon Asset Servicing has made a Member of the Executive Committee Country of origin: France significant commitment to trust and custody Assets under custody at 30 June 2011 Operating in Europe: 78 years services, contributing 31% to the Global: €2,379bn Corporation's overall revenue. Europe: €2,379bn Global custody as % of business: n/a Senior executives: Patrick Colle (Pantin, Paris) BHF Asset Servicing GmbH Net flow (year to 30 June 2011): +€50bn Recent acquisitions include: CEO 64

- 4. New wins (year to 30 June 2011): n/d CITI Net flow (year to 30 June 2011): Citibank Global Transaction Services +€200bn (key drivers are new business wins Citigroup Centre, Canada Square, Representative offices (Europe) in: France, Luxembourg, Germany, Ireland, from our clients consolidating custodian Belgium, Netherlands, Switzerland London E14 5LB providers) New wins (year to 30 June 2011): 100+ UK Products/services showing greatest ranging from new clients buying investor tel: +44 (0) 20 7500 5000 increase in demand (last 12 months): middle-office outsourcing solutions suite of products ( Funds Admin, Fiduciary, support in the production of KIIDs fax: +44 (0) 20 7500 2960 Custody, Collateral Management and web: www.transactionservices.citi.com Securities Lending), to clients buying global Country of origin: USA custody separately such as Universal Banks, Products/services launched or Operating in Europe: 29 years developed in the past 12 months: continued development of our securities Broker Dealers and Private Banks. lending offering; Chandresh Iyer (New York) Senior executives: enhanced depository controls including new Top three new custody wins: €40bn / Bank / Norway / DnB NOR reporting; Global Product Head for Custody and €5bn / UK Insurance-Fund Manager / UK improved clearing facilities for cash, listed €1.2bn / Bank-Broker / Denmark / Saxo Andrew Gelb (London) Investment Administration Services and OTC derivatives Bank AS Market focus (year to 30 June 2011): EMEA Head of Securities & Funds Germany Representative offices (Europe) in: Austria, Belgium, Bulgaria, Czech Republic, Nick Titmuss (London) Services North America Denmark, Finland, France, Germany, Asia Greece, Hungary, Ireland, Italy, Jersey, Terry Alleyne (London) EMEA Head of Global Custody Product Products/services for launch or Luxembourg, Norway, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, development in next 12 months: EMEA Head of Global Custody Business Further develop middle-office outsourcing Management Spain, Sweden, Switzerland, UK solutions, and cross-border distribution Assets under custody at 30 June 2011 support Global: €9,700bn Products/services showing greatest Europe: €5,000bn increase in demand (last 12 months): Collective Investment Services: custody & Global custody as % of business: 27% Market focus next 12 months: Germany execution for mutual funds, hedge fund and North America (Q1+2 2011 net income Global Transaction hedge fund of funds; Asia Services level) Execution to Custody for global equities: end-to-end solution for one-stop equity execution to custody settlement and asset servicing; Custody for Collateral Management, OTC derivative and other collateral requirements. Products/services launched or developed in the past 12 months: Collective Investment Services custody: continued development and investment; Corporate Action arbitrage: leveraging our investment bank capabilities to enhance our clients options on corporate action events; Private Equity custody services in Europe. Market focus (year to 30 June 2011): Nordic Region Luxembourg & Ireland Offshore markets Middle East Products/services for launch or development in next 12 months: Integrated Custody: further leveraging our proprietary network to create improved services and efficiencies to our global custody clients; Accelerated Dividends: enhanced payment terms to clients holding OECD Gov Debt for coupons & redemptions; Collective Investment Service: increasing our connectivity options for Collective Investment execution and custody services Market focus (EMEA) next 12 months: Middle East Region Europe: Germany, offshore Funds, Netherlands & UK CEEMEA markets: Eastern European outtflow opportunities 65

- 5. CUSTODY: DIRECTORY EC4Y 0JP will be its own subcustodian (India and UK Ireland already transitioned): HSBC HSBC Securities Services Level 28, 8 Canada Square tel: +44 (0) 20 7777 2000 web: www.jpmorgan.com Products/services for launch or London EPIC (Execution Plus Integrated Custody): development in next 12 months: E14 5HQ Country of origin: USA UK Operating in Europe: 30 years Trade Matching tel: +44 (0) 20 7005 8945 additional markets under review for Market focus next 12 months: web: www.hsbcnet.com/hss Francis Jackson (London) Senior executives: Country of origin: Hong Kong possible opening include Bosnia, Cambodia & Malawi; Managing Director, World Wide Securities Operating in Europe: 100 years Kelly Mathieson (New York) for Direct Custody & Clearing expansion: Services EMEA Markets Executive Drew Douglas (London) complete Brazil transition, and Senior executives: expansion in APAC and selected MENA Managing Director, Global Custody & Robert Ward (London) Clearance Business Executive Arjun Bambawale (London) Co Head HSBC Securities Services Managing Director, Global Custody & NORTHERN TRUST John Van Verre (London) 50 Bank Street Head of HSBC Securities Services, Europe Clearing EMEA Product Executive Assets under custody at 30 June 2011 London Paul Stillabower (London) Global: €11,718bn E14 5NT Head of Global Custody Europe: €3,937bn UK tel: +44 (0) 20 7982 2000 Global Head of Business Development, (conversion rate 1 USD = 0.69153 EUR) web: www.northerntrust.com Fund Services Worldwide Securities Services generated Global custody as % of business: Country of origin: USA Assets under custody at 30 June 2011 Global: €4,107bn Europe: €1,984bn $3.7 billion in net revenue for the full year Operating in Europe: 42 years Global custody as % of business: 18 % 2010. This represents 3.5 percent of JPMorgan Chase & Co.’s total net revenue Wilson Leech (UK) Senior executives: (in 2010) New wins (year to 30 June 2011): 130 for the year. Executive Vice President – Head of EMEA Net flow (year to 30 June 2011): +€1,444 bn Penelope Biggs (UK) Representative offices (Europe) in: Region United Kingdom, Luxembourg, Ireland (Dublin), Germany, Guernsey, Malta (conversion rate 1 USD = 0.69153 EUR) Executive Vice President – Regional Head New wins (year to 30 June 2011): 96 Toby Glaysher (UK) Products/services showing greatest of Institutional Investor Group Top three new custody wins: Large complex mandates encompassing a €21bn / Pension Fund provider / Sweden increase in demand (last 12 months): Senior Vice President – Regional Head of wide spectrum of securities services; €1.5bn / Asset Manager / Turkey Global Fund Services Exchange Traded Funds; €1.5bn / Pension Fund Provider / UK Assets under custody at 30 June 2011 Middle office services. Global: €3,069bn Europe: €873bn Representative offices (Europe) in: Amsterdam, Belgium, Denmark, Finland, France, Germany, Guernsey, Ireland, Italy, Global custody as % of business: 60% Products/services launched or Exchange Traded Funds support; Jersey, Luxembourg, Netherlands, Norway, in 2010 developed in the past 12 months: New compliance monitoring service; Poland, Russia, Spain,Sweden, Switzerland, Net flow (year to 30 June 2011): +600 Key Investor Information Document for UK Strong net flows in the last year attributed to: UCITS IV Products/services showing greatest Strong appetite for our Institutional increase in demand (last 12 months): Governance Services developed by our Asia: Pension Funds, Insurance Companies Transition Management Market focus (year to 30 June 2011): Retirement Solutions Practice; and Private Equity; Collateral Management Increased demand for regulatory expertise Middle East: Accounting & Valuation and Second generation outsourcing and solutions Analytics; Products/services launched or New wins (year to 30 June 2011): 96 North America: Alternative Funds J.P. Morgan Fund Order Routing and developed in the past 12 months: Top three new custody wins: €12.7bn / Corporate / EMEA Settlement Services (FORSS) and J.P. €8.5bn / Insurance / EMEA Products/services for launch or Global Money Markets Funds capabilities Morgan CARSSM; €8.0bn / Government / Americas development in next 12 months: Global Middle Office proposition Development of an on-line tax Global ex ante risk product documentation tool for clients; Representative offices (Europe) in: Amsterdam, Dublin, Guernsey, Jersey, detailed derivative market exposure reports Limerick, London, Luxembourg, Stockholm Europe/Asia/Middle East: comprehensive to assist in monitoring leverage and Market focus next 12 months: UCITS IV proposition consolidated issuer and counterparty Products/services showing greatest Europe/Asia/Middle East/North America: reporting increase in demand (last 12 months): Institutional Governance Solutions end-to-end Middle Office proposition Risk services these markets added to custody network: Market focus (year to 30 June 2011): Asia: Insurance, Pension and Private Equity Collateral management segments. Palestine Client directed pricing Trinidad and Tobago Uganda Products/services launched or WAEMU (Benin, Burkina Faso, Guinea JP MORGAN Institutional Governance Solutions developed in the past 12 months: J.P. Morgan Worldwide Securities Services 60 Victoria Embankment Bissau, Mali, Niger, Senegal and Togo) OTC derivatives – CCP London increasing the number of locations where it Investment operations outsourcing 66

- 6. CUSTODY: DIRECTORY 1986 and Dexia Fund Services since1959) Europe: €3,360bn Netherlands Market focus (year to 30 June 2011): Global custody as % of business: n/d Norway Tony Johnson (London) Senior executives: Finland Net flow (year to 30 June 2011): Global Head, Sales & Distribution +€150.5bn Products/services for launch or Assets under custody at 30 June 2011 New wins (year to 30 June 2011): >200 Global: €1,622bn Governance products & solutions development in next 12 months: Europe: €637bn Top three new custody wins: €9bn / Asset Manager / Italy / Allianz GI Enhanced risk services Global custody as % of business: 18% €6.1bn/ Private bank / CH, BE and GY, Peek-thru in 2010 €3bn / Asset Manager / France Saudi Arabia Market focus next 12 months: n/a Net flow 12 months to 30 June 2011: Representative offices (Europe) in: Croatia, Czech Republic, France, Germany, Switzerland Representative offices (Europe) in: Greece, Ireland, Italy, Luxembourg, Poland, Belgium, France, Luxembourg, Switzerland, Romania, Russia, Serbia, Slovenia, Spain, PICTET Italy, Spain, Ireland, UK Switzerland, United Kingdom Pictet & Cie. Route des Acacias 60 Products/services showing greatest Products/services showing greatest 1221 Geneva 73 increase in demand (last 12 months): Cash & Margin & Securities Finance: increase in demand (last 12 months) Independent pricing services Switzerland Fiduciary Investment and MMF sweep KIID service offering tel: +41 58 323 2323 Securities Lendings web: www.pictet.com Foreign Exchange: Currency Overlay Products/services launched or Country of origin: Switzerland KIID service offering developed in the past 12 months: Products/services launched or Operating in Europe: >50 years UCITS funds solution Cash & Margin & Securities Finance: developed in the past 12 months: Direct orders on French funds Marc Briol (Geneva) Fiduciary Investment and MMF sweep Senior executives: Securities Lending: Third Party Lending Market focus (year to 30 June 2011): Germany Foreign Exchange: Share Class Hedging Chief Executive Officer – Pictet Asset Emerging markets Gilles Paupe (Geneva) Services USA (Global Securities Services Alliance™ evaluating entry strategies for some key Market focus (year to 30 June 2011): Chief Marketing Officer – Pictet Asset with U.S. Bancorp Fund Services) Services markets where we currently do not have a presence, e.g. Germany and some APAC Products/services for launch or Assets under custody at 30 June 2011 Global: €299.7bn Solvency II solution development in next 12 months: Europe: n/a Products/services for launch or Cash & Margin & Securities Finance: OD development in next 12 months: Global custody as % of business: n/a Ireland/Luxembourg Market focus next 12 months: facilities for clients in Custody Emerging markets 3rd party funds / Europe Securities Lending: enhanced Securities Germany Top three new custody wins: 3rd party funds / Europe Lending Client Reporting capability Pension Funds / Middle-East on line self service reporting Foreign Exchange: Emerging Markets risk elimination Representative offices (Europe) in: Switzerland (4) Spain (2), Italy (4), Germany, Luxembourg, France, UK Continue to develop and grow our current Market focus next 12 months: markets and on entering key markets where Products/services showing greatest we do not have a presence today. increase in demand (last 12 months): Investment Controlling tool Regulatory Reporting SOCIETE GENERALE Societe Generale Securities Services Products/services launched or Investment reporting 170, place Henri Regnault developed in the past 12 months: On-line tool 92000 Paris La Défense 7 France tel: +33 1 42 14 20 00 Market focus (year to 30 June 2011): Switzerland Europe fax: +33 1 56 37 37 16 UK email: sgss.com@socgen.com web: www.sg-securities-services.com Country of origin: France Operating in Europe: over 50 years RBC DEXIA RBC Dexia Investor Services 71 Queen Victoria Street, 4th Floor Alain Closier (Paris) Senior executives: London EC4 V4DE Global Head of Societe Generale Securities UK Bruno Prigent (Paris) Services web: rbcdexia.com Country of origin: Canada/Belgium Deputy Head of Societe Generale Securities Operating in Europe: as RBC Dexia Services Investor Services since January 2006 Assets under custody at 30 June 2011 (predecessor RBC Global Services since Global: €3,445bn 68

- 7. STATE STREEET SWEDBANK UBS State Street Corporation Swedbank AB (Publ.) UBS AG 20 Churchill Place Regeringsgatan 13 Bahnhofstrasse 45, P.O. Box Canary Wharf Stockholm 8098 Zurich London SE-105 34 Switzerland E14 5HJ Sweden tel: +41-44-234 11 11 UK tel: +468 5859 00 00 fax: +41-44-239 91 11 tel: +44 20 3395 7000 fax: +468 732 71 47 email: assetservicing@ubs.com web: www.statestreet.com web: www.swedbank.com web: www.ubs.com/assetservicing Country of origin: USA Country of origin: Sweden Country of origin: Switzerland Operating in Europe: 39 Years Operating in Europe: 20+ years Operating in Europe: 157 years (State Street opened Munich office in 1972) Senior executives: Lukas Gähwiler (Zurich) Senior executives: Senior executives: Ola Laurin (Stockholm) Joseph Antonellis (London) CEO UBS Switzerland Jürg Zeltner (Zurich) Senior Vice President, Head of Securities Vice Chairman Stefan Gmür (Munich) Services Tiina Norberg (Stockholm & Tallinn) CEO UBS Wealth Management Executive Vice President Christine Novakovic (Zurich) Steven Smit (London) Vice President, Acting Head of Securities Head Corporate and Instiutional Clients Guido Bühler (Zurich Services Sofia Brånfelt (Stockholm) Senior Managing Director Willie Slattery (Dublin) Head of Asset Servicing Executive Vice President Vice President, Head of Global Custody & Assets under custody at 30 June 2011 Global: €2.243bn Network Management, Acting Head of Assets under custody at 30 June 2011 Global: €11,582bn Operations Europe: €763.7bn (assets under Global Europe: €2,015bn Henrik Staffas (Stockholm) Custody, booking center Switzerland) Global custody as % of business: n/a Vice President, Head of Funds Services Global custody as % of business: In 2010, Investment services accounted for Assets under custody at 30 June 2011 67% of total fee revenue Global: €120bn Net flow 12 months to 30 June 2011: Europe: €85bn + €52.6 (Global Custody, booking center New wins: 357 clients gained in 2010 Switzerland) Global custody as % of business: 70% in 2010 New wins (year to 30 June 2011): 22 (note: 235 of these resulting from acquisition Net flow (year to 30 June 2011): 1 Top three new custody wins: bn of Intesa Sanpaolo) €5.2bn / Banks / North America Top three new European custody wins: €122bn/ Asset manager / UK / F&C New wins (year to 30 June 2011): 15 €3.3bn / Pension Fund / Switzerland €32bn / Bank / Italy / Banca Mediolanum €3.2bn / Pension Fund / Switzerland €12bn / Fund manager / UK /First State Top three new custody wins: €0.6bn / Asset Manager / Sweden €0.3bn / Asset Manager / Sweden Representative offices (Europe) in: Austria, Belgium, Bulgaria, Croatia, Cyprus, Representative offices (Europe) in: Belgium, Channel Islands, France, €0.1bn / Fund Manager / Sweden Czech Republic, Denmark, Estonia, Germany, Ireland, Luxembourg, Finland, France, Germany, Greece, Netherlands, Poland, Switzerland, UK Representative offices (Europe) in: Estonia, Lithuania, Latvia, Russia, Finland, Guernsey, Hungary, Iceland, Ireland, Italy, Products/services showing greatest Norway Denmark, Spain, Ukraine Jersey, Latvia, Lithuania, Luxembourg, Norway, Netherlands, Poland, Portugal, increase in demand (last 12 months): Collateral management Products/services showing greatest Romania, Slovakia, Slovenia, Spain, Entity exposure monitoring increase in demand (last 12 months): Bundled offering for fund & custody services Sweden, Switzerland, UK Products/services launched or Collateral Management Derivatives Clearing developed in the past 12 months: Products/services showing greatest Risk reporting for UCITS increase in demand (last 12 months) Custody enhancements Products/services launched or - Fund and Managed Account Solutions Environmental, social and governance developed in the past 12 months: - Continous Linked Settlement Global Custody - Performance Reporting reporting services Fund Administration Transfer Agency Market focus (year to 30 June 2011): Products/services launched or Italy developed in the past 12 months: Luxembourg Market focus (year to 30 June 2011): - Risk and Performance Reporting on United Kingdom Home markets (Sweden & Baltics) Alternative Investments Globally through agents, - Individual Collateral Management Products/services for launch or Products/services for launch or Market focus (year to 30 June 2011): Asia development in next 12 months: Springboard: a mobile application, development in next 12 months: extending my.statestreet.com to Stronger offering to wealth management EMEA on-the-go users (from June 2011; and fund management clients. Services for Luxembourg based funds. Products/services for launch or CApTAIN: online corporate action development in next 12 months: notification and instruction tool upgrade Integrated Trading/Custody i.e. Broker - Cost Transparency Report Market focus next 12 months: Custody solution. - Online Reporting Enhancements Italy Market focus next 12 months: Market focus next 12 months: Luxembourg Home markets (Sweden & Baltics) - Asia United Kingdom Globally through agents - EMEA 69