Touch point maps

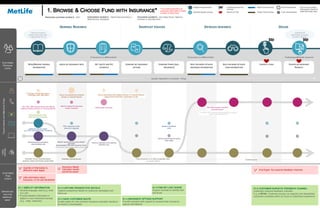

- 1. I obtained the information necessary to make a decision I need an insurance product with cover that is appropriate for me CUSTOMER PROCESS STEPS O1.1 SIMPLIFY INFORMATION Simplify language used (e.g. what is a unit) Provide detailed information in digital or more interactive formats (e.g. video, webinars) READ/BROWSE GENERAL INFORMATION COMPARE FUNDS (INCL. INSURANCE) COMPARE MY INSURANCE OPTIONS ASSESS MY INSURANCE NEED GET QUOTE AND FEE ESTIMATES SEEK FOR MORE DETAILED INSURANCE INFORMATION SEEK FOR MORE DETAILED FUND INFORMATION CHOOSE A FUND CHOOSE AN INSURANCE PRODUCT Quantity of information is difficult to read/ digest GENERAL RESEARCH SHORTLIST POLICIES DECIDEDETAILED RESEARCH Insurance Needs Calculator results cannot be saved Little information about insurance, or not well advertised O1.2 CAPTURE PROSPECTIVE DETAILS Capture prospective details for outbound campaigns and follow-up O1.4 INSURANCE OPTIONS SUPPORT Provide members with support to compare their insurance options with MetLife O1.5 FIND MY LOST SUPER Support member to identify their lost funds Materials may be mailed e.g. PDS, Insurance Guide, Handbook General product information, downloadable pdfs Premium calculator is for existing members only General enquiries email, Materials may be emailed Websites, forums, financial advisor; employer, family and friends, social media Moment of Truth Partner Owns Process MetLife Owns Process Pull communication Push communication Size of circle indicates most popular channel to those most rarely used Customer journey may end here Straight through process Alternate scenario process OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES First Super / MTAA field visits or First Super/ NSF main office 1300/1800 transfer to advisor/ financial planner Call 1300/ 1800 General advice with referral option to Intrafund Advisor or Financial Planner Variable (dependent on customer timing) If insurance is a differentiator If insurance is a differentiator If selecting additional insurance PRECEDING CUSTOMER JOURNEYS: N/A FOLLOWING JOURNEYS: Join A New Fund, I Need to Increase or Vary My Cover O1.6 CUSTOMER SURVEYS/ FEEDBACK CHANNEL Implement customer feedback channels. E.g. at MTAA, Customer surveys run regularly and dissatisfied customers contacted within 24 hours to understand experience First Super: No customer feedback channels One on one advice from Intrafund Advisor or Financial Planner Financial advisor or 3rd party comparator sites e.g. Canstar, RateCity Websites, financial advisor Member Handbook, other First Super: 50% of enquiries calls are referred to an advisor/ planner for personalised advice One on one advice from Intrafund Advisor or Financial Planner/ Support from First Super Coordinators on site PDS, Insurance Guide, other print materials Financial advisor View fund performance history, other offers MetLife ‘Assess My Insurance Needs’ calculator Downloadable PDS and Insurance Guide MetLife ‘Assess My Insurance Needs’ calculator O1.3 SAVE CUSTOMER QUOTE Enable option for new member insurance calculator results to be saved or downloaded NSF Insurance Guide includes table to work out cover Obtain quote via phone * For small proportion of customers who seek to make a choice in their fund CONCURRENT JOURNEYS: I Need Financial Advice, I Need Service, Complaint

- 2. I am on-boarded at my new fund I changed employers and/ or my employer joins me to a new fund CUSTOMER PROCESS STEPS O2.1 ENGAGEMENT UPFRONT Opportunity include general insurance information as employers/ members join new funds e.g. “About Us” packs Opportunity to visit employers for more direct contact especially where employers change funds First Super: include insurance information in script for new member general enquiries RECEIVE INFORMATION ABOUT NEW COMPANY’S DEFAULT FUND (OR COMPANY’S NEW DEFAULT FUND) RECEIVE FOLLOW-UP ON MINIMUM REQUIREMENTS OR OBVIOUS ERRORS COMPLETE STANDARD CHOICE/ CHOICE OF FUNDS FORM ACCESS, COMPLETE AND SUBMIT NEW FUND APPLICATION FORM Receive communication from employer about new fund, including insurance details Forms usually provided by the employer, May also be provided by unions and other work-related information centers NSF/ First Super: Online application form MTAA: Coming in Oct 2015 Downloadable application Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES 90 days by legislation; average 5-10 days General enquiries email address O2.5.2 WELCOME PACK IMPROVEMENT (CONTENT) Provide info about the insurance provider (‘About Us’) Produce PDS in more palatable formats (e.g. video, audio) Provide information about the insurance provider as part of the script in Welcome call MTAA does not have an online application (in-flight for Oct 2015) RECEIVE WELCOME FROM THE FUND STANDARD CHOICE/ CHOICE OF FUNDS ON-BOARDING MTAA Welcome calls made to new employers, and for fund transfers First Super: Welcome call, no Insurance specific script Preferred channel for NSF NSF employers receive welcome email Paper forms provided by the employer Paper member application form NSF: form includes consent to search for lost super, application for extra insurance, promotion of online application Welcome Pack including: Welcome letter or ‘Successful Transfer of Funds’ PDS MTAA/ NSF: Application Form or link (if member hasn’t already completed) First Super does not have outbound capabilities to follow up on missing application information Very little engagement at this stage in the customer journey; Most customers will only have two touch points with fund: 1) indirectly through Standard Choice form and other marketing, 2) Welcome Letter and PDS PRECEDING CUSTOMER JOURNEYS: Browse & Choose Fund with Insurance FOLLOWING JOURNEYS: Keep Me Informed, Complaint, Leave NEW FUND APPLICATION Not compulsory to set up fund; New member directed to application as part of welcome Not compulsory to set up fund Completed if member elects own fund If paper application and fields missing First Super Coordinators onsite visit or First Super/ NSF main office Call 1300/ 1800 to request forms Fund/MetLife involvement depends on size of the employer Downloadable forms on website Call 1300/ 1800 to request application First Super Coordinators may provide forms and support in completing General enquiries email address to request application Employer may have already joined member online. Member to complete missing personal information Name, date of birth, address, (TFN) are minimum requirements Welcome Pack may also include: Accounts Certificate incl. Member number, occupation rating, sum insured Prompt to register online Link to Insurance Guide online Contact centre number for insurance log-ins Transfer of Super and Transfer of Insurance forms (if elected in application form) Most recent newsletter Other marketing materials NSF: uses mail if there is no member email First Super has no outbound capabilities to follow up on missing information MTAA mostly uses phone No follow-ups as minimum requirement fields are mandatory Confirmation received online Mandatory fields: name, dob, address O2.2 OBTAIN EMAIL ADDRESSES Ask for communication preferences as part of join process (First Super in-flight project) Obtain company email addresses via employer NSF has a trigger that prompts operators to ask for member’s missing email or phone information when they call O2.4 FIRST SUPER APPLICATION IMPROVEMENT Embed an application follow up process Offer customer search for their ‘lost super’ Make insurance transfer process easier and embedded in the online process There is no follow-up if application form is not completed or returned; results in very little information about members captured O2.3 DIGITAL SIGNATURE Replace physical signature with digital MTAA Green ID in-flight O2.6 FIRST CONTRIBUTION COMMUNICATION Opportunity to create touch point after the first contribution is made e.g. Check your super; Do you need to consolidated your super? CONCURRENT JOURNEYS: Financial Advice, Increase/Vary My Cover, Service, Complaint O2.5.1 WELCOME PACK IMPROVEMENT (PROCESS) Promote self-service (incl. insurance) by including members’ log-in details in Welcome Pack

- 3. I have received relevant and useful advice I have had a life change CUSTOMER PROCESS STEPS O3.3 PROVIDE TOOLS FOR FINANCIAL ADVISORS Provide calculators and other tools for advisors Provide insurance-specific questionnaires for advisors to use with their members MAKE CONTACT WITH FUND TO OBTAIN ADVICE SPEAK WITH FINANCIAL PLANNERMAKE APPOINTMENT FOR FINANCIAL PLANNER RECEIVE GENERAL ADVICE SPEAK DIRECTLY WITH INTRAFUND ADVISOR * OR GET CALL BACK * ALSO ‘MONEY COACH’ OR ‘FINANCIAL EDUCATION ADVICE TEAM’ (FEAT) RECEIVE PERSONALISED ADVICE RECEIVE STATEMENT OF ADVICE First Super: Delay in making face-to-face appointments (availabilities depend on one advisor) O3.4 EDUCATE FINANCIAL ADVISORS/ KEEP IN TOUCH # Provide newsletters/content with insurance information and updates to Financial Advisors Mail to unique Locked Bag or PO Box MTAA/ NSF: Online enquiry form available General enquiries email address Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES REQUEST ADVICE RECEIVE ADVICE Depends on member/ advisor availabilitySame day If question has been answered Call 1300/ 1800 number Operators trained to provide general advice; Referred to advisor/ planner if questions are personal Needs-based questionnaire, 8 questions per topic (e.g. retirement, investment, insurance...), risk profile Forms, documents or factual information may be emailed Only if member specifies Forms and pdf documents may be mailed A plan or summary of the advice may be mailed First Super:. Desire to develop face-to-face, but limited capacity First Super: advisors use X-Plan to record notes in members’ account O3.1 OFFERING PROACTIVE FINANCIAL ADVICE SERVICES TO MEMBERS To be offered to selected members based on identified triggers for sought advice (e.g. leavers, specific contribution patterns) O3.2 PROVIDE TOOLS FOR GENERAL ADVISORS Provide FAQs and other tools to assist general operators providing general insurance advice If questions are personalised, continue… PRECEDING CUSTOMER JOURNEYS: Browse & Choose Fund with Insurance, Join a New Fund CONCURRENT JOURNEYS: I Need to Increase or Vary My Cover, I Need Service, Keep Me Informed, Complaint If advice required beyond fund e.g. switching funds First Super Coordinators onsite visit or First Super/ NSF main office First Super: Warm transfer if advisor available NSF: Warm transfer to Money Solutions MTAA: Usually call back by appointment, sometimes direct transfer NSF: can be face-to-face if complex If intrafund advice First Super mobile advisor meets members at their homes MTAA/ NSF: Can be face-to-face if complex MTAA: Warm transfer to Financial Planners First Super: Appointment time provided by general advisor, redirected if available NSF: Warm transfer to Money Solutions 3-6 ppl in MTAA FEAT team Legally, must be in writing NSF: 5 days First Super: can be face-to face depending on availability of 1 mobile advisor and location of member First Super : 4 advisors - 1 mobile, 3 phone-based 1-2 Financial Planners in MTAA External Financial Advisor, Accountant etc. No or little mention of insurance O3.6 MEASURE CUSTOMER SATISFACTION Provide FAQs and other tools to assist general operators providing general insurance advice No after-hours availability. Money Solutions only available from 8am to 6pm. FOLLOWING JOURNEYS: Claim, Leave O3.5 PROVIDE REMOTE ADVICE Through video or other digital channels

- 4. I have a product that fulfils my needs again MEMBER PROCESS STEPS OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND MEMBER PAIN POINTS THIRD PARTIES I have a new need MetLife: 5 days First Super: Same day NSF/ MTAA: Only if online Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedmember journey may end here Straight through process Alternate scenario process BROWSE / SEEK ADVICE ON PRODUCT OPTIONS RECEIVE LODGMENT CONFIRMATION GATHER DOCUMENTATION, COMPLETE AND SUBMIT CONTACT FUND ON REQUEST ACCESS APPLICATION FORM MY APPLICATION IS ACCEPTED MY APPLICATION IS REFERRED TO UNDERWRITING RECEIVE REQUEST FOR FURTHER DOCUMENTATION RECEIVE CONFIRMATION OF NEW POLICY DETAILS PROVIDE REQUESTED DOCUMENTATION MY APPLICATION IS DECLINED PRODUCT AND OPTION SELECTION APPLICATION ACCEPT / REQUEST FOR FURTHER INFORMATION FINAL CONFIRMATION 2 -6 weeks (if escalated) If application is declined First Super Coordinators onsite visit or First Super/ NSF main office Application summary sent from E- Apply (to both fund and member) If email preference specifiedGeneral enquiries email, Materials may be emailed Paper application form sent by fund Mail application to unique Locked Bag or PO Box Letter sent if member does not pick up calls Decision letter from fund, with explanation from MetLife Letter drafted and sent by fund Mail documents to unique Locked Bag or PO Box First Super only: Application received and sent to MetLife General product information, downloadable pdf MTAA/ NSF: Online enquiry form Download application form or E-Apply Save/ submit Download application summary Referred to underwriting page First Super: requires double sign-on to access E-Apply Member loses quote if opportunity to download the application summary is missed First Super: members are not provided with MetLife e-Apply login details unless requested O4.2 PROMOTE E- APPLY/ SSO First Super: enable single sign-on and earlier access to online account details O4.3 SAVE CUSTOMER QUOTE Provide option to save customer quote to member account if logged in O4.4 EXPAND E-APPLY Support E-Apply as an end-to-end digital process Identify customers who drop out of the application; H2 follow-up Confirm e-apply can support simultaneous change in cover and occupation rating O4.6 TRANSPARENT WORKFLOW Make workflow visible to the member/ customer e.g. doctor’s reports requested by UHG E-view tool should allow fund to directly post messages on case page to ask questions or request status O4.7.1 IMPROVE LETTERS OF DECLINE (CONTENT) Standardise wording of letters of decline – MetLife Letter Review in-flight MetLife to advise on alternate products, H2 lower risk etc. O4.8 TRACK CUSTOMER SATISFACTION Track customer feedback on process Direct to customer: MetLife tele-underwriting call; SMS sent if no pick-up Call 1300/ 1800, referral option to Advisor or Planner Pdf application forms sent via email PRECEDING MEMBER JOURNEYS: Browse & Choose Fund with Insurance, Join a New Fund FOLLOWING JOURNEYS: Claim, Leave If application is referred to underwriting Materials may be mailed e.g. PDS, Insurance Guide, Handbook Websites, forums, financial advisor; employer, family and friends, social media Financial advisor contacts fund on member’s behalf Visit to 3rd parties (e.g. accountant) to obtain required information Visit to 3rd parties (e.g. accountant) to obtain required information Instant online confirmation Instant online acceptance (if application is accepted) UHG may request medical reports on behalf of MetLife If email preference specified Always a letter unless member specifies Instant if online; 3 days if paper application With communication of acceptance E-Apply: ‘Your fund will be in contact’ screen This is from MetLife’s perspective a decline or an error in the application e.g. invalid member number. E-Apply (to be reviewed): E-Apply will apply original rate, if member applies for increase in cover and change in occupation rating at the same time. E-Apply process stops at underwriting and moves into paper channel Low volume of member email addresses First Super: Mostly paper applications 60^ of applications are change of employment category, which are automatically accepted Long wait to hear on decline of application MTAA: 70 – 75% E-Apply NSF: 50% E-Apply E-Apply form populated with basic information once logged in CONCURRENT JOURNEYS: I Need Service, Financial Advice, Keep Me Informed, Complaint O4.5 METLIFE TECHNOLOGY TROUBLESHOOTING Provide troubleshooting training for funds utilising MetLife technology, or establish warm transfers directly to MetLife IT Delays and inefficiencies in troubleshooting for E-Apply as members call the fund, who pass on messages to MetLife O4.7.2 IMPROVE LETTERS OF DECLINE (DELAY) MetLife to communicate declines directly to customer to avoid delays

- 5. My question/ need has been fulfilled I have a question or need CUSTOMER PROCESS STEPS O5.2 CAPTURE COMMUNICATION PREFERENCES First Super: In-flight project, includes push for more email communications where possible If change to personal Information First Super: Some members unaware they have insurance until seen in statement ‘…How dare you put me in without me knowing’ OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES EXPLAIN REQUEST RECEIVE INFORMATION/ SERVICE If claim If request to leave fund NOTIFY CUSTOMER SERVICE OF QUESTION OF NEED RECEIVE CONFIRMATION OF SERVICE FULFILLMENT RECEIVE INFORMATION RELEVANT TO QUESTION OR REQUEST ASK QUESTION OR REQUEST INFORMATION PROVIDE INFORMATION/ DOCUMENTS RELATED TO MY REQUEST ACCESS CLAIM FORMS SEE ‘I NEED TO MAKE A CLAIM’ ACCESS APPLICATION FORM SEE ‘I NEED TO INCREASE/ VARY MY COVER’ ACCESS ROLLOVER OR WITHDRAWAL FORM SEE ‘LEAVE’ 2-3 days (usu. resolved on first call) 2-3 days Receive documents/ forms via mail First Super: All forms sent by mail unless member specifies, physical signature sometimes required on form First Super: Delays in fulfillment of insurance requests First Super: No follow-up or notifications provided on insurance-related requests O5.4 FIRST SUPER OPPORTUNITIES Capture all communication history with customer Promote self-service incl. insurance (70-80% of calls can be self-served) O5.7 PDF FILLABLE FORMS First Super: Ongoing project; NSF: Previously an offering O5.3 EMBED CUSTOMER SERVICE TRIGGERS NSF: operators are monitored on advice quality, tone and value-added e.g. did they follow-up alerts on application form, online access, default cover etc. If increase/ vary my cover PRECEDING CUSTOMER JOURNEYS: N/A CONCURRENT JOURNEYS: Browse and Choose Fund, Join A New Fund, I Need Financial Advice, Increase/ Vary My Cover, Keep In Touch, Complaint, Claim, Leave External Financial Advisor, Accountant etc. Mail to unique Locked Bag or PO Box MTAA/ NSF: Online enquiry form available MTAA/ NSF/ First Super: Online member portal to view balance, change beneficiaries etc.) General enquiries email address Call 1300/ 1800 number First Super Coordinators onsite visit or First Super/ NSF main office First Super/ NSF: all hard copy unless email requested MTAA: eClaims available online Sent by mail 90% of the time NSF: 13% of enquiries Pdf forms may be sent via email 10% of claims made through eClaims NSF/ First Super: Warm transfer to claims administrator if complex First Super Coordinators onsite visit or First Super/ NSF main office Download application form or E-Apply MTAA: 70 – 75% E-Apply NSF: 50% E-Apply First Super/ NSF: If at office location Form downloadable from website Confirmations of service while on the phone First Super: Only if email preferred MTAA: If member sends enquiry by email Confirmation letter First Super: Excl. insurance requests MTAA: Only for address or investment option changes NSF: general ‘account updated’ communication only MTAA/ NSF/ First Super: Secure portal provides confirmation of saved changes Paper form sent by fund Directed to Pdf forms and information Direct to secure portal to view balance etc. Receive forms/ documents/ emailed response If service performed e.g. change of address, investment option Email enquiries growing (from 10% in 2014) Phone enquiries decreasing (from 90% in 2014) Operators provide general advice; or warm transfer to financial advisor (NSF: ~10% enquiries) NSF: 12% of enquiries O5.9 OFFER FINANCIAL ADVICE Offer support/ advice after claim payout, Provide support to members leaving on option to maintain insurance/ MetLife e.g. compare options between new cover and existing O5.6 MEASURE CUSTOMER SATISFACTION O5.1: WEBCHAT, SMS AND SOCIAL MEDIA Support (white label) web chat, SMS and social media functionalities to engage with customers and any complaints in their channel of choice O5.5 IMPROVE KNOWLEDGE BASE FOR FRONTLINE STAFF Provide leading practices for better service Provide knowledge base for frontline Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process O5.8 METLIFE TECHNOLOGY TROUBLESHOOTING Provide troubleshooting training for funds utilising MetLife technology, or establish warm transfers directly to MetLife IT Delays and inefficiencies in troubleshooting for E-Apply as members call the fund, who pass on messages to MetLife

- 6. I have received relevant information about my insurance I need to be pro- actively informed about my insurance CUSTOMER PROCESS STEPS INFORMED THAT THERE IS A CHANGE IN MY COVER RECEIVE PERSONALISED CONTENT/ MESSAGESRECEIVE A STATEMENTINFORMED THAT MY FUND’S INSURANCE PROVIDER CHANGES RECEIVE GENERAL INFORMATION “DID YOU KNOW” Significant Event Notice (SEN) letter MTAA: Insurance new offers, products or arrangements (included in newsletter if timing coincides) Sponsored community events and industry/ employer conferences Moment of Truth Partner Owns Process MetLife Owns Process Pull communication Push communication Size of circle indicates most popular channel to those most rarely used OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES First Super: Fact sheets provided during on-site visits First Super: Monthly and quarterly; MTAA/ NSF: Biannually SEN letter First Super: Targeted personalised campaigns (incl. Insurance) NSF: Targeted campaigns per marketing plan (e.g. consolidated super, insurance, life events); biannual newsletter MTAA: paper half-yearly update directing customers to online account First Super: Six-monthly and annual statement (includes insurance related information NSF: Yearly statement MTAA: Yearly update with Chairman’s report and general statement First Super: Personalised mailing campaigns (limited reach, pre-populated forms) – fund related only O6.2 CLAIMS EDUCATION/ POST CLAIMS First Super: Run campaigns to raise awareness and education on the insurance claim process (pilot for September 2015) Specific messaging for members post-claim O6.3 BEHAVIOURAL SEGMENTATION Tailor comms based on member segments (e.g. behavior on secure portal and online calculator for income protection); Establish follow-up outbound calls Specific messaging for active and in-active members O6.1 PUSH NOTIFICATION Push notification in email or sms when there is an update/ communication NSF e-communications project in-flight O6.6 PERSONALISED MESSAGING More Personalised (trigger or behavior based) communications E.g. Reminder to inactive members, ‘you still have an account’ Compliance type information sometimes difficult to understand Members discover insurance premium cost First Super: members are hit twice with monthly and quarterly newsletter every quarter. E-Newsletter content not aligned with needs/questions (click rate 1.1 – 1.6%) INFORMED ABOUT A CHANGE IN MY COVER RECEIVE INFORMATION ABOUT MY FUND & INSURANCE INFORMED ABOUT FUND RELATED OPPORTUNITIES RECEIVE A STATEMENT First Super: Every 6 months; MTAA/ NSF: Yearly Only First Super: 4 x planned road shows/ conferences, will touch on insurance NSF: seminars and employer visits by business development First Super: Segmented e-newsletter MTAA: monthly newsletters to employers NSF: members may opt-in for e- statements PRECEDING CUSTOMER JOURNEYS: Browse & Choose Fund with Insurance, Join a New Fund Low volume of member email addresses; First Super has only 13%, NSF has 20%, MTAA 25% (but half bounce back) Can be supplied electronically, however low volumes of member’s emails NSF will try email first, back up using post NSF: Targeted campaigns via outbound Member online portal MTAA/ NSF: E-statements are uploaded onto member portal First Super: Significant events also communicated in quarterly e-newsletter O6.4 MOVE TO DIGITAL COMMS How to move more to electronic communications NSF e-communications project in-flight O6.5 FIND MY LOST SUPER Support member to identify their lost funds If SEN, sent 30 days before change CONCURRENT/ FOLLOWING JOURNEYS: I Need Financial Advice, I Need to Increase or Vary My Cover, I Need Service, Claim, Complaint, Leave

- 7. Average 2-3 weeks wait with lack of transparency on complaint progress: Administration delay due to lack of integration between MetLife’s PICs and admin systems Communications sometimes delayed when carried across three parties (direct to fund) I need to make a complaint My complain was taken seriously, properly handled and resolved CUSTOMER PROCESS STEPS O7.1 ACCESSIBILITY AND EASE OF NAVIGATION Make navigation to complaints forms easy Make complaint FAQ, instructions and forms available in key languages Mail to Locked Bag or PO Box address MTAA: Address letter to The Complaints Resolution Officer MetLife: Complaint Template Form on website (in-flight) MTAA Complaints webpage directs to mail address MTAA/ NSF: Online enquiry form MetLife: Acknowledgement of complaint made via webpage (In-flight) General enquiries email address OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND PAIN POINTS THIRD PARTIES NOTIFY FOLLOW-UP RESOLVE 90 days per legislation; Average 10-15 daysFirst Super: 24h/ MTAA: 48h/ NSF: 5 days MetLife Preferred channel First Super/ MTAA: If by phone, recorded First Super only: if email is specifically requested Acknowledgement of complaint NSF/ First Super: Always via letter No follow-ups or updates for MTAA/ NSF, resolution letter only First Super: Always via letter, unless customer prefers other MetLife/ First Super/ MTAA/ NSF: A letter will always be sent to formalise the resolution of the complaint O7.5 CONSOLIDATED PORTAL ACCESS Support single and comprehensive customer view, integrated with Partners’ systems Support API/ visibility into insurance complaints in Partner’s systems O7.4 COMPLAINT RESOLUTION TRACKING Provide complaint resolution tracking through mobile application, or online O7.6 CUSTOMER SATISFACTION CHANNEL Implement customer feedback channels e.g. surveys, customer focus groups targeting complainants in last 12 months Customer surveys run regularly at MTAA. Dissatisfied customers contacted within 24 hours to understand experience Net Promoter Scoring will be trialed at MetLife in December 2015 Lack of clarity and simplicity of language on how to make a complaint NSF main office if complaint is complex, customer asked to submit complaint in writing Call 1300/ 1800 number MTAA: mostly by phone, if complaint is complex, customer asked to submit complaint in writing First Super only: if email is specifically requested Complaint may be driven from an external body e.g. solicitor, Superannuation Complaints Tribunal, Financial Ombudsman Service etc. Liaison with the external body, as directed O7.2: WEBCHAT AND SOCIAL MEDIA Support (white label) web chat, SMS and social media functionalities to engage with customers and any complaints in their channel of choice Complaints made about MetLife on social media and general web are unmanaged NOTIFY FUND/ METLIFE ABOUT MY COMPLAINT RECEIVE ACKNOWLEDGEMENT THAT MY COMPLAINT HAS BEEN RECEIVED RECEIVE UPDATE OR FOLLOW-UP ABOUT MY COMPLAINT RECEIVE FORMAL NOTIFICATION OF RESOLUTION MTAA: 90% of complaints are closed within 10 days, with a letter of resolution First Super: All complaints must be sent in writing (email or letter) First Super: All complaints must be sent in writing (email or letter) Lack of customer satisfaction measure/ survey of the process, outcome or next steps Lack of a clear and consolidated Complaints process between funds and MetLife O7.3: STANDARDISED PROCESS ACROSS PARTNERS AND METLIFE Incorporate a uniform process for complaints between funds and MetLife: Align Complaint definition (e.g. negative sentiment vs complaint; Informal vs formal complaint) Matched SLAs and clear RACI; Clarity in branding between MetLife and funds; insurance complaints directly handled by MetLife Lack of root cause analysis of complaints (now in-flight at MetLife) NSF: Few complaints received by phone; Complaint Form provided on request Liaison with the external body, as directed Liaison with the external body, as directed PRECEDING CUSTOMER JOURNEYS: N/A CONCURRENT JOURNEYS: Browse and Choose Fund, Join A New Fund, I Need Financial Advice, Increase/ Vary My Cover, Keep In Touch, Complaint, Claim, Leave Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process

- 8. I receive my payout/ my claim was rejected CUSTOMER PROCESS STEPS OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND PAIN POINTS THIRD PARTIES Something happened to me and I need to loge a claim PRECEDING CUSTOMER JOURNEYS: Browse and Choose Fund with Insurance, Join a New Fund, Increase/ Vary My Cover LODGE CLAIM DECISIONWAIT NOTIFY FUND RECEIVE CONFIRMATION OF RECEIPT RETURN CLAIM FORMS ELIGIBILITY ASSESSMENT RECEIVE & COMPLETE CLAIM FORMS RECEIVE UPDATE/ REQUEST FOR INFORMATION PROVIDE SUPPORTING DOCUMENTS PROVIDE SUPPORTING DOCUMENTS RECEIVE PROCEDURAL FAIRNESS LETTER RECEIVE COMMS FROM METLIFE AND REHAB RECEIVE PAYMENT (LUMP SUM/ FINAL PAYOUT) RECEIVE CLAIM DECISION (TPD, IP CLAIMANTS ONLY) O8.1 UPFRONT EDUCATION On insurance v fund eligibility; how to make a claim, how insurance works, economics of payouts Provide how-to checklist O8.4 CLAIM FORM REVIEW • Are form requirements unambiguous? e.g. medical statements • Are all min. requirements essential? (5% cases be can decided without all requirements) O8.6 MET-FLOW SHARE Funds/ third parties may input applications and supporting documents directly into MetLife’s workflow O8.7 PROACTIVE FOLLOW-UP Cut delays by following-up with customer when required support documents are not provided (e.g. every two weeks) O8.8 CLAIMS STATUS TRACKER Provide customers with status tracker of their claim incl. view of end to end assessment process, missing documents, time log from notification etc. Claims tracker should allow customers to ask questions, escalate issues and/ or raise complaints O8.2 DIRECT NUMBER FOR CLAIMS Establish direct number and clear contact for existing applications, avoiding repetitions and frustrations in challenging situations O8.5 PROMOTE ECLAIMS Roll out to all funds; include electronic upload of documents; eligibility assessment, ability members to initiate e-Claims online O8.12 MEASURE CUSTOMER SATISFACTION Ask customer to provide feedback on their claims experience O8.3 PARTNERSHIP ALIGNMENT Align with funds on eligibility, standardisation of process and SLAs, proactive alerts on claims (esp. TPD), and claim requirements CONFIRM PAYMENT SCHEDULE/DETAIL CLAIM STAKING FURTHER ASSESSMENTS (INCOME PROTECTION/ DEATH CLAIM STAKING ONLY) FINAL PAYOUT If decision is likely a decline RECEIVE PAYMENT (MONTHLY PAYOUT) If income protection If death and contentious beneficiaries If more information is required If eligible, continue OR receive ineligibility letter Calling through to Service Centre repeatedly on existing claims may be traumatic Pessimistic about claims due to others’ stories; claims process is daunting Fund and MetLife are not aligned on eligibility criteria Funds and M/L sometimes have duplicate requirements for claims and release of super Relationship with MetLife may come as a surprise. Customers may feel they are getting passed along Customers must wait 2-3 weeks to hear back on my application: • Delays caused by fund to MetLife admin and communication processes e.g. Some funds insist on email comms with MetLife to keep paper trail, culture of distrust between funds and MetLife Customers may not be able to speak directly to MetLife and the fund may not have all about the customer’s claim (Direct to fund) Customer may have to provide additional documents to progress claim. Could this have been asked for earlier? A decision has been made but MetLife cannot tell customer (Direct to fund) Customer is handed over again to access payout; Admit to payment takes more time Relationship ceases after final payout Customer expected larger payout or was not prepared for the final income protection payment Recurring monthly1 – 13 months24h 2-3 Weeks Visit to 3rd parties to obtain further documents First Super Coordinators onsite visit or First Super/ NSF main office Receive payout in nominated bank Call 1300/ 1800 NSF/ First Super: Warm transfer to Claims Administrator if complex First Super: call if minor part of application is missing Receive call General enquiries email address First Super/ NSF: all hard copy unless email requested if customer cannot be reached via phone Mail claim form to unique Locked Bag or PO Box Send documents to MetLife PO Box MTAA/ NSF: Online enquiry form available 50% of claims are made through an agent Agent manages customers’ claim Customer or beneficiary receives lump sum/ final payout/ commutation amount Receive fund Exit Statement Confirmation application has been sent to insurer Visit to 3rd parties (doctors, Medicare, ATO etc.) to obtain required documents Claim made through agent 10% of claims made through eClaims Claim returned via agent Admit letters sent directly by MetLife for income protection only MTAA: eClaims available online Agent manages communications on customers’ behalf Visits to/ from rehabilitation specialists Periodic follow- ups from MetLife case manager Sent by mail 90% of the time Receive claim forms/ follow-up letters Mail documents to Locked Bag or PO Box address Receive letter Additional beneficiaries receive claim form/ letter Receive ‘28 day’ letter if contentious claim Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process Call from MetLife Case Manager directly for MTAA and Income Protection Receive follow-up on outstanding documents FOLLOWING JOURNEYS: I Need to Increase/ Vary My Cover, Keep Me Informed, Leave Receive payment letter CONCURRENT JOURNEYS: I Need Service, Financial Advice, Keep Me Informed, Complaint Not for MTAA Letter from MetLife Case Manager directly for MTAA and Income Protection Receive payment advice O8.11 OFFER FINANCIAL ADVICE Offer support/ advice after claim payout O8.9 HEALTH AND WELLBEING PROPOSITION Provide support to help the customer get back to work

- 9. CUSTOMER PROCESS STEPS O9.1 STAY IN TOUCH WITH CUSTOMERS Proactive contact triggered by specific behaviors: (E.G. If There Are No Contributions Within 6 Months & Member Calls For The Spin) Moment of Truth Partner Owns Process MetLife Owns ProcessVisits to 3rd parties for required documents Interrupted process requiring variable wait time Pull communication Push communication Size of circle indicates most popular channel to those most rarely usedCustomer journey may end here Straight through process Alternate scenario process OPPORTUNI- TIES FOR IMPROVE- MENT @ TOUCHPOINTSWITHMETLIFE/FUND CUSTOMER PAIN POINTS THIRD PARTIES O9.2 ONLINE ROLLOVER/ WITHDRAWAL REQUEST Make transfer out application available online Prepopulated form and certified identification for withdrawal O9.4 OFFER FINANCIAL ADVICE Offer support/ advice after claim payout, Provide financial advice/ option to maintain insurance/ MetLife e.g. compare options between new cover and existing Help obtain same cover in new fund PRECEDING CUSTOMER JOURNEYS: Browse and Choose Fund, Join A New Fund, Financial Advice, Increase/ Vary My Cover, Claim CONCURRENT JOURNEYS: I Need Service, Keep Me Informed Complaint I was supported in the leaving process MAKE ENQUIRY ON INTENT TO LEAVE FUND RECEIVE FINAL STATEMENT WITH CONFIRMATION OF ACCOUNT CLOSURE ACCESS AND COMPLETE FORM (WITHDRAWAL/ ROLLOVER FORM) RECEIVE FOLLOW UP (FORM EXCEPTIONS, ADDITIONAL ID) Mail enquiry to Locked Bag/ PO Box address MTAA/ NSF: Online enquiry form General enquiries email address First Super Coordinators onsite or at First Super/ NSF main office Call 1300/ 1800 number First Super: Calls are often requests for SPIN 30 days per regulation, usually 3 days Very little engagement in the customer journey My employer changed (70%) /other MEMBER INITIATED LEAVE REQUEST FINAL STATEMENT My claim was accepted RECEIVE LOW BALANCE WARNING Final statement confirming final payout mailed after fully validated rollover form SEMI-ACTIVE/ LOST MEMBERS Automated low-balance letter NSF: If default cover, letter issued 1) when balance is close to $200; 2) when balance is <$200, insurance is cancelled NSF does not close the account Enquiries made through agent or new fund First Super: calls that are requests for SPIN are not flagged (in-flight initiative) First Super Coordinators or First Super/ NSF main offices Forms downloadable from website Forms can be emailed Complete physical form Follow up if member details do not match and additional information/ identification is required e.g. ATO match MTAA sends follow up letter with rollover/ withdrawal form re-attached. Member has 28 days to respond Follow up if member details do not match and additional information/ identification is required e.g. ATO match NSF: If member is rolling over balance >$50,000, business development will follow up with customer survey call MTAA: letter issued 1) when balance is <$100; 2) zero balance for 6 months; 3) Exit letter issued at zero balance for 12 months RECEIVE EXIT LETTER WITH CONFIRMATION OF ACCOUNT CLOSURE Final statement confirming final payout mailed after fully validated rollover form EXIT LETTER Lost member balances may be handed over to the ATO e.g. temporary residents O9.3 SPIN AND ABN AVAILABLE ONLINE Make SPIN available online O9.5 CUSTOMER FEEDBACK Create avenue to capture customer feedback upon leaving the fund