#Complete Analysis of EPCG Scheme# By SN Panigrahi

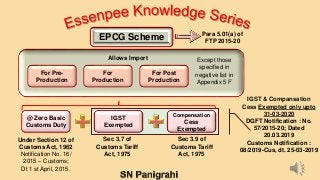

- 1. EPCG Scheme @ Zero Basic Customs Duty Under Section 12 of Customs Act, 1962 Notification No. 16/ 2015 – Customs; Dt 1 st April, 2015. Para 5.01(a) of FTP 2015-20 IGST Exempted Compensation Cess Exempted Sec 3.7 of Customs Tariff Act, 1975 Sec 3.9 of Customs Tariff Act, 1975 Allows Import Except those specified in negative list in Appendix 5 F For Pre- Production For Production For Post Production IGST & Compansation Cess Exempted only upto 31-03-2020 DGFT Notification : No. 57/2015-20; Dated 20.03.2019 Customs Notification : 08/2019-Cus, dt. 25-03-2019

- 2. 2 SN Panigrahi is a Versatile Practitioner, Strategist, Energetic Coach, Learning Enabler & Public Speaker. He is an International-Corporate Trainer, Mentor & Author He has diverse experience and expertise in Project Management, Contract Management, Supply Chain Management, Procurement, Strategic Sourcing, Global Sourcing, Logistics, Exports & Imports, Indirect Taxes – GST etc. He had done more than 150 Workshops on above Published more than 500 Articles He is an Engineer + MBA +PGD ISO 9000 / TQM with around 29 Yrs of Experience He is a certified PMP® from PMI (USA) and become PMI India Champion Also a Certified Lean Six Sigma Green Belt from Exemplar Global Trained in COD for 31/2 Yrs. on Strategy & Leadership GST Certified – MSME – Tech. Dev. Centre (Govt of India) ZED Consultant – Certified by QCI – MSME (Govt of India) Member Board of Studies, IIMM Co-Chairman, Indirect Tax Committee, FTAPCCI Empanelled Faculty in NI MSME He has shared his domain expertise in various forums as a speaker & presented a number of papers in various national and international public forums and received a number of awards for his writings and contribution to business thoughts. SN Panigrahi 9652571117 snpanigrahi1963@gmail.com Hyderabad

- 3. 3 Objective The objective of the EPCG Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India’s manufacturing competitiveness.

- 4. 4 Para 5.01 EPCG Scheme allows import of capital goods (except those specified in negative list in Appendix 5 F) for pre-production, production and post-production at zero customs duty. Capital goods imported under EPCG Authorisation for physical exports are also exempt from IGST and Compensation Cess upto 31-03-2020 only Capital goods for the purpose of the EPCG scheme shall include: (i) Capital Goods as defined in Chapter 9 including in CKD/SKD condition thereof; (ii) Computer systems and software which are a part of the Capital Goods being imported; (iii) Spares, moulds, dies, jigs, fixtures, tools & refractories; and (iv) Catalysts for initial charge plus one subsequent charge. Import of capital goods for Project Imports notified by Central Board of Excise and Customs is also permitted under EPCG Scheme.

- 5. 5 Chapter 5 of FTP Export Promotion Capital Goods (EPCG) Scheme Objectives The objective of the EPCG Scheme is to facilitate import of capital goods for producing quality goods and services and enhance India’s manufacturing competitiveness. Duty Exemption EPCG Scheme allows import of capital goods (except those specified in negative list in Appendix 5 F) for pre-production, production and post-production at zero customs duty. Two Options Import Validity : 24 months from the date of issue of Authorisation. No Revalidation permitted. Customs Duty + GST Exempted Domestic Procurement Supplies are Treated as Deemed Exports. GST First Payable, then can be Claimed as Refund Actual User Condition Imported CG shall be subject to Actual User condition till export obligation is completed and EODC is granted. Export Obligation 6 times of Duties, Taxes and Cess saved To be fulfilled in 6 years reckoned from date of issue of Authorisation. Conditions & Export Obligation

- 6. EPCG Scheme @ Zero Basic Customs Duty Under Section 12 of Customs Act, 1962 Notification No. 16/ 2015 – Customs; Dt 1 st April, 2015. Para 5.01(a) of FTP 2015-20 IGST Exempted Compensation Cess Exempted Sec 3.7 of Customs Tariff Act, 1975 Sec 3.9 of Customs Tariff Act, 1975 Allows Import Except those specified in negative list in Appendix 5 F For Pre- Production For Production For Post Production IGST & Compansation Cess Exempted only upto 31-03-2020 DGFT Notification : No. 57/2015-20; Dated 20.03.2019 Customs Notification : 08/2019-Cus, dt. 25-03-2019

- 7. 7 Capital Goods include Capital Goods as defined in Chapter 9 including in CKD/SKD condition Computer systems and software which are a part of CG Spares, Moulds, Dies, Jigs, Fixtures, Tools & Refractories Catalysts for initial charge plus one subsequent charge Para 9.08 of FTP : "Capital Goods" means any plant, machinery, equipment or accessories required for manufacture or production, either directly or indirectly, of goods or for rendering services, including those required for replacement, modernisation, technological up-gradation or expansion. It includes packaging machinery and equipment, refrigeration equipment, power generating sets, machine tools, equipment and instruments for testing, research and development, quality and pollution control. Capital goods may be for use in manufacturing, mining, agriculture, aquaculture, animal husbandry, floriculture, horticulture, pisciculture, poultry, sericulture and viticulture as well as for use in services sector. Note 1: Meaning of CG in GST As per Sec 2(19) of CGST Act “capital goods” means goods, the value of which is capitalised in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business Note: 2 As per Para 5.01(b) of FTP Import of capital goods for Project Imports notified by Central Board of Excise and Customs is also permitted under EPCG Scheme. Para 5.01 (a) of FTP 2015-20

- 8. 8 Coverage of EPCG Scheme Manufacturer exporters with or without supporting manufacturer(s), Merchant exporters tied to supporting manufacturer(s) and service providers. Name of supporting manufacturer(s) shall be endorsed on the EPCG Authorisation before installation of the capital goods in the factory / premises of the supporting manufacturer (s). Export Promotion Capital Goods (EPCG) Scheme also covers a service provider who is designated / certified as a Common Service Provider (CSP) by the DGFT, Department of Commerce or State Industrial Infrastructural Corporation in a Town of Export Excellence subject to provisions and conditions of Foreign Trade Policy 2015-2020.

- 9. 9 Export Obligation Export Obligation equivalent to 6 times of duties, taxes and cess saved on capital goods, to be fulfilled in 6 years reckoned from date of issue of Authorisation. Para 5.01(c) of FTP In case Integrated Tax and Compensation Cess are paid in cash on imports under EPCG, incidence of the said Integrated Tax and Compensation Cess would not be taken for computation of net duty saved provided Input Tax Credit is not availed. Para 5.01(e) of FTP Period from the date of issue of Authorisation Minimum export obligation to be fulfilled Block of 1st to 4th year 50% Block of 5th and 6th year Balance EO Block-wise Fulfilment of EO Para 5.04 of FTP EO under the scheme shall be, over and above, the average level of exports achieved by the applicant in the preceding three licensing years for the same and similar products Para 5.14 of HB

- 10. 10 Para 5.14 of HBP …………………… ……… …………. (b) The Authorisation holder would intimate the Regional Authority on the fulfilment of the export obligation, as well as average exports, within three months of completion of the block, by secured electronic filing using digital signatures. (c) Where EO of the first block is not fulfilled in terms of the above proportions, except in cases where the EO prescribed for first block is extended by the Regional Authority subject to payment of composition fee of 2% on duty saved amount proportionate to unfulfilled portion of EO pertaining to the block, the Authorization holder shall, within 3 months from the expiry of the block, pay duties of customs (along with applicable interest as notified by DOR) proportionate to duty saved amount on total unfulfilled EO of the first block. Intimation of Blockwise Fulfiment of Export Obligation

- 11. 11 Conditions for Export Obligation Para 5.04 of FTP : Following conditions shall apply to the fulfilment of EO:- (a) EO shall be fulfilled by the authorisation holder through export of goods which are manufactured by him or his supporting manufacturer / services rendered by him, for which the EPCG authorisation has been granted. (b) EO under the scheme shall be, over and above, the average level of exports achieved by the applicant in the preceding three licensing years for the same and similar products within the overall EO period including extended period, if any; except for categories mentioned in paragraph 5.13(a) of HBP. Such average would be the arithmetic mean of export performance in the preceding three licensing years for same and similar products. (c) In case of indigenous sourcing of Capital Goods, specific EO shall be 25% less than the EO stipulated in Para 5.01.

- 12. 12 (d) Shipments under Advance Authorisation, DFIA, Drawback scheme or reward schemes under Chapter 3 of FTP; would also count for fulfillment of EO under EPCG Scheme. (e) Export shall be physical export. However, supplies as specified in paragraph 7.02 (a), (b), (e), (f) & (h) of FTP (Deemed Exports) shall also be counted towards fulfillment of export obligation, along with usual benefits available under paragraph 7.03 of FTP. (f) EO can also be fulfilled by the supply of ITA-I items to DTA, provided realization is in free foreign exchange. (g) Royalty payments received by the Authorisation holder in freely convertible currency and foreign exchange received for R&D services shall also be counted for discharge under EPCG. (h) Payment received in rupee terms for such Services as notified in Appendix 5D shall also be counted towards discharge of export obligation under the EPCG scheme. Conditions for Export Obligation

- 13. 13 Para 5.08 of FTP In case of direct imports, EO shall be reckoned with reference to actual duty saved amount. Value of Customs Duty Saved (Say) = X, then Export Obligation shall be 6X In case of domestic sourcing, EO shall be reckoned with reference to notional Customs duties saved on FOR value. Calculation of Export Obligation

- 14. 14 Validity for Import Validity for Import 24 months from the date of issue of Authorisation. No Revalidation permitted. Para 5.01(d) of FTP Vide Public Notice No. 47/2015-20 Dated the 16th November, 2018 Validity period has been extended from 18 months to 24 months. Imported CG shall be subject to Actual User condition till export obligation is completed and EODC is granted. Para 5.03 of FTP Actual User Condition

- 15. 15 Public Notice No. 31/2015-20, Dated 29th August, 2018; Dated the 29th August, 2018 Para 5.04(a) of HBP: Authorization holder shall produce, within six months from date of completion of import, to the concerned RA, a certificate from the jurisdictional Customs authority or an independent Chartered Engineer, at the option of the authorisation holder, confirming installation of capital goods at factory / premises of authorization holder or his supporting manufacturer(s). The RA may allow one time extension of the said period for producing the certificate by a maximum period of 12 months with a composition fee of Rs.5000/-. Where the authorisation holder opts for independent Chartered Engineer’s certificate, he shall send a copy of the certificate to the jurisdictional Customs Authority for intimation/record. Para 5.04(b) of HBP In the case of import of spares, the installation certificate shall be submitted by the Authorization holder within a period of three years from the date of import.

- 16. 16 Public Notice No. 31/2015-20, Dated 29th August, 2018; Dated the 29th August, 2018 Para 5.04(a) of HBP: The authorization holder shall be permitted to shift capital goods during the entire export obligation period to other units mentioned in the IEC and RCMC of the authorization holder subject to production of fresh installation certificate to the RA concerned within six months of the shifting.

- 17. 17 Indigenous Sourcing of CG: Benefits to Domestic Supplier Para 5.07 of FTP A person holding an EPCG authorisation may source capital goods from a domestic manufacturer. Such domestic manufacturer shall be eligible for deemed export benefits under paragraph 7.03 of FTP and as may be provided under GST Rules under the category of deemed exports. Such domestic sourcing shall also be permitted from EOUs and these supplies shall be counted for purpose of fulfilment of positive NFE by said EOU as provided in Para 6.09 (a) of FTP.

- 18. 18 Indigenous Sourcing of CG Domestic Supplier of CG EPCG Authorization Holder Supply on Payment of GST Treated as Deemed Exports Notification No. 48/2017-Central Tax Dated 18th Oct’ 2017 Refund of Deemed Exports supply can be claimed by either Recipient or Supplier Notification No. 47/2017–Central Tax Dated 18 th Oct’ 2017 Para 5.07 of FTP Note: ARO facility shall not be available for sourcing of Capital Goods manufactured indigenously

- 19. 19 Evidences Required - to be produced by the Supplier of Deemed Export Supplies for Claiming Refund Notification No. 49/2017-Central Tax, 18th October, 2017 Evidence to be Produced by Supplier Acknowledgment by the jurisdictional Tax officer of the Export Promotion Capital Goods Authorisation holder, that the said deemed export supplies have been received by the said Export Promotion Capital Goods Authorisation holder. An undertaking by the recipient of deemed export supplies that no input tax credit on such supplies has been availed of by him An undertaking by the recipient of deemed export supplies that he shall not claim the refund in respect of such supplies and the supplier may claim the refund.

- 20. 20 Para 5.09 of FTP With a view to accelerating exports, in cases where Authorisation holder has fulfilled 75% or more of specific export obligation and 100% of Average Export Obligation till date, if any, in half or less than half the original export obligation period specified, remaining export obligation shall be condoned and the Authorisation redeemed by RA concerned. Incentive for early EO fulfilment

- 21. 21 Para 5.10 of FTP For exporters of Green Technology Products, Specific EO shall be 75% of EO as stipulated in Para 5.01. There shall be no change in average EO imposed, if any, as stipulated in Para 5.04. The list of Green Technology Products is given in Para 5.29 of HBP. Para 5.29 of HBP : Green Technology Products The Export Products covered under Paragraph 5.10 of FTP which provides for reduced export obligation of 75% for green technology products are: Reduced EO for Green Technology Products (i) Equipment for Solar Energy decentralized and grid connected products, (ix) Solar Collector and Parts thereof, (ii) Bio-Mass Gassifier, (x) Water Treatment Plants, (iii) Bio-Mass/Waste Boiler, (xi) Wind Mill, Wind Mill Turbine / Engine, (iv) Vapour Absorption Chillers, (xii) Other Generating Sets - Wind powered, (v) Waste Heat Boiler, (xiii) Electrically Operated Vehicles – Motor Cars, (vi) Waste Heat Recovery Units, (xiv) Electrically Operated Vehicles - Lorries and Trucks, (vii) Unfired Heat Recovery Steam Generators, (xv) Electrically Operated Vehicles – Motor Cycles/Mopeds, and (viii) Wind Turbine, (xvi) Solar Cells.

- 22. 22 Para 5.11 of FTP Reduced EO for North East Region and Jammu & Kashmir For units located in Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura and Jammu & Kashmir, specific EO shall be 25% of the EO, as stipulated in Para 5.01. There shall be no change in average EO imposed, if any, as stipulated in Para 5.04. Reduced EO for Green Technology Products

- 23. 23 Post Export EPCG Duty Credit Scrip(s) Par 5.12 of FTP (a) Post Export EPCG Duty Credit Scrip(s) shall be available to exporters who intend to import capital goods on full payment of applicable duties, taxes and cess in cash and choose to opt for this scheme. (b) Basic Customs duty paid on Capital Goods shall be remitted in the form of freely transferable duty credit scrip(s), similar to those issued under Chapter 3 of FTP. (c) Specific EO shall be 85% of the applicable specific EO under the EPCG Scheme. However, average EO shall remain unchanged. (d) Duty remission shall be in proportion to the EO fulfilled. (e) All provisions for utilization of scrips issued under Chapter 3 of FTP shall also be applicable to Post Export EPCG Duty Credit Scrip (s). (f) All provisions of the existing EPCG Scheme shall apply insofar as they are not inconsistent with this scheme.

- 24. 24 Notification No. 54/2018 – Central Tax; Dated 9th October, 2018 Amendment to Rule 89(4B) of CGST Rules : Where the person claiming refund of unutilised input tax credit on account of zero rated supplies without payment of tax has ………. (b) availed the benefit of Notification No. 79/2017-Customs, dated the 13th October, 2017 (Exemption under EPCG Scheme) refund of input tax credit can be claimed Comment : Even when Benefit of Exemption of EPCG Scheme availed, Refund of Input Tax on Export without Payment of Tax is allowed. Export without Payment of GST Claiming Refund of Input Tax Credit

- 25. 25 Notification No. 54/2018 – Central Tax; Dated 9th October, 2018 Amendment to Rule 96(10) of CGST Rules : The persons claiming Refund of integrated tax paid on exports of goods or services should not have …….. …….. ……… (b) availed the benefit under notification No. 79/2017-Customs, dated the 13th October, 2017 except so far it relates to receipt of capital goods by such person against Export Promotion Capital Goods Scheme Comment : Refund of Integrated Tax Paid is available even when Exemption of EPCG benefit is availed Export with Payment of GST Claiming Refund of Integrated Tax Paid

- 26. 26 Para 5.15 of HBP Authorisation holder shall submit to RA concerned by 30th April of every year, report on fulfilment of export obligation by secured electronic filing using digital signatures/ or hard copy thereof. Monitoring of Export Obligation

- 27. 27 Title Notification No. Date Exempt Integrated Tax / Cess on import of goods under AA / EPCG schemes Notification 16/2015- Customs Notification No. 79/2017-Customs, Notification No.66/2018-Customs Notification No. 08/2019-Customs 01/04/2015 3/10/2017 26/09/2018 25/03/ 2019 Evidences required to be produced by supplier of deemed export for claiming refund Notification No. 49/2017-Central Tax 18/10/2017 CBEC notifies certain supplies as deemed exports under CGST Act, 2017 Notification No. 48/2017-Central Tax 18/10/2017 GST Refund of deemed exports supply can be claimed by either recipient or supplier Notification No. 47/2017–Central Tax 18/10/2017 Export Refund of : a) Input Tax Credit b) Integrated Taxes Paid Notification No. 54/2018 – Central Tax; 19/10/2018

- 28. 28

- 30. 30SN Panigrahi

- 31. Session - 1 Overview of International Trade How to Start Export Business Session – 2 How to Identify Export Product & Customers Product X Market Selection Session – 7 Packing, Labeling & Quality Standards; Risks in International Business Session – 4 Export Costing – Pricing How to Negotiate International Contracts Session – 3 Export Logistics: Air, Sea, Road Transportation INCOTERMS; Port & Shipping Formalities Session - 6 Export Procedures & Documentation Customs Clearances Export - Import Session – 5 Introduction to Foreign Trade Policy; Export Incentives & Export Promotion Schemes Session – 8 Export Payment Methods Payment Risks Export Finance : Pre & Post Export Finance SN Panigrahi Two Days Workshop on Export – Import Management

- 32. 32