The World Economy On a Bumpy Road to Recovery

•

0 gefällt mir•634 views

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Mehr von QNB Group

Mehr von QNB Group (20)

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 06, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 06, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - August 31, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 31, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 24, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 24, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 23, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 23, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 21, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 21, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 14, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 14, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 02, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 02, 2023 التحليل الفني اليومي لبو...

Kürzlich hochgeladen

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. Gibson, Verified Chapters 1 - 13, Complete Newest Version.Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...rightmanforbloodline

Kürzlich hochgeladen (20)

DIGITAL COMMERCE SHAPE VIETNAMESE SHOPPING HABIT IN 4.0 INDUSTRY

DIGITAL COMMERCE SHAPE VIETNAMESE SHOPPING HABIT IN 4.0 INDUSTRY

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

a study on customer perception towards mutual funds

a study on customer perception towards mutual funds

Jual obat aborsi Jogja ( 085657271886 ) Cytote pil telat bulan penggugur kand...

Jual obat aborsi Jogja ( 085657271886 ) Cytote pil telat bulan penggugur kand...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

Solution Manual For Financial Statement Analysis, 13th Edition By Charles H. ...

GIFT City Overview India's Gateway to Global Finance

GIFT City Overview India's Gateway to Global Finance

Amil baba australia kala jadu in uk black magic in usa

Amil baba australia kala jadu in uk black magic in usa

amil baba kala jadu expert uk amil baba kala jadu removal uk amil baba in mal...

amil baba kala jadu expert uk amil baba kala jadu removal uk amil baba in mal...

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

Slideshare - ONS Economic Forum Slidepack - 13 May 2024.pptx

Slideshare - ONS Economic Forum Slidepack - 13 May 2024.pptx

black magic removal amil baba in pakistan karachi islamabad america canada uk...

black magic removal amil baba in pakistan karachi islamabad america canada uk...

The World Economy On a Bumpy Road to Recovery

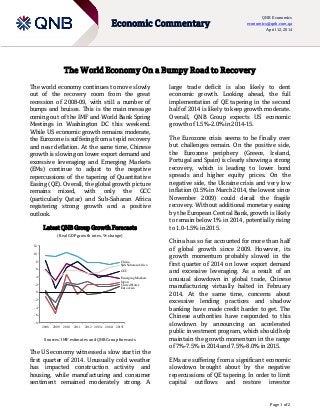

- 1. Page 1 of 2 Economic Commentary QNB Economics economics@qnb.com.qa April 12, 2014 -8 -6 -4 -2 0 2 4 6 8 10 12 2008 2009 2010 2011 2012 2013e 2014f 2015f China Sub-Saharan Africa GCC EmergingMarkets Japan UnitedStates Euro Area The World Economy On a Bumpy Road to Recovery The world economy continues to move slowly out of the recovery room from the great recession of 2008-09, with still a number of bumps and bruises. This is the main message coming out of the IMF and World Bank Spring Meetings in Washington DC this weekend. While US economic growth remains moderate, the Eurozone is suffering from a tepid recovery and near deflation. At the same time, Chinese growth is slowing on lower export demand and excessive leveraging and Emerging Markets (EMs) continue to adjust to the negative repercussions of the tapering of Quantitative Easing (QE). Overall, the global growth picture remains mixed, with only the GCC (particularly Qatar) and Sub-Saharan Africa registering strong growth and a positive outlook. Latest QNB Group Growth Forecasts (Real GDP growth rates, % change) Sources: IMF estimates and QNB Group forecasts The US economy witnessed a slow start in the first quarter of 2014. Unusually cold weather has impacted construction activity and housing, while manufacturing and consumer sentiment remained moderately strong. A large trade deficit is also likely to dent economic growth. Looking ahead, the full implementation of QE tapering in the second half of 2014 is likely to keep growth moderate. Overall, QNB Group expects US economic growth of 1.5%-2.0% in 2014-15. The Eurozone crisis seems to be finally over but challenges remain. On the positive side, the Eurozone periphery (Greece, Ireland, Portugal and Spain) is clearly showing a strong recovery, which is leading to lower bond spreads and higher equity prices. On the negative side, the Ukraine crisis and very low inflation (0.5% in March 2014, the lowest since November 2009) could derail the fragile recovery. Without additional monetary easing by the European Central Bank, growth is likely to remain below 1% in 2014, potentially rising to 1.0-1.5% in 2015. China has so far accounted for more than half of global growth since 2009. However, its growth momentum probably slowed in the first quarter of 2014 on lower export demand and excessive leveraging. As a result of an unusual slowdown in global trade, Chinese manufacturing virtually halted in February 2014. At the same time, concerns about excessive lending practices and shadow banking have made credit harder to get. The Chinese authorities have responded to this slowdown by announcing an accelerated public investment program, which should help maintain the growth momentum in the range of 7%-7.5% in 2014 and 7.5%-8.0% in 2015. EMs are suffering from a significant economic slowdown brought about by the negative repercussions of QE tapering. In order to limit capital outflows and restore investor

- 2. Page 2 of 2 Economic Commentary QNB Economics economics@qnb.com.qa April 12, 2014 confidence, most EMs have had to tighten macroeconomic policies. As a result, growth has significantly weakened in countries like Brazil, India, Russia, South Africa, Thailand, Turkey and, to a lesser extent, Indonesia. This is likely to continue as QE tapering is fully implemented and long-term interest rates in advanced economies start rising. EM growth will therefore slow to an average 4.0%-4.5% in 2014 and 3.5%-4.0% in 2015. Against this global trend, growth in the GCC region continues to strengthen. A strong push for diversification through strong infrastructure spending is pushing up non- hydrocarbon growth. Qatar is leading the region with projected double digit growth in the non-hydrocarbon sector, leading to 6.8% overall growth in 2014 and 7.8% in 2015. Overall, growth in the GCC region is expected to average 4.5%-5.0% in 2014 and 5.0%-5.5% in 2015. Last but not least, Sub-Saharan Africa continues to be the fastest growing region. Following the much anticipated rebasing of its GDP, Nigeria has become the biggest economy in the subcontinent (26th largest in the world) at USD509bn in 2013. It is expected to grow nearly 8% in 2014 and 7% in 2015 on a strong diversification drive. Large investment spending is also boosting growth in countries like Ghana, Mozambique and Tanzania. On the other hand, conflict in Central African Republic, South Sudan, and the Democratic Republic of Congo is hampering economic development. Overall, the subcontinent is expected to grow by 6.5% in 2014 and 7.0% in 2015. Overall, the global growth picture continues to be mixed. While advanced economies are slowly recovering from the global recession, their recovery looks fragile and still bumpy. China’s growth momentum is slowing, but the authorities have already taken measures to address the slowdown. EM growth is likely to weaken further in 2014 on tighter macroeconomic policies and the negative impact of further QE tapering. The only bright spots remain the GCC and Sub-Saharan Africa. Hopefully, no further bumps will derail the weak global recovery. Contacts Joannes Mongardini Head of Economics Tel. (+974) 4453-4412 Rory Fyfe Senior Economist Tel. (+974) 4453-4643 Ehsan Khoman Economist Tel. (+974) 4453-4423 Hamda Al-Thani Economist Tel. (+974) 4453-4646 Ziad Daoud Economist Tel. (+974) 4453-4642 Disclaimer and Copyright Notice: QNB Group accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Where an opinion is expressed, unless otherwise provided, it is that of the analyst or author only. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. The report is distributed on a complimentary basis. It may not be reproduced in whole or in part without permission from QNB Group.