QSE Index Declines Marginally; Real Estate and Telecoms Indices Fall

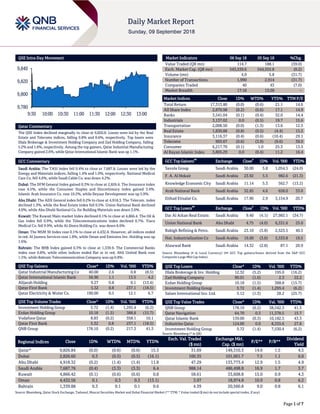

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined marginally to close at 9,826.8. Losses were led by the Real Estate and Telecoms indices, falling 0.8% and 0.6%, respectively. Top losers were Dlala Brokerage & Investment Holding Company and Zad Holding Company, falling 5.2% and 1.6%, respectively. Among the top gainers, Qatar Industrial Manufacturing Company gained 2.6%, while Qatar International Islamic Bank was up 1.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.4% to close at 7,687.8. Losses were led by the Energy and Materials indices, falling 1.4% and 1.0%, respectively. National Medical Care Co. fell 4.6%, while Saudi Cable Co. was down 4.2%. Dubai: The DFM General Index gained 0.3% to close at 2,826.6. The Insurance index rose 4.5%, while the Consumer Staples and Discretionary index gained 3.4%. Islamic Arab Insurance Co. rose 10.2%, while Deyaar Development was up 5.9%. Abu Dhabi: The ADX General index fell 0.2% to close at 4,918.3. The Telecom. index declined 1.3%, while the Real Estate index fell 0.5%. Union National Bank declined 4.0%, while Abu Dhabi National Co. for Building Materials was down 2.6%. Kuwait: The Kuwait Main market Index declined 0.1% to close at 4,866.4. The Oil & Gas index fell 0.9%, while the Telecommunications index declined 0.7%. Yiaco Medical Co. fell 9.9%, while Al-Deera Holding Co. was down 6.6%. Oman: The MSM 30 Index rose 0.1% to close at 4,432.6. However, all indices ended in red. Al Jazeera Services rose 1.8%, while Oman and Emirates Inv. Holding was up 1.6%. Bahrain: The BHB Index gained 0.3% to close at 1,339.9. The Commercial Banks index rose 0.8%, while other indices ended flat or in red. Ahli United Bank rose 1.5%, while Bahrain Telecommunication Company was up 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Industrial Manufacturing Co 40.00 2.6 0.8 (8.5) Qatar International Islamic Bank 56.90 1.1 13.5 4.2 Alijarah Holding 9.27 0.8 0.1 (13.4) Qatar First Bank 5.32 0.8 237.1 (18.5) Qatar Electricity & Water Co. 190.00 0.5 12.1 6.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Investment Holding Group 5.72 (1.4) 1,295.4 (6.2) Ezdan Holding Group 10.18 (1.5) 388.8 (15.7) Vodafone Qatar 8.83 (0.2) 358.1 10.1 Qatar First Bank 5.32 0.8 237.1 (18.5) QNB Group 178.10 (0.2) 217.3 41.3 Market Indicators 06 Sep 18 05 Sep 18 %Chg. Value Traded (QR mn) 114.7 188.1 (39.0) Exch. Market Cap. (QR mn) 543,539.6 544,555.8 (0.2) Volume (mn) 4.0 5.8 (31.7) Number of Transactions 1,990 2,914 (31.7) Companies Traded 40 43 (7.0) Market Breadth 17:18 13:28 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,313.80 (0.0) (0.6) 21.1 14.6 All Share Index 2,870.98 (0.2) (0.6) 17.1 14.9 Banks 3,541.04 (0.1) (0.4) 32.0 14.4 Industrials 3,137.02 0.0 (0.5) 19.7 15.6 Transportation 2,008.50 (0.0) (1.3) 13.6 12.5 Real Estate 1,830.88 (0.8) (0.5) (4.4) 15.5 Insurance 3,116.37 (0.4) (0.6) (10.4) 29.1 Telecoms 993.67 (0.6) (3.9) (9.6) 39.0 Consumer 6,217.70 (0.1) 1.0 25.3 13.5 Al Rayan Islamic Index 3,805.29 0.0 (0.4) 11.2 16.4 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Savola Group Saudi Arabia 30.00 5.8 1,054.5 (24.0) F. A. Al Hokair Saudi Arabia 23.92 5.5 982.6 (21.3) Knowledge Economic City Saudi Arabia 11.14 5.3 562.7 (13.2) Arab National Bank Saudi Arabia 32.85 4.6 658.0 33.0 Etihad Etisalat Co. Saudi Arabia 17.90 2.9 3,154.9 20.7 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Dar Al Arkan Real Estate. Saudi Arabia 9.40 (4.1) 27,983.1 (34.7) Union National Bank Abu Dhabi 4.75 (4.0) 6,331.6 25.0 Rabigh Refining & Petro. Saudi Arabia 23.10 (3.8) 2,523.5 40.5 Nat. Industrialization Co Saudi Arabia 19.60 (3.0) 3,533.8 19.5 Alawwal Bank Saudi Arabia 14.32 (2.8) 87.1 20.9 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding 12.32 (5.2) 195.0 (16.2) Zad Holding Company 90.01 (1.6) 2.3 22.2 Ezdan Holding Group 10.18 (1.5) 388.8 (15.7) Investment Holding Group 5.72 (1.4) 1,295.4 (6.2) Salam International Inv. Ltd. 5.12 (1.3) 28.2 (25.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 178.10 (0.2) 38,542.3 41.3 Qatar Navigation 64.70 0.3 11,378.5 15.7 Qatar Islamic Bank 139.00 (0.3) 10,182.5 43.3 Industries Qatar 124.00 0.0 8,335.6 27.8 Investment Holding Group 5.72 (1.4) 7,530.4 (6.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,826.84 (0.0) (0.6) (0.6) 15.3 31.69 149,310.3 14.6 1.5 4.5 Dubai 2,826.60 0.3 (0.5) (0.5) (16.1) 100.35 101,001.7 7.5 1.1 6.0 Abu Dhabi 4,918.32 (0.2) (1.4) (1.4) 11.8 47.29 133,773.4 12.9 1.5 4.9 Saudi Arabia 7,687.76 (0.4) (3.3) (3.3) 6.4 988.14 486,498.8 16.9 1.7 3.7 Kuwait 4,866.42 (0.1) (0.6) (0.6) 0.8 58.61 33,608.8 15.0 0.9 4.3 Oman 4,432.56 0.1 0.3 0.3 (13.1) 3.97 18,974.8 10.9 0.8 6.2 Bahrain 1,339.88 0.3 0.1 0.1 0.6 4.39 20,560.8 9.0 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,780 9,800 9,820 9,840 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined marginally to close at 9,826.8. The Real Estate and Telecoms indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Dlala Brokerage & Investment Holding Company and Zad Holding Company were the top losers, falling 5.2% and 1.6%, respectively. Among the top gainers, Qatar Industrial Manufacturing Company gained 2.6%, while Qatar International Islamic Bank was up 1.1%. Volume of shares traded on Thursday fell by 31.7% to 4.0mn from 5.8mn on Wednesday. Further, as compared to the 30-day moving average of 6.4mn, volume for the day was 38.2% lower. Investment Holding Group and Ezdan Holding Group were the most active stocks, contributing 32.6% and 9.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Arab Insurance Group A.M. Best Bahrain LT-ICR/FSR a-/A- bbb+/B++ Negative – Source: News reports (* LT – Long Term, ST – Short Term, ICR – Issuer Credit Rating, FSR- Financial Strength Rating) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/06 US Department of Labor Initial Jobless Claims 1-September 203k 213k 213k 09/06 US Department of Labor Continuing Claims 25-August 1,707k 1,720k 1,710k 09/06 US Markit Markit US Services PMI August F 54.8 55.2 55.2 09/06 US Markit Markit US Composite PMI August F 54.7 – 55.0 09/07 US Bureau of Labor Statistics Unemployment Rate August 3.9% 3.8% 3.9% 09/07 EU Eurostat GDP SA QoQ 2Q2018 F 0.4% 0.4% 0.4% 09/07 EU Eurostat GDP SA YoY 2Q2018 F 2.1% 2.2% 2.2% 09/06 Germany Markit Markit Germany Construction PMI August 51.5 – 50.0 09/07 Germany German Federal Statistical Office Trade Balance July 16.5bn 19.5bn 21.8bn 09/07 France Ministry of the Economy Trade Balance July -3,490mn -5,739mn -6,067mn 09/07 France INSEE Industrial Production MoM July 0.7% 0.2% 0.7% 09/07 France INSEE Industrial Production YoY July 1.8% 1.0% 1.8% 09/07 France INSEE Manufacturing Production MoM July 0.5% 0.2% 0.7% 09/07 France INSEE Manufacturing Production YoY July 1.9% 1.5% 1.8% 09/07 China National Bureau of Statistics Foreign Reserves August $3,109.72bn $3,115.00bn $3,117.95bn Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 25.43% 34.13% (9,983,913.65) Qatari Institutions 7.50% 28.80% (24,438,478.57) Qatari 32.93% 62.93% (34,422,392.22) GCC Individuals 0.32% 0.47% (167,557.80) GCC Institutions 0.14% 1.06% (1,054,846.10) GCC 0.46% 1.53% (1,222,403.90) Non-Qatari Individuals 9.63% 8.45% 1,357,628.74 Non-Qatari Institutions 56.98% 27.10% 34,287,167.38 Non-Qatari 66.61% 35.55% 35,644,796.12

- 3. Page 3 of 7 News Qatar MERS signs a contract with Qatar Rail Company – Al Meera Consumer Goods Company (MERS) has signed a contract with Qatar Rail Company to occupy a number of convenience stores in the red and green lines in Doha Metro. (QSE) QIMD discloses additional information regarding acquisition of foreign partner’s share in Qatar Plastic Products Company – Qatar Industrial Manufacturing Company (QIMD) provided details regarding the completion of acquisition of the foreign partner’s share in accordance with the provisions of QFMA’s acquisition and merger rules (Article 2, Section 3). QIMD acquired the foreign partner’s share in the limited liability company, Qatar Plastic Products Company, which has capital of QR27mn. The acquisition of foreign partner, Mr. Stefano Fratti’s share of 33.33% for QR33mn was financed by a local bank, and there is no conflict of interest between the persons involved in the offer, their board members or their senior shareholder. (QSE) QIA completes acquisition of 18.93% shares of Russia’s Rosneft – Qatar Investment Authority (QIA) announced the completion of its acquisition of 18.93% stake of Russia’s Rosneft Oil Company. The QIA and Swiss Glencore mining company Consortium announced in 2016 the purchase of 19.5% of Rosneft in a privatization deal. In early May 2018, it was announced that the consortium would be dissolved, with the QIA having 18.93% of Rosneft, and Glencore holding 0.57%. The QIA is one of the largest sovereign wealth funds in the world. Since its inception in 2006, QIA has built a major global portfolio spanning multiple asset classes and regions across the world. (Peninsula Qatar) Sheikh Ahmed: Blockade is a boon for Qatar – The 15-month blockade on Qatar by Saudi Arabia and three other Arab nations has been a “blessing” for the gas-rich nation’s economy, its economy and commerce minister said. Since the blockade began, Qatari exports have risen 19%, while its global trade climbed 16%, HE Sheikh Ahmed bin Jassim bin Mohamed Al- Thani said. Economic growth this year is forecast to be the fastest in the Gulf, at around 2.9%, the minister said, citing World Bank estimates. “The blockade on Qatar from an economic point of view is behind us,” the minister said. “We are doing excellent. In fact, from an economic point of view, it’s a blessing.” After the blockade, Qatar ventured into markets that had been ignored before including Turkey, Azerbaijan, Armenia, Pakistan, Iran and central Asia, he said. (Gulf-Times.com) Al-Sada: Qatar’s gas reserves require expansion effort – HE Minister of Energy and Industry, Mohammed bin Saleh Al-Sada affirmed that Qatar’s large gas reserves require an expansion effort, adding this is why Qatar has decided to increase this sector’s growth by 30%. Al-Sada pointed out that this requires efforts in the field of finance and the provision of equipment and construction, considering that an opportunity and a suitable ground for German companies to invest in Qatar. This came in his speech at the third session of the Qatar Germany Business and Investment Forum (QGBIF) in Berlin, which was held under the title “Industrial development: Key to Doha and Berlin to diversify sources of income.” Al-Sada said, “We invest gas reserves to diversify sources of income, which is in line with the objectives of Qatar National Vision 2030. One of these sources is industry that we use to diversify our sources of income that open up investment-stimulating areas, coupled with what Qatar has taken in this regard to stimulate the private sector to achieve investment growth.” He stressed that diversifying sources of income is not an objective as much as it is a way for Qatar to strengthen the economy. (Gulf- Times.com) Amir: Non-oil sector is Qatar economy’s key growth driver – Qatar’s non-hydrocarbon sector is the leading industry driving the country’s economy, according to HH the Emir Sheikh Tamim bin Hamad Al-Thani, who noted that major projects being undertaken in Qatar provide many investment opportunities for German companies. HH the Amir made the statement in a speech he delivered during the 9th Qatar- German Business and Investment Forum held in Berlin, Germany. “Qatar economy’s main driver at this stage is the non-oil sector, which relies mainly on massive investments in infrastructure, especially education, health, transportation, and constructions required for hosting the 2022 FIFA World Cup,” HH the Amir noted. HH the Amir stressed that development projects in Qatar “provide great opportunities for German companies” to increase their contribution to the development of Qatar’s economy in other sectors. The sectors also include infrastructure and construction sector, as well as education, training and research, and small and medium-sized enterprises (SMEs). (Gulf-Times.com) ‘Qatar private sector keen on investing in Germany’ – Qatar and its private sector have evinced interest in investing in ‘strategic’ sectors in Germany as part of strategies to strengthen the economic ties between the two countries. “Qatari government and the private sector are interested in investing in strategic sectors in Germany, which has been in recent years, whether in the automotive, contracting, tourism and technology sectors,” Rashid Al-Sraiya Al-Kaabi, Qatar Chamber board member, told Qatar-Germany Business and Investment Forum in Berlin. He said there is also a real desire to increase the volume of investments and trade exchange between the two countries, especially in the field of food and pharmaceutical industries, which will ensure the self- sufficiency for Qatar. Al-Kaabi stressed that this forum targets specific sectors and presents real projects for the private sector in both countries, especially the projects related to the 2022 World Cup. (Gulf-Times.com) Qatar’s Single Window System posts 98% investor satisfaction rate – Qatar’s Single Window System has garnered a 98% investor satisfaction rate, which recognizes the country’s efforts in easing business requirements in the country, an official announced at the ‘9th Qatar-German Business and Investment Forum’ held in Berlin, Germany. “The satisfaction rates reveal that Qatar has gone a long way to enhance the investment climate and facilitate the exercise of business activities, while the single window system is developing its mechanisms to achieve the best,” said Mohamed Salman Kaldari, the Chairman of the coordinating committee for the Single Window System Management. Using global best practices, the single window system helps jumpstart business

- 4. Page 4 of 7 application procedures by providing “integrated and easy services to local and foreign investors in one place.” (Gulf- Times.com) Qatar eyes €10bn investment in Germany over the next five years – Qatar is planning to invest €10bn in the German economy over the next five years, HH the Amir Sheikh Tamim bin Hamad Al-Thani announced at the opening of the 9 th Qatar- Germany Business and Investment Forum in Berlin. HH the Amir made the announcement in the presence of German Chancellor Angela Merkel, the Mayor of Berlin Michael Muller, and other high-level officials representing Qatar and Germany’s private and public sectors. (Gulf-Times.com) Qatar to award QR60bn worth projects in next four years – The combined value of Qatar’s proposed projects in infrastructure and real estate sectors for the next four years is QR60bn. This is in addition to QR2bn in terms of developing food security projects for the period, Khamis Ahmed Al Mohannadi, Chairman, Private Sector Development and Support, told The Peninsula on the sidelines of Qatar-Germany Business and Investment Forum. In the food security sector alone, Khamis said, 12 huge projects are in the pipeline. Foreign investors have huge opportunities in developing greenhouses, shrimp farms, organic farming with local partnership. The shrimp farming project aims to achieve self-sufficiency of about 90% of the of the local market demand. Khamis said projects related to food security topped the list of proposed projects. The initiative comes as part of the government’s efforts to reach self- sufficiency in food, agricultural, livestock and industrial products. (Peninsula Qatar) Qatari-German trade volume touched $12.6bn over 2013-17 – The Qatari-German bilateral trade volume over the 2013-2017 period grew significantly to approximately $12.6bn, and Qatar ranked as Germany’s 11th largest trading partner, and third largest export destination in 2017, Qatar’s Minister of Economy and Commerce, HE Sheikh Ahmed bin Jassim Al Thani noted in his address at the Qatar-Germany Business and Investment Forum, which kicked off in Berlin. Sheikh Ahmed highlighted on Qatari-German bilateral trade and investment ties, highlighting the most recent economic indicators and achievements of both countries. (Peninsula Qatar) Qatari Diar seeks to expand its real estate portfolio in Germany – The CEO of Qatari Diar Real Estate Investment and Development Company (Qatari Diar), Abdullah Hamad Al- Attiyah said that his company is participating in this year’s forum because it wants to expand its real estate portfolio with German real estate developers. He said that the German market was attractive to Qatari Diar, and confirmed that the company was looking for German companies to partner with. He said that the companies’ competitive advantage stems from their ability to examine investment opportunities well regardless of they are in the world. (Gulf-Times.com) Qatari investments in Jordanian stocks reach $1.5bn at end of August – Qatari investment in Jordanian stocks reached 1.084mn dinars, equivalent to $1.5bn. Qatari investments are ranked second in terms of nationalities with most holdings. Statistics provided by Jordan’s Securities Depository Centre revealed that Qatari investors held 180,273mn financial paper at the end of August. (Gulf-Times.com) Qatar’s real estate trading volume exceeds QR811mn in the second week of August – The volume of real estate transactions in the sales contracts registered with the Real Estate Registration Department at the Ministry of Justice during the period from August 12-16 was QR811,016,038. According to the weekly bulletin issued by the Department, the list of real estate sold includes land, housing, multi-use buildings, residential buildings and commercial buildings. Sales were concentrated in the municipalities of Doha, Al Rayyan, Umm Salal, Al Daayen, Al Khor, Dakhira, Al Wakrah and Al Shamal. (Gulf-Times.com) Qatar participates in 102 nd meeting of Economic and Social Council – The Economic and Social Council held its 102 nd meeting at the ministerial level at the headquarters of the Arab League. The State of Qatar participated in a delegation chaired by HE Qatar’s Permanent Envoy at the Arab League Ambassador Ibrahim bin Abdulaziz Al-Sahlawi. The meeting focuses on removing the obstacles facing the establishment of an Arab free zone, as well as increase trade between Arab countries. The meeting will also discuss the economic and social agenda of the council’s 30th summit, which is set to take place in Tunisia in March 2019. (Gulf-Times.com) Retaj Group to have 25 hotels over next five years – Retaj Hotels & Hospitality, a subsidiary of the Qatar-based Retaj Group, has announced its ambitious expansion plan. The company aims to have some 25 hotels and properties in its business portfolio over the next five years, revealed a senior official of the Group, the country’s leading Shari’ah-compliant hospitality services provider. Retaj currently operates nine properties in Qatar and overseas under its hospitality business portfolio, and has robust expansion plans as part of its growth strategy. (Peninsula Qatar) Big 5 launch in Qatar to be held under PM’s patronage – The Big 5 launch in Qatar will be held under the patronage of HE the Prime Minister and Interior Minister Sheikh Abdullah bin Nasser bin Khalifa Al-Thani, the organizers have announced. The event is set to host more than 200 exhibiting companies from 17 countries, including Kuwait, Turkey, Italy, China and Canada, among others. They will display the latest building technologies and solutions across dedicated product sectors. Supported by Qatar Tourism Authority (QTA) and organized by dmg events Doha, The Big 5 Qatar will be held from September 24 to 26 at Doha Exhibition and Convention Centre. (Gulf- Times.com) Minister: Proposed insurance fund will protect workers' dues – The most important function of the Workers' Support and Insurance Fund is to pay the dues of any worker, who is stranded because the employer cannot pay the sum due to bankruptcy, HE the Minister of Administrative Development, Labor and Social Affairs Issa bin Saad Al-Jafali Al-Nuaimi has stressed. “At the same time, the fund will establish playgrounds and entertainment facilities for workers in specified areas,” he said, referring to the draft law issued by the Cabinet on the establishment of the fund to support workers in the country. The decision was taken after the Cabinet reviewed recommendations of the Advisory Council on the matter. (Gulf- Times.com) Turkey’s exports to Qatar rise 93% in eight months – Turkey’s exports to Qatar have increased by 93% in the first eight

- 5. Page 5 of 7 months of this year, compared to the same period last year. The Turkish Aegean Exporters Association stated that Turkish exports to Qatar reached $636mn compared to $330mn in the same period in 2017. The mineral sector topped the list of Turkish exports to the State of Qatar during the period from January to August, with a value of $118mn, while the electrical and chemical products ranked second with $75mn, followed by the finished garments sector with a value of $45mn, QNA reported. (Peninsula Qatar) International US services data suggests upward revision to second-quarter GDP – US economic growth for the second quarter is likely to be revised higher, after data on September 7 suggested a bit more consumer spending than previously estimated. The findings of the Commerce Department’s quarterly services survey, or QSS, come on the heels of data last week showing a less steep decline in construction spending in June than previously reported. Before the QSS data, economists had expected that GDP growth for the April-June quarter would be raised to an annualized rate of 4.3% from the 4.2% pace that the government reported previously in its second GDP estimate. Based on the QSS data, JPMorgan and Macroeconomic Advisers estimated another one- tenth of a percentage point would be added to the GDP estimate. That means second-quarter GDP growth could be lifted to a 4.4% rate, when the government publishes its second revision later this month. In its second GDP estimate, the government had lowered second-quarter consumer spending growth to a 3.8% pace from the 4.0% rate, when then government published its advance GDP growth estimate back in July. Economists said last week’s QSS data showed more spending at nonprofit hospitals and other sectors. (Reuters) US job growth rises; annual wage gain largest since 2009 – US job growth accelerated in August and wages notched their largest annual increase in more than nine years, the clearest signs that the economy was so far weathering the Trump administration’s escalating trade war with China. The Labor Department’s closely watched employment report, which showed slack in the jobs market, was rapidly diminishing, with a broader measure of unemployment falling to a level not seen since 2001. The report cemented expectations for a third interest rate increase from the Federal Reserve this year, when policymakers meet on September 25-26. Analysts say the administration’s $1.5tn tax cut package and increased government spending were shielding the economy from the trade tensions, which have also seen Washington engaged in tit-for-tat tariffs with other trade partners, including the European Union, Canada and Mexico. (Reuters) Lidington: UK wants deal on Brexit by November at latest – Britain believes an orderly, agreed exit from the European Union (EU) is still the most likely outcome, but time is running out and a deal should be done by November at the latest, cabinet office minister David Lidington said. Speaking on the sidelines of Italy’s annual Ambrosetti conference on European affairs, Lidington said London wanted a deal that satisfied all EU member states, but its contingency plan for a ‘no-deal’ Brexit was well developed. He said it was important to wrap up negotiations by November in order to give British and European parliaments enough time to review and approve the text of any agreement. (Reuters) Eurozone’s second-quarter GDP growth confirmed at 0.4% despite negative trade – The Eurozone economy grew at 0.4% in the second quarter, EU statistics agency Eurostat confirmed, as business and other investments rose sharply, while net trade was negative. Eurostat confirmed its first estimate that the economy of the 19 countries sharing the Eurozone increased by 0.4% QoQ, while revising its YoY figure to 2.1% from an initial 2.2%. Gross fixed capital formation rose by 1.2% during the second quarter, contributing 0.3 percentage points to GDP (gross domestic product) growth. Changes in inventories, household spending and government expenditure each contributed 0.1 percentage point. (Reuters) EIB considering capital hike, changes to shareholding post Brexit – The European Investment Bank (EIB), owned by European Union governments, is considering a capital increase to allow some of its shareholders to increase their stake after Britain pulls out of the EU and the EIB in March next year, EU officials said. Britain’s exit will mean that the bank will lose 3.5bn Euros ($4.04bn) of British paid-in capital. That money will be replenished by other existing shareholders on a proportional basis, one EU official said. The world’s largest multilateral borrower and lender, the EIB relies on its ‘AAA’ credit rating to borrow on the market and then lend on for investment projects. It works closely with other EU institutions to implement EU policy. Replacing the UK capital after Brexit will be important for the bank to keep its top credit rating. Separately, the bank is working on a plan to raise capital to allow some countries, like Poland, to raise their holding. (Reuters) Japan’s GDP seen revised up on boost from capital expenditure – Japan’s economic growth in the second quarter is expected to be revised up due to acceleration in capital expenditure, a Reuters poll showed, suggesting the economy remains on a firm footing. The world’s third-largest economy is forecast to have grown an annualized 2.6% in April-June, up from the preliminary 1.9% announced last month, the poll of 18 economists showed. Japanese companies have been steadily increasing business investment to cope with labor shortages stemming from a shrinking population. Many companies are purchasing new equipment and software that allow them to run factories and provide services with fewer workers, and this spending is making a positive contribution to gross domestic product. (Reuters) China's record trade surplus with US adds fuel to trade war fire – China’s trade surplus with the US widened to a record in August even as the country’s export growth slowed slightly, an outcome that could push President Donald Trump to turn up the heat on Beijing in their cantankerous trade dispute. The politically sensitive surplus hit $31.05bn in August, up from $28.09bn in July, customs data showed, surpassing the previous record set in June. Over the first eight months of the year, China’s surplus with its largest export market has risen nearly 15%, adding to tensions in the trade relationship between the world’s two largest economies. China’s annual export growth in August moderated slightly to 9.8%, the data showed, the weakest rate since March but only slightly below recent trends.

- 6. Page 6 of 7 The number missed analysts’ forecasts that shipments from the world’s largest exporter would rise 10.1%, slowing only slightly from 12.2% in July. (Reuters) QNB Group: An 8% growth should emerge as India’s new normal – An 8% GDP growth should emerge as India’s new normal “once recent structural reforms fully bed down”, QNB Group said in an economic commentary. After several quarters in the doldrums, India’s economy roared back to life in the April-June quarter. GDP growth jumped to a nine-quarter high of 8.2% YoY; up from 7.7% YoY in the first quarter of the year, QNB Group said. The acceleration was powered by a sharp pick- up in the pace of consumer demand growth, which is the largest contributor to GDP. Private consumption gained by 8.6% in 2Q2018; up from 6.7% in the preceding quarter. (Gulf- Times.com) Regional IATA: Middle East’s airlines fly record 216.1mn passengers in 2017 – The Middle East region has seen record 216.1mn passengers in 2017, which accounts for 5.3% of the global market share, according to the International Air Transport Association (IATA). This represents an increase of 4.6% on 2016, IATA stated in its ‘World Air Transport Statistics’. Worldwide annual air passenger numbers exceeded 4bn for the first time, supported by a broad-based improvement in global economic conditions and lower average airfares. At the same time, IATA noted that airlines connected a record number of cities worldwide, providing regular services to over 20,000 city pairs in 2017, more than double the level of 1995. (Gulf- Times.com) OPEC, non-OPEC panel to discuss sharing oil-output boost – An OPEC and non-OPEC technical committee will later this month discuss proposals for sharing out an oil-output increase, sources said, a tense topic for the producer group after it decided in June to ease supply curbs. A panel called the Joint Technical Committee will on September 17 consider proposals on distributing the agreed output increase of 1mn barrels per day. (Reuters) Saudi Arabia’s financial sector strong enough to withstand shocks – Saudi Arabia’s financial sector remains sound and resilient to economic shocks, Fahad Al Shathri, Deputy Governor for Supervision at the Saudi Arabia Monetary Authority (SAMA), said. Delivering a keynote address at the Corporate Restructuring Summit 2018, Al Shathri said, “Kingdom’s banking and financial sector stood on sound footing despite the macroeconomic headwinds faced by the country. In October 2017, the IMF undertook the Financial Sector Assessment Program (FSAP) and we were pleased to see that the financial sector in Saudi Arabia remains sound and resilient to economic shocks.” Banks constitute the core of the Saudi Arabian financial system, with total assets of approximately $595bn and they are the key credit providers. The banking sector also enjoys a strong capital ratio of 21%, a sound liquidity coverage ratio (LCR) of 197% and robust net stable funding Ratio (NSFR) of 125%, as at June 2018. (GulfBase.com) Dar Al Arkan to open VOX Cinemas multiplex in Riyadh – Dar Al Arkan Real Estate Development Company (Dar Al Arkan) stated it has signed an agreement with Majid Al Futtaim, a leading shopping mall, communities, retail and leisure pioneer in the region, to open VOX Cinemas multiplex in the Kingdom. As per the deal, VOX Cinemas will operate the new 15-screen multiplex at Dar Al Arkan's Al Qasr Mall in Saudi Arabia’s capital. VOX Cinemas, a unit of Majid Al Futtaim, is the Middle East's most innovative and customer-focused cinema exhibitor. (GulfBase.com) ACWA Power, ENGIE in race for Saudi Arabia’s water project – Saudi Arabia’s Water & Electricity Company stated it has received bids from consortiums led by six leading global players in the utility sector for the Kingdom's Shuqaiq-3 independent water project. The top bidders are Saudi Arabia-based ACWA Power with consortium partners Al Babtain Contracting and Saudi Brothers Company; Japan's Marubeni with Acciona Agua, Abdul Latif Jameel and Bahr Rawafid; Paris-based Veolia with Marafiq and Alamwal Al Khaleejiah Al Thaniya; European utility giant FCC Aqualia with Nesma aand Haaco; Spanish infrastructure group Cobra with Orascom and Al Blagha Investment and French utility group ENGIE with Mitsubishi Corporation, SSEM and Metito. (GulfBase.com) Saudi Aramco to weigh $1bn venture capital fund – Saudi Aramco is considering a $1bn venture capital fund focused on technologies complementing the company’s operations, Wall Street Journal reported, citing unidentified people familiar with the proposal. Investments wouldn’t necessarily focus on energy; the company wants to locate tech firms in Saudi Arabia to create jobs, but that isn’t primary reason to establish the fund, sources added. (Bloomberg) Hinduja mulls stake in UAE’s banks, moving headquarter – The Indian conglomerate Hinduja Group is in talks with two banks in the UAE to acquire a stake and might move its headquarters to the country, the Khaleej Times reported, citing the group’s Co-Chairman Gopichand Hinduja. A potential acquisition would be done by Hinduja’s Mauritius-based unit IndusInd International Holdings, the biggest shareholder in India’s IndusInd Bank Ltd. London-based Hinduja is also seriously looking at moving its base to either the UAE or Singapore in the wake of uncertainties arising from Brexit, according to its Co- Chairman. (Bloomberg) Bahrain approves rules allowing foreign firms to set up independent subsidiaries – Bahrain approved regulation allowing foreign companies to establish independent subsidiaries in the Kingdom and do business without a local partner, a move aimed at spurring economic growth. Bahrain’s Cabinet, chaired by Prime Minister Khalifa Bin Salman Al Khalifa, formally endorsed the new rules earlier this week, two years after the country approved 100% business ownership in certain sectors, according to a Gulf Daily News report. The regulations amend provisions of a corporate law issued in 2001. (GulfBase.com)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns, # Market closed on September 7, 2018) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 Series3 Series1 Series2 (0.4%) (0.0%) (0.1%) 0.3% 0.1% (0.2%) 0.3% (0.6%) (0.3%) 0.0% 0.3% 0.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,196.24 (0.3) (0.4) (8.2) MSCI World Index 2,137.60 (0.3) (1.7) 1.6 Silver/Ounce 14.18 0.1 (2.5) (16.3) DJ Industrial 25,916.54 (0.3) (0.2) 4.8 Crude Oil (Brent)/Barrel (FM Future) 76.83 0.4 (0.8) 14.9 S&P 500 2,871.68 (0.2) (1.0) 7.4 Crude Oil (WTI)/Barrel (FM Future) 67.75 (0.0) (2.9) 12.1 NASDAQ 100 7,902.54 (0.3) (2.6) 14.5 Natural Gas (Henry Hub)/MMBtu 2.88 (1.7) (2.7) (18.6) STOXX 600 373.77 (0.5) (2.5) (7.6) LPG Propane (Arab Gulf)/Ton 105.00 0.7 1.0 7.4 DAX 11,959.63 (0.5) (3.6) (11.0) LPG Butane (Arab Gulf)/Ton 112.50 (0.4) 1.9 6.5 FTSE 100 7,277.70 (0.6) (2.3) (9.5) Euro 1.16 (0.6) (0.4) (3.8) CAC 40 5,252.22 (0.4) (3.1) (4.9) Yen 110.99 0.2 (0.0) (1.5) Nikkei 22,307.06 (1.0) (2.4) (0.6) GBP 1.29 (0.1) (0.3) (4.4) MSCI EM 1,022.98 0.5 (3.1) (11.7) CHF 1.03 (0.4) (0.0) 0.5 SHANGHAI SE Composite 2,702.30 0.1 (1.1) (22.5) AUD 0.71 (1.3) (1.1) (9.0) HANG SENG 26,973.47 (0.0) (3.3) (10.3) USD Index 95.37 0.4 0.2 3.5 BSE SENSEX 38,389.82 0.3 (2.2) (0.0) RUB 69.92 1.0 3.5 21.3 Bovespa# 76,416.01 0.0 (1.6) (20.2) BRL 0.25 (0.1) (0.1) (18.4) RTS 1,050.51 (0.4) (3.8) (9.0) 79.4 77.4 76.3