QNBFS Daily Market Report September 20, 2018

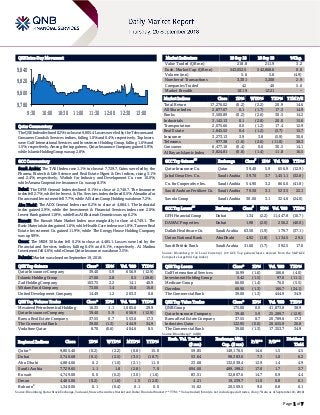

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 9,805.4. Losses were led by the Telecoms and Consumer Goods & Services indices, falling 1.0% and 0.4%, respectively. Top losers were Gulf International Services and Investment Holding Group, falling 1.6% and 1.5%, respectively. Among the top gainers, Qatar Insurance Company gained 5.9%, while Islamic Holding Group was up 2.8%. GCC Commentary Saudi Arabia: The TASI Index rose 1.1% to close at 7,729.7. Gains were led by the Pharma, Biotech & Life Science and Real Estate Mgmt & Dev indices, rising 3.1% and 2.4%, respectively. Wafrah for Industry and Development Co. rose 10.0%, while Amana Cooperative Insurance Co. was up 8.3%. Dubai: The DFM General Index declined 0.1% to close at 2,740.7. The Insurance index fell 2.7%, while the Invest. & Fin. Services index declined 0.5%. Almadina for Finance and Investment fell 7.7%, while Al Salam Group Holding was down 7.2%. Abu Dhabi: The ADX General Index rose 0.2% to close at 4,884.1. The Industrial index gained 2.9%, while the Investment & Financial Services index rose 2.0%. Invest Bank gained 11.9%, while Ras Al Khaimah Ceramics was up 6.2%. Kuwait: The Kuwait Main Market Index rose marginally to close at 4,749.1. The Basic Materials index gained 1.6%, while Health Care index rose 1.0%. Tameer Real Estate Investment Co. gained 11.9%, while The Energy House Holding Company was up 9.9%. Oman: The MSM 30 Index fell 0.2% to close at 4,485.1. Losses were led by the Financial and Services indices, falling 0.4% and 0.1%, respectively. Al Madina Investment fell 4.6%, while Oman Qatar Insurance was down 3.5%. Bahrain: Market was closed on September 19, 2018. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Company 39.40 5.9 656.9 (12.9) Islamic Holding Group 27.00 2.8 0.5 (28.0) Zad Holding Company 103.75 2.2 14.1 40.9 Widam Food Company 73.00 1.4 15.0 16.8 United Development Company 14.49 1.2 203.3 0.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.35 1.1 1,005.6 29.9 Qatar Insurance Company 39.40 5.9 656.9 (12.9) Barwa Real Estate Company 37.55 0.7 553.6 17.3 The Commercial Bank 39.00 (1.3) 444.9 34.9 Vodafone Qatar 8.70 (0.6) 404.6 8.5 Market Indicators 19 Sep 18 18 Sep 18 %Chg. Value Traded (QR mn) 218.8 211.9 3.2 Exch. Market Cap. (QR mn) 543,052.5 542,868.6 0.0 Volume (mn) 5.6 5.8 (4.9) Number of Transactions 3,301 3,208 2.9 Companies Traded 42 40 5.0 Market Breadth 18:19 12:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,276.02 (0.2) (2.2) 20.9 14.6 All Share Index 2,877.07 0.1 (1.7) 17.3 14.9 Banks 3,500.89 (0.2) (2.6) 30.5 14.2 Industrials 3,145.13 0.1 (2.0) 20.0 15.6 Transportation 2,075.66 0.0 (1.2) 17.4 12.9 Real Estate 1,845.52 0.4 (1.2) (3.7) 15.7 Insurance 3,273.13 3.9 3.8 (5.9) 30.6 Telecoms 977.38 (1.0) (2.6) (11.0) 38.3 Consumer 6,477.10 (0.4) 0.6 30.5 14.1 Al Rayan Islamic Index 3,824.81 (0.0) (1.4) 11.8 16.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Qatar Insurance Co. Qatar 39.40 5.9 656.9 (12.9) Jabal Omar Dev. Co. Saudi Arabia 39.70 3.7 1,451.1 (32.8) Co. for Cooperative Ins. Saudi Arabia 54.90 3.2 860.0 (41.8) Saudi Arabian Fertilizer Co. Saudi Arabia 79.50 3.1 523.5 22.1 Savola Group Saudi Arabia 30.00 3.1 324.6 (24.0) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% GFH Financial Group Dubai 1.34 (2.2) 11,447.8 (10.7) DAMAC Properties Dubai 1.98 (2.0) 256.2 (40.0) Dallah Healthcare Co. Saudi Arabia 63.50 (1.9) 179.7 (37.1) Union National Bank Abu Dhabi 4.92 (1.8) 1,134.5 29.5 Saudi British Bank Saudi Arabia 31.60 (1.7) 392.5 17.0 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf International Services 16.99 (1.6) 186.6 (4.0) Investment Holding Group 5.42 (1.5) 97.0 (11.1) Medicare Group 66.00 (1.4) 76.0 (5.5) Ooredoo 68.90 (1.3) 166.7 (24.1) The Commercial Bank 39.00 (1.3) 444.9 34.9 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 175.00 0.0 41,873.8 38.9 Qatar Insurance Company 39.40 5.9 25,289.7 (12.9) Barwa Real Estate Company 37.55 0.7 20,789.6 17.3 Industries Qatar 122.95 (0.0) 20,655.9 26.8 The Commercial Bank 39.00 (1.3) 17,353.7 34.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,805.40 (0.2) (2.2) (0.8) 15.0 59.85 149,176.5 14.6 1.5 4.5 Dubai 2,740.68 (0.1) (2.5) (3.5) (18.7) 53.64 98,383.6 7.3 1.0 6.2 Abu Dhabi 4,884.06 0.2 (1.0) (2.1) 11.0 23.68 132,038.4 12.9 1.4 4.9 Saudi Arabia 7,729.65 1.1 1.8 (2.8) 7.0 694.00 489,198.2 17.0 1.7 3.7 Kuwait 4,749.08 0.0 (0.2) (3.0) (1.6) 83.51 32,807.6 14.7 0.9 4.4 Oman 4,485.06 (0.2) (1.6) 1.5 (12.0) 4.21 19,239.7 11.0 0.8 6.1 Bahrain# 1,340.06 0.1 (0.4) 0.1 0.6 15.62 20,569.5 9.0 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of September 18, 2018) 9,780 9,800 9,820 9,840 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.2% to close at 9,805.4. The Telecoms and Consumer Goods & Services indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Gulf International Services and Investment Holding Group were the top losers, falling 1.6% and 1.5%, respectively. Among the top gainers, Qatar Insurance Company gained 5.9%, while Islamic Holding Group was up 2.8%. Volume of shares traded on Wednesday fell by 4.9% to 5.6mn from 5.8mn on Tuesday. Further, as compared to the 30-day moving average of 5.9mn, volume for the day was 6.5% lower. Mesaieed Petrochemical Holding Company and Qatar Insurance Company were the most active stocks, contributing 18.1% and 11.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/19 US Mortgage Bankers Association MBA Mortgage Applications 14-September 1.6% – -1.8% 09/19 UK UK Office for National Statistics CPI MoM August 0.7% 0.5% 0.0% 09/19 UK UK Office for National Statistics CPI YoY August 2.7% 2.4% 2.5% 09/19 UK UK Office for National Statistics CPI Core YoY August 2.1% 1.8% 1.9% 09/19 Japan Ministry of Finance Japan Trade Balance August -¥444.6bn -¥483.2bn -¥231.2bn 09/19 Japan Ministry of Finance Japan Trade Balance Adjusted August -¥190.4bn -¥144.1bn -¥45.6bn 09/19 Japan Ministry of Finance Japan Exports YoY August 6.6% 5.2% 3.9% 09/19 Japan Ministry of Finance Japan Imports YoY August 15.4% 14.5% 14.6% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QNB Group: Exports to drive Qatar current account surplus to 9% of GDP in 2018 – Buoyant exports will drive Qatar’s current account surplus to nearly 9% of the country’s GDP in 2018; an increase of around 5%, according to a recent QNB Group report. With oil prices expected to average $72 for a barrel and LNG demand growth in Asia remaining vibrant, hydrocarbon exports should sustain the country’s strong growth, QNB Group said in its ‘Qatar Economic Insight – September.’ On the import side, the expected pick-up in non-hydrocarbon GDP growth should see moderate growth resume, reflecting the twin drivers of steady population increase and continued investment spending. Government policies to promote self-sufficiency and food security will however help cap overall import growth, QNB Group stated. For 2019, the current account surplus is expected to narrow back towards 7% of GDP as slightly lower oil prices crimp export revenues and moderate import growth continues. Qatar’s current account returned to a surplus of 3.8% of GDP in 2017, on the back of higher energy prices, QNB Group stated. Exports saw a robust growth of 17.5%, reflecting the continued recovery in the oil price and booming LNG demand, particularly from China. Imports, meanwhile, were broadly flat for the year as a whole. (Gulf-Times.com) QNB Group revises up oil price forecast to $72 per barrel for 2018 – QNB Group has revised up its forecasts for average annual oil prices to $72 per barrel for 2018 from $69 per barrel and to $69 per barrel in 2019 from $66 per barrel. Both demand and supply factors, however, suggest a tilt towards lower prices in 2019 as global demand cools and infrastructure constraints on US shale supply fade. On the demand front, QNB Group analysts said, global growth is set to soften. The Eurozone, Japan and China have all shown signs of slower growth in recent months, while the US Federal Reserve looks set to continue its steady drip-feed of interest-rate rises until US GDP growth, currently booming at a 4% annualized pace, pulls back to a more sustainable 2% annualized clip. (Peninsula Qatar) Qatar appoints Mansour Al-Mahmoud as CEO of QIA – Qatar has appointed Mansour Ibrahim Al-Mahmoud as CEO of the Qatar Investment Authority (QIA) the state news agency stated. The fund's previous CEO, royal family member Sheikh Abdullah bin Mohamed bin Saud Al-Thani, was appointed minister of state, the Qatar News Agency quoted a royal decree as saying. (Zawya) Doha Bank being ‘conservative’ on dividends – Doha Bank is taking a conservative approach to dividend payouts amid a prolonged and unjust regional standoff, its CEO said. “Directors have given a cautious look to the dividend policy and they want to be conservative on the dividend payout as well,” R Seetharaman said. The bank expects its expansion in Qatar off setting a minor contraction in other Gulf Cooperation Council countries, the CEO said. The bank has shrunk its operations in the UAE to the “bare minimum,” Seetharaman said, as it seeks Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 25.01% 34.94% (21,727,956.74) Qatari Institutions 19.21% 30.41% (24,523,011.83) Qatari 44.22% 65.35% (46,250,968.57) GCC Individuals 0.76% 1.12% (791,356.33) GCC Institutions 1.02% 10.25% (20,181,976.00) GCC 1.78% 11.37% (20,973,332.33) Non-Qatari Individuals 8.05% 6.65% 3,069,322.88 Non-Qatari Institutions 45.95% 16.63% 64,154,978.02 Non-Qatari 54.00% 23.28% 67,224,300.90

- 3. Page 3 of 7 to adapt after neighboring Gulf states cut diplomatic relations and closed transport routes with the country in June last year. (Gulf-Times.com) Al Khaliji: Announcement on not pursuing disposal of subsidiary – Al Khalij Commercial Bank (Al Khaliji) has engaged in discussions with various bidders for the disposal of its subsidiary, Al Khaliji France S.A. The board of directors of the bank considered the terms of the various offers received to be not in the best interest of the bank’s stakeholders, and has therefore decided not to pursue the process any further. (QSE) QSE bets on new listings to boost liquidity – The Qatar Stock Exchange (QSE) is betting that more Initial Public Offerings (IPO), especially by family-owned companies, will improve liquidity. “IPOs are a market fuel,” the bourse’s CEO, Rashid bin Ali Al-Mansoori said. “Family-owned companies, which are mainly in the non-oil sector are playing a big role in our economy. Some of them are now being run by the third generation. We are encouraging and incentivizing them to come for a listing.” Qatar Pharma submitted papers to list and Rayyan Water is also in the process to sell shares, Al-Mansoori said. Food producing company Baladna already announced plans for an IPO, he said, adding that the listing of Qatalum, Qatar Petroleum’s aluminium smelter, “should be happening in the next few weeks.” (Gulf-Times.com) Qatar’s Industrial Production Index rises in July – Qatar’s Industrial Production index (IPI) rose to 107.7 points for the month of July, up by 2.2% compared to the previous month , and increased by 1.4% from a year ago. The index of Mining sector increased by 2.4% MoM, due to the increase in the quantities of ‘crude oil and natural gas’. When compared to the corresponding month of the previous year, the IPI of Mining increased by 2.1%. The Manufacturing sector recorded an increase of 1.2% in July compared to the previous month, because of the increase in production of five groups: ‘Manufacture of basic metals’ by 9.1%, ‘Manufacture of beverages’ by 7.4%, ‘Manufacture of Cement & other non- metallic mineral products’ by 6.7%, and ‘Manufacture of refined petroleum products’ and ‘Manufacture of rubber and plastics products’ by 1.6% each. (Peninsula Qatar) Qatar plant to produce 700hp, 1,000 kilometers range electric car – The first electric car from the proposed new venture from Qatar Quality Trading Company will roll out of the assembly line in 2022, it was announced. Named `Katara', the 700hp green car will have a range of 1,000 kilometers on a 10-minute single charge. The $9bn-project is backed by the production technology of ARM of Japan and is expected to come up near the New Industrial Area, company officials said. The plant will be spread over 6.5 square kilometers. Addressing a press conference, the promoters said once all approvals and clearances are received, the work of the state-of- the-art complex, containing six factories, with 12 production lines will start production as early as 2022. In his presentation ARM’s Managing Director, Takayuki Hirayama said the company will produce 500,000 cars in the first three years after commencing the production in 2022. "Our expectation is that approximately one million units would be launched by the end of 2035." (Gulf- Times.com) Qatar Airways raises stake in Cathay Pacific to 9.99% from 9.94% – Qatar Airways Group increased its stake in Cathay Pacific to 9.99%, the carrier stated. Qatar Airways’ stake in the Hong Kong carrier stood at 9.94% as of March 31, 2018 according to the carrier’s annual report. (Bloomberg) Hassad sets up firm to support local farmers – Hassad Food Company, the leading investment company in the food sector, has established a local marketing and agricultural services company in order to support the private agricultural sector and to contribute to self-sufficiency. This was announced by the Ministerial Group for the Encouragement and Participation of the Private Sector following the directives of HE the Prime Minister and Minister of Interior Sheikh Abdullah bin Nasser bin Khalifa Al-Thani. The new company will support local farmers by marketing their products, as well as providing various other agricultural services, in order to increase the quantity and quality of local production. (Gulf-Times.com) GE hosts ‘Qatar Power Technology Day’ – GE Power hosted ‘Qatar Power Technology Day’ in Doha, highlighting innovations that can help unlock further productivity, flexibility and operational efficiency for the country’s energy ecosystem in line with Qatar’s National Vision 2030. The event was hosted in collaboration with the US Embassy in Qatar and was attended by senior officials of the Ministry of Energy and Industry, Qatar General Electricity & Water Corporation (Kahramaa), Qatar Electricity and Water Company (QEWS), and other energy sector stakeholders. Underlining GE Power’s commitment to supporting Qatar’s power sector, the event featured in-depth discussions on trends and technologies driving the transformation of the energy ecosystem; advanced power generation technology offering greater operational flexibility and unprecedented levels of efficiency; battery storage solutions that can support the growth of renewable energy; and upgrade solutions that can help to enhance the efficiency of the existing installed base of power generation assets. (Peninsula Qatar) The Commercial Bank plans to expand ‘60 Seconds Remittance’ service to the UK, Europe – The Commercial Bank is planning to expand its ‘60 Seconds Remittance’ service to the UK and other European markets over the next few months, said the bank’s Executive General Manager (consumer banking) Amit Sah. A first-of-its-kind service in Qatar, it allows customers to send money almost instantly to their home country accounts in India, Pakistan, Sri Lanka, Nepal and The Philippines. The service has become “very popular”, which is evident from The Commercial Bank recording in excess of 1mn transactions since it was launched in June 2017. (Gulf-Times.com) International US housing starts rise on jump in multi-family construction – US homebuilding increased more than expected in August, a positive sign for the housing market, which has underperformed the broader economy amid rising interest rates for home loans. Housing starts rose 9.2% to a seasonally adjusted annual rate of 1.282mn units in August, according to the Commerce Department. Analyst polled by Reuters has expected an annual rate of 1.235mn units. The Commerce Department raised its estimate for starts in July to a 1.174mn- unit rate. US housing starts data can be volatile and subject to

- 4. Page 4 of 7 large revisions. Much of August’s gain was in the particularly volatile multi-family component, with starts on buildings with two or more units rising 29.3% to an annual rate of 406,000 units. Single-family homebuilding, which accounts for the largest share of the housing market, rose a more modest 1.9% to a rate of 876,000 units in August. (Reuters) US current account deficit decreases to 2.0% of GDP – The US current account deficit decreased in the second quarter as goods exports rose, the Commerce Department noted in a report that also showed US firms paid about $169bn in dividends from repatriated earnings. The Commerce Department stated the current account deficit, which measures the flow of goods, services and investments into and out of the country, narrowed by $20.3bn to $101.5bn, or 2.0% of national economic output, in the April-June period. The current account deficit amounted to the smallest share of national output since the third quarter of 2014. Analysts polled by Reuters had expected the current account deficit to narrow to $103.5bn. (Reuters) UK inflation unexpectedly leaps to 6-month high in August – British inflation jumped unexpectedly to a six-month high in August, pushed up by bigger-than-usual seasonal increases in sea and air fares and briefly sending sterling above $1.32 for the first time since July. Consumer price inflation rose to an annual rate of 2.7% in August from 2.5% in July, the Office for National Statistics stated - above all forecasts in a Reuters poll of economists that had pointed to a fall to 2.4%. The ONS also stated British house prices rose at the weakest annual rate in nearly five years, dragged down by the biggest drop in London house prices since 2009 - the latest sign of a slack housing market since the 2016 Brexit vote. British government bond prices fell and sterling rose sharply, but it dropped later on a report Prime Minister Theresa May will reject a new European Union plan to solve the Irish border problem around Brexit. The inflation figures are also likely to surprise Bank of England officials who had expected inflation to cool to 2.4% in August. (Reuters) Eurozone’s current account surplus narrows in July – The current account surplus of the 19 countries sharing the Euro narrowed to €21bn in July from €24bn in the previous month as the trade surplus also slipped, according to the European Central Bank. In the 12 months to July 2018, the surplus increased to 3.5% of the bloc’s gross domestic product from 3.3% in the preceding 12-month period, primarily on a rise in the surplus on services. The surplus, often criticized by the US administration as excessive, is expected to narrow to 2.8% of GDP next year, according to the ECB’s projections. (Reuters) China’s trade official sees shake-up of WTO developing country rules – The World Trade Organization (WTO) should bring in a new system to determine which countries are classed as “developing”, based on the size but also the structure of the economy, a senior official from China’s Commerce Ministry said. Currently WTO members can decide whether or not they are developing, entitling them to special treatment, which critics of the global body, including US President Donald Trump, say undermines the rigor of the international trade system. Zhang Jianping, Director of the ministry’s research center for regional economic cooperation, told a seminar at the Centre for Trade and Economic Integration in Geneva that the WTO was outdated. Among the reforms should be new rules on investment, in cooperation with the International Monetary Fund, he said. (Reuters) Regional Over $3.5bn spend to boost MENA’s film sector – More than $3.54bn investment in cinema screens across the Gulf is expected to help the region’s cinema industry expand manifold, according to organizers of the upcoming inaugural Mena Cinema Forum in Dubai. The Development and Investment Entertainment Company (DIEC), a wholly owned subsidiary of Saudi Arabia’s Public Investment Fund (PIF), intends to invest up to $2.7bn in entertainment projects across Saudi Arabia by 2030. Dubai-based developer Majid Al Futtaim, owner of VOX Cinemas, stated it will invest $540mn in 600 screens across Saudi Arabia, after making an announcement of $300mn in other GCC markets. (GulfBase.com) New fuel oil regulations for shipping industry to create winners and losers – The decision this year of the International Maritime Organization (IMO), a specialized agency of the United Nations, to introduce new rules aimed at reducing the cap on the sulfur content of marine fuel has an impact on the Gulf’s oil dynamics, Arab Petroleum Investments Corporation (APICORP), the multilateral development bank focused on the energy sector, stated in its latest research report. Under the IMO ruling, beginning 2020, ship owners will have to comply with a new 0.5% cap on the amount of sulfur in marine fuel, compared with the existing limit of 3.5% that was enforced back in 2012. The immediate impact will be on consumers of High Sulfur Fuel Oil (HSFO), namely shippers, but also on refineries that produce large quantities of HSFO. In the likely scenario that there will be more reliance on LSFO and marine diesel, the downstream sector will create winners and losers, with simple refineries at most risk. Refineries that failed to invest in cokers and other residue destroying equipment needed to contain HSFO production will find it difficult to market the fuel. (GulfBase.com) Tadawul announces the addition of the bonus shares and fluctuation limits for United Electronics Company – United Electronics Company’s EGM, which was held on September 18, 2018, approved the capital increase via bonus shares. Thus, the fluctuation limits on September 19, 2018 for United Electronics Company was based on share price of SR48.05. Furthermore, the Securities Depository Center will deposit the addition shares into the investor’s portfolios by September 24, 2018. (Tadawul) Pakistan’s Prime Minister expected to boost aid and trade from visit to Saudi Arabia – Faced with a financial crisis at home, Pakistan’s Prime Minister, Imran Khan’s first visit to Saudi Arabia could provide a much needed boost to the country’s political and economic confidence, according to experts. Khan is expected to seek $2-3bn in economic aid from the Kingdom, with an urgent need to inject around $9bn into the economy to stabilize external accounts largely inflated from high imports and insufficient exports. Despite holding great potential, bilateral trade between Pakistan and Saudi Arabia is only $3.4bn and largely in favor of Saudi Arabia. Pakistan imported $3.1bn worth of goods from the Kingdom during FY 2017-18,

- 5. Page 5 of 7 while exports stood at $316.7mn, acceding to the State Bank of Pakistan. (GulfBase.com) Alstom wins $848mn Riyadh Metro network contract – Alstom, as a part of Flow consortium, has been awarded a contract worth more than $848mn from Arriyadh Development Authority (ADA) to provide operation and maintenance services for lines 3, 4, 5 and 6 of the Riyadh Metro network over a period of 12 years including the mobilization period. The total value for the consortium comes to around $2.9bn. (GulfBase.com) Islamic Development Bank issues $1.3bn Sukuk – The Jeddah- based Islamic Development Bank raised $1.3bn in senior, unsecured Sukuk, according to a bank document seen by Reuters. Islamic Development Bank, a triple-A rated institution, is a regular issuer of international Sukuk, which it raises to fund its business activities and to promote the international Sukuk market by building a liquid yield curve. The new transaction has a five-year maturity and a profit rate of 3.389%, corresponding to a spread of 32 basis points over mid-swaps. The deal was marketed earlier this week with initial price guidance in the high 30 basis points over mid-swaps. CIMB, Citi, Dubai Islamic Bank, Gulf International Bank, HSBC, LBBW, Natixis, and Standard Chartered Bank arranged the bond sale. (Reuters) UAE’s central bank trims 2018 GDP growth forecast to 2.3% – The UAE’s central bank cut its forecast for economic growth this year after non-oil growth slowed slightly in the second quarter, according to a report released by the central bank. The central bank now expects the UAE’s inflation-adjusted gross domestic product to expand 2.3% in 2018, instead of the 2.7% which it had projected in its last report three months ago. The non-oil part of the economy grew 3.6% YoY in the second quarter, compared to a revised 3.8% in the first quarter, which was the fastest rate since the beginning of 2016. “Growth remained resilient in the second quarter of 2018, against the backdrop of firming oil prices, supportive fiscal policy and resilient tourism and related activities,” the central bank stated. Oil production shrank 1.7% YoY in the second quarter because of output reductions agreed by oil producers globally. The central bank now expects the non-oil economy to grow 3.6% in the whole of 2018 while oil GDP shrinks 0.5%; global oil producers have agreed to increase output in the second half of this year. (Reuters) UAE’s government spending reaches AED10.44bn in 1Q2018 – The value of spending of federal authorities increased to around AED10.44bn during 1Q2018, an increase of 17% compared to AED8.92bn during the same period in 2017, highlighting the country’s continuing overall development. According to a financial performance report on the country’s budget issued by the Ministry of Finance, the level of commitment to implementing the budget reached 100% during 1Q2018, with public sector spending accounting for the largest proportion of government spending during the first three months of the year, reaching around AED3.277bn, or 31.4% of total spending. Ministry statistics revealed spending on public services during 1Q2018 grew by 2.9% compared to 2017. (GulfBase.com) Gulftainer to operate US port of Wilmington – Gulftainer, the UAE-based port operator, stated it won a 50-year concession to operate and develop the Wilmington port in Delaware, US, with $600mn investment. Privately-owned Gulftainer currently operates the Canaveral Cargo Terminal in the Port of Canaveral, Florida and provides services to the US armed forces and the US space industry. Gulftainer plans to invest up to $600mn in the port, including $400mn on a new 1.2mn TEU (twenty-foot equivalent units) container facility at DuPont’s former Edgemoor site, which was acquired by the Diamond State Port Corporation in 2016. (Reuters) UAE leads in ICT Global Competitiveness Index – The UAE has achieved a new accomplishment in ICT global competitiveness by achieving advanced ranks in the Global Competitiveness Index, according to the results published recently by the International Telecommunication Union (ITU). The results showed that the UAE is ranked first globally in the rate of mobile-broadband subscriptions, in addition to ranking first in the rate of the population covered by a mobile-cellular network, as well as the population covered by at least a 3G mobile network. The UAE also ranked second globally in Mobile- cellular subscriptions. (GulfBase.com) Dubai’s non-oil foreign trade tops AED645bn in 1H2018 – Dubai’s non-oil foreign trade recorded AED645bn in 1H2018, an increase of AED5bn from 2017 figures. Dubai’s re-exports registered AED24bn increase and grew 14% to AED203bn, which reflects the robust and healthy position Dubai leads as a distinctive regional and international re-export hub, while imports touched AED377bn and exports totaled AED65bn, Emirates news agency Wam reported. (GulfBase.com) DP World raises over $3bn in four-part bond sale – DP World raised more than $3bn from the sale of Dollar, Euro and Pound- denominated bonds, as the Dubai-owned ports operator buys back Sukuk and expands. DP World’s sale included: $1bn of 10- year Sukuk at a yield of 4.848%, $1bn of 30-year bonds at a yield of 5.7%, $875mn of 8-year notes at a coupon of 2.375% and $460mn of 12-year bonds at a coupon of 4.25%. (Bloomberg) Abu Dhabi studies restructuring options for $1.2bn Etihad Airways-linked bonds – The government of Abu Dhabi is looking at proposals to restructure some $1.2bn of troubled bonds that were issued by Abu Dhabi state-owned carrier Etihad Airways in partnership with other airlines, according to sources. Etihad Airways issued $700mn of bonds through a special purpose vehicle (SPV) called Equity Alliance Partners (EAP) in 2015, and $500mn in 2016. Proceeds of the paper went to Etihad Airways and other airlines it partially owned at the time, including Alitalia and Air Berlin, which are now both insolvent. (Reuters) Al Ahli Bank of Kuwait issues $300mn perpetual bond – Al Ahli Bank of Kuwait issued $300mn in perpetual bonds, according to a bank document seen by Reuters. The Kuwaiti lender, rated ‘A2’ by Moody’s and ‘A+’ by Fitch, priced the Tier 1 paper on September 19 with a coupon rate of 7.25%. Citi, HSBC, and JPMorgan arranged the transaction. (Reuters) CBO issues treasury bills worth OMR30.40mn – The Central Bank of Oman (CBO) raised OMR30.40mn by way of allotting treasury bills. The treasury bills are for a maturity period of 28 days, from September 19, 2018 until October 17, 2018. The average accepted price reached 99.836 for every OMR100, and

- 6. Page 6 of 7 the minimum accepted price arrived at 99.835 per OMR100. The average discount rate and the average yield reached 2.13588% and 2.13939%, respectively. (GulfBase.com) Alizz Islamic inks pact with Takaful Oman – Reinforcing its position as one of Oman's most innovative Islamic banking institutions, Alizz Islamic Bank signed a Memorandum of Understanding (MoU) with Takaful Oman, the Sultanate’s first full-fledged Islamic insurance provider, to add Shari’ah- compliant insurance products (Takaful) to the bank's customer base. Alizz Islamic Bank has obtained approval from the Capital Market Authority and the Central Bank of Oman to launch Takaful products in the local market. As part of the cooperation between the two parties, Motor Takaful will be the first product to be launched. (GulfBase.com)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of September 18, 2018) Source: Bloomberg ( # Market closed on September 19, 2018) Source: Bloomberg (*$ adjusted returns) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&PPanArab S&PGCC 1.1% (0.2%) 0.0% 0.1% (0.2%) 0.2% (0.1%) (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain# Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,204.04 0.5 0.9 (7.6) MSCI World Index 2,177.74 0.3 0.5 3.5 Silver/Ounce 14.24 0.6 1.3 (15.9) DJ Industrial 26,405.76 0.6 1.0 6.8 Crude Oil (Brent)/Barrel (FM Future) 79.40 0.5 1.7 18.7 S&P 500 2,907.95 0.1 0.1 8.8 Crude Oil (WTI)/Barrel (FM Future) 71.12 1.8 3.1 17.7 NASDAQ 100 7,950.04 (0.1) (0.7) 15.2 Natural Gas (Henry Hub)/MMBtu 3.11 3.7 6.9 0.6 STOXX 600 379.98 0.5 1.0 (5.1) LPG Propane (Arab Gulf)/Ton 105.75 (0.7) 0.0 6.8 DAX 12,219.02 0.7 1.2 (8.1) LPG Butane (Arab Gulf)/Ton# 118.00 0.0 0.4 8.8 FTSE 100 7,331.12 0.6 1.1 (7.2) Euro 1.17 0.1 0.4 (2.8) CAC 40 5,393.74 0.8 1.2 (1.3) Yen 112.28 (0.1) 0.2 (0.4) Nikkei 23,672.52 1.2 2.3 4.3 GBP 1.31 (0.0) 0.6 (2.7) MSCI EM 1,031.07 1.1 0.2 (11.0) CHF 1.03 (0.3) 0.0 0.8 SHANGHAI SE Composite 2,730.85 1.5 2.1 (21.6) AUD 0.73 0.6 1.5 (7.0) HANG SENG 27,407.37 1.2 0.5 (8.8) USD Index 94.54 (0.1) (0.4) 2.6 BSE SENSEX 37,121.22 0.4 (2.8) (3.5) RUB 66.82 (0.8) (1.9) 16.0 Bovespa 78,168.66 0.5 5.4 (17.7) BRL 0.24 0.9 1.1 (19.7) RTS 1,134.10 1.0 3.6 (1.8) 79.5 77.1 76.1