QNBFS Daily Market Report October 7, 2018

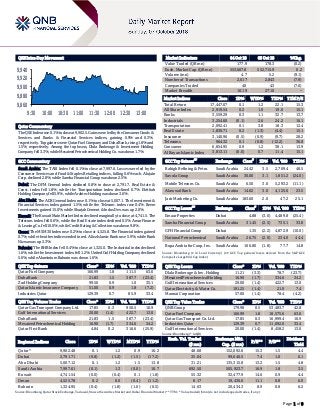

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.1% to close at 9,902.5. Gains were led by the Consumer Goods & Services and Banks & Financial Services indices, gaining 0.9% and 0.3%, respectively. Top gainers were Qatar Fuel Company and Doha Bank, rising 1.8% and 1.5%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 3.3%, while Mesaieed Petrochemical Holding Co. was down 1.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.1% to close at 7,997.6. Losses were led by the Consumer Services and Food & Staples Retailing indices, falling 0.6% each. Alujain Corp. declined 2.8%, while Samba Financial Group was down 2.5%. Dubai: The DFM General Index declined 0.8% to close at 2,791.7. Real Estate & Const. index fell 1.8%, while the Transportation index declined 0.7%. Ekttitab Holding Company fell 5.9%, while Arabtec Holding was down 3.6%. Abu Dhabi: The ADX General Index rose 0.1% to close at 5,007.1. The Investment & Financial Services index gained 1.5%, while the Telecom. index rose 0.4%. Reem Investments gained 15.0%, while Sharjah Cement & Indus Dev. was up 2.0%. Kuwait: The Kuwait Main Market Index declined marginally to close at 4,741.5. The Telecom. index fell 0.6%, while the Real Estate index declined 0.5%. Amar Finance & Leasing Co. fell 10.0%, while Credit Rating & Collection was down 9.8%. Oman: The MSM 30 Index rose 0.2% to close at 4,525.8. The Financial index gained 0.7%, while the other indices ended in red. Alizz Islamic Bank rose 5.9%, while Bank Nizwa was up 2.3%. Bahrain: The BHB Index fell 0.4% to close at 1,325.0. The Industrial index declined 1.6%, while the Investment index fell 1.2%. United Gulf Holding Company declined 5.6%, while Aluminium Bahrain was down 1.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 166.99 1.8 111.5 63.6 Doha Bank 21.83 1.5 387.7 (23.4) Zad Holding Company 99.50 0.9 1.0 35.1 Qatar Islamic Insurance Company 51.00 0.9 1.8 (7.2) Industries Qatar 129.39 0.7 85.9 33.4 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Company Ltd. 17.85 0.3 950.5 10.9 Gulf International Services 20.00 (1.4) 422.7 13.0 Doha Bank 21.83 1.5 387.7 (23.4) Mesaieed Petrochemical Holding 16.90 (1.7) 334.6 34.2 Qatar First Bank 4.84 0.2 316.6 (25.9) Market Indicators 04 Oct 18 03 Oct 18 %Chg. Value Traded (QR mn) 177.9 178.3 (0.2) Exch. Market Cap. (QR mn) 553,667.8 552,715.9 0.2 Volume (mn) 4.7 5.2 (9.1) Number of Transactions 2,617 2,843 (7.9) Companies Traded 40 43 (7.0) Market Breadth 16:19 27:10 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,447.07 0.1 1.2 22.1 15.3 All Share Index 2,919.54 0.2 1.0 19.0 15.1 Banks 3,559.29 0.3 1.1 32.7 13.7 Industrials 3,254.60 (0.1) 2.6 24.2 16.1 Transportation 2,092.41 0.1 3.8 18.3 12.4 Real Estate 1,830.71 0.2 (1.3) (4.4) 15.1 Insurance 3,140.96 (0.5) (0.9) (9.7) 28.2 Telecoms 964.32 0.1 (0.8) (12.2) 36.8 Consumer 6,854.95 0.9 1.2 38.1 13.9 Al Rayan Islamic Index 3,813.11 (0.0) 0.7 11.4 15.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Rabigh Refining & Petro. Saudi Arabia 24.42 3.5 2,709.4 48.5 Savola Group Saudi Arabia 30.00 3.1 1,851.2 (24.0) Mobile Telecom. Co. Saudi Arabia 6.50 3.0 5,293.2 (11.1) Alawwal Bank Saudi Arabia 14.62 3.0 4,125.6 23.5 Jarir Marketing Co. Saudi Arabia 183.60 2.0 47.2 25.1 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Emaar Properties Dubai 4.88 (3.0) 4,489.8 (25.4) Samba Financial Group Saudi Arabia 31.45 (2.5) 735.1 33.8 GFH Financial Group Dubai 1.35 (2.2) 4,872.9 (10.0) National Petrochemical Saudi Arabia 26.75 (2.0) 234.0 44.4 Bupa Arabia for Coop. Ins. Saudi Arabia 106.80 (1.8) 77.7 14.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding 11.21 (3.3) 78.7 (23.7) Mesaieed Petrochemical Holding 16.90 (1.7) 334.6 34.2 Gulf International Services 20.00 (1.4) 422.7 13.0 Qatar Electricity & Water Co. 191.25 (1.4) 21.9 7.4 Mannai Corporation 57.00 (1.4) 78.4 (4.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 179.98 0.5 53,483.7 42.8 Qatar Fuel Company 166.99 1.8 18,575.6 63.6 Qatar Gas Transport Co. Ltd. 17.85 0.3 16,999.4 10.9 Industries Qatar 129.39 0.7 11,092.0 33.4 Gulf International Services 20.00 (1.4) 8,458.2 13.0 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,902.48 0.1 1.2 0.9 16.2 48.68 152,092.6 15.3 1.5 4.4 Dubai 2,791.71 (0.8) (1.2) (1.5) (17.2) 35.04 99,646.5 7.4 1.0 6.1 Abu Dhabi 5,007.12 0.1 1.2 1.5 13.8 31.21 135,315.8 13.2 1.5 4.8 Saudi Arabia 7,997.61 (0.1) 1.3 (0.0) 10.7 692.50 505,923.7 16.9 1.8 3.5 Kuwait 4,741.54 (0.0) (0.4) 0.1 (1.8) 55.32 32,477.9 14.6 0.9 4.4 Oman 4,525.78 0.2 0.0 (0.4) (11.2) 8.17 19,436.6 11.1 0.8 6.0 Bahrain 1,324.95 (0.4) (1.8) (1.0) (0.5) 14.63 20,434.3 8.9 0.8 6.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,860 9,880 9,900 9,920 9,940 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QSE Index rose 0.1% to close at 9,902.5. The Consumer Goods & Services and Banks & Financial Services indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar Fuel Company and Doha Bank were the top gainers, rising 1.8% and 1.5%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 3.3%, while Mesaieed Petrochemical Holding Company was down 1.7%. Volume of shares traded on Thursday fell by 9.1% to 4.7mn from 5.2mn on Wednesday. Further, as compared to the 30-day moving average of 6.2mn, volume for the day was 23.8% lower. Qatar Gas Transport Company Limited and Gulf International Services were the most active stocks, contributing 20.2% and 9.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/04 US Department of Labor Initial Jobless Claims 29-September 207k 215k 215k 10/04 US Department of Labor Continuing Claims 22-September 1,650k 1,665k 1,663k 10/05 US US Census Bureau Trade Balance August -$53.2bn -$53.6bn -$50.0bn 10/05 France Ministry of the Economy Trade Balance August -5,632mn -4,848mn -3,427mn 10/05 Germany German Federal Statistical Office PPI MoM August 0.3% 0.2% 0.2% 10/05 Germany German Federal Statistical Office PPI YoY August 3.1% 2.9% 3.0% 10/04 India Markit Nikkei India PMI Services September 50.9 – 51.5 10/04 India Markit Nikkei India PMI Composite September 51.6 – 51.9 10/05 India Reserve Bank of India RBI Repurchase Rate 5-October 6.5% 6.8% 6.5% 10/05 India Reserve Bank of India RBI Reverse Repo Rate 5-October 6.3% 6.5% 6.3% 10/05 India Reserve Bank of India RBI Cash Reserve Ratio 5-October 4.0% 4.0% 4.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QNBK QNB Group 10-Oct-18 3 Due MARK Masraf Al Rayan 15-Oct-18 8 Due DBIS Dlala Brokerage & Investment Holding Company 15-Oct-18 8 Due MCGS Medicare Group 16-Oct-18 9 Due QNCD Qatar National Cement Company 17-Oct-18 10 Due QEWS Qatar Electricity & Water Company 17-Oct-18 10 Due QIBK Qatar Islamic Bank 17-Oct-18 10 Due DHBK Doha Bank 17-Oct-18 10 Due UDCD United Development Company 17-Oct-18 10 Due NLCS Alijarah Holding 18-Oct-18 11 Due QISI The Group Islamic Insurance Company 21-Oct-18 14 Due GWCS Gulf Warehousing Company 21-Oct-18 14 Due ABQK Ahli Bank 21-Oct-18 14 Due QIGD Qatari Investors Group 21-Oct-18 14 Due IHGS Islamic Holding Group 22-Oct-18 15 Due VFQS Vodafone Qatar 22-Oct-18 15 Due KCBK Al Khalij Commercial Bank 23-Oct-18 16 Due CBQK The Commercial Bank 23-Oct-18 16 Due QGMD Qatari German Company for Medical Devices 28-Oct-18 21 Due AKHI Al Khaleej Takaful Insurance Company 28-Oct-18 21 Due DOHI Doha Insurance Group 29-Oct-18 22 Due ERES Ezdan Holding Group 29-Oct-18 22 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 27.76% 44.71% (30,167,006.66) Qatari Institutions 15.79% 21.98% (11,023,410.64) Qatari 43.55% 66.69% (41,190,417.30) GCC Individuals 0.59% 0.84% (435,352.30) GCC Institutions 9.68% 3.55% 10,904,096.31 GCC 10.27% 4.39% 10,468,744.01 Non-Qatari Individuals 7.10% 10.12% (5,373,842.57) Non-Qatari Institutions 39.09% 18.80% 36,095,515.86 Non-Qatari 46.19% 28.92% 30,721,673.29

- 3. Page 3 of 9 News Qatar Moody’s upgrades Qatar’s banking sector outlook to ‘Stable’ – Credit rating agency, Moody’s Investors Service upgraded the outlook for Qatar’s banking system to ‘Stable’ from ‘Negative’, reflecting the resilience of the country’s economy and banking system to the ongoing regional dispute, as well as the ‘Stable’ outlook on the Government of Qatar’s ‘Aa3’ long-term issuer rating. Qatar has been able to rebalance the country’s economy following the regional dispute, which began in June 2017, and the high level of government spending on infrastructure in preparation for the FIFA World Cup in 2022 has been unaffected. Moody’s expects average real GDP growth of 2.8% during 2018-2022, up from 1.6% in 2017. “The Qatari economy has rebalanced as supply chain disruptions recovered rapidly following the blockade from other Gulf states and Egypt,” Moody’s Vice-President and Senior Credit Officer, Nitish Bhojnagarwala said. “Likewise, the banking system rebalanced its funding profile with the reduced liquidity from GCC sources offset by inflows from government and related entities,” Nitish Bhojnagarwala added. (Peninsula Qatar) Reduction in stocks’ face value to impact market positively – Qatar Stock Exchange’s move to lower stock’s face value of listed companies to QR1 from QR10 will have a positive impact on the stock market, according to experts. They stressed that it was important to raise awareness among investors in the stock market, whether inside or outside the country, on the goal and the nature of the new system. Dean of Qatar University’s College Of Business and Economics, Khalid Al Abdulqader said that the new system will have a very positive impact, especially that the Qatari economy is a very attractive and promising one. He added that there are many benefits to implementing the new system, most notably allowing a bigger number of small investors to gain access to shares, QNA reported. Al Abdulqader pointed out that there is a need to educate investors on the new system, as some could be led to believe that the value of their holdings will decrease, something that is not true. This is because the total number of shares held will increase, making up for the decline in per share value and leaving the total value of holdings unchanged. (Peninsula Qatar) QIGD appoints CEO for the group – Qatari Investors Group (QIGD) announced the appointment of Raja Victor Assili as CEO of the Group with effect from October 3, 2018. (QSE) MERS to disclose 3Q2018 financial statements on October 28 – Al Meera Consumer Goods Company (MERS) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 28, 2018. (QSE) QGMD to disclose 3Q2018 financial statements on October 28 – Qatari German Company for Medical Devices (QGMD) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 28, 2018. (QSE) VFQS to disclose 3Q2018 financial statements on October 22 – Vodafone Qatar (VFQS) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 22, 2018. (QSE) IHGS to disclose 3Q2018 financial statements on October 22 – Islamic Holding Group (IHGS) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 22, 2018. (QSE) MERS delegation visits Turkey to forge new business opportunities – A delegation from Al Meera Consumer Goods Company (MERS) has met with public and private sector officials in Turkey to enhance bilateral trade relations between the two countries. The delegation was led by MERS’ Deputy CEO, Salah Al-Hammadi, who held meetings with Istanbul and Samsun-based investors and businesses looking to expand in Qatar. Meetings were also held with government officials, including Samsun’s Governor, Osman Kaymak. The MERS delegation visited Happy Center and its Chairman, Ismail Altun, and CEO, Yavuz Altun, where they discussed strategic partnerships and ways to improve mutual cooperation. Al- Hammadi also graced the opening ceremony of Happy Center’s 135 th outlet. The delegation also met with the Chamber of Commerce of Istanbul, the third largest chamber in the world with about 420,000 members. Members of the delegation were welcomed by Vice Chairman Ahmet Uzair. During the meeting, the two sides discussed the possibility of developing a solid network of partners in Turkey based on the recommendation of the chamber. (Gulf-Times.com) Qatar Rail to purchase 35 additional trains for Metro – Qatar Railways Company (Qatar Rail) announced that it has signed an agreement to procure 35 additional trains for the Doha Metro, taking the total number of trains serving the project to 110. The additional trains will help increase the capacity of the Metro system, especially when Qatar hosts the 2022 FIFA World Cup that is expected to attract more than a million visitors during the tournament, Qatar Rail stated. The trains will also serve the future expansion of Doha Metro lines, which Qatar Rail intends to carry out after the implementation of Phase 1 of the Metro project. (Gulf-Times.com) Al Sada: Natural gas demand will grow significantly by 2030 – Minister of Energy and Industry HE Mohammed bin Saleh Al Sada affirmed that the demand for natural gas will achieve the highest rate of growth among other fossil fuels during the period between now and 2030. This came during HE Al Sada’s speech at the session held within the Russian Energy Week under the slogan ‘Sustainable Energy in a Changing World.’ HE Al Sada said, at the session titled ‘The Global Gas Market in 2030’, that the Liquefied Natural Gas (LNG) share of the gas market will grow at an average rate of 8% over the same period to equal the market share of pipeline gas by 2030. The Minister said that the growth in global demand for LNG will come mainly from Asia, while Europe is expected to face major challenges in the next phase of renewable energy sources. He added that the total demand for LNG will reach about 450mn tons annually by 2030, equivalent to more than 50% increase over 2017’s demand. (Peninsula Qatar) Manateq gives special focus to downstream SMEs – The Economic Zones Company-Qatar (Manateq) is offering special focus on small and medium-sized enterprises (SMEs) particularly those related to downstream industries such as aluminum, steel, and automotive sector, to accelerate the

- 4. Page 4 of 9 process of economic diversification. The efforts are part of the initiatives of Manateq, which is working in cooperation with other state and private agencies to diversify Qatar’s economy through the provision of world class infrastructures within strategically placed economic zones and logistics parks, which are being developed in line with the country’s long-term vision, said a top official of the company. The state-backed entity is overseeing the developments of several economic zones, and industrial and warehousing complexes across the country. It also works in close coordination with the recently established Free Zones Authority, attracting investors and SMEs from all over the world. (Peninsula Qatar) Qatar has ambitious plans to invest in oil & gas sector – The MENA region will see a number of critical energy projects pushed through over the next five years. Around $345bn has already been committed to projects under execution, while an additional $574bn worth of development is planned. The MENA energy industry investment outlook released by the Arab Petroleum Investments Corporation (Apicorp) at the just concluded 11 th Arab Energy Conference being held in Marrakech, Morocco, forecasts that with Qatar lifting the North Field moratorium, the country is poised for higher investments in gas development. “The majority of Qatar’s investments have come into fruition, and with the lifting of the moratorium recently, we expect higher investments in gas development as the country plans to double the size of its planned expansion, increasing LNG capacity to 100mn t/y by the end of the outlook or shortly after,” the Apicorp report, presented by its CEO Attiga Ali Attiga, noted. Qatar has ambitious plans to invest in further oil & gas development, particularly the redevelopment of the Bul Hanine, which is expected to more than double its existing capacity. Current committed investments in the energy sector amount to around $13bn. Among the projects coming on line within Apicorp’s outlook include the Barzan gas field. (Peninsula Qatar) QDC to meet 100% of Qatar’s detergent demand – Qatar Detergent Company (QDC) has recently launched a new fully- automated factory, giving it the potential to cater to 100% of Qatar’s laundry detergent requirements. The new facility also enables it to exponentially increase its capacity, and further improve the quality of its product, matching international quality standards. QDC has been operating in Qatar since 1978, and has always strived to provide high quality cleaning products that are affordable to a wide cross-section of customers, throughout the country. The vision is to make QDC one of the country’s’ most ‘valuable’ corporations through world class products, quality, and innovations. (Peninsula Qatar) Minister of Economy and Commerce holds talks with Argentine ministers – Minister of Economy and Commerce, HE Sheikh Ahmed bin Jassim bin Mohammed Al Thani, met in Buenos Aires with Minister of Foreign Affairs of the Argentine Republic, Jorge Marcelo Faurie, and Secretary for International Economic Relations, Horacio Reyser, in separate meetings. They discussed bilateral relations and the means to enhance them in all fields, particularly in the fields of electricity generation, infrastructure, transportation, and tourism. They also discussed ways to activate the agreements signed between the two countries. They also followed up on the outcomes of the Qatari-Argentinean ministerial committee’s meeting that took place in December 2017. Trade volume between the State of Qatar and the Argentine Republic was QR1.2bn. The two sides have a number of bilateral agreements, including on economic, commerce, and technical cooperation. They also have agreements to encourage and protect investments, as well as to avoid double taxation. The two sides also have many Memorandums of Understanding in the sports, tourism, scientific research, and cultural fields. (Peninsula Qatar) Gulf Labs launch new jack-up drilling platform ‘Ammonite’ – Local Qatari geotechnical and material testing laboratory, Gulf Laboratories Company, has recently added the new jack-up drilling platform ‘Ammonite’ to its fleet of nearshore drilling equipment. “The addition of this larger jack-up, together with our existing jack-up ‘Nautilus’, now allows us to carry out geotechnical drilling works from the inter-tidal area out to water depths of 20 meters,” General Manager Andrew Slate said. Gulf Laboratories has carried out numerous nearshore geotechnical investigations in Qatar, including works for the Hamad International Airport and Hamad Port, as well as other ports, harbor, and marine reclamation and development schemes. Fabricated in Qatar, the fully-registered vessel is available for nearshore ground investigation projects or for charter as a work barge. (Gulf-Times.com) International US trade deficit jumps to six-month high in August – US trade deficit increased to a six-month high in August as exports dropped further amid declining soybean shipments and imports hit a record high, suggesting that trade could weigh on economic growth in the third quarter. The Commerce Department stated the trade gap increased 6.4% to $53.2bn, widening for a third straight month. Data for July was revised to show a trade deficit of $50.0bn, instead of the previously reported $50.1bn. The politically sensitive goods trade deficit with China increased 4.7% to a record high of $38.6bn. Economists polled by Reuters had forecasted the overall trade deficit swelling to $53.5bn in August. The trade gap continues to widen despite the Trump administration’s ‘America First’ policies, which have led to a bitter trade war between the US and China. (Reuters) US job growth cools; unemployment rate drops to 3.7% – US job growth slowed sharply in September, likely as Hurricane Florence depressed restaurant and retail payrolls, but the unemployment rate fell to near a 49-year low of 3.7%, pointing to a further tightening in labor market conditions. The Labor Department’s closely watched monthly employment report also showed a steady rise in wages, suggesting moderate inflation pressures, which could ease concerns about the economy overheating and keep the Federal Reserve on a path of gradual interest rate increases. Nonfarm payrolls increased by 134,000 jobs last month, the fewest in a year, as the retail and leisure and hospitality sectors shed employment. Data for July and August were revised to show 87,000 more jobs added than previously reported. The economy needs to create roughly 120,000 jobs per month to keep up with growth in the working- age population. Economists polled by Reuters had forecasted payrolls increasing by 185,000 jobs in September and the

- 5. Page 5 of 9 unemployment rate falling one-tenth of a percentage point to 3.8%. (Reuters) QNB Group: Strong US Dollar likely as Fed set to carry on with rate hike – A strong US Dollar is likely to stay for the foreseeable future as the Federal Reserve (Fed) carries on with rate hiking, QNB Group has stated in an economic commentary. The US Federal Reserve duly hiked short-term interest rates by 25bps for the third time this year, following its September 26-27 meeting. The decision comes despite the continued escalation of trade tensions between the US and China. With the decision to lift interest rates for an eight time since December 2016 to 2.0-2.5% a foregone conclusion, the Fed continued confident about the need for further tightening, probably as soon as December. Both the policy statement accompanying the decision and Fed Chair Powell’s remarks in the post-meeting press conference signaled that the Fed remains unusually bullish in its assessment of the economy and for the time being sees little impact on the economy from trade tensions, QNB Group stated. (Gulf-Times.Com) UK’s productivity grows at fastest rate since late 2016 – British workers’ productivity grew at the fastest pace since late 2016 in the three months to June and labor cost growth slowed, suggesting the home-grown inflation pressures that the Bank of England (BoE) is watching closely remain muted. Output per hour rose by 1.4% compared with a year earlier, the biggest increase since the three months to December 2016, albeit a fraction below an initial estimate of 1.5%, official data showed. Britain’s chronically weak productivity has limited pay growth, but its potential to push up inflation is why the BoE has started to raise interest rates, despite sluggishness in the overall economy ahead of Brexit. Workers in Britain are about 20% less productive than their rivals in the US, Germany and France and productivity has barely grown since the financial crisis, in contrast to growth of more than 2% a year before. (Reuters) Germany reportedly lowers growth forecasts for 2018, 2019 – The German government has revised down its economic growth forecasts for this year and next, according to a source. The source said the government expects the economy to grow by around 1.7% to 1.8% this year, down from a previous estimate of 2.3%. It expects an expansion of around 2.0% in 2019, lower than the 2.1% forecast in April. (Reuters) French trade deficit widens more than expected in August – France’s trade deficit widened more than expected in August as aircraft exports fell and the energy bill rose, seasonally adjusted data published by the customs office showed. France recorded a trade deficit of €5.6bn ($6.45bn), after €3.4bn in July. A Reuters poll of seven economists had forecasted on average a shortfall of €4.5bn. The customs office stated that imports rose 4.9% in August from July due mainly to an increase in France’s energy bill, while exports dipped 0.1% as Airbus shipments pulled back after a strong July. Separately, the central bank said the current account showed a deficit of €1.6bn in August after a surplus of €300mn in July owing to the larger trade deficit and a smaller services surplus. (Reuters) Japan’s household spending posts biggest rise in three years, signals steady recovery – Japan’s household spending jumped in August at the fastest annual pace in three years as bigger bonuses boosted consumption, suggesting that robust domestic demand could help offset the ill effects of escalating trade frictions. Upbeat data, published on October 5, may moderate some analysts’ fears that the world’s third largest economy may slow or even contract in the July-September quarter, when Japan was hit by heat waves, heavy rain, typhoons and an earthquake. But a separate central bank survey showed households were gloomier about the economy than three months ago, highlighting the fragile nature of Japan’s recovery. Household spending rose 2.8% in August from a year earlier, confounding market expectations for 0.1% fall and increasing at its fastest since August 2015, government data showed. It was the second straight month of gains following a 0.1% rise in July. (Reuters) China's September new loans seen rising as policymakers seek to underpin growth – Growth in China’s new bank loans likely rebounded modestly in September after easing the two previous months, as the government sought to ensure sufficient liquidity, while keeping debt risks in check, a Reuters poll showed. Chinese banks were estimated to have issued ¥1.35tn ($196.56bn) in net new Yuan loans in September, compared to ¥1.28tn in August, according to the poll that surveyed 26 analysts. The People’s Bank of China (PBOC) has scrambled to boost liquidity and support lending to businesses in response to the downward pressures on economic growth as trade disputes with the US have worsened. Average interest rates faced by companies have edged down since April, as a more generous liquidity policy from the PBOC has lowered market rates, even as benchmark lending rates remained unchanged, Oxford Economics stated in a report. (Reuters) Regional MENA’s growth set for modest rebound in 2018, new jobs vital – Growth in the Middle East and North Africa (MENA) region is projected to rebound to an average of 2% in 2018, up from an average 1.4% last year, according to a recent World Bank’s report. The modest rebound in growth is driven mostly by the recent rise in oil prices, which has benefitted the region’s oil exporters while putting pressure on the budgets of oil importers. The rebound also reflects the impact of modest reforms and stabilization efforts undertaken in some countries in the region. The slow pace of growth, however, will not generate enough jobs for the region’s large youth population. New drivers of growth are needed to reach the level of job creation required. (GulfBase.com) Saudi Arabia’s Crown Prince says “we did our job” on replacing Iranian oil – Saudi Arabia’s Crown Prince, Mohammed bin Salman said the Kingdom has met its promise to US to make up for Iranian crude oil supplies lost through US sanctions. “The request that America made to Saudi Arabia and other OPEC countries is to be sure that if there is any loss of supply from Iran, that we will supply that. And that happened. Iran reduced their exports by 700,000 barrels a day, if I’m not mistaken. And Saudi Arabia and OPEC and non-OPEC countries, they’ve produced 1.5mn barrels a day. So we export as much as 2 barrels for any barrel that disappeared from Iran recently. So we did our job and more,” the Crown Prince said. (Reuters) S&P affirms Saudi Arabia’s ‘A-/A-2’ ratings; ‘Stable’ outlook – S&P Global Ratings (S&P) affirmed its ‘A-/A-2’ unsolicited long- and short-term foreign and local currency sovereign credit

- 6. Page 6 of 9 ratings on Saudi Arabia. The outlook is ‘Stable’. The ‘Stable’ outlook is based on S&P’s expectation that moderate economic growth will continue through 2021, supported by rising government investment. At the same time, S&P expects that the Saudi Arabian authorities will continue to take steps to consolidate public finances over the next two years, while maintaining the government's large stocks of liquid external assets. S&P could raise the ratings if Saudi Arabia's economic growth prospects improved markedly beyond its current assumptions. The ratings on Saudi Arabia are supported by its strong external and fiscal stock positions, which S&P expects it will maintain despite ongoing central government deficits. (Bloomberg) Fitch affirms Saudi Electricity Company at ‘A’; ‘Stable’ outlook – Fitch Ratings (Fitch) affirmed Saudi Electricity Company's long-term issuer default rating (IDR) and senior unsecured rating at ‘A’. The outlook on the long-term IDR is ‘Stable’. The affirmation reflects the continued strength of Saudi Electricity Company's links with the Kingdom of Saudi Arabia under Government-Related Entities (GRE) rating criteria. (Bloomberg) Saudi Arabia to invest $20bn in spare oil production capacity – Saudi Arabia will invest $20bn in the next few years to maintain and possibly expand its spare oil production capacity, according to Saudi Arabia’s Energy Minister, Khalid al-Falih. Saudi Arabia is the only oil producer with significant spare capacity on hand to supply the market if needed. The Kingdom has a maximum sustainable capacity of 12mn barrels per day (bpd). Al-Falih said the country had not decided yet whether it wanted to take its capacity up to 13mn bpd or keep it at current levels. The Energy Minister has repeatedly called on other oil producers to invest in capacity-building to avoid a supply shock and spike in oil prices. (Reuters) Saudi Arabia doubles SoftBank bet with extra $45bn – Saudi Arabia is preparing to double-down on its bet that SoftBank’s CEO Masayoshi Son can pick the technology giants of the future. The country’s sovereign fund will make another $45bn investment in Son’s second massive Vision Fund. The Public Investment Fund (PIF) is set to make the investment as it looks for ways to deploy $170bn windfall it’s expecting over the next three-to-four years. That money would come from the sale of a stake in Saudi Basic Industries Corp. and the initial public offering of Saudi Aramco, according to Saudi Arabia’s Crown Prince and PIF’s Chairman, Mohammed bin Salman. (Bloomberg) Saudi British Bank secures binding deal for $5bn acquisition of Alawwal Bank – Saudi British Bank and smaller rival Alawwal Bank are merging to create Saudi Arabia’s third-biggest lender with a market capitalization of about $17.2bn. The deal values the smaller Alawwal Bank, partly owned by a consortium including Royal Bank of Scotland, at $5bn, in the largest Saudi Arabian banking merger and acquisition deal. Alawwal Bank’s assets and liabilities will be transferred to Saudi British Bank, partly owned by HSBC Holdings. (Reuters) Sipchem and Sahara plan SR8.25bn petchem merger – Saudi International Petrochemical Company (Sipchem) signed a non- binding agreement to buy Sahara Petrochemicals Company (Sahara) in a deal valued at SR8.25bn four years after merger talks stalled. Sipchem will make an offer to buy all of Sahara's shares and each Sahara shareholder will receive 0.8356 new Sipchem shares. “The merger would help in increasing scale and resilience in the evolving petrochemicals sector, both in the Kingdom and internationally," the companies stated. (GulfBase.com) Crown Prince: Saudi Arabia’s sovereign wealth fund will surpass $600bn target by 2020 – Saudi Arabia’s Crown Prince, Mohammed bin Salman said the Kingdom’s main sovereign wealth fund (PIF) will surpass its target of increasing its assets to $600bn by 2020, as part of a plan to reduce the economy’s dependence on oil. “We are now above $300bn, we’re getting close to $400bn. Our target in 2020 is around $600bn. I believe we will surpass that target in 2020,” the Crown Prince said. The fund, with more than 50% of its investments located in Saudi Arabia, will be investing in more places next year. Further he added his country will privatize more than 20 companies in 2019, helping the government’s strategy to diversify revenues away from oil. Moreover, the first town in Saudi Arabia’s planned $500bn business zone called NEOM will be ready in 2019 or 2020, with the entire site completed by 2025, the Crown Prince said. (Reuters) Saudi Aramco agrees to invest in Pakistan's new oil refinery – Saudi Aramco agreed in principle to invest in an oil refinery in Pakistan, Saudi Arabia-owned Al Arabiya television stated, without providing further details. State-owned Pakistan State Oil will partner with Saudi Aramco in a new oil refinery in Pakistan’s Chinese-funded deep-water port of Gwadar, Pakistan’s Petroleum Minister, Ghulam Sarwar Khan said. (Reuters) Saudi Arabia’s Crown Prince insists on Saudi Aramco IPO by 2021 – Saudi Arabia’s Crown Prince insisted the stalled plan to sell shares in Saudi Aramco will go ahead, promising an initial public offering (IPO) by 2021 and sticking to his ambitious view the state-run company is worth $2tn or more. (Bloomberg) Consultancy bids for $4bn Bahrain-Saudi Arabia causeway soon – Consultancy bids for the King Hamad Causeway, a 25- km-long strategic artery linking Bahrain with Saudi Arabia, to be built at an investment of $4bn, will be issued later this year, while the main construction work will be tendered by the end of 2020. The new causeway, which is set to run parallel to the existing King Fahad Causeway, will carry passenger trains, freight trains and vehicles, reported BNA. (GulfBase.com) Saudi Arabia sees deal with Kuwait to restart shared oil fields soon – Saudi Arabia’s Crown Prince said he’s getting close to striking a deal with Kuwait about two jointly owned fields that can produce half a million barrels a day of crude. “We believe that we are almost close to having something with Kuwait,” the Crown Prince, Mohammed bin Salman, who met with Kuwait’s Emir Sheikh Sabah al-Ahmed al-Sabah, said in an interview. (Gulf-Times.com) UAE eyes investment law to attract expatriates – As UAE developers unveiled another raft of projects at Cityscape Global this week, a legal expert said more of the new homes will be snapped up by expatriates encouraged to stay longer in the country by changes to company ownership and visa rules. Plans to introduce an investment law allowing 100% foreign ownership this year, as well as a new 10-year visa for international investors and talented professionals were

- 7. Page 7 of 9 announced by the UAE cabinet in May. Partner at STA Law Firm, Zisha Rizvi, said, “There is a growing interest both from investors around the world and expatriate professionals in many sectors who are anxiously awaiting the government’s draft regulations. One thing that is certain is that the new visa rules will change the trend for the UAE’s traditionally transient expatriate population to simply come and go. They’re saying that they will be far more inclined to stay, contribute to the economy on a long-term basis, and invest in property.” (GulfBase.com) UAE building massive oil-storage facility – The UAE started building a giant oil-storage facility that will be able to hold 42mn barrels in a series of underground caverns, the Daily Telegraph reported. The Mandous facility, to be located in the Emirate of Fujairah, is expected to provide a buffer during periods of supply disruptions. South Korea’s SK Engineering & Construction Co. was awarded $1.8bn contract for the work late last year, the paper stated, adding that there was no public contract-signing ceremony. It didn’t mention an expected date of completion. (Bloomberg) Gulf Islamic Investments to hold significant stake in Mumzworld – Gulf Islamic Investments announced a major investment into the booming e-commerce sector with the successful closing of an extended Series B Equity Funding round in Mumzworld. Being the leading e-commerce vertical player in its sector in the Middle East, Mumzworld specializes in products related to Mothers, Babies and Children. This investment makes Gulf Islamic Investments the largest shareholder in Mumzworld. (GulfBase.com) Shuaa Capital executes share purchase scheme after approval – Shuaa Capital stated it received a regulatory approval from Capital Markets Authority in Kuwait and has executed a voluntary acquisition offer of 128mn shares of Amwal International Investments (Amwal). Shuaa Capital now owns 87% of Amwal. (GulfBase.com) Dubai tourism strategy targets 25mn visitors by 2025 – Dubai has approved an ambitious tourism strategy to attract 21mn to 23mn tourists by 2022 and 25mn visitors by 2025. This is a part of a strategy to strengthen Dubai’s position as a favored destination and the most visited city in the world. The strategy was approved during a meeting of the Dubai Executive Council (DEC) chaired by Dubai’s Crown Prince and Chairman of DEC, Shaikh Hamdan bin Mohammad bin Rashid Al Maktoum. The strategy focuses on ensuring that Dubai is not impacted by fundamental changes in the future, and to be a leader when it comes to changes in the tourism sector. It also will seek to boost growth in major tourist exporting markets and diversifying sources from markets with high potential. (GulfBase.com) Dubai says FDI rose 26% in first half versus year ago – Foreign direct investment (FDI) in Dubai rose 26% in 1H2018 compared with the same period last year, the government stated. The second-largest of the UAE federation received AED17.76bn in FDI in the first half of the year. (Reuters) Dubai awards AED630mn road contracts ahead of Expo 2020 – Dubai’s Road and Transport Authority stated it has awarded construction contracts for roads, tunnels and bridges worth AED630mn as part of the city’s infrastructure development plan ahead of the Expo 2020 world fair it is hosting in two years. (Reuters) Dubai Aerospace Enterprise increases existing loan deal to $800mn – State-owned aircraft lessor, Dubai Aerospace Enterprise (DAE) stated it had increased an existing four-year loan deal to $800mn. DAE stated in May it had signed $480mn loan, which included both conventional and Islamic finance tranches, and has a so-called accordion facility allowing it to be increased to up to $800mn. Al Ahli Bank of Kuwait coordinated the latest loan deal and was also the lead arranger and joint bookrunner together with First Abu Dhabi Bank, while Noor Bank joined the deal as lead arranger. (Reuters) Kuwait fund, Huawei sign deal to encourage industry – Kuwait National Fund for Small and Medium Enterprise Development (SMEs) signed a memorandum of understanding (MoU) with Huawei, which aims to encourage and develop small and medium enterprises. National SMEs fund stated that the MoU is designed to boost development of small and medium establishments, their competitive capacities in Kuwait, in addition to enhancing companies’ advanced services in information technology and communications, as part of Kuwait 2035 vision. (GulfBase.com) Alizz Islamic Bank, Oman Arab Bank sign MoU for potential merger – Alizz Islamic Bank and Oman Arab Bank signed MoU for their potential merger which will result in the formation of a new financial entity, according to Alizz Islamic Bank. Alizz Islamic Bank will continue operating as a dedicated Islamic banking franchise of the merged entity, to maintain management autonomy. Lenders have in-principal approval from regulatory bodies. “As we are only at the early stages of the proposed merger and due to confidentiality obligations, only limited information can be disclosed,” the bank stated. (Bloomberg) ODB funds 4,520 projects worth OMR29mn – The Oman Development Bank (ODB) announced that it has funded 4,520 projects in the agriculture and livestock sector between January 2014 and August 2018, which was 19% of the total projects financed by the bank during the same period. It was valued at OMR29.06mn. (GulfBase.com) Bahrain promised $10bn of support from Gulf neighbors – Saudi Arabia, Kuwait and the UAE have agreed to give Bahrain $10bn to support the country’s funding requirements as it embarks on a fiscal program aimed at eliminating its budget deficit by 2022. Bahrain’s finances have been hit hard by a slump in oil prices in 2014 and help from its neighbors is needed to prevent Bahrain’s rising public debt from triggering a financial crisis. It also makes sense economically and politically for the three wealthy Gulf states, which are diplomatic allies of Bahrain. Any collapse of Bahrain’s currency or a potential credit crunch could undermine confidence throughout the region. (Reuters) Bahrain’s four new laws to help investment push – Bahrain has issued four new laws covering data protection, competition, bankruptcy and health insurance as part of reforms that will enhance the Kingdom’s investment ecosystem, officials said. The laws, officially issued by HM King Hamad bin Isa Al Khalifa, address a range of issues and will have a particularly strong impact on the Kingdom’s economy and its growing

- 8. Page 8 of 9 startup ecosystem, a statement from Bahrain’s Economic Development Board stated. (GulfBase.com) Gulf International Bank decides not to pursue Reg S USD bond sale – Gulf International Bank decided not to pursue a Reg S USD bond issue at the current time. Gulf International Bank is stated to continue with other funding opportunities at more favorable levels. Gulf International Bank is rated ‘BBB+’ by Fitch and ‘Baa1’ by Moody’s, and 97.2% indirectly owned by the Government of Saudi Arabia through the Public Investment Fund. (Bloomberg)

- 9. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns, # Market closed on October 5, 2018) 45.0 70.0 95.0 120.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&P Pan Arab S&P GCC (0.1%) 0.1% (0.0%) (0.4%) 0.2% 0.1% (0.8%)(1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,202.95 0.2 0.9 (7.7) MSCI World Index 2,151.42 (0.6) (1.5) 2.3 Silver/Ounce 14.65 0.4 (0.3) (13.5) DJ Industrial 26,447.05 (0.7) (0.0) 7.0 Crude Oil (Brent)/Barrel (FM Future) 84.16 (0.5) 1.7 25.9 S&P 500 2,885.57 (0.6) (1.0) 7.9 Crude Oil (WTI)/Barrel (FM Future) 74.34 0.0 1.5 23.0 NASDAQ 100 7,788.45 (1.2) (3.2) 12.8 Natural Gas (Henry Hub)/MMBtu 3.28 (3.2) 7.7 (7.3) STOXX 600 376.41 (0.8) (2.6) (7.4) LPG Propane (Arab Gulf)/Ton 104.00 1.0 (3.7) 6.4 DAX 12,111.90 (1.0) (2.0) (10.2) LPG Butane (Arab Gulf)/Ton 123.75 (0.4) (4.1) 17.2 FTSE 100 7,318.54 (0.7) (2.2) (7.8) Euro 1.15 0.1 (0.7) (4.0) CAC 40 5,359.36 (0.9) (3.3) (3.4) Yen 113.72 (0.2) 0.0 0.9 Nikkei 23,783.72 (0.7) (1.5) 3.5 GBP 1.31 0.8 0.7 (2.9) MSCI EM 1,000.76 (1.0) (4.5) (13.6) CHF 1.01 (0.0) (1.0) (1.8) SHANGHAI SE Composite# 2,821.35 0.0 0.0 (19.2) AUD 0.71 (0.3) (2.4) (9.7) HANG SENG 26,572.57 (0.2) (4.5) (11.5) USD Index 95.62 (0.1) 0.5 3.8 BSE SENSEX 34,376.99 (2.7) (7.2) (13.1) RUB 66.60 (0.6) 1.6 15.6 Bovespa 82,321.52 0.6 7.6 (8.1) BRL 0.26 0.8 5.3 (13.8) RTS 1,159.33 (0.1) (2.7) 0.4 76.5 74.3 72.3