QNBFS Daily Market Report November 17, 2016

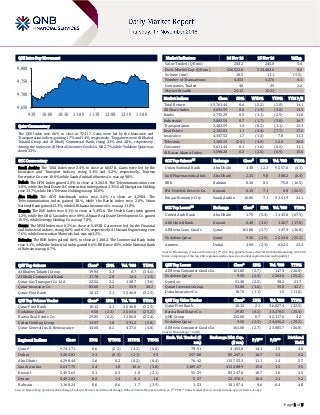

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.6% to close at 9,741.7. Gains were led by the Insurance and Transportation indices, gaining 1.7% and 1.4%, respectively. Top gainers were Al Khaleej Takaful Group and Al Khalij Commercial Bank, rising 3.3% and 2.8%, respectively. Among the top losers, Al Meera Consumer Goods Co. fell 2.7%, while Vodafone Qatar was down 2.5%. GCC Commentary Saudi Arabia: The TASI Index rose 2.4% to close at 6,647.8. Gains were led by the Insurance and Transport indices, rising 3.4% and 3.2%, respectively. Tourism Enterprise Co. rose 10.0%, while Saudi Arabia Refineries Co. was up 9.8%. Dubai: The DFM Index gained 2.0% to close at 3,262.8. The Telecommunication rose 3.8%, while the Real Estate & Construction index gained 2.3%. Gulf Navigation Holding rose 13.7%, while Hits Telecom Holding was up 10.0%. Abu Dhabi: The ADX benchmark index rose 2.6% to close at 4,290.4. The Telecommunication index gained 3.8%, while the Banks index rose 2.8%. Union National Bank gained 12.3%, while Al Khazna Insurance Co. was up 11.8%. Kuwait: The KSE Index rose 0.1% to close at 5,495.6. The Health Care index gained 1.2%, while the Oil & Gas index rose 0.9%. Abyaar Real Estate Development Co. gained 10.5%, while Senergy Holding Co. was up 7.8%. Oman: The MSM Index rose 0.2% to close at 5,493.8. Gains were led by the Financial and Industrial indices, rising 0.4% and 0.1%, respectively. Al Hassan Engineering rose 7.6%, while Construction Materials Ind. was up 3.2%. Bahrain: The BHB Index gained 0.6% to close at 1,168.2. The Commercial Bank index rose 1.1%, while the Industrial index gained 0.6%. BBK rose 8.3%, while National Bank of Bahrain was up 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 19.94 3.3 0.7 (34.6) Al Khalij Commercial Bank 17.70 2.8 12.4 (1.5) Qatar Gas Transport Co. Ltd. 22.52 2.2 138.7 (3.6) Qatar Insurance Co. 83.60 2.2 53.9 20.2 Qatar First Bank 10.12 2.1 3,546.8 (32.5) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 10.12 2.1 3,546.8 (32.5) Vodafone Qatar 9.50 (2.5) 2,563.6 (25.2) Barwa Real Estate Co. 29.85 (0.2) 1,106.8 (25.4) Ezdan Holding Group 14.97 1.8 591.2 (5.8) Qatar General Ins. & Reinsurance 44.60 0.2 437.6 (4.0) Market Indicators 16 Nov 16 15 Nov 16 %Chg. Value Traded (QR mn) 258.2 245.0 5.4 Exch. Market Cap. (QR mn) 526,522.0 523,482.6 0.6 Volume (mn) 10.5 11.1 (5.5) Number of Transactions 4,453 4,276 4.1 Companies Traded 40 39 2.6 Market Breadth 24:12 15:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,761.44 0.6 (2.2) (2.8) 14.1 All Share Index 2,692.59 0.6 (1.9) (3.0) 13.3 Banks 2,735.29 0.5 (1.1) (2.5) 11.8 Industrials 3,002.54 0.7 (1.7) (5.8) 16.7 Transportation 2,403.59 1.4 (0.2) (1.1) 12.3 Real Estate 2,152.03 1.1 (4.4) (7.7) 17.6 Insurance 4,347.52 1.7 (1.4) 7.8 11.3 Telecoms 1,105.23 (2.3) (4.6) 12.0 20.0 Consumer 5,611.44 0.1 (1.6) (6.5) 11.1 Al Rayan Islamic Index 3,590.20 0.2 (2.6) (6.9) 15.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Union National Bank Abu Dhabi 4.48 12.3 9,557.0 (4.3) Gulf Pharmaceutical Ind. Abu Dhabi 2.25 9.8 380.2 (6.4) BBK Bahrain 0.36 8.3 75.0 (16.5) IFA Hotels & Resorts Co. Kuwait 0.15 7.1 0.8 (26.5) Emaar Economic City Saudi Arabia 16.06 7.1 3,161.9 24.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Arab Bank Abu Dhabi 1.75 (5.4) 1,145.0 (67.5) Ahli United Bank Kuwait 0.40 (3.6) 120.7 (17.0) Al Meera Cons. Goods Qatar 161.00 (2.7) 147.3 (26.8) Vodafone Qatar Qatar 9.50 (2.5) 2,563.6 (25.2) Aramex Dubai 3.90 (2.3) 662.5 23.4 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Al Meera Consumer Goods Co. 161.00 (2.7) 147.3 (26.8) Vodafone Qatar 9.50 (2.5) 2,563.6 (25.2) Ooredoo 91.30 (2.2) 98.2 21.7 Qatari Investors Group 53.80 (1.6) 19.8 42.7 Doha Insurance Co. 18.70 (1.1) 1.5 (11.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar First Bank 10.12 2.1 36,027.4 (32.5) Barwa Real Estate Co. 29.85 (0.2) 33,278.5 (25.4) QNB Group 152.00 0.7 32,117.6 4.2 Vodafone Qatar 9.50 (2.5) 24,696.2 (25.2) Al Meera Consumer Goods Co. 161.00 (2.7) 23,885.7 (26.8) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,741.71 0.6 (2.2) (4.2) (6.6) 70.91 4,453.0 14.1 1.5 4.2 Dubai 3,262.82 2.1 (0.3) (2.1) 3.5 257.80 85,247.1 10.7 1.2 4.2 Abu Dhabi 4,290.44 2.6 0.2 (0.2) (0.4) 76.42 113,755.3 11.1 1.4 5.7 Saudi Arabia 6,647.75 2.4 1.8 10.6 (3.8) 1,409.67 412,388.9 15.8 1.5 3.5 Kuwait 5,495.63 0.1 0.3 1.8 (2.1) 55.59 83,347.8 18.7 1.0 4.3 Oman 5,493.82 0.2 1.4 0.2 1.6 5.27 22,376.1 10.4 1.1 5.2 Bahrain 1,168.24 0.6 0.6 1.7 (3.9) 1.53 18,187.4 9.6 0.4 4.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,650 9,700 9,750 9,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 0.6% to close at 9,741.7. The Insurance and Transportation indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Al Khaleej Takaful Group and Al Khalij Commercial Bank were the top gainers, rising 3.3% and 2.8%, respectively. Among the top losers, Al Meera Consumer Goods Co. fell 2.7%, while Vodafone Qatar was down 2.5%. Volume of shares traded on Wednesday fell by 5.5% to 10.5mn from 11.1mn on Tuesday. However, as compared to the 30-day moving average of 6.6mn, volume for the day was 58.2% higher. Qatar First Bank and Vodafone Qatar were the most active stocks, contributing 33.8% and 24.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Bank Muscat S&P Oman LT-FC-CCR/ST-LC- CCR BBB-/A-3 BBB-/A-3 – Negative Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CCR – Counterparty Credit Ratings) Earnings Releases Company Market Currency Revenue (mn) 3Q2016 % Change YoY Operating Profit (mn) 3Q2016 % Change YoY Net Profit (mn) 3Q2016 % Change YoY Almadina for Finance & Inv. Co. Kuwait KD – – – – -0.6 N/A The National Investor Co.* Abu Dhabi AED – – 58.8 10.2% -5.0 N/A Source: Company data, DFM, ADX, MSM (*6M2016 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/16 US Mortgage Bankers Association MBA Mortgage Applications November-11 -9.2% – -1.2% 11/16 US Federal Reserve Industrial Production MoM October -0.2% 0.2% 0.1% 11/16 UK Office for National Statist Jobless Claims Change October 5.6k 2.0k 0.7k Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.08% 36.82% (9,644,580.41) Qatari Institutions 15.00% 14.21% 2,051,073.89 Qatari 48.08% 51.03% (7,593,506.52) GCC Individuals 1.20% 0.82% 973,894.74 GCC Institutions 7.31% 4.83% 6,396,667.01 GCC 8.51% 5.65% 7,370,561.75 Non-Qatari Individuals 19.46% 10.39% 23,433,930.03 Non-Qatari Institutions 23.95% 32.93% (23,210,985.26) Non-Qatari 43.41% 43.32% 222,944.77

- 3. Page 3 of 5 News Qatar DHBK plans rights issue to raise capital by 20% – Doha Bank (DHBK) planning to raise the capital by 20% through a rights issue by the first half of 2017 in order to meet its strategic business development requirements. The bank is proposing to issue 51.67mn new shares to existing shareholders. The board’s proposal will have to be approved by shareholders at an EGM, which is scheduled to be held in March 2017. Further, the company has picked banks for a conventional bond issue, banking sources said. One of the sources said the issue would be in the region of $300mn to $400mn and that the issue was planned for the first quarter of 2017. (Gulf-Times.com, Reuters) CBQK shareholders approve QR1.5bn rights issue – Commercial Bank (CBQK) shareholders have approved QR1.5bn rights issue at their EGM. They approved an increase in total share capital to QR3.85bn by way of offering 58.8mn new ordinary shares at QR25.5 per piece, which consists of a nominal value of QR10 per share and a premium of QR15.50. CBQK shareholders would be allowed to buy one new share for every 5.5 held. Any remaining unsubscribed shares will be dealt with by the bank’s board of directors subject to any required approval of the Commercial Companies Department at the Ministry of Economy & Commerce and the Qatar Financial Markets Authority in line with the Trading in Rights Issue Regulations issued by the QFMA (the QFMA Regulations) and any other applicable regulations. (Gulf- Times.com) MERS announces resignation of CEO – Al Meera Consumer Goods Company (MERS) announced that the company's CEO, Mr. Guy Sauvage has submitted his resignation and the Board of Directors accepted the resignation request. For the sake of continuity, the Board has requested the CEO that the notice period shall be concluded once the General Assembly Meeting of the financial year of 2016, which is planned to take place in March or April 2017, has been convened. (QSE) MCGS postpones its AGM and EGM to November 22 – Medicare group (MCGS) announced that due to non-legal quorum during the Extraordinary General Meeting (EGM) on November 15, 2016, “The quorum was 51.96 % of the Capital” the company decided to postpone the meeting to a second meeting set preliminary on November 22, 2016 at the same venue; and after obtaining the confirmation of the relevant authorities on the set avenue, time and date. (QSE) IHGS postpones its AGM and EGM to November 22 – Islamic Holding Group (IHGS) postponed its Extraordinary General assembly (EGM) & General assembly Meeting (AGM) which not reached the official quorum on November 15, 2016. The company will hold its EGM & AGM in the alternative meeting on November 22, 2016 at the same time and place. (QSE) QDB eyes angel investors to develop small businesses – Qatar development bank (QDB) Head of learning Saoud Abdullah al- Mannai said the company wants to tap angel investors to promote Qatar’s entrepreneurship culture and help propel the country’s small and medium-sized enterprise (SME) sector. He said early this month, the bank hosted an angel investment ‘meet-up’ to link budding entrepreneurs with potential investors. Al-Mannai said, “We are also planning to conduct a training program to support this category, and allow angel investors to push the innovation wheel and bring entrepreneurs to new territories.” Al-Mannai stressed that QDB has launched an innovation program that focuses on startups and young entrepreneurs, whom he described as “active” in attending training courses and “are known for devising bold initiatives in the market. The innovation program is an ongoing initiative that caters to entrepreneurs who want an innovative business plan, meaning they want to start and contribute something different in the market.” (Gulf-Times.com) Qatar, Switzerland explore ways to enhance economic relations – Qatar and Switzerland explored ways to enhance bilateral economic relations between the countries in view of the free trade agreement (FTA) between the Gulf Cooperation Council (GCC) countries and EFTA Association, which includes Switzerland, Norway, Iceland and Liechtenstein. This was disclosed by Qatari Businessmen Association (QBA) chairman Sheikh Faisal bin Qassim al-Thani, along with other members, in an interaction with a Swiss delegation, led by Guillaume Barazzone, mayor of Geneva. They discussed the potential investment opportunities, especially considering that the Qatari private sector reached a stage of maturity and strength that enables it to enhance its investments into other markets such as Switzerland. (Gulf-Times.com) International US manufacturing sector stabilizing; producer prices tame – US manufacturing output increased for a second straight month in October amid gains in the production of motor vehicles and a range of other goods, suggesting that the battered factory sector was slowly recovering. Other data showed a moderation in producer inflation last month. Still, the disinflationary impulse is ebbing as oil prices rise and the dollar's rally fades, which could see an increase in price pressures in the coming months. The Federal Reserve said factory production rose 0.2% last month after a similar gain in September. Output was supported by a 0.9% rise in the production of motor vehicles and parts. There were also increases in the production of primary metals and computers and electronic products. The report added to a survey early this month showing a second straight month of expansion in factory activity in October. Manufacturing accounts for 12% of the US economy. The sector has suffered a prolonged slump in the aftermath of the dollar's surge between June 2014 and January 2016, which has constrained exports. Activity has also been hurt by the collapse in oil drilling after oil prices plunged. (Reuters) EU Commission decides not to suspend EU funds for Spain, Portugal – The European Commission (EU) said it will not suspend EU funds for Spain and Portugal 2017 following their breach of EU budget rules, as it also called for looser fiscal policy across the Eurozone. The European Union's executive Commission has the power to impose fines and to suspend EU funds for countries that run deficits above 3% of their GDP and do not take measures to correct their excessive gaps. Commission Vice President Valdis Dombrovskis said, Spain and Portugal were found in breach of EU fiscal rules last year, but the Commission has concluded there is no need to sanction them as they have taken sufficient measures to correct their imbalances. (Reuters) British jobless rate hits 11-year low, but warning signs appear – Britain's unemployment rate unexpectedly fell to its lowest level in 11 years in the first three months after the Brexit vote, official data showed, but there were signs that a slowdown in the labor market could be coming. The jobless rate edged down to 4.8% in the July- September period, compared with a median forecast of 4.9% in a Reuters poll of economists. The Office for National Statistics said the increase of 49,000 in the number of people in work was the slowest since the three months to March, and the number of people claiming unemployment benefit gathered speed in October. Britain's economy weathered the initial shock of the Brexit vote better than the Bank of England and almost all private-sector economists expected. (Reuters) Commerce Ministry: China's retail sales to reach about 48tn Yuan by 2020 – The country's Commerce Ministry said China's retail sales would reach about 48tn Yuan ($6.99tn) by 2020, with

- 4. Page 4 of 5 average annual retail sales growth at 10%. E-commerce trade volume is also projected to grow at an average annual rate of about 15% in 2016-2020, according to a five-year plan for the country's domestic trade posted on the ministry's website. Beijing has pledged to transform the economy into one more reliant on consumption than exports, and cut overcapacity in industrial sectors, amid stubbornly weak external demand. The Commerce Ministry said that the plan laid out nine "major tasks" to achieve the growth targets, such as pushing bricks-and-mortar businesses to transform and innovate, and modernizing traditional sectors such as agriculture. Domestic consumption will contribute significantly more to China's economic growth during 2016-2020. The ministry said China's total retail sales stood at 30.1tn Yuan ($4.38tn) by 2015, with an average growth rate for the 2011-2015 periods at 13.8%. (Reuters) Moody's affirms India's rating, says reforms yet to produce results – Moody's Investors Service on affirmed India's sovereign ratings, citing economic and institutional reforms under Prime Minister Narendra Modi, but said the measures have yet to produce enough dividends to warrant an upgrade. Moody's becomes the second ratings agency after Standard & Poor's to decline an upgrade to India's ratings despite government lobbying. Moody's rates India at "Baa3", the lowest investment-grade rating, but with a "positive" outlook. The credit agency welcomed economic and institutional reforms introduced under Modi, saying they "offer a reasonable expectation that India's growth will outperform that of its peers over the medium term." However, Moody's said, "The reform effort to date has not yet achieved the conditions that would support an upgrade," saying the country still needed to accelerate private investment in order to reduce the government's debt burden. (Reuters) Regional Siemens: Middle East to require additional 267GW power generation capacity by 2030 – Siemens said that the Middle East will require additional power capacity of 267 gigawatts (GW) by 2030. This will take the region’s capacity to 509GW, from 307GW now, resulting in an increase of 66%. The next 15 years will also see 66GW of capacity retired. In its outlook, Siemens maps out the region’s current power generation scenario, upcoming challenges, allocation of energy sources and the role digitalization will play in the future energy mix. To overcome these, power generation needs to allow for fuel diversity, and to become more affordable, reliable, highly efficient with lower emissions, and flexible enough to complement renewables. (Gulf-Times.com) KSMC signs new deal with SGBC – King Saud Medical City (KSMC) has signed a memorandum of understanding with The Saudi Green Building Council (SGBC) in a project that promotes energy conservation. This agreement, corresponding to the Kingdom’s Vision 2030, emphasizes on energy consumption in terms of using the best methods of practice to support a healthy and eco-friendly environment. (Bloomberg) Dubai October inflation rate rises to 2.7% – The Dubai Statistics Center released the following October consumer price data for the Gulf Arab Emirate stating that inflation rose to 2.7% YoY in October as compared to 2.4% YoY in September. Housing and utility costs rose 4.5% YoY in October while food and beverage prices edged up 0.3%. (Reuters) EGA's AED11bn project reaches key milestone – Emirates Global Aluminium's Al Taweelah alumina refinery, an AED11bn new plant set to be a critical part of the UAE's growing aluminium industry, reached a significant construction milestone. EGA's Executive Vice- President Upstream Yousuf Bastaki was joined by Finnish Ambassador Riitta Swan and Chief Executive Officer of Finland- headquartered global minerals and metals technology company Outotec, Markku Teräsvasara to celebrate the 60% completion of the Calciners section of the project. Overall completion of the project is currently at 37%. (Bloomberg) Abu Dhabi said to mull more bank mergers after NBAD-FGB deal – Abu Dhabi is considering more mergers to boost its financial services industry after combining National Bank of Abu Dhabi and First Gulf Bank. According to sources, the oil-rich Emirate is weighing a plan to merge Abu Dhabi Commercial Bank and Union National Bank and also combine Abu Dhabi Islamic Bank with Al- Hilal Bank. (Gulf-Times.com) Oman awards $437mn port project contracts – Oman's Special Economic Zone Authority at Duqm (Sezad) has signed three agreements worth OMR169mn ($437mn) for the construction of a fishing port and the second package of the Duqm Port. This awarding of contracts comes as part of the government's plan to make Sezad a major centre for fishery industries in the sultanate. The first agreement related to the construction of the marine fishing port was signed with the CEO of Galfar Engineering and Contracting, Dr Johannes Gustavus Erlings. The second was a consultancy services agreement for the construction and supervision of the fishery port at Duqm which was awarded to Cering International Engineering Consulting Company in cooperation with AAK. Al Jabri signed the agreement for OMR60.7mn ($156.9mn) fishery port project with Sering’s Chief Executive, Sergio Di Maio. (GulfBase.com) Moody’s revises Omani banks’ outlook to stable – Moody’s Investors Service has revised its outlook for Oman’s banking system to stable from negative. The global rating agency said that the stable outlook reflects Moody’s expectation that Omani banks’ credit profiles will remain broadly stable over the outlook horizon, as increased government borrowing and higher hydrocarbon output will support a level of public spending that will help stabilize the softened economy. The outlook expresses Moody’s expectation of how bank creditworthiness will evolve in Oman over the next 12 to 18 months. Moody’s expects real GDP growth to slow gradually to 1.7% in 2016 and 2.0% in 2017, from 3.3% in 2015. Subsequently, credit growth will decelerate to an average of 7% to 9% over 2016-2017, from 12% in 2015. (GulfBase.com) National Finance, Oman Orix Leasing plan merger – The boards of National Finance Company and Oman Orix Leasing Company have jointly decided to appoint an independent consultant to study the possibility of a merger of both leasing firms. This follows the recommendation of a joint working group formed by both leasing firms for a merger. The working group has studied the options for a strategic collaboration between the two firms and said that the only viable option for a strategic collaboration between National Finance and Oman Orix Leasing could be a merger of both institutions. (GulfBase.com)

- 5. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (#Market closed on November 16, 2016) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Oct-12 Oct-13 Oct-14 Oct-15 Oct-16 QSEI ndex S& PPanA r ab S& PGCC 2.4% 0.6% 0.1% 0.6% 0.2% 2.6% 2.1% 0.0% 0.8% 1.6% 2.4% 3.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,225.22 (0.3) (0.2) 15.4 MSCI World Index 1,698.41 (0.2) 0.1 2.1 Silver/Ounce 16.98 (0.5) (2.3) 22.5 DJ Industrial 18,868.14 (0.3) 0.1 8.3 Crude Oil (Brent)/Barrel (FM Future) 46.63 (0.7) 4.2 25.1 S&P 500 2,176.94 (0.2) 0.6 6.5 Crude Oil (WTI)/Barrel (FM Future) 45.57 (0.5) 5.0 23.0 NASDAQ 100 5,294.58 0.4 1.1 5.7 Natural Gas (Henry Hub)/MMBtu 2.53 1.7 24.8 9.5 STOXX 600 338.47 (0.5) (1.2) (8.9) LPG Propane (Arab Gulf)/Ton 51.63 (2.4) (0.5) 31.9 DAX 10,663.87 (1.0) (1.5) (2.7) LPG Butane (Arab Gulf)/Ton# 69.00 0.0 0.7 20.0 FTSE 100 6,749.72 (0.6) (0.9) (8.7) Euro 1.07 (0.3) (1.5) (1.6) CAC 40 4,501.14 (1.1) (1.2) (4.4) Yen 109.08 (0.1) 2.3 (9.3) Nikkei 17,862.21 0.8 0.3 3.7 GBP 1.24 (0.1) (1.2) (15.6) MSCI EM 847.15 0.7 (0.2) 6.7 CHF 1.00 (0.0) (1.4) 0.0 SHANGHAI SE Composite 3,205.06 (0.3) (0.7) (14.5) AUD 0.75 (1.0) (0.9) 2.7 HANG SENG 22,280.53 (0.2) (1.1) 1.6 USD Index 100.41 0.2 1.4 1.8 BSE SENSEX 26,298.69 (0.4) (2.5) (2.0) RUB 64.75 0.6 (1.7) (10.7) Bovespa 60,759.32 2.6 1.9 62.0 BRL 0.29 0.4 (0.8) 15.8 RTS 989.68 0.9 2.0 30.7 114.3 99.6 95.8