QNBFS Daily Market Report July 12, 2018

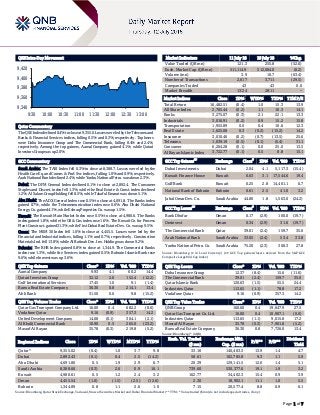

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.4% to close at 9,355.0. Losses were led by the Telecoms and Banks & Financial Services indices, falling 0.5% and 0.3%, respectively. Top losers were Doha Insurance Group and The Commercial Bank, falling 8.4% and 2.4%, respectively. Among the top gainers, Aamal Company gained 4.1%, while Qatari Investors Group was up 2.0%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 8,388.7. Losses were led by the Health Care Eq. and Comm. & Prof. Svc indices, falling 1.0% and 0.9%, respectively. Arab National Bank declined 2.4%, while Yanbu National Petro. was down 2.3%. Dubai: The DFM General Index declined 0.1% to close at 2,892.4. The Consumer Staples and Discret. index fell 1.3%, while the Real Estate & Const. index declined 1.2%. Al Salam Group Holding fell 8.5%, while Takaful Emarat was down 5.1%. Abu Dhabi: The ADX General Index rose 0.5% to close at 4,691.8. The Banks index gained 0.7%, while the Telecommunication index rose 0.6%. Abu Dhabi National Energy Co. gained 4.1%, while Eshraq Properties Co. was up 1.5%. Kuwait: The Kuwait Main Market Index rose 0.5% to close at 4,980.6. The Banks index gained 1.8%, while the Oil & Gas index rose 1.6%. The Kuwait Co. for Process Plant Construct. gained 31.3%, while First Dubai Real Estate Dev. Co. was up 9.5%. Oman: The MSM 30 Index fell 1.0% to close at 4,455.5. Losses were led by the Financial and Industrial indices, falling 1.1% and 0.7%, respectively. Construction Materials Ind. fell 13.8%, while Al Batinah Dev. Inv. Holding was down 9.2%. Bahrain: The BHB Index gained 0.8% to close at 1,344.9. The Commercial Banks index rose 1.3%, while the Services index gained 0.5%. Bahrain Islamic Bank rose 9.6%, while Inovest was up 3.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Aamal Company 9.93 4.1 60.2 14.4 Qatari Investors Group 32.12 2.0 152.4 (12.2) Gulf International Services 17.45 1.0 9.1 (1.4) Barwa Real Estate Company 36.30 0.8 214.1 13.4 Ahli Bank 31.50 0.6 9.8 (15.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Company Ltd. 16.00 0.4 682.2 (0.6) Vodafone Qatar 9.16 (0.9) 357.3 14.2 United Development Company 14.08 (0.1) 304.1 (2.1) Al Khalij Commercial Bank 10.90 0.5 265.0 (23.2) Masraf Al Rayan 35.78 (0.3) 219.8 (5.2) Market Indicators 11 July 18 10 July 18 %Chg. Value Traded (QR mn) 121.3 255.8 (52.6) Exch. Market Cap. (QR mn) 511,114.9 512,084.0 (0.2) Volume (mn) 3.9 10.7 (63.4) Number of Transactions 2,617 3,711 (29.5) Companies Traded 43 43 0.0 Market Breadth 13:24 28:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,482.51 (0.4) 1.0 15.3 13.9 All Share Index 2,705.44 (0.2) 1.1 10.3 14.1 Banks 3,275.07 (0.3) 2.1 22.1 13.3 Industrials 3,016.91 (0.2) 0.9 15.2 15.8 Transportation 1,955.89 0.0 0.4 10.6 12.3 Real Estate 1,625.08 0.3 (0.2) (15.2) 14.2 Insurance 3,010.46 (0.2) (0.7) (13.5) 25.6 Telecoms 1,039.19 (0.5) (0.1) (5.4) 31.1 Consumer 6,204.28 (0.1) 0.0 25.0 13.5 Al Rayan Islamic Index 3,722.77 (0.1) 0.5 8.8 15.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Dubai Investments Dubai 2.04 4.1 5,117.3 (15.4) Kuwait Finance House Kuwait 0.63 3.1 17,544.6 19.4 Gulf Bank Kuwait 0.25 2.8 14,401.1 6.7 National Bank of Bahrain Bahrain 0.61 2.5 41.0 3.2 Jabal Omar Dev. Co. Saudi Arabia 44.80 1.8 1,563.0 (24.2) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Bank Dhofar Oman 0.17 (2.9) 100.0 (19.7) Ominvest Oman 0.34 (2.9) 31.6 (19.7) The Commercial Bank Qatar 39.01 (2.4) 159.7 35.0 Arab National Bank Saudi Arabia 33.05 (2.4) 53.4 33.8 Yanbu National Petro. Co. Saudi Arabia 75.20 (2.3) 308.3 27.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 12.37 (8.4) 15.6 (11.6) The Commercial Bank 39.01 (2.4) 159.7 35.0 Qatar Islamic Bank 120.63 (1.5) 55.5 24.4 Industries Qatar 113.65 (1.1) 78.8 17.2 Vodafone Qatar 9.16 (0.9) 357.3 14.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 160.60 0.4 19,647.9 27.5 Qatar Gas Transport Co. Ltd. 16.00 0.4 10,907.1 (0.6) Industries Qatar 113.65 (1.1) 9,015.8 17.2 Masraf Al Rayan 35.78 (0.3) 7,901.8 (5.2) Barwa Real Estate Company 36.30 0.8 7,726.0 13.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,355.02 (0.4) 1.0 3.7 9.8 33.16 140,403.3 13.9 1.4 4.7 Dubai 2,892.43 (0.1) 0.4 2.5 (14.2) 58.61 102,785.8 9.3 1.1 5.9 Abu Dhabi 4,691.80 0.5 1.9 2.9 6.7 20.39 129,141.5 12.6 1.4 5.1 Saudi Arabia 8,388.66 (0.3) 2.6 0.9 16.1 739.60 530,377.6 19.1 1.9 3.2 Kuwait 4,980.61 0.5 1.2 2.4 3.2 162.77 34,402.3 15.4 0.9 3.9 Oman 4,455.54 (1.0) (1.5) (2.5) (12.6) 2.30 18,902.1 11.1 1.0 5.5 Bahrain 1,344.89 0.8 1.1 2.6 1.0 7.15 20,577.4 8.8 0.9 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,340 9,360 9,380 9,400 9,420 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.4% to close at 9,355.0. The Telecoms and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Doha Insurance Group and The Commercial Bank were the top losers, falling 8.4% and 2.4%, respectively. Among the top gainers, Aamal Company gained 4.1%, while Qatari Investors Group was up 2.0%. Volume of shares traded on Wednesday fell by 63.4% to 3.9mn from 10.7mn on Tuesday. Further, as compared to the 30-day moving average of 11.0mn, volume for the day was 64.4% lower. Qatar Gas Transport Company Limited and Vodafone Qatar were the most active stocks, contributing 17.4% and 9.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2Q2018 % Change YoY Operating Profit (mn) 2Q2018 % Change YoY Net Profit (mn) 2Q2018 % Change YoY Filling & Packing Materials Mfg. Co. Saudi Arabia SR – – 1.2 29.3% 0.7 54.2% Muscat City Desalination* Oman OMR 8.0 5.3% – – 0.7 N/A Al Suwadi Power* Oman OMR 37.6 5.3% – – 4.0 155.7% National Securities* Oman OMR 0.0 – – – -0.1 N/A Al Batinah Power* Oman OMR 35.0 -4.3% – – 4.2 608.8% Gulf Investment Services* Oman OMR 1.9 882.0% – – 1.1 N/A Sharqiyah Desalination* Oman OMR 7.2 10.5% – – 0.8 N/A Voltamp Energy*# Oman OMR 19,157.1 -5.8% – – 2.9 -99.8% Al Batinah Hotels* Oman OMR 0.5 15.0% – – 0.2 -16.8% Al Kamil Power* Oman OMR 5.5 17.0% 1.2 -25.7% 1.0 67.5% Gulf Mushroom Products* Oman OMR 3.8 17.8% – – 0.3 82.1% Seef Properties Bahrain BHD 4.3 -3.9% 3.6 -6.1% 2.4 -10.4% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for 1H2018; # Values in ‘000) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/11 US Mortgage Bankers Association MBA Mortgage Applications 6-July 2.5% – -0.5% 07/11 Japan Bank of Japan PPI YoY June 2.8% 2.8% 2.7% 07/11 Japan Bank of Japan PPI MoM June 0.2% 0.2% 0.6% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2018 results No. of days remaining Status QIBK Qatar Islamic Bank 15-Jul-18 3 Due MARK Masraf Al Rayan 16-Jul-18 4 Due WDAM Widam Food Company 17-Jul-18 5 Due ERES Ezdan Holding Group 17-Jul-18 5 Due QEWS Qatar Electricity & Water Company 18-Jul-18 6 Due UDCD United Development Company 18-Jul-18 6 Due CBQK The Commercial Bank 18-Jul-18 6 Due GWCS Gulf Warehousing Company 19-Jul-18 7 Due QIIK Qatar International Islamic Bank 19-Jul-18 7 Due IHGS Islamic Holding Group 19-Jul-18 7 Due KCBK Al Khalij Commercial Bank 19-Jul-18 7 Due ABQK Ahli Bank 19-Jul-18 7 Due DHBK Doha Bank 19-Jul-18 7 Due QIGD Qatari Investors Group 23-Jul-18 11 Due QNCD Qatar National Cement Company 23-Jul-18 11 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 35.85% 51.99% (19,566,496.30) Qatari Institutions 8.98% 9.23% (301,421.85) Qatari 44.83% 61.22% (19,867,918.15) GCC Individuals 0.63% 0.79% (191,382.94) GCC Institutions 0.76% 2.18% (1,715,531.35) GCC 1.39% 2.97% (1,906,914.29) Non-Qatari Individuals 11.49% 11.66% (202,525.07) Non-Qatari Institutions 42.29% 24.17% 21,977,357.51 Non-Qatari 53.78% 35.83% 21,774,832.44

- 3. Page 3 of 7 QATI Qatar Insurance Company 24-Jul-18 12 Due VFQS Vodafone Qatar 24-Jul-18 12 Due BRES Barwa Real Estate Company 24-Jul-18 12 Due QOIS Qatar Oman Investment Company 25-Jul-18 13 Due DBIS Dlala Brokerage & Investment Holding Company 25-Jul-18 13 Due QIMD Qatar Industrial Manufacturing Company 26-Jul-18 14 Due NLCS Alijarah Holding 26-Jul-18 14 Due ORDS Ooredoo 29-Jul-18 17 Due AHCS Aamal Company 30-Jul-18 18 Due QISI Qatar Islamic Insurance Company 30-Jul-18 18 Due AKHI Al Khaleej Takaful Insurance Company 30-Jul-18 18 Due SIIS Salam International Investment Limited 31-Jul-18 19 Due DOHI Doha Insurance Group 31-Jul-18 19 Due Source: QSE News Qatar QNBK’s net profit rises 7% YoY to QR7.1bn in 1H2018 – QNB Group (QNBK) recorded net profit of QR7.1bn in 1H2018, up 7% compared to the previous year. Operating Income increased by 10% YoY to QR12.2bn. This reflects QNBK’s success in maintaining growth across the range of revenue sources. QNBK’s drive for operational efficiency is yielding cost-savings in addition to sustainable revenue generating sources. This helped QNBK to improve the efficiency ratio (cost to income ratio) to 27.2%, from 29.3% last year, which is considered one of the best ratios among large financial institutions in the MEA. Total assets increased by 10% YoY to reach QR846bn at the end of June 30, 2018. The key driver of total assets growth was from loans and advances which grew by 9% to reach QR604bn. This was mainly funded by customer deposits which increased by 9% to reach QR614bn from June 2017. This helped to maintain QNBK’s loans to deposits ratio at 98.4% as at June 30, 2018 reflecting the strength of the long term funding sources and considered to be at the optimum level. QNBK’s conservative policy in regard to provisioning continued with the coverage ratio reaching at 110% in June 30, 2018. Total Equity increased by 3% YoY to reach QR76bn as at June 30, 2018. EPS increased to QR7.4 in 1H2018 as compared to QR7.0 in 1H2017. QNBK’s strong recovery efforts helped reduce the net impairment charge on QNBK’s loan book during the year demonstrating strong credit quality of the bank’s asset base. Also maintaining the stock of nonperforming loans ratio at 1.8% reflecting the high quality of QNBK’s loan book and the effective management of credit risk. QNBK’s conservative policy in regard to provisioning maintained the coverage ratio at 110% as at June 30, 2018. Capital Adequacy Ratio (CAR) as at June 30, 2018 amounted to 15.8%, higher than the regulatory minimum requirements of the Qatar Central Bank and Basel Committee. In April 2018, the Extraordinary General Assembly Meeting of shareholders approved the increase of non-Qatari ownership limit to 49% as well as increase of single ownership limit to 5%. QNBK’s successful funding from the international markets during the first six months of 2018 which includes, amongst others, (1) capital market issuances of $560mn with a five and ten-year maturity in Australia and (2) $720mn bonds with 30 year maturity in Taiwan. This reflects the group’s success in diversifying funding sources by entering new debt markets, sourcing sustainable long term funding, extending the maturity profile of funding sources and the trust of international investors in the strong financial position of QNBK and its strategy. QNBK remains a highly-rated bank, demonstrating a strength that continues to attract institutional, corporate and individual customers to bank with QNBK, and for investors and markets to believe in QNBK’s strong financial position and strategy. In June 2018, Fitch Ratings has revised the Outlook to ‘Stable’ due to successful management of the impact from the blockade. Based on QNBK’s continuous strong performance and its diversified international presence, QNBK is now the most valuable banking brand in the MEA region, with the value of its brand increased to $4.2bn to rise to the 60th place globally, in addition to attaining the highest rating of AA+ in brand strength, making it the only Qatari banking brand among the world’s top 100. QNB Group’s presence spans more than 31 countries serving more than 22mn customers through more than 1,100 locations, 4,400 ATMs and more than 29,000 staff. (QNB Group Press Release) QGTS’ bottom line rises 5% YoY/QoQ in 2Q2018, modestly better than our estimate (divergence of 5%) – Qatar Gas Transport Company Limited’s (QGTS) net profit rose 4.8% YoY (5.2% QoQ) to QR227.72mn in 2Q2018, modestly besting our estimate of QR216.02mn (variation of 5.4%). Wholly-owned ship business was in-line with gross profits lower by 1% vs. our forecast. The beat vs. our earnings estimate came primarily due to higher-than-expected JV income (likely due to impact of the 2 conventional vessels added in March in the 40%-owned Maran JV) and lower depreciation expenses. JV income of QR106.8mn (4.9% YoY/25.7% QoQ) was 16.9% better than our forecast and was at the highest level seen since 4Q2016. Going forward, we envision a further boost to the quarterly run-rate of JV income given the addition of a 55% stake in a FSRU vessel. We continue to favor Nakilat, #1 owner/operator of LNG vessels globally, as a LT play geared to Qatari LNG’s dominance and anticipated growth in the LNG market. We believe the stock is attractive at current levels and reiterate our QR21 price target and Outperform rating. (QNBFS Research, QSE, Gulf- Times.com) BRES’ subsidiary, Alaqaria, terminates leasing agreement with Qatar Petroleum; insignificant impact to numbers– Barwa Real Estate Company (BRES) announced that its fully owned subsidiary, Qatar Real Estate Investments Company (Alaqaria), signed contract termination and discharge release for financial

- 4. Page 4 of 7 leasing agreements, related to real estate projects, with Qatar Petroleum that Alaqaria has been constructing to be leased to Qatar petroleum. The contract termination and discharge releases will result in Alaqaria to receive QR670mn, which will entail an increase in the balance of cash and bank balances of BRES and will support the investing activities of the group. There is no major impact to numbers as the announcement implies that BRES will record revenue of QR670mn likely in 3Q2017 in a sales transaction instead of recognizing finance lease income over several years. Moreover, there is minimal impact to the bottom-line given the nature of the agreement with QP. We continue to rate BRES an Accumulate with a QR39 price target. (QNBFS Research, QSE) GDI, Seadrill sign pact for utilization of off-shore drilling rig West Tucana – Gulf International Services announces that its subsidiary Gulf Drilling International (GDI) signed a definitive agreement with Seadrill for the utilization of the offshore drilling rig West Tucana. As a part of the agreement, the ‘West Tucana’, a JU 2000E, will be contracted to work in Qatar offshore for a firm period of 440 days with options in place for further extensions. GDI also announced that it has signed a Strategic Cooperation Agreement with Seadrill that provides the foundation for future synergies in Qatar’s offshore market between GDI & Seadrill. GDI’s CEO, Mubarak A. Al-Hajri said, “This partnership with Seadrill will lead to greater strategic and competitive advantage strengthening our position as the leader in Qatar Offshore drilling market. By bringing together Seadrill’s high-specification jack up fleet, GDI’s diverse customer base, and our combined experience, we plan to continue delivering market leading level of operational and safety performance to our clients.” (QSE) QGRI to disclose its semi-annual financials on July 31 – Qatar General Insurance & Reinsurance Company (QGRI) announced that it will disclose its semi-annual financial reports for the period ending June 30, 2018 on July 31, 2018. (QSE) QFBQ to disclose its semi-annual financials on July 30 – Qatar First Bank (QFBQ) announced that it will disclose its semi- annual financial reports for the period ending June 30, 2018 on July 30, 2018. (QSE) Real estate deals stood at QR2bn between July 1-5 – The trading volume of registered real estates between July 1 and July 5 stood at QR1.945bn, official figures showed. The trading included empty lands, residential units, multipurpose buildings, empty multipurpose lands, residential complex and building. Most of the trading took place in Doha, Al Wakra, Al Rayyan, Al Daayen, Al Shamal, Al Khor, Al Thakhira and Umm Salal. The trading volume of registered real estates in between June 24 to June 28 was QR470.4mn. (Qatar Tribune) Over 66,200 cruise tourists visited Qatar in six months – Qatar is fast emerging as the favorite tourist destination for cruise passengers. More than 66,200 cruise passengers came to Qatar during the first six months of current year, according to figures released by Mwani Qatar. The data further added that close to 2,500 ships called at Hamad Port, Doha Port and Al Ruwais Port during January to June this year. These ships handled 647,234 Twenty-Foot Equivalent Units (TEUs) containers and 665,555 tons of general cargo. A total of 33,404 vehicles and 636,008 heads of livestock were handled by these ports. The vessels carried 177,157 tons of building material which was need for various infrastructure related works in the country. Among the three ports, Hamad Port received 803 ships during January-June period and handled 644,824 TEUs containers 631,076 break- bulk cargo. (Peninsula Qatar) International US producer inflation rises on strong services gains – US producer prices increased more than expected in June amid gains in the cost of services and motor vehicles, leading to the biggest annual increase in 6-1/2 years. The report published by the Labor Department also showed a pickup in underlying producer inflation last month. Economists expect tariffs on lumber, steel and aluminum imports to drive up prices, likely keeping the Federal Reserve on track to increase interest rates two more times this year. The producer price index for final demand climbed 0.3% last month after rising 0.5% in May. That pushed the annual increase in the PPI to 3.4%, the largest rise since November 2011, from 3.1% in May. (Reuters) MBA: US home refinancing requests drop to lowest since 2000 – US loan applications to refinance existing homes fell to their lowest in over 17-1/2 years even as most 30-year home borrowing costs fell last week, data from the Mortgage Bankers Association (MBA) showed. The Washington-based industry group stated its seasonally adjusted index on homeowners’ requests for refinancing fell 3.8% to 958.5 in the week ended July 6. This was the lowest weekly reading since December 2000. Refinancing share of weekly mortgage activity fell to its lowest since August 2008 at 34.8% of total applications. This compared with 37.2% the previous week, MBA stated. Interest rates on 30-year fixed-rate conforming home loans, whose balances are $453,100 or less, averaged 4.76% from 4.79% the week before. (Reuters) Trump lashes Germany over gas pipeline deal, calls it Russia's captive – US President Donald Trump launched a sharp public attack on Germany for supporting a Baltic Sea gas pipeline deal with Russia, saying Berlin had become a captive to Russia and criticized it for failing to raise defense spending more. Trump, meeting reporters with NATO Secretary-General Jens Stoltenberg, before a NATO summit in Brussels, said it was very inappropriate that the US was paying for European defense against Russia while Germany, the biggest European economy, was supporting gas deals with Moscow. Trump was due to meet German Chancellor, Angela Merkel at the summit later in the day and will meet Russian President Vladimir Putin in Helsinki. Berlin has given political support to the building of a new, $11bn pipeline to bring Russian gas across the Baltic Sea called Nord Stream 2, despite qualms among other EU states. However, Merkel insists the project is a private commercial venture and is not funded by German taxpayers. (Reuters) France to ease finance, tax rules to attract Brexit bankers – France will pare back financial regulations to EU minimums and introduce new tax incentives to make Paris a more attractive finance hub, Prime Minister, Edouard Philippe said. Speaking to a reception, Philippe said most of the changes would be made by the end of the year, as countries across the EU battle to attract bankers from London amid uncertainty over the impact of Brexit on the region’s biggest financial centre. For asset managers coming to France, they will be able to have capital

- 5. Page 5 of 7 income known as carried interest taxed at 30% rather than higher income tax rates. (Reuters) China vows to hit back over US proposal for fresh tariffs – China accused the US of bullying and warned it would hit back after the Trump administration raised the stakes in their trade dispute, threatening 10% tariffs on $200bn of Chinese goods in a move that rattled global markets. China’s commerce ministry stated it was shocked and would complain to the World Trade Organization, but did not immediately say how China would retaliate in the dispute between the world’s two biggest economies. Further, China’s exports growth is expected to have cooled only slightly in June, possibly further boosting a trade surplus with the US in a test for China as it tries to weather a volley of US tariffs on its goods that much fear could harm its economy. (Reuters) Regional IIF: GCC’s GDP to grow 2.5% in 2018 on higher oil prices – Higher oil prices are expected to strengthen the economic activity in the GCC through additional public spending and improvement in private sector confidence, according to Institute of International Finance (IIF). “We expect overall real GDP in the GCC region to shift from a contraction of 0.3% in 2017 to a growth of 2.5% in 2018, supported by higher oil output and government stimulus,” IIF noted in a report. (Gulf- Times.com) OPEC sees lower demand for its oil in 2019 – OPEC forecasted that world’s demand for its crude will decline next year as growth in consumption slows and rivals pump more, pointing to the return of an oil market surplus despite an OPEC-led pact to restrain supplies. Giving its first 2019 forecasts in a monthly report, OPEC stated that world would need 32.18mn barrels per day (bpd) of crude from its 15 members next year, down 760,000 bpd from this year. The drop in demand for OPEC crude means there will be less strain on producers in making up for supply losses such as falling Venezuelan and Libyan output, and an imminent drop in Iranian exports as US sanctions return. (Peninsula Qatar) MENA’s M&A deal value in 2Q2018 hits eight-year high at $34bn – The value of announced M&A transactions with any MENA involvement reached $33.9bn during 2Q2018, 74% more than the value recorded during 2Q2017 and an eight-year high, a report stated. Deals with a MENA target reached an all-time high rising to $21.3bn, up 110% from the same period in 2017 while inter-MENA or domestic deals reached a five-year high, up 232% YoY. Driven by Saudi British Bank acquisition of the entire share of capital of Alawwal Bank for $5bn, MENA inbound M&A currently stands at an all-time high. In the other hand, outbound M&A decreased from $6.9bn in 2Q2017 to $6.6bn so far this year. (GulfBase.com) China offers $20bn loans to Arab states – Chinese President, Xi Jinping announced that his country will provide Arab states with $20bn in loans for economic development. The money will be earmarked for projects that will produce good employment opportunities and positive social impact in Arab States that have reconstruction needs, he said. China and Arab countries have also agreed to establish a future-oriented strategic partnership of comprehensive cooperation and common development, sources said. (GulfBase.com) CMA approves the capital increase request for United Electronics Company – Saudi Arabia’s Capital Market Authority (CMA) issued its resolution approving United Electronics Company’s request to increase its capital from SR420mn to SR500mn through issuing one bonus share for every seven existing shares owned by the shareholders. Such increase will be paid by transferring an amount of SR60mn from Retained Earnings account and an amount of SR20mn from Statutory Reserve account to the company’s capital. (Tadawul) UAE-Vietnam foreign trade hits $9bn in 2017 – The value of foreign trade between the UAE and Vietnam, including free zones trade, totaled nearly $9bn in 2017, with exports accounting for around $324mn, re-exports for around $282mn, and imports for around $8.4bn, according to a report. The value of Vietnam’s global exports in 2016 reached $219.8bn, compared to $162bn in 2015, an increase of 35.7%. The UAE is in the first place internationally in terms of importing phones from Vietnam in 2016, third in importing information self- processing machines, 15th in importing parts and supplies except for covers, 18th in importing shoes made from synthetic materials, and 21st in importing leather shoes. (GulfBase.com) CBD’s net profit rises to AED281.0mn in 2Q2018 – Commercial Bank of Dubai (CBD) recorded net profit of AED281.0mn in 2Q2018 as compared to AED172.3mn in 2Q2017. Net interest income and net income from Islamic financing came in at AED480.2mn as compared to AED455.1mn in 2Q2017. Total operating income came in at AED669.8mn as compared to AED685.3mn in 2Q2017. Total assets stood at AED68.91bn at the end of June 30, 2018 as compared to AED70.41bn at the end of December 31, 2017. Loans and advances and Islamic financing (net) stood at AED47.22bn, while customers’ deposits and Islamic customer deposits stood at AED48.12bn at the end of June 30, 2018. EPS came in at AED0.1 in 2Q2018 as compared to AED0.06 in 2Q2017. (DFM) Sustainability of Dubai Islamic Bank’s credit quality in focus – A strengthening economy and ambitious lending growth trajectory will help Dubai Islamic Bank (DIB) lower its nonperforming loan (NPL) ratio further this year, closer to its 2018 target of 3% from 3.4% in 4Q2017. The cost of risk is expected to increase to about 70 bps in 2018 on the back of fewer recoveries and potential pressure on household income. (Bloomberg) Landlords in Dubai keep sweetening rental offers – In Dubai, another 3,200 homes were delivered in the second quarter on top of the estimated 3,800 units completed in the first three months. And the new supply continues to have an impact on property values and rents. “Rent declines are expected to continue during the second-half, with new handovers planned in both freehold and leasehold communities,” Cavendish Maxwell stated in its Dubai residential market report. Given this kind of pressure on rents, landlords will continue offering flexible payment schemes and rent-free stays, and if not, even opt to cut their rates for existing tenants. (GulfBase.com) FAB reveals $21.4mn loan exposure to Abraaj Group – First Abu Dhabi Bank (FAB) stated it gave Abraaj Group a $21.4mn, three-year secured loan that matures in April 2019. The revelation sees FAB join a growing list companies that have disclosed their exposure to the embattled private equity fund.

- 6. Page 6 of 7 “The loan was collateralized with Abraaj Holdings’ stakes in its funds, which invested in various companies globally,” FAB stated. Emirates Insurance also disclosed a $2.4mn investment in the Abraaj Buyout fund II. (GulfBase.com) CBO issues treasury bills worth OMR61mn – Central Bank of Oman (CBO) raised OMR61mn by way of allotting treasury bills. The treasury bills are for a maturity period of 28 days, from July 11, until August, 8, 2018. The average accepted price reached 99.847 for every OMR100, and the minimum accepted price arrived at 99.830 per OMR100. Whereas the average discount rate and the average yield reached 1.99810% and 2.00119%, respectively. The interest rate on the Repo operations with CBO is 2.578% for the period from July 10, 2018 to 16 July, 2018, while the discount rate on the Treasury Bills Discounting Facility with CBO is 3.328%, for the same period. (GulfBase.com) Nationwide wastewater system in Oman requires OMR6bn in investment – A long-term plan for the implementation of a modern wastewater system for Oman envisions an investment of around OMR6bn, according to Haya Water. According to the master plan, the total number of sewage treatment plants (STPs) required in various governorates will number 133 stations, catering to more than 4.1mn people by 2045. The STPs will be designed keeping in mind various environmental, health, social and economic criteria. (GulfBase.com) Bahrain’s economy shrinks in 1Q2018 as oil production sags – Bahrain’s economy shrank on an annual basis in 1Q2018 for the first time in at least seven years, hit by a fall in oil production, data from the official statistics agency showed. The figures may increase concern about the health of Bahrain’s economy as it struggles with a current account gap and a large state budget deficit, which have dragged down prices of its international bonds and pushed the Bahraini Dinar to a 17-year low against the US Dollar late last month. The Dinar then partly recovered after Saudi Arabia, the UAE and Kuwait said they would soon announce an assistance program to support the country’s fiscal stability and economic reforms, but the first-quarter data underlines the challenges that Bahrain faces as it tries to grow its economy and state revenues out of trouble. Gross domestic product, adjusted for inflation, shrank 1.2% from a year earlier and declined 0.5% from the previous quarter. This was largely because the oil sector of the economy shrank 14.7% from a year earlier. (Reuters) Bahrain, China ink MoU on Belt and Road project – The foreign ministers of Bahrain and China signed a memorandum of understanding (MoU) to jointly advance the construction of the Belt and Road project. The two sides would continue to firmly support each other on issues concerning each others’ core interests and promote pragmatic cooperation across the board under the Belt and Road framework. Bahrain’s Foreign Minister, Shaikh Khalid Bin Ahmed Al Khalifa said, “Bahrain highly applauds and supports the Belt and Road Initiative and stands ready to strengthen all-round cooperation with China and boost bilateral ties.” (GulfBase.com)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on July 11, 2018) Source: Bloomberg (*$ adjusted returns) 40.0 60.0 80.0 100.0 120.0 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 QSE Index S&P Pan Arab S&P GCC (0.3%) (0.4%) 0.5% 0.8% (1.0%) 0.5% (0.1%) (1.2%) (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,241.90 (1.1) (1.1) (4.7) MSCI World Index 2,117.30 (0.9) 0.2 0.7 Silver/Ounce 15.81 (1.6) (1.4) (6.7) DJ Industrial 24,700.45 (0.9) 1.0 (0.1) Crude Oil (Brent)/Barrel (FM Future) 73.40 (6.9) (4.8) 9.8 S&P 500 2,774.02 (0.7) 0.5 3.8 Crude Oil (WTI)/Barrel (FM Future) 70.38 (5.0) (4.6) 16.5 NASDAQ 100 7,716.61 (0.5) 0.4 11.8 Natural Gas (Henry Hub)/MMBtu# 2.84 0.0 (2.4) (19.8) STOXX 600 381.40 (1.5) (0.6) (4.6) LPG Propane (Arab Gulf)/Ton 94.25 (3.3) (1.6) (4.8) DAX 12,417.13 (1.8) (1.0) (6.4) LPG Butane (Arab Gulf)/Ton 103.50 (2.8) (1.4) (4.6) FTSE 100 7,591.96 (1.5) (0.7) (3.5) Euro 1.17 (0.6) (0.6) (2.8) CAC 40 5,353.93 (1.8) (0.8) (1.9) Yen 112.01 0.9 1.4 (0.6) Nikkei 21,932.21 (1.7) (0.6) (3.1) GBP 1.32 (0.5) (0.6) (2.3) MSCI EM 1,064.72 (1.1) 0.4 (8.1) CHF 1.00 (0.4) (0.6) (2.1) SHANGHAI SE Composite 2,777.77 (1.8) 0.7 (18.1) AUD 0.74 (1.2) (0.9) (5.7) HANG SENG 28,311.69 (1.3) (0.0) (5.8) USD Index 94.72 0.6 0.8 2.8 BSE SENSEX 36,265.93 (0.1) 1.7 (1.2) RUB 62.37 1.0 (0.9) 8.2 Bovespa 74,398.55 (1.9) 0.0 (16.8) BRL 0.26 (1.6) (0.3) (14.5) RTS 1,186.36 (1.3) 1.1 2.8 83.7 81.3 68.3