QNBFS Daily Market Report July 11, 2021

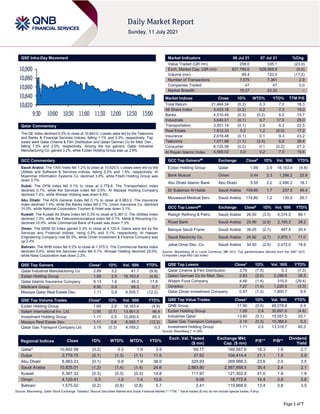

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.2% to close at 10,843.0. Losses were led by the Telecoms and Banks & Financial Services indices, falling 1.1% and 0.3%, respectively. Top losers were Qatar Cinema & Film Distribution and Qatari German Co for Med. Dev., falling 7.5% and 2.0%, respectively. Among the top gainers, Qatar Industrial Manufacturing Co. gained 3.2%, while Ezdan Holding Group was up 2.9%. GCC Commentary Saudi Arabia: The TASI Index fell 1.2% to close at 10,825.0. Losses were led by the Utilities and Software & Services indices, falling 2.2% and 1.9%, respectively. Al Moammar Information Systems Co. declined 3.8%, while Fitaihi Holding Group was down 3.7%. Dubai: The DFM Index fell 0.1% to close at 2,779.8. The Transportation index declined 0.7%, while the Services index fell 0.6%. Al Mazaya Holding Company declined 7.4%, while Ithmaar Holding was down 6.8%. Abu Dhabi: The ADX General Index fell 0.1% to close at 6,963.2. The Insurance index declined 1.4%, while the Banks index fell 0.7%. Union Insurance Co. declined 10.0%, while National Corporation Tourism & Hotel was down 3.1%. Kuwait: The Kuwait All Share Index fell 0.3% to close at 6,367.3. The Utilities index declined 1.3%, while the Telecommunications index fell 0.7%. Metal & Recycling Co. declined 10.0%, while Commercial Bank of Kuwait was down 7.3%. Oman: The MSM 30 Index gained 0.3% to close at 4,120.4. Gains were led by the Services and Financial indices, rising 0.2% and 0.1%, respectively. Al Hassan Engineering Company rose 65.5%, while Oman Investment & Finance Company was up 2.4%. Bahrain: The BHB Index fell 0.2% to close at 1,575.0. The Commercial Banks index declined 0.4%, while the Services index fell 0.1%. Ithmaar Holding declined 25.0%, while Nass Corporation was down 2.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Industrial Manufacturing Co 2.89 3.2 41.7 (9.9) Ezdan Holding Group 1.69 2.9 18,163.4 (4.8) Qatar Islamic Insurance Company 8.13 1.6 45.3 17.8 Medicare Group 8.90 0.9 99.3 0.7 Mazaya Qatar Real Estate Dev. 1.11 0.8 6,555.7 (12.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 1.69 2.9 18,163.4 (4.8) Salam International Inv. Ltd. 0.95 (0.7) 13,901.5 46.4 Investment Holding Group 1.11 0.5 12,000.5 85.3 Mazaya Real Estate Dev. 1.11 0.8 6,555.7 (12.2) Qatar Gas Transport Company Ltd 3.19 (0.3) 4,769.2 0.3 Market Indicators 08 Jul 21 07 Jul 21 %Chg. Value Traded (QR mn) 258.0 335.1 (23.0) Exch. Market Cap. (QR mn) 627,795.6 628,068.9 (0.0) Volume (mn) 99.4 120.0 (17.2) Number of Transactions 7,575 7,361 2.9 Companies Traded 47 47 0.0 Market Breadth 15:27 23:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 21,464.34 (0.2) 0.3 7.0 18.3 All Share Index 3,433.18 (0.2) 0.2 7.3 19.0 Banks 4,510.45 (0.3) (0.2) 6.2 15.7 Industrials 3,640.01 (0.1) 0.7 17.5 28.0 Transportation 3,501.14 (0.1) 2.8 6.2 22.5 Real Estate 1,812.33 0.2 1.2 (6.0) 17.2 Insurance 2,619.48 (0.1) 0.1 9.3 23.2 Telecoms 1,071.68 (1.1) (2.4) 6.0 28.4 Consumer 8,125.58 (0.2) 0.1 (0.2) 27.3 Al Rayan Islamic Index 4,568.02 0.0 0.2 7.0 19.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 1.69 2.9 18,163.4 (4.8) Bank Muscat Oman 0.44 2.3 1,266.2 22.8 Abu Dhabi Islamic Bank Abu Dhabi 5.55 2.2 2,490.2 18.1 Dr Sulaiman Al Habib Saudi Arabia 159.60 1.7 237.5 46.4 Mouwasat Medical Serv. Saudi Arabia 174.80 1.2 130.5 26.7 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Rabigh Refining & Petro. Saudi Arabia 26.00 (3.5) 6,374.5 88.1 Riyad Bank Saudi Arabia 25.90 (2.8) 2,165.3 28.2 Banque Saudi Fransi Saudi Arabia 38.05 (2.7) 487.4 20.4 Saudi Electricity Co. Saudi Arabia 24.92 (2.7) 2,970.1 17.0 Jabal Omar Dev. Co. Saudi Arabia 34.50 (2.5) 2,472.0 18.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 3.70 (7.5) 0.3 (7.3) Qatari German Co for Med. Dev. 2.83 (2.0) 2,298.6 26.5 Widam Food Company 4.46 (1.4) 310.5 (29.4) Ooredoo 7.27 (1.4) 1,220.5 (3.3) Qatar Oman Investment Company 0.97 (1.3) 1,800.7 8.9 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 17.90 (0.4) 48,278.6 0.4 Ezdan Holding Group 1.69 2.9 30,691.8 (4.8) Industries Qatar 13.60 (0.1) 15,557.5 25.1 Qatar Gas Transport Company 3.19 (0.3) 15,388.4 0.3 Investment Holding Group 1.11 0.5 13,318.7 85.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,842.99 (0.2) 0.3 1.0 3.9 69.77 169,567.6 18.3 1.6 2.7 Dubai 2,779.75 (0.1) (1.3) (1.1) 11.5 37.62 104,414.4 21.1 1.0 2.9 Abu Dhabi 6,963.23 (0.1) 0.9 1.9 38.0 329.93 269,988.3 23.6 2.0 3.5 Saudi Arabia 10,825.01 (1.2) (1.4) (1.4) 24.6 2,883.80 2,567,858.5 35.4 2.4 2.1 Kuwait 6,367.32 (0.3) (0.3) (0.3) 14.8 111.97 121,302.8 41.0 1.6 1.9 Oman 4,120.41 0.3 1.0 1.4 12.6 9.06 18,772.8 14.4 0.8 3.8 Bahrain 1,575.02 (0.2) (0.8) (0.8) 5.7 2.41 119,868.9 13.4 0.8 3.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,820 10,840 10,860 10,880 10,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE Index declined 0.2% to close at 10,843.0. The Telecoms and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from Qatari and Arab shareholders despite buying support from GCC and foreign shareholders. Qatar Cinema & Film Distribution and Qatari German Co for Med. Dev. were the top losers, falling 7.5% and 2.0%, respectively. Among the top gainers, Qatar Industrial Manufacturing Co gained 3.2%, while Ezdan Holding Group was up 2.9%. Volume of shares traded on Thursday fell by 17.2% to 99.4mn from 120.0mn on Wednesday. Further, as compared to the 30-day moving average of 159.2mn, volume for the day was 37.6% lower. Ezdan Holding Group and Salam International Inv. Ltd. were the most active stocks, contributing 18.3% and 14.0% to the total volume, respectively. Source: Qatar Stock Exchange (*as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2Q2021 % Change YoY Operating Profit (mn) 2Q2021 % Change YoY Net Profit (mn) 2Q2021 % Change YoY Oman Cables Industry* Oman OMR 110.1 31.4% – – 3.4 41.3% Al-Anwar Ceramic Tiles Co.* Oman OMR 14.2 40.9% – – 3.5 153.9% Dhofar Cattle Feed Co.* Oman OMR 16.6 -5.8% 0.2 N/A (0.0) N/A Oman Refreshment Co.* Oman OMR 34.6 26.6% – 4.7 113.2% Hotels Management Co. Int.#* Oman OMR 856.0 -66.6% – – (1,402.6) N/A Source: Company data, DFM, ADX, MSM, TASI, BHB. (#Values in Thousands, *Financial for 6M2021) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08-07 US Department of Labor Initial Jobless Claims 03-Jul 373k 350k 371k 08-07 US Department of Labor Continuing Claims 26-Jun 3339k 3350k 3484k 09-07 US US Census Bureau Wholesale Inventories MoM May 1.30% 1.10% 1.10% 09-07 US US Census Bureau Wholesale Trade Sales MoM May 0.80% – 1.10% 09-07 UK UK Office for National Statistics Monthly GDP (3M/3M) May 3.60% 3.90% 1.50% 09-07 UK UK Office for National Statistics Monthly GDP (MoM) May 0.80% 1.50% 2.00% 09-07 UK UK Office for National Statistics Industrial Production MoM May 0.80% 1.40% -1.00% 09-07 UK UK Office for National Statistics Industrial Production YoY May 20.60% 21.60% 27.20% 09-07 UK UK Office for National Statistics Manufacturing Production MoM May -0.10% 1.00% 0.00% 09-07 UK UK Office for National Statistics Manufacturing Production YoY May 27.70% 29.50% 39.10% 09-07 Japan Bank of Japan Money Stock M2 YoY Jun 5.90% 6.00% 7.90% 09-07 Japan Bank of Japan Money Stock M3 YoY Jun 5.20% 5.20% 6.80% 09-07 China National Bureau of Statistics CPI YoY Jun 1.10% 1.20% 1.30% 09-07 China National Bureau of Statistics PPI YoY Jun 8.80% 8.80% 9.00% 09-07 China The People's Bank of China Money Supply M2 YoY Jun 8.60% 8.20% 8.30% 09-07 China The People's Bank of China Money Supply M0 YoY Jun 6.20% 5.50% 5.60% 09-07 China The People's Bank of China Money Supply M1 YoY Jun 5.50% 6.00% 6.10% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 37.91% 38.91% (2,582,982.5) Qatari Institutions 21.62% 23.39% (4,566,003.6) Qatari 59.54% 62.31% (7,148,986.1) GCC Individuals 0.69% 0.79% (259,855.3) GCC Institutions 3.26% 0.55% 6,992,216.8 GCC 3.94% 1.33% 6,732,361.5 Arab Individuals 12.02% 12.61% (1,536,835.9) Arab Institutions 0.02% 0.15% (325,431.3) Arab 12.04% 12.76% (1,862,267.2) Foreigners Individuals 4.06% 4.28% (567,292.0) Foreigners Institutions 20.43% 19.33% 2,846,183.9 Foreigners 24.49% 23.60% 2,278,891.8

- 3. Page 3 of 7 Earnings Calendar Tickers Company Name Date of reporting 2Q2021 results No. of days remaining Status QNBK QNB Group 11-Jul-21 0 Due QFLS Qatar Fuel Company 11-Jul-21 0 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 12-Jul-21 1 Due MARK Masraf Al Rayan 13-Jul-21 2 Due WDAM Widam Food Company 14-Jul-21 3 Due VFQS Vodafone Qatar 14-Jul-21 3 Due QIBK Qatar Islamic Bank 14-Jul-21 3 Due QEWS Qatar Electricity & Water Company 14-Jul-21 3 Due QNNS Qatar Navigation (Milaha) 15-Jul-21 4 Due MCGS Medicare Group 15-Jul-21 4 Due KCBK Al Khalij Commercial Bank 15-Jul-21 4 Due NLCS Alijarah Holding 15-Jul-21 4 Due ABQK Ahli Bank 15-Jul-21 4 Due QIIK Qatar International Islamic Bank 26-Jul-21 15 Due DHBK Doha Bank 27-Jul-21 16 Due ORDS Ooredoo 28-Jul-21 17 Due QIMD Qatar Industrial Manufacturing Company 28-Jul-21 17 Due IHGS INMA Holding Group 08-Aug-21 28 Due Source: QSE News Qatar QNB expands its footprint in Asia with Hong Kong branch opening – QNB Group, the largest financial institution in the Middle East and Africa, has opened officially its branch in Hong Kong, one of the world’s prominent global financial hubs. Commenting on the occasion, QNB Group CEO, Mr. Abdulla Mubarak Al-Khalifa, said: “We are pleased to announce the official opening of our first branch in Hong Kong, one of the most attractive markets in the world. As part of our Group’s strategy to expand into strategically located markets with excellent infrastructure and a business friendly environment, we are planning to continue diversifying our sources of revenue and profit, particularly in the MEASEA markets’’. As a newcomer to the market, QNB seeks to position itself as a reputable foreign bank to customers with trade and investment flows between Hong Kong, the Middle East, Africa, and Mainland China. The Branch aims to facilitate cross border business with a range of corporate banking products and services, treasury and investments, foreign exchange solutions, syndication strategies, and project financing. Hong Kong is the gateway for the Group’s clients to Mainland China and wider Asia. It is a major trade hub accounting for USD 1,077.5 billion in imports and exports. The Branch will work closely with the Group’s global network, and particularly the Singapore branch and Shanghai representative office. It will advise QNB’s clients in China on their outbound growth through Hong Kong as a base and will link with Singapore to cover South East Asia region. (Press Release) FIFA WC Qatar 2022: Five Out Of Eight Stadiums Complete As 500-day Countdown Begins – With just about 500 days to go until Qatar hosts the very first FIFA World Cup in the Middle East and Arab world, Qatari officials informed that five out of the eight stadiums have been completed and the rest will be ready by the end of this year, sources reported’. The 22nd edition of the tournament is scheduled to kick off on November 21, 2022, when Qatar, who are the reigning champions of Asia, will make their FIFA World Cup Finals debut in the tournament's first match at the stunning 60,000-seat Al Bayt Stadium in Al Khor City. (Bloomberg) ORDS to disclose its semi-annual financial results on July 28 – Ooredoo (ORDS) will disclose its financial statement for the period ending June 30, 2021 on July 28, 2021. (QSE) ORDS to hold its investors relation conference call on July 29 – Ooredoo (ORDS) will hold the conference call with the Investors to discuss the financial results for the semi-annual 2021 on July 29, 2021 at 02:00pm , Doha Time. (QSE) QNNS to disclose its semi-annual financial results on July 15 – Qatar Navigation (QNNS) will disclose its financial statement for the period ending June 30, 2021 on July 15, 2021. (QSE) QNCD to disclose its Semi-Annual financial results on 28/07/2021. Qatar National Cement Co. discloses its financial statement for the period ending 30th June 2021 on 28/07/2021. (QSE) Barwa Real Estate Group Extends Agreement to Sell Janadriyah Land in Saudi Capital, Riyadh. Barwa Real Estate Company Q.P.S.C. announced the extension of the Sale Agreement to sell the land plot owned by Wahat Al-Riyadh Real Estate Company, "wholly owned by Barwa Group", for additional 50 days. The Agreement shall be extended and all its terms and conditions shall remain in full force and effect, provided that the sale process is completed and registered with the notary upon fulfilling all the terms and conditions of the agreement and paying the rest of the sale price within a period not exceeding 50 days from the date of signing the sale agreement extension. Wahat Al- Riyadh Real Estate Company received an amount of SAR 30 million as a deposit for sale. As previously announced, the total sale price is SAR 742,380,100 (seven hundred and forty-two million, three hundred and eighty thousand and one hundred Saudi riyals), excluding real estate transfer tax. The aforementioned land was purchased in 2016 for a value of SAR 659,277,850, along with other amounts spent on land

- 4. Page 4 of 7 development as well as financing costs. As previously announced, all financial terms of the agreement, its financial impact and the estimated amounts of profits generated from the sale transaction will be announced after the sale is completed and the land is evacuated for the buyer. This will allow the company to precisely calculate all costs and expenses related to the land. It should be noted that there is no conflict of interest between the contracting parties and that the extension of the contract term has no impact on the company's financial statements. (QSE) KCBK final reminder on uncollected dividends for 10+ years – In compliance with Qatar Central Bank’s regulations concerning dividends that have remained uncollected for more than 10 years, and in order to protect the interests of its shareholders who have not received their dividend payments, Al Khalij Commercial Bank (KCBK, al Khaliji) is pleased to announce that the list of shareholders with uncollected dividends for more than 10 years is now available on the Bank’s website www.alkhaliji.com under the “Investor Relations- Dividend” section. The shareholders whose name appear on the said list are kindly requested to contact the email or phone number below or visit any branch of al Khaliji to collect their shares’ dividends entitled since 10 years within a month from the date of releasing this reminder. The unclaimed dividends not claimed by this date will be transferred to the General Authority for Minors Affairs in accordance with Qatar Central Bank’s regulations concerning dividends that have remained uncollected for 10 years. For more information and clarification regarding dividend payments or any other dividend- related issues, al Khaliji’s shareholders can contact the Investor Relations Department at Investor-Relations@alkhaliji.com or call our Contact Center +974-44940077 available 24/7. (QSE) ORDS introducing 'world-class' Wi-Fi 6 to customers – Ooredoo (ORDS) has announced that it is bringing Wi-Fi 6 to all consumer homes in partnership with Netgear, the leading provider of mesh whole-home Wi-Fi systems. Ooredoo is the first operator in the world to make available the latest generation of Wi-Fi 6 technology by including it with 1Gbps and 10Gbps Ooredoo ONE plans. Key benefits of Wi-Fi 6 include higher data speeds, increased capacity, lower latency, better performance and lower power consumption in homes with many connected devices, the company has said in a statement. Wi-Fi 6 provides the foundation for meeting the needs of emerging customer trends, including streaming 8K ultra high-definition movies, applications, such as gaming that require high bandwidth and low latency, smart home deployments and the Internet of Things (IoT). Wi-Fi 6 devices will provide households the required bandwidth to address the increasing demands of today’s homes, such as streaming ultra-high definition (UHD) video and using streaming services, such as Shahid VIP, Starz Play and the OSN streaming app, together with online gaming, online exercise classes and live video meetings. The new Ooredoo Wi-Fi 6 devices provide the capability to support upward of 40 devices simultaneously without interruption, while provide great home coverage, the statement notes. (Gulf-Times.com) Mekdam Holding all to join QSE venture market – The Qatar Stock Exchange (QSE) Thursday said all the procedures have been completed for the listing of Mekdam Holding Group, which will be the second entity to get listed on the venture market or QEVM. “Coordination is currently taking place between the QSE and the Qatar Financial Market Authority to determine the appropriate time for the market to list the shares of Mekdam Holding Group, as all the necessary procedures for listing have been completed,” QSE chief executive Rashid bin Ali Al-Mansoori said in a tweet. The company, which was assigned 'gcBBB-' Gulf regional rating by Standard & Poor's in March this year, will be included in the market for small and medium enterprises. Its listing comes after Al Faleh Educational Holding Company got listed on the QEVM in April this year. (Gulf-Times.com) Building permits issued in Qatar more than double MoM in June – Qatar’s real estate sector showed signs of rebound as it witnessed a strong 28.3% YoY expansion in the total number of building permits issued and a more than doubled MoM jump this June. In terms of yearly performance, Umm Slal reported 53.3% surge, Al Daayen (51%), Al Khor (40.9%), Al Rayyan (31.1%), Doha (30.9%) and Wakra (4.8%); while Al Shahaniya witnessed 11.1% decline in the review period, said the figures released by the Planning and Statistics Authority (PSA). On a monthly basis, at the national level, the number of building permits issued grew 111% with Al Shamal witnessing 333% surge, Al Daayen (180%), Umm Slal (156%), Al Khor (107%, Al Wakra (102%), Al Rayyan (101%), Doha (76%) and Al Shahaniya 33%. Qatar issued a total of 734 building permits in June 2021 with Al Rayyan, Doha and Al Daayen municipalities together constituting as much as 68% of the total. In its latest data, the PSA reported that of the total number of new building permits issued, Al Rayyan constituted 30% or 219 permits, Al Daayen (21% or 151 permits), Al Wakra (18% or 131 permits), Doha (17% or 127 permits), Umm Slal (6% or 46 permits), Al Khor (4% or 31 permits), Al Shahaniya (2% or 16 permits) and Al Shamal (2% or 13 permits). The PSA data indicates that the new building permits (residential and non- residential) constituted 42% (310 permits) of the total building permits issued in June 2021, additions 55% (400 permits) and fencing 3% (24 permits). (Gulf-Times.com) Major boost to tourism seen in 3rd quarter with opening of markets – Domestic tourism is seen to make great strides by the third quarter of this year following the government’s easing of pandemic-related protocols, as well as forecasts by authorities that Qatar will be able to achieve herd immunity in the near period, an expert in the travel industry has said. With a large number of Qatar’s population getting vaccinated, “there is a lot of positive vibes coming in, especially with the number of Covid-19 infection cases in Qatar dropping”, according to Tawfeeq Travel Group CEO Rehan Ali Syed. (Gulf-Times.com) German magazine: Qatar among top countries in Covid handling – German publication 'Der Spiegel' has ranked Qatar among the countries that have handled the Covid-19 pandemic the best. Qatar is ranked No 15 on the list, which is topped by Finland. Qatar is the only Arab country in the top 15. Qatar's handling of the pandemic, as well as its national vaccination program, have come in for praise from various sources. A number of hospitals have resumed normal services after discharging their last Covid-19 patients, highlighting how the combined impact of government restrictions, rollout of the vaccination program and the community’s adherence to preventive measures have helped curb the spread of the virus. As for inoculation, more than 1.5mn people in the country have received both doses of the Covid-19 vaccine. (Gulf-Times.com) Phase 3 of lifting Covid restrictions begins – Residents welcomed the start of Phase 3 of the gradual lifting of Covid-19 restrictions in Qatar Friday, while also stressing the need to keep following the precautionary and preventive measures. Among others, the highlights of this phase include permitting private healthcare facilities to operate at full capacity, allowing children in cinemas subject to conditions, increasing the capacity of Doha Metro and public transport, driving schools, wedding halls, barbershops, amusement parks, entertainment centers, museums, libraries, nurseries, educational centers and private training centers, and allowing more people in a group to gather in parks and on beaches and opening playgrounds and exercising equipment there. This phase is marked by several allowances for vaccinated people, like the previous ones. Also, the Ministry of Public Health (MoPH) has said Covid-19-recovered patients who

- 5. Page 5 of 7 have been infected in the last nine months are entitled to the same privileges as vaccinated individuals. (Gulf-Times.com) International Biden signs order to tackle corporate abuses across US economy – President Joe Biden signed a sweeping executive order on Friday to promote more competition in the US economy, urging agencies to crack down on anti-competitive practices in sectors from agriculture to drugs and labor. If fully implemented, the effort will help lower Americans' internet costs, allow for airline baggage fee refunds for delayed luggage, among other steps. The order instructs antitrust agencies to focus on labor, healthcare, technology and agriculture as they address a laundry list of issues that have irritated consumers, and in the case of drug prices, has bankrupted some. "No more tolerance of abusive actions by monopolies. No more bad mergers that lead to massive layoffs, higher prices and fewer options for workers and consumers alike," Biden said at a White House signing ceremony. The president noted areas where advocates feel that prices are too high, wages are tamped down or new businesses excluded from competition. "Let me be very clear, capitalism without competition isn't capitalism, it's exploitation," he said. The White House says the rate of new business formation has fallen by almost 50% since the 1970s as large businesses make it harder for Americans with good ideas to break into markets. Biden's action goes after corporate monopolies across a broad swath of industries, and includes 72 initiatives he wants more than a dozen federal agencies to act on. Lower wages caused by lack of competition are estimated to cost the median American household $5,000 per year, according to a White House fact sheet that cites research from the American Economic Liberties Project - an influential Washington-based anti-monopoly group. The initiatives will no doubt kick off a series of fights with the affected industries. (Reuters) UK's economic rebound slowed in May despite looser COVID rules – Britain's post-lockdown economic rebound slowed sharply in May despite a relaxation of social-distancing rules, according to official data which also showed a hit to carmakers from the global shortage of microchips. Gross domestic product expanded by a monthly 0.8%, much faster than its typical pre- pandemic pace but down from April's 2.0% surge. It was also a lot weaker than the median forecast of 1.5% in a Reuters poll of economists. Britain suffered one of the biggest hits from the pandemic among advanced economies last year and GDP in May was 3.1% below its level in February 2020 just before the pandemic struck. The Bank of England expects Britain's economy to grow by 7.25% this year, the fastest since 1941. Last year output plunged by almost 10%, the biggest drop in more than 300 years. April saw the easing of restrictions for many retailers, hairdressers, and pubs and restaurants that could serve customers outside. In May, hospitality firms were allowed to resume indoor service. Britain's dominant services sector grew by a weaker-than-expected 0.9% in May from April as a huge 37.1% monthly jump for accommodation and food services failed to offset slower increases elsewhere in the sector. Supermarket sales fell as more people ate out, and education output dropped due to a decline in school attendance. Reduced COVID-19 testing also weighed on GDP. Industrial output grew by 0.8% but manufacturing shrank narrowly. The chip shortage affecting carmakers led to the biggest fall in their output since April 2020. (Reuters) UK exports to EU recover from initial post-Brexit slump – British goods exports to the European Union rose to their highest since October 2019 in May, official data showed on Friday, reversing a slump at the start of 2021 when Britain exited the bloc's single market and customs union. Britain's government is likely to view the data as backing its expectation that the change in customs arrangements would only cause temporary inconvenience to most businesses. However, overall trade with the EU has lagged behind growth in sales to the rest of the world, and business groups said they still faced extra red tape dealing with European customers and suppliers as a result of Brexit. Britain's Office for National Statistics said goods exports to the European Union, excluding precious metals, rose to 14.0bn Pounds ($19.4bn) in May on a seasonally adjusted basis, their highest since October 2019 and almost twice January's level. Total goods exports of 27.9bn Pounds, excluding precious metals, were the highest since January 2020, just before the coronavirus pandemic began to cause disruption. Imports from the EU have also risen after a slump at the start of the year, when COVID-19 disrupted traffic across the English Channel, although they remain slightly below imports from the rest of the world. Before 2021, Britain almost always sourced most of its imports from the EU. (Reuters) Japan's households, firms keep saving on prolonged impact of pandemic – Japan's currency in circulation and bank deposits hit a record high for the fourth straight month in June, data showed on Friday, as households and companies continued to pile up savings on uncertainty over the economic fallout from the COVID-19 pandemic. The data highlights how Japan is lagging other major economies in emerging from the pandemic's blow, with the government's declaration of fresh state of emergency curbs in Tokyo expected to hurt already weak consumption. Japan's M3 money stock - or currency in circulation and deposits at financial institutions - rose 5.2% in June from a year earlier to a record 1.52 quadrillion yen ($13.84 trillion), Bank of Japan data showed. The increase followed a 6.8% gain in May and was the slowest pace since May last year, the data showed. The slowdown was largely due to the base effect of sharp rises last year, when the initial hit from the pandemic forced companies to hoard cash. Bank deposits were up 9.3% in June from a year earlier, marking the slowest pace of increase since April last year, though the total balance - at 863.5 trillion yen - was the second highest on record, the data showed. (Reuters) China frees up $154bn for banks to underpin economic recovery – China will cut the amount of cash that banks must hold as reserves, releasing around 1 trillion yuan ($154.19bn) in long-term liquidity to underpin its post-COVID economic recovery that is starting to lose momentum. The People’s Bank of China (PBOC) said on its website it would cut the reserve requirement ratio (RRR) for all banks by 50 basis points (bps), effective from July 15. The world’s second-largest economy has largely rebounded to its pre-pandemic growth levels, driven by a surprisingly resilient export sector. But growth is losing steam and smaller firms are bearing the brunt of a recent surge in raw material prices. Many analysts believe pent-up COVID demand has now peaked and that growth rates will start to moderate in the second half of the year, weighed down by weakening exports, surging producer price inflation and Beijing’s continued crackdown on the property market. (Reuters) China June new bank loans, broad credit growth surge past expectations – China’s new bank loans rose more than expected in June from the previous month, while broad credit growth also picked up substantially, as the central bank seeks to shore up slowing growth in the world’s second biggest economy. Chinese banks extended 2.12tn Yuan ($327bn) in new yuan loans in June, up from 1.5tn Yuan the previous month, data from the People’s Bank of China showed on Friday. Analysts polled by Reuters had predicted new yuan loans would rise to 1.8tn Yuan in June. The Chinese economy has largely rebounded to its pre-pandemic growth levels, driven by the surprisingly resilient export sector. However, smaller firms are bearing the brunt of the recent surge in raw material prices, as they struggle to pass on increased costs

- 6. Page 6 of 7 to consumers. To help small firms coping with rising costs, the PBOC on Friday also announced a new cut in the amount of cash that banks must hold as reserves, the first such move since April last year when the economy was still badly affected by the coronavirus crisis. Loans to households rose to 868.5bn yuan in June from 623.2bn Yuan in May, while corporate loans surged to 1.46tn Yuan from 805.7bn Yuan in May. In June, total social financing (TSF), a broad measure of credit and liquidity in the economy, rose to 3.67tn Yuan from 1.92tn Yuan in May and substantially higher than analysts’ forecasts of 2.87tn Yuan. (Reuters) Regional IMF sees Saudi growth at 2.4% this year with non-oil sector leading rebound – The IMF said on Thursday Saudi Arabia's economy is recovering well from the COVID-19 pandemic and the fund expected the non-oil economy to grow by 4.3% this year, with overall GDP growth seen at 2.4%. Real oil GDP is expected to shrink by 0.4%, the IMF said in a statement, as production is assumed to stay in line with an agreement between the OPEC, Russia and allies, known as OPEC+. Saudi Arabia, the world's biggest crude exporter, was pummeled by the double blow of last year's historic oil price crash and the COVID-19 pandemic's impact, though the economy showed signs of improvement from late in the year. Investment by the Kingdom's sovereign wealth fund, the Public Investment Fund, is expected to offset government fiscal consolidation's drag on growth, the IMF said. PIF's investments are a central part of the country's economic development program Vision 2030, which aims to wean the economy off oil. (Reuters) ACWA to invest $16bn in new projects this year – Saudi renewable energy company ACWA Power will invest $16bn in new projects around the world in 2021, Arab News reported, citing the Chief Portfolio Management and interim Chief Investment Officer Rajit Nanda. Four projects have already closed this year, a couple of them will close in the next 30 days. ACWA is looking at opportunities in Africa such as Senegal and Tunisia, and at markets in Central Asia and parts of Southeast Asia, such as Vietnam, Indonesia and Bangladesh. (Bloomberg) Private Department of Skeikh Mohamed Bin Khalid Al Nahyan abandons bond sale – The Private Department of Skeikh Mohamed Bin Khalid Al Nahyan has decided not to proceed with the offering and will revisit at an appropriate time, subject to market conditions, according to sources. (Bloomberg) Dubai's Ruler launches with big tech companies a national program for coders – Dubai's Ruler, Sheikh Mohammed bin Rashid al-Maktoum, on Saturday launched a national program for coders that aims to establish 1,000 tech companies and increase start-up investments from AED1.5bn to AED4bn. The program, which is in cooperation with Google, Microsoft, Amazon AWS, Cisco, IBM, HPE, LinkedIn, Nvidia, and Facebook, is aimed at training 100,000 coders and establish tech companies that will go global. "The new program represents a new step towards establishing our digital economy. The world is rapidly changing and the fast-growing digital economy will create new types of jobs," he said. (Reuters) Mubadala's Yahsat IPO set to raise AED2.68bn after final pricing – The IPO of Yahsat, the satellite company of Abu Dhabi state investor Mubadala, is set to raise AED2.68bn after the deal was priced around the middle of an indicative price range. Al Yah Satellite Communications Co (Yahsat) priced its IPO at AED2.75, against an earlier indicative price range of AED2.55-3.05 a share, it said in a statement. This is the first major IPO on the Abu Dhabi bourse since Abu Dhabi National Oil Co Distribution was listed in 2017. Mubadala is selling a 40% stake in the deal, giving Yahsat a market capitalization of AED6.7bn. The Emirates Investment Authority has exercised its preferential right to subscribe 5% of the final offer size. The deal garnered strong demand for the IPO at the middle of the indicative price range, Reuters reported on Thursday, citing three sources familiar with the deal. (Reuters) Japanese firms, ADNOC to explore feasibility of ammonia production in UAE – Japan's Inpex Corp, JERA, and Japan Oil, Gas and Metals National Corp (JOGMEC) said on Thursday they had agreed with Abu Dhabi National Oil Company (ADNOC) to explore the feasibility of producing ammonia in the United Arab Emirates (UAE). Inpex, Japan's biggest oil and gas company, JERA, Japan's biggest power generator, and state-run JOGMEC will work with ADNOC to study the commercial potential of producing and transporting ammonia to Japan, they said in a statement. Ammonia is used for fertilizer and industrial materials but is also seen as an effective future energy source, along with hydrogen. It does not emit carbon dioxide when burned, but its production produces emissions if it is made with fossil fuel. The four companies plan to explore the feasibility of producing ammonia with a reduced carbon footprint from natural gas- derived hydrogen, with most of the CO2 emitted from the production of ammonia to be sequestered and utilized in enhanced oil recovery operations at Abu Dhabi onshore oil fields. They aim to complete the joint study by November, a JERA spokesman said. (Reuters) Abu Dhabi takes stake in EdgePoint Infrastructure, commits up to $500mn – A subsidiary of the Abu Dhabi Investment Authority (ADIA) has acquired a significant minority stake in southeast Asia-focused digital infrastructure platform EdgePoint Infrastructure, ADIA said. "ADIA has committed up to $500mn to invest in EdgePoint and to support the future growth of the platform, which is expected to include both acquisitions and the development of new towers," ADIA said, without disclosing the size of the stake. EdgePoint focuses on developing, acquiring and operating telecommunication towers, distributed antenna systems and related infrastructure in Southeast Asia, the statement said. EdgePoint was formed by DigitalBridge Group, Inc. It has secured more than 10,000 sites across Indonesia and Malaysia and is looking at further growth opportunities in markets across Asia-Pacific. (Reuters) Sohar International Bank plans OMR50mn Rights Issue – Sohar International Bank plans OMR50mn Rights Issue as a response to the increased international and regional focus o enhanced regulatory capital requirements as a result of the Basel III regime to further strengthen the quality of the capital base of the bank to be in line with the best global practices. (Bloomberg) Ominvest gets approval to raise stake in Bank Muscat by up to 5% – Bank Muscat says Oman International Development and Investment Co., also known as Ominvest, received the Central Bank’s approval to acquire additional shareholding of up to 5%. Ominvest to make additional stake purchase “through the market in a time-bound manner depending on the market conditions.” (Bloomberg) GFH buys $100mn student housing portfolio in the US – Bahrain’s GFH Financial Group has signed an agreement to acquire a $100mn US-based student housing portfolio in partnership with specialist asset manager Student Quarters. The portfolio includes buildings and facilities near the University of Arkansas, Florida State University and the University of Tennessee. The deal is GFH’s first in partnership with Atlanta- based Student Quarters. “Given the increasing pace at which the US economy is recovering, with the vaccination drive successfully implemented, the prospects for the student housing sector have a positive outlook,” GFH said. (Bloomberg)

- 7. Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Shahan Keushgerian Mehmet Aksoy, PhD Head of Research Senior Research Analyst Senior Research Analyst saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa mehmet.aksoy@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Jun-17 Jun-18 Jun-19 Jun-20 Jun-21 QSE Index S&PPan Arab S&PGCC (1.2%) (0.2%) (0.3%) (0.2%) 0.3% (0.1%) (0.1%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,808.32 0.3 1.2 (4.7) MSCI World Index 3,053.12 1.0 0.2 13.5 Silver/Ounce 26.10 0.7 (1.4) (1.1) DJ Industrial 34,870.16 1.3 0.2 13.9 Crude Oil (Brent)/Barrel (FM Future) 75.55 1.9 (0.8) 45.8 S&P 500 4,369.55 1.1 0.4 16.3 Crude Oil (WTI)/Barrel (FM Future) 74.56 2.2 (0.8) 53.7 NASDAQ 100 14,701.92 1.0 0.4 14.1 Natural Gas (Henry Hub)/MMBtu 3.71 5.4 2.0 55.2 STOXX 600 457.67 1.5 0.4 11.3 LPG Propane (Arab Gulf)/Ton 110.63 1.8 (1.0) 47.0 DAX 15,687.93 1.9 0.4 10.4 LPG Butane (Arab Gulf)/Ton 123.00 1.4 (0.6) 77.0 FTSE 100 7,121.88 1.9 0.4 11.9 Euro 1.19 0.3 0.1 (2.8) CAC 40 6,529.42 2.3 (0.2) 14.2 Yen 110.14 0.4 (0.8) 6.7 Nikkei 27,940.42 (1.0) (2.0) (4.6) GBP 1.39 0.8 0.6 1.7 MSCI EM 1,318.18 0.1 (2.7) 2.1 CHF 1.09 0.1 0.8 (3.2) SHANGHAI SE Composite 3,524.09 0.1 0.1 2.2 AUD 0.75 0.8 (0.5) (2.7) HANG SENG 27,344.54 0.7 (3.4) 0.2 USD Index 92.13 (0.3) (0.1) 2.4 BSE SENSEX 52,386.19 (0.0) (0.2) 7.5 RUB 74.35 (0.6) 1.5 (0.1) Bovespa 125,427.80 - (5.1) 4.0 BRL 0.19 0.0 (3.8) (1.2) RTS 1,635.04 0.5 (1.5) 17.8 143.0 136.6 109.1