QNBFS Daily Market Report July 02, 2018

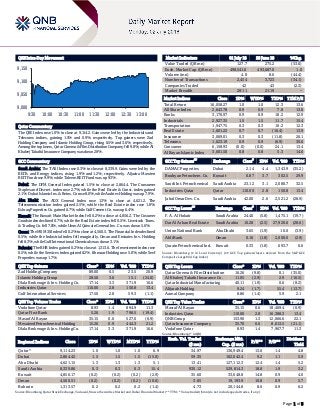

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.0% to close at 9,114.2. Gains were led by the Industrials and Telecoms indices, gaining 1.5% and 0.9%, respectively. Top gainers were Zad Holding Company and Islamic Holding Group, rising 6.5% and 3.6%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.8%, while Al Khaleej Takaful Insurance Company was down 2.9%. GCC Commentary Saudi Arabia: The TASI Index rose 0.3% to close at 8,339.9. Gains were led by the REITs and Energy indices, rising 1.9% and 1.2%, respectively. Aljazira Mawten REIT Fund rose 9.9%, while Taleem REIT Fund was up 9.3%. Dubai: The DFM General Index gained 1.5% to close at 2,864.4. The Consumer Staples and Discret. index rose 2.7%, while the Real Estate & Const. index gained 2.1%. Dubai Islamic Ins. & Reins. Co rose 8.0%, while Arabtec Holding was up 7.9%. Abu Dhabi: The ADX General Index rose 1.3% to close at 4,621.2. The Telecommunication index gained 2.5%, while the Real Estate index rose 1.8%. Eshraq Properties Co. gained 6.7%, while Gulf Cement Co. was up 6.4%. Kuwait: The Kuwait Main Market Index fell 0.2% to close at 4,856.2. The Cosumer Goods index declined 0.7%, while the Real Estate index fell 0.5%. Livestock Trans. & Trading Co. fell 7.0%, while Umm Al Qaiwain General Inv. Co. was down 5.6%. Oman: The MSM 30 Index fell 0.2% to close at 4,560.5. The Financial Index declined 0.5%, while the Industrial index fell marginally. Oman and Emirates Inv. Holding fell 8.3%, while Gulf International Chemicals was down 3.1%. Bahrain: The BHB Index gained 0.2% to close at 1,313.6. The Investment index rose 0.5%, while the Services index gained 0.2%. Ithmaar Holding rose 5.0%, while Seef Properties was up 1.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Zad Holding Company 89.00 6.5 23.5 20.9 Islamic Holding Group 28.50 3.6 15.1 (24.0) Dlala Brokerage & Inv. Holding Co. 17.14 3.3 371.9 16.6 Industries Qatar 110.00 2.8 150.8 13.4 Gulf International Services 17.50 2.8 59.3 (1.1) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.93 1.4 894.9 11.3 Qatar First Bank 5.26 1.9 798.5 (19.4) Masraf Al Rayan 35.15 0.6 527.0 (6.9) Mesaieed Petrochemical Holding 15.26 0.9 444.3 21.2 Dlala Brokerage & Inv. Holding Co. 17.14 3.3 371.9 16.6 Market Indicators 01 July 18 28 June 18 %Chg. Value Traded (QR mn) 127.7 275.2 (53.6) Exch. Market Cap. (QR mn) 498,541.6 493,687.0 1.0 Volume (mn) 4.8 8.6 (44.4) Number of Transactions 2,454 3,723 (34.1) Companies Traded 42 43 (2.3) Market Breadth 28:11 21:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,058.27 1.0 1.0 12.3 13.6 All Share Index 2,643.78 0.9 0.9 7.8 13.8 Banks 3,170.97 0.9 0.9 18.2 12.9 Industrials 2,927.35 1.5 1.5 11.7 15.4 Transportation 1,947.75 0.3 0.3 10.2 12.3 Real Estate 1,601.22 0.7 0.7 (16.4) 13.9 Insurance 3,069.01 0.3 0.3 (11.8) 26.1 Telecoms 1,023.19 0.9 0.9 (6.9) 30.6 Consumer 6,158.93 (0.0) (0.0) 24.1 13.4 Al Rayan Islamic Index 3,601.50 0.8 0.8 5.3 14.6 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% DAMAC Properties Dubai 2.14 4.4 1,343.9 (35.2) Boubyan Petrochem. Co. Kuwait 0.87 3.7 302.5 29.9 Saudi Int. Petrochemical Saudi Arabia 23.12 3.1 2,080.7 32.5 Industries Qatar Qatar 110.00 2.8 150.8 13.4 Jabal Omar Dev. Co. Saudi Arabia 42.00 2.6 2,521.2 (28.9) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% F. A. Al Hokair Saudi Arabia 24.40 (5.8) 1,475.1 (19.7) Dar Al Arkan Real Estate Saudi Arabia 10.28 (2.5) 27,920.6 (28.6) Union National Bank Abu Dhabi 3.65 (1.9) 10.0 (3.9) Ahli Bank Oman 0.16 (1.8) 2,000.0 (2.9) Qurain Petrochemical Ind. Kuwait 0.33 (1.8) 693.7 0.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 16.26 (9.8) 0.1 (35.0) Al Khaleej Takaful Insurance Co. 11.05 (2.9) 2.9 (16.5) Qatar Industrial Manufacturing 40.11 (1.9) 0.6 (8.2) Alijarah Holding 9.24 (1.7) 55.4 (13.7) Aamal Company 8.86 (1.4) 5.9 2.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 35.15 0.6 18,469.4 (6.9) Industries Qatar 110.00 2.8 16,388.3 13.4 QNB Group 153.90 1.3 12,066.6 22.1 Qatar Insurance Company 35.70 0.6 8,613.5 (21.1) Vodafone Qatar 8.93 1.4 7,967.7 11.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,114.23 1.0 1.0 1.0 6.9 34.97 136,949.4 13.6 1.4 4.8 Dubai 2,864.42 1.5 1.5 1.5 (15.0) 59.35 102,042.4 9.2 1.1 5.9 Abu Dhabi 4,621.15 1.3 1.3 1.3 5.1 13.41 127,112.3 12.4 1.4 5.2 Saudi Arabia 8,339.86 0.3 0.3 0.3 15.4 930.12 529,814.3 18.8 1.9 3.2 Kuwait 4,856.17 (0.2) (0.2) (0.2) (2.9) 35.60 33,648.8 14.8 0.9 4.0 Oman 4,560.51 (0.2) (0.2) (0.2) (10.6) 3.85 19,193.9 10.8 0.9 5.7 Bahrain 1,313.57 0.2 0.2 0.2 (1.4) 4.73 20,144.8 8.6 0.9 6.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,000 9,050 9,100 9,150 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 1.0% to close at 9,114.2. The Industrials and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Zad Holding Company and Islamic Holding Group were the top gainers, rising 6.5% and 3.6%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.8%, while Al Khaleej Takaful Insurance Company was down 2.9%. Volume of shares traded on Sunday fell by 44.4% to 4.8mn from 8.6mn on Thursday. Further, as compared to the 30-day moving average of 11.2mn, volume for the day was 57.6% lower. Vodafone Qatar and Qatar First Bank were the most active stocks, contributing 18.8% and 16.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Calendar Tickers Company Name Date of reporting 2Q2018 results No. of days remaining Status QNBK QNB Group 11-Jul-18 9 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 11-Jul-18 9 Due QIBK Qatar Islamic Bank 15-Jul-18 13 Due MARK Masraf Al Rayan 16-Jul-18 14 Due ERES Ezdan Holding Group 17-Jul-18 15 Due QEWS Qatar Electricity & Water Company 18-Jul-18 16 Due UDCD United Development Company 18-Jul-18 16 Due CBQK The Commercial Bank 18-Jul-18 16 Due KCBK Al Khalij Commercial Bank 19-Jul-18 17 Due ABQK Ahli Bank 19-Jul-18 17 Due DHBK Doha Bank 19-Jul-18 17 Due NLCS Alijarah Holding 26-Jul-18 24 Due ORDS Ooredoo 29-Jul-18 27 Due AKHI Al Khaleej Takaful Insurance Company 3-Aug-18 32 Due Source: QSE News Qatar Ezdan Holding Group to disclose its semi-annual financials on July 17 – Ezdan Holding Group announced that it will disclose its semi-annual financial reports for the period ending June 30, 2018 on July 17, 2018. (QSE) Ooredoo to disclose its semi-annual financials on July 29 – Ooredoo announced that it will disclose its semi-annual financial reports for the period ending June 30, 2018 on July 29, 2018. (QSE) Al Khalij Commercial Bank to disclose its semi-annual financials on July 19 – Al Khalij Commercial Bank announced that it will disclose its semi-annual financial reports for the period ending June 30, 2018 on July 19, 2018. (QSE) Alijarah Holding to disclose its semi-annual financials on July 26 – Alijarah Holding announced that it will disclose its semi- annual financial reports for the period ending June 30, 2018 on July 26, 2018. (QSE) Qatar Electricity & Water Company to disclose its semi-annual financials on July 18 – Qatar Electricity & Water Company announced that it will disclose its semi-annual financial reports for the period ending June 30, 2018 on July 18, 2018. (QSE) Alijarah Holding modifies the concession contract with Karwa – Alijarah Holding agreed with Mowasalat (Karwa) to reduce the numbers of operated taxis from 1000 to 500 starting July 1, 2018. (QSE) Qatar posts 1.4% YoY GDP growth in 1Q2018 – An expansion of about 5% in the non-hydrocarbons sector mitigated the more than 2% decline in hydrocarbons, enabling Qatar to report 1.4% YoY real (inflation-adjusted) growth in 1Q2018. However, the country’s GDP at constant prices (base year 2013) fell 3.6% compared to 4Q2017 on weaker hydrocarbons and non- hydrocarbons, according to figures released by the Ministry of Development Planning and Statistics (MDPS). On a quarterly basis, the mining and quarrying sector is estimated to have decelerated 3.3% and non-hydrocarbons by 4% during 1Q2018. On a nominal basis (at current prices), Qatar’s GDP is estimated to have grown 7% on yearly basis; whereas it declined 1% QoQ. The hydrocarbons sector saw 4.3% expansion YoY; while it shrank 5.2% on quarterly basis; while in the case of non- hydrocarbons, it reported 8.3% and 1.2% growth respectively. The yearly nominal growth in the non-mining sector during 1Q2018 was mainly due to the construction sector which saw 21.8% growth, followed by manufacturing (13%), finance and Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 36.21% 50.82% (18,648,645.94) Qatari Institutions 21.17% 20.09% 1,381,395.52 Qatari 57.38% 70.91% (17,267,250.42) GCC Individuals 1.50% 2.05% (705,222.28) GCC Institutions 1.17% 4.96% (4,842,839.73) GCC 2.67% 7.01% (5,548,062.01) Non-Qatari Individuals 12.88% 14.58% (2,181,538.66) Non-Qatari Institutions 27.07% 7.49% 24,996,851.09 Non-Qatari 39.95% 22.07% 22,815,312.43

- 3. Page 3 of 5 insurance (5.3%), transport and storage (2.4%) and wholesale and retail trade (0.5%). (Gulf-Times.com) Qatari insurance sector’s balance sheet tops QR50bn in 2017 – Qatar’s insurance sector continued to record robust growth during 2017, outpace the banking sector, and saw a growth of 13.7% in its aggregate balance sheet to QR50.6bn last year. The aggregate balance sheet of the domestic insurance firms stood at QR44.5bn in 2016, Qatar Central Bank (QCB) stated in its ninth Financial Stability Review (FSR). Reflecting the healthy growth in insurance, gross written premium (GWP) accelerated by 14.5% during the year on top of 11.8% increase in the previous year. GWP stood at QR14.4bn in end-December 2017. The contribution of domestic insurers in Qatar was QR12.3bn and that of international branches was QR0.3bn. Net written premium (NWP) grew by 10.7%. Though the gross income increased by 6.4% during 2017 compared to the previous year, the net profit, albeit positive, recorded a sharp decline. Solvency coverage of insurance firms remained much above the regulatory requirement. Average solvency ratio stood at 271% on a consolidated basis. Leverage ratio remained almost stable around the previous year level. (Gulf-Times.com) New Swedish chamber eyes stronger Qatar-Sweden trade ties – Citing figures from the National Board Trade of Sweden, Swedish Chamber of Commerce in Qatar’s (SCCQ) board member, Mattias Nordfeldt said Sweden’s exports to Qatar jumped 32% to reach 1.96bn Swedish Krona (SEK) in 2017 compared to 1.48bn SEK in 2016. Nordfeldt noted that the Swedish chamber will support efforts to increase Qatar-Sweden bilateral trade volume by connecting Swedish businesses with decision makers in Qatar, both from the public and private sectors, and vice versa. The chamber will work in close collaboration with the Embassy of Sweden in Qatar in these tasks, starting with a large networking event later this fall, Nordfeldt said. (Gulf-Times.com) International Japan’s June manufacturing PMI shows growth but export orders contract – Japanese manufacturing activity grew at a slightly faster pace in June, but export orders fell more than initially reported in a worrying sign of the potential impact of a trade dispute between the US and major economies. The final Markit/Nikkei survey for Japan showed the manufacturing Purchasing Managers Index (PMI) was a seasonally adjusted 53.0, lower than the flash reading of 53.1 but still above a final 52.8 in May. The index remained above the 50 threshold that separates expansion from contraction for 22nd consecutive month. The final index for new export orders went below the preliminary 49.5 and was off May’s 51.1, marking the first decline in 22 months. (Reuters) Japanese 2Q2018 manufacturers’ morale worsens, seen flat ahead – Japanese big manufacturers’ business confidence worsened in June from three months ago, the Bank of Japan’s closely watched quarterly tankan survey showed. The headline index for big manufacturers’ sentiment stood at plus 21 in June, versus plus 24 three months ago and down for a second straight quarter, the tankan showed. It was the first time since the final three months of 2012 that big manufacturers’ mood soured for two quarters in a row. The headline index compared with the median estimate of plus 22 in a Reuters poll of analysts, and is expected to stay flat over the next three months, it showed. The survey also showed big firms plan to raise their capital spending by 13.6% in the financial year from April 2018, versus economists’ median estimate of 9.3% gain. (Reuters) Regional Saudi Arabian economy escapes recession in 1Q2018 – Saudi Arabia’s economy pulled out of recession in 1Q2018, due to rising oil prices and rise in the non-crude sector. The Kingdom’s economy grew by 1.15% in 1Q2018 compared to 1Q2017 when it shrank by 0.84%, according to the General Authority for Statistics. The body attributed the growth to 2.7% jump in the non-oil sphere and 0.62% rise in the oil sector, which contracted by nearly 2% in 1Q2017. Oil prices have been steadily rising since early 2016, when OPEC and non-OPEC producers struck a deal to cut output. The cut in oil revenue had pushed Saudi Arabia’s economy into negative territory last year for the first time since 2009, a year after the global financial crisis. (Gulf- Times.com) Saudi Arabia’s oil exports value rises in 1Q2018 – General Authority for Statistics in Saudi Arabia reported preliminary value of exports for 1Q2018. Exports value of crude oil, natural gas and refined oil products was SR187.5bn in 1Q2018 versus SR161.9bn in 1Q2017, whereas non-oil exports value was SR56.2bn versus SR44.8bn. (Bloomberg) SABIC working on tightening Clariant ties – Saudi Basic Industries Corporation (SABIC) is considering increasing its holding in Clariant and pursuing joint ventures as the Saudi Arabian firm looks to strengthen ties with the Swiss chemicals group, sources said. SABIC had bought 24.9% stake in Clariant this year and is expected to intensify research and development with the Swiss specialty chemicals maker as well as hike its stake over time. (GulfBase.com) Saudi Aramco signs deal to make onshore oil rigs, equipment – Saudi Aramco signed a deal with National Oilwell Varco Inc. (NOV) to form a joint venture to make onshore rigs and equipment in Saudi Arabia. Saudi Aramco will own 30% of the venture, while the rest will be owned by NOV. Saudi Aramco’s CEO, Amin Nasser said that the deal was a step towards the creation of a vibrant energy services sector. (GulfBase.com) Omani banks extend OMR20.90bn in credit – Credit extended by commercial banks in Oman in 1Q2018 stood at OMR20.90bn, 6% increase from the OMR19.72bn recorded during 1Q2017. The quarterly statistical bulletin issued by Central Bank of Oman (CBO) showed that personal loans accounted for OMR8,227.7mn or 39.4% of the total banking credit extended during 1Q2018, while OMR2,027.2mn or 9.7% went to the construction sector and OMR2,021.3mn or 9.7% was extended to the services sector. The industry sector received OMR1,510.6mn or 7.2% of the total amount. The bulletin also revealed that the import sector received OMR1,140.9mn or 5.5% of the credit granted by commercial banks during 1Q2018. (GulfBase.com) Moody’s: Bahrain’s credit rating depends on GCC financial package – Bahrain’s credit rating will depend on the size, timing and the form of the financial support pledged by its Arabian Gulf allies to ensure fiscal stability of the Kingdom’s financial institutions. The Gulf’s smallest economy will need around $2.3bn to $2.8bn in 2H2018 and more than $4bn in 2019 to

- 4. Page 4 of 5 finance its budget deficit and service its debts, according to a Moody’s report. Moody’s stated, “Prompt and sizeable financial support would support Bahrain’s credit profile. Conversely, delays or lack of clarity on the form and modality of financial support by the GCC would put negative pressure on the sovereign’s creditworthiness.” (GulfBase.com) Bahrain’s central bank net foreign assets fall in May as currency under threat – Net foreign assets at Bahrain’s central bank fell in May, according to official data that may fuel concern about the country’s ability to defend its currency against a current account deficit and rising public debt. The assets dropped to BHD671.1mn from BHD779.4mn in April, the central bank stated. Net foreign assets at Bahraini retail banks also fell, to minus BHD1.20bn from minus BHD1.17bn, meaning liabilities exceeded assets. Combined, the net foreign assets of the central bank and retail banks sank to minus BHD526.1mn in May, the lowest level on record. (Gulf-Times.com) Bahrain looks to repair strained finances as credit risk hits record high – Bahrain pledged to implement steps to repair its strained finances widely seen as crucial to help the Kingdom receive support from Gulf Arab allies. Bahrain’s Prime Minister, Khalifah Bin Salman Al Khalifah set up a committee to devise plans to balance the budget. The committee, whose members include Finance Minister and central bank’s Chief, will present its plans to the premier, who will take a decision at the earliest possible time. The announcement comes after Saudi Arabia, the UAE and Kuwait said they were working with Bahrain on a program to stabilize its finances after the Kingdom’s bonds tumbled and its credit risk rose to a record-high. (Gulf- Times.com)

- 5. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 40.0 60.0 80.0 100.0 120.0 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 QSE Index S&P Pan Arab S&P GCC 0.3% 1.0% (0.2%) 0.2% (0.2%) 1.3% 1.5% (0.6%) 0.0% 0.6% 1.2% 1.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,253.16 0.4 (1.3) (3.8) MSCI World Index 2,089.30 0.5 (1.2) (0.7) Silver/Ounce 16.12 0.7 (2.1) (4.9) DJ Industrial 24,271.41 0.2 (1.3) (1.8) Crude Oil (Brent)/Barrel (FM Future) 79.44 2.0 5.1 18.8 S&P 500 2,718.37 0.1 (1.3) 1.7 Crude Oil (WTI)/Barrel (FM Future) 74.15 1.0 8.1 22.7 NASDAQ 100 7,510.30 0.1 (2.4) 8.8 Natural Gas (Henry Hub)/MMBtu 2.97 0.1 1.0 (16.1) STOXX 600 379.93 1.6 (1.1) (5.2) LPG Propane (Arab Gulf)/Ton 93.75 2.5 9.6 (4.1) DAX 12,306.00 1.9 (1.9) (7.5) LPG Butane (Arab Gulf)/Ton 104.00 4.6 11.5 (1.5) FTSE 100 7,636.93 1.0 (1.0) (3.1) Euro 1.17 1.0 0.3 (2.7) CAC 40 5,323.53 1.7 (0.9) (2.7) Yen 110.76 0.2 0.7 (1.7) Nikkei 22,304.51 (0.2) (1.7) (0.4) GBP 1.32 1.0 (0.4) (2.3) MSCI EM 1,069.52 2.2 (1.7) (7.7) CHF 1.01 0.7 (0.3) (1.6) SHANGHAI SE Composite 2,847.42 2.2 (3.1) (15.4) AUD 0.74 0.7 (0.5) (5.2) HANG SENG 28,955.11 1.6 (1.3) (3.6) USD Index 94.47 (0.9) (0.1) 2.5 BSE SENSEX 35,423.48 1.6 (1.6) (3.0) RUB 62.74 (0.1) (0.2) 8.9 Bovespa 72,762.51 1.2 0.3 (18.5) BRL 0.26 (0.4) (2.4) (14.6) RTS 1,154.16 2.6 2.6 (0.0) 82.3 80.4 66.5