QNBFS Daily Market Report February 18, 2019

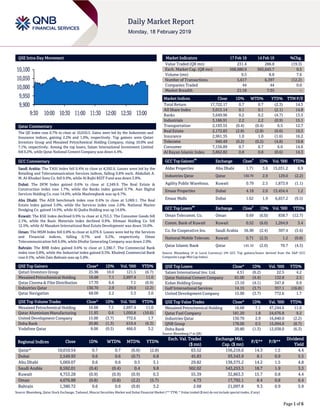

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.7% to close at 10,010.5. Gains were led by the Industrials and Insurance indices, gaining 2.2% and 1.0%, respectively. Top gainers were Qatari Investors Group and Mesaieed Petrochemical Holding Company, rising 10.0% and 7.1%, respectively. Among the top losers, Salam International Investment Limited fell 6.2%, while Qatar National Cement Company was down 4.4%. GCC Commentary Saudi Arabia: The TASI Index fell 0.4% to close at 8,592.0. Losses were led by the Retailing and Telecommunication Services indices, falling 0.8% each. Abdullah A. M. Al-Khodari Sons Co. fell 9.9%, while Al Rajhi REIT Fund was down 3.8%. Dubai: The DFM Index gained 0.6% to close at 2,549.9. The Real Estate & Construction index rose 1.7%, while the Banks index gained 0.7%. Aan Digital Services Holding Co. rose 14.6%, while Mashreqbank was up 6.7%. Abu Dhabi: The ADX benchmark index rose 0.6% to close at 5,069.1. The Real Estate index gained 3.0%, while the Services index rose 2.0%. National Marine Dredging Co. gained 14.9%, while Al Qudra Holding was up 14.6%. Kuwait: The KSE Index declined 0.9% to close at 4,753.3. The Consumer Goods fell 2.1%, while the Basic Materials index declined 0.9%. Ithmaar Holding Co. fell 12.5%, while Al Masaken International Real Estate Development was down 10.0%. Oman: The MSM Index fell 0.8% to close at 4,076.9. Losses were led by the Services and Financial indices, falling 0.7% and 0.2%, respectively. Oman Telecommunication fell 6.0%, while Dhofar Generating Company was down 2.9%. Bahrain: The BHB Index gained 0.6% to close at 1,380.7. The Commercial Bank index rose 0.8%, while the Industrial index gained 0.5%. Khaleeji Commercial Bank rose 9.5%, while Zain Bahrain was up 5.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 25.96 10.0 121.5 (6.7) Mesaieed Petrochemical Holding 16.68 7.1 2,897.4 11.0 Qatar Cinema & Film Distribution 17.70 6.6 7.1 (6.9) Industries Qatar 130.70 2.9 129.0 (2.2) Qatar Navigation 68.00 2.2 3.3 3.0 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.68 7.1 2,897.4 11.0 Qatar Aluminium Manufacturing 11.93 0.6 1,050.8 (10.6) United Development Company 15.00 (3.7) 772.6 1.7 Doha Bank 20.80 (1.3) 619.4 (6.3) Vodafone Qatar 8.06 (0.5) 466.0 3.2 Market Indicators 17 Feb 19 14 Feb 19 %Chg. Value Traded (QR mn) 231.4 286.8 (19.3) Exch. Market Cap. (QR mn) 568,680.9 565,645.7 0.5 Volume (mn) 9.5 8.8 7.6 Number of Transactions 5,617 6,397 (12.2) Companies Traded 44 44 0.0 Market Breadth 21:18 7:35 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,722.17 0.7 0.7 (2.3) 14.3 All Share Index 3,015.14 0.1 0.1 (2.1) 14.8 Banks 3,649.96 0.2 0.2 (4.7) 13.5 Industrials 3,186.91 2.2 2.2 (0.9) 15.1 Transportation 2,193.55 (0.4) (0.4) 6.5 12.7 Real Estate 2,172.83 (2.8) (2.8) (0.6) 19.5 Insurance 2,961.35 1.0 1.0 (1.6) 16.2 Telecoms 940.49 (0.2) (0.2) (4.8) 19.8 Consumer 7,156.89 0.7 0.7 6.0 14.6 Al Rayan Islamic Index 3,862.82 0.8 0.8 (0.6) 14.3 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Aldar Properties Abu Dhabi 1.71 3.6 15,031.2 6.9 Industries Qatar Qatar 130.70 2.9 129.0 (2.2) Agility Public Warehous. Kuwait 0.79 2.5 1,873.9 (1.1) Emaar Properties Dubai 4.18 2.0 13,454.4 1.2 Emaar Malls Dubai 1.62 1.9 6,657.2 (9.5) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Oman Telecomm. Co. Oman 0.69 (6.0) 838.7 (12.7) Comm. Bank of Kuwait Kuwait 0.52 (6.0) 1,264.9 3.4 Co. for Cooperative Ins. Saudi Arabia 56.90 (2.4) 307.4 (5.6) National Mobile Telecom. Kuwait 0.71 (2.3) 1.2 (0.8) Qatar Islamic Bank Qatar 145.10 (2.0) 70.7 (4.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 4.51 (6.2) 22.5 4.2 Qatar National Cement Company 61.00 (4.4) 132.8 2.5 Ezdan Holding Group 13.10 (4.1) 347.8 0.9 Gulf International Services 14.15 (3.7) 357.1 (16.8) United Development Company 15.00 (3.7) 772.6 1.7 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Mesaieed Petrochemical Holding 16.68 7.1 47,244.6 11.0 Qatar Fuel Company 181.20 1.8 24,676.8 9.2 Industries Qatar 130.70 2.9 16,840.0 (2.2) QNB Group 178.00 0.5 15,094.0 (8.7) Doha Bank 20.80 (1.3) 12,938.0 (6.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,010.54 0.7 0.7 (6.6) (2.8) 63.52 156,216.6 14.3 1.5 4.4 Dubai 2,549.93 0.6 0.6 (0.7) 0.8 45.83 93,543.9 8.1 0.9 5.5 Abu Dhabi 5,069.07 0.6 0.6 0.5 3.1 29.82 138,575.2 14.2 1.5 4.8 Saudi Arabia 8,592.01 (0.4) (0.4) 0.4 9.8 502.02 543,253.3 18.7 1.9 3.3 Kuwait 4,753.28 (0.9) (0.9) (0.9) 0.3 55.39 32,863.3 15.7 0.8 4.4 Oman 4,076.88 (0.8) (0.8) (2.2) (5.7) 4.73 17,792.1 8.4 0.8 6.4 Bahrain 1,380.72 0.6 0.6 (0.8) 3.2 2.68 21,097.8 9.3 0.9 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,900 9,950 10,000 10,050 10,100 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QE Index rose 0.7% to close at 10,010.5. The Industrials and Insurance indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatari Investors Group and Mesaieed Petrochemical Holding Company were the top gainers, rising 10.0% and 7.1%, respectively. Among the top losers, Salam International Investment Limited fell 6.2%, while Qatar National Cement Company was down 4.4%. Volume of shares traded on Sunday rose by 7.6% to 9.5mn from 8.8mn on Thursday. Further, as compared to the 30-day moving average of 9.3mn, volume for the day was 1.4% higher. Mesaieed Petrochemical Holding Company and Qatar Aluminium Manufacturing Company were the most active stocks, contributing 30.6% and 11.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Jabal Omar Development Co. * Saudi Arabia SR 1,962.6 245.0% 812.5 N/A 193.8 N/A Rak Properties* Abu Dhabi AED 101.4 -67.6% – – 150.5 -21.5% Manazel Real Estate* Abu Dhabi AED 974.7 13.1% – – 239.1 8.4% United Paper Industries#** Bahrain BHD 3247.5 6.3% – – -12.1 N/A Inovest* Bahrain USD 27.7 19.5% 12.5 2.8% 14.0 139.2% Bahrain & Kuwait Insurance Co.* Bahrain BHD 81.6 37.1% – – 3.2 21.7% National Hotels Company* Bahrain BHD 6.5 N/A – – 1.1 -48.3% Gulf Hotels Group* Bahrain BHD 35.1 -5.8% – – 6.9 -37.3% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018, # Figures in ‘000, ** Financials for 3Q2018-19) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QAMC Qatar Aluminum Manufacturing Company 20-Feb-19 2 Due QOIS Qatar Oman Investment Company 20-Feb-19 2 Due MERS Al Meera Consumer Goods Company 24-Feb-19 6 Due QFLS Qatar Fuel Company 25-Feb-19 7 Due BRES Barwa Real Estate Company 25-Feb-19 7 Due QISI The Group Islamic Insurance Company 25-Feb-19 7 Due QNNS Qatar Navigation (Milaha) 25-Feb-19 7 Due QCFS Qatar Cinema & Film Distribution Company 26-Feb-19 8 Due MCCS Mannai Corporation 26-Feb-19 8 Due AHCS Aamal Company 27-Feb-19 9 Due QGRI Qatar General Insurance & Reinsurance Company 4-Mar-19 14 Due SIIS Salam International Investment Limited 6-Mar-19 16 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 23 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 38.01% 49.33% (26,189,007.11) Qatari Institutions 28.45% 21.33% 16,491,713.10 Qatari 66.46% 70.66% (9,697,294.01) GCC Individuals 1.01% 0.88% 314,960.65 GCC Institutions 2.94% 2.67% 624,949.21 GCC 3.95% 3.55% 939,909.86 Non-Qatari Individuals 14.99% 14.86% 291,451.61 Non-Qatari Institutions 14.60% 10.94% 8,465,932.54 Non-Qatari 29.59% 25.80% 8,757,384.15

- 3. Page 3 of 6 News Qatar QGTS 4Q2018 net income down 3% YoY but up 9% QoQ exceeding our estimate by 9%; DPS flat at QR1 slightly below our estimate; Maintain Accumulate at QR21 – Qatar Gas Transport Company Limited's (QGTS) posted a net profit of QR233mn in 4Q2018, beating our estimate of QR214mn (variation of +9%). Operating metrics were in line with our estimates, with adjusted revenue of QR878mn lower by 1.5% relative to our estimate of QR891mn and adjusted EBITDA of QR679mn flattish vs. our forecast of QR681mn. Most of the beat for the quarter came from lower than expected finance charges, which came in at QR287mn (-2.5% YoY, -6.1% QoQ) vs. our estimate of QR309mn despite total debt for 2018 coming in exactly in-line with our model at QR19.8bn. In FY2018, Nakilat reported 5% YoY growth in net profit to QR891mn. Excluding the 2017 one-off item (available for sale investments), the company’s 2018 net profit saw a 14% growth. The board has recommended a cash dividend of QR1 per share (compared to our estimate of QR1.05 per share) to be approved by shareholders at the Annual General Assembly scheduled on March 19, 2019. In terms of catalysts, we believe expansion of Qatar’s LNG output from 77 MTPA to 110 MTPA is a significant driver. Currently our model does not assume any fleet expansion and we will incorporate such expansion once more details are revealed. We foresee significant upward revision to our estimates and price target once we factor in this expansion. Also, QGTS is targeting FSRUs with one vessel already added to the fleet. We note that the company’s ships have 40-years of life vs. maximum debt life of 25 years (last debt maturing 2033), creating refinancing opportunities to increase fleet size. Medium-term, we believe the shipyard business, which is no longer loss making, could further improve. (QNB FS Research, QSE, Gulf-Times.com) Vodafone Qatar announces the list of candidates for board membership – Vodafone Qatar's board of directors, in its meeting dated February 11, 2019, has approved the list of candidates for the independent membership election. The approved list of candidates will be presented to the company’s AGM scheduled on March 4, 2019, during which the three independent board members will be elected from the list of approved candidates. The other four board members were appointed by Vodafone Qatar and Qatar Foundation in accordance with Article 29 of Vodafone Qatar's Articles of Association. (QSE) Ooredoo to hold its AGM and EGM on March 19, 2019 – Ooredoo’s board of directors invited its shareholders to attend the Ordinary Assembly Meeting (AGM) and Extraordinary Assembly Meeting (EGM), which will be held on March 19, 2019. If there is no quorum, an alternative meeting will be held on March 31, 2019. (QSE) QGRI postpones disclosure of the financial statements ended December 31, 2018 to March 4, 2019 – Qatar General Insurance & Reinsurance Company (QGRI) announced that the company will postpone its board meeting from February 18, 2019 to March 4, 2019 to discuss and adopt financials for the period ended December 31, 2018. (QSE) IHGS announces the extension of the term of board of directors’ membership for a period of three years from 2019-2021 – Islamic Holding Group’s (IHGS) board of directors announced the extension of the opening period of the candidacy for membership of the board of directors for its new session until 2:00 pm on February 24, 2019 instead of the previously announced date ending on February 18, 2019 for a period of next three years. Shareholders who wish to apply for membership of the board of directors and have membership requirements must obtain applications from the company's main office from 8:00 am to 2:00 pm until February 24, 2019. (QSE) QFC targeting 10 listings on QSE, eyes 5% of capitalization – Qatar Financial Centre (QFC) is targeting 10 listings on the Qatar Stock Exchange (QSE) as it aims to account for 5% of QSE market capitalization in another three years. This was disclosed by QFC Authority’s CEO, Yousuf Mohamed Al-Jaida at a meeting to unveil its strategies beyond 2022, to be implemented in association with Qatar Development Bank, Aspire Zone Foundation and Msheireb Properties. Already two exchange traded funds (ETFs) – one sponsored by Masraf Al Rayan and another by Doha Bank – has been incorporated under the QFC and listed on the QSE. Moreover, Qatar First Bank, which is also a QFC authorized entity, is listed on the domestic bourse. Indications are that family-owned companies may create holding companies (under the QFC umbrella), which in turn may seek listings. Similar is the case with those sovereign- backed entities that wish to go public. In its 2017-2022 roadmap, QFC had stated it would allow more stock listings and financial products on the bourse, including ETFs, Sukuk, real estate investment trusts and family-owned companies in order to achieve 5% of QSE market capitalization. Al-Jaida said overseas institutional investors were net buyers of about $2.3bn on the QSE during 2018, which was more than triple the foreign flows into the neighboring countries. (Gulf-Times.com) QFC to triple asset size to $70bn; help create $20bn sport market – Qatar Financial Centre (QFC) unveiled its aggressive 2022 strategic roadmap aims to enable it to emerge as a major financial hub in MENA and South Asian region. The QFC 2.0 expansion plans target to triple the size of QFC’s assets to $70bn and create 10,000 high skilled jobs in the private sector, in addition to increasing the total number of firms on the QFC platform to 1,000. Creation of four strategic clusters, namely, Sports, Digital, Financial and Media, and a New Emerging Belt Initiative (NEBI) are the key highlights of QFC’s 2022 Strategy. QFC also aims to list at least 10 of its licensed companies on the Qatar Stock Exchange (QSE) by 2022. As part of the New Emerging Belt Initiative (NEBI), QFC will develop an economic corridor that focuses on strategic alliances with markets such as Kuwait, Oman, Turkey, Pakistan and India. These new emerging markets have been identified because they possess a large potential for future growth, especially considering that their combined GDP is estimated to be approximately $2.1tn, with total global FDI from these markets exceeding $150bn. Elaborating on the ambitious plans, QFC Authority’s CEO, Yousuf Mohamed Al Jaida said that Qatar is a well-positioned international player in all the above said four strategic clusters. QFC’s new strategy aims to leverage its experience and

- 4. Page 4 of 6 expertise even further. Highlighting the potential of sports industry businesses in Qatar, Al Jaida noted the market size of the sports sector in Qatar is expected to reach $20bn (QR72bn) by 2023. In 2017, estimated size of the global sports industry was $1.3tn. The ecosystem of the global sports industry generates $700bn annually. The QFC is aiming to attract sport consultancy and advisory, sport legal advisory, sort financing and contracting, sport event management and promotion, sport technology companies. Moreover, it is eyeing Islamic finance’s global coverage through Qatar, Turkey and Malaysia hubs, Al- Jaida added. The QFC is also working very closely with Qatar Development Bank to advance the country’s national FinTech agenda. (Peninsula Qatar, Gulf-Times.com) Ooredoo, Colt to launch new cloud connectivity services – Ooredoo, along with global connectivity provider, Colt Technology Services (Colt) announced the launch of Ooredoo’s Cloud Connect service for business customers to scale innovation with global cloud providers. With Ooredoo Cloud Connect, Ooredoo’s business customers can now establish managed cloud connectivity from their local data centre to global cloud service providers. Ooredoo Qatar’s Chief Operating Officer, Yousuf Abdulla al Kubaisi said, “Our Ooredoo Cloud Connect provides secure cloud connectivity to enable real-time decision-making for digital transformation. Business customers can offload their cloud management to Ooredoo, so IT staff can focus on business innovation.” (Qatar Tribune) Siemens Qatar’s CEO: Digitalization, smart infrastructure key to Qatar's urban development – Digitalization and smart infrastructure are keys to helping cities like Doha provide a high quality of life, prepare for future challenges, and offer an environment that encourages economic growth, according to Siemens Qatar’s CEO, Adrian Wood. Siemens, he said, is currently collaborating with a number of customers to promote smart buildings in Qatar through the development of a pilot project focusing on the implementation of Siemens’ ‘Navigator’ technology. Analytical building performance tools from Siemens - ‘Navigator’ and ‘Demand Flow’ - are able to identify energy and water savings of up to 30%, he said. Digitalization can help the infrastructure to drive economic development in areas such as smart manufacturing, he noted. (Gulf-Times.com) International CIPD: UK’s businesses plan to raise pay by most since 2012 – British businesses plan to raise basic wages by the most in at least seven years, due to recruitment difficulties and a need to keep pay in line with competitors, a survey showed, highlighting ongoing strength in Britain’s jobs market. The Chartered Institute of Personnel and Development (CIPD), a human resources professional body, stated private-sector employers planned to increase basic pay rates this year by 2.5%, on average, the most since the survey started in 2012. Britain’s labor market has proved resilient in the run-up to Brexit, with unemployment falling to its lowest since the mid- 1970s, despite a broader slowdown that caused investment to slide and cut overall growth in 2018 to its weakest since 2012. (Reuters) ECB's Rehn sees Eurozone’s economy weakening – Recent data point to a weakening Eurozone economy, the European Central Bank’s (ECB) Olli Rehn told a German newspaper, adding that interest rates would remain at the current level until monetary policy goals have been met. The ECB has stated it aims to keep interest rates at current record lows at least through the summer but its longstanding rate guidance is increasingly out of sync with market expectations due to an economic slowdown. He attributed it to greater uncertainties outside Eurozone, such as the trade conflict between the US and China but also pointed to uncertainty over Brexit, protests in France, fiscal issues in Italy and slower industrial production in Germany. His comments come before an ECB meeting on March 7, when policymakers are widely expected to slash their growth and inflation projections, as the Eurozone is experiencing its biggest slowdown in half a decade. (Reuters) Japan's machinery orders slump as trade frictions bite – Overseas orders for Japanese machinery posted their biggest decline in more than a decade in December and manufacturers expect orders to fall further this quarter as trade frictions weigh on global demand. Data showed core machinery orders, considered a leading indicator of capital expenditure, fell 0.1% MoM in December. This was the first decline in three months but was smaller than the median estimate for a 1.1% decrease. Highlighting bigger concerns about the external environment, however, was a 21.9% MoM tumble in machinery orders from overseas, the biggest fall since November 2007. A cabinet official said the slump was partly due to the base effect of large overseas orders seen over the past two months; however, forecasts showed manufacturers expect overseas orders to fall 17.1% in the current quarter. Manufacturers surveyed by the Cabinet Office forecast core orders will fall 1.8% in January- March after decreasing 4.2% in October-December. The Cabinet Office cut its assessment of orders to say they are stalling. Orders from manufacturers fell 8.5% MoM in December after a 6.4% decline in November, due to lower orders from makers of manufacturing equipment and electronics. Service-sector orders rose 6.8%, faster than a 2.5% increase the previous month due to a pick-up in orders from the telecommunications sector. Despite this acceleration, economists are likely to remain more concerned about the manufacturing sector and global demand. (Reuters) China to lure foreign investment in its larger state-owned enterprises – China will seek to attract foreign investment in its larger state-owned enterprises (SOEs), which are undergoing reforms to make them more competitive, the head of the country’s state asset regulator said. China began a new round of reforms in 2016, aimed at streamlining its lumbering SOEs by introducing private capital, curbing overcapacity, shutting down zombie subsidiaries and restructuring assets. “Private and foreign firms should actively participate in reform and development of central enterprises, and jointly explore ways of deep cooperation including mixed-ownership”, Xiao Yaqing, Chairman of the State-Owned Assets Supervision and Administration Commission (SASAC), said. (Reuters) Regional Saudi Arabian stocks will attract about $600mn as FTSE starts inclusion – Saudi Arabian stocks will attract about $600mn after FTSE Russell completed the first of five phases of adding the nation’s shares to the index provider’s EM gauge, according to calculations by equities strategist, Mohamad Al Hajj. SABIC

- 5. Page 5 of 6 will likely see inflows of $92.3mn, Al Rajhi of $80.2mn, National Commercial Bank (NCB) of $58.4mn, Samba Financial Group of $36.5mn, and Saudi Telecom Company (STC) of $34.4mn. FTSE Russell announced on February 15, 2019 its semi-annual review, in which it disclosed the list of Saudi Arabian companies that will be added to its indexes in the first of five tranches. The inclusion will be effective as of business close on March 15, 2019. Kuwaiti stocks have been seen attracting around $500mn after four major weight increases, with changes to National Bank of Kuwait (NBK) being the most meaningful of them. About $200mn is expected as inflows into Qatar, and $15mn into the UAE. (Bloomberg) Saudi Arabia signs oil agreement to supply Pakistan with crude oil – Saudi Arabia has signed an agreement to supply Pakistan with crude oil and petroleum products to secure its fuel needs, Saudi Arabia’s Energy Minister, Khalid Al-Falih said. Saudi Arabia’s Crown Prince, Mohammed bin Salman arrived in Pakistan and said that Saudi Arabia has signed investment agreements worth $20bn during his visit to the country. (Reuters) Saudi Arabia introduces 12-year domestic Riyal Sukuk – Saudi Arabia has introduced a 12-year tenor domestic Riyal Sukuk for the first time in February, Maaal reported, citing sources. The Sukuk which was sold previously had maturities of 10, 7 and 5 years. (Bloomberg) ARNB posts 9.3% YoY rise in net profit to SR3,310mn in FY2018 – Arab National Bank (ARNB) recorded net profit of SR3,310mn in FY2018, an increase of 9.3% YoY. Total operating profit rose 2.5% YoY to SR6,535mn in FY2018. Total revenue for special commissions/investments rose 13.2% YoY to SR6,832mn in FY2018. Total assets stood at SR178.3bn at the end of December 31, 2018 as compared to SR171.7bn at the end of December 31, 2017. Loans and advances stood at SR121.0bn (+5.7% YoY), while customer deposits stood at SR140.9bn (+3.6% YoY) at the end of December 31, 2018. EPS came in at SR3.31 in FY2018 as compared to SR3.03 in FY2017. (Tadawul) UAE raises holdings of US T-bills in December – The UAE has increased its holdings of US Treasury bonds by 0.88%, or $500mn, MoM, to $56.8bn in December 2018. YoY, the GCC nation’s US Treasury holdings declined 1.6%, or $900mn, in the last month of 2018, compared to $57.7bn in December 2017, data by the US Treasury Department showed. The UAE ranked second among investors in the US Treasuries in the Arab world, with Saudi Arabia taking the lead with $171.6bn in US treasury holdings. (Zawya) Abu Dhabi Islamic Bank says it is not in the process of merging – Abu Dhabi Islamic Bank (ADIB) has stated that it is currently not in a process for a merger or acquisition. The UAE-based lender stated that it “is always studying options available in the market that will strengthen our client base and market value.” (Bloomberg) BOS posts 33% YoY rise in net profit to AED352mn in FY2018 – Bank of Sharjah (BOS) recorded net profit of AED352mn in FY2018, an increase of 33% YoY. Net interest income rose 10% YoY to AED513mn in FY2018. Operating income fell 7% YoY to AED726mn in FY2018. Total assets stood at AED29.2bn at the end of December 31, 2018 as compared to AED30.5bn at the end of December 31, 2017. Loans and advances stood at AED16.4bn, while customers’ deposits stood at AED20.1bn at the end of December 31, 2018. EPS came in at AED0.167 in FY2018 as compared to AED0.127 in FY2017. (ADX) Oman starts bid round for six onshore oil and gas blocks – Oman’s Ministry of Oil & Gas has invited bids from oil and gas companies for six onshore blocks, according to the Ministry’s website. The Blocks 58, 70, 73, 74, 75 and 76 are included in the bid round. The bids will be accepted until May 30, 2019. Block 70 includes Mafraq, an undeveloped heavy oil field. Blocks were relinquished by Petroleum Development Oman, the Ministry’s Director of Petroleum Concessions, Suleiman Al Ghunaimi said. (Bloomberg)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&P Pan Arab S&P GCC (0.4%) 0.7% (0.9%) 0.6% (0.8%) 0.6% 0.6% (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,321.55 0.7 0.5 3.0 MSCI World Index 2,066.59 0.9 2.3 9.7 Silver/Ounce 15.79 1.1 (0.3) 1.9 DJ Industrial 25,883.25 1.7 3.1 11.0 Crude Oil (Brent)/Barrel (FM Future) 66.25 2.6 6.7 23.1 S&P 500 2,775.60 1.1 2.5 10.7 Crude Oil (WTI)/Barrel (FM Future) 55.59 2.2 5.4 22.4 NASDAQ 100 7,472.41 0.6 2.4 12.6 Natural Gas (Henry Hub)/MMBtu 2.59 (0.4) (1.1) (18.7) STOXX 600 368.94 1.2 2.5 7.6 LPG Propane (Arab Gulf)/Ton 68.50 3.8 12.1 7.9 DAX 11,299.80 1.7 3.1 5.4 LPG Butane (Arab Gulf)/Ton 85.00 10.4 24.1 21.4 FTSE 100 7,236.68 1.1 1.9 8.6 Euro 1.13 0.0 (0.2) (1.5) CAC 40 5,153.19 1.6 3.3 7.2 Yen 110.47 (0.0) 0.7 0.7 Nikkei 20,900.63 (1.1) 2.0 4.3 GBP 1.29 0.7 (0.4) 1.1 MSCI EM 1,030.64 (0.8) (0.5) 6.7 CHF 0.99 (0.1) (0.5) (2.4) SHANGHAI SE Composite 2,682.39 (1.4) 2.0 9.2 AUD 0.71 0.5 0.7 1.3 HANG SENG 27,900.84 (1.9) (0.2) 7.7 USD Index 96.90 (0.1) 0.3 0.8 BSE SENSEX 35,808.95 (0.7) (2.2) (3.1) RUB 66.32 (0.5) 0.8 (4.9) Bovespa 97,525.91 0.2 2.9 15.8 BRL 0.27 0.6 0.7 4.9 RTS 1,177.50 1.8 (1.8) 10.2 97.7 91.7 77.9