QNBFS Daily Market Report February 17, 2019

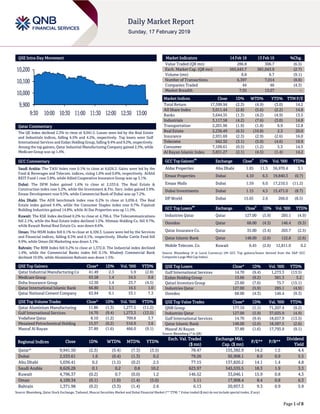

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index declined 2.3% to close at 9,941.5. Losses were led by the Real Estate and Industrials indices, falling 6.5% and 4.2%, respectively. Top losers were Gulf International Services and Ezdan Holding Group, falling 9.4% and 9.2%, respectively. Among the top gainers, Qatar Industrial Manufacturing Company gained 2.3%, while Medicare Group was up 1.4%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 8,626.3. Gains were led by the Food & Beverages and Telecom. indices, rising 1.0% and 0.8%, respectively. AlAhli REIT Fund 1 rose 3.8%, while Allied Cooperative Insurance Group was up 3.1%. Dubai: The DFM Index gained 1.6% to close at 2,533.6. The Real Estate & Construction index rose 5.2%, while the Investment & Fin. Serv. index gained 3.9%. Emaar Development rose 9.5%, while Commercial Bank of Dubai was up 7.2%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 5,036.4. The Real Estate index gained 9.4%, while the Consumer Staples index rose 0.7%. Fujairah Building Industries gained 14.8%, while Al Dar Properties was up 11.5%. Kuwait: The KSE Index declined 0.2% to close at 4,796.4. The Telecommunications fell 2.1%, while the Real Estate index declined 1.5%. Ithmaar Holding Co. fell 9.7%, while Kuwait Remal Real Estate Co. was down 8.6%. Oman: The MSM Index fell 0.1% to close at 4,109.3. Losses were led by the Services and Financial indices, falling 0.3% and 0.1%, respectively. Dhofar Cattle Feed fell 9.9%, while Oman Oil Marketing was down 3.1%. Bahrain: The BHB Index fell 0.2% to close at 1,372.0. The Industrial index declined 1.4%, while the Commercial Banks index fell 0.1%. Khaleeji Commercial Bank declined 10.0%, while Aluminium Bahrain was down 1.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Industrial Manufacturing Co 41.49 2.3 5.9 (2.8) Medicare Group 63.58 1.4 54.5 0.8 Doha Insurance Group 12.50 1.4 23.7 (4.5) Qatar International Islamic Bank 66.80 1.1 16.5 1.0 Qatar National Cement Company 63.84 0.1 53.1 7.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Aluminium Manufacturing 11.86 (1.3) 1,277.5 (11.2) Gulf International Services 14.70 (9.4) 1,273.3 (13.5) Vodafone Qatar 8.10 (1.2) 709.8 3.7 Mesaieed Petrochemical Holding 15.57 (0.2) 516.9 3.6 Masraf Al Rayan 37.89 (1.6) 466.0 (9.1) Market Indicators 14 Feb 19 13 Feb 19 %Chg. Value Traded (QR mn) 286.8 306.7 (6.5) Exch. Market Cap. (QR mn) 565,645.7 581,043.9 (2.7) Volume (mn) 8.8 9.7 (9.1) Number of Transactions 6,397 7,014 (8.8) Companies Traded 44 46 (4.3) Market Breadth 7:35 13:27 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,599.94 (2.3) (4.9) (3.0) 14.2 All Share Index 3,011.44 (2.8) (5.6) (2.2) 14.8 Banks 3,644.35 (1.3) (4.2) (4.9) 13.5 Industrials 3,117.58 (4.2) (7.6) (3.0) 14.8 Transportation 2,201.96 (1.9) (1.8) 6.9 12.8 Real Estate 2,236.49 (6.5) (10.8) 2.3 20.0 Insurance 2,931.69 (2.3) (2.9) (2.6) 16.0 Telecoms 942.32 (3.1) (5.0) (4.6) 19.9 Consumer 7,109.61 (0.5) (1.2) 5.3 14.5 Al Rayan Islamic Index 3,831.27 (2.1) (4.5) (1.4) 14.2 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Aldar Properties Abu Dhabi 1.65 11.5 56,970.4 3.1 Emaar Properties Dubai 4.10 6.5 19,840.3 (0.7) Emaar Malls Dubai 1.59 6.0 17,210.5 (11.2) Dubai Investments Dubai 1.15 4.5 15,471.0 (8.7) DP World Dubai 15.65 2.6 266.0 (8.5) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Industries Qatar Qatar 127.00 (5.9) 285.1 (4.9) Ooredoo Qatar 68.00 (4.3) 146.4 (9.3) Qatar Insurance Co. Qatar 35.00 (3.4) 203.7 (2.5) Qatar Islamic Bank Qatar 148.00 (2.6) 122.8 (2.6) Mobile Telecom. Co. Kuwait 0.45 (2.6) 12,811.0 0.2 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf International Services 14.70 (9.4) 1,273.3 (13.5) Ezdan Holding Group 13.66 (9.2) 381.3 5.2 Qatari Investors Group 23.60 (7.6) 75.7 (15.1) Industries Qatar 127.00 (5.9) 285.1 (4.9) Ooredoo 68.00 (4.3) 146.4 (9.3) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 177.10 (1.1) 71,207.4 (9.2) Industries Qatar 127.00 (5.9) 37,025.9 (4.9) Gulf International Services 14.70 (9.4) 18,657.9 (13.5) Qatar Islamic Bank 148.00 (2.6) 18,587.5 (2.6) Masraf Al Rayan 37.89 (1.6) 17,793.9 (9.1) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,941.50 (2.3) (5.4) (7.3) (3.5) 78.47 155,382.9 14.2 1.5 4.4 Dubai 2,533.61 1.6 (0.4) (1.3) 0.2 79.26 92,908.1 8.0 0.9 5.5 Abu Dhabi 5,036.41 0.2 (1.5) (0.2) 2.5 77.15 137,820.2 14.1 1.4 4.8 Saudi Arabia 8,626.28 0.1 0.2 0.8 10.2 623.97 545,535.5 18.3 1.9 3.3 Kuwait 4,796.37 (0.2) 0.7 (0.0) 1.2 146.52 33,046.1 15.9 0.8 4.3 Oman 4,109.34 (0.1) (1.0) (1.4) (5.0) 5.11 17,908.4 8.4 0.8 6.3 Bahrain 1,371.98 (0.2) (3.3) (1.4) 2.6 6.13 20,957.3 9.3 0.9 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,900 10,000 10,100 10,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index declined 2.3% to close at 9,941.5. The Real Estate and Industrials indices led the losses. The index fell on the back of selling pressure from Qatari and non-Qatari shareholders despite buying support from GCC shareholders. Gulf International Services and Ezdan Holding Group were the top losers, falling 9.4% and 9.2%, respectively. Among the top gainers, Qatar Industrial Manufacturing Company gained 2.3%, while Medicare Group was up 1.4%. Volume of shares traded on Thursday fell by 9.1% to 8.8mn from 9.7mn on Wednesday. Further, as compared to the 30-day moving average of 9.3mn, volume for the day was 5.1% lower. Qatar Aluminium Manufacturing Company and Gulf International Services were the most active stocks, contributing 14.5% and 14.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Almarai Company S&P Saudi Arabia LT-LIC/ST-LIC/ LT- FIC/ST-FIC – BBB-/A-3/BBB-/ A-3/ – Stable – Almarai Company Moody's Saudi Arabia IR – Baa3 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, LIC – Local Issuer Credit, FIC – Foreign Issuer Credit, IR – Issuer Rating) Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Yamama Cement Co. Saudi Arabia SR 160.4 -5.1% 15.7 -61.8% 7.0 -43.2% Al Kathiri Holding Co.* Saudi Arabia SR 50.8 18.2% 10.0 27.8% 9.3 40.0% National International Holding Co. Kuwait KD 4.5 55.0% 2.3 60.2% 2.3 68.2% Damac Properties Dubai AED 6,132.7 -17.7% – – 1,151.9 -58.3% Emaar Development Dubai AED 15,433.4 74.1% – – 3,901.2 42.2% Gulf General Investment Company Dubai AED 594.3 0.5% – – -169.8 N/A Arabian Scandinavian Insurance Co. Dubai AED 168.5 -27.9% 10.0 – 21.9 300.9% Air Arabia Dubai AED 4,122.0 10.2% – – -609.5 N/A Amanat Holdings Dubai AED 49.4 – – – 42.9 1.4% International Financial Advisors Kuwait KD 11.3 -67.7% -19.7 N/A -14.8 N/A Arig Bahrain USD 262.8 16.5% – – -55.3 N/A Gulfa Mineral Water & Processing Industries Co. Dubai AED 25.1 -36.2% -0.9 N/A -16.6 N/A Agility Kuwait KD 1,550.2 10.2% 118.8 17.3% 81.1 18.4% Islamic Arab Insurance Co. Dubai AED 1,063.3 31.5% 157.6 -11.3% 0.6 -98.3% Emirates Integrated Telecommunications Co. Dubai AED 13.4 3.2% 3.8 2.5% 1.8 2.4% Gulf Navigation Holding Dubai AED 147.1 6.6% – – -40.0 N/A Dubai Refreshment Dubai AED 596.0 -31.6% 38.3 -54.5% 42.3 -53.9% Unikai Foods Dubai AED 341.5 -3.9% -28.9 N/A -20.4 N/A Emaar Properties Dubai AED 25,694.3 37.0% – – 6,108.2 9.6% Shuaa Capital Dubai AED 165.2 22.7% – – 27.2 -63.3% Dar Al Takaful Dubai AED – – 46.2 3.5% 6.7 -33.7% Al Sagr insurance Dubai AED 355.7 -1.9% 75.8 -2.1% 21.8 6.9% Union Properties Dubai AED 763.0 19.2% 62.3 – 62.3 – Ras Al Khaimah Poultry & Feeding Co. Abu Dhabi AED 30.1 -27.4% -14.2 – -7.4 – Gulf Pharmaceuticals Industries Abu Dhabi AED 862.8 -32.2% -130.7 – -153.5 – Sharjah Group Company Abu Dhabi AED 13.2 -17.6% 11.8 -19.2% -8.1 – Wahat Al Zaweya Holding Abu Dhabi AED 1,149.7 19563.6% – – 307.2 N/A Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.75% 36.91% (9,060,221.47) Qatari Institutions 11.62% 11.36% 746,913.25 Qatari 45.37% 48.27% (8,313,308.22) GCC Individuals 0.85% 0.67% 528,556.63 GCC Institutions 12.86% 1.47% 32,661,835.17 GCC 13.71% 2.14% 33,190,391.80 Non-Qatari Individuals 7.75% 7.58% 497,712.37 Non-Qatari Institutions 33.17% 42.01% (25,374,795.95) Non-Qatari 40.92% 49.59% (24,877,083.58)

- 3. Page 3 of 8 Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Arkan Building Materials Co. * Abu Dhabi AED 909.2 0.1% – – 52.4 73.5% Abu Dhabi National Co. for Shipping Materials Abu Dhabi AED 78.4 -2.4% 3.1 -20.4% -52.6 N/A Fidelity United Abu Dhabi AED 146.2 71.1% -19.2 N/A -9.4 N/A Al Fujairah National Insurance Co. Abu Dhabi AED 266.6 9.7% 41.2 28.2% 30.6 9.3% Al Buhaira National insurance Co. Abu Dhabi AED 529.9 8.9% 30.7 19.3% 52.2 11.7% Ras Al Khaimah Insurance Co. Abu Dhabi AED 494.0 4.7% 16.7 -55.6% 22.5 -18.6% Abu Dhabi Ship Building Abu Dhabi AED 456.0 -36.0% – – -135.9 N/A Sharjah Cement & Industrial Development Co. Abu Dhabi AED 597.0 -8.2% 34.0 -40.4% 29.0 -55.4% Gulf Medical Projects Co. Abu Dhabi AED 485.5 10.8% 108.2 42.5% 119.7 -91.7% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/14 US Department of Labor Initial Jobless Claims 9-February 239k 225k 235k 02/14 US Department of Labor Continuing Claims 2-February 1,773k 1,740k 1,736k 02/14 US Federal Reserve Industrial Production MoM January -0.6% 0.1% 0.1% 02/14 EU Eurostat GDP SA QoQ 4Q2018 0.2% 0.2% 0.2% 02/14 EU Eurostat GDP SA YoY 4Q2018 1.2% 1.2% 1.2% 02/14 Germany German Federal Statistical Off GDP SA QoQ 4Q2018 0.0% 0.1% -0.2% 02/14 Germany German Federal Statistical Off GDP NSA YoY 4Q2018 0.9% 0.8% 1.1% 02/14 Japan Economic and Social Research Institute GDP SA QoQ 4Q2018 0.3% 0.4% -0.7% 02/14 Japan Economic and Social Research Institute GDP Annualized SA QoQ 4Q2018 1.4% 1.4% -2.6% 02/14 Japan Economic and Social Research Institute GDP Nominal SA QoQ 4Q2018 0.3% 0.4% -0.6% 02/14 Japan Ministry of Economy Trade and Industry Industrial Production MoM December -0.1% – -0.1% 02/14 Japan Ministry of Economy Trade and Industry Industrial Production YoY December -1.9% – -1.9% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QAMC Qatar Aluminum Manufacturing Company 20-Feb-19 3 Due QOIS Qatar Oman Investment Company 20-Feb-19 3 Due MERS Al Meera Consumer Goods Company 24-Feb-19 7 Due QFLS Qatar Fuel Company 25-Feb-19 8 Due BRES Barwa Real Estate Company 25-Feb-19 8 Due QISI The Group Islamic Insurance Company 25-Feb-19 8 Due QNNS Qatar Navigation (Milaha) 25-Feb-19 8 Due QCFS Qatar Cinema & Film Distribution Company 26-Feb-19 9 Due MCCS Mannai Corporation 26-Feb-19 9 Due AHCS Aamal Company 27-Feb-19 10 Due SIIS Salam International Investment Limited 6-Mar-19 17 Due Source: QSE

- 4. Page 4 of 8 News Qatar FTSE Russell announced the semi-annual review results for the FTSE Global Equity Index Series – Middle East & Africa. Accordingly 1) Large Cap Index: Inclusions: Mesaieed Petrochemical Holding 2) Mid-Cap index: Inclusions: Qatar Fuel (Woqod) Q.S.C. & Qatar Insurance Co 3) Small Cap Index: Inclusions: Qatari Investors Group. Exclusions: Salam International Investment and Gulf Warehousing 4) Micro Cap Index: Inclusions: Al Khaleej Takaful Group, Qatar First Bank and Widam Food Co. 5) FTSE All-World Index: Inclusions: Mesaieed Petrochemical Holding, Qatar Fuel (Woqod), Qatar Insurance and Qatari Investors Group 6) FTSE All-Cap Index: Inclusions: Mesaieed Petrochemical Holding, Qatar Fuel (Woqod), Qatar Insurance Co and Qatari Investors Group. Exclusions: Gulf Warehousing Co and Salam International Investment 7) FTSE Total-Cap Index: Inclusions: Al Khaleej Takaful Group, Mesaieed Petrochemical Holding, Qatar First Bank, Qatar Fuel (Woqod), Qatar Insurance Co, Qatari Investors Group, Widam Food Co. Exclusions: Gulf Warehousing Co, Salam International Investment. (FTSE) MPHC's bottom line rises 29.7% YoY and 1.4% QoQ in 4Q2018 – Mesaieed Petrochemical Holding Company's (MPHC) net profit rose 29.7% YoY (+1.4% QoQ) to QR366.3mn in 4Q2018. The company's share of results from joint ventures came in at QR280.6mn in 4Q2018, which represents an increase of 12.6% YoY. However, on QoQ basis, share of results from joint ventures fell 11.8%. EPS increased to QR1.11 in FY2018 from QR0.87 in FY2017. In FY2018, higher group sales volumes and selling prices helped MPHC to register 28.1% YoY growth in net profit to QR1.4bn. The region’s premier diversified petrochemical conglomerate, with interests in the production of olefins, poly-olefins, alpha olefins and chlor-alkali, has recommended a total annual dividend of QR1bn, equivalent to a payout of QR0.8 per share, representing 72% of the group’s profit. The distributions, since inception (including the proposed distribution for 2018), amounts to QR5.3bn. The profit for the year was also aided by the recognition of a tax refund of approximately QR169mn during the year. The group continued to benefit from the supply of competitively priced ethane feedstock and fuel gas under long-term supply agreements. QChem and QChem II also benefited from the increased availability of feedstock of 8% during the year through separate agreements. "These contractual arrangements are an important value driver for the group to sustain its strong profitability in a highly competitive market environment," an MPHC spokesman said. The closing cash position at the end of December 31, 2018, after distribution of the previous years’ dividends of QR855mn, was a robust QR1.9bn. The total assets stood at QR15.3bn in 2018 compared to QR14.8bn the previous year. The company’s board of directors also approved the calling to convene an Ordinary and Extraordinary General Assembly Meetings of the shareholders on March 12, 2019. Agenda items and meeting details will be provided later. (QSE, Company financials, Gulf- Times.com) Qatar’s income tax law – Qatari Official Gazette January 17 published the income tax law of 2018. The law includes: (1) A general income tax rate of 10%, (2) A minimum tax rate of 35% for the petrochemical industries, (3) A withholding tax rate of 5% on payments to non-residents, (4) A catch-all tax rate of 35%, if a treaty does not provide a tax rate, (5) An exemption for gross income and qualified capital gains of resident individuals, (6) An exemption for investments in shares listed on the stock exchange, (7) Exemptions for qualified dividends, (8) An exemption for companies operating in the agricultural and fishing sectors, (9) An exemption for gross income of non- Qatari air or maritime companies, subject to reciprocity, and (10) An enabling regulatory regime for the establishment of the General Authority for Taxes. The law enters into force and generally takes effect the same date. (Bloomberg) Qatar’s CPI drops 1.59% YoY and 0.97% MoM in January 2019 – Qatar’s January 2019 consumer price index (CPI) decreased by 1.59% YoY and 0.97% MoM, according to data released by the Planning and Statistics Authority (PSA). PSA stated the CPI of January 2019 reached 107.57 points (base year 2013). The YoY price decrease was primarily due to the decreasing prices observed in eight groups, namely: communication by 11.45%, followed by recreation and culture (5.05%), clothing and footwear (4.04%), housing, water, electricity and other fuel (2.67%), food and beverages (2.51%), transport (2.12%), restaurants and hotels (0.13%), and miscellaneous goods and services (0.04%). An increase in price levels was observed in four groups namely: tobacco by 127.19%, education (9.25%), furniture & household equipment (1.33%) and health (0.10%). The CPI of January 2019 excluding housing, water, electricity and other fuel group stood at 107.94 points, a decrease of 1.21% compared to December 2018, and a decrease of 1.29% compared to the CPI of January 2018, PSA data showed. (Qatar Tribune) Qatar received over 1.8mn visitors last year – Over 1.8mn people visited Qatar last year, driven by strong inflow of travelers from countries in Asia and Europe. Out of the total visitors, 41% were from ‘other Asia’ region while 29% of the visitors were from Europe in 2018, according to the Ministry of Development Planning and Statistics data. From the figures, 753,161 visitors were from countries in ‘other Asia’ region while 528,333 visitors came from Europe. A little over 200,000 visitors came from GCC countries, taking the share of visitors of these countries to 11% in total visitor inflow during 2018. The visitors from Americas accounted for 9% of the total visitor arrivals as 161,162 visitors from Americas travelled to Qatar last year. Share of visitors from ‘other Arab countries’ to Qatar was 7% while the share of visitors from ‘other African countries’ was 3% in 2018. (Peninsula Qatar) MoTC, Chatham House forum focuses on risks weighing on maritime sector – International policy think-tank Chatham House, and the Ministry of Transport and Communications (MoTC) held a forum for experts from around the world to discuss electronic threats to the business and infrastructure of shipping and ports. Titled ‘Cyber Security of the Maritime Sector: Challenges and Opportunities' the event brought together specialists from shipping, industry, government and research to exchange ideas and experiences on the ever- evolving risks facing the transport of commodities by sea. Joining Chatham House and MoTC were senior specialists from Milaha, Nakilat, Hamad Bin Khalifa University, Coventry

- 5. Page 5 of 8 University UK, Associated British Ports, Hudson Cyber USA, and Aon, among others. With 97% of its imports arriving by sea, Qatar’s economy is especially vulnerable to both physical and electronic attacks on the maritime sector, and local experts revealed how both the government and industry are working together on building sustainable resilience in the area. (Gulf- Times.com) Baladna launches Qatar's first locally produced long-life milk – Baladna Food Industries (Baladna), Qatar’s largest producer of fresh dairy, has commenced its third phase with the launch of the country’s first UHT (ultra high-temperature pasteurization) - or long-life milk - line. The new state-of-the-art UHT production line aims to help Qatar move closer to achieving self-sufficiency and food security, the company stated. A true Qatari flagship brand, Baladna is now expanding its business into a new phase to build its product portfolio. With an investment of approximately QR21mn, the UHT line is looking to produce an average of 80 tons of long-life milk daily. (Gulf- Times.com) International MBA: US mortgage delinquencies hit 18-year low in 4Q2018 – The number of US homeowners who fell behind on their mortgage payments dropped to the lowest levels in 18 years in the final quarter of 2018, the Mortgage Bankers Association (MBA) stated. On the other hand, the number of homeowners who saw their loans goes into foreclosure rose slightly in the prior quarter, the Washington-based industry group stated. “With the unemployment rate near a 50-year low, wage growth trending higher and household debt levels relative to disposable incomes at a 35-year low, homeowners are in great shape, and mortgage performance is quite strong,” MBA’s Vice President of Industry Analysis, Marina Walsh said. The decline in delinquencies in late 2018 came as the housing market slowed due to higher mortgage rates and tight inventories. The Federal Reserve stated earlier total mortgage debt fell $16bn in the fourth quarter from the prior quarter to $9.1tn. That marked the first drop in home loans since 2016. (Reuters) Sputtering auto production sinks US manufacturing output – US manufacturing fell sharply in January, led by the biggest drop in motor vehicle production since the recession, the latest indication that the economy was losing momentum. The Federal Reserve’s report on the heels of data showing retail sales tumbling by the most in more than nine years in December. The string of weak reports together with tame inflation are supportive of the Fed’s pledge to be patient before raising interest rates further this year. Manufacturing production slumped 0.9% in January, the biggest drop in eight months. Data for December was revised down to show output at factories rising 0.8% instead of the previously report 1.1% rise. Manufacturing accounts for about 12% of the US economy. (Reuters) Weakest US retail sales since 2009 cast pall over economy – US retail sales recorded their biggest drop in more than nine years in December as receipts fell across the board, suggesting a sharp slowdown in economic activity at the end of 2018. The shockingly weak report from the Commerce Department led to growth estimates for the fourth-quarter being cut to below a 2.0% annualized rate. December’s collapse in retail sales and other data showing an unexpected increase in the number of Americans filing claims for unemployment benefits last week and a second straight monthly decline in producer prices in January support the Federal Reserve’s pledge to be patient before raising interest rates further this year. Retail sales tumbled 1.2%, the largest decline since September 2009 when the economy was emerging from recession. Sales edged up 0.1% in November. Economists polled by Reuters had forecasted retail sales gaining 0.2% in December. Sales in December rose 2.3% from a year ago. (Reuters) US-China trade talks to resume next week, Trump hints at extension – The US and China will resume trade talks next week in Washington with time running short to ease their bruising trade war, but US President, Donald Trump repeated that he may extend a March 1 deadline for a deal and keep tariffs on Chinese goods from rising. Both the US and China reported progress in five days of negotiations in Beijing. Trump, speaking at a White House news conference, said the US was closer than ever before to having a real trade deal with China and said he would be honored to remove tariffs if an agreement can be reached. (Reuters) UK’s retail sales bounce as shoppers flock to January sales – British retail sales rebounded strongly in January as steep clothing discounts attracted wary shoppers, bucking a slowdown in consumer spending ahead of Brexit. Retail sales volumes jumped by a monthly 1.0% after their biggest fall in December in a year-and-a-half, the Office for National Statistics (ONS) stated, far above the median forecast in a Reuters poll of economists for a 0.2% rise. Compared with a year ago, retail sales were 4.2% higher in January, the biggest annual rise since December 2016 and again outstripping almost all forecasts in the poll. (Reuters) Eurozone’s economic growth slows YoY in fourth quarter, employment up – The Eurozone economy slowed as expected YoY in the last three months of 2018 as growth in Germany came to a halt and Italy slipped into recession, official data showed confirming earlier estimates. The European Union’s statistics office Eurostat stated gross domestic product in the 19 countries sharing the Euro currency rose 0.2% QoQ for a 1.2% YoY increase, slowing from 1.6% YoY in the third quarter. The figures, which are still subject to possible revision, were in line with market expectations and with Eurostat’s earlier preliminary estimate. Eurostat also stated employment in the Eurozone rose 0.3% QoQ in the last three months of 2018 and was 1.2% higher than in the same period a year earlier. (Reuters) Eurostat: Eurozone’s trade surplus shrinks in 2018 – The Eurozone’s trade surplus in goods with the rest of the world shrank last year because of higher imports, data from the European Union’s statistics office Eurostat showed. Eurostat stated the unadjusted trade surplus of the 19-country currency bloc amounted to EUR194.2bn in 2018, down from EUR234.9bn in 2017. Eurozone’s imports increased last year by 6.2%, while exports rose only 3.7% compared to 2017. In December the Eurozone recorded a EUR17bn trade surplus, down from EUR24.5bn in December 2017. Eurostat did not provide a detailed breakdown of the imports and exports for the Eurozone alone, but stated the trade deficit in energy of the 28-nation

- 6. Page 6 of 8 European Union, which includes the Eurozone, rose to EUR298.5bn last year from EUR234.8bn in 2017. (Reuters) German economy stalled in 4Q2018, just escaping recession – The German economy stalled in the final quarter of last year, escaping recession by the narrowest of margins after contracting in the July-September period for the first time since 2015. Gross domestic product (GDP) in Europe’s biggest economy grew by zero percent QoQ, the Federal Statistics Office stated. That compared with a Reuters forecast for growth of 0.1%. German companies are grappling with a cooling global economy and trade disputes triggered by US President, Donald Trump’s ‘America First’ policies. The risk that Britain leaves the European Union without a deal in March is another uncertainty. Compared with the same quarter of the previous year, the economy grew by 0.6% from October to December, calendar- adjusted data showed. Analysts polled by Reuters had expected 0.7%. (Reuters) Reuters poll: Japan’s January exports seen falling most in two years on Sino-US trade row – Japan’s exports in January are forecast to have fallen at the fastest pace in more than two years as the US-Sino trade war put the brakes on demand for Japanese electronics, car parts, and heavy equipment. Core machinery orders, a volatile data series seen as a leading indicator of capital expenditure, are expected to have fallen in December for the first time in three months, suggesting business investment could weaken. Separate data are expected to show core consumer prices edged higher in January from the same period a year earlier but remained well off the pace needed to get near the Bank of Japan’s 2% inflation target. On the whole, the data could paint a picture of an export-oriented economy that is shifting down to a lower pace of growth as uncertainty about trade frictions hits global demand. (Reuters) China's producer prices slow for seventh straight month, raising deflation fears – China’s factory-gate inflation slowed for a seventh straight month in January to its weakest pace since September 2016, raising concerns the world’s second- biggest economy may see the return of deflation as domestic demand cools. Consumer inflation, meanwhile, eased in January from December to a 12-month low due to slower gains in food prices, official data showed, despite the Lunar New Year holiday, which typically pushes up demand for food. China’s producer price index (PPI) in January rose a meager 0.1% from a year earlier, data from the National Bureau of Statistics (NBS) showed, and a sharp slowdown from the previous month’s 0.9% increase. Analysts polled by Reuters had expected producer inflation would slow to 0.2%. While tame inflation gives authorities the flexibility to ease monetary policy to shore up economic growth, deflationary risks could further hurt corporate profitability. On a monthly basis, producer prices have already been falling over the past three months. In December, PPI fell 0.6%, moderating from a 1% decrease in December. (Reuters) China's banks throw open spigots in January, lend record CNY3.23tn – China’s banks made the most new loans on record in January - totaling CNY3.23tn - as policymakers try to jumpstart sluggish investment and prevent a sharper slowdown in the world’s second-largest economy. Chinese banks tend to front-load loans early in the year to get higher-quality customers and win market share. However they have also faced months of pressure from regulators to step up lending, particularly to cash-starved smaller firms. Net new Yuan lending last month was far more than expected, and eclipsed the last high of CNY2.9tn in January 2018. Analysts polled by Reuters had predicted new loans of CNY2.8tn, more than double the level seen in December. (Reuters) India's January trade deficit widens, slow exports growth a concern – India’s trade deficit widened in January pushed by a rise in gold imports, while exports growth remained low, deepening concerns for Prime Minister Narendra Modi who wants to accelerate economic expansion ahead of elections. India’s goods exports have shown little growth since Modi took charge in 2014, as small exporters - contributing nearly 35% to total exports - have been hit hard by rising input costs after the chaotic launch of national sales tax in 2017. In January, merchandise exports rose 3.74% from a year earlier to $26.36bn, while imports were up 0.01% to $41.09bn, data released by the commerce ministry showed. (Reuters) Regional Fitch Solutions: GCC’s overall fiscal stability ‘reasonably well- insulated’ against external shocks – Most GCC states are able to lean on their large foreign assets to support currency pegs and temper speculative pressures on government debt securities, Fitch Solutions stated in a report. The region’s overall fiscal stability is reasonably well-insulated against any eventual external shocks, Fitch Solutions stated. “However, it still sees risks of a sharper-than-expected global growth correction and ‘risk-off’ sentiment as substantial. Such a development will have negative implications for MENA growth, however, we view the region’s overall fiscal stability as relatively well positioned to withstand such pressures,” Fitch Solutions stated. Meanwhile, the more fiscally vulnerable countries in the region will most likely be able to draw on support from the GCC or external allies in the event of mounting pressures. In each of these instances, bond yields declined sharply on the back of the GCC aid announcements. Despite decelerating oil price and revenue growth, Fitch Solutions believes most GCC governments will prioritize the stimulation of economic activity over strict fiscal prudence in the near term. (Gulf- Times.com) CEO: Eni's Gulf expansion has just started – Italian major Eni stated that it intends to expand in the Middle East after a spree of deals in the Gulf last year, pressing ahead with plans to reduce its reliance on Africa and oil and gas exploration. Since last March Eni has secured nine deals in the UAE, gained a foothold in Bahrain and expanded in Oman to underpin its future growth. Last month it pledged $3.3bn to buy part of the world’s fourth-biggest refinery in the UAE, increasing its own refining capacity overnight by more than a third. Eni’s CEO, Claudio Descalzi said that there were huge opportunities to grow in the Gulf area and rebalance the group’s operational portfolio. “It’s not finished, we’ve just started,” he told analysts on a conference call after its fourth-quarter results, adding long- term the group aimed to produce 100,000 barrels per day in the area. Eni, which generates more than half its output in Africa, produced record 1.851mn barrels of oil equivalent per day in 2018, lifted by operations in Egypt, Indonesia and Kazakhstan.

- 7. Page 7 of 8 Giant gas discoveries in Mozambique and, more recently, Egypt has given the energy major the strongest discovery record in the industry, boosting its credentials with oil-producing nations. (Reuters) OPEC may deepen oil cuts to fight shale Tsunami – OPEC and its allies may deepen production cuts at their next meeting as a global oil surplus proves harder to beat than expected, according to Rapidan Energy Group. Although the OPEC has made a strong start to its latest round of output curbs, group leader Saudi Arabia has announced plans to cut supply even further next month, to the lowest in several years. That’s a signal the Kingdom believes the whole group must step up efforts to defend prices against booming US shale supply and a faltering global economy, the consultant said. “There’s a whiff of panic circulating that the supply tsunami and macro risks are keeping the risk of a price bust real, and that current cuts are inadequate,” Rapidan’s President, Bob McNally said. (Bloomberg) Saudi Aramco picks banks for debut international bond – Saudi Aramco has selected banks to arrange its first international debt sale, which will help it finance the acquisition of a stake in Saudi Arabian Basic Industries Corp (SABIC), according to sources. Saudi Aramco has picked a group of banks including JPMorgan, Morgan Stanley, Citi, HSBC and Saudi Arabia’s National Commercial Bank. JPMorgan and Morgan Stanley have been appointed joint global coordinators and, together with the other banks, joint book runners. Saudi Aramco, the world’s top oil producer, plans to issue its first international bonds in the second quarter of 2019, likely worth about $10bn, according to Saudi Arabia’s Energy Minister, Khalid Al-Falih. Sources previously told Reuters the oil giant could borrow as much as $50bn from international investors to fund the purchase of all, or nearly all, of the 70% stake in SABIC held by the Public Investment Fund, the Kingdom’s top sovereign wealth fund. (Reuters) Saudi Aramco and Total will invest $1bn in Saudi Arabian fuel stations – Saudi Aramco and Total SA have agreed to invest around $1bn over the next 6 years to build a network of fuel stations in the Kingdom, the companies stated. The companies have also agreed to acquire Tas’helat Marketing Co. and Sahel Transport Co., which together operate 270 gas stations and a fuel tanker fleet. The terms of the deal are not disclosed. The Joint Venture (JV) firm’s Chairman will be Abdulaziz Al- Judaimi, Saudi Aramco’s current Senior Vice President of downstream; Mohammed Al-Gahtani is named as the CEO of the JV. (Bloomberg) Moody's assigns ‘Baa3’ rating to Almarai Company with a ‘Stable’ outlook – Moody's Investors Service (Moody's) has assigned a ‘Baa3’ issuer rating to Almarai Company. The rating outlook is ‘Stable’. Moody's Lead Analyst, Lahlou Meksaoui said, "Almarai Company 's ‘Baa3’ rating reflects its leading market positions and high EBITDA margin thanks to a vertically integrated supply chain, which partially offsets its concentration risk on dairy products.” (Bloomberg) Saudi Arabia’s central bank Governor sees no impact from European Union’s decision – Saudi Arabia’s central bank Governor, Ahmed Al-Kholifey said that he did not expect the European Union’s decision to add his country to a list of high risk countries to have any impact for now, Al-Arabiya TV reported. The European Union added Saudi Arabia, Panama and four US territories to a blacklist of nations seen as posing a threat to the bloc because of lax controls against terrorism financing and money laundering. (Reuters) EIBANK's net profit falls 31.5% YoY to AED38.7mn in FY2018 – Emirates Investment Bank (EIBANK) recorded net profit of AED38.7mn in FY2018, registering decrease of 31.5% YoY. Revenues fell 9.3% YoY to AED190.0mn in FY2018. Operating profit fell 21.0% YoY to AED136.0mn in FY2018. Total assets stood at AED4.0bn at the end of December 31, 2018 as compared to AED4.9bn at the end of December 31, 2017. EPS came in at AED52.79 in FY2018 as compared to AED77.18 in FY2017. (DFM) Kuwait bourse in deal to sell 44% stake, plans IPO later – A consortium led by Kuwait’s National Investment Co. (NIC) and including the Athens bourse won a tender to acquire 44% of the Kuwait stock exchange, according to NIC’s Chairman, Hamad Al-Omairi. Al-Omairi said, “The winner is the private sector, the investors and the listed companies, all the ideas we said about developing the bourse will be implemented.” The consortium that won the tender also includes Arzan Financial Group and First Investment. It offered KD0.237 per share for the stake. Kuwait’s stock exchange has plans for an initial public offering (IPO) at a later stage, the CEO of the Athens bourse said. “There are plans by the Kuwait exchange for an IPO at a later stage to sell 50% and get listed,” CEO at Hellenic Exchanges, Socrates Lazaridis told Reuters. Under the plan, a further 6% stake will go to Kuwait’s main pension fund as part of the bourse’s privatization, he said. “Our main role as part of the consortium will be to provide the technical infrastructure, install our trading system and help on business development strategy,” he said. (Reuters) Panalpina confirms talks with Kuwait’s Agility for tie-up – Panalpina Welttransport Holding AG is in talks for a tie-up with Kuwaiti logistics provider Agility - a deal which would help the Swiss freight forwarder bulk up and fend off interest from Denmark’s DSV A/S. The talks are at a preliminary stage and Panalpina is still reviewing an approach by DSV, the company stated. Negotiations about combining Panalpina and Agility are progressing and a transaction is backed by the Ernst Goehner Foundation, Panalpina’s biggest shareholder, sources said. That support can be key: The foundation, which owns 46% of Panalpina, rebuffed DSV’s unsolicited $4bn offer this month. (Gulf-Times.com) Oman’s December bank credit to private sector falls MoM to OMR18.72bn – Central Bank of Oman published data on bank assets, which showed that bank credit to private sector fell to OMR18.72bn in December 2018 from OMR18.9bn in November 2018. The bank credit to public enterprises rose to OMR2.41bn in December 2018 from OMR2.3bn in November 2018. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSE Index S&P Pan Arab S&P GCC 0.1% (2.3%) (0.2%) (0.2%) (0.1%) 0.2% 1.6% (3.0%) (2.0%) (1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,321.55 0.7 0.5 3.0 MSCI World Index 2,066.59 0.9 2.3 9.7 Silver/Ounce 15.79 1.1 (0.3) 1.9 DJ Industrial 25,883.25 1.7 3.1 11.0 Crude Oil (Brent)/Barrel (FM Future) 66.25 2.6 6.7 23.1 S&P 500 2,775.60 1.1 2.5 10.7 Crude Oil (WTI)/Barrel (FM Future) 55.59 2.2 5.4 22.4 NASDAQ 100 7,472.41 0.6 2.4 12.6 Natural Gas (Henry Hub)/MMBtu 2.59 (0.4) (1.1) (18.7) STOXX 600 368.94 1.2 2.5 7.6 LPG Propane (Arab Gulf)/Ton 68.50 3.8 12.1 7.9 DAX 11,299.80 1.7 3.1 5.4 LPG Butane (Arab Gulf)/Ton 85.00 10.4 24.1 21.4 FTSE 100 7,236.68 1.1 1.9 8.6 Euro 1.13 0.0 (0.2) (1.5) CAC 40 5,153.19 1.6 3.3 7.2 Yen 110.47 (0.0) 0.7 0.7 Nikkei 20,900.63 (1.1) 2.0 4.3 GBP 1.29 0.7 (0.4) 1.1 MSCI EM 1,030.64 (0.8) (0.5) 6.7 CHF 0.99 (0.1) (0.5) (2.4) SHANGHAI SE Composite 2,682.39 (1.4) 2.0 9.2 AUD 0.71 0.5 0.7 1.3 HANG SENG 27,900.84 (1.9) (0.2) 7.7 USD Index 96.90 (0.1) 0.3 0.8 BSE SENSEX 35,808.95 (0.7) (2.2) (3.1) RUB 66.32 (0.5) 0.8 (4.9) Bovespa 97,525.91 0.2 2.9 15.8 BRL 0.27 0.6 0.7 4.9 RTS 1,177.50 1.8 (1.8) 10.2 97.8 91.8 77.3