QNBFS Daily Market Report April 25, 2019

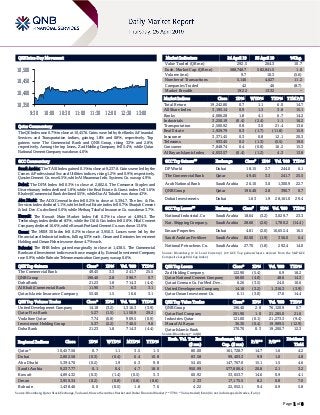

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.7% to close at 10,457.6. Gains were led by the Banks & Financial Services and Transportation indices, gaining 1.8% and 0.8%, respectively. Top gainers were The Commercial Bank and QNB Group, rising 3.3% and 2.8%, respectively. Among the top losers, Zad Holding Company fell 5.4%, while Qatar National Cement Company was down 4.0%. GCC Commentary Saudi Arabia: The TASI Index gained 0.1% to close at 9,237.8. Gains were led by the Comm. & Professional Svc and Utilities indices, rising 1.2% and 0.9%, respectively. Qassim Cement Co. rose 6.5%, while Al Moammar Info. Systems Co. was up 4.9%. Dubai: The DFM Index fell 0.3% to close at 2,802.6. The Consumer Staples and Discretionary index declined 1.8%, while the Real Estate & Const. index fell 1.6%. Khaleeji Commercial Bank declined 5.5%, while Dar Al Takaful was down 4.3%. Abu Dhabi: The ADX General Index fell 0.2% to close at 5,394.7. The Inv. & Fin. Services index declined 1.1%, while the Real Estate index fell 0.7%. Sharjah Cement & Ind. Dev. Co. declined 5.0%, while Methaq Takaful Insurance Co. was down 3.7%. Kuwait: The Kuwait Main Market Index fell 0.3% to close at 4,894.3. The Technology index declined 8.3%, while the Oil & Gas index fell 2.0%. Hilal Cement Company declined 16.6%, while Kuwait Portland Cement Co. was down 13.6%. Oman: The MSM 30 Index fell 0.2% to close at 3,950.3. Losses were led by the Financial and Industrial indices, falling 0.3% each. Oman and Emirates Investment Holding and Oman Fisheries were down 4.7% each. Bahrain: The BHB Index gained marginally to close at 1,438.5. The Commercial Banks and Investment indices each rose marginally. Esterad Investment Company rose 0.9%, while Bahrain Telecommunication Company was up 0.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% The Commercial Bank 49.45 3.3 241.7 25.5 QNB Group 196.40 2.8 390.7 0.7 Doha Bank 21.23 1.8 714.3 (4.4) Al Khalij Commercial Bank 11.90 1.7 6.3 3.1 Qatar Islamic Insurance Company 55.40 1.5 16.6 3.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 14.18 (3.2) 1,316.3 (3.9) Qatar First Bank 5.27 (1.5) 1,150.9 29.2 Vodafone Qatar 7.74 (0.8) 909.5 (0.9) Investment Holding Group 5.37 (2.2) 740.5 9.8 Doha Bank 21.23 1.8 714.3 (4.4) Market Indicators 24 April 19 23 April 19 %Chg. Value Traded (QR mn) 292.5 264.3 10.7 Exch. Market Cap. (QR mn) 588,746.7 582,841.5 1.0 Volume (mn) 9.7 10.3 (5.6) Number of Transactions 5,146 4,627 11.2 Companies Traded 42 46 (8.7) Market Breadth 19:22 13:32 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,242.80 0.7 1.1 6.0 14.7 All Share Index 3,195.14 0.9 1.3 3.8 15.1 Banks 4,086.28 1.8 4.1 6.7 14.2 Industrials 3,250.19 (0.4) (2.4) 1.1 16.2 Transportation 2,500.92 0.8 3.0 21.4 13.6 Real Estate 1,929.79 0.3 (1.7) (11.8) 15.9 Insurance 3,371.45 0.3 0.8 12.1 20.3 Telecoms 933.45 0.2 (1.3) (5.5) 19.0 Consumer 7,848.74 0.4 (0.8) 16.2 15.3 Al Rayan Islamic Index 4,053.57 (0.4) (1.2) 4.3 13.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% DP World Dubai 18.15 3.7 244.0 6.1 The Commercial Bank Qatar 49.45 3.3 241.7 25.5 Arab National Bank Saudi Arabia 26.10 3.0 1,300.9 22.7 QNB Group Qatar 196.40 2.8 390.7 0.7 Dubai Investments Dubai 1.63 1.9 28,161.0 29.4 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% National Industrial. Co Saudi Arabia 18.64 (3.2) 3,029.7 23.3 Nat. Shipping Company. Saudi Arabia 28.60 (2.6) 1,780.2 (14.4) Emaar Properties Dubai 4.81 (2.0) 10,652.4 16.5 Saudi Arabian Fertilizer Saudi Arabia 82.00 (1.9) 356.0 6.4 National Petrochem. Co. Saudi Arabia 27.70 (1.8) 292.4 14.0 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Zad Holding Company 122.90 (5.4) 6.9 18.2 Qatar National Cement Company 68.00 (4.0) 48.6 14.3 Qatari German Co. for Med. Dev. 6.26 (3.5) 24.0 10.6 United Development Company 14.18 (3.2) 1,316.3 (3.9) Qatar Oman Investment Co. 6.11 (3.0) 17.6 14.4 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 196.40 2.8 76,120.9 0.7 Qatar Fuel Company 201.90 1.0 21,285.0 21.6 Industries Qatar 121.00 (0.1) 21,273.3 (9.4) Masraf Al Rayan 36.30 (0.4) 19,989.5 (12.9) Qatar Islamic Bank 170.70 0.3 19,200.7 12.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,457.56 0.7 1.1 3.5 1.5 80.00 161,728.7 14.7 1.6 4.2 Dubai 2,802.58 (0.3) (0.4) 6.4 10.8 83.58 99,403.3 9.9 1.0 4.8 Abu Dhabi 5,394.70 (0.2) 1.9 6.3 9.8 54.65 147,767.0 15.1 1.5 4.6 Saudi Arabia 9,237.77 0.1 0.4 4.7 18.0 950.99 577,806.4 20.8 2.1 3.2 Kuwait 4,894.32 (0.3) (1.4) (0.5) 3.3 60.92 33,653.7 14.6 0.9 4.1 Oman 3,950.34 (0.2) (0.8) (0.8) (8.6) 2.33 17,175.5 8.2 0.8 7.0 Bahrain 1,438.46 0.0 (0.5) 1.8 7.6 4.22 22,052.1 9.4 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,350 10,400 10,450 10,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index rose 0.7% to close at 10,457.6. The Banks & Financial Services and Transportation indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. The Commercial Bank and QNB Group were the top gainers, rising 3.3% and 2.8%, respectively. Among the top losers, Zad Holding Company fell 5.4%, while Qatar National Cement Company was down 4.0%. Volume of shares traded on Wednesday fell by 5.6% to 9.7mn from 10.3mn on Tuesday. Further, as compared to the 30-day moving average of 12.8mn, volume for the day was 24.3% lower. United Development Company and Qatar First Bank were the most active stocks, contributing 13.5% and 11.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2019 % Change YoY Operating Profit (mn) 1Q2019 % Change YoY Net Profit (mn) 1Q2019 % Change YoY Saudi International Petrochem. Co. Saudi Arabia SR 1,121.6 -4.2% 267.4 -5.7% 114.7 -24.2% Saudi Industrial Investment Group Saudi Arabia SR 2,020.0 -8.6% 454.0 -28.7% 178.0 -10.6% Saudi Industrial Development Co. Saudi Arabia SR 50.1 12.1% -3.2 N/A 3.0 1,664.7% Sahara Petrochemicals Co. Saudi Arabia SR 365.3 N/A 176.8 19.6% 142.7 1.8% Tabuk Cement Co. Saudi Arabia SR 52.8 12.9% 8.0 N/A 3.6 N/A Arabian Cement Co. Saudi Arabia SR 189.1 -5.3% 48.7 N/A 37.1 N/A ASharqiyah Development Co. Saudi Arabia SR – – -0.7 N/A -0.7 N/A Bahrain Kuwait Insurance Company Bahrain BHD 17.6 5.8% – – 0.8 -23.9% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/24 US Mortgage Bankers Association MBA Mortgage Applications 19-April -7.3% – -3.5% 04/24 France INSEE National Statistics Office Business Confidence April 105 104 105 04/24 Japan Bank of Japan PPI Services YoY March 1.1% 1.1% 1.1% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status MPHC Mesaieed Petrochemical Holding Company 25-Apr-19 0 Due QATI Qatar Insurance Company 28-Apr-19 3 Due QAMC Qatar Aluminum Manufacturing Company 28-Apr-19 3 Due QNNS Qatar Navigation (Milaha) 28-Apr-19 3 Due IGRD Investment Holding Group 28-Apr-19 3 Due QFLS Qatar Fuel Company 28-Apr-19 3 Due MERS Al Meera Consumer Goods Company 28-Apr-19 3 Due BRES Barwa Real Estate Company 29-Apr-19 4 Due AHCS Aamal Company 29-Apr-19 4 Due SIIS Salam International Investment Limited 29-Apr-19 4 Due ZHCD Zad Holding Company 29-Apr-19 4 Due QGRI Qatar General Insurance & Reinsurance Company 29-Apr-19 4 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-19 4 Due MCCS Mannai Corporation 29-Apr-19 4 Due QOIS Qatar Oman Investment Company 29-Apr-19 4 Due DOHI Doha Insurance Group 29-Apr-19 4 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 27.28% 43.07% (46,191,020.22) Qatari Institutions 16.42% 16.98% (1,632,674.29) Qatari 43.70% 60.05% (47,823,694.51) GCC Individuals 0.47% 0.53% (184,545.91) GCC Institutions 4.92% 6.56% (4,801,534.89) GCC 5.39% 7.09% (4,986,080.80) Non-Qatari Individuals 6.58% 8.67% (6,120,903.33) Non-Qatari Institutions 44.33% 24.18% 58,930,678.64 Non-Qatari 50.91% 32.85% 52,809,775.31

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status ORDS Ooredoo 29-Apr-19 4 Due KCBK Al Khalij Commercial Bank 29-Apr-19 4 Due VFQS Vodafone Qatar 30-Apr-19 5 Due QGMD Qatari German Company for Medical Devices 30-Apr-19 5 Due DHBK Doha Bank 30-Apr-19 5 Due Source: QSE Stock Split Dates for Listed Qatari Companies Source: QSE News Qatar UDCD posts ~20% YoY decrease but ~52% QoQ increase in net profit in 1Q2019 – United Development Company's (UDCD) net profit declined ~20% YoY (but rose ~52% on QoQ basis) to ~QR176mn in 1Q2019. EPS decreased to QR0.48 in 1Q2019 from QR0.61 in 1Q2018. The revenues of the real estate giant, which is the master developer of The Pearl-Qatar and Gewan islands, stood at QR530mn for the period. UDCD’s Chairman, Turki bin Mohammed Al Khater said, “I am pleased to see UDCD getting off to a good start in 2019. These results are especially noteworthy given the challenging market conditions under which they were generated. With many significant developments coming up at The Pearl-Qatar to complement the properties already developed, it shows that the future for UDCD is indeed bright, with the development of The Pearl-Qatar in full bloom.” Al Khater added, “UDCD is well positioned to sustain its success, given the broad mix of quality assets that are available at The Pearl-Qatar. With a portfolio that includes land plots, apartments and townhouse developments to sell, and office, residential, retail, and hospitality units to lease, all set within in a safe, secure and self-sufficient community, The Pearl-Qatar has become the crown jewel of Qatar’s real estate market. Designed and constructed to the highest of international standards, its quality, ambiance, and aesthetics are unmatched in the State of Qatar.” UDCD’s President, CEO and Member of the Board, Ibrahim Jassim Al Othman said, “ The volume of leased retail properties is holding steady year over year making The Pearl-Qatar the premier location for retailers and residents alike.” (QSE, Peninsula Qatar) QFBQ reports net profit of QR3.2mn in 1Q2019 – Qatar First Bank (QFBQ) reported net profit of QR3.2mn in 1Q2019 as compared to net loss of QR47.1mn in 1Q2018 and net loss of QR56.4mn in 4Q2018. Total Income increased 71.0% YoY and 7.7% QoQ in 1Q2019 to QR57.5mn. The bank's total assets stood at QR3.3bn at the end of March 31, 2019, down 31.3% YoY. However, on QoQ basis, the bank's total assets increased 1.8%. Financing assets were QR1.5bn, registering a decline of 0.2% YoY (-0.9% QoQ) at the end of March 31, 2019. Financing liabilities declined 71.1% YoY and 45.0% QoQ to reach QR0.2bn at the end of March 31, 2019. Earnings per share amounted to

- 4. Page 4 of 8 QR0.02 in 1Q2019 as compared to loss per share of QR0.24 in 1Q2018. QFBQ’s new Chairman, Sheikh Faisal bin Thani Al Thani said, “We are glad to see the turnaround performance of the bank by generating a net profit in the first quarter. Positive results are a direct manifest that QFBQ is back on the right track with a new strategy that executive management has developed and implemented. This is only the start and I am looking to see more over the current financial year. Board and the executive management team’s efforts fruited these positive results. With the new elected BoD, assisted by the executive team, we will work together to mine new opportunities and avail them for the best interests of QFBQ shareholders, customers and depositors.” Key highlights for the current period were a total income growth of 71% compared to the same period of 2018, mainly driven by an increase in fee based income on structured products and investments from QR6.5mn to QR14.4mn, and increase in net financing income from QR3.2mn to QR11.9mn. The increase in fee-based income is due to the bank’s newly implemented business strategy of moving away from asset-based income generation to being a fee income based business. The increase in net financing income was mainly driven by a reduction in the costs of funding due to better management of the bank’s loan to deposit ratio and more competitive profit rates offered on deposits. The bank’s stakeholders are witnessing the results of revised strategy where the bank is undergoing a transformational shift from a proprietary based investment model to having a diversified base of fee-based revenue streams. Aligning to this new strategy, QFBQ has already begun generating fee income by offering client-focused investment products, primarily in real estate and aviation. At the recently concluded bank’s AGM, QFBQ shareholders have elected a robust well-diversified new BoD that consists of prominent economic and business figures which will definitely support QFBQ transactions volume and work to improve the bank’s financial performance over the current financial year. (Company releases, Peninsula Qatar) MRDS’ net loss widens to QR11.5mn in 1Q2019 – Mazaya Qatar Real Estate Development (MRDS) reported net loss of QR11.5mn in 1Q2019 as compared to net loss of QR6.3mn in 1Q2018 and QR5.5mn in 4Q2018. Loss per share amounted to QR0.099 in 1Q2019 as compared to loss per share of QR0.055 in 1Q2018. (QSE) MCGS' net profit declines 0.4% YoY and 53.5% QoQ in 1Q2019 – Medicare Group's (MCGS) net profit declined 0.4% YoY (-53.5% QoQ) to QR20.4mn in 1Q2019. The company's operating income came in at QR128.2mn in 1Q2019, which represents an increase of 0.6% YoY (+1.1% QoQ). EPS amounted to QR0.72 in 1Q2019 as compared to QR0.73 in 1Q2018. (QSE) QIMD posts ~33% YoY decrease but ~15% QoQ increase in net profit in 1Q2019 – Qatar Industrial Manufacturing Company's (QIMD) net profit declined ~33% YoY (but rose ~15% on QoQ basis) to QR34.0mn in 1Q2019. EPS decreased to QR0.71 in 1Q2019 from QR1.07 in 1Q2018. (QSE) QCFS' bottom line rises ~16% YoY and ~49% QoQ in 1Q2019 – Qatar Cinema and Film Distribution Company's (QCFS) net profit rose ~16% YoY (~+49% QoQ) to QR3.1mn in 1Q2019. EPS increased to QR0.50 in 1Q2019 from QR0.44 in 1Q2018. (QSE) Nebras Power Investment Management signs a binding agreement to acquire 80% equity stake in four Greenfield solar PV projects in Brazil – Nebras Power Investment Management, a Dutch affiliate of Nebras Power has signed a binding agreement to acquire 80% equity stake in four Greenfield solar PV projects in Brazil from Canadian Solar, a leading global solar PV developer and solar panels manufacturer. The acquisition provides Nebras Power with access to the attractive and fast growing Brazilian renewable power market and is line with Nebras Power's stated objectives of establishing itself as a leading international power developer. The portfolio being transacted is the largest bifacial solar PV portfolio to commence construction in Latin America with a total capacity of 482.6MW peak. The Greenfield projects are Salgueiro Solar Holding 114.3MW peak, Francisco Sa Solar Holding 114.3MW peak, Jaiba Solar Holding 101.6MW peak and Lavras Solar Holding 152.4MW peak. Nebras Power’s Chairman, Fahad Hamad Al- Mohannadi said, “Nebras Power is strengthening its international expansion with successful and reputable partners and makes a foray into key market, Brazil. This transaction not only conforms this vision, but at the same time increases Nebras power's global capabilities while bringing further geographic and technologic diversification to its portfolio." (QSE, Gulf-Times.com) Aamal Company appoints Imran Chughtai as Chief Financial Officer – Aamal Company has appointed Imran Chughtai as Chief Financial Officer. Chughtai will follow Mohamed Ramahi, who is now appointed as the adviser to the CEO of Aamal Company, and the Chief Financial Officer of Al Faisal Holding, which is Aamal Company’s majority shareholder. Previously, he was group Chief Financial Officer for Zuellig Pharma. He has held senior finance leadership roles with Huawei Technologies and with Whirlpool Corporation across Europe and Asia. (Gulf- Times.com) Qatar’s first dry gas seal repair, testing facility opens in Ras Laffan – The opening of Qatar’s first dry gas seal and testing facility in Ras Laffan will help attract more international companies to the country amid efforts to stimulate private sector participation in major projects, a Qatar Petroleum’s (QP) official has said. “You will play an important part in encouraging small businesses in Qatar to bring in other major players to support the economy of Qatar, and at the same time, to develop local companies in Qatar,” QP Industrial Cities Directorate Vice President Abdulaziz Al-Muftah said, referring to the facility opened by US-based company John Crane, a global leader in rotating equipment solutions, supplying engineered technologies and services to process industries. Located in the Ras Laffan Industrial City (RLIC) security area, the new service centre will provide John Crane with the capabilities necessary for aftermarket support for its customers within the region, while also allowing them to deliver quick turnaround service capabilities and reduce downtime costs. For nearly 40 years, Al-Ahed Trading and Contracting Company has represented John Crane within Qatar, providing a range of John Crane products and multidisciplinary services to oil and gas customers within the region. The service center is part of John Crane’s commitment to continue investing in and developing its network of global service centers, as well as

- 5. Page 5 of 8 bolster support for local customer service needs. (Gulf- Times.com) QGMD’s AGM endorses items on its agenda and postpones its EGM to May 26 – Qatari German Company for Medical Devices’ (QGMD) AGM endorsed items on its agenda. Under the supervision of Ministry of Commerce & Industry & company’s external auditor’s representatives the below listed names have been elected by cumulative voting. The board members names are as follows: (i) Khamis Mubarak Khamis Zamel Al-Kuwari independent member of the board of directors, and (ii) Saleh Johar Saed Mohamed Al-Mohamed reserved independent member in the event of a vacancy in the board of directors. Further, QGMD postponed its EGM to May 26, 2019 due to lack of quorum. (QSE) Cabinet nod to decision on regulations for non-Qatari capital in economic activity – The Cabinet at its weekly meeting chaired by Prime Minister HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani approved a draft decision of the Minister of Commerce and Industry (MoCI) about the executive regulation of Law No 1 of 2019 on the non-Qatari capital in economic activity. The Ministry of Commerce and Industry has prepared the draft decision within the framework of implementing the provisions of Law No 1 of 2019. The Cabinet also approved a draft law amending certain provisions of Decree Law No 10 of 1974 on the establishment of Qatar Petroleum and referred it to the Shura Council. (Qatar Tribune) Qatar poised to export dairy products, courtesy Baladna – Qatar’s relentless drive to achieve self-sufficiency in the wake of the blockade is bearing fruits. The campaign for self-reliance in food production is led by a Qatar-based company Baladna Food Industries (Baladna), which has been able to meet nearly 100% of the dairy products need of the country with local production but also hopes to export milk and other dairy products to countries in the region soon. Baladna is in a position to export milk and dairy products to the countries in the region, according to Baladna’s Senior Marketing Director, Maher Eldaly. (Qatar Tribune) International MBA: US mortgage applications post biggest fall in four months – The US mortgage applications to buy a home and to refinance one recorded their steepest weekly decline in four months as some mortgage rates increased to one-month highs, in step with higher bond yields, Mortgage Bankers Association (MBA) stated. The Washington-based industry group stated its seasonally adjusted index on home loan requests to lenders fell by 7.3% to 425.6 in the week ended April 19. The drop was the biggest since a 9.9% decrease in the week of December 21. Interest rates on conforming 30-year mortgages, with loan balances of $484,350 or less, averaged 4.46% last week, marking a one-month peak and edging up from 4.44% a week earlier, MBA stated. (Reuters) German retail body upholds forecast of 2% sales growth this year – Germany’s HDE retail association confirmed its forecast that sales would increase by 2% this year, marking a tenth straight year of growth, as shoppers benefit from record-high employment and rising wages. HDE stated it expected retail sales to grow to EUR537.4bn in 2019, adding that, in price- adjusted terms, it saw a growth rate of 0.5%. “Consumers seem to be largely unfazed by the economic slowdown,” HDE stated after the government and institutes have cut their forecasts for Germany’s economic growth. As exporters struggle with weaker foreign demand, trade tensions and Brexit-related uncertainty, Germany’s vibrant domestic demand is expected to be the sole driver of growth this year and next. (Reuters) German business morale dips as economy loses steam – German business morale deteriorated in April, a survey showed, bucking expectations for a small rise and suggesting Europe’s largest economy is losing momentum as trade tensions hamper its exporters. The Munich-based Ifo economic institute stated its business climate index fell to 99.2 from an upwardly revised 99.7 in the previous month. The April reading compared with a consensus forecast for 99.9. “The German economy continues to lose steam,” Ifo’s President, Clemens Fuest said. (Reuters) French industry morale fell in April to near three year low – French industrial confidence fell in April to its lowest level in nearly three years although overall business sentiment held steady, a survey showed. The INSEE official statistics agency stated its industrial confidence index fell to 101 points - the lowest since June 2016 - from 103 in March, which was revised down from a preliminary reading of 102. The result fell slightly short of the 102 points expected on average in a Reuters’ poll of economists. The overall business morale was unchanged from March at 105, the highest level since November before confidence took a knock from a series of violent street protests against the government and the high cost of living. It was revised up from 104 in a preliminary reading in March. Meanwhile, confidence in the dominant services sector held steady in April at 105 while the March reading was revised up from 103. (Reuters) RBI steps up liquidity management to make rate cuts count – Reserve Bank of India’s (RBI) surprise announcement of new open market purchases of government bonds is a sign the central bank is stepping up efforts to increase the economic impact of its policy decisions, analysts said. The RBI’s two rate cuts this year, totaling 50 basis points, have not been followed with moves of a similar magnitude by commercial banks, which are reluctant to take risks while sitting on a pile of non- performing loans. In an unexpected move late, the RBI announced a new set of open market operations to purchase a total of INR250bn worth of bonds in May, with the first auction for INR125bn on May 2. (Reuters) Regional Growth outlook lowered for Gulf Arab economies this year – Expectations for growth in the Gulf Arab economies this year have been lowered, according to a quarterly Reuters poll of economists released, as oil output cuts, austerity measures and sluggish non-oil growth continue to weigh on them. GDP in Saudi Arabia will grow 1.8% in 2019 and 2.2% in 2020, the poll of 23 economists projected. Three months ago, the forecasts were for growth of 2.1% in 2019 and 2.2% in 2020. The Saudi Arabian economy grew 2.21% in 2018, buoyed by strong oil sector growth and recovering from a 0.74% contraction in 2017 when the economy was hit by weak oil prices and austerity measures. “We see only marginal improvement this year for the GCC compared to 2018, weighed down by oil supply cuts, with the non-oil sector being the primary engine of growth,” Senior

- 6. Page 6 of 8 Economist for the Middle East at Oxford Economics, Maya Senussi said. Growth expectations for the UAE - the most diversified in the region - fell by 0.1 percentage point since the last quarterly poll, to 3.0% for 2019 and 3.2% for 2020. The latest poll continues to predict sizeable however improving budget and current account deficits for the two weakest Gulf Arab economies — Bahrain and Oman — through 2021. Bahrain has stated that it is on track to deliver a balanced budget in 2022. (Reuters) Saudi Arabia starts year with budget surplus first time since 2014 – Saudi Arabia has started the year with a quarterly budget surplus for the first time since the 2014 collapse in oil prices. Saudi Arabia has posted a surplus of $7.41bn in the first quarter, helped by an increase in non-oil revenue as well as income from crude exports, Finance Minister, Mohammed Al- Jadaan said. Total spending increased by 8% while revenue jumped 48%. “These results clearly illustrate the remarkable progress achieved in the performance of our fiscal position,” he added. Higher oil revenue and the introduction of value-added taxation as well as subsidy cuts have helped the Kingdom repair public finances battered by lower crude prices. The budget deficit narrowed to 5.9% of gross domestic product (GDP) last year from 9.3% in 2017. “At first glance, the data seem surprising given that oil revenue should be weaker year-on- year in the first quarter based on price and production performance,” Chief Economist at Abu Dhabi Commercial Bank, Monica Malik said. “At the same time, we haven’t seen any major new fiscal reforms, with the rise in an expat levy being the main change. Transfers from government entities could be a factor but we await more detailed data,” she added. (Bloomberg) Saudi Arabia's Falih sees no need for swift output action after Iran oil waivers end – Saudi Arabia’s Energy Minister, Khalid Al-Falih said that he saw no need to raise oil output immediately after the US ends waivers granted to buyers of Iranian crude, however added that the Kingdom will respond to customers’ needs if asked for more oil. He said that he is guided by oil market fundamentals not prices, and that Saudi Arabia remained focused on balancing the global oil market. “Inventories are actually continuing to rise despite what is happening in Venezuela and despite the tightening of sanctions on Iran. I don’t see the need to do anything immediately,” he added. The US has decided not to renew exemptions from sanctions against Iran granted last year to buyers of Iranian oil, taking a tougher line than expected. “Our intent is to remain within our voluntary (OPEC) production limit,” he said, adding that Saudi Arabia “will be responsive to our customers, especially those who have been under waivers and those whose waivers have been withdrawn.” (Reuters) Samba CEO sees loan pickup as higher oil boosts state spending – Samba Financial Group (Samba) expects loan growth to pick up as higher oil prices enable Saudi Arabia to increase spending, CEO, Rania Nashar of the Kingdom’s third-biggest lender said. "We are expecting loan growth because now oil prices are going up," she said. "We’re seeing more government spending and also on mortgage and small- and medium-sized enterprises,” she added. Samba’s loan book shrank in 2018. Saudi Arabia pledged to lift government expenditure by more than 7% this year to help economic growth even as it grapples with the need to clip its fiscal deficit and curb crude output under an OPEC plans to support the oil prices. Bank lending increased 3.3% in the 12 months through February, according to SAMA. The Kingdom’s banking industry is also undergoing a transformation. Samba expects the mergers of its competitors to create "opportunities for the bank rather than challenges, getting clients of two merged banks that don’t want to have concentration, or to get more talent, we’re seeing this as more of an opportunity, Samba isn’t planning a merger at the moment, however “we are looking at all the opportunities and studying all the proposals," she said. (Bloomberg) SAMA preparing rules to force insurance consolidation – SAMA is working on regulations that will force consolidation in the insurance industry, the bank’s Governor, Ahmed Al Kholifey said. “Most insurance companies in Saudi Arabia have a small market value and that is why we encourage them really to consolidate, if there is no regulation to force that consolidation, I don’t think it will take place," he said. There has been little interest by insurance companies to consolidate, “we have only seen two interests, one is at an advanced stage,” he added. (Bloomberg) Tadawul targets 10% foreign stock ownership by end of 2020 – The Tadawul is aiming to boost foreign ownership levels in stocks to 10% by the end of next year, CEO, Khalid Al-Hussan said. Foreigners currently hold just over 5% of the stocks traded on the exchange. “There are four IPO in the pipeline, three of them have planned to list on the main market and one on the Nomu parallel market for small- and medium-sized companies,” he said. First index future derivative will start trading in 3Q2019. Registered qualified foreign investors are currently at 775 and the number could double by the end of next month. Saudi Arabia’s inclusion in MSCI Emerging Markets indexes will start in the month of May. IPO of the stock exchange definitely is "not happening in 2019," he added. He predicts ownership of equities by foreigners will triple by 2022, driven by flows from index trackers, as the country awaits the listing of its crown- jewel, Saudi Aramco. “Since we opened up the market, we wanted to make sure we have enough companies, diversified sectors and industries,” he said. “We are ready for the Aramco IPO, however as they change their plans, it gives more time for the exchange to develop,” he added. (Bloomberg) Deutsche Bank sees $45bn flowing to Saudi Arabian equities – Deutsche Bank sees $45bn flowing to Saudi Arabian equities. Within that amount, $15bn will be from passive investors tracking emerging-market benchmarks compiled FTSE Russell and MSCI, and $30bn will come from active investors, the CEO for the Middle East, Africa at Deutsche Bank, Jamal Al Kishi said. The pace of active investor’s arrival will be a function of market movements. He also said that Deutsche Bank is bullish on the Saudi Arabian market. (Bloomberg) Saudi Arabia approves banking license for Credit Suisse – Council of ministers in Saudi Arabia have approved the banking license for Credit Suisse, the Zurich-based bank, Finance Minister, Mohammed Al-Jadaan said. (Bloomberg) Saudi Arabian Minister says Saudi Aramco inaugural bond `only the beginning' – Saudi Arabia plans to sell more bonds and the debut Dollar debt offering by state-run oil giant Saudi Aramco is

- 7. Page 7 of 8 ‘only the beginning,’ Energy Minister, Khalid Al-Falih said. “There will be more, I won’t tell you what and when, and it won’t be bonds only,” he said. "Aramco sooner than you think will be accessing equity markets," he said. The 2021 IPO date for the company "could slip a little bit, could come forward," he added. (Bloomberg) March container transshipment at Saudi Arabian ports up 8.7% YoY – The total container transshipment at Saudi Arabia’s nine ports managed by Saudi Ports Authority (MAWANI) stood at 166.4 TEUs in March 2019 as compared to 153.0 thousand TEUs in the same period year ago, representing a rise of 8.7% YoY, Saudi Ports Authority stated. (Bloomberg) UAE’s March foreign assets rise to AED377.06bn – The Central Bank of the UAE (CBUAE) published data on foreign assets as at end of March, which showed that the total foreign assets rose to AED377.06bn in March from AED359.0bn in February. Cash, bank balances and deposits with banks abroad rose by AED17.8bn to AED307.6bn in the month of March. Investment in foreign securities rose to AED55.3bn in March from AED55.2bn in February. (Bloomberg) RAKBANK posts 32.3% YoY rise in net profit to AED269.7mn in 1Q2019 – The National Bank of Ras Al-Khaimah (RAKBANK) recorded net profit of AED269.7mn in 1Q2019, an increase of 32.3% YoY. Net interest income rose 2.7% YoY to AED608.4mn in 1Q2019. Operating income rose 8.5% YoY to AED1,001.0mn in 1Q2019. Total assets stood at AED53.5bn at the end of March 31, 2019 as compared to AED52.7bn at the end of December 31, 2018. Loans and advances (net) stood at AED32.8bn (-0.2% QoQ), while customers’ acceptances stood at AED0.5bn (-4.2% QoQ) at the end of March 31, 2019. EPS came in at AED0.16 in 1Q2019 as compared to AED0.12 in 1Q2018. (ADX) UNB's net profit falls 40.4% YoY to AED251.4mn in 1Q2019 – Union National Bank (UNB) recorded net profit of AED251.4mn in 1Q2019, registering decrease of 40.4% YoY. Net interest income rose 2.7% YoY to AED652.8mn in 1Q2019. Operating income fell 4.0% YoY to AED847.7mn in 1Q2019. Total assets stood at AED105.0bn at the end of March 31, 2019 as compared to AED107.0bn at the end of December 31, 2018. Loans and advances measured at amortized cost stood at AED72.2bn (- 0.1% QoQ), while customers’ deposits stood at AED76.6bn (- 1.1% QoQ) at the end of March 31, 2019. EPS came in at AED0.07 in 1Q2019 as compared to AED0.14 in 1Q2018. (ADX) Mabanee unit signs initial accord for $1.4bn financing – Shomoul Holding, a unit of Kuwait’s Mabanee, has signed an initial agreement with nine GCC banks for $1.4bn to finance the development of the Avenues Riyadh commercial complex. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 QSE Index S&P Pan Arab S&P GCC 0.1% 0.7% (0.3%) 0.0% (0.2%) (0.2%) (0.3%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,275.75 0.3 0.0 (0.5) MSCI World Index 2,168.81 (0.3) 0.4 15.1 Silver/Ounce 14.94 0.7 (0.3) (3.6) DJ Industrial 26,597.05 (0.2) 0.1 14.0 Crude Oil (Brent)/Barrel (FM Future) 74.57 0.1 3.6 38.6 S&P 500 2,927.25 (0.2) 0.8 16.8 Crude Oil (WTI)/Barrel (FM Future) 65.89 (0.6) 3.0 45.1 NASDAQ 100 8,102.02 (0.2) 1.3 22.1 Natural Gas (Henry Hub)/MMBtu 2.54 0.4 0.0 (20.3) STOXX 600 390.98 (0.6) (0.5) 12.8 LPG Propane (Arab Gulf)/Ton 67.00 1.1 8.1 4.7 DAX 12,313.16 0.1 0.1 13.7 LPG Butane (Arab Gulf)/Ton 70.25 0.9 6.4 1.1 FTSE 100 7,471.75 (0.9) (0.3) 12.6 Euro 1.12 (0.6) (0.8) (2.7) CAC 40 5,576.06 (0.8) (0.7) 14.9 Yen 112.19 0.3 0.2 2.3 Nikkei 22,200.00 (0.4) (0.0) 9.4 GBP 1.29 (0.3) (0.7) 1.2 MSCI EM 1,084.52 (0.5) (0.7) 12.3 CHF 0.98 (0.0) (0.6) (3.8) SHANGHAI SE Composite 3,201.61 0.2 (2.4) 31.4 AUD 0.70 (1.2) (1.9) (0.5) HANG SENG 29,805.83 (0.5) (0.5) 15.2 USD Index 98.17 0.6 0.8 2.1 BSE SENSEX 39,054.68 0.9 (1.0) 7.8 RUB 64.34 1.0 0.4 (7.7) Bovespa 95,045.43 (2.1) (0.9) 4.9 BRL 0.25 (1.8) (1.5) (2.8) RTS 1,263.97 (1.1) 0.2 18.3 104.4 97.1 84.0