QNBFS Daily Market Report April 24, 2018

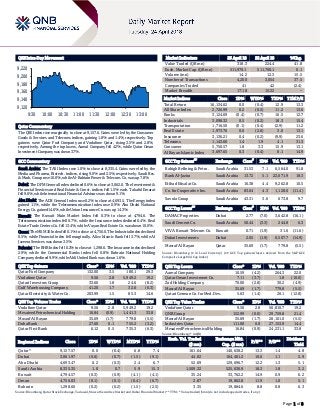

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index rose marginally to close at 9,157.6. Gains were led by the Consumer Goods & Services and Telecoms indices, gaining 1.8% and 1.4%, respectively. Top gainers were Qatar Fuel Company and Vodafone Qatar, rising 3.5% and 2.8%, respectively. Among the top losers, Aamal Company fell 4.2%, while Qatar Oman Investment Company was down 3.7%. GCC Commentary Saudi Arabia: The TASI Index rose 1.0% to close at 8,335.4. Gains were led by the Media and Pharma, Biotech. indices, rising 9.0% and 2.5%, respectively. Saudi Res. & Mark. Group rose 10.0%, while Al-Babtain Power & Telecom. Co. was up 7.8%. Dubai: The DFM General Index declined 0.6% to close at 3,062.0. The Investment & Financial Services and Real Estate & Const. indices fell 1.5% each. Takaful Emarat fell 9.6%, while International Financial Advisors was down 9.1%. Abu Dhabi: The ADX General Index rose 0.2% to close at 4,693.5. The Energy index gained 1.1%, while the Telecommunication index rose 0.9%. Abu Dhabi National Energy Co. gained 14.6%, while Union Insurance Co. was up 14.3%. Kuwait: The Kuwait Main Market Index fell 0.3% to close at 4,794.6. The Telecommunication index fell 0.7%, while the Insurance index declined 0.4%. Real Estate Trade Centers Co. fell 13.4%, while A’ayan Real Estate Co. was down 10.0%. Oman: The MSM 30 Index fell 0.1% to close at 4,756.0. The Industrial index declined 0.5%, while Financial index fell marginally. Alizz Islamic Bank fell 3.7%, while Al Jazeera Services was down 3.5%. Bahrain: The BHB Index fell 0.2% to close at 1,298.6. The Insurance index declined 2.9%, while the Commercial Banks index fell 0.8%. Bahrain National Holding Company declined 9.9%, while Ahli United Bank was down 1.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 132.00 3.5 180.1 29.3 Vodafone Qatar 9.56 2.8 5,949.2 19.2 Qatari Investors Group 33.60 1.8 24.6 (8.2) Gulf Warehousing Company 41.20 1.7 32.6 (6.3) Qatar Electricity & Water Co. 203.99 1.5 85.3 14.6 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.56 2.8 5,949.2 19.2 Mesaieed Petrochemical Holding 16.84 (0.9) 1,441.3 33.8 Masraf Al Rayan 35.69 (1.7) 779.8 (5.5) Doha Bank 27.60 0.1 755.2 (3.2) Qatar First Bank 6.12 0.5 735.3 (6.3) Market Indicators 23 April 18 22 April 18 %Chg. Value Traded (QR mn) 318.3 224.4 41.8 Exch. Market Cap. (QR mn) 511,970.1 511,700.1 0.1 Volume (mn) 14.2 12.3 15.5 Number of Transactions 4,200 3,054 37.5 Companies Traded 41 42 (2.4) Market Breadth 17:18 15:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,134.62 0.0 (0.4) 12.9 13.3 All Share Index 2,726.99 0.2 (0.5) 11.2 13.6 Banks 3,124.69 (0.4) (0.7) 16.5 12.7 Industrials 3,098.32 0.5 (0.2) 18.3 15.4 Transportation 1,716.50 (0.1) (0.4) (2.9) 11.2 Real Estate 1,973.76 0.0 (2.6) 3.0 13.1 Insurance 3,136.21 0.4 (0.2) (9.9) 23.6 Telecoms 1,143.60 1.4 1.9 4.1 31.3 Consumer 5,750.57 1.8 3.3 15.9 13.1 Al Rayan Islamic Index 3,697.65 0.3 (0.4) 8.1 14.9 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Rabigh Refining & Petro. Saudi Arabia 31.53 7.1 6,564.0 91.8 Bank Al-Jazira Saudi Arabia 13.72 5.1 22,071.9 18.3 Etihad Etisalat Co. Saudi Arabia 16.38 4.4 9,262.8 10.5 Co. for Cooperative Ins. Saudi Arabia 83.64 4.3 1,128.6 (11.4) Savola Group Saudi Arabia 43.31 3.6 673.8 9.7 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% DAMAC Properties Dubai 2.77 (7.0) 3,642.8 (16.1) Saudi Cement Co. Saudi Arabia 50.44 (3.3) 244.8 6.3 VIVA Kuwait Telecom Co. Kuwait 0.71 (1.9) 31.6 (11.6) Dubai Investments Dubai 2.05 (1.9) 6,507.7 (14.9) Masraf Al Rayan Qatar 35.69 (1.7) 779.8 (5.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Aamal Company 10.59 (4.2) 264.3 22.0 Qatar Oman Investment Co. 7.11 (3.7) 1.8 (10.0) Zad Holding Company 70.00 (2.8) 30.2 (4.9) Masraf Al Rayan 35.69 (1.7) 779.8 (5.5) Qatari German Co. for Med. Dev. 5.63 (1.4) 20.1 (12.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Vodafone Qatar 9.56 2.8 56,810.7 19.2 QNB Group 152.99 (0.0) 29,759.8 21.4 Masraf Al Rayan 35.69 (1.7) 28,101.0 (5.5) Industries Qatar 111.00 0.0 27,153.9 14.4 Mesaieed Petrochemical Holding 16.84 (0.9) 24,231.1 33.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,157.57 0.0 (0.4) 6.8 7.4 161.64 140,638.2 13.3 1.4 4.8 Dubai 3,061.97 (0.6) (0.7) (1.5) (9.1) 44.02 104,461.2 10.6 1.1 5.9 Abu Dhabi 4,693.47 0.2 (0.3) 2.4 6.7 52.69 129,696.7 12.2 1.3 5.1 Saudi Arabia 8,335.35 1.0 0.7 5.9 15.3 1,509.32 525,636.9 18.3 1.8 3.2 Kuwait 4,794.57 (0.3) (0.9) (4.1) (4.1) 35.24 33,762.2 14.9 0.9 6.2 Oman 4,756.03 (0.1) (0.1) (0.4) (6.7) 2.87 19,862.8 11.9 1.0 5.1 Bahrain 1,298.60 (0.2) (0.2) (1.5) (2.5) 3.35 19,884.6 8.8 0.8 6.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,120 9,140 9,160 9,180 9,200 9,220 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index rose marginally to close at 9,157.6. The Consumer Goods & Services and Telecoms indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar Fuel Company and Vodafone Qatar were the top gainers, rising 3.5% and 2.8%, respectively. Among the top losers, Aamal Company fell 4.2%, while Qatar Oman Investment Company was down 3.7%. Volume of shares traded on Monday rose by 15.5% to 14.2mn from 12.3mn on Sunday. Further, as compared to the 30-day moving average of 12.7mn, volume for the day was 11.6% higher. Vodafone Qatar and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 42.0% and 10.2% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2018 % Change YoY Operating Profit (mn) 1Q2018 % Change YoY Net Profit (mn) 1Q2018 % Change YoY Filling & Packing Materials MFG. Co. Saudi Arabia SR – – – – 1.2 -63.5% Saudi Paper Manufacturing Co. Saudi Arabia SR – – 11.7 431.8% 4.7 N/A Saudia Dairy and Foodstuff Co. Saudi Arabia SR – – 56.2 -25.1% 49.9 -32.5% Sahara Petrochemical Co. Saudi Arabia SR – – – – 140.2 46.2% United Wire Factories Co. Saudi Arabia SR – – 11.1 9.1% 7.7 0.3% Takaful Emarat Dubai AED – – – – 2.0 196.0% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/23 US Markit Markit US Manufacturing PMI April 56.5 55.2 55.6 04/23 US Markit Markit US Services PMI April 54.4 54.1 54.0 04/23 US Markit Markit US Composite PMI April 54.8 – 54.2 04/23 EU Markit Markit Eurozone Manufacturing PMI April 56.0 56.1 56.6 04/23 EU Markit Markit Eurozone Services PMI April 55.0 54.6 54.9 04/23 EU Markit Markit Eurozone Composite PMI April 55.2 54.8 55.2 04/23 Germany Markit Markit/BME Germany Manufacturing PMI April 58.1 57.5 58.2 04/23 Germany Markit Markit Germany Services PMI April 54.1 53.7 53.9 04/23 Germany Markit Markit/BME Germany Composite PMI April 55.3 54.8 55.1 04/23 France Markit Markit France Manufacturing PMI April 53.4 53.5 53.7 04/23 France Markit Markit France Services PMI April 57.4 56.5 56.9 04/23 France Markit Markit France Composite PMI April 56.9 55.9 56.3 04/23 Japan Markit Nikkei Japan PMI Mfg April 53.3 – 53.1 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2018 results No. of days remaining Status GISS Gulf International Services 24-Apr-18 0 Due BRES Barwa Real Estate Company 24-Apr-18 0 Due QATI Qatar Insurance Company 24-Apr-18 0 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 24-Apr-18 0 Due QGRI Qatar General Insurance & Reinsurance Company 25-Apr-18 1 Due QIMD Qatar Industrial Manufacturing Company 25-Apr-18 1 Due ORDS Ooredoo 25-Apr-18 1 Due IQCD Industries Qatar 26-Apr-18 2 Due ZHCD Zad Holding Company 26-Apr-18 2 Due IGRD Investment Holding Group 28-Apr-18 4 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 43.31% 45.32% (6,400,802.32) Qatari Institutions 17.28% 19.75% (7,850,525.17) Qatari 60.59% 65.07% (14,251,327.49) GCC Individuals 1.26% 1.81% (1,761,075.07) GCC Institutions 8.76% 4.68% 12,976,352.70 GCC 10.02% 6.49% 11,215,277.63 Non-Qatari Individuals 9.84% 10.41% (1,832,691.59) Non-Qatari Institutions 19.56% 18.03% 4,868,741.45 Non-Qatari 29.40% 28.44% 3,036,049.86

- 3. Page 3 of 8 QGMD Qatari German Company for Medical Devices 29-Apr-18 5 Due QFBQ Qatar First Bank 29-Apr-18 5 Due MCCS Mannai Corporation 29-Apr-18 5 Due QNNS Qatar Navigation (Milaha) 29-Apr-18 5 Due QCFS Qatar Cinema & Film Distribution Company 29-Apr-18 5 Due UDCD United Development Company 29-Apr-18 5 Due MERS Al Meera Consumer Goods Company 29-Apr-18 5 Due QOIS Qatar Oman Investment Company 29-Apr-18 5 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-18 5 Due QFLS Qatar Fuel Company 29-Apr-18 5 Due MPHC Mesaieed Petrochemical Holding Company 30-Apr-18 6 Due VFQS Vodafone Qatar 30-Apr-18 6 Due AHCS Aamal Company 30-Apr-18 6 Due ERES Ezdan Holding Group 30-Apr-18 6 Due Source: QSE News Qatar QNB Group inks landmark merchant agreement with Qatar Rail – QNB Group, the largest financial institution in the Middle East and Africa region, has signed a landmark merchant agreement with Qatar Rail, which will see the bank join as a strategic partner and the official Acquirer Bank for all TravelCard and Fare Media payments. The agreement was signed by Ali Ahmed Al Kuwari, QNB Group’s Chief Executive Officer, and Qatar Rail’s Managing Director and Chief Executive Officer, Abdulla Abdulaziz T Al Subaie, on the sidelines of Cityscape Qatar exhibition inaugurated by H E Sheikh Abdullah bin Nasser bin Khalifa Al Thani , the Prime Minister and Interior Minister. This agreement underscores QNB Group’s commitment towards supporting the country’s economy, by enhancing the role of the private sector and supporting such projects, which will further boost the national economy. (Peninsula Qatar) IHGS reports QR0.24mn net profit in 1Q2018 – Islamic Holding Group (IHGS) recorded net profit of QR0.24mn in 1Q2018 as compared to a net loss of QR0.73mn in 4Q2017. However, on YoY basis net profit declined 81.9%. The company's net brokerage & commission income came in at QR1.02mn in 1Q2018, which represents an increase of 71.8% QoQ. However, on YoY basis net brokerage & commission income fell 63.4%. EPS amounted to QR0.04 in 1Q2018 as compared to QR0.23 in 1Q2017. (QSE) WDAM's net profit declines 4.5% QoQ in 1Q2018 – Widam Food Company's (WDAM) net profit declined 4.5% QoQ to QR26.66mn in 1Q2018. However, on YoY basis net profit rose 16.2%. EPS amounted to QR1.48 in 1Q2018 as compared to QR1.28 in 1Q2017. (QSE) SIIS reports net loss of QR8.22mn in 1Q2018 – Salam International Investment Limited (SIIS) reported net loss of QR8.22mn in 1Q2018 as compared to QR96.96mn in 4Q2017. Loss per share amounted to QR0.07 in 1Q2018 as compared to earnings per share of QR0.18 in 1Q2017. (QSE) UDCD signs three contracts worth QR334mn for Gewan Island project – United Development Company (UDCD), the master developer of The Pearl-Qatar, signed three contracts on April 23 worth QR334mn for the development of Gewan Island, on the sidelines of Cityscape Qatar 2018. Gewan Island, UDCD’s current biggest real estate project, spans across 400,000sq m. The island, which derives its name from the full-round, pink- tinted and perfectly shaped pearl, will support a mix of property types, catering for different accommodation and investment needs. (Gulf-Times.com) IQCD to disclose 1Q2018 financial results on April 26 – Industries Qatar (IQCD) announced its intention to disclose its 1Q2018 financial results on April 26, 2018. (QSE) GISS to disclose 1Q2018 financial results on April 24 – Gulf International Services company (GISS) announced its intention to disclose its 1Q2018 financial results on April 24, 2018. (QSE) QGMD to disclose 1Q2018 financial results on April 29 – Qatari German Company for Medical Devices (QGMD) announced its intention to disclose its 1Q2018 financial results on April 29, 2018. (QSE) MPHC to disclose 1Q2018 financial results on April 30 – Mesaieed Petrochemical Holding Company (MPHC) announced its intention to disclose its 1Q2018 financial results on April 30, 2018. (QSE) MRDS to disclose its 1Q2018 financial results on April 29 – Mazaya Qatar Real Estate Development (MRDS) announced its intention to disclose its 1Q2018 financial results on April 29, 2018. (QSE) WDAM postpones its EGM to May 30 – Widam Food Company (WDAM) announced that the EGM which was supposed to be held on April 23, 2018 will be postponed to May 30, 2018 due to lack of quorum. (QSE) Primary receiving of cement mills for cement plant no. 5 – Qatar National Cement Company announced its two cement mills of plant no. 5 after successful completion of the performance test, the capacity of the cement mills is more than 5000 tons cement per day. The other parts of the plant are expected to be completed by June 2018. (QSE) More than 2,000 business opportunities worth QR6.5bn for SMEs – More than 2,000 business opportunities valued at QR6.5bn await Qatar’ small and medium enterprises (SMEs) this year, a reflection of the growing diversification of the economy on a sustainable basis. These opportunities as well as public tenders extended by 40 big buyers – such as larger private sector companies, semi-governmental and governmental bodies – were disclosed by Qatar Development Bank (QDB) Chief Executive, Abdulaziz bin Nasser al-Khalifa at

- 4. Page 4 of 8 the third edition of ‘Moushtrayat’ – the Government Procurement and Contracting Conference and Exhibition. The expo was inaugurated by HE the Energy and Industry Minister Mohamed bin Saleh al-Sada, in the presence of Qatar Central Bank Governor HE Sheikh Abdulla bin Saoud al-Thani and other dignitaries. (Gulf-Times.com) QFC is launching Qatar PMI report by IHS Markit – The Qatar Financial Centre (QFC) has launched a new PMI (Purchasing Managers’ Index) for the non-oil private sector, compiled by IHS Markit, a world leader in critical information, analytics and solutions. The PMI series produced by IHS Markit is one of the most closely watched signals of business activity and is valued worldwide by central banks, financial markets and business decision makers for providing timely and often unique monthly indicators of economic trends. The indices are based on monthly surveys of more than 28,000 senior business executives to quantify variables such as output, new orders, employment and prices. Qatar marks the 43rd country covered by the global PMI series from IHS Markit. (Gulf-Times.com) Sheikh Ahmed holds meetings in Germany to promote trade, investment – HE the Minister of Economy and Commerce Sheikh Ahmed bin Jassim bin Mohamed al-Thani has held meetings with German officials on the sidelines of Qatar’s participation in the ongoing Hanover Fair 2018. Qatar is participating in the event, considered the world’s largest industrial fair, for the first time with a 900 square meters pavilion. The fair continues until April 27. Sheikh Ahmed met with Peter Altmaier, Germany’s Federal Minister for Economic Affairs and Energy. Discussions touched on the promotion of Qatari-German bilateral relations and co-operation, particularly in the economic, trade and investment fields. Discussions also touched on Qatar’s economic development over the past years and reviewed investment opportunities across various sectors as well as initiatives launched by Qatar to support the private sector and enhance its contribution to the overall economic development of the country and the increase in foreign investments, the Ministry of Economy and Commerce said. (Gulf-Times.com) Qatar Airways assures its support for local SMEs – Qatar Airways’ support for local suppliers has grown significantly in the past year to witness a 21% growth during the blockade, a senior official said. “We take pride in that,” said Liazid Benkoussa, Senior Vice President for procurement at Qatar Airways, which is participating in the ‘3rd Government Procurement and Contracting Conference and Exhibition – Moushtarayat’, taking place at the Doha Exhibition and Convention Centre from April 23 to 25. “One of Qatar Airways’ values is showing pride in Qatar, and being a part of the Moushtarayat initiative is a wonderful way to show our support for the local market, as well as potential business opportunities,” he continued. During the conference, Qatar Airways will discuss potential procurement opportunities for SMEs, such as supplier registration for developing supplier lists for future tender processes. Organized by Qatar Development Bank, Moushtarayat aims to create opportunities for local suppliers and SMEs by providing access to a network of prominent buyers and suppliers for government, semi- government, and large private entities. (Gulf-Times.com) Qatar Airways to expand fleet with 11 new planes this year – Qatar Airways Group Chief Executive Akbar Al Baker announced yesterday that the airline will add 11 new planes to its fleet this year as it prepares to launch 16 new destinations in 2018 and 2019. He said that the national carrier, which is preparing to announce its financial results in June, remains strong despite the siege imposed on Qatar. It continues to expand and invest in new markets, adds new aircraft, and employs more workers. (Peninsula Qatar) Qatar firms need 6 months to be VAT ready, says expert – Six months is enough for Qatari companies to prepare for the implementation of value added tax (VAT) in the country, an expert said during a seminar held at the Qatar Chamber. Francois Malan, Senior Manager – Indirect Tax at Ernst & Young, cautioned, however, that companies in some countries in the region where VAT was applied “without preparations” experienced “confusion and interruption.” Malan, who was speaking at the seminar titled ‘The Impact of VAT Compliance on Energy Sector in Qatar’, said only 10% of the institutions and companies in some countries in the region “were fully prepared to implement the new law.” The remaining 90%, he continued, were not able to enforce VAT successfully despite outsourcing help and adopting solutions and delayed measures in preparation for VAT implementation. According to Ernst & Young Qatar Partner and VAT implementation leader Jennifer O’Sullivan, Qatar’s legislative framework “is ready for the VAT implementation.” O’Sullivan said she expects that all GCC countries will apply the tax by 2019, and assured that “all companies shall be ready before the tax enters into force.” (Gulf-Times.com) Qatar celebrates listing of Formosa Bond at Taipei Exchange – Qatar marked a historical milestone by ringing the bell on the floor of the Taipei Exchange. The ceremony recognized Qatar as the first-ever sovereign to list a Formosa bond and reiterated the growing relationship between the two markets. Key representatives of Qatar and Taiwan’s Ministries of Finance, the Taiwan Financial Supervisory Commission and the Taipei Exchange’s leadership attended the event, QNA reported. Earlier this month, Qatar successfully marked its return to international debt markets, pricing a $12bn triple tranche bond, offering $3bn 5-year, $3bn 10-year and $6bn 30-year notes. The bond also generated the largest order book for all emerging markets in 2018, at $53bn. Qatar’s economic outlook remains positive, with a forecasted growth expected to exceed 2.8% in 2018. (Peninsula Qatar) Qatar produces over 10,000 MW electricity and 456 MG of water – Electricity production in Qatar reached 10,170 megawatts last year, up 19% from 2013, said President of Qatar General Electricity and Water Corporation, Kahramaa, Eng. Essa bin Hilal Al Kuwari, adding that production is expected to rise to 12,883 MW in 2024. Presenting Kahramaa’s achievements at a meeting in the Advisory Council, Al Kuwari said that the water production reached 456mn gallons (MG), about 40% higher than five years ago. He expected that water production will rise to 586 MG by 2024. (Peninsula Qatar) New line between Hamad Port and Iraq’s Umm Qasr – HE the Minister of Transport and Communications Jassim Seif Ahmed al-Sulaiti met with Iraqi Minister of Transport Kadhim Finjan

- 5. Page 5 of 8 al-Hammami. The meeting reviewed prospects of cooperation in the fields of maritime transport, ports and aviation, and means of boosting them, in addition to discussing a number of issues of common concern between the two fraternal countries. In addition, the meeting saw the announcement of opening a new navigation line between Hamad Port and Umm Qasr Port in Iraq, with the first ship set to arrive in the Iraqi port on May 1. (Gulf-Times.com) International US home sales increase strongly; inventory remains tight – US home sales increased for a second straight month in March amid a rebound in activity in the Northeast and Midwest regions, but a dearth of houses on the market and higher prices remain headwinds as the spring selling season kicks off. The supply squeeze is expected to ease somewhat later this year as data last week showed the stock of housing under construction rising in March to levels last seen in July 2007. The National Association of Realtors (NAR) said that existing home sales rose 1.1% to a seasonally adjusted annual rate of 5.60mn units last month. The market for previously owned homes accounts for about 90% of US home sales. Sales fell 1.2% YoY in March. Sales increased in the Northeast and Midwest, after being weighed down by bad weather in February, but fell in the South and the West. There is an acute shortage of homes, especially at the lower end of the market. According to the NAR, sales of houses priced below $100,000 dropped 21% in March from a year ago. (Reuters) Eurozone’s business growth stabilizes but Euro a rising concern – Business activity across the Eurozone was still growing as the second quarter began, but at a more modest rate than around the turn of the year, a survey showed. The Eurozone unexpectedly was one of the best-performing major economies last year. But after peaking in January, growth has steadily slowed on a strong currency and fears a trade spat between China and the United States could start to hurt. IHS Markit’s composite flash Purchasing Managers’ Index (PMI) for the Eurozone, seen as a good guide to overall economic health, held steady in April at March’s 14-month low of 55.2, defying a Reuters poll forecast for a fall to 54.9. Germany and France, the bloc’s two biggest economies and the only ones to publish flash readings, showed improvement, suggesting growth must have slowed in other big economies. Still, survey compiler IHS Markit said the PMI pointed to solid quarterly GDP growth of 0.6%, matching the consensus view in the latest Reuters poll. (Reuters) Eurozone’s debt, deficit drop in 2017 as economy grows – The Eurozone’s public debt and deficit dropped last year as the bloc’s economy grew at a healthy rate, provisional data from the European Union’s statistics office showed. Debt in the 19- country currency bloc fell to 86.7% of gross domestic product last year from 89.0% in 2016, Eurostat said using data provided by member states. The deficit dropped to 0.9% of GDP from 1.5% in 2016, Eurostat said. The improvement in public finances can reduce governments’ funding costs. The fall in the budget shortfalls was partly due to the bloc’s strong growth last year, which the European Commission in its last economic forecast in February estimated at 2.4%, the fastest pace in a decade. (Reuters) Germany’s private sector outlook deteriorates in April – The outlook for business activity in Germany’s private-sector deteriorated to a five-month low in April, a survey showed, as growth in new orders slowed. IHS Markit said growth in new orders slumped to a more than 18-month low. New business in the service sector posted the smallest gain since August and manufacturers reported new orders had eased to the lowest level since November 2016. Markit’s flash composite Purchasing Managers’ Index (PMI), which tracks the manufacturing and services sectors that account for more than two-thirds of the economy, nevertheless rose to 55.3 in April, a two-month high. It had fallen to an eight-month low in March. Phil Smith, principal economist at IHS Markit, said the slowdown in new order growth raises some concern, as reflected in the survey’s measure of business confidence, which slipped further from the highs of last year. But overall, he said, the April survey points to a strong start to the April-June quarter. (Reuters) French private sector growth picks up in April – Activity in the French private sector unexpectedly rebounded in April despite a wave of rolling strikes by railway workers, a survey showed, signaling a strong recovery was not being blown off course. Data compiler IHS Markit said its composite preliminary manufacturing Purchasing Managers’ Index (PMI) rose to 56.9 in April from 56.3 in March, defying expectations for a drop to 55.9 in a Reuters poll of economists. The positive surprise came from the dominant service sector, whose PMI increased to 57.4 in April from 56.9 in March, higher than economists’ average forecast of 56.5 and above the 50-point threshold demarcating an expansion from a contraction. In the manufacturing sector, the index fell to 53.4 this month from 53.7 in March, a touch below expectations and the lowest point in 13 months. But the manufacturing output sub-index rose to 54.7 from 53.9. The French economy was resilient in the face of rolling strikes launched by railway workers since April 3 to protest against President Emmanuel Macron’s reform of state-owned rail company SNCF, causing widespread disruption. (Reuters) Regional Gulf companies challenged by debt and rising interest rates – There has been an uptick in recent months in heavily-borrowed companies in the Gulf seeking to restructure their debts with lenders. Although the pressure on companies is not comparable to levels witnessed in the region following the 2008 global financial crisis, rising interest rates will eventually begin to have a greater impact, say experts. Matthew Wilde, a partner at consultancy PwC in Dubai, said “We do expect that interest rate increases will gradually start to impact companies over the next 12 months, but to date the impact of hedging and the runoff of older fixed rate deals has meant the impact is fairly muted so far.” (GulfBase.com) S&P: GCC set to jump into solar energy industry in big way – At a time when the global renewable energy industry is growing strongly, supported by a steady decline in renewable generation costs and push by world governments, the GCC is steadily increasing its solar generation capacity. S&P Global Ratings (S&P) stated the region is jumping into renewable energy in a big way. It expects most GCC countries to continue to invest in solar efforts in the years to come. S&P expects solar investment

- 6. Page 6 of 8 in the GCC to continue to increase quickly over the next decade. While all projects announced to date are bank-funded, S&P expects that some might be refinanced via the capital markets once they are operational. (Peninsula Qatar) Saudi Arabia’s insurance sector’s profit drops 55% in 2017 – With all listed insurers in Saudi Arabia having published their preliminary year-end 2017 financial reports, S&P Global Ratings (S&P) calculates that net income for the whole sector dropped by 55% to about SR1.1bn from SR2.5bn in 2016. In addition, the sector posted a modest decline in gross premiums written (GPW) and a slim increase in overall shareholders' equity. While overall credit conditions in the market remained supportive in 2017, S&P’s recent rating actions on Mediterranean & Gulf Cooperative Insurance and Reinsurance Co. and The Company for Cooperative Insurance reflected some company-specific issues. The decline in 2017 net income follows an increase in earnings by 140% in 2016, when risk- based actuarial pricing was more consistently applied. (GulfBase.com) Saudi Arabian finance ministry sells SR5bn of domestic Sukuk – Saudi Arabia’s government sold SR5.0bn of domestic Sukuk in its sixth monthly offer of domestic Sukuk, according to the Ministry of Finance. The ministry sold SR3.8bn of five-year Sukuk, SR750mn of seven-year and SR450mn of ten-year. Last month, the ministry sold SR4.9bn of domestic Sukuk. (Reuters) Britain, Saudi Arabia target $90bn trade, investment opportunities – Saudi Arabia and Britain have set out a new vision of their bilateral relationship, with an ambitious target of achieving $90bn in trade and investment opportunities in the coming years, said Simon Collis, British ambassador to the Kingdom. A number of other commercial initiatives have been lined up within the framework of the newly created UK-Saudi Arabia Strategic Partnership Council following the visit of Crown Prince Mohammed Bin Salman to Britain. Close on the wheels is a high-profile meeting of Saudi Arabia and British tech entrepreneurs on April 24, 2018 in London, which will further boost ties. (GulfBase.com) HSBC Saudi Arabia announces the rebalancing of the HSBC Saudi 20 ETF in line with the Index – The rebalancing of the HSBC Saudi 20 ETF has been carried out on April 22, 2018 in line with the Index. The Capital Market Authority and the Saudi Arabian Stock Exchange take no responsibility for the contents of this disclosure, make no representations as to its accuracy or completeness, and expressly disclaim any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this disclosure, and the issuer accepts full responsibility for the accuracy of the information contained in it and confirms, having made all reasonable enquiries, that to the best of their knowledge and belief, there are no other facts or information the omission of which would make the disclosure misleading, incomplete or inaccurate. (Tadawul) Saudia Dairy & Foodstuff Company recommends cash dividend for FY2017-2018 – The board of directors of Saudia Dairy & Foodstuff Company recommended the distribution of dividends to the shareholders for FY2017-2018 with the total amount of distribution of dividend being SR65mn and dividend per share of SR2. (Tadawul) UAE inflation continues easing in March after tax boost – Consumer price inflation in the UAE continued to ease in March after hitting a multi-year high in January when the government imposed 5% value-added tax, official data showed. Annual inflation dropped to 3.4% last month from 4.5% in February and 4.8% in January, which was the highest since 2015. On MoM basis, consumer prices fell 0.7% in March. Some companies have been discounting to maintain market share after initially hiking prices more sharply in response to the tax. (Reuters) UAE says top oil producers committed to supply cuts until year end – All OPEC and non-OPEC oil producers including Russia are committed to supply cuts until the end of the year, according to UAE’s Energy Minister, Suhail Mohamed Al Mazrouei. Al Mazrouei said, “All in all, the fundamentals of the market, the supply and demand, the job is not complete. We need to continue until we see a true balanced market.” (Reuters) MASQ's net profit rises to AED598.2mn in 1Q2018 – Mashreqbank (MASQ) recorded net profit of AED598.2mn in 1Q2018 as compared to AED546.2mn in 1Q2017. Net interest income and net income from Islamic products came in at AED909.1mn as compared to AED852.2mn in 1Q2017. Operating income came in at AED1,517.8mn as compared to AED1,459.7mn in 1Q2017. Total assets stood at AED123.42bn at the end of March 31, 2018 as compared to AED125.19bn at the end of December 31, 2017. Loans and advances measured at amortized cost stood at AED55.97bn, while customers’ deposits stood at AED68.97bn at the end of March 31, 2018. EPS came in at AED3.37 in 1Q2018 as compared to AED3.08 in 1Q2017. (DFM) DIFC’s FinTech hive expands accelerator program – Dubai International Financial Centre’s (DIFC) FinTech hive is expanding its accelerator program for start-ups to include insurance, Islamic finance and regulatory technological services. The program gives FinTech companies with a proven track record advice and makes connections for them with financial services firms looking for technological solutions to bring about greater operational nimbleness. The hive also helps them find investors. (GulfBase.com) Amanat Holdings increases payout by AED11.4mn at Annual General Meeting – Amanat Holdings, GCC’s largest healthcare and education investment company, announced that it has concluded its Annual General Meeting on April 22, 2018. The General Meeting approved an increase of the payout for the fiscal year ending December 31, 2017. Prior to the General Meeting, the board had proposed to distribute cash dividends of 1.50% of the nominal value for each share i.e., 1.5 Fils per share. Following shareholders’ request during the General Meeting to increase the payout, the request was approved to an increase of AED11.4mn, which will be paid from retained earnings of AED5.7mn and from the share issuance reserve of AED5.7mn while obtaining the Securities and Commodities Authority’s approval. This implies total payout of AED48.9mn, or 1.956% of the nominal value of each share i.e. 1.956 Fils per share. (GulfBase.com) Shuaa Capital says acquisition offer of Amwal is pending regulatory approvals – Shuaa Capital stated that launch of voluntary acquisition offer of Amwal International Investment (Amwal) is currently pending approvals from regulatory

- 7. Page 7 of 8 authorities in Kuwait. Shuaa Capital continues to seek, and in discussion with number of acquisition targets including Egypt. (Reuters) Abu Dhabi Islamic Bank’s net profit rises to AED590.4mn in 1Q2018 – Abu Dhabi Islamic Bank recorded net profit after zakat & tax of AED590.4mn in 1Q2018 as compared to AED577.5mn in 1Q2017. Net revenue came in at AED1.36bn as compared to AED1.37bn in 1Q2017. As of March 31, 2018, customer deposits grew 1.2% to AED102.2bn, from AED101.0bn at the end of March 31, 2017. Capital adequacy ratio under Basel III at March 31, 2018 is 16.02% versus 16.09% at December 31, 2017 after adjusting for 2017’s dividend. (Reuters) Abu Dhabi, Shanghai plan exchange focusing on China trade – Abu Dhabi Global Market (ADGM), the Emirate’s international financial center, has agreed in principle with the Shanghai Stock Exchange to cooperate in establishing an exchange focusing on China’s foreign trade and investment, according to ADGM. The partners signed a memorandum of understanding to develop the exchange in Abu Dhabi. It would cater to companies and investors involved in China’s Belt and Road initiative, a Beijing-backed drive to win trade and investment deals along routes linking China to Europe. (Reuters) Mubadala Investment Company invests In Phoenician Capital – Mubadala Investment Company acquires minority stake in general partner of Phoenician Capital. The investment is made through Mubadala Capital, Mubadala’s financial investment arm. This partnership includes agreement for Mubadala Capital to invest in fund managed by Phoenician Capital. (Reuters) ADNOC sets up oil trading business to help find new markets – Abu Dhabi National Oil Company (ADNOC) is setting up a new trading unit to handle its crude oil and refined products, part of the state-run firm’s efforts to expand its international business and secure new markets. The new business will be part of ADNOC’s Marketing, Sales and Trading Directorate. The unit will introduce and manage non-speculative trading to further maximize value from every barrel of crude oil and refined product that is produced and marketed by the company, ADNOC stated. (Reuters) Mubadala halts Abraaj investment business deal talks – Abu Dhabi state investor Mubadala halted talks to buy Abraaj’s investment business, sources said, in a blow to the private equity firm which is facing an investigation by investors into how it used some of their money. Mubadala, which has more than $200bn in assets, and Abraaj held initial talks a month ago, but these did not progress. (Gulf-Times.com) Omantel issues $1.5bn bonds in two tranches – Oman Telecommunications Company (Omantel) issued an inaugural dual tranche bond with a total size of $1.5bn. The longer $900mn 2023 bond is paying an annual coupon of 5.625% and the shorter $600mn 2028 bond is paying an annual coupon of 6.625%. The proceeds of the new issue will be used to repay the full amount of the bridge loan facility taken for the acquisition of Omantel stake in Zain Kuwait. (MSM) Ahli United Bank buys 7.3% stake in Bank AlJazira – Bahrain’s Ahli United Bank stated it has bought 7.3% stake in Saudi Arabia’s Islamic lender, Bank AlJazira, for $173mn. The investment is not expected to have any material impact on Ahli United Bank’s financial position. The move comes as regional and international banks accelerate moves to boost their presence in Saudi Arabia, encouraged by the economic reforms that aim to boost the Kingdom’s financial markets. Other Bahraini financial institutions are also banking on close proximity to Saudi Arabia to help revive Bahrain’s reputation as a major Middle East business centre. GFH Financial recently announced plans to develop its business in Saudi Arabia. (Reuters) Al Salam Bank-Bahrain appoints new CEO – Al Salam Bank- Bahrain appointed Rafik Nayed as the bank's new CEO, effective from April 19, 2018. (Reuters)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 QSEIndex S&P Pan Arab S&P GCC 1.0% 0.0% (0.3%) (0.2%) (0.1%) 0.2% (0.6%) (0.7%) 0.0% 0.7% 1.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,324.86 (0.8) (0.8) 1.7 MSCI World Index 2,097.22 (0.1) (0.1) (0.3) Silver/Ounce 16.62 (2.9) (2.9) (1.9) DJ Industrial 24,448.69 (0.1) (0.1) (1.1) Crude Oil (Brent)/Barrel (FM Future) 74.71 0.9 0.9 11.7 S&P 500 2,670.29 0.0 0.0 (0.1) Crude Oil (WTI)/Barrel (FM Future) 68.64 0.4 0.4 13.6 NASDAQ 100 7,128.60 (0.2) (0.2) 3.3 Natural Gas (Henry Hub)/MMBtu 2.75 (1.1) (1.1) (22.3) STOXX 600 383.18 (0.3) (0.3) 0.1 LPG Propane (Arab Gulf)/Ton 83.50 0.9 0.9 (15.7) DAX 12,572.39 (0.4) (0.4) (1.1) LPG Butane (Arab Gulf)/Ton 84.25 (0.6) (0.6) (22.4) FTSE 100 7,398.87 (0.2) (0.2) (0.8) Euro 1.22 (0.6) (0.6) 1.7 CAC 40 5,438.55 (0.2) (0.2) 4.0 Yen 108.71 1.0 1.0 (3.5) Nikkei 22,088.04 (1.4) (1.4) 0.5 GBP 1.39 (0.4) (0.4) 3.2 MSCI EM 1,158.26 (0.9) (0.9) (0.0) CHF 1.02 (0.3) (0.3) (0.4) SHANGHAI SE Composite 3,068.01 (0.4) (0.4) (4.4) AUD 0.76 (0.9) (0.9) (2.6) HANG SENG 30,254.40 (0.5) (0.5) 0.7 USD Index 90.95 0.7 0.7 (1.3) BSE SENSEX 34,450.77 (0.4) (0.4) (2.9) RUB 61.84 0.7 0.7 7.3 Bovespa 85,602.50 (0.9) (0.9) 7.6 BRL 0.29 (1.1) (1.1) (4.0) RTS 1,144.66 (0.1) (0.1) (0.8) 88.6 87.4 77.8