QNBFS Daily Market Report April 22, 2019

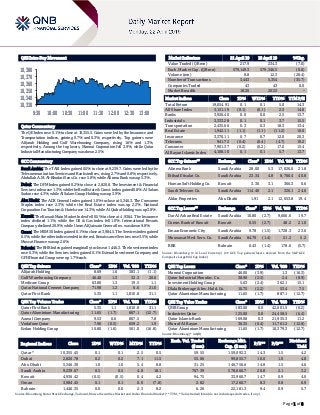

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.1% to close at 10,355.5. Gains were led by the Insurance and Transportation indices, gaining 0.7% and 0.3%, respectively. Top gainers were Alijarah Holding and Gulf Warehousing Company, rising 1.6% and 1.3%, respectively. Among the top losers, Mannai Corporation fell 3.9%, while Qatar Industrial Manufacturing Company was down 2.5%. GCC Commentary Saudi Arabia: The TASI Index gained 0.5% to close at 9,239.7. Gains were led by the Telecommunication Services and Banks indices, rising 2.7% and 0.8%, respectively. Abdullah A.M. Al-Khodari Sons Co. rose 5.8%, while Alinma Bank was up 5.3%. Dubai: The DFM Index gained 0.2% to close at 2,820.8. The Investment & Financial Services index rose 1.3%, while the Real Estate & Const. index gained 0.8%. Al Salam Sudan rose 4.3%, while Al Salam Group Holding was up 3.9%. Abu Dhabi: The ADX General Index gained 1.0% to close at 5,346.3. The Consumer Staples index rose 2.3%, while the Real Estate index was up 2.2%. National Corporation for Tourism & Hotels rose 14.3%, while Al Qudra Holding was up 3.8%. Kuwait: The Kuwait Main Market Index fell 0.5% to close at 4,936.4. The Insurance index declined 1.1%, while the Oil & Gas index fell 1.0%. International Resorts Company declined 20.9%, while Umm Al Qaiwain General Inv. was down 9.8%. Oman: The MSM 30 Index gained 0.1% to close at 3,984.5. The Services index gained 0.5%, while the other indices ended in the red. Renaissance Services rose 3.5%, while Muscat Finance was up 2.6%. Bahrain: The BHB Index gained marginally to close at 1,446.3. The Investment index rose 0.3%, while the Services index gained 0.1%. Esterad Investment Company and GFH Financial Group were up 1.7% each. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Alijarah Holding 8.69 1.6 383.1 (1.1) Gulf Warehousing Company 46.40 1.3 32.3 20.6 Medicare Group 63.80 1.3 19.5 1.1 Qatar National Cement Company 71.98 1.2 6.6 21.0 Qatar First Bank 5.35 1.1 1,810.8 31.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 5.35 1.1 1,810.8 31.1 Qatar Aluminium Manufacturing 11.65 (1.7) 887.1 (12.7) Aamal Company 9.53 0.6 807.5 7.8 Vodafone Qatar 7.96 (0.5) 659.2 1.9 Ezdan Holding Group 10.80 (1.6) 561.0 (16.8) Market Indicators 21 April 19 18 April 19 %Chg. Value Traded (QR mn) 217.9 234.3 (7.0) Exch. Market Cap. (QR mn) 579,149.3 579,346.5 (0.0) Volume (mn) 8.8 12.3 (28.4) Number of Transactions 3,443 5,354 (35.7) Companies Traded 43 43 0.0 Market Breadth 18:20 20:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,054.91 0.1 0.1 5.0 14.3 All Share Index 3,151.19 (0.1) (0.1) 2.3 14.8 Banks 3,926.40 0.0 0.0 2.5 13.7 Industrials 3,333.28 0.1 0.1 3.7 15.5 Transportation 2,435.66 0.3 0.3 18.3 13.4 Real Estate 1,942.11 (1.1) (1.1) (11.2) 16.0 Insurance 3,370.11 0.7 0.7 12.0 20.3 Telecoms 941.72 (0.4) (0.4) (4.7) 19.2 Consumer 7,901.37 (0.2) (0.2) 17.0 15.4 Al Rayan Islamic Index 4,108.10 0.1 0.1 5.7 13.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Alinma Bank Saudi Arabia 28.00 5.3 17,026.0 21.8 Etihad Etisalat Co. Saudi Arabia 23.34 4.8 8,706.4 40.8 Human Soft Holding Co. Kuwait 3.30 3.1 366.3 0.6 Saudi Telecom Co. Saudi Arabia 114.40 2.1 326.1 24.6 Aldar Properties Abu Dhabi 1.91 2.1 12,653.8 19.4 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Dar Al Arkan Real Estate Saudi Arabia 10.80 (2.7) 9,666.6 19.7 Comm. Bank of Kuwait Kuwait 0.55 (2.7) 48.2 21.0 Emaar Economic City Saudi Arabia 9.78 (1.5) 1,728.3 23.6 Mouwasat Med. Serv. Co. Saudi Arabia 84.70 (1.4) 51.2 5.2 BBK Bahrain 0.43 (1.4) 178.6 (5.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 46.00 (3.9) 1.3 (16.3) Qatar Industrial Manufac. Co. 38.90 (2.5) 2.4 (8.9) Investment Holding Group 5.63 (2.4) 362.1 15.1 Dlala Brokerage & Inv. Hold. Co. 10.75 (2.2) 53.4 7.5 Qatar Aluminium Manufacturing 11.65 (1.7) 887.1 (12.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 183.00 0.0 42,601.5 (6.2) Industries Qatar 125.00 0.0 24,458.5 (6.4) Qatar Islamic Bank 169.08 0.3 21,935.3 11.2 Masraf Al Rayan 36.35 (0.4) 11,761.2 (12.8) Qatar Aluminium Manufacturing 11.65 (1.7) 10,379.3 (12.7) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,355.45 0.1 0.1 2.5 0.5 59.55 159,092.3 14.3 1.5 4.2 Dubai 2,820.78 0.2 0.2 7.1 11.5 55.06 99,855.7 10.0 1.0 4.8 Abu Dhabi 5,346.30 1.0 1.0 5.4 8.8 31.25 146,756.6 14.8 1.5 4.6 Saudi Arabia 9,239.67 0.5 0.5 4.8 18.1 767.39 578,666.7 20.8 2.1 3.2 Kuwait 4,936.42 (0.5) (0.5) 0.4 4.2 94.75 33,960.7 14.7 0.9 4.0 Oman 3,984.45 0.1 0.1 0.0 (7.8) 2.82 17,260.7 8.3 0.8 6.9 Bahrain 1,446.35 0.0 0.0 2.3 8.2 6.26 22,181.3 9.4 0.9 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,330 10,340 10,350 10,360 10,370 10,380 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index rose 0.1% to close at 10,355.5. The Insurance and Transportation indices led the gains. The index rose on the back of buying support from GCC shareholders despite selling pressure from Qatari and non-Qatari shareholders. Alijarah Holding and Gulf Warehousing Company were the top gainers, rising 1.6% and 1.3%, respectively. Among the top losers, Mannai Corporation fell 3.9%, while Qatar Industrial Manufacturing Company was down 2.5%. Volume of shares traded on Sunday fell by 28.4% to 8.8mn from 12.3mn on Thursday. Further, as compared to the 30-day moving average of 12.8mn, volume for the day was 31.0% lower. Qatar First Bank and Qatar Aluminium Manufacturing Company were the most active stocks, contributing 20.5% and 10.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2019 % Change YoY Operating Profit (mn) 1Q2019 % Change YoY Net Profit (mn) 1Q2019 % Change YoY Jarir Marketing Co. Saudi Arabia SR 1,886.6 18.0% 253.9 15.0% 233.7 6.7% Saudi Advanced Industries Co. Saudi Arabia SR 6.0 10.2% 4.5 4.1% 4.1 -0.7% Etihad Etisalat Co. Saudi Arabia SR 3,201.0 13.0% 277.0 174.3% 67.3 N/A National Hotels Company Bahrain BHD 1.9 27.1% 0.7 104.9% 0.6 161.5% Bahrain Car Parks Company# Bahrain BHD – – – – 191.0 -23.7% Source: Company data, DFM, ADX, MSM, TASI, BHB. (# Values in ‘000) Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status IQCD Industries Qatar 22-Apr-19 0 Due WDAM Widam Food Company 22-Apr-19 0 Due DBIS Dlala Brokerage & Investment Holding Company 23-Apr-19 1 Due QIGD Qatari Investors Group 23-Apr-19 1 Due MRDS Mazaya Qatar Real Estate Development 24-Apr-19 2 Due MCGS Medicare Group 24-Apr-19 2 Due QFBQ Qatar First Bank 24-Apr-19 2 Due QIMD Qatar Industrial Manufacturing Company 24-Apr-19 2 Due UDCD United Development Company 24-Apr-19 2 Due QCFS Qatar Cinema & Film Distribution Company 25-Apr-19 3 Due QATI Qatar Insurance Company 28-Apr-19 6 Due QAMC Qatar Aluminum Manufacturing Company 28-Apr-19 6 Due QNNS Qatar Navigation (Milaha) 28-Apr-19 6 Due IGRD Investment Holding Group 28-Apr-19 6 Due QFLS Qatar Fuel Company 28-Apr-19 6 Due MERS Al Meera Consumer Goods Company 28-Apr-19 6 Due BRES Barwa Real Estate Company 29-Apr-19 7 Due AHCS Aamal Company 29-Apr-19 7 Due SIIS Salam International Investment Limited 29-Apr-19 7 Due ZHCD Zad Holding Company 29-Apr-19 7 Due QGRI Qatar General Insurance & Reinsurance Company 29-Apr-19 7 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-19 7 Due MCCS Mannai Corporation 29-Apr-19 7 Due QOIS Qatar Oman Investment Company 29-Apr-19 7 Due DOHI Doha Insurance Group 29-Apr-19 7 Due ORDS Ooredoo 29-Apr-19 7 Due KCBK Al Khalij Commercial Bank 29-Apr-19 7 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 25.79% 33.86% (17,587,691.37) Qatari Institutions 10.68% 6.23% 9,716,433.86 Qatari 36.47% 40.09% (7,871,257.51) GCC Individuals 0.62% 0.47% 323,763.47 GCC Institutions 8.17% 1.09% 15,413,806.48 GCC 8.79% 1.56% 15,737,569.95 Non-Qatari Individuals 9.71% 10.41% (1,531,344.26) Non-Qatari Institutions 45.02% 47.93% (6,334,968.18) Non-Qatari 54.73% 58.34% (7,866,312.44)

- 3. Page 3 of 8 Source: QSE Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status VFQS Vodafone Qatar 30-Apr-19 8 Due QGMD Qatari German Company for Medical Devices 30-Apr-19 8 Due DHBK Doha Bank 30-Apr-19 8 Due Source: QSE Stock Split Dates for Listed Qatari Companies Source: QSE News Qatar QSE announced stock split days for listed Qatari companies – Please refer to the table above (QSE) QGTS' bottom line rises 9.1% YoY and 1.3% QoQ in 1Q2019, in- line with our estimate; Maintain Accumulate with QR24 price target – Qatar Gas Transport Co.’s (QGTS) net profit rose 9.1% YoY (+1.3% QoQ) to QR236.0mn in 1Q2019, in line with our estimate of QR226.6mn (variation of +4.1%). Overall operating metrics also remained in-line with our modeled estimates with: (1) Wholly-owned LNG ship charter revenue of QR751.9mn (- 0.8% YoY, -1.4% QoQ) coming in 0.8% ahead of QNB FS expectations of QR745.7mn; (2) Adjusted revenue (that includes JV income & income from marine & agency services) of QR867.4mn (+1.2% YoY, -1.2% YoY) was just 0.2% short of our estimate of QR869.6mn; and (3) Adjusted EBITDA (which comprises of wholly-owned vessel EBITDA & JV income) of QR673.6mn (+1.9% YoY, -0.9% QoQ) again came in just 0.2% shy of our estimate of QR674.7mn. EPS amounted to QR0.43 in 1Q2019 as compared to QR0.39 in 1Q2018 and QR0.42 in 4Q2018. In 1Q2019, Nakilat’s profit growth was mainly attributed to the acquisitions of two Liquefied Natural Gas (LNG) carriers and one Floating Storage Regasification Unit (FSRU) in 2018, and higher volume of projects at Nakilat’s ship repair facility. According to the company, positive results across QGTS’ operations was also attributed to the rationalization of operational expenses and enhanced operational efficiency. We note the company has managed to grow its international portfolio through the recent expansion with Maran Gas Ventures Inc. to include four additional LNG carriers, demonstrating the enhanced operational efficiency and financial strength of the company. With 4 LNG vessels under the new JV, the number of Nakilat’s vessels has increased to 74, accounting for approximately 11.5% of the global LNG fleet in carrying capacity. During the recently held, Qatar Petroleum’s Localization Program for Services and Industries in the Energy Sector ‘TAWTEEN’, Nakilat signed an agreement with McDermott to form a JV providing offshore and

- 4. Page 4 of 8 onshore fabrication services in Qatar. This project will provide a range of new services that will support Nakilat and its joint ventures to undertake the construction, maintenance, repair and refurbishment of offshore and onshore structures, and all types of vessels. Overall, these are solid set of results and we do not envision any changes to our estimates for now. We rate QGTS an Accumulate with a QR24 price target. (QNB FS Research, Peninsula Qatar) GWCS posts 9.8% YoY increase but 9.9% QoQ decline in net profit in 1Q2019, in-line with our estimate; Maintain Accumulate with QR51 price target – Gulf Warehousing Co.'s (GWCS) net profit rose 9.8% YoY (but declined 9.9% on QoQ basis) to QR59.5mn in 1Q2019, in line with our estimate of QR58.7mn (variation of +1.5%). We note that 4Q2018 net income is not strictly comparable due to the restatement of 2018 results on account of IFRS 16; GWCS has only disclosed 1Q2018 restated figures thus far. The company's revenue came in at QR303.7mn in 1Q2019, which represents a decrease of 3.7% YoY (-1.3% QoQ). EPS amounted to QR1.02 in 1Q2019 as compared to QR0.93 in 1Q2018. Overall results are in-line with QNB FS estimates and we do not envision any changes to our estimates for now. We maintain our Accumulate rating and QR51 price target. (QNB FS Research, Peninsula Qatar) QIIK's bottom line rises 5.1% YoY and 81.0% QoQ in 1Q2019, in- line with our estimate – Qatar International Islamic Bank's (QIIK) net profit rose 5.1% YoY (+81.0% QoQ) to QR266.1mn in 1Q2019, in line with our estimate of QR268.5mn (variation of - 0.9%). Total income from financing & investing activities increased 12.3% YoY and 7.8% QoQ in 1Q2019 to QR536.2mn. The company's total income came in at QR558.1mn in 1Q2019, which represents an increase of 8.6% YoY (+13.0% QoQ). The bank's total assets stood at QR54.3bn at the end of March 31, 2019, up 8.0% QoQ. Financing assets were QR31.0bn, registering an increase of 10.9% QoQ. Deposits expanded by 13.4% QoQ to reach QR35.3bn at the end of March 31, 2019. Al-Shaibei noted that the bank’s capital adequacy under Basel III stand at 16.13%, which reflects QIIK’s strong financial position, ability to respond to the various challenges and the soundness of our policies in respect of the various risks involved. QIIK’s Chairman and Managing Director, Sheikh Khalid bin Thani bin Abdullah Al- Thani said, “Despite our focus on the local market, we have noticed that QIIK’s position and trustworthiness at the international markets reached record levels, as evidenced by the recent interest in the $500mn Sukuk issued by the bank and subsequently listed on the London Stock Exchange. The offering was oversubscribed seven times with a total order book of $3.4bn, attracting investors from around the world with 30% from the Middle East and the remaining 70% from Europe, Asia, Australia and other countries.” (QNB FS, QSE, Gulf-Times.com) QISI's bottom line rises 7.6% YoY and 348.9% QoQ in 1Q2019 – Qatar Islamic Insurance Company’s (QISI) net profit rose 7.6% YoY (+348.9% QoQ) to QR24.9mn in 1Q2019. The company's total revenue came in at QR34.3mn in 1Q2019, which represents an increase of 8.2% YoY (+41.7% QoQ). EPS increased to QR1.66 in 1Q2019 from QR1.54 in 1Q2018. (QSE) ERES’ AGM endorses items on its agenda – Ezdan Holding Group (ERES) held its Ordinary General Meeting (AGM) on April 21, 2019 endorsed items on its agenda. The AGM approved board of directors’ recommendation of no distribution of dividends. ERES’ AGM elected the following members for the board of directors for a further three-year period (2019 to 2022): (i) Imtilak Trading & Contracting and Property Investment Company, represented by Sheikh Khalid bin Thani bin Abdullah Al Thani as a Chairman, (ii) Tadawul Trading Group, represented by Sheikh Abdullah bin Thani Abdullah Al Thani as a Vice Chairman, and (iii) Al Sarh Business Company, represented by Sheikh Thani bin Abdullah Thani Al Thani as a Managing Director. (QSE) GISS signs a Contract With North Oil Company; Maintain Accumulate – In a press release, GISS announced that its drilling subsidiary, GDI, signed a three-year contract for its Dukhan rig with the North Oil Company (NOC). The contract was signed on March 11, 2019 and will see the Dukhan rig being deployed in NOC’s ongoing development program in the Al-Shaheen oil field. Located in Qatari waters 80 km north of Ras Laffan, the Al- Shaheen field is Qatar’s largest offshore oil field (and one of the largest offshore oil fields in the world) producing 300k b/d via a network of 33 platforms and 300+ wells. The NOC is a JV between QP (70%) and Total (30%) which is tasked with operating and further developing the Al-Shaheen oil field for 25 years. We have not changed our model, as we were expecting the Dukhan rig to be picked up for a contract in 1Q2019. This rig was previously being utilized by QP until December 20, 2018. At roughly $75,000 a day rig rate, this contract with NOC could be worth around $75mn over three years, which is roughly around 8% of our annual revenue estimate of QR1.2bn revenue for GDI in 2019 and 3% of our total revenue estimate of QR2.8bn for 2019. GISS stock is up 11% (vs. 5% for the QSE Index) since we upgraded the stock to an Accumulate on March 24, 2019. Our overall thesis on the stock remains the same – GISS’ story consists of a sum of moving parts, not entirely predictable and fairly volatile. We do not expect this to change. However, we do expect the drilling segment to pull itself out of losses suffered during 2016-2019 by 2020 in light of increasing demand due to the proposed North Field expansion and given our assumption of high utilization of existing rigs and modest cost savings. We rate GISS an Accumulate with a QR17 price target. (QNB FS Research) Barwa Bank and International Bank of Qatar complete legal merger – Barwa Bank announced the official completion of its legal merger with International Bank of Qatar. The merger, which brings two of Qatar’s leading financial players under one roof, will establish a Shari’ah compliant financial institution in both local and regional markets. The combined entity’s total assets are valued at more than QR80bn, and its shareholders and customers equity base, a robust baseline, will enable both operational scale and the modernization of its products and services development in keeping pace with customers’ and shareholders’ growing expectations. The merger announcement follows the initial agreement signing between both banks in the mid of 2018, which culminated a rigorous series of approvals by both the Qatar Central Bank and other regulatory authorities, as well as by shareholders. With its legal completion made official, the next phase of the merger will focally roll out the operational consolidation of both banks into one Shari’ah compliant institution, slated for finalization in the last quarter of this year. Meanwhile, Barwa Bank and International Bank of Qatar will operate as a unified entity. (Peninsula Qatar)

- 5. Page 5 of 8 Qatar’s March Real Estate Price Index rises 1.5% MoM and 1.0% YoY – Qatar Central Bank published data on Real Estate Price Index, which showed that Real Estate Price Index was up 1.5% MoM and 1.0% YoY in March. (Bloomberg) QSE’s CEO reveals plan to privatize stock exchange, new initiatives to encourage IPOs – Qatar Stock Exchange’s (QSE) CEO, Rashid Al Mansoori revealed a plan to implement a privatization program as an important step in driving the market in line with the management strategy to develop and expand the stock exchange as an important gateway to attracting foreign investment. Mansoori stressed that QSE needs support from stakeholders to prepare and implement the privatization program so that there will be indeed a schedule for periodic and continuous listings and a movement to activate liquidity, diversify choices and give new opportunities to investors. Onthe steps that have been taken in this regard, Mansoori said that a communication is taking place through a committee called the Financial Markets Development Committee (FMDC) with all concerned levels to encourage privatization programs and initial public offerings (IPOs). “At the same time, the QSE is also working with family companies to be listed on the stock exchange to expand the market,” he added. He also announced a plan to add a new sector in the stock exchange called the energy sector during the current year, pointing out that there are arrangements to list real estate funds after making sure that these funds meet the needs of the shareholders. Mansoori noted the importance of stock split for local and foreign investors, adding that this will support the market and will attract a large new segment of shareholders, which is a requirement for some local and international financial institutions. (Qatar Tribune) The Amir’s tour in Africa a new shift for Qatar’s strategic partnerships – Within the framework of the extensive Qatari diplomatic activity in various countries and continents, and in a clear indication of the increasing Qatari commitment to building solid relations and strategic partnerships with the African continent, the visit of HH the Amir Sheikh Tamim bin Hamad Al- Thani to the Republic of Rwanda comes at a beginning of a new African tour of HH, which also includes the Federal Republic of Nigeria. HH the Amir will hold talks with the leaders of the two countries and senior officials on bilateral relations and means of enhancing them in various fields. HH will also discuss a number of issues of common concern. The two visits will witness the signing of a number of agreements and memorandums of understanding in various fields of cooperation. HH's new visit to the African continent comes at a time when Qatar has been able to fortify its infrastructure, national facilities and economic and strategic sectors with unparalleled success, enabling it to defend the country, its interests, aspirations and goals in various regional and international forums and fields. (Qatar Tribune) Transport Minister launches Qatar Open Data Portal – Recognizing the importance of government transparency and open data, the Ministry of Transport and Communications launched the Qatar Open Data Portal on Sunday. HE the Minister of Transport and Communications Jassim Saif Ahmed Al-Sulaiti said, “The Ministry of Transport and Communications launched the Open Data Policy in 2014 to achieve the objectives of national development and Qatar National Vision 2030. The aim is to provide public services efficiently and transparently, build the knowledge-based economy, and boost innovation and creativity through an open and transparent culture where knowledge is available and accessible.” (Gulf-Times.com) International Chinese steel, iron ore rise after Beijing says to keep supporting economy – China’s steel and iron ore futures rose nearly 3% after last week recording their worst weekly performance in several months, buoyed after Beijing stated it would maintain policy support for the economy. A top decision-making body of the Communist Party stated that support would come as China’s economy still faces downward pressure and difficulties despite better-than-expected first quarter growth. The world’s second largest economy last week reported first quarter growth at 6.4% as industrial production jumped sharply and consumer demand showed signs of improvement. More economic stimulus policies are widely expected. (Reuters) In nod to debt concerns, China Belt and Road summit to urge sustainable financing – World leaders meeting in Beijing this week for a summit on China’s Belt and Road initiative will agree to project financing that respects global debt goals and promotes green growth, according to a draft communiqué seen by Reuters. The Belt and Road Initiative is a key policy of President Xi Jinping and envisions rebuilding the old Silk Road to connect China with Asia, Europe and beyond with massive infrastructure spending. However it has proved controversial in many Western capitals, particularly Washington, which views it as merely a means to spread Chinese influence abroad and saddle countries with unsustainable debt through nontransparent projects. The US has been particularly critical of Italy’s decision to sign up to the plan last month, the first for a G7 nation. (Reuters) Regional GCC debt market continues to be strong – Sovereign bond issuances dominated GCC’s debt market activity in the first quarter of 2019, with notable multi-tranche issuances by the State of Qatar and the Saudi Arabia. The PricewaterhouseCoopers (PwC) GCC Capital Market Watch for 1Q2019 noted that Qatar issued $12.0bn worth of sovereign bonds in three tranches: a $6.0bn tranche with a coupon rate of 4.8%, maturing in 30 years; a $4.0bn tranche with a coupon rate of 4.0%, maturing in 10 years and a $2.0bn tranche with a coupon rate of 3.4%, maturing in five years. QNB Finance Limited issued a single tranche of corporate bonds with a coupon rate of 3.5%, maturing in five years. The inclusion of GCC sovereign bonds to JP Morgan’s Emerging Market Bond Index (EMBI) from January 2019 is expected to further boost the demand for GCC sovereign bonds, as evidenced by the over-subscription of Qatar and the recent Saudi Arabian bond issuances. Corporate debt activity is also very active in the region with a number of issuances this quarter stemming from banking institutions, including a Tier 1 Sukuk by Dubai Islamic Bank and program drawdowns by Qatar International Islamic Bank (QIIK), Mashreqbank and First Abu Dhabi Bank (FAB). The PwC report has noted that the Initial Public Offering (IPO) activities eased in the region during 1Q2019. After a busy end to last year, 2019 started softly with just one IPO in the GCC during the first quarter. (Peninsula Qatar) ALINMA posts 21.8% YoY rise in net profit to SR709mn in 1Q2019 – Alinma Bank (ALINMA) recorded net profit of

- 6. Page 6 of 8 SR709mn in 1Q2019, an increase of 21.8% YoY. Total operating profit rose 16.2% YoY to SR1,290mn in 1Q2019. Total revenue for special commissions/investments rose 17.4% YoY to SR1,307mn in 1Q2019. Total assets stood at SR121.8bn at the end of March 31, 2019 as compared to SR113.9bn at the end of March 31, 2018. Loans and advances stood at SR85.9bn (+8.7% YoY), while customer deposits stood at SR92.3bn (+3.3% YoY) at the end of March 31, 2019. EPS came in at SR0.48 in 1Q2019 as compared to SR0.39 in 1Q2018. (Tadawul) BJAZ posts 7.3% YoY rise in net profit to SR263.3mn in 1Q2019 – Bank AlJazira (BJAZ) recorded net profit of SR263.3mn in 1Q2019, an increase of 7.3% YoY. Total operating profit rose 7.7% YoY to SR695.8mn in 1Q2019. Total revenue for special commissions/investments rose 20.5% YoY to SR749.9mn in 1Q2019. Total assets stood at SR73.9bn at the end of March 31, 2019 as compared to SR68.0bn at the end of March 31, 2018. Loans and advances stood at SR42.1bn (+7.6% YoY), while customer deposits stood at SR51.4bn (+1.7% YoY) at the end of March 31, 2019. EPS came in at SR0.32 in 1Q2019 as compared to SR0.43 in 1Q2018. (Tadawul) Saudi Aramco to buy stake in Sasref refinery for $631mn – Saudi Aramco will acquire Shell Saudi Arabia Refining’s 50% share of the Sasref joint venture in Jubail Industrial City for $631mn, Shell has stated. Saudi Aramco will take full ownership and integrate the refinery into its growing downstream portfolio, Saudi Aramco‘s Senior Vice President of Downstream, Abdulaziz Al-Judaimi said. Sasref will continue to be a “critical facility in our refining and chemicals business and we look forward to further optimizing its performance and long term viability,” he added. The acquisition is part of Saudi Aramco’s plan to expand capacity of its refineries. (Bloomberg) HSBC Asia to own majority in HSBC Saudi Arabia after SABB stake sale – HSBC Asia has agreed to increase its stake in HSBC Saudi Arabia to 51% by buying 2% from Saudi British Bank (SABB). HSBC Asia will buy 1mn shares valued at SR36mn. Following the completion of transaction, SABB will directly and indirectly own 49% of HSBC Saudi Arabia. (Bloomberg) Saudi Arabia’s ADC to acquire Schlumberger's Saudi Arabian drilling business – Khobar-based Arabian Drilling Company (ADC) will acquire the Saudi Arabian drilling business of Schlumberger, news publication Al Maaal reported, citing unnamed sources. ADC is a partnership between the Industrialization & Energy Services Company (TAQA), a Saudi Arabian Joint Stock company and Services Petroliers Schlumberger S.A., which owns the remaining 49%, according to ADC's website. (Reuters) Saudi Arabian debt management office issues new local Sukuk – Saudi Arabia’s government debt management office has issued new Riyal denominated Sukuk, the news publication Maaal reported. (Reuters) Dubai's escape from its economic funk hinges on retail and tourism – Dubai is looking to retail and tourism to break free of its weakest economic expansion in almost a decade. Growth in the city’s gross domestic product (GDP) is set to accelerate to 2.1% in 2019 and 3.8% the following year before slowing to 2.8% in 2021, according to projections released by the Emirate’s Department Of Economic Development. GDP expanded only 1.9% in 2018, substantially below forecasts made by the International Monetary Fund (IMF). A turnaround for the economy is riding on a better performance for industries other than Dubai’s bellwether real estate sector, with improvements seen this year and next for finance, tourism as well as retail and wholesale. The Emirate’s 2020 World Expo will contribute AED22.7bn to the economy during the fair next year and another AED62.2bn after it is over, according to auditing firm Ernst & Young (EY). (Bloomberg) Dubai’s February foreign visitors stood at 3.14mn – Foreign tourists who visited Dubai during January-February 2019 stood at 3.14mn as compared to 3.05mn in the same period of 2018. The total number of international guests who visited Dubai during first two months of 2019 grew by 90,000 compared to same period of 2018, according to data published by Dubai Department of Tourism and Commerce Marketing. The average occupancy rate for hotel establishments during January-February 2019 stood at 84% as compared to 87%, 88% and 85% in same period of 2018, 2017 and 2016, respectively.Revenue per available room came in at AED432 during January-February 2019 as compared to AED501, AED516 and AED522 in the same period of 2018, 2017 and 2016, respectively. The average daily room rate stood at AED513 during January-February 2019 as compared to AED574, AED589 and AED613 in the same period of 2018, 2017 and 2016, respectively. (Bloomberg) CBI's net profit falls 49.4% YoY to AED20.0mn in 1Q2019 – Commercial Bank International (CBI) recorded net profit of AED20.0mn in 1Q2019, registering decrease of 49.4% YoY. Total interest income and income from Islamic financing and investing assets rose 12.8% YoY to AED239.8mn in 1Q2019. Net operating income rose 0.5% YoY to AED207.6mn in 1Q2019. Total assets stood at AED21.3bn at the end of March 31, 2019 as compared to AED22.8bn at the end of December 31, 2018. Loans and advances to customers stood at AED12.0bn (-5.1% QoQ), while customers’ deposits stood at AED13.4bn (-8.5% QoQ) at the end of March 31, 2019. EPS from continuing operation came in at AED0.012 in 1Q2019 as compared to AED0.023 in 1Q2018. (ADX) Abu Dhabi transport department reveals $2.18bn worth of projects at Cityscape – Department of Transport in Abu Dhabi (DoT) has unveiled three infrastructure projects with total investments of $2.18bn at Cityscape Abu Dhabi 2019. The new projects will improve the quality of life in Abu Dhabi and promote the economic development, Director of Integrated Transportation Planning Division at DoT, Bader Al Qamzi said, Emirates News Agency (WAM) reported. The new projects include 1.3 kilometers tunnel in Mina Zayed, with a total cost of AED1.3bn, which is slated for completion by the first quarter of 2023. Cityscape Abu Dhabi 2019 is showcasing a portfolio of exciting new projects that will transform Abu Dhabi and make the GCC Emirate one of the most liveable cities in the world by 2021, as part of the Ghadan 2021 Plan. (Zawya) Abu Dhabi Investment Council appoints Chairman and CEO for Al Hilal Bank – Abu Dhabi Islamic lender Al Hilal Bank has stated that its owner, the Abu Dhabi Investment Council,has appointed Alaa Eraiqat as the bank’s Chairman. Alaa Eraiqat is currently group CEO of Abu Dhabi Commercial Bank (ADCB), which is expected to merge with Al Hilal Bank and Union National Bank (UNB) in the first half of 2019. He will serve as the Chairman at

- 7. Page 7 of 8 Al Hilal in addition to his current role at ADCB. The Abu Dhabi Investment Council, a sovereign wealth fund which combined with Abu Dhabi state fund Mubadala last year, also appointed Amr Saad Al Menhali as Chief Executive of Al Hilal Bank. (Reuters) Burgan Bank gets approval to issue $500mn of capital securities – Kuwait-based Burgan Bank has received the Central Bank of Kuwait’s (CBK) preliminary approval to issue as much as $500mn of capital securities, the bank has stated. CBK has also allowed the bank to start a tender to buy-back offer of its outstanding capital securities. The transactions will “assist the bank in adhering to its capital and long term regulatory requirements,” it stated. (Bloomberg) Once ‘A’-rated at S&P, Oman now risks further downgrades – S&P Global Ratings has started a 12-month countdown for Oman to steady its public finances and stop loading up on external debt, or risk an even deeper descent into junk. Rated ‘A’ by S&P as recently as four years ago, it has put Oman on notice by cutting the outlook to ‘Negative’ while affirming its debt score at ‘BB’, two levels below investment grade and on par with Paraguay and Serbia. Both Fitch Ratings and Moody’s Investors Service have Oman one notch higher than S&P. “The negative outlook reflects our expectation that we could lower our ratings on Oman over the next 12 months if we view the government as unable to moderate external debt accumulation related to still-sizable fiscal deficits, which we expect will continue to increase through 2022,” S&P analysts led by Zahabia Gupta said in a report. Oman’s economy has been struggling since the collapse of oil prices in 2014, forcing the government to join other Gulf countries in tapping international debt markets to plug budget shortfalls. But it has been slow to implement fiscal reforms despite dwindling reserves, even raising worry it could follow Bahrain in needing a bailout from wealthier neighbors. S&P, the first of the major credit assessors to give Oman a non- investment grade, said its ratings reflect a view that ‘timely support’ for the monarchy will be forthcoming, if needed, from countries in the GCC. Moody’s, which downgraded Oman’s credit rating to junk in March, stated that it probably will not require a rescue in the next 12 to 18 months because the government does not have any significant debt coming due in that period and its buffers are sufficient for now. Still, the yield on Oman’s bond due in 2028 remains higher than Bahrain’s similar-maturity debt, which rallied last year after the nation won a $10bn bailout package and inclusion in JPMorgan Chase & Co.’s emerging- market bond indexes. S&P rates Bahrain two levels lower than Oman at ‘B+’. (Bloomberg) Bahrain’s March consumer prices rise 1.2% YoY; rise 0.8% MoM – Information & eGovernment Authority in Manama published Bahrain’s March consumer price indices which showed that the consumer prices rose 1.2% YoY. The consumer prices rose 0.8% MoM in March as compared to a rise of 0.2% in the previous month. Food and non-alcoholic beverages price index rose 0.1% MoM in March as compared to a rise of 1.6% in the previous month. Housing & utilities price index rose 3.7% MoM in March as compared to a fall of 0.1% in the previous month. (Bloomberg) Bahrain's GIB establishes Saudi Arabian arm with $2bn capital – Bahrain-based Gulf International Bank (GIB) has converted its Saudi Arabian operation into a locally incorporated bank with $2bn capital, as the lender looks to boost its presence in the Kingdom. The bank’s Saudi Arabian arm will be owned equally by GIB and Saudi Arabia’s Public Investment Fund (PIF), according to a statement. Abdulla bin Mohammed Al Zamil is the Chairman of GIB Saudi Arabia, while GIB CEO, Abdulaziz bin Abdulrahman Al-Helaissi will be the Executive Director and CEO of the Saudi Arabian business. GIB launched Meem, an online Islamic bank in Saudi Arabia in 2015 as it moved into retail banking. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 QSE Index S&P Pan Arab S&P GCC 0.5% 0.1% (0.5%) 0.0% 0.1% 1.0% 0.2% (1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,275.39 (0.0) (1.2) (0.6) MSCI World Index 2,160.36 0.0 0.0 14.7 Silver/Ounce 14.98 (0.2) 0.1 (3.3) DJ Industrial 26,559.54 0.0 0.6 13.9 Crude Oil (Brent)/Barrel (FM Future) 71.97 0.0 0.6 33.8 S&P 500 2,905.03 0.0 (0.1) 15.9 Crude Oil (WTI)/Barrel (FM Future) 64.00 0.0 0.2 40.9 NASDAQ 100 7,998.06 0.0 0.2 20.5 Natural Gas (Henry Hub)/MMBtu 2.54 0.0 (7.6) (20.3) STOXX 600 390.46 0.0 0.1 13.4 LPG Propane (Arab Gulf)/Ton 62.00 0.0 (6.1) (2.4) DAX 12,222.39 0.0 1.2 13.6 LPG Butane (Arab Gulf)/Ton 65.38 0.0 (2.2) (6.6) FTSE 100 7,459.88 0.0 (0.5) 12.9 Euro 1.12 0.1 (0.5) (1.9) CAC 40 5,580.38 0.0 0.8 15.7 Yen 111.92 (0.0) (0.1) 2.0 Nikkei 22,200.56 0.6 1.6 9.4 GBP 1.30 0.0 (0.6) 1.9 MSCI EM 1,092.52 0.0 0.3 13.1 CHF 0.99 0.1 (1.2) (3.2) SHANGHAI SE Composite 3,270.80 0.7 2.6 34.6 AUD 0.72 0.0 (0.3) 1.5 HANG SENG 29,963.26 0.0 0.1 15.7 USD Index 97.38 (0.1) 0.4 1.3 BSE SENSEX 39,140.28 0.0 0.7 8.9 RUB 64.06 0.2 (0.5) (8.1) Bovespa 94,578.26 0.0 0.7 5.8 BRL 0.25 (0.2) (1.4) (1.4) RTS 1,260.82 (0.1) 0.6 18.0 104.0 96.9 83.2