Daily Market Report March 21

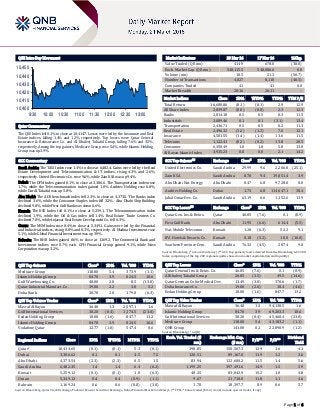

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index fell 0.1% to close at 10,414.7. Losses were led by the Insurance and Real Estate indices, falling 1.4% and 1.2%, respectively. Top losers were Qatar General Insurance & Reinsurance Co. and Al Khaleej Takaful Group, falling 7.6% and 3.5%, respectively. Among the top gainers, Medicare Group rose 5.4%, while Islamic Holding Group was up 3.9%. GCC Commentary Saudi Arabia: The TASI Index rose 1.4% to close at 6,482.4. Gains were led by the Real Estate Development and Telecommunication & IT indices, rising 4.3% and 2.6%, respectively. United Electronics Co. rose 9.6%, while Zain KSA was up 9.4%. Dubai: The DFM Index gained 0.1% to close at 3,386.6. The Transportation index rose 1.7%, while the Telecommunication index gained 1.0%. Arabtec Holding rose 6.8%, while Dar Al Takaful was up 5.8%. Abu Dhabi: The ADX benchmark index fell 2.3% to close at 4,373.5. The Banks index declined 3.6%, while the Consumer Staples index fell 3.2%. Abu Dhabi Ship Building declined 9.8%, while First Gulf Bank was down 6.6%. Kuwait: The KSE Index fell 0.1% to close at 5,259.1. The Telecommunication index declined 1.9%, while the Oil & Gas index fell 1.4%. Real Estate Trade Centers Co. declined 7.0%, while Injazzat Real Estate Development Co. fell 6.3%. Oman: The MSM Index rose 0.4% to close at 5,349.1. Gains were led by the Financial and Industrial indices, rising 0.8% and 0.3%, respectively. Al Madina Investment rose 5.1%, while Global Financial Investment was up 3.9%. Bahrain: The BHB Index gained 0.6% to close at 1,169.2. The Commercial Bank and Investment indices rose 0.7% each. GFH Financial Group gained 9.1%, while Nass Corporation was up 3.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 118.00 5.4 373.9 (1.1) Islamic Holding Group 84.70 3.9 824.5 10.6 Gulf Warehousing Co. 48.00 2.8 8.5 (13.0) Qatar Industrial Manufact. Co. 39.00 2.2 3.0 5.2 Doha Bank 38.70 2.0 179.0 (6.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 36.40 1.3 2,597.1 1.6 Gulf International Services 38.20 (0.4) 1,174.5 (23.8) Ezdan Holding Group 18.00 (1.6) 847.7 13.2 Islamic Holding Group 84.70 3.9 824.5 10.6 Vodafone Qatar 12.77 (1.0) 547.4 0.6 Market Indicators 20 Mar 16 17 Mar 16 %Chg. Value Traded (QR mn) 414.9 678.0 (38.8) Exch. Market Cap. (QR mn) 548,115.5 548,086.6 0.0 Volume (mn) 10.5 21.3 (50.7) Number of Transactions 4,827 8,110 (40.5) Companies Traded 41 41 0.0 Market Breadth 20:16 26:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,680.86 (0.1) (0.1) 2.9 12.9 All Share Index 2,839.87 (0.0) (0.0) 2.3 12.3 Banks 2,814.18 0.5 0.5 0.3 11.5 Industrials 3,089.46 0.1 0.1 (3.1) 13.4 Transportation 2,436.71 0.5 0.5 0.2 11.3 Real Estate 2,496.32 (1.2) (1.2) 7.0 12.1 Insurance 4,581.55 (1.4) (1.4) 13.6 11.5 Telecoms 1,122.41 (0.2) (0.2) 13.8 20.5 Consumer 6,350.49 1.0 1.0 5.8 13.0 Al Rayan Islamic Index 3,935.23 0.0 0.0 2.1 14.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% United Electronics Co. Saudi Arabia 29.99 9.6 2,206.8 (25.1) Zain KSA Saudi Arabia 8.70 9.4 19,051.4 3.9 Abu Dhabi Nat. Energy Abu Dhabi 0.47 6.8 9,728.0 0.0 Arabtec Holding Co. Dubai 1.73 6.8 114,647.1 38.4 Jabal Omar Dev. Co. Saudi Arabia 63.19 6.6 1,152.6 13.9 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Qatar Gen. Ins. & Reins. Qatar 46.05 (7.6) 0.1 (0.9) First Gulf Bank Abu Dhabi 11.95 (6.6) 614.4 (5.5) Nat. Mobile Telecomm. Kuwait 1.20 (6.3) 52.2 9.1 IFA Hotels & Resorts Co. Kuwait 0.18 (5.2) 10.0 (10.8) Southern Province Cem. Saudi Arabia 76.32 (4.5) 287.4 9.0 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 46.05 (7.6) 0.1 (0.9) Al Khaleej Takaful Group 26.05 (3.5) 49.5 (14.6) Qatar German Co for Medical Dev. 13.49 (3.0) 370.6 (1.7) Doha Insurance Co. 19.00 (2.6) 18.4 (4.6) Ezdan Holding Group 18.00 (1.6) 847.7 13.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 36.40 1.3 94,138.5 1.6 Islamic Holding Group 84.70 3.9 69,203.3 10.6 Gulf International Services 38.20 (0.4) 45,460.4 (23.8) Medicare Group 118.00 5.4 43,183.2 (1.1) QNB Group 141.00 0.1 22,890.9 (1.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,414.65 (0.1) (0.1) 5.3 (0.1) 198.05 150,567.3 12.9 1.6 4.1 Dubai 3,386.62 0.1 0.1 4.5 7.5 120.51 89,167.0 11.9 1.2 3.6 Abu Dhabi 4,373.54 (2.3) (2.3) 0.5 1.5 83.94 122,600.2 11.5 1.4 5.6 Saudi Arabia 6,482.35 1.4 1.4 6.4 (6.2) 1,199.25 397,491.6 14.9 1.5 3.9 Kuwait 5,259.12 (0.1) (0.1) 1.0 (6.3) 48.25 83,042.9 15.2 1.0 4.8 Oman 5,349.12 0.4 0.4 (0.9) (1.1) 9.67 21,718.0 11.8 1.1 4.6 Bahrain 1,169.24 0.6 0.6 (0.8) (3.8) 1.70 18,397.7 8.9 0.6 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,400 10,410 10,420 10,430 10,440 10,450 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index fell 0.1% to close at 10,414.7. The Insurance and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Qatar General Insurance & Reinsurance Co. and Al Khaleej Takaful Group were the top losers, falling 7.6% and 3.5%, respectively. Among the top gainers, Medicare Group rose 5.4%, while Islamic Holding Group was up 3.9%. Volume of shares traded on Sunday fell by 50.7% to 10.5mn from 21.3mn on Thursday. Further, as compared to the 30-day moving average of 11.6mn, volume for the day was 9.8% lower. Masraf Al Rayan and Gulf International Services were the most active stocks, contributing 24.7% and 11.2% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Calendar Earnings Calendar Tickers Company Name Date of reporting 4Q2015 results No. of days remaining Status QGMD Qatar German Company for Medical Devices 30-Mar-16 9 Due ZHCD Zad Holding Company 30-Mar-16 9 Due Source: QSE News Qatar GISS: Drilling unit to maintain operating activities – Gulf International Services Company (GISS) has announced that a new set of effective measures are being taken by its subsidiary Gulf Drilling International (GDI) to maintain and boost its asset utilization rates with the plunge in oil prices and falling global demand for drilling services. In response to the reduced operating rates, GDI developed a mechanism, wherein the operating rates are indexed to crude oil prices enabling positive variation in the rates when crude oil prices increase. In addition to implementing several cost optimization initiatives to minimize the impact of the market downturn, GDI is exploring potential new business opportunities throughout the GCC region. Driven by low crude oil prices and reduced demand for drilling rigs worldwide, five offshore drilling rigs, one onshore rig, and one accommodation jack-up have been released from their existing contract with various clients. Meanwhile, GISS has announced a fire incident on one of its subsidiary GDI Rigs. The incident took place while the rig was being prepared for a move to another work location. The fire was extinguished by GDI’s firefighting team and QP Emergency Services. Injured personnel consisting of six GDI employees were immediately transported to nearby hospitals and most of them discharged after having received treatment. All other personnel on location were evacuated safely to a secure location. The rig named GDI-3 was moved to another location where it was repaired and put into service again. (QSE, Peninsula Qatar, Company Press Release) KCBK denies merger talks with ABQK and IBQ – Al Khalij Commercial Bank (KCBK) denied speculations of merger with Ahli Bank (ABQK) and International Bank of Qatar (IBQ). (QSE) Al-Subaie: Doha Metro trial and testing expected to start by 2017- end – Qatar Rail Managing Director Abdulla Abdulaziz Al-Subaie has said that the trial and testing operations of the Doha Metro are expected to start towards the end of 2017. He said, “The coaches, each nearly 20m long, are expected to arrive towards the end of this year.” It has been announced earlier that the first phase of the ambitious project, consisting of over 108 kilometers (km) of tracks and 40 stations, would be operational towards 2019-end. Al- Subaie was speaking at a ceremony to announce the completion of the tunneling of the northern section of the 42km long Red Line, at Doha Golf Club, in the presence of Qatar Rail CEO Saad Al- Mohannadi. Briefing journalists about the ongoing works, the officials said that electrical, mechanical and signaling works of the tunnels were expected to start towards the end of 2016. This would be followed by more developmental works, including the test runs towards the last quarter of 2017. While expressing confidence that tunneling of over 85km of the first phase of the Doha Metro would be over latest by 2016-end, the Qatar Rail officials said that over 95% of the tunneling of the 22km Green Line between Mansoura and Al Riffa (via Mushereib and Mall of Qatar in Rayyan) was now complete. Meanwhile, over 34,000 workers have been deployed across Doha and its immediate suburbs as part of the ongoing first phase of the Doha Metro project. As many as 44 nationalities are working on the project. Works are progressing to build 37 stations for the Red, Green and Gold lines. From the beginning of this month, approximately 112,580,321 man hours were spent on the project. As part of the project, 963 tons of waste has been recycled. Over 63,000 tons of steel has been used so far and 1.6mn cubic meters of excavation carried out. It was also informed that 2.3mn km of truck runs were completed until the beginning of March 2016. (Gulf-Times.com) Court judgment issued in favor of BRES subsidiary – Barwa Real Estate Company (BRES) has announced the judgment of the Dubai Court of Cassation regarding the commercial appeal case number 54/2014, filed by Dream Land Urban Construction and Investment Limited, against Barwa International Company and Green City Real Estate development company limited (a company incorporated in Republic of Sudan, and fully owned by Barwa Real Estate Group). The Court of appeal upheld a judgment issued by the Dubai Court of First Instance to overturn the Arbitration Center ruling number 20 of 2009 which ordered Barwa International and Green City Company Limited to pay jointly an amount of $ 31,003,668 in favor of Dream Land Company. Dream Land Company has filed an objection on the appeal judgment number 933/2012 commercial. Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 47.44% 45.16% 9,459,723.55 Qatari Institutions 17.43% 31.98% (60,376,157.81) Qatari 64.87% 77.14% (50,916,434.26) GCC Individuals 1.36% 1.12% 994,410.87 GCC Institutions 2.75% 3.81% (4,423,778.54) GCC 4.11% 4.93% (3,429,367.67) Non-Qatari Individuals 16.13% 15.77% 1,493,783.64 Non-Qatari Institutions 14.90% 2.16% 52,852,018.29 Non-Qatari 31.03% 17.93% 54,345,801.93

- 3. Page 3 of 6 This objection was registered under number 54/2014 commercial. The Court of Cassation has ruled to reject this objection. (QSE) KCBK extends contract financing to joint venture for Al Wakrah Stadium project – Al Khalij Commercial Bank (KCBK) successfully closed a facility to finance a joint venture among Midmac Contracting, Porr Qatar Construction, and Six Construct Qatar for the Al Wakrah stadium, precinct main works, and the master plan project. The bank confirmed that this was in line with its continuous support to Qatar’s mega projects development. In addition to KCBK’s financing package, the bank will also play the role of “Project account bank” for the transaction. KCBK Group CEO Fahad al-Khalifa said: “Our financing of a project of such national importance, which will essentially place Qatar at the global heart of sport, is a testament to our commitment and support to major plans that aim to bring the economic and social development of Qatar to the next level.” “Whether large-scale projects that impact the nation as a whole, or smaller developments that move the country towards a knowledge-based economy in accordance with QNV2030, KCBK is ready, willing, and has the capacity to provide the necessary financial support. We will continue to broaden our future projects focusing on infrastructure and logistic financing, leading up to the 2022 World Cup.” (Gulf-Times.com) Doha Bank is optimistic on Qatar macro fundamentals – Doha Bank (DHBK) Group Chief Executive R Seetharaman said that the bank, which is slated to see a modest 5% credit expansion in 2016, below the industry average of 8%, is optimistic on Qatar’s macro fundamentals, as oil prices may touch $50 a barrel in six months and then stabilize at $60 within a year. The bank’s credit expansion will rather be driven by wholesale lending than the retail, which is set to see rationalization due to low influx of bankable population. He said, “If the economy is going to grow between 3-4%, our growth could be maximum 6-7%, but I am moderating it further to 5% as more credit rationing will take place in the current phase.” He said the wholesale side will drive the credit growth, indicating the possibility of more lending to contract, trading and real estate segments, in line with the expected fast growth in Qatar’s non-hydrocarbons sector. Asserting that the country’s banking industry is expected to see credit growth of 5-8%, Seetharaman however added that DHBK is focused on asset optimization rather than maximization of balance sheet. (Gulf-Times.com) ABQK launches Qatar’s first contactless credit card – Ahli bank (ABQK) and MasterCard launched the “first contactless” credit card in Qatar. As the first-of-its-kind contactless-enabled payment product in Qatar, ABQK’s contactless Titanium MasterCard credit card can be used for low value purchases of QR100 or less with just a tap, eliminating the need to sign or enter a PIN code. As the latest enhancement to the range of benefits that come with the Ahlibank Titanium MasterCard credit card, the new feature will provide customers with a faster and secure way to pay at point of sale (POS) terminals at retailers displaying the contactless logo. (Gulf-Times.com) ERES extends support to Civil Defense campaigns – Ezdan Holding Group (ERES) donated QR1mn to the General Directorate of the Civil Defense (GDCD) to support its awareness campaigns among all the segments of society. ERES Chairman Sheikh Dr Khalid bin Thani bin Abdulla al-Thani presented the check to GDCD Director General Staff Brigadier General Abdulla Mohamed al-Suwaidi. GDCD Assistant Director General Brigadier Aman Saad al-Sulaiti and Prevention Department Director Major Hussein Aman al-Ali were present at the ceremony held at the ERES headquarters at Dafna area. (Gulf-Times.com) International Euro lenders, Greece make progress on tax, pension reforms – According to a European Commission spokesperson, the European lenders have made important progress in talks with Greece on tax and pension reforms that are part of a package of measures Athens must adopt to win new loans and debt relief. Inspectors from the European Commission, the European Central Bank, and the International Monetary Fund (IMF) assessing Greece’s progress on reforms left Athens on Sunday. Greek Prime Minister Alexis Tsipras wants to wrap up the reform review quickly to clear the way for talks on debt relief, help restore confidence in the country’s economy, and persuade the Greek people that their sacrifices over six years of austerity are paying off. However, the talks have dragged on for months due to disagreements over fiscal targets, pension cuts, and tax reforms between Athens and its European Union, and IMF lenders and among the EU and the IMF institutions themselves. The focus is on ways to cover an estimated fiscal gap of 3% of GDP by 2018. (Reuters) CBI : Brexit could cost Britain £100bn and a million jobs – According to research commissioned by employers’ group the Confederation of British Industry (CBI), a British vote to leave the European Union (EU) could cost the economy £100bn and 950,000 jobs by 2020. The CBI said, ‘Brexit’ would deliver a serious shock to the British economy, regardless of any trade deals the country could negotiate with its former European partners. The CBI, which has said it will promote the economic case for Britain to remain in the EU, has been criticized by anti-EU campaigners, who say the business community is split on the issue. (Reuters) China’s central bank chief sounds warning over rising debt – People’s Bank of China Governor Zhou Xiaochuan sounded a warning over rising debt levels, saying corporate lending as a ratio to gross domestic product (GDP) has gone too high and the country must develop more robust capital markets. He said China still has a problem with illegal fundraising and financial services are insufficient. Zhou said the country still needs regulation to guard against excessive leverage in foreign currencies. (Bloomberg) Chinese officials: Economy improving, capital outflows cooling – According to top Chinese officials, China’s economy is showing signs of improvement, while capital outflows from the country are moderating, seeking to shore up investor confidence after recent market volatility. Chinese leaders have repeatedly tried to reassure jittery financial markets and China’s major trading partners that Beijing is able to manage the slowing economy, following a slide in the country’s stock market and depreciation of the yuan. (Reuters) Regional Markaz Head of Research: GCC countries required to mobilize $151.3bn in 2016 to meet financial obligations – Markaz Head of Research M.R. Raghu said that GCC countries are required to mobilize an estimated $151.3bn in 2016 to meet their financial obligations. Around 52% of the GCC funding requirements for 2016 ($78.1bn) is expected to come from reserves, while $57.7bn is expected from domestic and international bond issuances (38%) and the rest through loans (10%). He said overall GCC governments are expected to raise between $285-390bn cumulatively through 2020 via local and international bonds. (GulfBase.com) Saudi CMA approves public offering of Elite Flexi Saudi Equities Fund – The Saudi Capital Market Authority’s (CMA) board of commissioners has approved the public offer of Elite Flexi Saudi Equities Fund by Saudi Economic and Development Securities Company. (Tadawul) Maaal: KSA to issue bonds worth SR20bn – Maaal has reported that the Saudi Arabian government has told local banks that it will sell

- 4. Page 4 of 6 them SR20bn of three, five and seven-year bonds, with floating as well as fixed rates. The government has been selling SR20bn of bonds every month since August 2015 to cover a budget deficit created by low oil prices. Among the new fixed-rate bonds, the three-year tranche will be priced at 55-60 basis points (bps) over US Treasuries, the five-year tranche at 61-66 bps over and the seven-year tranche at 72-77 bps over. The floating rate bonds would be priced at the three-month Saudi interbank offered rate minus 25-30 bps for the three-year tranche, minus 10-15 bps for the five-year tranche, and flat to 5 bps over for the seven-year tranche. (GulfBase.com) NMC expects acquisitions to drive 2016 earnings jump – NMC Health expects earnings to increase by 45% in 2016 on the back of recent and future acquisitions as well as organic growth. NMC Deputy CEO Prasanth Manghat said that the company could also tap loan and convertible bond markets to supplement around $300mn it has for acquisitions. (Reuters) Arabtec Construction wins AED1.7bn contract – Arabtec Construction, a subsidiary of Arabtec Holding, has been awarded an AED1.7bn project to build 1,100 villas for UAE nationals in Mohamed Bin Zayed City, Fujairah. This project comprises a total built up area of 430,000 square meters on a plot area of 215 hectares. The construction work will commence shortly. (DFM) Dubai Refreshment AGM approves 70% cash dividend – Dubai Refreshment’s annual general assembly meeting (AGM) has approved the board of directors’ (BoD) proposal to distribute 70% cash dividend from the capital, amounting to AED63mn. (DFM) RAK Properties shareholders approve 5% cash dividend – RAK Properties’ annual general meeting (AGM) has approved the board of directors’ (BoD) proposal to distribute 5% cash dividend from the capital. (ADX) Gulf Medical Projects AGM approves 7.5% cash dividend – Gulf Medical Projects Company’s annual general assembly meeting (AGM) has approved the board of directors’ (BoD) proposal to distribute 7.5% cash from the company’s capital for the year ending December 31, 2015. (ADX) OMV, ADNOC, Occidental to explore offshore oil & gas fields in Abu Dhabi – OMV has signed a four-year program with the Abu Dhabi National Oil Company (ADNOC) and Occidental Petroleum to evaluate offshore oil & gas fields northwest of Abu Dhabi. The fields the companies will analyze through seismic, drilling and engineering studies include the Ghasha and Hail areas with a view to appraising and developing them. OMV is already working with ADNOC on the appraisal of the Shuwaihat field. OMV is increasingly looking toward Russia and the UAE for future output. (Reuters) Waha Capital plans to invest $100mn in core business – Waha Capital is planning to invest at least $100mn in its core business, eyeing acquisition deals potentially in 2016 to capitalize on attractive market valuations. Waha Capital CEO Salem Al Noaimi said that the company is in talks with various potential partners about acquisitions, but there were no concrete deals yet. The company will carry out future acquisitions in sectors such as energy, infrastructure, financial services, health care and education. (GulfBase.com) ADIB fully committed to becoming largest retail bank by 2020 – Abu Dhabi Islamic Bank (ADIB) Head of Retail Banking Philip King said that the bank is fully committed to its strategy of becoming the largest retail bank in assets by 2020, and investing in both physical and digital infrastructure to enhance new customer acquisition. (GulfBase.com) SCAD: Abu Dhabi inflation rate rises – The Statistics Centre in Abu Dhabi (SCAD) has released the latest issue of its monthly report on the consumer price index (CPI) and the inflation rate in Abu Dhabi for February 2016, replacing with 2014 as the base year. This CPI is used in measuring inflation and represents an important input in economic and monetary planning. As the report, the inflation rate in consumer prices for the first two months of 2016 was 3.3% as compared with the same period of 2015, as shown by the increase in the CPI to 105.6 points during January-February 2016, up from 102.2 points for the same period of 2015. Housing, water, electricity, gas and other fuels’ group accounted for the largest rise in the index during the first two months of 2016 as compared with the same period of 2015, contributing 79.5 percentage points as a result of an increase of 8.2% in the prices of this group. The food & beverages group contributed 5 percentage points to the overall increase in the CPI during January-February 2016 as compared with the same period of 2015. (GulfBase.com) Burgan Bank reports 31% YoY increase in 4Q2015 net profit – Kuwait’s Burgan Bank has reported a net profit of KD17.1mn in 4Q2015 as compared to KD13.1mn in 4Q2014, representing an increase of 31% YoY. Earlier, on December 31, 2015, the bank announced that it is selling a controlling stake in Jordan Kuwait Bank to another subsidiary of parent firm KIPCO, in a transaction it later disclosed was worth KD191.1mn. The impact of the sale was due to be included in its 4Q2015 numbers. The bank’s 2015 profit was KD76.1mn, up from KD61.8mn in 2014. The lender has proposed paying a 2015 dividend of KD0.018 per share. This compares with KD0.015 cash dividend and 5% stock dividend for 2014. (Reuters) Zain: No fresh developments in tower sale plan – Zain Group has said that there are no fresh developments in its plans to sell mobile transmitter towers in Saudi Arabia and its domestic market Kuwait. The company is always looking for opportunities to add value and seek investment opportunities to support or benefit shareholders. (Reuters) Al Hassan Engineering MD steps down – Al Hassan Engineering has informed that Maqbool bin Ali Salman has resigned from the post of Managing Director, with effect from March 20, 2016. The board of directors (BoD) has accepted his resignation. However, he will continue his position as a non-executive member & vice chairman of the board. This decision has been taken in compliance with the new code of corporate governance issued by the Capital Market Authority. (MSM) Leasing firms raise capital to OMR25mn ahead of regulatory deadline – A majority of leasing and hire purchase companies in Oman have reached the minimum capital requirement stipulated by the Central Bank of Oman (CBO) at OMR25mn, well ahead of its deadline by the year-end. A few other companies have structured their bond conversion plans in such a way so as to touch the paid- up capital at OMR25mn before 2016-end. (GulfBase.com) NAP AGM approves cash dividend – National Aluminium Products’ (NAP) annual general meeting (AGM) has approved a total cash dividend of 13 baizas per share (representing 13% of the value of each share). (MSM) Oman not yet invited to Doha oil producers meeting – Oman’s Oil Minister Mohammad bin Hamad al-Rumhy said that Oman has not yet been invited to the April 17 meeting in Qatar, where oil producers plan to discuss a global pact to freeze production to support prices. OPEC and non-OPEC producers will meet in Doha in April 2016, following an initial deal in February 2016 between Saudi Arabia, Qatar, Venezuela and non-OPEC member Russia. It remains unclear whether all 13 OPEC members will attend the Doha meeting, and which non-OPEC producers will do so. Oman is a small non-OPEC producer. (Reuters) Investcorp acquires five residential properties – Investcorp has announced that its US-based real estate arm, through two separate transactions, has acquired five residential properties in the

- 5. Page 5 of 6 metropolitan areas of Boca Raton, Florida and Minneapolis, Minnesota for around $220mn. The acquisitions are consistent with lnvestcorp's strategy to invest in desirable, high quality properties located in high demand markets providing attractive cash yields. (Bahrain Bourse) BKIC general assembly approves 30% cash dividend – Bahrain Kuwait Insurance Company’s (BKIC) general assembly has approved 30% cash dividend from the paid-up capital. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Feb-12 Feb-13 Feb-14 Feb-15 Feb-16 QSE Index S&P Pan Arab S&P GCC 1.4% (0.1%) (0.1%) 0.6% 0.4% (2.3%) 0.1% (3.0%) (1.5%) 0.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,255.32 (0.2) 0.4 18.3 MSCI World Index 1,645.57 0.2 1.2 (1.0) Silver/Ounce 15.80 (0.7) 2.9 14.0 DJ Industrial 17,602.30 0.7 2.3 1.0 Crude Oil (Brent)/Barrel (FM Future) 41.20 (0.8) 2.0 10.5 S&P 500 2,049.58 0.4 1.4 0.3 Crude Oil (WTI)/Barrel (FM Future) 39.44 (1.9) 2.4 6.5 NASDAQ 100 4,795.65 0.4 1.0 (4.2) Natural Gas (Henry Hub)/MMBtu 1.84 1.1 6.7 (20.5) STOXX 600 341.71 (0.1) 0.9 (3.1) LPG Propane (Arab Gulf)/Ton 46.00 (2.4) (2.6) 17.6 DAX 9,950.80 0.2 2.3 (4.3) LPG Butane (Arab Gulf)/Ton 52.75 (1.4) 1.0 (8.3) FTSE 100 6,189.64 (0.1) 1.4 (2.5) Euro 1.13 (0.4) 1.0 3.8 CAC 40 4,462.51 0.1 0.4 (0.1) Yen 111.55 0.1 (2.0) (7.2) Nikkei 16,724.81 (1.4) 0.6 (5.0) GBP 1.45 (0.0) 0.7 (1.8) MSCI EM 826.75 1.2 3.2 4.1 CHF 1.03 (0.2) 1.4 3.4 SHANGHAI SE Composite 2,955.15 1.8 5.3 (16.3) AUD 0.76 (0.5) 0.6 4.4 HANG SENG 20,671.63 0.8 2.4 (5.7) USD Index 95.09 0.3 (1.1) (3.6) BSE SENSEX 24,952.74 1.2 1.8 (4.7) RUB 68.24 0.2 (2.1) (5.9) Bovespa 50,814.66 1.2 2.8 28.8 BRL 0.28 0.0 (1.2) 9.2 RTS 885.13 1.3 4.7 16.9 121.5 98.5 96.9