20121119 efar gcc bonds_vsfinal

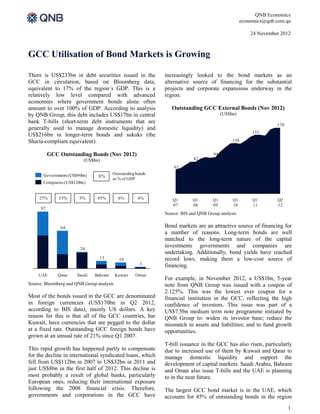

- 1. QNB Economics economics@qnb.com.qa 24 November 2012 GCC Utilisation of Bond Markets is Growing There is US$233bn in debt securities issued in the increasingly looked to the bond markets as an GCC in circulation, based on Bloomberg data, alternative source of financing for the substantial equivalent to 17% of the region’s GDP. This is a projects and corporate expansions underway in the relatively low level compared with advanced region. economies where government bonds alone often amount to over 100% of GDP. According to analysis Outstanding GCC External Bonds (Nov 2012) by QNB Group, this debt includes US$17bn in central (US$bn) bank T-bills (short-term debt instruments that are 170 generally used to manage domestic liquidity) and 152 US$216bn in longer-term bonds and sukuks (the Sharia-compliant equivalent). 130 GCC Outstanding Bonds (Nov 2012) 94 (US$bn) 82 62 Governments (US$96bn) Outstanding bonds X% as % of GDP Companies (US$120bn) 27% 33% 5% 45% 6% 4% Q1 Q1 Q1 Q1 Q1 Q2 07 08 09 10 11 12 97 Source: BIS and QNB Group analysis 64 Bond markets are an attractive source of financing for a number of reasons. Long-term bonds are well matched to the long-term nature of the capital 28 investments governments and companies are undertaking. Additionally, bond yields have reached 13 10 record lows, making them a low-cost source of 3 financing. UAE Qatar Saudi Bahrain Kuwait Oman For example, in November 2012, a US$1bn, 5-year Source: Bloomberg and QNB Group analysis note from QNB Group was issued with a coupon of 2.125%. This was the lowest ever coupon for a Most of the bonds issued in the GCC are denominated financial institution in the GCC, reflecting the high in foreign currencies (US$170bn in Q2 2012, confidence of investors. This issue was part of a according to BIS data), mainly US dollars. A key US$7.5bn medium term note programme initiated by reason for this is that all of the GCC countries, bar QNB Group to: widen its investor base; reduce the Kuwait, have currencies that are pegged to the dollar mismatch in assets and liabilities; and to fund growth at a fixed rate. Outstanding GCC foreign bonds have opportunities. grown at an annual rate of 21% since Q1 2007. T-bill issuance in the GCC has also risen, particularly This rapid growth has happened partly to compensate due to increased use of them by Kuwait and Qatar to for the decline in international syndicated loans, which manage domestic liquidity and support the fell from US$112bn in 2007 to US$32bn in 2011 and development of capital markets. Saudi Arabia, Bahrain just US$8bn in the first half of 2012. This decline is and Oman also issue T-bills and the UAE is planning most probably a result of global banks, particularly to in the near future. European ones, reducing their international exposure following the 2008 financial crisis. Therefore, The largest GCC bond market is in the UAE, which governments and corporations in the GCC have accounts for 45% of outstanding bonds in the region 1

- 2. QNB Economics economics@qnb.com.qa and 27% of GDP. This is because the UAE has a Saudi Arabia over the next five years, the Kingdom’s longer history of debt financing for major projects than debt market is likely to grow rapidly. other countries in the region. Dolphin Energy, a UAE-Qatar gas pipeline company, Issuance of new bonds in the GCC reached US$38bn issued a US$1.3bn bond in February 2012 to refinance for 2012 as at 20th November, slightly below the existing debt. US$45bn issued in 2011. This was due to lower government issuance. In 2011, Qatar had issued almost Abu Dhabi Islamic Bank issued a US$1bn sukuk in US$19bn in sovereign bonds and sukuks in 2011, November 2012 to shore up its core capital ahead of compared to only US$4bn in 2012, to help build a the implementation of Basel III standards. The sukuk yield curve to support local capital markets. was the GCC’s first perpetual bond with no stated maturity. GCC Bond Issuance (2011 to Nov 2012) (US$bn) QNB Group expects that regional companies will continue to drive bond issuance higher in 2013 for a 21.0 2011 (US$45bn) number of reasons. Firstly, tapping debt markets has 19.0 Nov 2012 (US$38bn) the benefit of broadening the investor base of GCC 15.0 companies. Secondly, companies will be keen to take advantage of the prevailing low interest rate environment. Thirdly, strong growth is expected in the 9.6 GCC, which will drive continued demand for project 8.2 financing. Fourthly, the global ambition of leading regional companies will continue to drive their 2.5 3.2 international expansion, sustaining demand for 1.6 1.8 0.7 0.4 0.5 financing. Fifthly, many companies will need to refinance existing debt issues, particularly in the UAE. UAE Qatar Saudi Bahrain Kuwait Oman Finally, as the introduction of Basel III standards gets Source: Bloomberg and QNB Group analysis closer, more banks in the region could look at raising core capital through debt issuance. However, corporate debt issuance has risen strongly in 2012, accounting for 75% (US$29bn) of new bond GCC sovereigns have relatively high ratings, with a issuance, more than double the corporate bond growing number of institutions obtaining a credit issuance of US$14bn in 2011. rating. This makes most GCC companies well positioned to enter the bond market and obtain The largest issue was a 10-year US$4bn sukuk from relatively favourable financing terms. Furthermore, Saudi Arabia’s General Authority for Civil Aviation. It from the perspective of global institutional investors, was the Kingdom’s first government-backed issue and the strong rating of GCC sovereigns and companies was priced with a coupon of 2.5%, providing a broad provide attractive opportunities for portfolio indication of the local currency risk-free rate. Given diversification. that US$500bn of infrastructure spending is planned in 2