1 November Daily market report

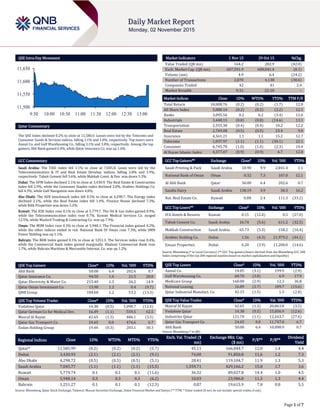

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 11,586.0. Losses were led by the Telecoms and Consumer Goods & Services indices, falling 1.1% and 1.0%, respectively. Top losers were Aamal Co. and Gulf Warehousing Co., falling 3.1% and 3.0%, respectively. Among the top gainers, Ahli Bank gained 6.4%, while Qatar Insurance Co. was up 1.6%. GCC Commentary Saudi Arabia: The TASI Index fell 1.1% to close at 7,045.8. Loses were led by the Telecommunication & IT and Real Estate Develop. indices, falling 2.8% and 1.9%, respectively. Tabuk Cement fell 5.6%, while Makkah Const. & Dev. was down 5.3%. Dubai: The DFM Index declined 2.1% to close at 3,430.9. The Real Estate & Construction index fell 2.9%, while the Consumer Staples index declined 2.0%. Arabtec Holdings Co. fell 4.3%, while Gulf Navigation was down 4.0%. Abu Dhabi: The ADX benchmark index fell 0.5% to close at 4,298.7. The Energy index declined 2.1%, while the Real Estate index fell 1.4%. Finance House declined 7.3%, while RAK Properties was down 5.2%. Kuwait: The KSE Index rose 0.1% to close at 5,779.7. The Oil & Gas index gained 0.9%, while the Telecommunication index rose 0.7%. Kuwait Medical Services Co. surged 12.5%, while Mushrif Trading & Contracting Co. was up 7.9%. Oman: The MSM Index rose 0.3% to close at 5,948.1. The Financial index gained 0.2%, while the other indices ended in red. National Bank Of Oman rose 7.3%, while SMN Power Holding was up 1.1%. Bahrain: The BHB Index gained 0.1% to close at 1251.3. The Services index rose 0.4%, while the Commercial Bank index gained marginally. Khaleeji Commercial Bank rose 1.7%, while Bahrain Maritime & Mercantile Internat. Co. was up 1.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 50.00 6.4 202.6 0.7 Qatar Insurance Co. 94.50 1.6 21.5 20.0 Qatar Electricity & Water Co. 215.40 1.3 26.2 14.9 Qatar Oman Investment Co. 13.90 1.2 0.4 (9.7) QNB Group 184.60 1.2 53.2 (13.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.38 (0.5) 1,098.7 (12.6) Qatar German Co for Medical Dev. 16.49 (1.1) 559.5 62.5 Masraf Al Rayan 42.65 (1.3) 486.1 (3.5) Qatar Gas Transport Co. 24.65 0.0 476.6 6.7 Ezdan Holding Group 19.44 (0.3) 203.1 30.3 Market Indicators 1 Nov 15 29 Oct 15 %Chg. Value Traded (QR mn) 164.2 282.9 (42.0) Exch. Market Cap. (QR mn) 607,591.9 608,041.4 (0.1) Volume (mn) 4.9 6.4 (24.2) Number of Transactions 2,870 4,138 (30.6) Companies Traded 42 41 2.4 Market Breadth 9:31 22:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,008.76 (0.2) (0.2) (1.7) 12.0 All Share Index 3,080.14 (0.2) (0.2) (2.2) 12.1 Banks 3,095.56 0.2 0.2 (3.4) 12.6 Industrials 3,448.15 (0.8) (0.8) (14.6) 13.1 Transportation 2,555.30 (0.4) (0.4) 10.2 12.2 Real Estate 2,769.08 (0.5) (0.5) 23.4 9.0 Insurance 4,561.21 1.1 1.1 15.2 12.7 Telecoms 1,037.97 (1.1) (1.1) (30.1) 22.1 Consumer 6,745.70 (1.0) (1.0) (2.3) 14.4 Al Rayan Islamic Index 4,377.07 (0.9) (0.9) 6.7 12.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Printing & Pack Saudi Arabia 18.90 9.9 2,841.4 1.1 National Bank of Oman Oman 0.32 7.3 107.0 12.1 Al Ahli Bank Qatar 50.00 6.4 202.6 0.7 Saudia Dairy Saudi Arabia 138.19 3.9 30.3 16.2 Nat. Real Estate Co. Kuwait 0.08 2.4 111.3 (33.2) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% IFA Hotels & Resorts Kuwait 0.15 (12.0) 0.5 (27.0) Tabuk Cement Co. Saudi Arabia 16.74 (5.6) 611.2 (32.5) Makkah Construction Saudi Arabia 65.73 (5.3) 158.2 (16.4) Arabtec Holding Co. Dubai 1.56 (4.3) 21,979.2 (44.1) Emaar Properties Dubai 6.20 (3.9) 11,200.0 (14.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Aamal Co. 14.05 (3.1) 199.9 (2.9) Gulf Warehousing Co. 60.70 (3.0) 6.9 17.9 Medicare Group 160.00 (2.9) 12.3 36.8 National Leasing 16.89 (2.7) 189.7 (15.6) Qatar Industrial Manufact. Co. 42.15 (1.5) 1.3 (2.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 42.65 (1.3) 20,863.8 (3.5) Vodafone Qatar 14.38 (0.5) 15,856.9 (12.6) Industries Qatar 121.70 (1.1) 12,163.7 (27.6) Qatar Gas Transport Co. 24.65 0.0 11,747.0 6.7 Ahli Bank 50.00 6.4 10,098.9 0.7 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,585.99 (0.2) (0.2) (0.2) (5.7) 45.11 166,844.7 12.0 1.4 4.4 Dubai 3,430.93 (2.1) (2.1) (2.1) (9.1) 74.00 91,850.8 11.6 1.2 7.3 Abu Dhabi 4,298.72 (0.5) (0.5) (0.5) (5.1) 28.41 119,104.7 11.9 1.3 5.3 Saudi Arabia 7,045.77 (1.1) (1.1) (1.1) (15.5) 1,359.71 429,166.2 15.8 1.7 3.6 Kuwait 5,779.74 0.1 0.1 0.1 (11.6) 36.32 89,027.8 14.4 1.0 4.5 Oman 5,948.14 0.3 0.3 0.3 (6.2) 10.03 23,986.8 11.3 1.3 4.4 Bahrain 1,251.27 0.1 0.1 0.1 (12.3) 0.87 19,615.9 7.8 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,500 11,550 11,600 11,650 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.2% to close at 11,586.0. The Telecoms and Consumer Goods & Services indices led the losses. The index fell on the back of selling pressure from Qatari and non-Qatari shareholders despite buying support from GCC shareholders. Aamal Co. and Gulf Warehousing Co. were the top losers, falling 3.1% and 3.0%, respectively. Among the top gainers, Ahli Bank gained 6.4%, while Qatar Insurance Co. was up 1.6%. Volume of shares traded on Sunday fell by 24.2% to 4.9mn from 6.4mn on Thursday. Further, as compared to the 30-day moving average of 7.3mn, volume for the day was 33.4% lower. Vodafone Qatar and Qatar German Co for Medical Devices were the most active stocks, contributing 22.6% and 11.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Oman Arab Bank (OAB) Moody’s Oman DR/CRR ‘A2/P-1’/A1 ‘A2/P-1’/A1 – – – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, DR – Deposit Rating, CRR – Counterparty Risk Rating) Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Emaar Properties Dubai AED 3,329.0 55.9% – – 843.0 30.7% Gulf Navigation Holding (GNH) Dubai AED 34.5 4.6% 6.0 30.4% 5.6 69.0% Sharjah Cement & Industrial Development Co. (SCIDC)* Abu Dhabi AED 151.1 13.7% – – 4.9 -27.8% Ras Al Khaimah Cement Co. (RAKCC)* Abu Dhabi AED 165.6 -2.4% – – 7.3 25.9% Emirates Insurance Co. (EIC) Abu Dhabi AED 98.3 5.3% -2.8 NA -6.5 NA Sharjah Group Co. Abu Dhabi AED – – – – 1.5 14.1% Ras Al Khaimah National Insurance Co. (RAKNIC)* Abu Dhabi AED 287.2 40.4% 56.5 47.5% 34.4 78.2% Viva Kuwait Kuwait KD 70.0 NA – – 11.3 9.2% Gulf Stone Co.* Oman OMR – – – – 0.1 -64.7% Source: Company data, DFM, ADX, MSM Overall Activity Buy %* Sell %* Net (QR) Qatari 62.06% 64.96% (4,762,929.47) GCC 16.73% 8.01% 14,313,500.67 Non-Qatari 21.21% 27.03% (9,550,571.20)

- 3. Page 3 of 7 Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Due ABQK Al Ahli Bank 14-Oct-15 - Due MRDS Mazaya Qatar 14-Oct-15 - Due QIGD Qatari Investor Group 16-Oct-15 - Due DBIS Dlala Brokerage & Investment Holding Company 18-Oct-15 - Due KCBK Al khalij Commercial Bank 19-Oct-15 - Due DOHI Doha Insurance 19-Oct-15 - Due QEWS Qatar Electricity & Water Company 20-Oct-15 - Due SIIS Salam International 20-Oct-15 - Due AKHI Al Kaleej Takaful 20-Oct-15 - Due IHGS Islamic Holding 20-Oct-15 - Due QIIK International Islamic Bank 20-Oct-15 - Due GWCS Gulf Warehousing Company 20-Oct-15 - Due QGTS Qatar Gas Transport Company, Nakilat 20-Oct-15 - Due QIMD Industrial Manufacturing Company 21-Oct-15 - Due QNNS Qatar Navigation 21-Oct-15 - Due QATI Qatar Insurance 21-Oct-15 - Due MARK Masraf Al Rayan 21-Oct-15 - Due DHBK Doha Bank 22-Oct-15 - Due QISI Qatar Islamic Insurance 22-Oct-15 - Due QGRI Qatar General Insurance & Reinsurance 24-Oct-15 - Due QOIS Qatar & Oman Investment Company 25-Oct-15 - Due MCGS Medicare Group 25-Oct-15 - Due UDCD United Development Company 25-Oct-15 - Due QFLS Qatar Fuel Company 25-Oct-15 - Due ERES Ezdan Real Estate Company 25-Oct-15 - Due MERS Al Meera Consumer Goods Company 25-Oct-15 - Due ORDS Ooredoo 25-Oct-15 - Due AHCS Aamal Company 25-Oct-15 - Due QNCD Qatar National Cement Company 25-Oct-15 - Due CBQK Commercial Bank 26-Oct-15 - Due BRES Barwa Real Estate Company 26-Oct-15 - Due NLCS National Leasing 26-Oct-15 - Due GISS Gulf International Services 27-Oct-15 - Due IQCD Industries Qatar 27-Oct-15 - Due MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 - Due MCCS Mannai Corp. 28-Oct-15 - Due QCFS Qatar Cinema & Film Distribution Company 28-Oct-15 - Due WDAM Widam Food Company 29-Oct-15 - Due QGMD Qatar German Company for Medical Devices 29-Oct-15 - Due ZHCD Zad Holding Company 29-Oct-15 - Due VFQS Vodafone Qatar 12-Nov-15 10 Due Source: QSE

- 4. Page 4 of 7 News Qatar QInvest secures $200mn Islamic loan – QInvest has secured a $200mn five-year Islamic loan. The loan was arranged by Masraf Al Rayan (MARK), France’s Natixis and Al Khaliji France, a subsidiary of Al Khalij Commercial Bank (KCBK). (Reuters) PM inaugurates largest labor city in Gulf region – HE the Prime Minister & Minister of Interior, Sheikh Abdullah bin Nasser bin Khalifa al-Thani has inaugurated the Labor City at Mesaimeer near the Industrial Area, which is the largest of its kind in Qatar and the Gulf region. Built over an area of 1.1mn square meters, the new Labor City can accommodate 100,000 workers and is considered as a human and cultural model. It provides a suitable environment, security & safety, care and recreation areas, reflecting the concern of the State to provide services for residents and develop the individual and the community. (Gulf-times.com) Father Emir inaugurates Al Attiyah Foundation for Energy & Sustainable Development – HH the Father Emir, Sheikh Hamad bin Khalifa al-Thani has formally inaugurated the Abdullah Bin Hamad Al Attiyah Foundation for Energy & Sustainable Development yesterday in Doha. The Al Attiyah Foundation will advise states on how to tackle such critical challenges as energy efficiency. The foundation will aim to deliver useful counsel and share knowledge by providing information, research & analysis on energy & sustainable development, primarily related to the Arabian Gulf region. (Gulf-times.com) MDPS: Qatar population tops 2.4mn in October – According to data released by the Ministry of Development Planning & Statistics (MDPS), Qatar has 2,412,000 residents as of October 31, 2015. The latest figures show an increase of 8.8% YoY and 2.8% MoM. The population is expected to shoot up in the coming months except toward the end of December when usually a large number of residents are overseas. (Gulf-times.com) ORDS launches ‘Ooredoo Extra’ website – Ooredoo (ORDS) has launched the new Ooredoo Extra website, designed to give customers a one-stop-shop for all the company’s entertainment, add-ons and news-based services. The Ooredoo Extra feature has been developed to bring more ease and convenience to customers by managing their own services, without having to go to an Ooredoo shop or calling a customer service agent. The launch is part of ORDS’ ongoing digital update campaign. (Gulf-times.com) beIN expands into entertainment sector – beIN Media Group has launched 24 new movie and entertainment channels across the Middle East and North Africa. By offering a new suite of channels, as well as competitive prices, beIN expects significant subscriber growth. (Bloomberg) International IMF pushes Europe for formal restructuring accord on Greek debt – The International Monetary Fund’s (IMF) first Deputy Managing Director, David Lipton said Eurozone countries must commit to a formal restructuring of Greece’s debt before the IMF lends new money to the country. He said the pledge to review Greece’s debt servicing would not be enough unless they are accompanied by specific terms for paring back the borrowing burden. Greece had received an €86bn bailout in August from the 19-nation currency bloc, which now wants the IMF to provide further support. Greek Prime Minister Alexis Tsipras has requested a new IMF program, which would replace a dormant one that is on track to expire in March 2016. Any new IMF program would have to be approved by an executive board representing the fund’s 188 member nations. Lipton said the amount of new IMF funding has not been decided. (Bloomberg) Japan manufacturing activity hits one-year high as demand grows – Japanese manufacturing activity in October expanded at the fastest pace in a year as new domestic and export orders increased. The Markit/Nikkei Japan Final Manufacturing Purchasing Managers Index (PMI) rose to a seasonally adjusted 52.4 in October, slightly less than a preliminary reading of 52.5 but a solid improvement from the final reading of 51.0 in September. The findings add to evidence that the world’s third-largest economy is recovering from a dip earlier in 2015 as demand at home and abroad is starting to pick up. The PMI for new export orders was 52.2 in October, just above a preliminary 52.1 and showing a return to growth from 48.0 in September. The index for overall new orders - both those at home and abroad - was 54.2 in October. This was less than the flash reading of 54.9 but still the fastest expansion in a year. (Reuters) China, Japan, South Korea pledge economic cooperation – Leaders of South Korea, Japan and China have pledged to work toward greater economic integration at their first joint meeting in over three years on Sunday, as they work to ease tensions stemming from Japan’s wartime past. South Korean President Park Geun-hye, Japanese Prime Minister Shinzo Abe and Chinese Premier Li Keqiang also said they would resume annual meetings, which had been suspended since 2012 amid disagreements over history and territory. Park said she agreed with Abe and Li to work toward the conclusion of a 16-nation free trade area as well as a separate three-way free trade deal that has been on the table since 2013. Negotiators for the 16 countries, which also include India and the 10 states of the Association of Southeast Asia Nations (ASEAN) met in Busan, South Korea, in October to discuss market opening and tariff reductions in goods and services. (Reuters) Premier Li: China’s consumption has ‘a lot of room’ to grow – Chinese Premier, Li Keqiang said China is firmly committed to restructuring & reforms and consumption has “a lot of room” to grow, dismissing concerns that the economy may be at risk of hard landing. Li said the Chinese economy will maintain a mid- to high- level of growth for quite some time in the future. He added that China possesses a large market, and it has potential, in particular, the consumption potential has not been fully realized. China said last week that it will significantly increase the share of consumption in its economic growth in the next five years and increase its targeted adjustment to economic policy to keep growth at a relatively quick pace. Li was speaking at a gathering of business leaders in South Korea, which counts China as its largest export market. (Reuters) Regional KHC sells 29.9% stake in SRMG – Kingdom Holding Company (KHC) has sold its entire 29.9% stake in Saudi Research & Marking Group (SRMG) in a private off-market transaction for a total consideration of SR837.31mn. KHC sold 23,923,296 shares at a price of SR35 per share. The proceeds from the transaction will be redeployed for other corporate projects and investment opportunities, which are in line with KHC’s strategic objectives. The divestment will be recorded in 4Q2015 results. (Tadawul) Al-Khodari gains SR18.4mn from equipment sale – Abdullah A. M. Al-Khodari Sons Company has completed public auction of its plant and machinery. The company has recorded SR18.4mn in profits from selling equipment worth SR49.7mn. The financial impact will be reflected in 4Q2015 financial results. (Tadawul) Sadara signs TSCA & TSA with JCSSC – Sadara Basic Services Company, being indirectly owned 100% by Sadara Chemical Company (Sadara), has entered into a tank storage construction agreement (TSCA) and a terminal services agreement (TSA) with Jubail Chemical and Storage Services Company (JCSSC). Under the TSCA, Sadara will sell certain tank storage facilities to JCSSC for approximately SR1.76bn. The TSCA will terminate upon final

- 5. Page 5 of 7 acceptance of the tank storage facilities by JCSSC. Under the TSA, which has an initial term of 20 years, JCSSC will provide bulk storage and product handling services to Sadara at the King Fahd Industrial Port in Jubail. The tariff payable by Sadara under the TSA will be composed of a fee compensating JCSSC for financing the port and the tank storage facilities and being the terminal owner, a fee compensating JCSSC for provision of the operational services to Sadara and a utilities fee for the utilities used to provide services to Sadara. (Tadawul) RSHS BoD recommends to relocate headquarters – Red Sea Housing Services Company’s (RSHS) board of directors (BoD) has recommended the company’s headquarters to relocate from its current location in the King Abdullah Economic City (KAEC) in Rabigh to Jeddah. The recommendation will be presented to the shareholders at the earliest convened general assembly for voting, after obtaining the necessary approvals from the relevant authorities. This step compliments RSHS’ plans in supporting its organizational structure and future operations. (Tadawul) Tahseen Consulting: KSA publishing, digital content industries may grow up to $3.6bn by 2017 – According to a new study by Tahseen Consulting, if Saudi Arabia addresses key industry challenges, the publishing, media and digital content industries could generate $3.6bn and create 9,800 additional jobs by 2017. The study was conducted to support the Saudi Publishers Association’s recent successful bid to gain full membership of the International Publishers’ Association. Saudi is the fourth country in the Arab World to achieve full membership in this prestigious international organization, which represents publishers’ interests globally. (GulfBase.com) Aldrees gets qualification certificate for managing, operating & maintaining fuel stations & service centers on highways – Aldrees Petroleum & Transport Services Company has received the Ministry of Municipal and Rural Affairs’ (MoMRA) approval to obtain qualification certificate for three years in managing, operating and maintaining gas stations and service centers on regional highways. This certificate will create significant impact on gaining new investment opportunities through the acquisition of new and distinctive sites. (Tadawul) Union Properties confirms profit expectations in 2015 – Union Properties has confirmed its Chairman Khalid Bin Kalban’s expectations that it would generate profits of around AED450mn in 2015. The developer has confirmed that it would launch a new project with Naif Alrajhi in the beginning of 2016. (DFM) EBS completes projects worth AED132mn in 1H2015 – Emirates Building Systems (EBS) has announced completion of projects worth AED132mn in 1H2015 amid escalating demand for steel structures in the region fueled by ongoing construction boom. The company successfully executed 26 contracts in the period, across the UAE, Qatar, Oman, Saudi Arabia, Kuwait and Africa. As a result, EBS recorded a 19% YoY growth in the period under review as compared to 2014. The company also announced a strong focus in Africa, particularly in Nigeria, Ghana, Ethiopia and Tanzania, given the escalating demand for steel structures for infrastructure and commercial projects as well as the oil and gas sector in the continent. EBS is a subsidiary of Dubai Investments and a regional pioneer in the design, fabrication and construction of steel structures. (DFM) Takaful Emarat rights issue opens – Takaful Emarat’s rights issue opened yesterday. It is tradable on the Dubai Financial Market (DFM) from November 1 until 15 November 2015. Trading of the rights issue enables existing shareholders of the company, who do not wish to subscribe to the new shares, which the company plans to issue as part of its capital increase, to sell all or part of their rights to other investors, who wish to subscribe. The subscription for newly issued shares will open on November 9 and will close on November 22. Takaful Emarat has published the schedule for the subscription process as required by law, and informed its shareholders through newspaper announcement on how to exercise their rights to subscribe for shares or trade the rights. The proposed capital raise will increase the company’s capital by AED50mn initially, with approval from shareholders to raise up to AED100mn. The proceeds will be used to accelerate Takaful Emarat’s growth momentum and capitalize on the company’s recent restructuring under a new management team and its return to operating a profitable underwriting model. (DFM) Dubai Customs: Dubai’s non-oil foreign trade hits AED652bn – According to figures released by Dubai Customs, Dubai maintains high foreign trade figures despite the turmoil across global markets due to the deflation in oil and commodity prices as well as the fluctuation in the exchange rates of major global currencies. Dubai’s non-oil foreign trade during 1H2015 reached AED652bn, with imports adding up to AED402bn, exports up to AED65bn and re-exports accounting for AED185bn. Phones had the lion’s share of traded commodities in Dubai, as they represented 15% of the emirate’s overall foreign trade with a total value of AED95bn in 1H2015. Automobiles, worth AED35bn, were traded through Dubai in 1H2015, showing the emirate’s status as a booming automotive trade hub. (GulfBase.com) Al Habtoor Group may sell stake in HLG – Al Habtoor Group Chairman Khalaf al-Habtoor has said that the company is planning to sell its stake in construction joint venture Habtoor Leighton Group (HLG) as it seeks to focus on core businesses. Its co-owner is Australian construction firm CIMIC Group. This divestment will enable Habtoor Group to focus on its wholly owned assets including hotels, real estate and schools. Mr. Khalaf said several international and regional companies were interested in buying the stake in the venture. HLG employs over 21,000 people and has operations in the UAE, Oman, Iraq, Qatar and Saudi Arabia. (Reuters) NBAD buys RBS’ Indian offshore loan portfolio – National Bank of Abu Dhabi (NBAD) has signed an agreement with Royal Bank of Scotland (RBS) to purchase a portfolio of around $900mn in offshore loans to Indian corporate organizations. Subject to certain completion conditions, including third party consents, the transaction is expected to complete progressively from 3Q2015. (ADX) Sudatel BoD approves 2016-2020 business plan – Sudatel Telecommunication Group Company Limited’s board of directors (BoD) has approved the five-year strategy and business plan (2016-2020). The strategy aims business transformation through adopting industry’s best practices and enhancing customer experience besides laying the ground for information & communications technology (ICT) services and finally, developing the company’s human capital. Moreover, the strategy focused at length on Sudatel’s infrastructure as its competitive advantage that can potentially transform Sudatel to become the leading ICT provider in services in Sudan. According to the business plan prepared by (DETECON), revenues are expected to grow 7% annually attaining $3.2bn in the coming five years and an EBITDA of $1.2bn. The growth is driven by the focus on ICT services such as machine to machine (M2M), mobile money, internet of things (IoT) and cloud services. The company is expected to invest $554mn till 2020. Furthermore, the main markets of focus will be Sudan, Senegal and Mauritania. The group’s strategy is focused on exploring all opportunities and exerting maximum efforts to maximize growth and increase shareholders returns. (ADX) Abu Dhabi targets 20% rise in UK visitors – Mubarak Al Nuaimi, Director, Promotions & Overseas Offices, TCA Abu Dhabi, has said

- 6. Page 6 of 7 that the UK remains the leading European market for visitors to Abu Dhabi with guest arrivals rising 16% YoY to 142,134, delivering 586,521 guest nights across the emirate, which is a significant rise of 10% YoY from 2014. He said, World Travel Market (WTM) in London, is a perfect platform for Abu Dhabi to build on its successes and ensure it meets a target of a 20% increase in UK guests staying in 163 hotels and hotel apartments and to increase their average length of stay, which is currently 4.13 nights. (GulfBase.com) Burgan Bank net profit surges 41% YoY in 3Q2015 – Kuwaiti Burgan Bank reported a net profit of KD21.64mn in 3Q2015 as compared to KD15.35mn in 3Q2014, representing a 41% YoY increase. (Reuters) US DoC files anti-dumping suit against UAE, Oman, Pakistan, Philippines & Vietnam – Al Jazeera Steel Products Company has said that the US Department of Commerce (DoC) has filed an anti- dumping suit against the UAE, Oman, Pakistan, the Philippines and Vietnam for selling below the fair price, based on allegations of US- based manufacturing companies. The department had chosen for investigation a period between July 2014 and June 2015. The management feels that there won’t be much impact on the sales revenue. Further developments will be informed to shareholders in the due course. (MSM) Oman invites nine firms to bid for dry port license – Nine domestic and global logistics service providers have been invited by the Omani government to bid for a license to operate and manage the country’s first dry port in South Al Batinah. This kind of mainstream project is aimed at positioning Oman as a logistics gateway for the wider region. In particular, the successful bidder will secure a license for the long-term lease and operation of an inland port facility that will form the centerpiece of the ambitious he South Al Batinah Logistics Area (SABLA) development. However, attention is currently focused on Block-A, which is a roughly three kilometer area that will host some of the crucial fundamentals necessary to kick-start this landmark development. (GulfBase.com) CBO: Money supply grows 14.5% to OMR5.3bn by August 2015-end – According to a report released by the Central Bank of Oman (CBO), the country’s narrow money supply had grown by 14.5% to OMR5.3bn by August 2015-end as compared to August 2014-end. This growth was a result of an increase in currency with the public by 5.2%, coupled with an increase in demand deposits by 17.6%. As per the report, quasi-money witnessed a growth of 7.7% during the period. Broad money supply M2 (M1 plus quasi-money) stood at OMR14.6bn as of August 2015-end, up from OMR13.3bn on August 2014-end, registering an increase of 10% during the period. The CBO’s policy rate for injection of liquidity remained unchanged at 1% since March 2012. The overnight Omani rial domestic inter-bank lending rate increased from 0.140% in August 2014 to 0.158% in August 2015. The weighted average interest rate on Omani rial deposits had declined from 1.047% in August 2014 to 0.895% in August 2015 while the weighted average Omani Rial lending rate had declined from 5.204% to 4.791% during the same period. (GulfBase.com) BisB reports BHD8.57mn net profit in 9M2015 – Bahrain Islamic Bank (BisB) posted a net profit of BHD8.57mn in 9M2015 as compared to BHD6.58mn in 9M2014. Total income in 9M2015 had stood at BHD31.4mn as compared to BHD29.1mn in 9M2014. The bank’s total assets had stood at BHD909.2mn at the end of September 30, 2015 as compared to BHD875.2mn on December 31, 2014. Financing assets reached BHD466mn, while customers’ current accounts had stood at BHD133.7mn. EPS had amounted to BHD9.15 in 9M2015 versus BHD7.03 in 9M2014. (Bahrain Bourse) Bahrain Middle East Bank reports $5mn net profit in 9M2015 – Bahrain Middle East Bank reported a net profit of $5mn in 9M2015 as compared to $3.25mn in 9M2014. Total operating income in 9M2015 had stood at $9mn as compared to $8.7mn in 9M2014. The bank’s total assets were recorded at $171.77mn at the end of September 30, 2015 as compared to $172.84mn on December 31, 2014. Loans & advances reached $142.13mn, while deposits from customers and financial institution had stood at $9.64mn and $125.22mn, respectively. EPS had amounted to $2.07 in 9M2015 versus $1.35 in 9M2014. (Bahrain Bourse) Bank ABC 9M2015 net profit drops 27% YoY – Arab Banking Corporation’s (Bank ABC) net profit fell 27% YoY to $144mn in 9M2015 as compared to $197mn in 9M2014. Total operating income had stood at $514mn in 9M2015 as compared to $676mn in 9M2014. The bank’s total assets had stood at $28.6bn at the end of September 30, 2015 as compared to $29.4bn on December 31, 2014. Loans & advances had reached $14.08bn, while deposits from customers and banks & other financial institution were valued at $13.78bn and $4.9bn, respectively. Bank ABC’s consolidated total capital adequacy ratio (CAR) had continued to remain strong at 19.8%, comprising predominantly Tier 1 at 17.5%. The ratio of non-performing loans to gross loans at 2.5% remains healthy (2.4% at 2014-end). (Bahrain Bourse) Ithmaar Bank signs MoU with Aramex – Ithmaar Bank has signed an MoU with Aramex to offer its cardholders a discounted lifetime Aramex ‘Shop &Ship’ membership, as well as exclusive discounts on shipping charges. (GulfBase.com) GDN: Bahrain’s investments in Egypt tops $955mn – Gulf Daily News (GDN), citing a recent report released by the General Authority for Investment & Free Zones, reported that Bahrain’s overall investments in Egypt topped $955mn by August 2015-end. As per the report, a total of 173 Bahraini companies are now investing in Egypt. Financial investment projects carried out through 16 companies make up a major bulk of $475mn, followed by industrial investments, which topped $233mn with 36 companies. (GulfBase.com)

- 7. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Inde x S&P Pa n Ara b S&P GCC (1.1%) (0.2%) 0.1% 0.1% 0.3% (0.5%) (2.1%)(2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,142.16 (0.3) (1.9) (3.6) MSCI World Index 1,705.80 (0.0) (0.0) (0.2) Silver/Ounce 15.55 (0.3) (1.8) (1.0) DJ Industrial 17,663.54 (0.5) 0.1 (0.9) Crude Oil (Brent)/Barrel (FM Future) 49.56 1.6 3.3 (13.6) S&P 500 2,079.36 (0.5) 0.2 1.0 Crude Oil (WTI)/Barrel (FM Future) 46.59 1.2 4.5 (12.5) NASDAQ 100 5,053.75 (0.4) 0.4 6.7 Natural Gas (Henry Hub)/MMBtu 1.94 (7.9) (14.4) (35.3) STOXX 600 375.47 0.4 (0.5) (0.2) LPG Propane (Arab Gulf)/Ton 45.00 2.3 5.6 (8.2) DAX 10,850.14 0.9 0.5 0.3 LPG Butane (Arab Gulf)/Ton 62.50 2.3 5.9 (4.6) FTSE 100 6,361.09 0.4 (0.6) (4.0) Euro 1.10 0.3 (0.1) (9.0) CAC 40 4,897.66 0.7 (0.5) 4.4 Yen 120.62 (0.4) (0.7) 0.7 Nikkei 19,083.10 1.1 1.8 8.2 GBP 1.54 0.8 0.7 (1.0) MSCI EM 847.84 0.2 (2.4) (11.3) CHF 1.01 0.2 (0.9) 0.7 SHANGHAI SE Composite 3,382.56 0.4 (0.4) 2.8 AUD 0.71 0.9 (1.1) (12.7) HANG SENG 22,640.04 (0.8) (2.2) (4.0) USD Index 96.95 (0.3) (0.2) 7.4 BSE SENSEX 26,656.83 (0.9) (3.5) (6.3) RUB 63.95 (0.7) 2.5 5.3 Bovespa 45,868.82 0.5 (2.7) (37.2) BRL 0.26 (0.2) 0.6 (31.3) RTS 845.54 0.7 (3.1) 6.9 138.7 110.6 107.2