Fibrocell Science ($FCSC) - Rodman & Renshaw 2011

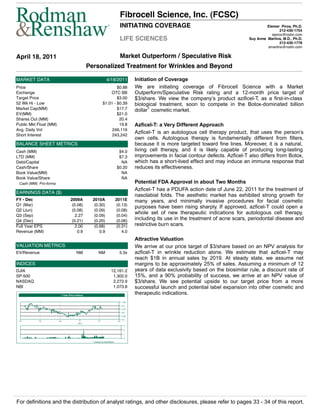

- 1. Fibrocell Science, Inc. (FCSC) ® INITIATING COVERAGE Elemer Piros, Ph.D. 212-430-1754 epiros@rodm.com LIFE SCIENCES Suy Anne Martins, M.D., Ph.D. 212-430-1778 smartins@rodm.com April 18, 2011 Market Outperform / Speculative Risk Personalized Treatment for Wrinkles and Beyond MARKET DATA 4/18/2011 Initiation of Coverage Price $0.88 We are initiating coverage of Fibrocell Science with a Market Exchange OTC BB Outperform/Speculative Risk rating and a 12-month price target of Target Price $3.00 $3/share. We view the company’s product azificel-T, as a first-in-class 52 Wk Hi - Low $1.01 - $0.39 biological treatment, soon to compete in the Botox-dominated billion Market Cap(MM) $17.7 dollar+ cosmetic market. EV(MM) $21.0 Shares Out (MM) 20.4 Public Mkt Float (MM) 19.8 Azficel-T: a Very Different Approach Avg. Daily Vol 246,116 Short Interest 243,242 Azficel-T is an autologous cell therapy product, that uses the person’s own cells. Autologous therapy is fundamentally different from fillers, BALANCE SHEET METRICS because it is more targeted toward fine lines. Moreover, it is a natural, Cash (MM) $4.0 living cell therapy, and it is likely capable of producing long-lasting LTD (MM) $7.3 improvements in facial contour defects. Azficel-T also differs from Botox, Debt/Capital NA which has a short-lived effect and may induce an immune response that Cash/Share $0.20 reduces its effectiveness. Book Value(MM) NA Book Value/Share NA Cash (MM): Pro-forma Potential FDA Approval in about Two Months Azficel-T has a PDUFA action date of June 22, 2011 for the treatment of EARNINGS DATA ($) nasolabial folds. The aesthetic market has exhibited strong growth for FY - Dec 2009A 2010A 2011E many years, and minimally invasive procedures for facial cosmetic Q1 (Mar) (0.08) (0.30) (0.13) purposes have been rising sharply. If approved, azficel-T could open a Q2 (Jun) (0.08) (0.09) (0.08) Q3 (Sep) 2.27 (0.09) (0.04) whole set of new therapeutic indications for autologous cell therapy, Q4 (Dec) (0.21) (0.20) (0.06) including its use in the treatment of acne scars, periodontal disease and Full Year EPS 2.00 (0.68) (0.31) restrictive burn scars. Revenue (MM) 0.9 0.9 4.0 Attractive Valuation VALUATION METRICS We arrive at our price target of $3/share based on an NPV analysis for EV/Revenue NM NM 5.3x azficel-T in wrinkle reduction alone. We estimate that azficel-T may reach $1B in annual sales by 2019. At steady state, we assume net INDICES margins to be approximately 25% of sales. Assuming a minimum of 12 DJIA 12,161.2 years of data exclusivity based on the biosimilar rule, a discount rate of SP-500 1,302.0 15%, and a 90% probability of success, we arrive at an NPV value of NASDAQ 2,272.9 $3/share. We see potential upside to our target price from a more NBI 1,073.8 successful launch and potential label expansion into other cosmetic and 1 Year Price History therapeutic indications. 1.05 0.9 0.75 0.6 0.45 0.3 Q1 Q2 Q3 Q1 Q2 2011 3 2 1 0 Created by BlueMatrix For definitions and the distribution of analyst ratings, and other disclosures, please refer to pages 33 - 34 of this report.

- 2. Fibrocell Science, Inc. April 18, 2011 TABLE OF CONTENTS INITIATION OF COVERAGE ........................................................................................................................ 1 INVESTMENT THESIS ................................................................................................................................. 3 RISK ANALYSIS ........................................................................................................................................... 4 COMPANY OVERVIEW ................................................................................................................................ 5 COMPETITIVE FACIAL INJECTABLE MARKET ......................................................................................... 6 WHY AZFICEL-T IS DIFFERENT FROM FILLERS AND BOTULINUM TOXIN? ...................................... 12 A SIMPLE AND RELIABLE MANUFACTURING PROCESS ..................................................................... 14 SAFETY EXPERIENCE IN THE U.K., U.S., AUSTRALIA AND NEW ZEALAND ...................................... 15 FDA ADVISORY PANEL RAISED SAFETY CONCERNS RELATED TO AZFICEL-T .............................. 15 AZFICEL-T POSITIVE EFFICACY RESULTS IN TWO PHASE 3 TRIALS ................................................ 16 POTENTIAL FDA APPROVAL FOR NASOLABIAL FOLD IN MID-2011 ................................................... 20 COSMETIC & THERAPEUTIC OPPORTUNITY ........................................................................................ 21 MULTIPLE POTENTIAL INDICATIONS ..................................................................................................... 23 INTELLECTUAL PROPERTY ..................................................................................................................... 24 MANUFACTURING CAPACITY ................................................................................................................. 24 VALUATION ................................................................................................................................................ 25 EXECUTIVE BIOGRAPHY ......................................................................................................................... 28 FINANCIALS ............................................................................................................................................... 30 RODMAN & RENSHAW EQUITY RESEARCH 2

- 3. Fibrocell Science, Inc. April 18, 2011 INVESTMENT THESIS Fibrocell Science, Inc. (FCSC, Market Outperform) is a biotechnology company focused on developing designed to improve the appearance of skin injured by the effects of aging, sun exposure, acne and burns using the patient's own (autologous) fibroblast cells produced in the proprietary Fibrocell Process. The company also markets a skin care product line with application in target markets through its subsidiary Agera Laboratories, Inc. Fibrocell also plans to market a personalized cream that can be used as a complement to azficel-T, or as a stand alone product. The cream manufacturer has been selected and several formulations are under consideration, and testing plan is under development to evaluate preservatives and collagen content. The expected launch for the personalized cream is in mid-2011. The com therapy is azficel-T (proposed brand name LaViv ) for the treatment of moderate to severe nasolabial fold wrinkles in adults. Autologous, injectable material appears to provide long-term correction, require minor surgery for initial tissue harvest, and have the potential for multiple applications without the need for additional tissue harvests sample from the patient to develop an autologous fibroblast cell line. Living cells are then injected back into the patient to correct skin contour defects. Once reintroduced into the skin, fibroblasts participate in a long-term protein repair process that appears to help sustaining the corrective effect. The experience with the autologous living fibroblast injection process indicates that it is likely capable of producing ongoing improvements in facial contour defects without the hypersensitivity complications and harvesting 1 challenges associated with other treatments . On March 16, 2011, the company submitted a final study report to the FDA for a completed, six-month histological study examining skin after injections of azficel-T. The study was a requirement in the Complete (BLA) for azficel-T for the treatment of moderate to severe nasolabial folds and wrinkles. Fibrocell has a PDUFA action date of June 22, 2011 for this BLA. We estimate that azficel-T has the potential to reach sales of approximately $1B by 2019. Azficel-T appears to be an effective treatment for a number of cosmetic indications, including fine lines and wrinkles. In addition, it seems to play an important role in the treatment of scar tissue as seen in pilot studies treating acne and early burn scars. The autologous cellular therapy is designed to offer a personalized treatment platform for patients in the form of a natural, living cell therapy. We believe this autologous cell process could have broad applications in a number of medical and aesthetic uses, and Fibrocell could benefit from multiple, large market opportunities. 1 Weiss R.A., et al., Dermatologic Surgery (2007) 33(3):263-268. RODMAN & RENSHAW EQUITY RESEARCH 3

- 4. Fibrocell Science, Inc. April 18, 2011 RISK ANALYSIS We ascribe a Speculative Risk rating to Fibrocell Science shares. In addition to development, marketing, and financial risks associated with emerging companies, specific additional risk factors to be considered are as follows: Regulatory Risk In October 2009, the FDA Cellular, Tissue and Gene Therapies Advisory Committee reviewed azficel-T. treatment of In r provide data from a histopathological study on biopsied tissue samples from patients following injection of azficel-T. The company submitted the final study to sup believes it has met FDA requirements. The study contained data from the 29-patient blinded study (IT-H- 001), and objectively evaluated the effect of repeated azficel-T injections at three months and six months. No clinical concerns were identified by either direct or comparative observations of the cellular morphology and integrity of the skin when biopsies from tissue treated with azficel-T were compared to either placebo or untreated tissue. FDA participated in the design of the protocol and data analysis The letter also requested finalized Chemistry, Manufacturing and Controls (CMC) information regarding the manufacture of azficel-T, as well as revised policies and procedures regarding shipping practices, and information is updated with the FDA, as well as information regarding survival of cells and cell viability during the shipping procedure. The company believes it has met the FDA requirements. However, if the data obtained from the histopathological study and/or the CMC information and revised policies and procedures required by the FDA is not satisfactory, approval maybe delayed beyond the PDUFA date. Commercial Risk The autologous cell therapy is the first of its kind for the treatment of moderate to severe nasolabial folds. It will represent a new entrance in a competitive market dominated by other approaches represented by established brands, such as Botox, Restylane, Juvederm, and penetration in this market may represent a challenge for azficel-T. Financial Risk Fibrocell ended 2010 with $868K on the balance sheet, and we estimate the company to burn approximately $15MM during 2011. The company recently raised approximately $6.1MM as the result of the issuance of preferred stock series D and warrants, and we believe it will need additional capital to achieve commercialization of its product candidates and to execute its business strategy. If the company is unable to raise additional financing on favorable terms or at all, its business may be adversely impacted. Partnership Risks Fibrocell currently has worldwide rights to its leading pipeline assets. Given the cost of marketing its products, the company may seek a marketing partner. A partnership may be necessary to fully realize the commercial value of azficel-T. If the company is unable to find such a favorable partnership and/or the partner does not execute effectively on the commercialization strategy, Fibrocell may not realize the full commercial value of azficel-T. RODMAN & RENSHAW EQUITY RESEARCH 4

- 5. Fibrocell Science, Inc. April 18, 2011 COMPANY OVERVIEW Fibrocell Science is a biotechnology company focused on developing novel skin and tissue rejuvenation own, (autologous) and its most advanced indication is for the treatment of nasolabial folds/wrinkles (azficel-T). Azficel-T has completed Phase 3 clinical studies, and the related BLA was submitted to the FDA in March 2009. In indication, and on December 21, 2009, Fibrocell received a Complete Response letter (CRL) related to the BLA for azficel-T. The CRL requested the company to provide data from a histopathological study on biopsied tissue samples from patients following injection of azficel-T. On March 16, 2011, the company submitted a final study report to the FDA for a completed, six-month histological study examining skin after injections of azficel-T and it has a PDUFA action date of June 22, 2011 for this BLA. Exit from Bankruptcy Fibrocell Science, formerly known as Isolagen, was founded in 1995 and it is headquartered in Exton, Pennsylvania. In June, 2009, Isolagen sought to reorganize under Chapter 11 of the U.S. Bankruptcy Code. The company ran out of cash at a critical point in its development, when azficel-T was undergoing review by the FDA. Therefore, it was unable to repay or convert $90MM of convertible debt. Companies, large and small, struggled in 2008-2009 in a difficult fund-raising environment. The company was able to emerge from bankruptcy under the name Fibrocell Science on September 3, 2009. Azficel-T was in fact marketed as a non-regulated product before the FDA brought it under the regulatory guidelines of the IND. In the U.S., it was marketed between 1995 and 1999, in the U.K. the product was sold between 2002 and 2007, and in Australia and New Zealand it was marketed in 2003 and 2004. Over 1,000 patients in the U.S. were treated while it was commercially available and over 6,000 patients received the treatment in the U.K. In 1999, in response to the increasing use of cellular therapy by consumers in the U.S., the FDA began to regulate such therapies. Fibrocell was notified by the FDA that approval was required to market azficel-T (at the time, known as Isolagen Process) in the U.S., and that In order to conserve capital required to run the U.S. clinical trials, Fibrocell completed the closure of the U.K. manufacturing facility in 2007. Clinical Trials Numerous Medical Applications In addition to wrinkle correction, Fibrocell has obtained statistically significant results in a Phase 2/3 acne scar clinical trial and favorable Phase 2 open label results in full face rejuvenation study. The company also develops and markets an advanced skin care product line through its Agera subsidiary, in which the company acquired a 57% interest in August 2006. Fibrocell also has results in early burn scars and periodontal disease studies (Exhibit 1). RODMAN & RENSHAW EQUITY RESEARCH 5

- 6. Fibrocell Science, Inc. April 18, 2011 Exhibit 1: Fibrocell Clinical Trials FIBROCELL THERAPY INDICATION PRE-CLINICAL PHASE 1 PHASE 2 PHASE 3 BLA/NDA MARKET laViv® - FACIAL WRINKLES ACNE SCARS TOTAL FACE PERIODONTAL RESTRICTIVE BURN SCARS Source: Fibrocell Investor Presentation December 2010. COMPETITIVE FACIAL INJECTABLE MARKET Botulinum Toxin Botulinum t toxin, produced by the Gram-positive rod Clostridium botulinum. Through research efforts over the past 30 years, medicine has utilized the powerful toxin for use in a variety of therapeutic and aesthetic settings. Therapeutic potential was first recognized in the 2 1970s when it was used to treat strabismus (crossed eyes) in monkeys . Thereafter, botulinum toxin type A (BTX-A) was produced commercially under the trade name Oculinum by Oculinum, Inc. (Private, Not Rated) and marketed by Allergan (AGN, Not Rated). The product gained the FDA approval in 1989 for the treatment of neurological movement disorders called dystonias. Allergan purchased the rights to produce BTX-A in 1991 from Oculinum Inc., and changed the name to the well-known Botox. In 2000, botulinum toxin-B (BTX-B) was approved for treatment of cervical dystonia under the commercial name Myobloc by Elan Pharmaceuticals (ELAN, Not Rated). The efficacy of BTX-A and BTX-B seems to be quite similar, but most physicians in the U.S. use BTX-A, since it is approved by the FDA for hyperhidrosis (abnormally increased perspiration), cervical dystonia and treatment of wrinkles. BTX-B is licensed by the FDA only for the treatment of cervical dystonia. Since its initial FDA approval, the therapeutic range of botulinum toxin has expanded to include treatment 3,4 of a variety of spastic disorders, pain syndromes, hypersecretory conditions, and aesthetic concerns . The cosmetic effect of BTX-A on wrinkles was originally documented in 1989, and on April 12, 2002, the FDA announced its regulatory approval to temporarily improve the appearance of moderate to severe frown lines between the eyebrows (glabellar lines). Subsequently, cosmetic use of BTX-A became 3 widespread, and the toxin is currently FDA approved for treatment of over 20 conditions (Exhibit 2) . 2 Scott A.B., Ophthalmology (1980) 87:1044-1049. 3 Charles P.D., American Journal of Health System Pharmacy (2004) 61 (22 Suppl 6):S11-S23. 4 Zalvan C., et al., Dermatologic Clinics (2004) 22:187-195. RODMAN & RENSHAW EQUITY RESEARCH 6

- 7. Fibrocell Science, Inc. April 18, 2011 Exhibit 2: FDA Approved Indications for Botulinum Toxin Trade Name FDA-Approved Uses Botox Upper lim spasticity Cervical dystonia Primary axilary hyperhydrosis Facial distonia and strabismus Glabellar rhytides Xeomin Cervical dystonia Blepharospasm Dysport Cervical dystonia Glabellar rhytides Myobloc Cervical dystonia Source: Berbos Z.J., et al., Current Opinion in Ophthalmology (2010) 21(5):387-395 and Rodman & Renshaw Research. Origin, Structure and Mechanism Clostridium botulinum is a bacteria that causes botulism. It produces seven distinct neurotoxins that are neuromuscular paralyzing agents. The toxins are called botulinum toxin type A, B, C1, D, E, F, and G, 5 each with differing terminal binding configurations . Each neurotoxin consists of a two chain polypeptide linked by a disulfide bond. The larger polypeptide (heavy chain), is the same for all seven toxins. The smaller one (light chain) varies for each toxin subtype. BTX-A (Botox, Dysport, and Xeomin) and BTX-B (Myobloc) are commercially produced since they have 6 properties making them most clinically beneficial . The toxin functions by inhibiting the acetylcholine (Ach) release at the neuromuscular junction, resulting in flaccid paralysis of targeted muscles. In other words, it blocks the transmission of overactive nerve impulses to the targeted muscle by selectively preventing the release of Ach at the neuromuscular junction, temporarily preventing muscle contraction. BTX-B is structurally and functionally similar to BTX-A. However, BTX-B has specific differences in molecular size, neuronal acceptor binding sites, intracellular enzymatic sites, and species sensitivities 2 suggesting that it is a distinct pharmacologic entitiy . The fact that BTX-A and B differ in their binding site 7,8 and target molecules is clinically relevant, allowing alternative toxins to be employed in the event of 9 treatment failure with a particular agent . 5 Melling J., et al., Eye (1988) 2:16-23. 6 Hankins C.L., Dermatologic Surgery (1998) 24:1181-1183. 7 Aoki K.R., et al., European Journal of Neurology (2001); 8 (Suppl 5):21 29. 8 Foran P.G., et al., Journal of Biological Chemistry (2003) 278:1363-1371. 9 Badarny S., et al., The Israel Medical Association Journal (2008) 10:520-522. RODMAN & RENSHAW EQUITY RESEARCH 7

- 8. Fibrocell Science, Inc. April 18, 2011 Available Formulations of Botulinum Toxin Type A (BTX-A) There are currently three available formulations of BTX-A: Botox (OnabotulinumtoxinA 900 kDa) Botox is the most well studied of the type A botulinum toxins. Approved for use in dystonias in 1989 and Botox Cosmetic for cosmetic use in 2002, Botox is distributed as a vacuum-dried powder that requires reconstitution with 0.9% (or physiologic) normal saline. Allergan packaging recommends reconstitution with nonpreserved saline, requiring use within four hours. Nevertheless, numerous studies have demonstrated no reduction in clinical efficacy, duration of action, or degree of paralysis when reconstituted with preserved saline and refrigerated up to two weeks. In practice, many clinicians use 10 preserved saline and refrigerate Botox for use up to seven-ten days after reconstitution . Dysport (AbobotulinumtoxinA 500/900 kDa) Dysport is made from the same neurotoxin (BTX-A) as Botox, and it was also originally developed in the 1990s to treat neuromuscular disorders. Approved for cosmetic use in the U.S. in April 2009, Dysport by 11 Allergan has been used in over 65 countries worldwide since 1991 . It differs from Botox in purification methodology. It is distributed as a lyophilized powder requiring reconstitution with nonpreserved saline and use within eight hours of reconstitution as per packaging recommendations. As with Botox, studies have shown safety and efficacy when used beyond two weeks after reconstitution with preserved saline. Dysport is a smaller-sized molecule, and the unit measurement is different from Botox. The conversion 12 ratio of 1.6:1 for Dysport:Botox is estimated in the literature , which means that surgeons have to inject approximately 1.6 times more units of Dysport than Botox to achieve a similar result. Although there are subtle differences between Dysport and Botox protein coats, molecular properties they have essentially similar effects in the muscle. Xeomin (IncobotulinumtoxinA 150 kDa) Xeomin by Merz Pharmaceuticals is an Ach release inhibitor and neuromuscular blocking agent approved 13 for use in spastic disorders and for cosmetic purposes in Europe, Mexico, and Argentina . Xeomin was approved by the FDA for the treatment of cervical dystonias and blepharospasm (abnormal contraction or twitch of the eyelid) in 2010, and the toxin is currently in Phase 3 trials for use in glabellar rhytides (brow furrows). Initial FDA approval of Xeomin was for the treatment of cervical dystonia or blepharospasms, both of which are neurological in nature and can be considered quite painful and for some, disabling. Xeomin works by injection into the site to cease muscle spasms from the nerve. The product differs from Botox and Dysport by isolating the therapeutic component from the ancillary complex proteins, and therefore appears to deliver more biologic activity and less protein load. Another way Xeomin differs from Botox and Dysport, is it does not require refrigeration prior to reconstitution. In summary, potential benefits of Xeomin include reduced immunogenicity given the lack of complexing proteins, and ease of storage, as 13,14 the solution is stable unrefrigerated up to four years . By simplifying the usage, it appears to be less room for human error while preserving product integrity. 10 Dutton J.J., et al., Survey of Ophthalmology (2007) 52:13-31. 11 Kane M.A., et al., Plastic and Reconstructive Surgery (2009) 124:1619-1629. 12 Wohlfarth K., et al., Journal of Neurology (2008) 255:1932-1939. 13 Frevert J. European Journal Neurology (2009) 16 (Suppl 2):11-13. 14 Frevert J. Toxicon (2009) 54:697-701. RODMAN & RENSHAW EQUITY RESEARCH 8

- 9. Fibrocell Science, Inc. April 18, 2011 Complications of Botulinum Toxin There are a number of potential complications with the use of all clinical preparations of botulinum toxin. Although its application is considered a safe treatment modality, complications occur as a result of patient 15 and physician related factors, but they tend to be localized and reversible . Systemic side effects: small quantities of botulinum toxin may spread to nearby structures or enter the circulatory system and elicit a loco-regional or systemic reaction, leading to botulinum toxin resistance Botulinum toxin is contraindicated in patients who have known hypersensitivity or allergy to botulinum toxin or human albumin; also, it is not recommended for people with neuromuscular disorders such as myasthenia gravis and multiple sclerosis In any state where neuromuscular transmission is compromised, botulinum toxin injections may worsen the symptoms Injection site pain, edema, and hematoma occurs with varying frequencies Headaches, dry-mouth sensation, and flu-like mild malaise may also occur Patients on anticoagulant medications may experience higher rates of bruising Local diffusion of botulinum toxin can assume the most clinical significance in periorbital (periocular) injections, where functional and cosmetic problems can occur, such as upper lid ptosis (drooping eyelid), lower lid ectropion (eversion of the eyelid away from the ocular globe), entropion (inversion of the eyelid), facial asymmetry, dry eyes, transient strabismus (crossed eyes). It is worth mentioning that these complications are usually temporary in nature. 15 Vartanian A.J., et al., Facial Plastic Surgery Clinics of North America (2005) 13:1-10. RODMAN & RENSHAW EQUITY RESEARCH 9

- 10. Fibrocell Science, Inc. April 18, 2011 Dermal Fillers Dermal fillers for the correction of facial contour deformities such as nasolabial folds, glabellar crease, deep wrinkles, and acne scars have been in clinical use for almost three decades. Volume enhancement utilizing autologous fat dates back well over a century, and the introduction of bovine collagen products in the 1980s led to an explosion in the use of dermal fillers as a result of enhanced longevity and superior 16 reproducibility of clinical effect . Concerns with respect to the immunogenicity of bovine collagen and restricted duration of effect led to development of human and porcine collagen products. Recently, hyaluronic acid (HA) fillers have become the leading product for cosmetic volume augmentation, 17 accounting for more than 85% of fillers used in 2008 , given their favorable physical properties 18 (biologically inert, stable, space occupying, longlasting, reversibility with hyaluronidase) . HA is a naturally occurring linear carbohydrate (polysaccharide). Unlike collagen, it exhibits no species or tissue specificity; its chemical structure is uniform throughout nature, and it has no potential for immunogenicity in its pure form. In the skin, it forms the dynamic viscous fluid matrix in which collagen 19 fibers, elastic fibers, and other intercellular structures are embedded . The number of commercially available HA fillers has increased rapidly over the years. Products differ in the concentration of HA, particle size, percentage of HA cross-linking, cross-linking agent used, and relative stiffness. Higher percentage HA cross-linking yields a stiffer product, which resists 20 biodegradation and provides a longer duration of effect (Exhibit 3) . Exhibit 3: Physical Characteristics of HA-Based Fillers Characteristic Clinical Significance Gel Hardness Structure and Stifness Particle Size Degree of Correction, Volume Filling HA Concentration Longevity and Stability Swelling Degree of Inflamation and Induration Source: Monheit G., et al., Dermatologic Therapy (2006) 19:141 150. Early HA fillers were derived from rooster combs, requiring skin testing prior to use. This disadvantage led to the development of biocompatible non-animal stabilized HA (NASHA) fillers that are frequently used today. Long-lasting fillers composed of calcium hydroxyapatite, silicone, polymethylmethacrylate (PMMA), and other synthetic materials are available, but given the sophisticated injection technique 19,21 required and potential for complications , they will not be discussed in our report. It is worth taking into consideration that, although increased duration of efficacy is generally a desirable characteristic of fillers, permanent products may lead to unsightly bumps and ridges. 16 Klein A.W. American Journal of Clinical Dermatology (2006) 7:107-120. 17 Beasley K.L., et al., Facial Plastic Surgery (2009) 25:86-94. 18 Lupo M. Seminars in Cutaneous Medicine and Surgery (2006) 25:122-126. 19 Narins R.S., et al., Clinics in Plastic Surgery (2005) 32:151-162. 20 Monheit G., et al., Dermatologic Therapy (2006) 19:141 150. 21 De Boulle K. Journal of Cosmetic Dermatology (2004) 3:2-15. RODMAN & RENSHAW EQUITY RESEARCH 10

- 11. Fibrocell Science, Inc. April 18, 2011 General Principles Products with smaller particles (softer consistency) are most suitable for superficial injection to address fine lines, while larger particle (stiffer) HA fillers are more appropriate for deeper injection to treat volume 21 loss and deep rhytides . This approach attains optimal results and minimizes potential complications, 22 such as entrapment of larger particle fillers injected into the superficial dermis . Layering multiple products is a useful approach to areas requiring both volume augmentation and fine wrinkle correction. In general, superficial fine-line products last approximately six months or more, while larger particle products range six-twelve months. Exhibit 4: FDA Approved HA Dermal Fillers Product Recommended Needle Size (Gauge) Depth of Injection Hyalaform 30 Mid to deep dermis Restylane 30 Mid to deep dermis Juvederm Ultra 30 Mid to deep dermis Juvederm Ultra Plus 27 Mid to deep dermis Perlane 27 Deep dermis to superficial Subcutaneous space Source: Sherman R.N. Clinics in Dermatology (2009) 27:S23-S32. Complications of Dermal Fillers The injection of dermal fillers may be associated to minor adverse effects such as injection-site burning, itching or pain. Hematoma, bruising and edema tend to occur soon after injection, usually being 23 temporary in nature . Other potential complications include: Tyndall effect: bluish or blue-gray color change that is seen when light refraction through the skin changes; occurs with superficial or excess implantation of clear, viscous HA Overcorrection with HA products may cause a puffy, edematous appearance, especially in the periorbital area Papule or nodule formation, surface irregularities, overcorrection, and asymmetry may also occur Delayed-onset granulomas, a type of foreign body reaction, may be seen with fillers that stimulate the formation of new collagen 22 Carruthers J., et al., Plastic and Reconstructive Surgery (2008) 121(Suppl 5):5-30. 23 Sherman R.N. Clinics in Dermatology (2009) 27:S23-S32. RODMAN & RENSHAW EQUITY RESEARCH 11

- 12. Fibrocell Science, Inc. April 18, 2011 WHY AZFICEL-T IS DIFFERENT FROM FILLERS AND BOTULINUM TOXIN? Using autologous fibroblasts as an injectable system to repair dermal and subcutaneous defects such as rhytids and scars opens a new window for reconstructive surgeons. The Fibrocell system utilizes the t contour 24 deformity . A Little Bit about Fibroblasts Fibroblasts are connective tissue cells that secrete an extracellular matrix (ECM) rich in collagen, the structural framework for animal tissues. Cultured fibroblasts may be used to augment tissue repair in a variety of conditions ranging from acute and chronic wounds through to their application in aesthetic and 25 reconstructive surgery (Exhibit 5). Exhibit 5: Human Fibroblast Cell Source: Fibrocell Investor Presentation December 2010. Autologous Cell Approach v s. Fillers In terms of aesthetic procedures, the use of injectable fillers for facial rejuvenation is currently widespread and popular. Azficel-T is being studied by Fibrocell as an alternative to traditional fillers, such as Restylane and Juvederm. There is evidence that autologous fibroblast injections can improve the 26 appearances of facial wrinkles and depressed scars . The advantage of injecting a live and dynamic autologous filler appears to be obvious, as it not only leads to longer-term and sustained correction but also eliminates the problem of hypersensitivity and foreign body granulomatous reactions. Furthermore, there have been no reports of hypertrophic scarring or keloid scarring following the intradermal injection of autologous fibroblasts, suggesting that fibroblast proliferation and collagen synthesis is naturally 26 regulated by cell-cell and cell ECM contact . It also appears that soft tissue augmentation with 26 autologous material circumvents problems with resorption and allergic reactions . 24 Boss W.K., et al., Annals of Plastic Surgery (2000) 44:536-542. 25 Fimiani M., et al., Clinics in Dermatology (2005) 23:396-402. 26 Watson D., et al., Archives of Facial Plastic Surgery (1999) 1:165-170. RODMAN & RENSHAW EQUITY RESEARCH 12

- 13. Fibrocell Science, Inc. April 18, 2011 Autologous vs. Allogeneic Fibroblasts used in tissue engineering may be autologous (cells are taken from the same patient) or allogeneic (cells are taken from different individuals). In contrast to allogeneic cells, autologous fibroblasts carry no risk of rejection or risk of cross-infection, and it seems that autologous fibroblasts are 27 necessary for permanent engraftment (tissue incorporation) . Nevertheless, it takes longer to culture autologous cells to obtain sufficient cell numbers, whereas allogeneic cells are cryopreserved and readily 28 available . Autologous Cell Approach vs. Botulinum Toxin The mechanism of botulinum toxin is to prevent the release of Ach at the motor end plate. Without this release, the electrical impulse is not transmitted; hence, the muscle does not move. Selective paralysis is the keystone of neuromodulator treatment but only if the toxin is in the anticipated and desired location. Some of the complications of this approach when compared to azficel-T are related to the paralysis effect caused by the toxin, such as problems with swallowing, speaking, or breathing, loss of strength and muscle weakness all over the body, hoarseness or change of voice, blurred vision and dropping eyelids, 29 dry eyes . Although temporary, those can represent significant problems for patients, as they not only affect their appearance, but also may make easy tasks impracticable, such as talking, reading and driving. In addition, the desire of a long-lasting and natural appearance claimed by azficel-T should favor the autologous cell therapy. The effects of a botulinum toxin injection are temporary. The symptoms may return completely in three months, and after repeated injections, some patients may develop an immune response to the toxin that may reduce its effectiveness. 27 Wong T., et al., British Journal of Dermatology (2007) 156:1149-1155. 28 Bello Y.M., et al., American Journal of Clinical Dermatology (2001) 2:305-313. 29 Botox Medication Guide RODMAN & RENSHAW EQUITY RESEARCH 13

- 14. Fibrocell Science, Inc. April 18, 2011 A SIMPLE AND RELIABLE MANUFACTURING PROCESS Autologous cellular therapy is the process whereby a patient's own cells are extracted, expanded, cryopreserved, and then reintroduced to the patient. The Fibrocell Process is an autologous cellular therapy designed to replenish deficiencies caused through the loss of fibroblast cells. In the Fibrocell Process, the patient's cells are taken from a small skin sample from which millions of fibroblast cells are separated and reproduced, and then injected into the patient in or around the areas to be treated (Exhibit 6). EXHIBIT 6: The Fibrocell Process Source: FDA Advisory Committee Meeting Presentation 2009. The source material is a post-auricular biopsy. Three millimeter punch biopsies are taken in the facility at two to eight degrees Celsius. Once the cells arrive at the manufacturing facility and are checked for any signs of any gross contamination, cells are isolated from the biopsies and placed into a tissue culture vessel. The cells are then expanded through two to three passages until sufficient cells are obtained for each of the three sets of injections required for treatment. During this time, the cells are routinely monitored for morphology. Once sufficient cells have been obtained, they are harvested, washed, resuspended in cryopreservation medium, and then frozen down until all testing has been completed. Once all the testing has been completed (cell count, cell viability, collagen content, endotoxin, sterility, product purity/identity), the cells are cleared for release to the clinical site. However, due to the nature of the cells being a living cell population, they are not sent to the clinical site until the day before they are needed. So once the testing is completed, the physician is notified and a patient appointment is made. Then, when required, the cells are thawed, washed, and formulated in an RODMAN & RENSHAW EQUITY RESEARCH 14

- 15. Fibrocell Science, Inc. April 18, 2011 A final set of tests is then performed on the final product before shipment, including sterility, gram stain, and potency. Then the cells are shipped to the clinical site overnight at two to eight degrees Celsius. The whole process from the collection of the biopsy to the shipment to the physician for the first treatment is approximately 90 days. Fibroblasts proliferate faster in vitro than other dermal cell types, and represent greater than or equal to 98 percent of the cells in the final product. Keratinocytes comprise up to 2 percent of the product. Cell growth and morphology are monitored throughout the cell expansion phase to distinguish abnormal fibroblasts from transformed fibroblasts and other cell types. It should be pointed out that during the pivotal trials, there were no reported occurrences of abnormal morphology during the manufacture of azficel-T. SAFETY EXPERIENCE IN THE U.K., U.S., AUSTRALIA and NEW ZEALAND Azficel-T was actually marketed commercially as a non-regulated product before the FDA brought it under the regulatory guidelines of the BLA. In the U.S., it was marketed between 1995 and 1999, in the U.K. between 2002 and 2007, in Australia and New Zealand the product was marketed in 2003 and 2004. Over 1,000 patients were treated in the U.S. and over 6,000 patients received the treatment in the U.K. The largest experience was in the U.K., and the adverse event (AE) profile reported a total of 26 events from 2004 to 2006, almost all of them limited to the injection site. Most of these AE resolved without any 30 medical intervention . FDA ADVISORY PANEL RAISED SAFETY CONCERNS RELATED TO AZFICEL-T In October 2009, the FDA Advisory Committee reviewed azficel-T, and safety was one of the big on azficel- onstrated safety, both for the proposed indication. One of the questions that the FDA raised to the panel was about tumorigenicity, which is the process of initiating and promoting the development of a tumor. Tumorigenity was not a concern for the majority Advisory Committee members. The company had two cases of basal cell carcinoma (CBC) in its Phase 3 clinical trials (studies IT-R-005 and IT-R-006), but these findings were deemed consistent with the normal incidence of CBC in the U.S. population and not related to the azficel-T treatment. In addition, there were no unresolved nodules, papules, or anything that could lead to some tumor brewing. Nevertheless, on December 21, 2009, the company received a CRL from the FDA related to the BLA for azficel-T. The CRL requested data from a histopathological study on biopsied tissue samples from patients following injection of azficel-T. Fibrocell initiated the histology study (IT-H-001) in May, 2010, evaluating tissue treated with azficel-T as compared to tissue treated with sterile saline (placebo). The study also provided information about the skin after treatment, including evaluation of collagen and elastin fibrils, and cellular structure of the sampled tissues. The company submitted data from a three-month assessment for this study in December, 2010, and final results (six-month assessment) were reported in March, 2011. The study contained data from 29 patients, and the FDA participated in the design of the protocol and data analysis plan. No clinical concerns were identified by either direct or comparative observations of the cellular morphology and integrity of the skin when biopsies from tissue treated with azficel-T were compared with placebo-treated or untreated tissue. 30 FDA Advisory Committee Meeting 2009 Transcript. RODMAN & RENSHAW EQUITY RESEARCH 15

- 16. Fibrocell Science, Inc. April 18, 2011 The letter also requested finalized Chemistry, Manufacturing and Controls (CMC) information regarding the manufacture of azficel-T, as well as revised policies and procedures regarding shipping practices, and formed us that all the CMC information is updated with the FDA, as well as information regarding survival of cells and cell viability during the shipping procedure. The company believes it has met the FDA requirements. During the trials, there were common adverse events seen with azficel-T injections, typically redness, swelling, bruising, and bleeding. 508 patients were treated with azficel-T, and 59% of them reported adverse events. 354 subjects were treated with the vehicle alone, and 49% of them had at least one adverse event. The majority of these events were mild and short-lived. There were also some rare adverse events, mostly in the injection site areas, such as lumps, bumps, and papules, but they were also self-limited and resolved promptly. Other concerns raised during the panel gravitated towards ischemia, the importance of mast cells in keloid scar formation, aged fibroblasts, culture contamination, fibroblast proliferation and collagen synthesis. We believe the company provided adequate and satisfactory answers to the related questions posed by the FDA. The majority of the panelists became comfortable with these issues, based on existing data from Phase 3 studies and from the previous marketing experience. AZFICEL-T POSITIVE EFFICACY RESULTS IN TWO PHASE 3 TRIALS Two pivotal Phase 3 trials (IT-R-005 and IT-R-006) evaluated the efficacy and safety of Fibrocell therapy (azficel-T) against placebo in approximately 400 subjects total with approximately 200 subjects enrolled in each trial. They were two identical, multicenter, randomized, double-blinded vehicle-controlled studies, enrolled simultaneously. IT-R-005 had 203 subjects at seven U.S. clinical sites and IT-R-006 had 218 subjects studied across six U.S. clinical centers. During the trials, three doses of azficel-T or vehicle were administered bilaterally to nasolabial fold wrinkles five weeks apart. The co-primary efficacy endpoints included (1) a subject live wrinkle assessment (measured by a two- -point scale, Exhibit 7), and (2) an evaluator live wrinkle assessment (measured by a two-point improvement on a six- point Lemperle scale, Exhibit 8). These endpoints were evaluated at six months after the first treatment. The subject, injecting physician, and the evaluator were all blinded. There were some secondary efficacy endpoints included: (1) a two-point move on the subject and evaluator live assessment scale, not at six months but at visit three (treatment three), four (two-month follow up), and five (four-month follow up), and (2) an improvement in the subject and evaluator photographic assessments comparing the photographs at visit baseline, at the following time points: visit three, four, five, and six. RODMAN & RENSHAW EQUITY RESEARCH 16

- 17. Fibrocell Science, Inc. April 18, 2011 Exhibit 7: Subject Live Wrinkle Assessment How do you feel about the wrinkles in the lower part of your face? -2 I am very dissatisfied with the wrinkles on the lower part of my face -1 I am dissatisfied with the wrinkles on the lower part of my face 0 I am somewhat satisfied with the wrinkles on the lower part of my face 1 I am satisfied with the wrinkles on the lower part of my face 2 I am very satisfied with the wrinkles on the lower part of my face Source: Adapted from Cohen S.R., et al., Plastic and Reconstructive Surgery (2004) 114(4):964-976. The subject live wrinkle assessment was done in the clinic. The subjects were asked how they felt about these wrinkles on the lower part of their face (below the dotted line), and to grade themselves on the scale listed here. Exhibit 8: Photoguide for the Evaluator Live Wrinkle Assessment Six-Point Lemperle Scale (One Grade Assigned per Wrinkle) Source: Adapted from Lemperle G., et al., Plastic and Reconstructive Surgery (2001) 108(6):1735-1750 RODMAN & RENSHAW EQUITY RESEARCH 17

- 18. Fibrocell Science, Inc. April 18, 2011 The evaluator live wrinkle assessment was also performed in the clinic, but subsequent to the subject assessment. It was also performed at the following intervals: baseline, treatment three, month two, month four, and month six. Both right and left nasolabial folds were scored separately. This was performed by a separate blinded evaluating physician who was not the injector. The Lemperle scale was used as the photoguide. Primary Efficacy in IT -R-005 and IT-R-006 In the IT-R-005 study, both the subject and evaluator assessments met the co-primary endpoints and were statistically significant achieving p-values of 0.0001 and <0.0001, respectively. In the IT-R-006, statistical significance was also achieved for both primary efficacy endpoints, achieving p-values of <0.0001 and 0.0075 for the subject and evaluator assessments, respectively. Note the extreme statistical significance (Exhibit 9 and 10). Exhibit 9: Subject Live Wrinkle Assessment at Visit Six Source: FDA Advisory Committee Meeting Presentation 2009. Exhibit 10: Evaluator Live Wrinkle Assessment at Visit Six Source: FDA Advisory Committee Meeting Presentation 2009. RODMAN & RENSHAW EQUITY RESEARCH 18

- 19. Fibrocell Science, Inc. April 18, 2011 Secondary Efficacy Endpoints The secondary efficacy endpoints were assessed at time points other than or including visit six. The subject scale, which was a two point improvement, showed a gradual improvement from visit three to visit six. The study also compared the vehicle versus azficel-T (Exhibit 11). Exhibit 11: Subject Scale Two-Point Improvement at Visits Three, Four, Five, and Six Source: FDA Advisory Committee Meeting Presentation 2009. The same results apply for the evaluator scale. In addition to the gradual improvement observed from visit three to visit six, there is also an immediate improvement beginning at visit three and a widening gap of the response compared to the vehicle (Exhibit 12). Exhibit 12: Evaluator Scale Two-Point Improvement at Visits Three, Four, Five, and Six Source: FDA Advisory Committee Meeting Presentation 2009. With the photographs that were reviewed at visit six, 67% of the subjects treated with Azficel-T versus 26% of the vehicle-treated indicated that their appearance was better or much better than baseline (Exhibit 13). RODMAN & RENSHAW EQUITY RESEARCH 19

- 20. Fibrocell Science, Inc. April 18, 2011 Exhibit 13: Subject Photographs at Baseline and Visit Six Source: FDA Advisory Committee Meeting Presentation 2009. The injections were completed in January 2008 and the trial data results were disclosed in October 2008. The Phase 3 trial data results indicated statistically significant efficacy results for the treatment of nasolabial fold wrinkles, with extremely significant p-values. No serious AE related to azficel-T were observed in the studies. POTENTIAL FDA APPROVAL FOR NASOLABIAL FOLD IN MID-2011 Fibrocell submitted the related BLA to the FDA in March 2009. In May 2009, the FDA accepted its BLA iewed azficel-T. The -T demonstrated efficacy, and 6 2009, the company received a CRL from the FDA related to the BLA for azficel-T. The CRL requested data from a histopathological study on biopsied tissue samples from patients following injection of azficel- T. Fibrocell initiated the histology study (IT-H-001) in May, 2010, evaluating tissue treated with azficel-T as compared to tissue treated with sterile saline (placebo). The study also provided information about the skin after treatment, including evaluation of collagen and elastin fibrils, and cellular structure of the sampled tissues. The company submitted data from a three-month assessment for this study in December, 2010, and final results (six-month assessment) were reported in March, 2011. The study contained data from 29 patients, and the FDA participated in the design of the protocol and data analysis plan. No clinical concerns were identified by either direct or comparative observations of the cellular morphology and integrity of the skin when biopsies from tissue treated with azficel-T were compared with placebo-treated o this was a significant milestone for Fibrocell towards the approval path. The company has a PDUFA action date of June 22, 2011 for this BLA. RODMAN & RENSHAW EQUITY RESEARCH 20

- 21. Fibrocell Science, Inc. April 18, 2011 COSMETIC & THERAPEUTIC OPPORTUNITY The aesthetic market has exhibited strong growth for many years. The overall number of cosmetic procedures has increased 147% since 1997, with nonsurgical procedures increasing by 231% over the same period according to statistics released by the American Society for Aesthetic Plastic Surgery 31 (ASAPS) . Almost 10MM cosmetic surgical and nonsurgical procedures were performed in the U.S. in 2009 as compared to 10.3MM in 2008, and from those 10MM approximately 8.5MM were nonsurgical, making up approximately 85% of the total. In addition, it appears that the concept of nonsurgical cosmetic procedures involving injectable materials has become more popular and established, with the following table showing the top five nonsurgical cosmetic procedures performed in the U.S. in 2009 (Exhibit 14): Exhibit 14: Top Five Nonsurgical Cosmetic Procedures in 2009 Procedure Volume (in Millions) Botulinum toxin type A 2.56 Hyaluronic acid 1.31 Laser hair removal 1.28 Microdermabrasion 0.62 Chemical peel 0.53 Source: The American Society for Aesthetic Plastic Surgery (ASAPS) 2009 Statistics Historically, science-based development has not been evident in the cosmetic field. We have seen therapies developed in other fields migrating towards the aesthetic field, such as botulinum toxin coming from neurology, and fillers coming from orthopedics. This picture is changing, since this market offers diversification away from publicly-reimbursed health care and usually a quick product adoption. Besides, the social stigma associated with aesthetic procedures has vanished, and regulatory bodies are changing the way they analyze aesthetics indications. As an example, we can refer to the FDA approval of Latisse by Allergan for the treatment of hypotricosis (short eyelashes) in 2008. Trends now are for less invasive procedures as well as for more preventive intervention to slow the 18 damage from ultraviolet light and environmental factors, as well as from intrinsic aging . The goal of these injectable procedures is to eliminate or delay the need for corrective surgery, and over the past ten 32 years, the use of botulinum toxin and dermal fillers for aesthetic purposes has risen sharply . Aesthetic Market Opportunity product candidate for wrinkles/nasolabial folds and full face rejuvenation are directed primarily at the aesthetic market. Aesthetic procedures have traditionally been performed by dermatologists, plastic surgeons and other cosmetic surgeons, and according to ASAPS, the total market for nonsurgical cosmetic procedures was approximately $4.5B in 2009. The aesthetic procedure market is basically driven by: Aging of the baby boomer population, which currently includes ages approximately 46 to 64 The desire of individuals to improve their appearance Impact of managed care and reimbursement policies on physician economics, which has motivated physicians to establish or expand the menu of elective, private-pay aesthetic procedures that they offer Broadening base of the practitioners performing cosmetic procedures beyond dermatologists and plastic surgeons to non-traditional providers 31 The American Society for Aesthetic Plastic Surgery (ASAPS) 2009 Statistics. 32 Berbos Z.J., et al., Current Opinion in Opthalmology (2010) 21(5):387-395. RODMAN & RENSHAW EQUITY RESEARCH 21

- 22. Fibrocell Science, Inc. April 18, 2011 The potential size of the market for facial injectable procedures in the U.S. is approximately $2B, according to ASAPS (Exhibit 15). Exhibit 15: Total Market Size of Aesthetic Injectable Procedures (2009) Units U.S. Market Size Product Price/Unit (in Thousands) ($ in Millions) Botulinum toxin $195 5,014 $980 Dermal Fillers $400-$1,000 1,547 $932 Source: The American Society for Aesthetic Plastic Surgery (ASAPS) 2009 statistics. Botox Sales Botox was developed in 1970s by a San Francisco doctor looking for ways to correct strabismus. In 1990s, doctors started to notice something else intriguing: the drug paralyzing properties seemed to greatly reduce frown lines and wrinkles in patients getting it for eye problems. Allergan conducted clinical trials, which led to FDA regulatory approval of Botox for cosmetic indications in 2002. Sales of Botox respectively, and have been rising dramatically since 1993 (Exhibit 16). Exhibit 16: Botox Sales from 1993 to 2010 Botox Sales from 1993-2010 1,600 1,400 Sales ($ in Millions) 1,200 1,000 800 600 400 200 0 1993 1995 1997 1998 1999 2000 2002 2004 2006 2007 2009 1994 1996 2001 2003 2005 2008 2010 Source: Allergan Reports and Rodman & Renshaw Research (including cosmetic and neurologic indications). Market for Dermal Fillers 31 Dermal fillers represent a substantial market with approximately $900MM in sales in the U.S . The two most used compounds used are HA and collagen, but the filler market is saturated with about 15-20 different kinds of treatments, putting pressure on unit price. In our view, the Fibrocell technology may provide an advantage when compared to fillers, as azficel-T provides a natural tissue formation of the patient own cells and these cells could last longer than the fillers. Therefore, there is a sound reason to believe that azficel-t may take market share from fillers in the future, if it gets approved. Azficel-T: Cosmetic Long-Term Treatment with Personalized Appeal The Fibrocell therapy appears to replenish fibroblasts that potentially stimulate the production of collagen and elastic fibers. Moreover, we have the promise of a cosmetic long term ongoing treatment, and we believe there is a broad market opportunity for a personalized treatment such as azficel-T. RODMAN & RENSHAW EQUITY RESEARCH 22

- 23. Fibrocell Science, Inc. April 18, 2011 MULTIPLE POTENTIAL INDICATIONS Acne Scars - Phase 2/3 Trial In November 2007, Fibrocell initiated an acne scar Phase 2/3 study. This study included approximately 95 subjects, and it was designed to evaluate the use of azficel-T to correct or improve the appearance of acne scars. Each subject served as their own control, receiving azficel-T on one side of their face and placebo on the other. The subjects received three treatments, two weeks apart. The follow-up and evaluation period was trial data results, which included statistically significant efficacy results for the treatment of moderate to severe acne scars. This study was powered to demonstrate efficacy, and Fibrocell submitted on August 9, 2010, a clinical study report for its Phase 2/3 study of azficel-T for the treatment of moderate to severe acne scars to the FDA. The next step is to initiate a discussion with the FDA related to the validation of the evaluator assessment scale and agree on a path forward. Restrictive Burn Scars - Phase 2 Trial In January 2007, Fibrocell met with the FDA to discuss its clinical program for the use of azficel-T for restrictive burn scar patients. This Phase 2 trial would evaluate the use of azficel-T to improve range of motion, function and flexibility, among other parameters, in existing restrictive burn scars in approximately 20 patients. Dental Study - Phase 2 Trial In 2006, Fibrocell initiated a Phase 2 open-label dental trial for the treatment of a condition relating to periodontal disease, specifically to treat interdental papillary insufficiency. This single site study included 11 subjects. All study treatment and follow up visits were completed, but full analysis of the study was currently reviewing potential other clinical paths in the dental arena. Additional potential indications would include the treatment of vocal fold scarring, and the treatment of ® wrinkles in multiple facial regions. The company is also developing U , the first skincare topical product inco fibroblasts, and a facial cream. RODMAN & RENSHAW EQUITY RESEARCH 23

- 24. Fibrocell Science, Inc. April 18, 2011 INTELLECTUAL PROPERTY As of December 31, 2010, Fibrocell had ten issued and three pending U.S. patent applications, 30 granted method of using autologous cell fibroblasts for the repair of skin and soft tissue defects and the use of autologous fibroblast cells for tissue regeneration. Fibrocell is in the process of pursuing several other patent applications. The patent family ISLGN-002 is directed primarily to the repair of skin and soft tissue defects in humans. All the patents and applications share the identical disclosure, as they all derive from the original first U.S. filing on 28 July, 1995. The foreign applications were either derived from a Patent Cooperation Treaty (PCT) filed on 3 July, 1996, or individual national filings. The patent family ISLGN-003 covers the repair of degenerated tissue using autologous fibroblasts together with a biodegradable acellular matrix. The primary focus of this portfolio is dental use. The ISLGN-005 patent family is distinguished from ISLGN-002 and ISLGN-003 in that it provides compositions and methods of treating degenerated tissue comprising autologous passaged fibroblasts, but with the addition of autologous passaged muscle cells. It is granted only in New Zealand. The patent family ISLGN-007 is directed primarily to producing neurons from undifferentiated mesenchymal cells (UMC), and using the neurons in compositions for the repair of damaged neurological tissue. For the repair of vocal cord tissue, Fibrocell relies on the ISLGN-008 patent family and it was assigned to the company in January 2003. Fibrocell also patented its method of using fibroblasts to promote healing of wounds and fistulas (family ISLGN-009). Lastly, the company has one patent family covering its method of culturing fibroblasts (ISLGN-017) and another one covering its method of culturing dermal cells for treatment of skin injuries, such as burns (ISLGN-018). On March 08, 2011, the company entered into a scientific collaboration with University of California (UCLA) to research the conversion of dermal fibroblasts into pure functional human cell types that may have greater regenerative capacity, setting the stage for future potential personalized diagnostics or betes and cardiopathies. Through this collaboration, the company seeks to optimize the current range of clinical applications for autologous cell therapies and broaden the use of patented Fibrocell technology. In addition, Fibrocell have accessed key patents from Stanford University to enable the process. MANUFACTURING CAPACITY Currently Fibrocell has a manufacturing facility located in Exton, Pennsylvania. The location consists of 86.5K square feet, with approximately 15K square feet dedicated to laboratory spaces. Currently, the production facility can handle 15K to 17K procedures annually. Upon approval, the company plans to launch the product gradually, initially to previous clinical investigators and thought leaders in the field. We estimate Fibrocell to perform 1K procedures in the second half of 2011, its first year of commercialization, and then ramp up production steadily. For the second year (2012), we model the treatment of 6K patients, followed by 15K patients by 2013. Beyond that year, we believe the company has to upgrade in order to expand its manufacturing capacity, with a cost of $4MM to $5MM for each additional 15K to 20K patients. The current facility has a maximum production capacity to treat 80K patients, forecasted to be achieved by 2016. At that stage, the company may outsource the processing of perhaps an additional 50K procedures. Beyond that point, Fibrocell will probably have to move or build another facility. We believe the company has a well-thought out commercialization strategy at hand. RODMAN & RENSHAW EQUITY RESEARCH 24

- 25. Fibrocell Science, Inc. April 18, 2011 VALUATION Potential Blockbuster Product Azficel-T could probably be premium priced, since the product differentiates itself from other facial injectable products, as it offers a long- estimate the procedure would cost $3K for new patients and $1.2K for returning patients. By 2017, we assume 70% of patients will be returning, and 30% will be new patients. We forecast revenues of $17MM and $40MM by 2012 and 2013, respectively, and ramp up to approximately $1B in sales in its peak penetration year, by 2019. Given the growth in the facial fillers market (Exhibit 17, Page 27), and the fact that azficel-T represents a first-in-class biological treatment for nasolabial folds, we believe sales could probably continue to rise until the end of the biosimilar data protection period in 2023 (Exhibit 18, Page 28). NPV Analysis We performed an NPV analysis of azficel-T. As described above, we assume that azficel-T is launched in 2011 and ramps up to approximately $1B in sales by 2019. We estimated cost of sales to be 60% of revenues in 2011. Those costs could gradually decrease as the company achieves economies of scale. Furthermore, we assume SG&A expenses associated with azficel-T to grow from $10MM in 2011 to $16.5MM in 2012, R&D costs to increase from $6.5MM in 2011 to $9.5MM in 2012, as the company plans to continue its acne scar trials (Exhibit 20, Page 31). At steady state, we assume net margins to be approximately 25% of sales. Applying an annual discount rate of 15% for the commercial risk associated with the drug, a 90% probability of success, and assuming a cash position of $21MM by the end of 2011, we arrive at a total NPV of $306MM, or $3/share. To calculate our NPV/share, we used a fully diluted share count of 105MM. We believe that azficel-T has a potential upside to our valuation due to its differentiated profile as a personalized treatment, and the size of the cosmetic injectable market in the U.S. Additionally, Fibrocell may seek label expansion of azficel-T to other aesthetic and therapeutic indications, such as acne scars, restrictive burn scars and dental applications (Exhibit 19, Page 28). RODMAN & RENSHAW EQUITY RESEARCH 25

- 26. Fibrocell Science, Inc. April 18, 2011 Exhibit 17: Historical Market for Facial Injectable Procedures (All figures in thousands) 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 # Botulinum toxin procedures1 498 1,097 1,600 1,659 2,272 2,837 3,295 3,182 2,775 2,464 2,557 % Growth 120% 46% 4% 37% 25% 16% -3% -13% -11% 4% CAGR (1999-2009) 18% Facial fillers market1 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Calcium hydroxylapatite (Radiance) - 0 0 0 32 70 40 77 119 123 118 Collagen - 592 1,099 783 620 785 221 160 64 58 59 Hyaluronic acid (including Hylaform, Juvederm, Perlane/Restylane) - - - - 116 882 1,194 1,594 1,449 1,263 1,313 Poly-l-latic acid (Sculptra) - - - - - 8 35 45 35 32 40 Polymethyl methacrylate (Artecoll, Artefill) - - - - - - - - 12 11 7 # Facial filler procedures per year2 0 592 1,099 783 769 1,746 1,490 1,876 1,679 1,487 1,537 % Growth in facial filler procedures NA 85% -29% -2% 127% -15% 26% -10% -11% 3% CAGR facial filler procedures (1999-2009) 11% CAGR facial filler procedures (2005-2009) 1% # Total facial injectable procedures (botulinum toxin + facial fillers) 498 1,689 2,699 2,442 3,041 4,583 4,785 5,057 4,454 3,951 4,094 # Patients receiving facial injectable procedures per year2,3 166 563 900 814 1,014 1,528 1,595 1,686 1,485 1,317 1,365 % Growth in patient population receiving facial Injectable procedures 239% 60% -10% 25% 51% 4% 6% -12% -11% 4% CAGR patient population receiving facial injectable procedures (1999-2009) 23% % Market Share Botulinum toxin 100% 65% 59% 68% 75% 62% 69% 63% 62% 62% 62% Calcium hydroxylapatite 0% 0% 0% 0% 1% 2% 1% 2% 3% 3% 3% Collagen 0% 35% 41% 32% 20% 17% 5% 3% 1% 1% 1% Hyaluronic acid 0% 0% 0% 0% 4% 19% 25% 32% 33% 32% 32% Poly-l-latic acid (Sculptra) 0% 0% 0% 0% 0% 0% 1% 1% 1% 1% 1% Polymethyl methacrylate 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Notes: 1 The American Society for Aesthetic Plastic Surgery (ASAPS). 2 Assuming 3 procedures per year 3 The American Society for Aesthetic Plastic Surgery (ASAPS) and Rodman forecasts Source: ASAPS, Rodman & Renshaw Estimates RODMAN & RENSHAW EQUITY RESEARCH 26