GLIO Index

•

0 gefällt mir•457 views

OECD High-level Seminar on Quality Infrastructure Investment Session 4-fraser-hughes-glio

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

This presentation by Cristina Camacho, Head of Cabinet and Head of International Relations, Portuguese Competition Authority, was made during the discussion “Use of Economic Evidence in Cartel Cases” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/egci.

This presentation was uploaded with the author’s consent.

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...OECD Directorate for Financial and Enterprise Affairs

Weitere ähnliche Inhalte

Ähnlich wie GLIO Index

Ähnlich wie GLIO Index (20)

Scott-Macon Aerospace & Defense Monthly Update (November 2018)

Scott-Macon Aerospace & Defense Monthly Update (November 2018)

Scott-Macon Aerospace, Defense and Government Services (Oct 2019)

Scott-Macon Aerospace, Defense and Government Services (Oct 2019)

Scott-Macon Aerospace, Defense and Government Industry Update

Scott-Macon Aerospace, Defense and Government Industry Update

Aerospace, Defense and Government Services Monthly Market Overview

Aerospace, Defense and Government Services Monthly Market Overview

Scott-Macon Aerospace & Defense Market Update (Feb 2018)

Scott-Macon Aerospace & Defense Market Update (Feb 2018)

Scott-Macon Aerospace & Defense Market Update (January 2018)

Scott-Macon Aerospace & Defense Market Update (January 2018)

Mehr von OECD Directorate for Financial and Enterprise Affairs

This presentation by Cristina Camacho, Head of Cabinet and Head of International Relations, Portuguese Competition Authority, was made during the discussion “Use of Economic Evidence in Cartel Cases” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/egci.

This presentation was uploaded with the author’s consent.

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...OECD Directorate for Financial and Enterprise Affairs

This presentation by William E. Kovacic, Global Competition Professor of Law and Policy and Director, Competition Law Center, The George Washington University, was made during the discussion “Ex-post Assessment of Merger Remedies” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/eamr.

This presentation was uploaded with the author’s consent.

Ex-post Assessment of Merger Remedies – KOVACIC – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – KOVACIC – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by John E. Kwoka, Neal F. Finnegan Distinguished Professor of Economics, Northeastern University, was made during the discussion “Ex-post Assessment of Merger Remedies” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/eamr.

This presentation was uploaded with the author’s consent.

Ex-post Assessment of Merger Remedies – KWOKA – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – KWOKA – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Amelia Fletcher CBE, Professor of Competition Policy, University of East Anglia, was made during the discussion “Ex-post Assessment of Merger Remedies” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/eamr.

This presentation was uploaded with the author’s consent.

Ex-post Assessment of Merger Remedies – FLETCHER – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – FLETCHER – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by the OECD Secretariat was made during the discussion “Ex-post Assessment of Merger Remedies” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/eamr.

This presentation was uploaded with the author’s consent.

Ex-post Assessment of Merger Remedies – OECD – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – OECD – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by John Davies, Member, UK Competition Appeal Tribunal, was made during the discussion “Use of Economic Evidence in Cartel Cases” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/egci.

This presentation was uploaded with the author’s consent.

Use of Economic Evidence in Cartel Cases – DAVIES – December 2023 OECD discus...

Use of Economic Evidence in Cartel Cases – DAVIES – December 2023 OECD discus...OECD Directorate for Financial and Enterprise Affairs

This presentation by Simon Roberts, Professor, Centre for Competition, Regulation and Economic Development, University of Johannesburg, was made during the discussion “Use of Economic Evidence in Cartel Cases” held at the 22nd meeting of the OECD Global Forum on Competition on 8 December 2023. More papers and presentations on the topic can be found out at oe.cd/egci.

This presentation was uploaded with the author’s consent.

Use of Economic Evidence in Cartel Cases – ROBERTS – December 2023 OECD discu...

Use of Economic Evidence in Cartel Cases – ROBERTS – December 2023 OECD discu...OECD Directorate for Financial and Enterprise Affairs

This presentation by Serbia was made during the discussion “Alternatives to Leniency Programmes” held at the 22nd meeting of the OECD Global Forum on Competition on 7 December 2023. More papers and presentations on the topic can be found out at oe.cd/atlp.

This presentation was uploaded with the author’s consent.

Alternatives to Leniency Programmes – SERBIA – December 2023 OECD discussion

Alternatives to Leniency Programmes – SERBIA – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Italy was made during the discussion “Alternatives to Leniency Programmes” held at the 22nd meeting of the OECD Global Forum on Competition on 7 December 2023. More papers and presentations on the topic can be found out at oe.cd/atlp.

This presentation was uploaded with the author’s consent.

Alternatives to Leniency Programmes – ITALY – December 2023 OECD discussion

Alternatives to Leniency Programmes – ITALY – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Daniel CRANE, Richard W. Pogue Professor of Law, University of Michigan, was made during the discussion “Out-of-Market Efficiencies in Competition Enforcement” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/omee.

This presentation was uploaded with the author’s consent.

Out-of-Market Efficiencies in Competition Enforcement – CRANE – December 2023...

Out-of-Market Efficiencies in Competition Enforcement – CRANE – December 2023...OECD Directorate for Financial and Enterprise Affairs

This presentation by John DAVIES, Member, Competition Appeal Tribunal UK, was made during the discussion “Out-of-Market Efficiencies in Competition Enforcement” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/omee.

This presentation was uploaded with the author’s consent.

Out-of-Market Efficiencies in Competition Enforcement – DAVIES – December 202...

Out-of-Market Efficiencies in Competition Enforcement – DAVIES – December 202...OECD Directorate for Financial and Enterprise Affairs

This presentation by Nancy ROSE, Head of the Department of Economics and Charles P. Kindleberger Professor of Applied Economics, Massachusetts Institute of Technology (MIT), was made during the discussion “Out-of-Market Efficiencies in Competition Enforcement” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/omee.

This presentation was uploaded with the author’s consent.

Out-of-Market Efficiencies in Competition Enforcement – ROSE – December 2023 ...

Out-of-Market Efficiencies in Competition Enforcement – ROSE – December 2023 ...OECD Directorate for Financial and Enterprise Affairs

This presentation by Nicole ROSENBOOM, Principal, Oxera Consulting LLP, was made during the discussion “Out-of-Market Efficiencies in Competition Enforcement” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/omee.

This presentation was uploaded with the author’s consent.Out-of-Market Efficiencies in Competition Enforcement – ROSENBOOM – December ...

Out-of-Market Efficiencies in Competition Enforcement – ROSENBOOM – December ...OECD Directorate for Financial and Enterprise Affairs

This presentation by Anna TZANAKI, Lecturer in Law, University of Leeds, was made during the discussion “Serial Acquisitions and Industry Roll-ups” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/sair.

This presentation was uploaded with the author’s consent.

Serial Acquisitions and Industry Roll-ups –TZANAKI – December 2023 OECD discu...

Serial Acquisitions and Industry Roll-ups –TZANAKI – December 2023 OECD discu...OECD Directorate for Financial and Enterprise Affairs

This presentation by Sha'ista GOGA, Director, Acacia Economics, was made during the discussion “Serial Acquisitions and Industry Roll-ups” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/sair.

This presentation was uploaded with the author’s consent.

Serial Acquisitions and Industry Roll-ups – GOGA – December 2023 OECD discussion

Serial Acquisitions and Industry Roll-ups – GOGA – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Ioannis KOKKORIS, Chair in Competition Law and Economics and Director, Centre for Commercial Law Studies, Queen Mary University of London, was made during the discussion “Serial Acquisitions and Industry Roll-ups” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/sair.

This presentation was uploaded with the author’s consent.

Serial Acquisitions and Industry Roll-ups – KOKKORIS – December 2023 OECD dis...

Serial Acquisitions and Industry Roll-ups – KOKKORIS – December 2023 OECD dis...OECD Directorate for Financial and Enterprise Affairs

This presentation by the OECD Secretariat was made during the discussion “Serial Acquisitions and Industry Roll-ups” held at the 141st meeting of the OECD Competition Committee on 6 December 2023. More papers and presentations on the topic can be found out at oe.cd/sair.

This presentation was uploaded with the author’s consent.

Serial Acquisitions and Industry Roll-ups – OECD – December 2023 OECD discussion

Serial Acquisitions and Industry Roll-ups – OECD – December 2023 OECD discussionOECD Directorate for Financial and Enterprise Affairs

This presentation by Simonetta VEZZOSO, Associate Professor, Economics Department, University of Trento, was made during the discussion “Competition and Innovation - The Role of Innovation in Enforcement Cases” held at the 141st meeting of the OECD Competition Committee on 5 December 2023. More papers and presentations on the topic can be found out at oe.cd/rbci.

This presentation was uploaded with the author’s consent.

Competition and Innovation - The Role of Innovation in Enforcement Cases – VE...

Competition and Innovation - The Role of Innovation in Enforcement Cases – VE...OECD Directorate for Financial and Enterprise Affairs

This presentation by the OECD Secretariat, was made during the discussion “Competition and Innovation - The Role of Innovation in Enforcement Cases” held at the 141st meeting of the OECD Competition Committee on 5 December 2023. More papers and presentations on the topic can be found out at oe.cd/rbci.

This presentation was uploaded with the author’s consent.

Competition and Innovation - The Role of Innovation in Enforcement Cases – OE...

Competition and Innovation - The Role of Innovation in Enforcement Cases – OE...OECD Directorate for Financial and Enterprise Affairs

Mehr von OECD Directorate for Financial and Enterprise Affairs (20)

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...

Use of Economic Evidence in Cartel Cases – CAMACHO – December 2023 OECD discu...

Ex-post Assessment of Merger Remedies – KOVACIC – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – KOVACIC – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – KWOKA – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – KWOKA – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – FLETCHER – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – FLETCHER – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – OECD – December 2023 OECD discussion

Ex-post Assessment of Merger Remedies – OECD – December 2023 OECD discussion

Use of Economic Evidence in Cartel Cases – DAVIES – December 2023 OECD discus...

Use of Economic Evidence in Cartel Cases – DAVIES – December 2023 OECD discus...

Use of Economic Evidence in Cartel Cases – ROBERTS – December 2023 OECD discu...

Use of Economic Evidence in Cartel Cases – ROBERTS – December 2023 OECD discu...

Alternatives to Leniency Programmes – SERBIA – December 2023 OECD discussion

Alternatives to Leniency Programmes – SERBIA – December 2023 OECD discussion

Alternatives to Leniency Programmes – ITALY – December 2023 OECD discussion

Alternatives to Leniency Programmes – ITALY – December 2023 OECD discussion

Out-of-Market Efficiencies in Competition Enforcement – CRANE – December 2023...

Out-of-Market Efficiencies in Competition Enforcement – CRANE – December 2023...

Out-of-Market Efficiencies in Competition Enforcement – DAVIES – December 202...

Out-of-Market Efficiencies in Competition Enforcement – DAVIES – December 202...

Out-of-Market Efficiencies in Competition Enforcement – ROSE – December 2023 ...

Out-of-Market Efficiencies in Competition Enforcement – ROSE – December 2023 ...

Out-of-Market Efficiencies in Competition Enforcement – ROSENBOOM – December ...

Out-of-Market Efficiencies in Competition Enforcement – ROSENBOOM – December ...

Serial Acquisitions and Industry Roll-ups –TZANAKI – December 2023 OECD discu...

Serial Acquisitions and Industry Roll-ups –TZANAKI – December 2023 OECD discu...

Serial Acquisitions and Industry Roll-ups – GOGA – December 2023 OECD discussion

Serial Acquisitions and Industry Roll-ups – GOGA – December 2023 OECD discussion

Serial Acquisitions and Industry Roll-ups – KOKKORIS – December 2023 OECD dis...

Serial Acquisitions and Industry Roll-ups – KOKKORIS – December 2023 OECD dis...

Serial Acquisitions and Industry Roll-ups – OECD – December 2023 OECD discussion

Serial Acquisitions and Industry Roll-ups – OECD – December 2023 OECD discussion

Competition and Innovation - The Role of Innovation in Enforcement Cases – VE...

Competition and Innovation - The Role of Innovation in Enforcement Cases – VE...

Competition and Innovation - The Role of Innovation in Enforcement Cases – OE...

Competition and Innovation - The Role of Innovation in Enforcement Cases – OE...

Kürzlich hochgeladen

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Kürzlich hochgeladen (20)

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Turbhe Fantastic Escorts📞📞9833754194 Kopar Khairane Marathi Call Girls-Kopar ...

Turbhe Fantastic Escorts📞📞9833754194 Kopar Khairane Marathi Call Girls-Kopar ...

Vip Call Girls Ravi Tailkes 😉 Bhubaneswar 9777949614 Housewife Call Girls Se...

Vip Call Girls Ravi Tailkes 😉 Bhubaneswar 9777949614 Housewife Call Girls Se...

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Kopar Khairane Cheapest Call Girls✔✔✔9833754194 Nerul Premium Call Girls-Navi...

Kopar Khairane Cheapest Call Girls✔✔✔9833754194 Nerul Premium Call Girls-Navi...

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

✂️ 👅 Independent Lucknow Escorts U.P Call Girls With Room Lucknow Call Girls ...

✂️ 👅 Independent Lucknow Escorts U.P Call Girls With Room Lucknow Call Girls ...

Call Girls In Kolkata-📞7033799463-Independent Escorts Services In Dam Dam Air...

Call Girls In Kolkata-📞7033799463-Independent Escorts Services In Dam Dam Air...

✂️ 👅 Independent Bhubaneswar Escorts Odisha Call Girls With Room Bhubaneswar ...

✂️ 👅 Independent Bhubaneswar Escorts Odisha Call Girls With Room Bhubaneswar ...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7

Dubai Call Girls Deira O525547819 Dubai Call Girls Bur Dubai Multiple

Dubai Call Girls Deira O525547819 Dubai Call Girls Bur Dubai Multiple

Vip Call Girls Rasulgada😉 Bhubaneswar 9777949614 Housewife Call Girls Servic...

Vip Call Girls Rasulgada😉 Bhubaneswar 9777949614 Housewife Call Girls Servic...

Strategic Resources May 2024 Corporate Presentation

Strategic Resources May 2024 Corporate Presentation

GIFT City Overview India's Gateway to Global Finance

GIFT City Overview India's Gateway to Global Finance

GLIO Index

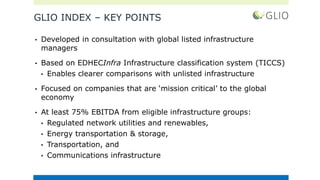

- 1. GLIO INDEX – KEY POINTS • Developed in consultation with global listed infrastructure managers • Based on EDHECInfra Infrastructure classification system (TICCS) • Enables clearer comparisons with unlisted infrastructure • Focused on companies that are ‘mission critical’ to the global economy • At least 75% EBITDA from eligible infrastructure groups: • Regulated network utilities and renewables, • Energy transportation & storage, • Transportation, and • Communications infrastructure

- 2. GLIO INDEX - BREAKDOWNS 2 Nov 30, 2020 Group Full MC ($M) Full MC (%) FF MC ($M) FF MC (%) Yield Beta Utilities 1,494,942 51.5% 1,341,502 53.6% 3.7% 0.63 Transportation 772,540 26.6% 642,726 25.7% 2.8% 1.06 Comms Infra 269,849 9.3% 242,237 9.7% 3.7% 0.80 Energy T&S 259,405 8.9% 237,996 9.5% 6.4% 1.04 Renewables 104,634 3.6% 38,610 1.5% 3.1% 0.77 Grand Total 2,901,370 100.0% 2,503,072 100.0% 3.7% 0.81 Sector Full MC ($M) Full MC (%) FF MC ($M) FF MC (%) Yield Beta Electric Utilities 1,175,693 40.5% 1,084,909 43.3% 4.1% 0.59 Railroads 423,797 14.6% 399,988 16.0% 1.8% 0.96 Energy T&S 259,405 8.9% 237,996 9.5% 6.4% 1.04 Telecom Infra 263,857 9.1% 237,283 9.5% 2.9% 0.66 Gas Utilities 236,938 8.2% 182,062 7.3% 3.0% 0.70 Toll-roads 154,872 5.3% 115,678 4.6% 2.7% 0.95 Water Utilities 82,312 2.8% 74,531 3.0% 2.8% 0.70 Airports 116,975 4.0% 60,699 2.4% 1.5% 1.30 Passenger Rail 58,531 2.0% 58,531 2.3% 1.5% 0.81 Renewables 104,634 3.6% 38,610 1.5% 3.1% 0.77 Marine Ports 18,365 0.6% 7,830 0.3% 8.3% 1.05 Satellites 5,992 0.2% 4,955 0.2% 7.4% 1.36 Grand Total 2,901,370 100.0% 2,503,072 100.0% 3.7% 0.81

- 4. GLIO/GRESB ESG INDEX • First specialist infrastructure index with ESG filter • Governed by GLIO Index Committee • All GLIO Index stocks included • Weighted by GRESB Public Disclosure Score (Transparency) Company Band (3 years PD results) American Tower 90% (large improvement) CN 90% (consistent) Southern Co 80% (consistent) WEC Energy 80% (consistent) Transurban 90% (best actual score 89) ONEOK 80% (large improvement) Cheniere Energy 60% (large improvement) Zurich Airport 70% (consistent)

- 5. INFRASTRUCTURE INVESTMENT TRUST (IIT) • Based on Real Estate Investment Trust (REIT) • But, clearly defined for infrastructure • Applied to mission critical economic infrastructure