Dublin rental and sales Quarter 1 2016

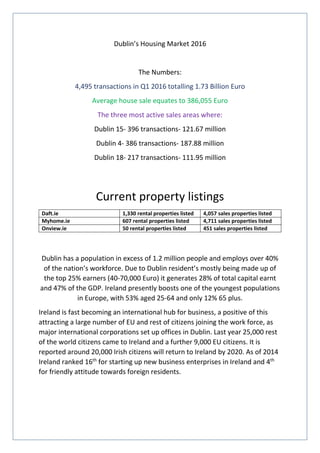

- 1. Dublin’s Housing Market 2016 The Numbers: 4,495 transactions in Q1 2016 totalling 1.73 Billion Euro Average house sale equates to 386,055 Euro The three most active sales areas where: Dublin 15- 396 transactions- 121.67 million Dublin 4- 386 transactions- 187.88 million Dublin 18- 217 transactions- 111.95 million Current property listings Daft.ie 1,330 rental properties listed 4,057 sales properties listed Myhome.ie 607 rental properties listed 4,711 sales properties listed Onview.ie 50 rental properties listed 451 sales properties listed Dublin has a population in excess of 1.2 million people and employs over 40% of the nation’s workforce. Due to Dublin resident’s mostly being made up of the top 25% earners (40-70,000 Euro) it generates 28% of total capital earnt and 47% of the GDP. Ireland presently boosts one of the youngest populations in Europe, with 53% aged 25-64 and only 12% 65 plus. Ireland is fast becoming an international hub for business, a positive of this attracting a large number of EU and rest of citizens joining the work force, as major international corporations set up offices in Dublin. Last year 25,000 rest of the world citizens came to Ireland and a further 9,000 EU citizens. It is reported around 20,000 Irish citizens will return to Ireland by 2020. As of 2014 Ireland ranked 16th for starting up new business enterprises in Ireland and 4th for friendly attitude towards foreign residents.

- 2. Dublin and Cork have long been the focus for new developments due to their populations, accounting for 42% of new build applications and 35% new completions. 63% of residents are now residing in urban areas, up from 50% in the 1980’s (Ireland is still below the EU28 average of 75%). Dublin had 5.38 billion Euro worth of planning applications in 2015 (up 40%), far above that of Leinster 2.77 billion Euro, Connaught and Ulster 1.24 billion Euro and Munster down 5% to 1.88 billion Euro. Construction employment during the peak year of 2007 was 386,000 and 19% of the employment force, by 2014 this had decreased to 160,000 and 8%. The upside since 2014 is that expenditure on construction output has increased from 9.55 billion Euro to 12.55 billion Euro last year, with a projected spend of 15 billion by the end of the year. Presently, there is only 27 houses on sale per 10,000 in Dublin compared to 62 per 10,000 outside of the capital. The target age ranges most active in the buying market is 35-44 with 59.8% ownership with an existing mortgage, closely followed by 49% (45-54). These two age ranges unlike 0-24 and 25-34, have more ownership than private renting (19.4% and 10.3% private renting). The representation of cash buyers is three times that of 0-24 for 35-44 (9.1%) and almost ten times higher at 45-54 (29.6%). In 2015, Dublin equated to 59% of all the residential property transactions. The market value of the residential property market has increased year on year from 2013 (almost doubling) rising from 6 billion to 10.6 billion Euro (159 million Euro commission for real estate agencies) As the house prices in Dublin continue to remain higher than that of the rest of the country, this trend shows no signs of stopping any time soon. Over 75% of properties brought in 2015 where over the 220,000 Euro value (the national average selling price) The Greater Dublin Area is projected to see its population increase by 400,000 Irish citizens and a further 231,000 migrants by 2031. This level of population is not predicted elsewhere across Ireland, with the Mid West the next biggest population growth of 200,000 reaching 700,000 (currently at 500,000.) Most recently the consensus of 2016 reported a 4.8% growth in population of Dublin City and 5.1% South Dublin since 2011. Fingal experienced the largest population increase across the country at 8.1%. Across the whole of Ireland the total housing stock has only increased by 0.9% (up 18,891 houses) from 2,003,914 to 2,022,895 from 2011 to 2016. This is similar to the number of occupied houses, only seeing a 3% improvement over the same time period (1,669,180 to 1,718,465).

- 3. Sales by area breakdown Secondary homes sales are far above that of new homes, due to the slow construction of new residential units. The south side of Dublin has performed better than the north side, in both transactions 1,698 to 1,324 and total sales 760.21 million to 420.52 million. In the south, the average house sale price is 382,546 Euro whilst the North side 311,658 Euro. Since 2013, Dublin’s Residential Price Property Index has increased from 63.4 to 84.5 (still far below is 2007 peak of 133), far out performing that of the rest of Ireland at 78.9. Despite a price increase of 7.1% on 2015, house and apartment prices are still 35.2% below the peak prices of 2007. House prices are 33% below, whilst apartments 41.5%. 0 50 100 150 200 250 300 350 400 450 D1 D2 D3 D4 D5 D6 D7 D8 D9 D10D11D12D13D14D15D16D17D18D20D22D24 transaction breakdown New Home Sales Secondary Home Sales

- 4. Dublin construction output has remained low for some time. Apartments in both south Dublin and the Dublin city centre have dramatically reduced (656 to 62 and 657 to 322). House completions shows a reverse trend as output has increased (37 to 64 and 92-109). This is reflected in sales transactions figures of 194 new homes and 2,822 secondary homes. The top three areas with the most new home sales are Dublin 15 (39), Dublin 18 (31) and Dublin 16 (25), with the least active Dublin 10, Dublin 22 and Dublin 12 (all 0). New home sales in the south and north of Dublin are very similar at 99 to 95. Residential new builds in Ireland average between 1,250- 1.750 Euro per SQM, with the rest of Europe between 1,150 to 3,000 Euro. The most expensive builds in Ireland remain high rise apartments at 1,750 Euro per SQM, whilst townhouses cheapest at 1,250 Euro. Dublin had 165 of the 337 new residential projects in either planning or construction stage from end of 2015 to the February 2016 (48.96%) Nama in 2016 has 2,806 hectares in receivership with 60% of this located in Dublin, Kildare, Meath and Wicklow. This land will provide enough space for an additional 80,000 new homes. Ireland has always favoured dwelling in semi- detached houses rather than apartments or flats, house construction always accounted for over 75% of new residential builds year on year as apartments/flats barely make 25%. Since 2010, 9,000 residential units have been brought in bulk by investors rather than families (This is in just over 300 deals) A bulk of the 9,000 units 0 100 200 300 400 500 600 700 Housing completons Housing Scheme Apartment Completions Dublin Completions by Type 2014- 2016 South Dublin 2014 South Dublin 2015 South Dublin 2016 Dublin City Centre 2014 Dublin City Centre 2015 Dublin City Centre 2016

- 5. were purchased in Dublin, Cork and Galway worth 1.9 Billion Euro. Dublin has contributed 1.6 billion alone of the 1.9 billion Euro invested in residential property. The Journal.ie recently reported that one in every forty residents in Dublin is a technically a millionaire, ranking it 10th across all the European cities (the survey used to calculate this was completed by spears magazine) meaning there is nearly 32,000 millionaires in the capital city compared to 4,473 homeless people. It is believed that this newly found wealth is down to the growth and expansion of IT tech firms over the last few years. South Dublin has the lowest vacancy rates for homes across Ireland at 4% according to the 2016 consensus, Dublin city (9%) and Fingal (6%) also displayed a strong performance. The worst vacancy rates in Ireland were Leitrim (30%), Donegal (28%) and Kerry (24%)

- 6. Average sale price per area The areas boosting the highest average sale prices were: Dublin 24- 591,512 Euro Dublin 14- 522,708 Euro Dublin 18- 515,942 Euro 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 D1 D2 D3 D4 D5 D6 D7 D8 D9 D10 D11 D12 D13 D14 D15 D16 D17 D18 D20 D22 D24 Average sale Price (Euro Thousands)

- 7. Total sales per area The three areas within Dublin generating the most sales value are: Dublin 4- 187.88 million Euro Dublin 15- 121.67 million Euro Dublin 18- 111.95 million Euro 0 20 40 60 80 100 120 140 160 180 200 D1 D2 D3 D4 D5 D6 D7 D8 D9 D10D11D12D13D14D15D16D17D18D20D22D24 Total Sales (millions)

- 8. Renting in Dublin Rents are now double that the rest of the country at 1,435 Euro compared to 727 Euro (up 8% on 2014 prices) with a projected rental increase of 7-8% by the end of the 2016. Sherry Fitzgerald reported that since 2011 over 40,000 buy to let properties have been sold and 45% of the sales transactions last year involved buy to let properties. Only 18% of the properties were brought by fellow investors and 12% repossessions. The RTB (Formerly PRTB) has called for rent expenditure to be closer to the EU directive of 30%, as currently Ireland is the second highest in Europe at 37- 40%. Dublin residences are paying anywhere from 38% to 49%, whilst Limerick is only 21%. Home ownership In Ireland has reduced from 78% in 2006 to 68.6% in 2014. The target market for landlords is mid 20’s to late 30’s as they are more likely to be renting. The first time buyer’s age is creeping nearer to 40 now, 0-24 shows 74.2% private renting followed by 25-34 at 44.3%. The age group of 35- 44 shows a much smaller percentage privately renting (19.4%) compared to 59.8% owning property with an outstanding mortgage. The return of institutional investors has been a welcome one, but it is believed they are one of the main reasons that the rental prices have increased. Institutional investors such as REIT, IRES, Hibernia, US investment firm Starwood and Kennedy Wilson have been very active in the market. They have modernised the rental market by buying in bulk, getting a better price per unit and offering modern fit outs desired by the rental market. Very few landlords have the cash or equity to acquire property at the level of these investors, but the next best thing is the follow where they purchase. The properties due to their location and finishing standard will increase your chances of better rental yields over the long term. Locations such as Sandyford, Grand Canal, The Beacon, The Gas Works, Dundrum and Leopardstown have registered lots of interest and property investment. Landlords that purchase in areas such as

- 9. these will be working with a target market that accepts the current rental market conditions and the rental fees that come with living in a desirable location. Secondary Homes New Homes 0% 2% 4% 6% 8% 10% 12% 14% One Bedroom Apartments Two Bedroom Apartments Three Bedroom Semi Detached House Four Bedroom Semi Detached House Rent increase since 2014

- 10. 2 bedrooms apartments show the most rental income growth over 2015, with 11.21% to 5.1% 1 bedroom apartments demonstrated a similarly strong performance with 9.84% to 3.46% growth. 3 bedrooms continued the trend of 1 and 2 bedroom apartments with 9.79% to 5.07% growth. Dublin 17 was the only area to have a decrease in rental fees in 1,2 and 3 bedrooms (-0.76%, -1.84% and – 1.98%). In comparison to this Dublin 22, Dublin 13 and Dublin achieved the highest rental growth in all bedrooms. The rental increase ranged from 11.21% to 9.25%. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% One Bedroom Apartment Two Bedroom Apartment Two Bedroom Townhouse Three Bedroom Townhouse Three Bedroom Semi- Detached House Four Bedroom Semi Detached House Four/Five Bedroom Detached House Rent increase since 2014

- 11. Conclusion Any areas with low rental increases and low sales prices, as you can imagine have a low number of properties listed (Dublin 17- 24 and Dublin 10- 23). Dublin 18, Dublin 15 and Dublin 4 with the highest sales activity displays the highest number of listings, as buyers demonstrate a higher believe to sell on the current market and gain a sizeable profit (296, 455 and 303). Only Dublin 4 has a relatively close number of sales to rental properties (162 to 141), with Dublin 18 and Dublin 15 having a combined listing numbers of 595 sales properties to 156 rentals. In terms of the areas with the highest rental growth including Dublin 22, Dublin 13 and Dublin 18 all vary in the amount of Listings. As previously discussed Dublin 18, is a top performer in most field (transactions, rental growth and sales price) having 217 more than Dublin 22 with top rental increase but lowest sales price. Dublin 13 surprisingly despite the second highest rental growth in Dublin, has only 29 rental listed properties compared to 159 sales. Dublin 22, Dublin 13 and Dublin 18 all have more sales listings rentals across the board with 131 combined rental listings and 432 sales listings. In complete contract the three areas in Dublin with lowest rental increase (Dublin 17, Dublin 6 and Dublin 2) have more rental properties (230) than that of sales (158) These findings raise some important questions, in the areas of high growth rental why aren’t more people becoming landlords? This could be for a multitude of reasons: 1) Not enough confidence the rental market will continue to grow under its current levels for much longer 2) With the listed rental stock far short of that of listed sales properties, property owners would rather take advantage of the short term growth, rather than risk long term growth when construction of new residential units pick up. 3) Lack of housing shortage that can listed on the market

- 12. The three above reasons, could be a clear indicator and road map for the best location to build new residential developments. I believe that landlords are starting to realise the rent increases are a great concern to attracting future tenants. The rental market will only continue to get smaller, as more and more people are forced to rent outside of Dublin and commute to work. There is a fine line between realistic rental growth and rental growth that wipe out a market. Unless the Government, local authorities and developers can find a solution that makes the property market desirable once again, construction levels despite small increases won’t be helping anytime soon to adjust the high levels of rental growth and strain it puts on the shoulders of Dublin residents. Current property owners may also be in two minds, you have the option to sell your property now for an increased amount and make good profit. But then you face the dilemma that all buyers in the market encounter, you have to purchase a new property often above its true market value. So whatever profit you gained form originally selling your project can be wiped out buying the new property. Long term home owners will be aware that what you got for your money 15-20 years ago is a lot more than what you currently get. Unless you are selling a property in the higher end of the market, new buyers could potentially have to downsize for their property. The old notion of upgrading your property until retirement is now a notion of the past, often getting a mortgage approval or even getting on the property ladder is very difficult. First time buyers on average in Dublin have to save up at least 50,000 Euros as well as pay double the rent of the rest of the country, so it can take up to 10 years to even have the deposit saved up. First time buyer’s average age in 2005 was 29, now it is 33. Dublin house prices are far above that of the rest of country, and developers aren’t building at the same rate as 2006-2007 peak years as their profit per unit is massively reduced. Houses in Ireland have been getting progressively smaller, like the UK now the smallest houses in the EU28 (89 SQM to 87 SQM), whilst countries such as Denmark have seen their property sizes increase from 109 SQM to 137 SQM. Increased levels of repossessions (200% on 2014 numbers) and the fact 188,000 mortgages are in arrears of up to 1 year, has seen potential first time buyers prefer to stay renting and potential home owners play it safe and not risk being in an unfortunate position by upgrading their property. So I predict that the rental market will only become bigger and the sales market shrink until all this uncertainty is addressed properly from the banks and the Government. The property market in Ireland will become more investor friendly especially in residential property, it is well reported that residential investment dropped off in 1970’s due to low yield returns. The modern property market offers a great investment for investors looking to buy in bulk, or purchase multiple rental properties that don’t reside in Ireland. The

- 13. property prices and rental growth of Dublin alone is one that will remain strong for the foreseeable future and a great acquisition for any investors looking to increase their property portfolio. Investors will be far more attracted to the long term cash potential than that of a property owner with one or two properties. The banks need to play a large part in this, as it seems they have less of a risk appetite to fund investors and landlords. Landlords and Investors face a number of critical factors being the negative press they are currently receiving, and also the risk v reward battle as their maintenance and insurance fees increase. So despite the rental increases posted in 2015, their return of investment is not following suit. The current rental market is now geared more towards your higher earners, meaning that the quality of properties within the rental market is now of a better standard. It is a prime time for landlords and investors with cash and equity to enter the market, as they have less reliance on acquiring credit from banks and can take advantage of the long term market benefits. Produced by Matthew Scott Senior Commercial Sales Manager Acquaint/4PM Email: matthew@4pm.ie Mobile: +353 (0)874641388 Sources Daft Myhome Eurostat The Irish Independent The Irish Times Irish Telegraph The 2016 consensus