GERMANY FORUM 2016 KEY REAL ESTATE ISSUES

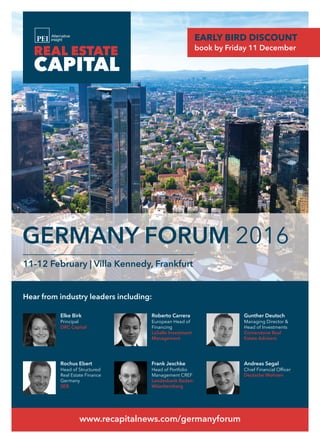

- 1. GERMANY FORUM 2016 www.recapitalnews.com/germanyforum Hear from industry leaders including: 11-12 February | Villa Kennedy, Frankfurt Elke Birk Principal DRC Capital Roberto Carrera European Head of Financing LaSalle Investment Management Gunther Deutsch Managing Director & Head of Investments Cornerstone Real Estate Advisers Rochus Ebert Head of Structured Real Estate Finance Germany SEB Frank Jeschke Head of Portfolio Management CREF Landesbank Baden- Wüerttemberg Andreas Segal Chief Financial Officer Deutsche Wohnen EARLY BIRD DISCOUNT book by Friday 11 December

- 2. www.recapitalnews.com/germanyforum AGENDA | DAY ONE: THURSDAY 11 FEBRUARY 8.20 Registration & coffee 9.00 REC Welcome 9.10 Opening comments from the Chair Alexander Fischbaum, Founder & Lead Advisor, AF Advisory 9.20 Keynote address The German economy and its impact on CRE 9.50 Opening panel session Germany: future growth prospects of a two-tier market • Domestic vs foreign demand for real estate investments • Evaluating and managing risk within the perceived safe haven • The question of liquidity: generating returns in smaller regional markets • The availability and cost of debt across sectors and regions • Where are we in the real estate cycle? Are lenders becoming more cautious? Bernd Bechheim, Head of Asset Management & Transactions, Continental Europe, Aberdeen Asset Management Deutschland Gunther Deutsch, Managing Director & Head of Investments, Cornerstone Real Estate Advisers Juergen Helm, Director, Head of Real Estate Germany, HSBC Trinkaus & Burkhardt Andreas Segal, Chief Financial Officer, Deutsche Wohnen 10.35 Coffee & networking 11.05 Panel session Debt funds: the role of non-banks in real estate financing • Raising capital: what debt funds are out there? • Do mezzanine funds still make sense in this market given how returns have compressed? • Risk vs return expectations: are real estate loans a good alternative to corporate and government bonds? • How is regulation impacting debt funds? AIFMD implementation/ Basel III • Deal flow and performance: challenges debt fund managers face Elke Birk, Principal, DRC Capital 11.50 Panel session New opportunities in the residential sector • Where are the current and future hotspots across Germany? • Expected returns in comparison to other asset classes • Mietpreisbremse (cap on rent increase) and its influence on your investment decisions • Lenders’ willingness to finance residential projects • Government’s involvement: is there a framework in place to facilitate development? Nikolai Dëus-von Homeyer, Managing Director, NAS Invest Marcus Eilers, Head of Residential Asset Management, Round Hill Capital Thomas Meyer, Chief Executive Officer, WERTGRUND Immobilien Christian Windfuhr, Chief Executive Officer, Grand City Properties 12.40 Lunch 13.40 Roundtable sessions A series of interactive roundtable discussions will allow you to learn and debate with attendees to get to the heart of the issues affecting the real estate community. Roundtable one - NPLs • Where are the distressed opportunities in Europe? • Buying NPLs and portfolios of NPLs • Securing finance to buy NPLs • What are the best strategies: fix and sell, or long term hold? Roundtable two - CMBS • Is CMBS relevant in the financing of European real estate debt today? • Are there assets and jurisdictions that are best suited for a CMBS? • Predictions for issuance volumes in 2016 14.40 Coffee & networking 15.10 Data presentation German commercial real estate market outlook 15.45 Panel session Germany’s finance market: fierce competition, low margins and strategies for finding value • Risks and ‘no-go’ geographical zones and assets: can everything with a strong sponsor and a sensible business plan be financed now? Where is debt pricing and where is it heading? • Challenges ahead: from regulation to interest rate hikes. What do lenders want to see in structures to future-proof today’s loans? • Germany’s senior syndication market • Challenges and opportunities for international banks in Germany • Going abroad: are German banks looking outside home borders for profit? Rochus Ebert, Head of Structured Real Estate Finance Germany, SEB Frank Jeschke, Head of Portfolio Management CREF, Landesbank Baden-Württemberg Norbert Kellner, Head of Debt Capital Markets & Sales Management, Helaba Raimund Frühmorgen, Managing Director, UniCredit Bank Helmut Mühlhofer, Head of Debt & Capital Markets, Allianz Real Estate Alexander Saur, General Manager, Natixis Pfandbriefbank

- 3. www.recapitalnews.com/germanyforum AGENDA | DAY TWO: FRIDAY 12 FEBRUARY 16.30 Closing keynote interview Entering the German real estate market: finding the right partner • Do investors today have different requirements regarding their local partners? • What role does the local partner play? • Setting up funds and partners in Germany: challenges and opportunities 17.00 Cocktail reception 8.40 Coffee & networking 9.10 Welcome from the Chair Alexander Fischbaum, Founder & Lead Advisor, AF Advisory 9.20 Panel session Borrowers’ perspective on sourcing debt • What are the biggest changes that have been seen in terms of sourcing finance in the last 12 months • Development financing/ refinancing/ acquisition financing: current requirements for loans • Relationship lending: does it really exist or is lending purely transaction driven? What are the key characteristics to look for in a lender • Managing leverage, deciding how much debt to take and diversifying funding sources • Banks vs alternative forms of financing: which do borrowers prefer and what are the pros and cons of each Roberto Carrera, European Head of Financing, LaSalle Investment Management Hugh Fraser, Director, M7 Real Estate Fabian John, Head of Corporate Finance, IVG Immobilien Barkha Mehmedagic, Head of Group Finance & Treasury, Commerz Real 10.05 Panel session Investor confidence in Germany • Arrival of long-term foreign capital: what assets/ risk profiles are investors after? Will the momentum continue? • Return expectations and competition levels: Germany vs UK vs France • Yield compression: is there still scope for a further fall in the near future? • Performance of secondary and tertiary markets • Student housing, medical service centres, elderly homes: opportunities in alterative sectors Rodney Bysh, Joint Chief Executive Officer, Cording Real Estate Group Udo Stöckl, Managing Director & Principal, Avison Young 10.50 Presentation Lending against operating assets: underwriting and structuring considerations 11.15 Coffee & networking 11.40 Panel session Starting new developments in Germany: is the timing right? • Development opportunities across German cities/ sectors • ‘Mega-schemes’: who is doing them and how are they being funded? • Who is lending on development projects and on what terms? What do developers need to be able to convince lenders to back them? • Construction financing: pre-let or speculative? Achieving a higher yield in today’s competitive market • The role of alternative lenders and the use of mezzanine debt in development projects 12.30 Closing keynote interview 13.00 Lunch & close of conference Great opportunity to meet up with senior real estate professionals. Perfect mix of panel discussions and networking time. Frank Jeschke, Head of Portfolio Management CREF, Landesbank Baden-Württemberg VENUE INFORMATION Villa Kennedy Villa Kennedy is set in the exclusive neighbourhood of Sachsenhausen, just off the Main River. Once a grand family home, Villa Kennedy is now the embodiment of a modern Frankfurt. Villa Kennedy is a short stroll from Museum Embankment and a mere 10-minute drive from the airport. Address: Kennedyallee 70 60596 Frankfurt, Germany Tel: +49 69 7171 20

- 4. www.recapitalnews.com/germanyforum REASONS TO ATTEND Co-sponsor: TO DISCUSS SPONSORSHIP OPPORTUNITIES CONTACT: Jane Popova | Senior Conference Producer, Real Estate Events – EMEA T: + 44 (0)20 7566 5475 E: jane.p@peimedia.com Discover borrowers’ perspective on sourcing debt Understand how borrowers manage leverage, decide on how much debt to take and diversify funding sources. We will explore what matters to investors when it comes to choosing which lender to work with and what type of financing they prefer.1 Understand the current lending landscape Hear from German and international lenders as they discuss debt pricing, senior syndication and strategies for finding value in an overly competitive real estate market. Discuss potential challenges that lie ahead and discover what lenders can do to future-proof today’s loans.2 Network with the most influential industry figures Real Estate Capital Germany Forum has the connections and industry reach to help you get ahead for 2016 and beyond. Interact, catch up with colleagues and make new connections during our open roundtables, networking breaks and on stage panel debates.3 REC Germany is a great conference bringing together classic debt capital with the new alternative world of financing. For us, a pioneer in this business, it’s a must-attend. Curth Flatow, Managing Partner, Flatow Advisory Partners

- 5. www.recapitalnews.com/germanyforum Bernd Bechheim Head of Asset Management & Transactions, Continental Europe Aberdeen Asset Management Deutschland Elke Birk Principal DRC Capital Rodney Bysh Joint Chief Executive Officer Cording Real Estate Group Roberto Carrera European Head of Financing LaSalle Investment Management Nikolai Dëus-von Homeyer Managing Director NAS Invest Gunther Deutsch Managing Director & Head of Investments Cornerstone Real Estate Advisers Rochus Ebert Head of Structured Real Estate Finance Germany SEB Marcus Eilers Head of Residential Asset Management Round Hill Capital Alexander Fischbaum Founder & Lead Advisor AF Advisory Hugh Fraser Director M7 Real Estate Raimund Frühmorgen Managing Director UniCredit Bank Juergen Helm Director, Head of Real Estate Germany HSBC Trinkaus & Burkhardt Frank Jeschke Head of Portfolio Management CREF Landesbank Baden- Wüerttemberg Norbert Kellner Head of Debt Capital Markets & Sales Management Helaba Thomas Meyer Chief Executive Officer WERTGRUND Immobilien Helmut Mühlhofer Head of Debt & Capital Markets Allianz Real Estate Alexander Saur General Manager Natixis Pfandbriefbank Andreas Segal Chief Financial Officer Deutsche Wohnen Udo Stöckl Managing Director & Principal Avison Young Christian Windfuhr Chief Executive Officer Grand City Properties Barkha Mehmedagic Head of Group Finance & Treasury Commerz Real SPEAKERS INCLUDE:

- 6. Cancellation policy: please visit the website for full details www.recapitalnews.com/terms-conditions If you’re an institutional investor you may be eligible for a complimentary pass. Email jane.p@peimedia.com for further details Full rate after Friday 11 December Early bird prices valid until Friday 11 December Pricing options One delegate £1,995£1,495 Further discounts apply for extra delegates. Call for more details: +44 (0)20 7566 5445 Two delegates £3,990£2,990 Three delegates £5,785£4,485 Save £500 £1,000 £1,300 3 WAYS TO REGISTER www.recapitalnews.com/ germanyforum customerservices@ peimedia.com +44 (0)20 7566 5445 SECURE YOUR PLACE TODAY: ATTENDING COMPANIES FROM 2015 INCLUDED: • Aareal Bank • Allianz Real Estate • Apollo Global Management • Avison Young • AXA Real Estate • Berlin Hyp • BNP Paribas • Bruton Capital • Caerus Debt Investments • Capita Asset Services • Cerberus Deutschland • Chenavari Investment Managers • Commerz Real • Debt Exchange Inc • DekaBank Deutsche Girozentrale • Deutsche Asset and Wealth Management • Deutsche Bank • Deutsche Hypo • Deutsche Pfandbriefbank • Deutsche Wohnen • DRC Capital • ECE Projektmanagement • Grand City Properties • GreenOak • Helaba • HSBC Trinkaus & Burkhardt • ING Bank • Investa Holding • IVG Immobilien • Landesbank Baden-Wurttemberg • LaSalle Investment Management • M&G Investment Management • Macquarie Bank • Muenchener Hypothekenbank • Natixis Pfandbriefbank • PAMERA Cornerstone Real Estate Advisers • Round Hill Capital • UniCredit Bank • Varde Partners Europe • Westgrund