Ld2 124

•Als DOCX, PDF herunterladen•

0 gefällt mir•23 views

Types of Business entities

Melden

Teilen

Melden

Teilen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

Advantages and disadvantages of 3 types of businesses shikarimartin

Advantages and disadvantages of 3 types of businesses shikarimartin

Sole Proprietorship - Partnership - Corporation Advantages And Disadvantages

Sole Proprietorship - Partnership - Corporation Advantages And Disadvantages

Register a limited liability partnership (llp) in india

Register a limited liability partnership (llp) in india

Ähnlich wie Ld2 124

An informative article outlining the key differences between a Private Limited Company and a Limited Liability Partnership, alongside the respective advantages and disadvantages of each.What are the differences between a Private Limited Company and a Limited Liab...

What are the differences between a Private Limited Company and a Limited Liab...Wisteria Formations Limited

Ähnlich wie Ld2 124 (20)

Choosing the Right Business Structure for Your Small Business in Texas

Choosing the Right Business Structure for Your Small Business in Texas

What are the differences between a Private Limited Company and a Limited Liab...

What are the differences between a Private Limited Company and a Limited Liab...

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

Call Girls Pune Just Call 9907093804 Top Class Call Girl Service Available

Call Girls Pune Just Call 9907093804 Top Class Call Girl Service Available

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

Ensure the security of your HCL environment by applying the Zero Trust princi...

Ensure the security of your HCL environment by applying the Zero Trust princi...

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

RSA Conference Exhibitor List 2024 - Exhibitors Data

RSA Conference Exhibitor List 2024 - Exhibitors Data

Ld2 124

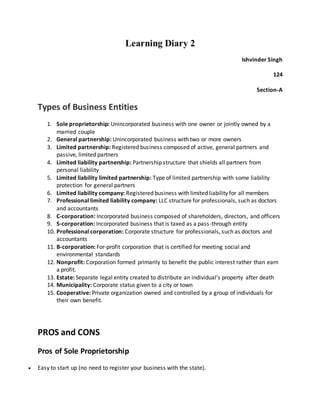

- 1. Learning Diary 2 Ishvinder Singh 124 Section-A Types of Business Entities 1. Sole proprietorship: Unincorporated business with one owner or jointly owned by a married couple 2. General partnership: Unincorporated business with two or more owners 3. Limited partnership: Registered business composed of active, general partners and passive, limited partners 4. Limited liability partnership: Partnership structure that shields all partners from personal liability 5. Limited liability limited partnership: Type of limited partnership with some liability protection for general partners 6. Limited liability company: Registered business with limited liability for all members 7. Professional limited liability company: LLC structure for professionals, such as doctors and accountants 8. C-corporation: Incorporated business composed of shareholders, directors, and officers 9. S-corporation: Incorporated business that is taxed as a pass-through entity 10. Professional corporation: Corporate structure for professionals, such as doctors and accountants 11. B-corporation: For-profit corporation that is certified for meeting social and environmental standards 12. Nonprofit: Corporation formed primarily to benefit the public interest rather than earn a profit. 13. Estate: Separate legal entity created to distribute an individual’s property after death 14. Municipality: Corporate status given to a city or town 15. Cooperative: Private organization owned and controlled by a group of individuals for their own benefit. PROS and CONS Pros of Sole Proprietorship Easy to start up (no need to register your business with the state).

- 2. No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc. You can deduct most business losses on your personal tax return. Tax filing is easy—simply fill out and attach Schedule C-Profit or Loss from Business to your personal income tax return. Cons of Sole Proprietorship As the only owner, you’re personally liable for all of the business’s debts and liabilities— someone who wins a lawsuit against your business can take your personal assets (your car, personal bank accounts, even your home in some situations). There’s no real separation between you and the business, so it’s more difficult to get a business loan and raise money (lenders and investors prefer LLCs or corps). It’s harder to build business credit without a registered business entity. Pros of General Partnership Easy to start up (no need to register your business with the state). No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc. You don’t need to absorb all the business losses on your own because the partners divide the profits and losses. Owners can deduct most business losses on their personal tax returns. Cons of General Partnership Each owner is personally liable for the business’s debts and other liabilities. In some states, each partner may be personally liable for another partner’s negligent actions or behavior (this is called joint and several liability). Disputes among partners can unravel the business (though drafting a solid partnership agreement can help you avoid this). It’s more difficult to get a business loan, land a big client, and build business credit without a registered business entity. Pros of Limited Partnership An LP is a good option for raising money because investors can serve as limited partners without personal liability. General partners get the money they need to operate but maintain authority over business operations. Limited partners can leave anytime without dissolving the business partnership.

- 3. Cons of Limited Partnership General partners are personally responsible for the business’s debts and liabilities. More expensive to create than a general partnership and requires a state filing. A limited partner may also face personal liability if they inadvertently take too active a role in the business. Pros of C-corporation Owners (shareholders) don’t have personal liability for the business’s debts and liabilities. C-corporations are eligible for more tax deductions than any other type of business. C-corporation owners pay lower self-employment taxes. You have the ability to offer stock options, which can help you raise money in the future. Cons of C-corporation More expensive to create than sole proprietorships and partnerships (filing fees range from $100 to $500 based on which state you’re in). C-corporations face double taxation: The company pays taxes on the corporate tax return, and then shareholders pay taxes on dividends on their personal tax returns. Owners cannot deduct business losses on their personal tax return. There are a lot of formalities that corporations have to meet, such as holding board meetings and shareholder meetings, keeping meeting minutes, and creating bylaws. Pros of S-corporation Owners (shareholders) don’t have personal liability for the business’s debts and liabilities. No corporate taxation and no double taxation: An S-corp is a pass-through entity, so the government taxes it much like a sole proprietorship or partnership. Cons of S-corporation Like C-corporations, S-corporations are more expensive to create than both sole proprietorships and partnerships (requires registration with the state). There are more limits on issuing stock in S-corps vs. C-corps. You still need to comply with corporate formalities, like creating bylaws and holding board and shareholder meetings. Pros of LLC Owners don’t have personal liability for the business’s debts or liabilities.

- 4. You can choose whether you want your LLC to be taxed as a partnership or as a corporation. Not as many corporate formalities compared to an S-corp or C-corp. Cons of LLC It’s more expensive to create an LLC than a sole proprietorship or partnership (requires registration with the state). Difference between E-Governance and E-Government? BASIS FOR COMPARISON E-GOVERNMENT E-GOVERNANCE Meaning The application of ICT, with the aim of supporting government operations, aware citizens and deliver services is called as e- Government. E-Governance refers to the use of ICT in enhancing the range and quality of information and services delivered to the public, in an effective manner. What it it? System Functionality Communication Protocol One way communication protocol Two way communication protocol