Chicago Suburbs Office Insight - Q2 2016

•

0 gefällt mir•185 views

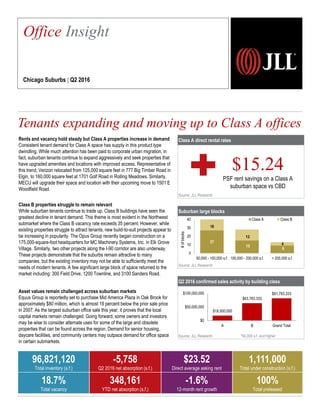

Despite perceptions to the contrary, we see many suburban tenants continuing to expand and seek new amenity-rich properties within the Chicago suburban footprint. Recently, telecom giant Verizon moved from its 125,000 square foot location in Elgin to a new 160,000 square foot space in Rolling Meadows. We found that companies can save more than $15.00 per square foot on average (Q2 2016) for Class A space in Chicago’s suburbs compared to the CBD. A broader tenant shift towards Class A space has brought opportunities within the existing Class B suburban market, especially in the Northwest submarket. As of Q2 2016, the Class B vacancy rate in Northwest now exceeds 35 percent.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (13)

JLL Grand Rapids Office Insight & Statistics - Q1 2018

JLL Grand Rapids Office Insight & Statistics - Q1 2018

What's been driving the Fort Lauderdale office market?

What's been driving the Fort Lauderdale office market?

Ähnlich wie Chicago Suburbs Office Insight - Q2 2016

Ähnlich wie Chicago Suburbs Office Insight - Q2 2016 (20)

JLL Ann Arbor Office Insight & Statistics - Spring 2018

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Investor Perspective: A look at why investment sales are surging in Cleveland

Investor Perspective: A look at why investment sales are surging in Cleveland

Mehr von Hailey Harrington

Mehr von Hailey Harrington (7)

Can the Chicago office vacancy predict a Cubs postseason appearance?

Can the Chicago office vacancy predict a Cubs postseason appearance?

JLL Downtown Chicago Office Market Update - Q3 2016

JLL Downtown Chicago Office Market Update - Q3 2016

Chicago's office buildings are casting a long shadow

Chicago's office buildings are casting a long shadow

Chicago's office construction history...where are we now?

Chicago's office construction history...where are we now?

Kürzlich hochgeladen

Kürzlich hochgeladen (20)

BDSM⚡Call Girls in Sector 55 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 55 Noida Escorts >༒8448380779 Escort Service

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

Magarpatta Nova Elegance Mundhwa Pune E-Brochure.pdf

Magarpatta Nova Elegance Mundhwa Pune E-Brochure.pdf

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Greater Vancouver Realtors Statistics Package April 2024

Greater Vancouver Realtors Statistics Package April 2024

Properties for Sale in Istanbul with Schools and Parks | Antalya Development

Properties for Sale in Istanbul with Schools and Parks | Antalya Development

M3M 129 E Brochure Noida Expressway, Sector 129, Noida

M3M 129 E Brochure Noida Expressway, Sector 129, Noida

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

9990771857 Call Girls Dwarka Sector 8 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 8 Delhi (Call Girls ) Delhi

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

Chicago Suburbs Office Insight - Q2 2016

- 1. Class A direct rental rates Source: JLL Research Suburban large blocks Source: JLL Research Q2 2016 confirmed sales activity by building class Source: JLL Research *50,000 s.f. and higher Rents and vacancy hold steady but Class A properties increase in demand Consistent tenant demand for Class A space has supply in this product type dwindling. While much attention has been paid to corporate urban migration, in fact, suburban tenants continue to expand aggressively and seek properties that have upgraded amenities and locations with improved access. Representative of this trend, Verizon relocated from 125,000 square feet in 777 Big Timber Road in Elgin, to 160,000 square feet at 1701 Golf Road in Rolling Meadows. Similarly, MECU will upgrade their space and location with their upcoming move to 1501 E Woodfield Road. Class B properties struggle to remain relevant While suburban tenants continue to trade up, Class B buildings have seen the greatest decline in tenant demand. This theme is most evident in the Northwest submarket where the Class B vacancy rate exceeds 35 percent. However, while existing properties struggle to attract tenants, new build-to-suit projects appear to be increasing in popularity. The Opus Group recently began construction on a 175,000-square-foot headquarters for MC Machinery Systems, Inc. in Elk Grove Village. Similarly, two other projects along the I-90 corridor are also underway. These projects demonstrate that the suburbs remain attractive to many companies, but the existing inventory may not be able to sufficiently meet the needs of modern tenants. A few significant large block of space returned to the market including: 300 Field Drive, 1200 Townline, and 3100 Sanders Road. Asset values remain challenged across suburban markets Equus Group is reportedly set to purchase Mid America Plaza in Oak Brook for approximately $80 million, which is almost 19 percent below the prior sale price in 2007. As the largest suburban office sale this year, it proves that the local capital markets remain challenged. Going forward, some owners and investors may be wise to consider alternate uses for some of the large and obsolete properties that can be found across the region. Demand for senior housing, daycare facilities, and community centers may outpace demand for office space in certain submarkets. Tenants expanding and moving up to Class A offices 2,257 Office Insight Chicago Suburbs | Q2 2016 96,821,120 Total inventory (s.f.) -5,758 Q2 2016 net absorption (s.f.) $23.52 Direct average asking rent 1,111,000 Total under construction (s.f.) 18.7% Total vacancy 348,161 YTD net absorption (s.f.) -1.6% 12-month rent growth 100% Total preleased $15.24 PSF rent savings on a Class A suburban space vs CBD 27 15 9 16 13 4 0 10 20 30 40 50,000 - 100,000 s.f. 100,000 - 200,000 s.f. > 200,000 s.f. #ofblocks Class A Class B $18,000,000 $63,783,333 $81,783,333 $0 $50,000,000 $100,000,000 A B Grand Total

- 2. Current conditions – submarket Historical leasing activity (s.f.) Source: JLL Research Source: JLL Research Total net absorption (s.f.) Source: JLL Research Total vacancy rate (%) Source: JLL Research Direct average asking rent ($ p.s.f.) Source: JLL Research -242,577 -1,018,749 -2,165,869 -283,123 394,775 -107,998 153,085 1,643,439 1,277,749 348,161 -3,000,000 -2,000,000 -1,000,000 0 1,000,000 2,000,000 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD 2016 $23.74 $24.10 $23.49 $23.08 $23.08 $23.12 $22.91 $23.60 $23.43 $23.52 $22.00 $22.50 $23.00 $23.50 $24.00 $24.50 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2016 20.7% 22.8% 24.8% 25.0% 24.5% 24.6% 24.3% 22.6% 18.5% 18.7% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2016 6,708,869 4,507,842 5,703,551 5,744,248 2,428,744 0 2,000,000 4,000,000 6,000,000 8,000,000 2012 2013 2014 2015 YTD 2016 ©2016 Jones Lang LaSalle IP, Inc. All rights reserved.For more information, contact: David Barnett | David.Barnett@am.jll.com Landlordleverage Tenantleverage Peaking market Falling market Bottoming market Rising market North Lake O’Hare Western East-West, Northwest North Cook, Eastern East-West