Chqclgpolicy memotomsd

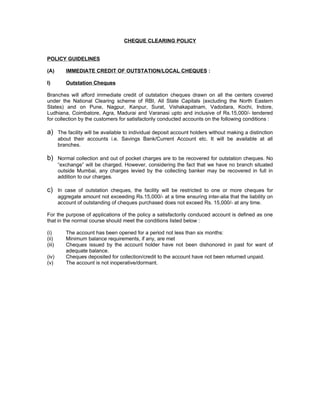

- 1. CHEQUE CLEARING POLICY POLICY GUIDELINES (A) IMMEDIATE CREDIT OF OUTSTATION/LOCAL CHEQUES : I) Outstation Cheques Branches will afford immediate credit of outstation cheques drawn on all the centers covered under the National Clearing scheme of RBI, All State Capitals (excluding the North Eastern States) and on Pune, Nagpur, Kanpur, Surat, Vishakapatnam, Vadodara, Kochi, Indore, Ludhiana, Coimbatore, Agra, Madurai and Varanasi upto and inclusive of Rs.15,000/- tendered for collection by the customers for satisfactorily conducted accounts on the following conditions : a) The facility will be available to individual deposit account holders without making a distinction about their accounts i.e. Savings Bank/Current Account etc. It will be available at all branches. b) Normal collection and out of pocket charges are to be recovered for outstation cheques. No “exchange” will be charged. However, considering the fact that we have no branch situated outside Mumbai, any charges levied by the collecting banker may be recovered in full in addition to our charges. c) In case of outstation cheques, the facility will be restricted to one or more cheques for aggregate amount not exceeding Rs.15,000/- at a time ensuring inter-alia that the liability on account of outstanding of cheques purchased does not exceed Rs. 15,000/- at any time. For the purpose of applications of the policy a satisfactorily conduced account is defined as one that in the normal course should meet the conditions listed below : (i) The account has been opened for a period not less than six months: (ii) Minimum balance requirements, if any, are met (iii) Cheques issued by the account holder have not been dishonored in past for want of adequate balance. (iv) Cheques deposited for collection/credit to the account have not been returned unpaid. (v) The account is not inoperative/dormant.

- 2. II) Local Cheques a) Negotiation of local cheques/instruments will not be encouraged. However, Branch Managers may use their discretion in exceptional circumstances to permit immediate credit of local instruments upto Rs. 15,000/- for deposit accounts on recovery of collection charges of Rs. 75/- per instrument. b) No charges will be levied for local collection of cheques/instruments which are collected through clearing except for item (II) (a) above. 2. If cheque/instrument for which immediate credit has been afforded is returned unpaid, Bank shall recover interest at clean overdraft rate for the period Bank remained out of funds and recover prescribed cheque returned charges subject to the following : a) No interest will be charged to the customer for the period between the date of credit of the outstation cheque lodged and its return. b) Bank will charge interest from the date of return of the cheque till the reimbursement of money to the bank. c) If proceeds are credited in an overdraft/loan account, interest would be recovered at applicable rate on the amount of returned cheque/instrument. (B) TIME FRAME FOR COLLECTION OF LOCAL/OUTSTATION INSTRUMENTS The delay in collection of outstation cheques for customers has always been an area of grievance for them and it has been constant endeavour of Bank to improve upon this count and hence the following guidelines are proposed : I) Time frame for collection of cheques/ instruments is proposed to be as under :- a) Collections between Metropolitan Centres/Major ‘A’ Class Cities (Mumbai, Chennai, Kolkata, New Delhi, Ahmedabad,Bangalore & Hyderabad) : 7 days b) Collections between places at (a) above and State Capitals (other than North Eastern States & Sikkim) and Area I Cities i.e. Pune, Nagpur, Kanpur, Surat, Vishakapatnam, Vadodara, Kochi, Indore, Ludhiana, Coimbatore, Agra, Madurai and Varanasi : 10 days c) Collections between all other Centres : 14 days

- 3. II) In no circumstances it shall be construed that Bank can take 7/10/14 days for collection/return of outstation instruments merely because a period of 7/10/14 days has been allowed. Once the proceeds are realised, these should be credited to the customer's account immediately. III) As the Bank has no foreign Branch/office, all cheques drawn on foreign Banks will be sent direct to the drawee bank/correspondent Banks with instructions to credit the proceeds to the respective Nostro Account of the Bank maintained with one of the correspondent banks. There will not be any time limit for collection of cheques/instruments payable in foreign countries as Bank will not be in a position to ensure timely collection from overseas banks as practices for collection vary from country to country. However, Bank will pursue for expeditious realization of cheques/instruments sent for collection through effective follow up. The Foreign Bank’s charges will also be recovered in addition to our charges and postage. (D) Local Cheques : All Cheques and other Negotiable Instruments payable locally would be presented through the clearing system prevailing at the Centre. The area of local clearing operations would be as decided by the respective clearing house where the Branch is located. Cheques deposited at branch counters and in collection boxes within the branch premises before the specified cut-off time will be presented for clearing on the same day. The cut off time for accepting the clearing cheques for presenting on the same date will be prominently displayed at the respective branches. Cheques deposited after the cut-off time and in collection boxes will be presented in the next clearing cycle. As a policy, bank would give credit to the customer account on the same day clearing settlement takes place with value dating effect from the same date. This would be generally two working days including the day of the deposit of the cheque. Withdrawal of amounts so credited would be permitted as per the cheque return schedule of the respective clearing house. Wherever applicable, facility of high-value clearing (same day credit) will be extended to customers. However, the cut off time for depositing cheques for high value clearing will also be displayed at the respective branches. Bank branches situated at Centres where no clearing house exists, would present local cheques on drawee banks across the counter and it would be the Bank’s endeavour to credit the proceeds at the earliest.

- 4. (E) Cheques/Instruments lost in transit/in clearing process or at paying bank’s branch : In the event a cheque or an instrument accepted for collection is lost in transit or in the clearing process or at the paying bank’s branch, the Bank shall immediately on coming to know of the loss, bring the same to the notice of the accountholder so that the accountholder can inform the drawer to record stop payment and also take care that cheques, if any, issued by him / her are not dishonoured due to non-credit of the amount of the lost cheques / instruments. The Bank would provide all assistance to the customer to obtain a duplicate instrument from the drawer of the cheque. In line with the compensation policy of the Bank, the Bank will compensate the accountholder in respect of instruments lost in transit in the following way: The Bank will pay interest on the amount of the cheque for a period exceeding the normal period accepted by the Bank for clearing of such cheques, at Savings Bank rate till the date of realization of such cheque and credit to customers accounts to provide for likely delay in obtaining duplicate cheque/instrument and collection thereof. Force Majeure The Bank shall not be liable to compensate customers for delayed credit if some unforeseen event (including but not limited to civil commotion, sabotage, lockout, strike or other labour disturbances, accident, fires, natural disasters or other “Acts of God”, war, damage to the Bank’s facilities or of its correspondent bank/(s), absence of the usual means of communication or all types of transportation, etc.) beyond the control of the Bank prevents it from performing its obligations within the specified service delivery parameters.

- 5. F) Return/Bouncing of cheques where Instant Credit was given and cheques sent for local/outstation clearing : If a cheque sent for collection for which immediate credit was provided by the Bank is returned unpaid, the value of the cheque will be immediately debited to the account where the credit was given. The customers will also be advised immediately about the bouncing of cheques. On receipt of information about the return / non-payment of cheques sent for collection, the customers will be immediately notified about the same and the appropriate charges as per the schedule of charges, as applicable, will be recovered from the customer’s account, under advice to the customers. (C) INTEREST PAYMENT FOR DELAYED COLLECTION : It is the responsibility of Bank to collect the instruments within the time frame prescribed for the purpose and to compensate the customers for delays due to non-adherence to time schedule. Following guidelines are, therefore, laid down : I) (a) Interest shall be payable without any claim from the customers, if the proceeds are not realised/credited to the customer's accounts within the period as mentioned in paragraph (B) above. (b) The rate of interest payable will be equivalent to the savings bank rate, if the collection of outstation instruments is delayed beyond the stipulated period of 7/10/14 days and upto 45 days where the proceeds of the instruments are to be credited to the deposit accounts. Where proceeds are to be credited to overdraft or loan accounts of the customers, the interest payable would be at the BPLR rates. II) A delay would be regarded as abnormal if the period of delay exceeds 45 days from the date of deposit of the cheque/instrument from the customer for credit to his account. III) For abnormal delays, the rate of interest payable would be 2% above the savings bank interest rate in deposit accounts and 2% above BPLR in case of overdraft/loan accounts. IV) Such interest shall be payable with a minimum of Rs. 5/- even if the interest calculated works out to less than Rs. 5/-.