Fareed Ebrahim CV Feb 2017

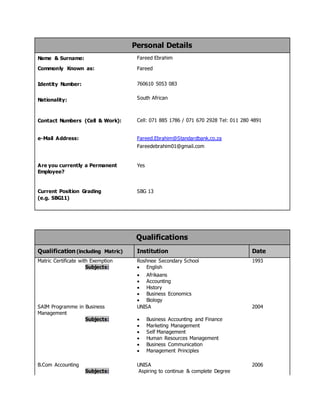

- 1. Personal Details Name & Surname: Fareed Ebrahim Commonly Known as: Identity Number: Nationality: Fareed 760610 5053 083 South African Contact Numbers (Cell & Work): Cell: 071 885 1786 / 071 670 2928 Tel: 011 280 4891 e-Mail Address: Fareed.Ebrahim@Standardbank.co.za Fareedebrahim01@gmail.com Are you currently a Permanent Employee? Yes Current Position Grading (e.g. SBG11) SBG 13 Qualifications Qualification (including Matric) Institution Date Matric Certificate with Exemption Roshnee Secondary School 1993 Subjects: English Afrikaans Accounting History Business Economics Biology SAIM Programme in Business Management UNISA 2004 Subjects: Business Accounting and Finance Marketing Management Self Management Human Resources Management Business Communication Management Principles B.Com Accounting UNISA 2006 Subjects: Aspiring to continue & complete Degree

- 2. Qualifications Qualification (including Matric) Institution Date Career Summary From Until Position Standardbank Vaal Processing Centre August 1994 November 1995 Waste Clerk Division: Branch Network Standardbank Vereeniging, Meyerton and Vanderbijlpark December 1995 December 2001 Teller, Bulk Teller, Central teller, Enquiries Clerk, Forex Clerk, CIC, ATM Custodian, Treasury Custodian, Team leader Tellers, Team Leader Enquiries, Customer (Sales) Consultant,Team Leader Customer Service Division: Branch Network Standardbank Gauteng Province 2001 2003 Provincial development Programme, Area Service Assistant, Area Sales Assistant, Team leader Service Centre Kruis Street Branch Division: Gauteng Province Standardbank, Vereeniging Southgate, The Glen and Soweto Branch 2003 2013 Branch Manager Standardbank Private Banking 2013 2015 Private Banker Relationship Manager 2015 current Private Banking Suite Head Career History (4 Most recent positions)

- 3. Career History (4 Most recent positions) Employer (1): Standardbank Southgate Division: PBB Branch Network Period: 2008 - 2009 Position: Branch Manager Summary of Duties and Responsibilities: Customer service Ensure that customer service standards are setand maintained in line with the requirements ofeach market segment. Ensure that customer complaints are monitored,trends and rootcauses identified and addreed atsource to prevent recurrence. Ensure that customer needs are anticipated and metthrough provision ofappropriate products and services via the mostsuitable channel. Ensure that opportunities to migrate customers to more appropriate,cost-effective channels are identified and actioned. Ensure efficient,customer-orientated switchboard and telephone procedures. Ensure that 5 Star process is implemented and sustained in the branch and managed effectively by 5 Star champions. Ensure correctscheduling ofstaff to meetcustomer demand byusing Branch Scheduling Tool Ensure that workload fit is achieved Re-run BST schedules as and when necessary Legislative compliance Conducta needs analysis to identify customer needs effectively when opening new accounts or giving productadvice, in line with Financial Advisory and IntermediaryService Act licence categories. Complete disclosure to the customers in terms of accreditation,service fees,and commission. Ensure proper record keeping in terms of Financial Advisory and IntermediaryServices Act as well as the Financial Intelligence Centre Act requirements. Health and Safety: Appointments Appoint Section 16(2) Assistants to assistyou in executing your OHS duties where necessary; Ensure the appointmentofthe required OHS employee representatives: Appoint Health and Safety Representatives,FirstAiders and Fire/Floor wardens,and any other appointments thatmay be required from time to time to assistin creating a healthy and safe work environment(Employee representatives can be replaced after a period of two years); Ensure that enough persons are appointed to cover annual leave, sick leave, shiftwork, or other periods ofabsence; Ensure that an OHS Committee is established (thatmustinclude all Health and Safety Representatives,and should also include all FirstAiders and Fire/Floor wardens); Ensure that all employee representatives activelyexercise their duties,allowing them the time,and where applicable,the place,to carry out these duties; Ensure that all employee representatives receive supportand assistance to perform their OHS functions and to resolve matters where required.

- 4. Structures Determine and facilitate the implementation ofOHS structures within the area of responsibility; Assistin the implementation and evaluation ofthe OHS managementsystem; Ensure that managementis represented atall OHS committee meetings and thatthe necessary documentation is completed for the area of responsibility(see Form 00034636 - Health and Safety Committee Minutes). Policies and procedures Ensure that the occupational health and safetypolicy is communicated to all employees in your area of responsibility; Promote the participation ofall members ofthe organisation,atall levels,in health and safety risk management; Ensure that policies,rules,procedures and instructions are followed; Enforce discipline where health and safetyrules are deliberatelyneglected or ignored. Compliance Ensure,as far as is reasonablypracticable,compliance with and adherence to the requirements ofthe OHS Act; Collaborate with the compliance function to promote health and safety within the bank; Reporton the progress ofOccupational Health and Safety (OHS) compliance (when requested or as necessary); Ensure that non-compliance with the OHS Act is reported in the monthly and quarterly compliance reports,and that any concerns regarding OHS matters are reported to the appropriate management office; Ensure compliance with the requirements ofthe various sets of Regulations ofthe OHS Act, where and when they become applicable in your area(s) of responsibility; Contractor Management: Ensure that every contractor in the workplace signs a Section 37(2) Agreement,whereby the contractor undertakes to complywith the provisions ofthe OHS Act (contact Group Compliance OHS for guidance:011 – 636 2671 / 5177). Risk assessments Ensure that workplace hazards are identified and that workplace risks are assessed; Ensure that OHS risk assessments are carried outbefore new projects are embarked upon in the workplace that may impacton the health and safety of persons (contactGroup Compliance OHS for guidance:011 – 636 2671 / 5177); Ensure that all employees (including permanent,temporaryand fixed term employees) and other persons are conversantwith the health and safety hazards, and the precautionarymeasures which mustbe taken or observed,in their areas of the workplace. Incidents Ensure that all incidents in the workplace (thatcould have caused injury,and that have in fact caused injury) are reported to Group Compliance OHS; In addition to no.1 above, injuries mustimmediatelybe reported telephonicallyto Corporate and InvestmentRisk Consultants (CIRC) at012-3468205 for compensation claim purposes (this is usually done through Human Resources); Ensure that an investigation into the cause of the incidentis done immediately(use Form 0034652 –

- 5. Recording and Investigation of Incidents) and that the necessarycorrective action to prevent a re- occurrence is implemented. Monitoring Ensure that management participates in internal and external audits and inspections (see OHS Performance SupportTool,Form 045463); Ensure that statutory health and safety inspections are conducted (atleastquarterly, using Form 00034623 – Health and Safety Representative Inspection Report); Ensure that employee representatives attend OHS committee meetings. Training Undertake the required e-learning,and ensure thatall OHS appointees (Section 16(2) Assistants, Health & Safety Representatives,FirstAiders and Fire/Floor Wardens) also undertake the e-learning; Supportrelevant employee representative training (for Health and Safety Representatives,FirstAiders and Fire/Floor wardens) and ensure re-training when training has expired; Ensure that all employees receive health and safety orientation when appointed or transferred from another business unit/department/ branch / province. Record retention Ensure that records ofall OHS related documentation are keptin accordance with the OHS Act and the bank’s record retention policies (atleast5 years). Technology used: Excel, Word & Power Point Achievements / Accomplishments / Value add: The work and exposure gained over the years in the branch network presenting me the opportunity of been a Service Centre Manager and with the exposure in that role thus been in the Branch Manager role currently. Employer (2): Standardbank – The Glen Division: PBB Branch Network Period: 2009 - 2010 Position: Branch Manager Summary of Duties and Responsibilities: Same as above

- 6. Technology used: Excel, Word and Power Point Achievements / Accomplishments / Value add: CEBS Results 2009 Employer (3): Standardbank Soweto Division: PBB Branch Network Period: 2011 – 2013 Position: Branch Manager Summary of Duties and Responsibilities: Same as above Employer (4): Standardbank Private Banking Division: PBB Branch Network Period: 2013 – 2015 Position: Private Banker Summary of Duties and Responsibilities: Job description Job purpose To proactively promote a relationship based offering through a primary point of contact, which meets client expectations by providing personalised financial solutions in line with the value proposition. To provide a competent relationship based offering to a Sub-Segment within the Private Banking Segment, that provides highly responsive and pro-active financial and business solutions, focused on the managing and building of wealth, in partnership with small business owners supported by expertise of specialists. To maintain a high level of integrity and ethical standards. Key responsibilities Service and Retention Establishes and builds one-on-one relationships with customers, based on mutual respect, in assigned portfolio by delivering the expected level of service, specifically focusing on a pro-active contact (calling) strategy and programme. Ensures successful retention of existing customers in assigned portfolio by strengthening and expanding relationships. This is achieved by intimately understanding the customer, servicing the customer’s business and personal financial needs and focusing on the management of key accounts. Interacts and build relationships with Business Banking Account Executive’s and (CIB) Corporate and Investment Banking Relationship Managers, in order to provide a seamless solution to the client’s banking requirements. To assist with related queries where possible, and facilitate when specialist advice is required by referring to Business Banking or CIB.

- 7. Manages the “Cost of Sales” through evaluation of margins, cost of service and utilisation of the multi-channel delivery strategies, such as actively managing customer migration onto electronic banking channels. Manage customer migration between segments and sub-segments of Private Banking. Actively ensures that customers are migrated to the correct sub-segment, as per the Value Propositions where appropriate. Effectively attend to and monitor customer complaints on portfolio, identify root causes and address at source, to prevent recurrence Proactively e-mail new product information to all customers. Profitable growth in portfolio sales Acquires new business for the Executive Sub-Segment market in line with the Customer Value Proposition segment income specifications, acquisition targets and/ or segment strategy to increase market share and specific sales strategies. Maximises bank profitability and ensure value add to customers through cross-selling specifically focusing on wealth and lending opportunities. Manages through use of contribution reports. Joins and supports business organisations that will assist in the acquisition of appropriate customers. Measures, tracks and manages sales targets and budgets for portfolio Lending Management Structures credit applications effectively, focusing on high quality motivations Advises customers on lending product selection, by recommending products to meet their specific needs Fulfills a training/coaching role through up skilling the Transactional Banker’s regarding their credit knowledge Restructures debt for efficiencies through debt consolidation, thereby bringing a customer’s asset base under one roof Establishes a sound working relationship with Credit, to ensure prompt turnaround times, accuracy and deadlines are strictly adhered to Manages the timeous completion of annual credit reviews on the portfolio Risk Management and Compliance Ensures that procedures laid down in Group Reference Guide are adhered to and, where flexibility needs to be exercised, that the necessary dispensation is held Ensures proper record keeping in terms of Financial Advisory and Intermediary Services Act as well as the Financial Intelligence Centre Act requirements. Ensures Code of Banking Practice is adhered to. Maintains information on Security and access control system (SACS) for the relevant private banking suite as per laid down procedure(if applicable) Key performance measures Sales and profitability targets achieved Satisfactory risk audit results Excellent customer experience measurement (CEM) results Engaged and motivated staff Client retention Competencies required Knowledge Understanding of the Private Banking markets customer profile and lifestyle. Sound knowledge of the full product spectrum as relevant to the Private Banking market, including qualification criteria, features, benefits, pricing, product combination possibilities for optimum use and relationship to other more specialised products.

- 8. Ability to interpret financial statements, management accounts, budgets and cash flows for all types of legal entities. Thorough understanding of Credit Principles and systems (behavioural scoring system). Qualification and/or experience in structuring business and personal deals and lending. Understanding of Group company products in respect of service level agreements (knowledge of criteria and customer expectations) and the bank’s service provision networks. Understanding of which products are most profitable to the bank and potentially beneficial to the customer. Ability to recognise when specialist product support is required. Knowledge of equivalent competitor products and services. Working knowledge of Personal & Business Banking strategy, overall Group strategy and Private Banking market value propositions. Understanding of current business issues and their impact on the local market. Working knowledge of branch systems and their impact on customer service. Financial management skills. People Management skills. Knowledge of Managing Local Market sales principles. Have a thorough understanding and knowledge of self service channels, e.g. Internet Strong Computer Literacy, able to capture/update customer database, migrate customers to remote channels and optimise service delivery within available technology channels (e.g. e-mail, internet and cellphone banking). Knowledge of the Financial Advisory and Intermediary Services Act. Knowledge of the Code of Banking Practice. Experience 4 – 5 years’ branch banking experience, with exposure to telling, enquiries, service, BDC/Forex, assets and overall customer service Technical competencies Computer literate Good communication skills Good numerical skills Good mentoring and coaching skills Good negotiation skills Personal competencies Socially confident Works well in teams and easily assumes team identity. Assertive. Able to express own opinion and convince others. Structured, systematic, organised, diligent, and conscientious. Perfectionist. In control of emotions and behaviour. Good verbal and communication skills required. Able to lead people, build teams and relationships. Supportive and able to give recognition to others. Enjoys training and developing people. Able to follow through and complete tasks. Pays attention to detail. Enjoys designing processes according to which work has to be done. Enjoys analysing client’s needs, negotiating and selling/servicing. Problem solving, planning and decision making Problem solving Identify potential difficulties and generate profitable solutions by taking into account many complex and diverse variables. Consider policies, principles and specific objectives when formulating solutions that should benefit both the customer and the bank.

- 9. Application of financial planning, credit and risk management principles are critical to problem solving. Creative flair required when dealing with financial scenarios not encountered before. Follow things through to completion and ensure problem is not merely handed over to another person for resolution Retain ownership despite responsibility for action being handed over to another individual. Planning Formulate action plans to achieve targets for retention and growth of the Private Banking portfolio, in line with the Segment Value Proposition and Business Plan, while being aware of the longer-term impact of plans. Analyse customers’ financial behaviour and accounts to match their needs with products that will result in greater benefit for the customer and increased revenue for the bank. Be analytical in approach, weighing up longer-term benefits and risks. Decision making Quick to assimilate and integrate new information. Monitor changes in the operating environment and act upon potential opportunities. Able to weigh things up quickly and take the initiative within limits of authority. When making decisions, required to take into account sensitivities relating to high-profile customers in the business community and their potential influence on business gained or lost for the Bank as a whole. Work environment Budget and costs None Organisation structure May need to be customised according to Branch/Service Centre . Working conditions None Physical requirements None Manager, Private Banking Suite Private Banker (Executive Portfolio) Transactional Banker

- 10. Employer : Standardbank – Rosebank & Hyde Park Period: 2015 – Current Position: Suite Head Summary of Duties and Responsibilities: Same as above Technology used: Excel, Word and Power Point Employment References Contact Person Organisation / Company Contact Detail Meela Govender Standard Bank 083 408 1095 Anton Nicoliasen Standard Bank 083 461 4046 Berrie De Jager Zama Mnyazi Standard Bank Standard Bank 083 454 3274 072 783 7282