How Top Sales Leaders Make Their Number

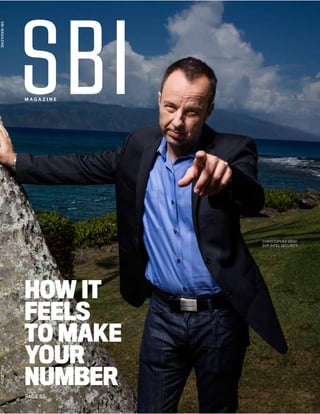

- 1. HOW IT FEELS TO MAKE YOUR NUMBER PAGE 52 M A G A Z I N E CHRISTOPHER BRAY, SVP, INTEL SECURITY SBIMAGAZINEFALL2015

- 2. SOME THINK HOLY GRAIL WHEN THEY READ IT. OTHERS THINK HOLY #$@%! SBI’S ANNUAL RESEARCH REPORT Order your copy at www.SalesBenchmarkIndex.com/2016Report

- 3. HOW IT FEELS TO MAKE YOUR NUMBERPAGE 54 M A G A Z I N E TED GRULIKOWSKI, VP, MARKETSOURCE

- 4. HOW IT FEELS TO MAKE YOUR NUMBER PAGE 56 M A G A Z I N E JULIE LYDA, EVP, BLACK BOX

- 5. HOW IT FEELS TO MAKE YOUR NUMBERPAGE 58 M A G A Z I N E DAVE MOORE, VP, BUSINESSOLVER

- 6. HOW IT FEELS TO MAKE YOUR NUMBER PAGE 60 M A G A Z I N E AARON STEAD, SVP, INFUSIONSOFT PAUL ROSEN, CHIEF SALES OFFICER, ONDECK

- 7. HOW IT FEELS TO MAKE YOUR NUMBER PAGE 62 M A G A Z I N E PAULA SHANNON, CHIEF SALES OFFICER AND SVP, LIONBRIDGE TECHNOLOGIES

- 8. M A G A Z I N E HOW IT FEELS TO MAKE YOUR NUMBER PAGE 64 BRANDON TOLANY, CHIEF SALES AND MARKETING OFFICER, FREESCALE SEMICONDUCTOR

- 9. YOU GOT YOUR HANDS ON THE REPORT. NOW GET HANDS-ON INSTRUCTION ON HOW TO APPLY IT. 2016 STRATEGY WORKSHOP Contact us at www.SalesBenchmarkIndex.com/2016Workshop to set up a SBI session for your team.

- 10. IF YOUR NECK IS ON THE LINE, GET YOUR EYES ON THIS NEWSLETTER. OUR FREE NEWSLETTER IS LOADED WITH TIPS AND INFORMATION THAT GIVE YOU A DECIDED ADVANTAGE IN ANY BUSINESS. -Insightful analysis -Proven strategies being used by your peers -Thought provoking articles from industry leaders SBI NEWSLETTER Subscribe today at www.SalesBenchmarkIndex.com/Newsletter

- 11. FALL 2015 9 LETTER HOW IT FEELS TO MAKE YOUR NUMBER What is it like to come out on top and make your number? It feels great! That is what the top B2B sales leaders told us on page 50 in our feature, “How It Feels to Make Your Number.” In August, the best in the business convened in Hawaii at the exclusive SBI Sales Strategy Summit, where these progressive minds explained how they made their numbers — and how you can do it, too. Coming from different companies, backgrounds, and countries, these men and women represent the gold standard in sales. Each one has wisdom to take away and apply to your strategy in 2016, whether it’s growing reseller revenue (page 52), selling in the small- business segment (page 60), or aligning your corporate and sales strategies (page 62). It has never been more important for the product team, marketing department, and the sales organization to work together, but it’s easier said than done. Turn to page 46 to learn the prescription for developing your 2016 sales strategy, with critical inputs from product management and marketing. We explain why you have to sell your vision to both your team and other executives, as well as how using the right inputs will improve your chances for success. Also in this issue, we explore the four eras of the modern buyer (page 20), get an insider’s perspective on how the board views marketing and sales effectiveness (page 28), and share strategies for your life outside of the office (page 67). We hope you made your number in 2015 and end the year with a big celebration. You deserve to feel great about what you and your team accomplished. As you head into next year, use this magazine to prepare for 2016; maybe next year you’ll be telling us all how you made your number. Sincerely, Greg Alexander CEO

- 12. 10 SBI MAGAZINE 50 HOW IT FEELS TO MAKE YOUR NUMBER A who’s who list of top sales leaders convened at the SBI Sales Strategy Summit to swap stories and share secrets for revenue growth. These enlightened minds have set the standards for what it will take to make your number in 2016. 46 THE RX FOR YOUR 2016 STRATEGY Use this framework to develop a sales strategy that will set you up for success in the new year. 72 ALOHA SBI’s exclusive summit in Hawaii gave the world’s most progressive sales leaders a look at tomorrow’s best practices. F E A T U R E S O N LY T H E B E S T

- 13. FALL 2015 11 23–31 The right performance conditions... the truth about best practices ... your strategic alignment road map ... the silver bullet to making your number ... and generating revenue from segmentation data. 28 Insider Perspective: How the Board Views Sales 67–71 Making a relocation work for the whole family ... and healthy lunch advice for ordering in. 70 The Overachiever’s Workout: Exercise on the Road 00 00 00 STREET SMARTS THE INFO YOU NEED TO MAKE TOUGH DECISIONS IDEAL LIFE ACHIEVING YOUR GOALS INSIDE AND OUTSIDE THE OFFICE CEO & EDITOR-IN-CHIEF Greg Alexander greg.alexander@salesbenchmarkindex.com PARTNER – NEW BUSINESS Matt Sharrers matt.sharrers@salesbenchmarkindex.com PRINCIPAL – TALENT MANAGEMENT Dan Perry dan.perry@salesbenchmarkindex.com DIRECTOR OF MARKETING Christina Dieckmeyer christina.dieckmeyer@salesbenchmarkindex.com TABLE OF CONTENTS 13–21 The myth of the ideal hiring profile ... the ultimate metric in customer acquisition ... strategy vs. tactics ... understanding the four eras of the modern buyer ... and strategy to execution. 16 Making 10,000 Reps More Productive: How HP Did It 33–44 The power of micro-questions ... how gamification will change your life ... what do you need in your 2016 sales plan? ... designing territories ... and why your reps won’t sell the new products. 42 The Digital Transformation of McGraw-Hill D E P A R T M E N T S PROSPECTS SALES TIPS AND TRENDS FOR MAKING YOUR NUMBER BEST PRACTICES SUCCESSFUL SALES APPROACHES PROVEN BY SBI RESEARCH

- 14. IT’S THE SALES LEADER’S LITTLE BLACK BOOK. Learn the best process to hire, coach and keep the best people. TALENT PROGRAM Get your FREE signed copy at www.SalesBenchmarkIndex.com/TopGrading

- 15. PROSPECTS S A L E S T R E N D S A N D T I P S F O R M A K I N G Y O U R N U M B E R Standardized hiring profiles for sales reps and sales managers are no longer effective. If you continue to use them, you will hire the wrong people and miss your number. Why? The hiring profile of an A player has dramatically changed in the past 12 months. Legacy profiles are backward-looking. They describe what the job was versus what the job is today. The vendors selling you these profiles and the associated talent-assessment tools cannot keep pace with the changing competencies. Great profiles, instead, consistently refresh the competencies needed to perform the job and the accountabilities measured in the job. Consider this: According to Compdata Surveys, turnover in 2008 was 18.7 percent, dropping to 14.4 percent in 2011. It rose to 15.7 percent in 2014 and is trending higher in 2015. If these online talent- assessment tools are accurate, why is the failure rate so high? There is no such thing as the ideal hiring profile. Take the time to build a custom hiring profile, unique to your company, and you’ll hire the right people for the job. THE MYTH OF THE IDEAL HIRING PROFILE Standardized Hiring Profiles Are No Longer the Answer by DAN PERRY 95%OF EMPLOYERS SAID A BAD HIRE NEGATIVELY IMPACTED WORKPLACE MORALE 17%MORE TIME IS SPENT OVERSEEING THE WORK OF A BAD HIRE (CAREERBUILDER) WHAT DOES A BAD HIRE COST YOU? FALL 2015 13 ILLUSTRATIONBYDANCOSGROVE

- 16. THE ULTIMATE METRIC: CAC:LTV RATIO Are You Spending Too Much to Acquire Customers? by RYAN TOGNAZZINI WHAT IS CAC:LTV? Customer Acquisition Cost (CAC) is the total amount of money spent on customer acquisition (sales, marketing, etc.) divided into the total number of customers acquired. If you spend $1,000 to acquire 10 customers, your CAC is $100. Customer Lifetime Value (LTV or CLTV) is the total amount of lifetime revenue generated from a customer. If you have a customer who spends $100 a year with you for three years, your LTV is $300. Using the two examples above, your ratio would be 3:1, or 3x LTV to CAC. Simply put, LTV needs to be higher than CAC. WHY IS THIS THE ULTIMATE METRIC? If your ratio is too high (>5:1), you’re potentially leaving market share and revenue on the table. Too low (LTV<2:1) and you might be using ineffective or expensive channels to acquire and retain customers. Customer churn can significantly impact CAC:LTV as well. If you have 5,000 customers and 5 percent churn, you have to sell 250 new customers each year just to remain flat. Can your sales team keep up with this? Getting this right means higher valuation, increased stock price, and increased company value. 5 LEVEL companies have 26% BETTER LTV than Level 1. (Learn more on page 26.) of companies know and measure CAC: LTV effectively. 3:1 to 4:1 IT COSTS 7X MORE TO ACQUIRE A CUSTOMER THAN TO KEEP ONE, YET MOST COMPANIES SPEND MORE THAN 80% OF SALES EXPENSE ON ACQUISITION VS. RETENTION IDEAL RATIO IMPACT ON CUSTOMER LIFETIME VALUE: LTV IMPROVEMENT OVER LEVEL 1 PERFORMANCE 0 10 20 30 26% 13% 8% 2% LEVEL 1 LEVEL 2 LEVEL 3 LEVEL 4 LEVEL 5 If you have 5,000 customers, a 5% churn rate is 250. You have to sell 250 new customers just to maintain status quo. THE IMPACT OF LTV INCREASES WITH THE SIZE OF YOUR BASE. 14 SBI MAGAZINE

- 17. WHAT HE KNOWS ABOUT MARKETING COULD FILL A PIPELINE WITH LEADS. LET VINCE HELP YOU TURN YOUR BUDGET INTO REVENUE. VINCE KOEHLER, SBI MARKETING PRACTICE LEAD Contact Vince Koehler at 770.241.1803 or vince.koehler@salesbenchmarkindex.com

- 18. What sales organization wouldn’t like to increase their sales reps’ selling time? HP, one of the world’s leading technology companies, did just that. How, you ask? We spoke with Stuart Kerst, vice president of sales operations of the HP Enterprise group to find out. To be successful, HP first focused on what would make the biggest impact. Each year, the company completed a sales rep satisfaction review with its team. What are they spending their time on? How are reps spending their time, and what technologies are supporting them in the field? Kerst’s challenge was to eliminate unnecessary tasks, while making the necessary ones more efficient. Ultimately, their goal was to move from 55 percent customer-facing time to upward of 60–65 percent. A small lift of only 5–10 percent multiplied across Kerst’s team of 10,000 reps would have a huge impact on productivity. The first area he looked at was sales support. Greg Alexander, CEO of SBI, asked Kerst a few key questions. “Was the fix mostly process work? Adding technology? Or was it a blend between process and technology automation?” Kerst found that the two go very much hand in hand. In one example, he says, “We understood what the workflow of the CPQ [configure price quote] process was and determined we needed to drive technology and automation into our process to truly move the needle.” In effect, HP used technologies such as PROS pricing software to enable salespeople to complete self-serve quoting without 16 SBI MAGAZINE PROSPECTS HOW HP MADE 10,000 REPS MORE PRODUCTIVE Process and Technology Go Hand in Hand by DAN PERRY going through the sales-operations organization. The result? Going from one of the industry’s worst quote turnaround times to one of the best. They were able to translate this benefit in many ways and especially with channel partners. “When a channel partner has a poor experience with you as a vendor, and it takes four or five iterations to get through a cycle, they stop quoting you,” Kerst says. There was business out there that HP didn’t even realize they were losing. It never came their way due to their reputation of being hard to do business with. But with new methods in place, the company was able to increase channel mind share by reducing the amount of

- 19. time it takes to turn around a quote. Partners who previously didn’t quote HP were now approaching them. Kerst and his team were also able to successfully lead one of the biggest Salesforce.com implementations. For a sales force of their size, they have an astounding 87 percent adoption rate. How did they manage this? Quite simply, says Kerst, it was about adding value. Salesforce.com allowed HP to increase collaboration among the different HP regions for a single customer experience across multiple continents. Again, HP became much easier to do business with on a global scale. So, how can you have success like HP? Kerst maintains you must realize you can’t do it all. The key, he says, is to ask yourself, “What is the true impact to the business? What is the risk of doing it? What is the cost of doing it? And finally, what is the financial ROI?” Only when these align should you move forward. FALL 2015 17 ILLUSTRATIONBYPETERBOLINGER

- 20. 18 SBI MAGAZINE PROSPECTS A NEW TAKE ON AN OLD ARGUMENT Strategy Vs. Tactics: How Can You Excel in Both? by DREW KIRAN Tactics involve doing things right. Strategy is doing the right things. A famous Peter Drucker quote is “There is nothing quite so useless as doing with great efficiency something that should not be done at all.” Yet this is the fate of many companies. TAKE A LOOK AT THE FIGURE BELOW. The four quadrants outline the relationship between the two. A brilliant plan that is executed poorly will allow a company to survive. The worst scenario is a poor plan that is executed inefficiently. This will produce the effect of dying slowly. IF YOU EXECUTE WITH GREAT EFFICIENCY, it will ensure one of two predictable outcomes. You will die quickly or thrive. The difference is having an effective plan. THE BEST POSITION is the upper right quadrant. To thrive, companies must have a brilliant plan and execute it with great efficiency. Having the right plan ensures you will succeed. Having the right plan that is executed brilliantly ensures you thrive. WHERE WILL YOU BE IN 2016? INEFFECTIVELY EFFECTIVELY EFFICIENCY DIE QUICKLY A poor plan executed brilliantly THRIVE A brilliant plan executed brilliantly INEFFICIENCY DIE SLOWLY A poor plan executed poorly SURVIVE A brilliant plan executed poorly STRATEGY — DOING THE RIGHT THINGS TACTICS— DOINGTHINGSRIGHT

- 22. 20 SBI MAGAZINE PROSPECTS Much has been written about the evolution of the self-directed B2B buyer. The migration of B2C buying behaviors into the B2B world changed sales forever. At SBI, we have seen four eras emerge. It is important you know which era your buyers are in so you can respond correctly. Let’s explore the four. ERA 0 — BUYER BEHAVIOR CHANGE (2009–2010) Buyers started discovering information on their problems and potential solutions independently. They began to de-value the relationship with the salesperson. Sales teams did not yet recognize the change in buyer behavior and did not adjust their approach. FROM CONSISTENT TO UNPREDICTABLE Understanding the Four Eras of the Modern Buyer Helps You Tailor Your Response by MATT SHARRERS ERA 1 — FRANTIC EXPERIMENTATION (2010–2011) Sales forces responded to the changes in buyer behavior with various tactics. Companies started to experiment with things such as inbound marketing and marketing automation. New, gimmicky sales methodologies hit the street, such as The Challenger Sale and Social Selling. Lots and lots of activity occurred but with little results. ERA 2 — SALES STRATEGIES (2012–2013) Documented sales strategies were more the norm. Executives learned the difference between tactics and strategy. Yet many sales and marketing leaders did not understand how to be a strategist. They grew up in a time where they could make the number on effort and charisma. This learning curve whipped out many well-intentioned leaders. For example, the sales leader began to realize he/she needed to integrate the sales strategy with the marketing strategy but did not know how. The marketing leader needed to integrate the marketing strategy with the product strategy but had never been trained how to do this. CEOs realized that despite having functional strategies, the revenue growth problem remained unsolved. ERA 3 — STRATEGIC ALIGNMENT (2014–PRESENT) Strategies designed in isolation don’t grow revenues. The alignment between revenue-facing functions

- 23. is called Strategic Alignment. You know you are strategically aligned when product, marketing, sales, and talent strategies are connected. This is strategic alignment in a nutshell. You are internally aligned functionally and externally aligned with the market. Revenue growth is no longer a sales goal. All the functions understand their roles, and they play them in a coordinated fashion. NOW WHAT ASK YOURSELF TWO QUESTIONS: Which era are my buyers in? What should my response be? SYSTEMATIZES REVENUE GROWTH. This is the one common practice among the top 10 percent of management teams working at companies who consistently make their numbers. LINKS INTERNAL STRATEGIES TO EXTERNAL MARKET CONDITIONS. This enables fast response to marketplace changes. DRIVES FUNCTIONAL SYNERGY. The mere working together of aligned strategies forces departmental cooperation on a scale not achievable by respective staffs. This lowers customer acquisition costs and increases customer lifetime value. Have your recent revenue growth initiatives run out of steam? Many companies have implemented projects focused on early-stage buyers — persona research, buyer journey mapping, content marketing, social selling, and mobile enablement, to name but a few. Though well founded, these initiatives were tactics masquerading as strategy. Big money is at stake: A typical company spends 35 percent of revenue on product (11 percent), marketing (5 percent), and sales (19 percent). When it comes to revenue growth, spend must be considered in aggregate. With 35 percent of revenue at risk, functional misalignment is a deadly malady. The snapback to this has recently been that the revenue-facing functions (product, marketing, and sales) are developing individual strategies and aligning each. The advantages to this approach are that it: FALL 2015 21 STRATEGY TO EXECUTION IN INTERNET TIME Break Down the Silos by MIKE DRAPEAU 9% OF ORGANIZATIONS HAVE ALIGNED STRATEGIES

- 24. INTRODUCING SBI ON DEMAND. THE SMALL BUSINESS SOLUTION FOR TURNING POTENTIAL INTO PROFITS. SBI ON DEMAND www.SalesBenchmarkIndex.com/OnDemand

- 25. STREET SMARTS T H E I N F O YO U N E E D T O M A K E T O U G H D E C I S I O N S 26% Organizations can only succeed in the marketplace if they place the right talent in the right performance conditions. With weak talent, even the ideal conditions result in below- market performance. Strong talent in poor performance conditions also results in below-market performance. Only strong talent and the right performance conditions result in a winning formula for growth. It’s a 50/50 equation. Establishing the ideal performance conditions requires contributions from all business functions. Sales teams are ultimately accountable for revenue, but the best sales force can’t make the number without good products and leads from marketing. The right performance conditions start with a well-defined strategy. Each functional area needs an operating plan to allocate resources (people, time, and money) correctly. But individual strategies aren’t enough. To systematize revenue growth you need strategic alignment, both internal and external. Strategies don’t execute themselves. They define the performance conditions. You need great talent to execute your strategies. Focus on building a team capable of defining and executing the functional strategies. What types of people do you need? What do they need to excel at? When do you need them? A great talent program defines the people to be sourced, hired, on-boarded, and developed in pursuit of your strategic goals. SEND MORE REPS TO THE PRESIDENT’S CLUB Find Your Ideal Model by GEORGE DE LOS REYES 96% CLTV IMPROVEMENT FOR A LEVEL 5 COMPANY ON THE REVENUE GROWTH MATURITY MODEL COMPARED TO A LEVEL 1 COMPANY OF LEVEL 5 COMPANIES ATTAIN THEIR GROWTH OBJECTIVES HOW DOES STRATEGIC ALIGNMENT BENEFIT YOU? FALL 2015 23

- 26. similar to the market standards, are caught in a competitive blood bath with lower win rates, prices, and margins. How do you know which camp you fit into? Leaders attempting to catch up are doing things such as installing out-of- the-box sales processes. They take the easy path. Those deploying emerging best practices are designing customized processes for tomorrow’s buyer. They were capitalizing on mobile and social three years ago. These leaders listen to the market and get ahead of the next growth trend. 24 SBI MAGAZINE STREET SMARTS The best practices of today are obsolete by the time your team adopts them. If you have gaps in your sales strategy when compared to best practices, don’t bother fixing them. Instead, look to emerging best practices, and “leap frog” over your competitors. It takes just as much effort to implement today’s best practices as it does tomorrow’s best practices. As Wayne Gretzsky once said, “Don’t skate to where the puck is now; skate to where the puck is going to be.” Leap frog-style leaders achieve the multiplier effect of the first mover advantage while the competition is stuck in the “me too” game. Emerging best practices help you win more often with higher prices. Leaders deploying today’s best practices, which are CATCH UP VS. LEAP FROG The Truth About Best Practices by SCOTT GRUHER Look to emerging best practices to stay ahead of the competition. MAKE THE NUMBER 96% 84% LEADERS WHO IMPLEMENT EMERGING BEST PRACTICES MAKE THE NUMBER 96% OF TIME LEADERS WHO IMPLEMENT TODAY’S EXISTING BEST PRACTICES MAKE THE NUMBER 84% OF TIME

- 27. WE BELIEVE IN PLAYING THE PERCENTAGES. JOHN GIVES YOU 96% ODDS OF MAKING YOUR NUMBER. JOHN STAPLES, PARTNER Contact John Staples at 303.330.3250 or john.staples@salesbenchmarkindex.com

- 28. 26 SBI MAGAZINE STREET SMARTS LEVEL 1: CHAOS A corporate strategy may exist, but functional strategies do not. The company operates in an environment that is neither stable nor predictable. Functions operate in conflict with one another, causing friction. LEVEL 2: DEFINED Corporate and functional strategies exist but collect dust on the shelf. While past successes are repeatable on similar initiatives with similar scope, management cannot rely upon such outcomes. Because functions continue to operate in conflict with one another, friction still exists. And the customer experience suffers. SBI’s 2016 annual research revealed the key to successful revenue attainment is strategic alignment. To help you plan your alignment road map SBI developed the Revenue Growth Maturity Model. As companies move up in maturity, their Customer Acquisition Cost (CAC), Customer Lifetime Value (CLTV), and Growth Attainment improve. The required sales, marketing, and R&D costs are reduced. To understand the impacts, see below: REVENUE GROWTH MATURITY MODEL How Much More Can You Get from Your Go-to-Market Investments? by AARON BARTELS

- 29. FALL 2015 27 LEVEL 3: IMPLEMENTED Corporate and functional strategies have been implemented. On a daily basis, functions operate in silos, focused exclusively on their own strategic execution. While friction within each function has been removed, it still exists among the functions. LEVEL 4: MANAGED Corporate and functional strategies have been defined, aligned, and implemented. The company has now achieved internal strategic alignment. Functions are operating in unison to support the corporate strategy. Friction no longer exists internally, yet the organization has not fully aligned itself with the market. LEVEL 5: PREDICTABLE Corporate and functional strategies have been defined, aligned, and implemented, both internally and with the external market. The company is now in full strategic alignment. The organization is driven to excel, rather than settle for improved internal performance year over year. It seeks quantum improvements that are validated by the marketplace. LEVEL 2LEVEL 1 51% - 79% - - - - % COMPANIES IMPACT ON CLTV % ATTAINING GROWTH OBJECTIVE IMPACT ON SALES EXPENSE IMPACT ON MARKETING EXPENSE IMPACT ON R&D EXPENSE IMPACT ON PRODUCTIVITY PER REP 21% 2% 84% -2% -2% -3% 4% 13% 8% 91% -6% -4% -9% 9% 6% 13% 93% -11% -7% -17% 18% 9% -IMPACT ON CAC -3% -8% -16% -30% 26% 96% -21% -31% -31% 31% LEVEL 3 LEVEL 4 LEVEL 5

- 30. 28 SBI MAGAZINE STREET SMARTS HOW THE BOARD VIEWS SALES AND MARKETING EFFECTIVENESS An Insider’s Perspective from the Chairman of the Board by MATT SHARRERS As CEO, you will spend many hours in board meetings. You will also spend hours preparing. But what does the board really want, and how can you best prepare? Greg Alexander, CEO of SBI, sums it up nicely, “If everyone is on the same page all the way through the board and they agree on a set of KPIs, then the prep work for the board meeting shouldn’t be that laborious.” Even if the CEO and the board are Fred Florjancic, chairman of the board at Ramsey Industries, spoke with SBI to share the board member’s perspective on sales and marketing effectiveness. How does a board member evaluate if the sales and marketing strategy is being executed? Florjancic says, “From a board’s perspective, you have to start with what the company really looks like. Is the company a market leader? Are they a follower or are they a turnaround in process? Depending upon where you are in that spectrum, the board will take a different view as to future performance.” on the same page, what happens when something goes amiss? First, if you’re CEO, Florjancic suggests pulling your management team together and gathering the facts. After you assess the situation, you must understand what went right versus what went wrong. This crucial step will lead you to fairly strong conclusions as to what needs to be fixed and how you should go about it. Additionally, Florjancic emphasizes

- 31. FALL 2015 29 IF EVERYONE IS ON THE SAME PAGE ALL THE WAY THROUGH THE BOARD AND THEY AGREE ON A SET OF KPIS, THEN THE PREP WORK FOR THE BOARD MEETING SHOULDN’T BE THAT LABORIOUS. the CEO’s role in leading sales and marketing. He believes the CEO has to be the No. 1 sales and marketing leader in the organization. Even more importantly, the CEO needs to be out front with the customer, as he or she is critical to understanding the marketplace. The last element of success in Florjancic’s view is your team. He recommends surrounding yourself with the best team money can buy. “You want the best people working for you, because you don’t have all the answers as an individual — you can’t possibly in today’s very complex world.” He sees hiring, onboarding, coaching, counseling, and training as part of the manager’s key functions. And at the end of the day, Florjancic says strategy is pretty simple. It’s the allocation of three things: people, money, and time.

- 32. 30 SBI MAGAZINE STREET SMARTS If I asked you to tell me what your corporate strategy is, would you know? Answering this question correctly can have a large impact on your revenue performance. The most successful organizations have been able to align the corporate strategy with the strategies of the functional departments, such as the product team, marketing organization, sales department, and human resources group. In fact, companies that are aligned in this way are four times more likely to make their 2016 revenue number, according to SBI’s ninth annual research report. Although all are important, it’s the alignment of sales and corporate strategy that many leaders struggle with. THE SILVER BULLET TO MAKING YOUR NUMBER EVERY YEAR Aligning the Corporate and Sales Strategy by JOSH HORSTMANN WHAT IS A CORPORATE STRATEGY? It’s where the company answers the questions, “Why do we exist?” “Which markets will we choose to compete in?” “Who are we going to compete with?” and “What strategic advantages do we have that will allow us to win?” Answers to these questions become inputs into the functional strategies. This allows the leadership team to decide how to best allocate people, money, and time to generate profitable growth. For instance, the CEO may decide to enter a new market because the current market is no longer growing. This decision ripples through the company, making its way to the sales team, who now must reorganize around a hunter/farmer model to penetrate the new market. WHAT IS A SALES STRATEGY? A sales strategy is the operating plan for the sales team. It allocates resources correctly to increase revenue while reducing costs. When the CEO and sales leader have alignment, the team is laser focused on what the goal is and, more importantly, how they will obtain it. The team knows how Marketing is going to support them with leads. They understand the value propositions of each product coming out of development, and how they will beat the competition. No matter how talented the sales leader, he/ she cannot make the number without the support of the entire company. WARNING SIGNS TO LOOK FOR Below are a few red flags that may point to misalignment within your organization. You try to fix underperformance with compensation changes and SPIFFs Opportunities are stalled in the sales cycle as prospects don’t see the value of moving forward Product launches are pushed out to sales with no prior input or collaboration Marketing is creating campaigns with little direction from sales Aligning the corporate strategy to the sales strategy is key to making your number every year. The most successful companies have aligned their corporate strategies with the strategies of the functional departments. ➜ ➜ ➜ ➜ 78% 80% 82% 84% 86% 88% 90% 92% 94% 96% 98% 96% 84% % OF COMPANIES ATTAINING GROWTH OBJECTIVE Aligned Strategies Misaligned Strategies PERCENTAGE OF COMPANIES OBTAINING GROW TH OBJECTIVE

- 33. FALL 2015 31 Market segmentation is dividing the market into subsets of buyers with common needs, priorities, and solution options. You do it because it is important. It helps decide where to compete and how to win. For sales, however, market segmentation is interesting but not a technique they use to bring in more revenue. They should use it. Why? It would result in revenue growth. How? Convert market segmentation data to account segmentation data. The goal of account segmentation is to understand which accounts are going to generate the most revenue over the shortest period of time and at what cost. The unit of measure for the sales team is the account. The unit of measure for the CEO, product leader, and CMO is the market. This is a subtle, but significant, difference. For example, if you tell a sales leader that the oil and gas market is a $1 billion market growing at 5 percent per year, he/she cannot do anything with this information. In contrast, if you tell a sales leader that Exxon Mobil will buy $2.3 million worth of your product in the next fiscal year, a sales leader can assign coverage, calculate quota, and build an account plan. To generate revenue from your segmentation data, take it to the account level. HOW TO GENERATE REVENUE FROM YOUR SEGMENTATION DATA Take It to the Account Level by BARRY WITONSKI

- 34. Alex Shootman President at Apptio THE SBI BLOG. IT’S WHERE I GO FOR WORDS OF BUSINESS WISDOM. SBI BLOG Sign up for the blog today at www.SalesBenchmarkIndex.com/SBI-Blog

- 35. FALL 2015 33 TOP FACTORS DERAILING LEAD FLOW SUCCESS 48% 44% 39% CONTENT NOT DEVELOPED FOR TARGET AUDIENCES CONTENT LACKS RELEVANCE FOR AUDIENCE NOT LEVERAGING RIGHT DISTRIBUTION CHANNELS Personas and buying process maps (BPMs) are now commonplace. Not that long ago they gave you a competitive edge. Not anymore. But there may still be untapped potential in your BPMs that you can leverage to gain a competitive advantage. The best BPMs cover three important elements: the buying phase, key buyer actions, and micro-questions. Most BPMs stop short of the third element. But micro-questions are the key to unlocking exactly what the buyer is concerned with at each step in the process. Creating a BPM without tapping into the power of micro- questions is a waste of time in today’s marketplace. Micro-questions capture the aspects of a purchase decision that the buyer needs to resolve before they move to the next phase of the buying process. Without this understanding, sales and marketing teams commonly risk accelerating the buying process prematurely. They advance the process before they’ve resolved the buyer’s concerns. How do you determine the micro-questions for each step in the buying process? Ask. Conduct a series of interviews with buyers. Discover and document the questions, concerns, fears, uncertainties, and doubts they have. Investing in micro-questions gives you an advantage throughout the buying process. Marketing teams use them to develop more focused content. Sales reps use them to better prepare for each sales call. And the buyer is more satisfied with the sales process knowing their concerns are being addressed along the way. It’s as if you’re reading their mind. KNOW THE INFORMATION NEEDS OF YOUR CUSTOMERS Capitalize on the Untapped Power of Micro-Questions by ERIC BAUER BEST PRACTICES S U C C E S S F U L S A L E S A P P R O A C H E S P R O V E N B Y S B I R E S E A R C H

- 36. 34 SBI MAGAZINE BEST PRACTICES HOW GAMIFICATION WILL CHANGE YOUR LIFE Move the Bottom Half of Your Team to Excellence by RANDALL LEVEAU Gamification capitalizes on the natural competitive instinct of sales reps but in a way that focuses on beating personal bests rather than trumping peers. The result is a lift of more than 10 percent in metrics like quota attainment and new customer acquisition. But not all gamification services are equal. Here are the criteria you should use in selecting a gamification vendor: Identify KPIs: Gather a list of behaviors you aim to motivate, and determine the associated KPI metrics within your system of record. Vendor Short List: Identify the vendors who specialize in integrating with your primary system of record and begin the evaluation process. Pilot: Begin a pilot program on a select group of reps and measure the effectiveness of the configuration before rolling the program out across the team.

- 37. Aaron Stead, SVP, Sales @Infusionsoft “I’M ALWAYS TUNED IN. YOU DON’T GET BUSINESS INSIGHTS LIKE THIS THROUGH THE GRAPEVINE.” —AARON STEAD SBI PODCAST Download at: www.SalesBenchmarkIndex.com/SBIPodcast

- 38. 36 SBI MAGAZINE BEST PRACTICES Eighty percent of companies will have higher sales quotas than the year before, but 40 percent of sales reps are going to miss their number. Of all reps, 19.4 percent will be out of the job by year’s end. Your products, prices, and competitors are all changing. How do you plan to make the number amid such uncertainty? What head count do you need to account for turnover, missed numbers, ramp time, and more? Sales planning starts with having the right model to track head count, costs, and projected revenue. The cost dimensions must inform the production needed from each rep in order for sales to break even; and the model must be dynamic enough to test all assumptions. The output of this work will not only answer the question of head-count planning, but also tell you what sales budget you need in order to meet your revenue goals. The model you create should be informed by your CFO’s budgeting method (percentage of revenue, competitive benchmarking, objective-based, affordability, etc.), because that will determine the budget questions it needs to answer. You must continue updating the model throughout the year as the assumptions you have made give way to new realities and raise additional questions. Regardless of which budgeting method you do use, the sales planning model should serve as a financial playbook for creating and executing your strategy. WHAT SHOULD BE INSIDE YOUR 2016 SALES PLAN? Strategy Among Uncertainty by ADAM DAVID OF COMPANIES HAVE A HIGHER REVENUE TARGET THAN LAST YEAR2 (56% ARE MORE THAN 20% HIGHER THAN LAST YEAR) OF SALES REPS MISS THEIR NUMBER3 80 % 40 % 63 % OF SALES REPS EXCEED 75% OF QUOTA 1 1 Sales Compensation and Performance Management Study 2014 Key Trends Analysis – Xactly 2 The State of Sales Productivity in 2015 (INFOGRAPHIC) – Salesforce Blog 3 The Twelve Sales Metrics That Matter Most – Harvard Business Review 0F SALES REPS HAVE HIGHER THAN 40% VARIABLE PAY 1

- 39. FALL 2015 37 PROSPECTS 10.6 % VOLUNTARY SALES REP TURNOVER1 8.7 % INVOLUNTARY SALES REP TURNOVER1 19.4 % SALES REP TURNOVER1 49 % OF ORGANIZATIONS HAVE ZERO MEANS TO MEASURE PRODUCTIVITY 2 OF EXECUTIVES LISTED “ACCURATELY TRACK AND MANAGE COST OF SALES” AS THEIR MOST IMPORTANT AREA OF FOCUS1 5.7% THE TYPICAL ORGANIZATION SPENDS $24,000 PER PERSON ON IMPROVING PRODUCTIVITY2 ILLUSTRATIONSBYSAMPEET

- 40. 38 SBI MAGAZINE BEST PRACTICES DESIGNING TERRITORIES ACROSS 220 COUNTRIES For This Logistics Industry Leader, It’s an Art and a Science by GEORGE DES LOS REYES most potential. Robertson has laid out a six-step process used by DHL to allocate the right reps to the right territories. 1 The first step is baselining current performance on items such as revenue, product mix, customer and prospect count, and close rates. DHL completes this critical step by starting with sales strategy and market segmentation. Then, they take it down How does DHL, the most international company in the world with 285,000 employees in 220 countries, design its sales territories? SBI spoke with Tim Robertson, the logistics industry leader’s U.S. vice president of sales and marketing, to find out. The objective of territory design is simple. You want to put your best salespeople in the territories with the to a channel analysis, and finally to the individual sales rep. 2 The second piece of the puzzle is analyzing customer spend. For Robertson, the diamonds are in the details. DHL looks at not only the available customer spend but also tries to project the lifetime value of each customer. 3 Next, they determine the market

- 41. FALL 2015 39 ILLUSTRATIONBYMARKROSS potential. In this case, you must take the output from step two down to the account level. The result is a stack ranking of accounts, top to bottom based on spend potential. “While this is a mission-critical step in territory design,” says Robertson, “I cannot overemphasize the role that the sales manager plays in weekly coaching sessions.” It is one thing to have all the data, but the sales manager must drive the actual activity. 4 The next step in territory design is producing initial territories. Greg Alexander, CEO of SBI, explains that there are three ways to do this: the customer-driven approach, the activity- driven approach, and the geographic approach. In the first method, a sales territory consists of a list of named accounts. The second involves a workload analysis. The third is based on geographic assignment; a rep sells to all customers in a given location. 5 The fifth step is all about rebalancing territory assignments. At this stage, focus should be placed on the number of customers, prospects, and market potential. 6 The final stage is creating territory plans, which also involves assigning goals for these territories. “This is an essential part of driving sales performance,” says Robertson. “We’re also continually making adjustments throughout the year. If we see a weakness, we make a quick adjustment.” Use these six simple steps to properly design territories to make your number. THE OBJECTIVE OF TERRITORY DESIGN IS SIMPLE. YOU WANT TO PUT YOUR BEST SALESPEOPLE IN THE TERRITORIES WITH THE MOST POTENTIAL.

- 42. HE DELIVERS ON TIME, ON BUDGET AND ON SPEC. NOT SURPRISINGLY, HE ALSO DELIVERS 97% CLIENT SATISFACTION. SCOTT GRUHER, PARTNER AND VP OF CLIENT SUCCESS Contact Scott Gruher at 415.608.9954 or scott.gruher@salesbenchmarkindex.com

- 43. “SBI TV MAKES BINGE WATCHING GOOD FOR BUSINESS.” —CHRISTOPHER BRAY www.SalesBenchmarkIndex.com/SBI-Blog Christopher Bray, Senior Vice President, WW Consumer at McAfee SBI TV Download at: www.SalesBenchmarkIndex.com/SBITV

- 44. 42 SBI MAGAZINE THE DIGITAL TRANSFORMATION OF MCGRAW-HILL How a 125-Year-Old Publishing Company Became a Digital Marketing Powerhouse by MIKE DRAPEAU ILLUSTRATIONBYMARIOWAGNER BEST PRACTICES SBI recently spoke with Chris Marjara, the chief marketing officer of McGraw-Hill Education. Newly hired at McGraw-Hill, Marjara is facing a unique challenge. He is leading the digital transformation of the company’s textbook business. Marjara is taking McGraw-Hill Education from a traditional textbook publisher to a digital-solutions company. This is no easy task. But it is one faced by many marketing teams: reinvention to stay relevant in the digital age. Marjara discussed in depth one of the biggest challenges — the budget. No marketing team can be successful in transforming their company without the proper budget. But how do you get the executive team on board? And once you do, how do you determine what your budget should be? “Companies that are trying to reinvent themselves need a big marketing budget to do so, but long- tenured executives married to the old

- 45. FALL 2015 43 business model are reluctant to invest,” claims Greg Alexander, CEO of SBI. “How do you change that?” Marjara says it’s simple. It’s about demonstrating real value. “You’ve got to prove your worth and keep proving your value every step of the way.” Only then will you gain the buy-in from your leadership team. Once you have the support, the next step is determining your budget. There are four common budget-setting methodologies. How do you know which one is right for you? One method is simply a percentage of revenue. If your company does $100 million in revenue and 10 percent is spent on marketing, your budget is $10 million. “This is the traditional method of calculating marketing spend, but it all depends on the context of the marketplace,” says Marjara. “For example, if you’re a brand-new technology looking to make an entrance into a new area, clearly you’re going to be spending a significant amount more to acquire new customers.” Alexander agrees. Though useful, this budget-setting methodology must be placed in the proper context. The second budget-setting approach commonly seen is competitive benchmarking. This requires establishing a peer group of companies and understanding how much they are spending on marketing. Then you must look at your spend. Is it greater than, less than, or equal to theirs? Again, Marjara maintains it’s all about context. What type of industry are you in? Is it mature? Is it on the verge of new innovations and technologies? All of these issues must be taken into account. Alexander recommends you take it a step further and benchmark at the program level. “Somebody can always outspend you. It’s a question of do you have the budget allocated correctly across the programs and are you intelligently spending to give yourself a competitive advantage.” The third method involves asking, “What can we afford?” In this case, it is a matter of making consumption choices. You are in survival mode and must make some tough decisions while looking at every dollar spent. Prioritization is key to increasing market share. The fourth and final budget-setting methodology is a favorite of both Marjara and Alexander: objective-based budgeting. In this scenario, marketing teams gather a list of objectives that need to get done and list what it will cost to accomplish each. Alexander recommends asking a series of questions. “How is the marketing strategy reflective of the corporate strategy? Are these mission- critical objectives?” If so, they must be properly funded. At the end of the day, no matter what your budget-setting method is, marketing teams must get the budget, allocate it, and spend it correctly. The key to modernizing your marketing team is investing your budget wisely, for there is only so much money to go around. THE KEY TO MODERNIZING YOUR MARKETING TEAM IS INVESTING YOUR BUDGET WISELY, FOR THERE IS ONLY SO MUCH MONEY TO GO AROUND.

- 46. 44 SBI MAGAZINE BEST PRACTICES WHY YOU CAN’T GET YOUR REPS TO SELL THE NEW PRODUCTS The Importance of a Sales Enablement Plan by DAN BERNOSKE HOW DO WE TELL A COMPELLING STORY? A successful launch hinges upon how well you communicate. A compelling story starts by addressing real market problems on the buyer’s terms. That story must compel someone to invest in you versus the competitive alternatives. Yet you can’t expect buyers to determine your product’s value on their own. You must spur them to action. Spell out the conviction of your value proposition. Shift the buyer from a price discussion to a value discussion. HOW DO WE ENSURE ORGANIZATIONAL READINESS FOR OUR LAUNCH? The world is littered with failed products because of poor launch planning. Product management can develop the perfect product, but that alone does not ensure success. This is the most critical step in your product life cycle before you execute. Here are a few ways to align functional leadership to be ready for launch: • Define the launch goals • State the launch strategy (e.g., land and expand, replacement, migration, upgrade) • Define the target buyers • Create a risk-mitigation plan • Hold functional leaders, including marketing and sales, accountable for their roles HOW DO WE EXECUTE THE LAUNCH PLAN TO ACHIEVE THE PRODUCT’S BUSINESS OBJECTIVES? A well-developed product and launch plan will only be successful with execution. Flawless execution requires a relentless effort to overcome old organizational and buyer habits. Here are a few keys to a successful product- launch execution: • Measure success against the launch goals and promote quick wins • Reinforce enablement through training and coaching • Incent the right sales behavior to facilitate the launch • Get ahead of possible issues before they jeopardize success A product road map prioritizes what the market has told you it needs. When properly built, it continuously spawns winning solutions and accelerates revenue growth. Even the best products can become obsolete overnight because competition is fierce. So keep listening to the market and innovate your products faster than the competition. Your future success depends on it. Your product road map provides validated ideas that deliver real value. It sets your organization up to capture more market share. But having a well-balanced product road map is only half of the equation. The other half of your future success rests upon a flawless sales enablement plan. This sales enablement plan must choreograph messaging, planning, and execution of your product launches. It’s well- synchronized with the road map’s timelines. This is the delicate handoff from product development to marketing and sales. BY THE NUMBERS 66%of new products still fail within two years (Booz Allen Hamilton) 96%of all innovations (of which most are new products) fail to return their cost of capital (Doblin)

- 47. “I THUMB THROUGH MOST MAGAZINES. I POUR THROUGH SBI MAGAZINE.” —PAUL ROSEN SBI MAGAZINE Order your SBI Magazine today at www.SalesBenchmarkIndex.com/SBIMagazine Paul Rosen, Chief Sales Officer at OnDeck

- 48. 46 SBI MAGAZINE

- 49. FALL 2015 47 THE SECRET RX FOR DEVELOPING YOUR 2016 SALES STRATEGY A Step-by-Step Guide to Success Mark Synek ILLUSTRATIONBYALLANDAVEY

- 50. 48 SBI MAGAZINE I sat, waiting for more. When I realized no other details were forthcoming, I took another approach. I asked him if he had a document or a PowerPoint he used to review his strategy with his team. “No,” he said. “I just talk through everything with the team on the forecast calls and at our annual kickoff. I think everyone’s pretty clear on what we expect.” This leader had fallen prey to the kind of overconfidence that assails many sales executives. His belief in his ability to be articulate had trumped preparation and thoughtfulness. Learn how to make sure you avoid his mistake. Strategy development can seem like a heavy lift. Here’s a framework to help you think it all through. FIRST, DEFINE WHAT STRATEGY IS What Is a Sales Strategy? It is an operating plan for a company’s sales force. What Does a Sales Strategy Do? It allocates sales resources efficiently to drive selling costs down and revenues up. What Does It Mean to Use a Sales Strategy? It means the sales executive will get the most out of his or her sales force. NEXT, WRITE IT DOWN! You must of course sell your strategy and vision to your team. But you must also sell it to other executives — your peers in marketing, product, and HR, for example. They don’t work for you; you have to successfully influence them to do what you want. You need a tool to help you: literally, a written document you can “slide across the table.” My experience tells me very few sales leaders have done this. Most strategies are vague and undocumented. Or they are just a collection of different tactics with no glue holding them together. GAIN ALIGNMENT BY USING THE RIGHT INPUTS If everything is important, then nothing is important. And if you place importance on the wrong things, you’ll be out of LAST YEAR, I WAS WORKING WITH THE HEAD OF SALES FOR A FORTUNE 250 COMPANY. WHEN WE FIRST MET, I ASKED HIM IF HE WOULD WALK ME THROUGH HIS SALES STRATEGY. “SURE,” HE SAID. “PROFITABLE GROWTH.” THE MA IN INPUT S F OR A SU CC E S S F U L SAL E S STR ATEGY Market Research Corporate Strategy Marketing Strategy Talent Strategy Product Strategy ILLUSTRATIONBYALLANDAVEY

- 51. FALL 2015 49 Before Strategic Alignment After Strategic Alignment alignment with the rest of your company. Your strategy will fail. Consider these five inputs: Market research is the main feed into your sales strategy. It confirms you’re competing in the right markets for your product, service, or solution. It tells you which accounts to prioritize. Finally, it tells you what your buyers want from you when you’re engaged with them. The objectives for your sales strategy should be pulled out of your company’s corporate strategy. For example, is your CEO more interested in new logos or minimizing churn? Your corporate strategy will tell you. And woe is the sales leader whose strategy is out of alignment with his CEO’s. Your company’s product strategy is what arms your gun with bullets. You can have the best sales force in the world, but if your products don’t solve your buyers’ market problems better than the competition, you’d better provide buyer feedback to your product team. Of the five inputs, the one you’re tied most closely to will be your marketing strategy. If it fails, you’re going to have a long year. Figure out how many leads you need from marketing. Go tell your peer down the hall. Gain agreement on how leads will be measured and understand how your marketing team plans to obtain them. Finally, your talent strategy tells you how many people you need when — and what type of people they need to be. It’s the plan for sourcing, hiring, onboarding, and developing your future A players. USE A FRAMEWORK TO FOLLOW THE RIGHT SEQUENCE Finally, be sure you do things in the right order. Did you ever revise a compensation plan before you evaluated territories and quotas? That’s a great example of performing work out of sequence. It’s painful and usually fails to accomplish the desired results. Here are the five steps involved in defining a properly sequenced sales strategy: 1. Planning: Develop the sales and data plans that will allow you to make the number. 2. Engagement: Define the process by which the sales team will interact with prospects and customers. 3. Organizational Structure: Confirm you’re set up with the right people in the right roles to execute the process. 4. Execution: Focus on the details — drive adoption of the strategy through sales enablement and data analysis. 5. Support: Get low-value activities off your team’s plate so they can maximize selling time. Using these tools and this sequence, you’ll develop a winning strategy. But once you implement it, don’t just walk away. Evaluate your strategy on a quarterly basis, and make agile adjustments as necessary. Don’t just wing it. If you do, you’re playing fast and loose with your career as a sales leader. • The sales strategy was nonexistent. • A spreadsheet model showed how the sales team was going to achieve its quota. • Other than that model, sales submitted 10 funding requests a year to approve initiatives needed to help them succeed. • If approved, these requests were executed in isolation and typically produced no sales lift. • Sales drove activity to make up for poor conver- sion rates. • The typical approach was: “If we generate enough leads, we will hopefully close enough to make our number.” • Sales dreaded new product launches. • A new product launch meant two days out of the field, many new KPIs to report upon, and a com- pensation SPIFF that was merely a distraction since no one would attain it. • Sales joked that new prod- ucts were not released; they “escaped.” • Sales’ current products were less attractive than they were five years ago. • Sales and marketing were at odds. • The team leaders were not speaking. • Sales seemed to get all the blame for declining revenue, yet marketing was doing nothing to help. • The sales strategy used the corporate strategy to understand its objectives. • The sales strategy was built around obtaining those objectives; it includ- ed everything needed to meet those objectives effi- ciently, because everything was connected in pursuit of the revenue goal. • The sales team used the market research to gain a deep understanding of buy- ers, learning what buyers really wanted from them. • Sales could approach each call most effectively, and, as a result, buyer engagement and win rates improved. • The sales team was included in product road map decisions early and educated on the benefits of the next new release as it related to buyers. • The sales team was excited about the new conversa- tions they could have with customers. • The product team contin- ued to ask for feedback, which was acted upon to address problems. • Sales and marketing worked as partners. • The sales team was direct with marketing on what was and was not working, and marketing adjusted based on the feedback. • Sales knew they could not succeed without the support of marketing and were appreciative of their contributions. Here’s a quick look at how one large sales organization operated before and after implementing this level of strategic alignment. Does any of this look familiar?

- 52. HOW 1T FEELS TO MAKE YOUR NUMB3RTOP SALES LEADERS REVEAL THEIR PROVEN PRACTICES FOR GROWING REVENUE BY GREG ALEXANDER PHOTOGRAPHY BY CHRIS RUPERT

- 53. W hen some of the top B2B sales leaders convened at The Ritz-Carlton, Kapalua in Maui, Hawaii, this August for the SBI Sales Strategy Summit, nobody really knew exactly what to expect. In one sense, it was like seeing the who’s who list of heads of sales up close and personal, as they stuck their toes in the sand and their hands in their golf gloves. In another sense, it was like watching a chemistry experiment, where glass beakers containing the most brilliant sales minds in the business were poured into the same think tank, allowing dynamic and daring personalities to mingle as they shared unique approaches to making the number. And allowing peers to ponder as they volleyed insights back and forth across a shiny mahogany conference table, while casually observing each other’s DNA under the forgiving lens of a make-believe microscope. The result? Nothing short of spectacular. These people of uncommon ability discovered that they actually had a lot in common. And though their roads to success may have been driven with different products and companies located in different states and countries, their paths remained remarkably parallel. This was a meeting of enlightened minds that have set the stage for strategic alignment and set the standards for what it will take for you to make your number in 2016. In this issue of SBI Magazine, several of our attendees will reveal their proven practices for growing revenue. Prepare to soak it up. PHOTOILLUSTRATIONBYALLANDAVEY

- 54. 52 SBI MAGAZINE52 SBI MAGAZINE “WE DON’T HAVE A ONE- SIZE-FITS-ALL MODEL; EVERYTHING WE DO, INCLUDING ENGINEERING, IS IN RESPONSE TO HOW OUR PARTNERS DO BUSINESS.” CHRISTOPHER BRAY, SVP, INTEL SECURITY

- 55. FALL 2015 53 Selling Through Partners ALWAYS KEEP THE END CUSTOMER IN MIND A re you reading this article in a digital format? If your answer is yes, chances are that Intel Security protects your PC, tablet, or other mobile device and the Internet service provider delivering it to you. Christopher Bray is senior vice president of the company and is responsible for consumer business worldwide. While you might think that products designed to give people the confidence to live and work safely in a digital world would sell themselves, it actually requires the help of really good partners. The trick is finding them. How do you know which ones have the potential to be the right fit? Though scale and reach are big factors for a company like Intel Security, it digs even deeper. “We look at [the] value proposition they offer their consumers,” Bray says. “And then we look at how we can integrate security to enhance that proposition.” Those who are actively engaged tend to make the best partners. “It’s not just about getting the product out there,” Bray says. “It’s also about getting users to adopt the product and retaining them over the long term.” Therefore, understanding the end user is key. Knowing how to compete is also right up there. “Back in the day, most people would walk into a big-box retailer and buy security software off that shelf,” Bray says. “Instead of going after the 800-pound gorilla to disrupt that channel, we forged our own path with the leading ISP provider at the time.” Today the sale is actually B2B2C. “We’ve been able to increase our coverage because we realize it’s about our customer’s end customer,” Bray says. “We don’t stop at the selling partner; we think all the way through to who’s going to use the product.” By knowing selling partners’ pain points and being able to put themselves in their shoes, Intel Security has enjoyed long and comfortable interactions resulting in long-term relationships and, more importantly, revenue growth. “We don’t have a one-size-fits-all model,” says Bray. “Everything we do, including engineering, is in response to how our partners do business.” HOW IT FEELS TO MAKE YOUR NUMBER NO. 1 CHRISTOPHER BRAY

- 56. 54 SBI MAGAZINE Outsourcing as Part of the Sales Strategy THIS UNDERRATED TECHNIQUE CAN LEAD TO A SALES VICTORY A t first glance, you might think Ted Grulikowski is the head of a special ops unit of the military elite. And that’s understandable when you consider his responsibilities. As vice president of the B2B business unit of MarketSource, the most successful sales outsourcing company in the world, Grulikowski is an expert at gathering intelligence and quickly deploying highly trained, well-equipped ground troops into designated battle zones to bolster existing forces or even establish key installations for future acquisitions. While there may not be anything covert about what he does, Grulikowski’s stealthy maneuvers certainly deserve a medal of honor. The 200 companies that have placed their outsourcing needs under his caring command — which includes providing inside, outside, direct, and indirect sales support — have grown their revenues by a staggering $6 billion. Results like that make it hard to explain why more companies don’t outsource at least part of their sales operations. “Nine times out of 10, they don’t think of outsourcing sales,” Grulikowski says. “They think of [it as] offshoring, low value, people on the phone handling billing issues.” In reality, he says, it’s a value-added resource that allows companies to acquire capabilities they may not have. “We look at what a company’s trying to solve and attack it from a sales challenge standpoint, serving any market in a way that’s much more effective,” says Grulikowski. MarketSource helps companies make more sales faster and better by designing, developing, recruiting, hiring,training,deploying,andmanagingsalesorganizationsacrosstheentireB2Bcustomer- engagement life cycle. “Many companies don’t have the latest and greatest sales-enablement tools,” Grulikowski says. “It’s hard for them to scale a sales force up or down efficiently.” Fortunately, the brigades at MarketSource stand at the ready. “We enable the legacy or existing sales team to focus on the things they need to make their number.” Obviously, thinking outside of the box isn’t a clichéd business goal for Grulikowski. It’s what his life is all about. And though he prefers nicely tailored suits to fatigues, his approach to outsourcing sales is that no mission, no matter how large or small, is impossible. HOW IT FEELS TO MAKE YOUR NUMBER NO. 2 TED GRULIKOWSKI

- 57. FALL 2015 55

- 58. 56 SBI MAGAZINE

- 59. FALL 2015 57 A New Organizational Model for the Sales Team HOW BLACK BOX SWITCHED IT UP FOR SUCCESS J ulie Lyda has impressive guns — something that came in handy for this part-time fitness buff and executive vice president of North American commercial sales for Black Box. After all, she led the charge to take her company from a decentralized branch-based sales team to a functional, centralized sales team after it had acquired 50 companies in just 15 years. But what gave this provider of IT infrastructure solutions with 4,000 employees and just under $1 billion in annual sales the courage to do so? Lyda says it was years of not being able to grow as an organization or leverage their capabilities. “We could no longer reach clients the way we wanted to reach them,” Lyda says. Black Box realized it had very large enterprise clients and smaller ones, and it was serving them by geography without a lot of focus. So the company identified the white space in each of its accounts as well as its best talent. “We moved our best people to our best accounts, providing a more economic approach to serving our SMB [small- and medium-sized-business] clients,” Lyda says. After considering the seven dominant B2B sales organization models, Black Box chose stratification, which involves stratifying accounts based on spend potential. Sure, switching to this organizational model was more expensive because it involves specialization, but the company knew its large enterprise clients were willing to pay the elevated costs for the complex solutions it provided. Lyda says, “We spent a lot of time learning what clients wanted from us, instead of the other way around.” But with any new org chart comes new positions on it. Who would call on which clients? “Prior to our reorganization, everybody did their own thing,” says Lyda. “We had no uniform sales process.” But by understanding its accounts and buyers, Black Box came up with a new five-step sales process that worked. Of course, when transitioning from the old way to the new, you must make sure that two things never happen. Lyda says, “You cannot lose key customers or top salespeople.” To that end,communicationisahugefactor.“Sincetheteamisonthefrontline,wekeptthemengaged in the decision-making,” says Lyda. “It’s about keeping everyone aware of what you’re doing and why.” HOW IT FEELS TO MAKE YOUR NUMBER NO. 3 JULIE LYDA

- 60. 58 SBI MAGAZINE Developing a Talent Strategy for the Sales Force THE ABCS OF HIRING SALES-TEAM SUPERSTARS U nless you put a team of superstars in the field, it’ll be tough to make your number. Nobody knows this better than Dave Moore, vice president of North American sales at Businessolver. His company provides a SaaS solution that allows employees and employers to get the most out of their benefits program. He says you’d better know your ABCs if you want to develop a talent strategy. “We build A-player profiles for each of the key roles in the sales organization,” says Moore. “Then we perform talent assessments against them.” It must be working. Businessolver doubled the sales force of its quota carriers in the last six months. How does the company find the talent it needs? By identifying key markets it wants to compete in and the talent needed to win, every year. “We constantly look at our networks so we can always tap into those A players,” Moore says. But it doesn’t happen overnight. Hiring begins with assessments via phone screens. Then the process moves to an internal recruiter, other sales leaders, and finally to Moore. Along the path, they calibrate. If everyone’s aligned, they bring in the candidate to meet with key stakeholders for tryouts. “SBI helped us implement a work tryout to have them perform tasks and behaviors we expect from our sales consultants,” Moore says. Once they find keepers, onboarding begins. “It’s not just about assimilating them into the company. It’s about deploying them quickly, getting them comfortable with Businessolver, and having them be productive out in the field,” says Moore. Further, Moore says he has individual development plans to help each employee gain the skills needed to succeed. To that end, the company uses a tool called Small Improvements that allows Businessolver to engage with consultants on a quarterly basis to get input. “We’re in a very agile and fast-paced industry, so we need more real-time feedback.” Once all of these elements are in place, the company builds a bench of future leaders. “For us, it’s a math equation,” Moore says. “We look at the span of control of our leadership team to see where we might need additional leadership and for how long.” HOW IT FEELS TO MAKE YOUR NUMBER NO. 4 DAVE MOORE

- 61. “SBI HELPED US IMPLEMENT A WORK TRYOUT TO HAVE THEM PERFORM TASKS AND BEHAVIORS WE EXPECT FROM OUR SALES CONSULTANTS.” DAVE MOORE, VP, BUSINESSOLVER

- 62. 60 SBI MAGAZINE “YOUR MESSAGE MUST CONVEY THAT YOU UNDERSTAND AND EMPATHIZE WITH WHAT THEY’RE GOING THROUGH; YOU HAVE TO DEVELOP AN EMOTIONAL LINK.” PAUL ROSEN, CHIEF SALES OFFICER, ONDECK (RIGHT)

- 63. Selling Successfully in the Small-Business Segment HOW TO MAKE IT BIG WITH SMALL-BUSINESS CUSTOMERS T hink small. After all, thinking like a small-business owner can lead to big revenue growth. Just ask Paul Rosen, chief sales officer at OnDeck, which provides capital to small- business owners; or Aaron Stead, senior vice president of sales at Infusionsoft, which provides sales and marketing software applications. These two sales leaders have been successful selling in the small-business segment by adopting this mind-set. And both agree that targeting the mind-boggling 7 million small-business owners in this country alone requires getting inside their heads. “These people work a ton and don’t have a lot of bandwidth,” Rosen says. “They want to focus on their core competency.” And you can’t hide the benefit of your product or service. It must be simple and easy to understand. “They don’t want to feel like they need a CPA or an MBA to figure it out,” Stead adds. Moreover, small-business owners are laser-focused on time to value. “If they can bring value into their businesses this week, [this] month, or this quarter, they are willing to pay for that exchange,” Rosen says. In fact, to make its software even more palatable, Infusionsoft offers a monthly subscription service. “We try to stay lower than a car payment,” Stead says. Of course, speed and price are just a few pain points to recognize. Your company’s brand attributes also have to hit the small-business owner right where they live. “Your message must convey that you understand and empathize with what they’re going through,” says Rosen. “You have to develop an emotional link.” Thisconnectioniskeyifyouexpecttoearntheirtrust,accordingtoStead.“Asmall-business owner is skeptical, primarily due to large companies serving mid-market and enterprise businesses trying to enter their space without even trying to connect on their level,” Stead says. “You have to convince them your product will solve their specific problems.” In some cases, you may have to convince their lawyer, CPA, or even a meet-up group. “Small- business owners often surround themselves with trusted advisors,” says Rosen. Bottom line? Make sure that their circle of influence always includes you. HOW IT FEELS TO MAKE YOUR NUMBER NO. 5 AARON STEAD / PAUL ROSEN FALL 2015 61

- 64. 62 SBI MAGAZINE Connecting Corporate Strategy and Sales Strategy THE CEO AND SALES LEADER NEED TO SPEAK THE SAME LANGUAGE T o some sales leaders, a corporate strategy is a foreign object. To Paula Shannon, chief sales officer and senior vice president of Lionbridge Technologies, it is her native tongue. That’s a good thing, considering she is responsible for staying a step ahead of the competition at the world’s largest language-services provider. Not only is Shannon fluent in the company’s objectives and competitors by market segment, but she also knows which products have been slotted to compete in those markets. No easy feat since the company has a broad portfolio of offerings. This savvy has certainly helped Lionbridge achieve strategic alignment. But how does it translate into sales? Flawlessly, of course. Instead of handing salespeople quotas that they automatically try to negotiate, she explains how they reached their numbers. “We want to make sure the pyramid doesn’t topple over,” Shannonsays.“Sowebuilditwithfacts,sharingthesamebigdatathatinformedourdecisions with our sales team.” “This garners respect for the sales leader,” says Shannon. “It tells them I’m giving them everything they need to succeed.” This also drives head-count allocation and hiring profiles, also based on passion and integrity. “Thanks to SBI, we use job trial to ensure candidates have both,” she says. After all, how people act when nobody’s looking is what defines a company. By all accounts, Lionbridge team members must be on their best behavior. They continue to outperform and outsmart the other guys by challenging customers to make sure they have all the right steps in place. And they maintain the deepest expertise in their industry by staying true to themselves. Shannon says, “We are language at the core.” Such an unwavering focus starts with a well-defined corporate strategy. Yet making sure that the CEO and the sales leader speak the same language is at the heart of any company firing on all cylinders. It’s what connects the corporate strategy to the sales strategy and, in turn, the company to its true potential for revenue growth. Shannon says, “If we want our solution architects to articulate the brand promise to our customers, we have to give them the blueprint.” HOW IT FEELS TO MAKE YOUR NUMBER NO. 6 PAULA SHANNON

- 65. FALL 2015 63

- 66. 64 SBI MAGAZINE

- 67. FALL 2015 65 Sales Ninjas PUT TOGETHER A SUPERHERO SALES TEAM TO SNAG CUSTOMERS N injas actually exist outside of that famous group of animated teenage reptiles. In fact, Brandon Tolany, chief sales and marketing officer at Freescale Semiconductor, claims they exist within the business unit of any great sales organization. And he should know. His company does just under $5 billion in annual sales and employs over 17,000 people worldwide. But before he turns his superhuman and highly technical sales force loose on customers, he performs market research to make the best allocations of people, money, and time. And this process involves segmenting markets, accounts, and buyers. “Freescale goes after vertical industries in the $332 billion semiconductor market,” says Tolany. “Fortunately, more than half of it is in our wheelhouse.” But when adjacencies emerge, he says they try to shift their resourcing on the fly toward those growth markets. “We need a lens that gives us a two- to three-year horizon for revenue, then we try to react.” But that lens isn’t focused on revising Freescale’s go-to-market model every time the wind changes direction. “For us, it’s less about product life cycle and more about customer personality,” says Tolany. “It’s about reaching them during their design cycle.” Apparently, Freescale doesn’t have to go far to do that. Tolany says the company’s ideal customer profile is somebody who’s already there. “If they already use our silicon and tools and are familiar with our software, but we have a smaller share, we know we can sell them more.” Of course, the key to selling is being able to pinpoint when customers have the propensity to buy. And that’s precisely how Freescale prioritizes resources. Tolany says, “There’s a window and if you miss their design cycle, you may not get back in it for years.” But knowing when means little if you can’t grasp who your buyers are and what they care about. “We are 95 percent custom for every design we are in,” says Tolany. “They’re all about lowest power and highest performance.” Tolany is convinced his buyers make decisions based on past experience. That leads us back to the importance of having superheroes on your sales team. HOW IT FEELS TO MAKE YOUR NUMBER NO. 7 BRANDON TOLANY

- 68. REVENUE GROWTH MATURITY MODEL DEFINED IMPLEMENTED MANAGED PREDICTABLE CHAOS 1LEVEL 2LEVEL 3LEVEL 4LEVEL 5LEVEL WHERE YOU RANK DETERMINES WHAT’S IN THE BANK. Benchmark yourself against your peers and find out if you’re positioned to make your number in 2016. 2016 STRATEGY WORKSHOP Contact us at www.SalesBenchmarkIndex.com/2016Workshop

- 69. A C H I E V I N G YO U R G O A L S I N S I D E A N D O U T S I D E T H E O F F I C E 29% 86%DECREASE IN EMPLOYEE RELUCTANCE TO RELOCATE FROM 2012 TO 2014 OF ORGANIZATIONS PROVIDE EXTRA INCENTIVES TO ENCOURAGE RELOCATION FALL 2015 67 HOW HIGHLY SUCCESSFUL PEOPLE HANDLE A RELOCATION Making It Work for the Whole Family by BARRY SOMERVELL ENGAGE EVERYONE IN THE PLAN Be inclusive when deciding on things like homes, schools, and extracurricular organizations. These decisions make all the difference in how the family will adjust to their new environment. ANTICIPATE AND MITIGATE Just as you plan for challenges and risks in business, think through what may negatively impact each family member and proactively address each issue in positive ways. MAKE IT AN ADVENTURE Relocation is filled with new experiences, meeting new people, and sometimes even unexpected surprises. Embrace and celebrate these adventures to make your family’s relocation a success. IDEAL LIFE You have been working hard, doing well, and finally an opportunity comes knocking. It is the perfect job and would be a big career advance. It sounds great, but it requires a relocation. Opportunities like this can be professionally and personally rewarding if you plan with the family in mind.

- 70. 68 SBI MAGAZINE IDEAL LIFE of hidden fat. Stay away from creamy salad dressings; substitute them for a clear dressing like balsamic vinaigrette. What you drink is as important as what you eat. Stay away from sodas, teas, and energy or sports drinks. They are full of sugar, which means more calories than you need. Dessert and cookies are an absolute no-no! Would you eat it at home? Being on the road isn’t a license for bad choices. You don’t always have a choice in what is provided for lunch when you are traveling. But you do have control over what you eat. It’s lunchtime and you have been asked to order in. Here are a few simple tips to help you keep it healthy. If lunch has been ordered for you, apply these tips to the choice of food you select. Stay away from anything labeled “crispy” or “crunchy.” This usually means fried, which can turn a healthy piece of chicken into calorie overload. It also has more saturated fat than you would like. Eliminate the bread on the deli sandwich. Can you order it as a lettuce wrap? Or take off the top layer of bread and make it open-faced. Exercise portion control. Just because the food is there to eat doesn’t mean you should. Keep your servings to only three at any given meal. A serving of food is equivalent to the amount of food that you can fit in your cupped hand. Some sandwiches can be considered two to three servings based on the size. Remember, you don’t have to eat the entire sandwich. Salads are always a great option; be careful, though. Salads can hold a lot LUNCH ENGINEERED FOR THOSE WHO WANT TO STAY FIT A Catered Lunch Doesn’t Have to Wreak Havoc on Your Diet by LYNNE SHARRERS ➜ ➜ ➜ ➜ ➜ Lynne Sharrers

- 71. FALL 2015 69 WOMEN HAVE INCREASED 330 MORE CALORIES PER DAY MEN HAVE INCREASED 200 MORE CALORIES PER DAY 43.5 SODA VS. WATER CUTTING 1 CAN OF COCA-COLA PER DAY IS EQUIVALENT TO SKIPPING ENOUGH CALORIES TO LOSE 14.5 POUNDS IN A YEAR 3 CANS PER DAY = POUNDS PORTION SIZES HAVE DOUBLED OR TRIPLED OVER THE LAST 20 YEARS THE AVERAGE MALE CONSUMES 175 CALORIES A DAY FROM DRINKS CONTAINING ADDED SUGAR Now it's 8 ounces (590 calories) A cheeseburger 20 years ago was 4.5 ounces (333 calories) A soda was 6.5 ounces (90 calories); now, it's 20 ounces (240 calories) PORTION SIZES CONTRIBUTE TO MORE CALORIES PER DAY THAN 20 YEARS AGO THINKTWICEABOUTWHATYOUEATANDDRINK

- 72. 70 SBI MAGAZINE IDEAL LIFE THE OVERACHIEVER’S WORKOUT It Only Takes 30 Minutes to Stay Fit While on the Road by LYNNE SHARRERS The hardest part about business travel is finding time for a workout. The first thing to recognize is that 30 minutes is all you need. The key is intensity. INTENSITY According to a survey conducted by The American College of Sports Medicine, high-intensity interval training (HIIT) is one of the top fitness trends in 2015. This technique incorporates short bursts of intense exercise followed by a low- intensity recovery exercise. For example, you can sprint for 30 seconds, then walk for 60 seconds. You can use HIIT both anaerobically (with weights) and aerobically (with cardio). THE PREP You prepare for big meetings with call plans and notes because they matter. Take the same approach with your workouts. Know what you will be doing before you enter the gym. Write down your workout on a small notepad or use the Notes app on your smartphone.

- 73. FALL 2015 71 UPPER BODY CONCENTRATION LOWER BODY CONCENTRATION TOTAL BODY CONCENTRATION THE WORKOUT You need to incorporate both resistance and cardiovascular training. I recommend 20 minutes of high-intensity resistance training and 10 minutes of cardio. The key is 10 strong minutes, incorporating intervals. Here is an example of a total body workout using both resistance and cardiovascular training: five-minute warm-up before and stretching after your workout, 15-minute circuit training, and 10 minutes of cardio. The circuit training should include three exercises in each circuit (five minutes per circuit). RESULTS An intense workout will burn more calories per minute than a lower-intensity workout. This leads to more calories expended after your workout, the afterburn. Fitting exercise into your busy life isn’t always easy, and traveling just adds another level of complexity. Make the time and take your workouts on the road to a higher level in only 30 minutes. BARBELL CURLS 21 (7 upper curls, 7 lower curls, 7 full curls) DUMBBELL SQUAT WITH AN OVERHEAD PRESS 10 BURPEE 10 (Use a medicine ball, if available. Add a push-up for higher intensity.) PLANK 60 seconds (Add windmill push-up for higher intensity.) FINISH WITH 10 MINUTES OF CARDIO Your choice: treadmill, elliptical, stair-stepper, etc. 30 seconds at the highest speed 30 seconds at normal speed 30 seconds at highest resistance 30 seconds at normal resistance DUMBBELL SINGLE-ARM ROW 10 each DUMBBELL PUNCHES 50 SINGLE-LEG DEADLIFT 8 each SQUAT JUMPS 15 (Do a squat and then jump. Add a weight, such as a weight plate or dumbbell, for higher intensity.) WALL SIT 60 seconds (Lean against a wall in a squat position, knees directly over ankles. Add a weight for higher intensity.) ILLUSTRATIONBYBEUGISM