Hedging funds & its impact on capital market

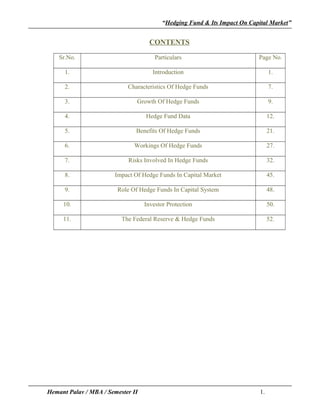

- 1. “Hedging Fund & Its Impact On Capital Market” CONTENTS Sr.No. Particulars Page No. 1. Introduction 1. 2. Characteristics Of Hedge Funds 7. 3. Growth Of Hedge Funds 9. 4. Hedge Fund Data 12. 5. Benefits Of Hedge Funds 21. 6. Workings Of Hedge Funds 27. 7. Risks Involved In Hedge Funds 32. 8. Impact Of Hedge Funds In Capital Market 45. 9. Role Of Hedge Funds In Capital System 48. 10. Investor Protection 50. 11. The Federal Reserve & Hedge Funds 52. Hemant Palav / MBA / Semester II 1.

- 2. “Hedging Fund & Its Impact On Capital Market” INTRODUCTION The term 'hedge fund' is used to describe a wide variety of institutional investors employing a diverse set of investment strategies. Although there is no formal definition of 'hedge fund,' hedge funds are largely defined by what they are not and by the regulations to which they are not subject. As a general matter, the term 'hedge fund' refers to unregistered, private investment partnerships for wealthy sophisticated investors (both natural persons and institutions) that use some form of leverage to carry out their investment strategies. The term 'hedge fund' is undefined, including in the federal securities laws. Indeed, there is no commonly accepted universal meaning. As hedge funds have gained stature and prominence, though, 'hedge fund' has developed into a catch-all classification for many unregistered privately managed pools of capital. These pools of capital may or may not utilize the sophisticated hedging and arbitrage strategies that traditional hedge funds employ, and many appear to engage in relatively simple equity strategies. Basically, many 'hedge funds' are not actually hedged, and the term has become a misnomer in many cases. Hedge funds engage in a variety of investment activities. They cater to sophisticated investors and are not subject to the regulations that apply to mutual funds geared toward the general public. Fund managers are compensated on the basis of performance rather than as a fixed percentage of assets. 'Performance funds' would be a more accurate description. Hemant Palav / MBA / Semester II 2.

- 3. “Hedging Fund & Its Impact On Capital Market” SeleCTeD DefINITIONS Of "HeDge fUND" "Hedge fund" is an expression believed to have been first applied in 1949 to a fund managed by Alfred Winslow Jones.1 Mr. Jones's private investment fund combined both long and short equity positions to "hedge" the portfolio's exposure to movements in the market. Today, hedge funds are no longer defined by a particular strategy and often do not "hedge" in the economic sense. The following is a selection of definitions and descriptions of the term "hedge fund" showing the diversity of views among commentators. "The term 'hedge fund' is commonly used to describe a variety of different types of investment vehicles that share some common characteristics. Although it is not statutorily defined, the term encompasses any pooled investment vehicle that is privately organized, administered by professional money managers, and not widely available to the public." --THe PReSIDeNT'S WORKINg gROUP ON fINANCIAl MARKeTS, HeDge fUNDS, leVeRAge, AND THe leSSONS Of lONg-TeRM CAPITAl MANAgeMeNT 1 (1999). "The term 'hedge fund' refers generally to a privately offered investment vehicle that pools the contributions of its investors in order to invest in a variety of asset classes, such as securities, futures contracts, options, bonds, and currencies." --THe SeCReTARY Of THe TReASURY, THe BOARD Of gOVeRNORS Of THe feDeRAl ReSeRVe SYSTeM, THe SeCURITIeS AND eXCHANge COMMISSION, A RePORT TO CONgReSS IN ACCORDANCe WITH § 356(C) Of THe USA PATRIOT ACT Of 2001 (2002). Hemant Palav / MBA / Semester II 3.

- 4. “Hedging Fund & Its Impact On Capital Market” "A hedge fund can be broadly defined as a privately offered fund that is administered by a professional investment management firm (or 'hedge fund manager'). The word 'hedge' refers to a hedge fund's ability to hedge the value of the assets it holds (e.g., through the use of options or the simultaneous use of long positions and short sales). However, some hedge funds engage only in 'buy and hold' strategies or other strategies that do not involve hedging in the traditional sense. In fact, the term 'hedge fund' is used to refer to funds engaging in over 25 different types of investment strategies .…" --MANAgeD fUNDS ASSOCIATION, HeDge fUND fAQS 1 (2003). "There is no universally accepted meaning of the expression 'hedge fund'; indeed, many competing (and sometimes partially contradicting) definitions exist. The term first came into use in the 1950s to describe any investment fund that used incentive fees, short-selling, and leverage. A summary definition frequently used in official sector reports is 'any pooled investment vehicle that is privately organised, administered by professional investment managers, and not widely available to the public'. The term can also be defined by considering the characteristics most commonly associated with hedge funds. Usually, hedge funds: • are organised as private investment partnerships or offshore investment corporations; • use a wide variety of trading strategies involving position-taking in a range of markets; • employ an assortment of trading techniques and instruments, often including short- selling, derivatives and leverage; • pay performance fees to their managers; and • Have an investor base comprising wealthy individuals and institutions and a relatively high minimum investment limit (set at US$100,000 or higher for most funds)." Hemant Palav / MBA / Semester II 4.

- 5. “Hedging Fund & Its Impact On Capital Market” --FINANCIAL SERVICES AUTHORITY (UNITED KINGDOM), HEDGE FUNDS AND THE FSA, DISCUSSION PAPER 16, at 8 (2002). "Originally set up to 'hedge bets' or insure against currency or interest rate risks, hedge funds have since taken on a much wider remit, investing in assets ranging from equities and fixed interest stocks to derivatives and commodities. Their aim is to make absolute returns, that is to make performance returns irrespective of which way the markets are going. Rather like derivative funds, hedge funds use derivative instruments or gearing (borrowing against the fund's assets) to gain greater exposure to their investments or to protect against losses." --ROBeRT B. MIlROY, STANDARD & POOR'S gUIDe TO OffSHORe INVeSTMeNT fUNDS 28 (2000). "The term 'hedge fund' was in use as early as the 1960s to describe a new speculative investment vehicle that used sophisticated hedging and arbitrage techniques in the corporate equities market. In the late 1960s, former Securities and Exchange Commissioner Hugh Owens described 'hedge funds' as 'private investment partnerships which employ the investment techniques of leveraging and hedging.' In the 1970s and 1980s, the activities of similar types of funds broadened into a range of financial instruments and activities .… The term 'hedge fund' does not have a precise definition, but it has been used to refer generally to a cadre of private investment partnerships that are engaged in active trading and arbitrage of a range of different securities and commodities." --DePARTMeNT Of THe TReASURY, SeCURITIeS AND eXCHANge COMMISSION, BOARD Of gOVeRNORS Of THe feDeRAl ReSeRVe SYSTeM, JOINT RePORT ON THe gOVeRNMeNT SeCURITIeS MARKeT, AT B-64 (1992) Hemant Palav / MBA / Semester II 5.

- 6. “Hedging Fund & Its Impact On Capital Market” (CITINg HUgH OWeNS, SeCURITIeS AND eXCHANge COMMISSIONeR, A RegUlATOR lOOKS AT SOMe UNRegUlATeD INVeSTMeNT COMPANIeS: THe eXOTIC fUNDS, ReMARKS BefORe THe NORTH AMeRICAN SeCURITIeS ADMINISTRATORS ASSOCIATION (OCT. 21, 1969)). A hedge fund is a "private investment partnership (for U.S. investors) or an off-shore investment corporation (for non-U.S. or tax-exempt investors) in which the general partner has made a substantial personal investment, and whose offering memorandum allows for the fund to take both long and short positions, use leverage and derivatives, and investment in many markets. Hedge funds often take large risks on speculative strategies, including [program trading, selling short, swap, and arbitrage]. A fund need not employ all of these tools all of the time; it must merely have them at its disposal." --JOHN DOWNeS AND JORDAN ellIOTT gOODMAN, BARRON'S, fINANCe & INVeSTMeNT HANDBOOK 358 (5TH eD. 1998). "There is no precise definition of the term 'hedge fund,' and one will not be found in the federal or state securities laws. The term was first used to describe private investment funds that combine both long and short equity positions within a single leveraged portfolio. It is generally believed that the first such fund to employ this approach was an investment partnership organized in 1949 by Alfred Winslow Jones … Hedge funds are no longer defined by the strategy they pursue. While a number of today's funds pursue the hedged equity strategy of Jones, numerous different investment styles are embraced by hedge funds .… Hedge funds are defined Hemant Palav / MBA / Semester II 6.

- 7. “Hedging Fund & Its Impact On Capital Market” more by their form of organization and manner of operation than by the substance of their financial strategies." --SCOTT J. leDeRMAN, HeDge fUNDS, IN fINANCIAl PRODUCT fUNDAMeNTAlS: A gUIDe fOR lAWYeRS 11-3, 11-4, 11-5 (ClIffORD e. KIRSCH eD., 2000). "Like mutual funds, hedge funds pool investors' money and invest those funds in financial instruments in an effort to make a positive return. However, unlike mutual funds, hedge funds are not registered with the SEC. This means that hedge funds are subject to very few regulatory controls. In addition, many hedge fund managers are not required to register with the SEC and therefore are not subject to regular SEC oversight. Because of this lack of regulatory oversight, hedge funds historically have been available to accredited investors and large institutions, and have limited their investors through high investment minimums (e.g., $1 million). Many hedge funds seek to profit in all kinds of markets by pursuing leveraging and other speculative investment practices that may increase the risk of investment loss." --SeCURITIeS AND eXCHANge COMMISSION, HeDgINg YOUR BeTS: A HeADS UP ON HeDge fUNDS AND fUNDS Of HeDge fUNDS, AVAIlABle AT HTTP://WWW.SeC.gOV/ANSWeRS/HeDge.HTM. "'Hedge fund' is a general, non-legal term used to describe private, unregistered investment pools that traditionally have been limited to sophisticated, wealthy investors. Hedge funds are not mutual funds and, as such, are not subject to the numerous regulations that apply to mutual funds for the protection of investors - including regulations requiring a certain degree of liquidity, regulations requiring that mutual fund shares be redeemable at any time, regulations protecting against conflicts of interest, regulations to assure fairness in the pricing of fund shares, disclosure regulations, regulations limiting the use of leverage, and more." Hemant Palav / MBA / Semester II 7.

- 8. “Hedging Fund & Its Impact On Capital Market” --SeCURITIeS AND eXCHANge COMMISSION, INVeST WISelY: AN INTRODUCTION TO MUTUAl fUNDS, AVAIlABle AT HTTP://WWW.SeC.gOV/INVeSTOR/PUBS/INWSMf.HTM. "A hedge fund is an actively managed investment fund that seeks attractive absolute return. In pursuit of their absolute return objective, hedge funds use a wide variety of investment strategies and tools. Hedge funds are designed for a small number of large investors, and the manager of the fund receives a percentage of the profits earned by the fund. Hedge fund managers are active managers seeking absolute return." --ROBeRT A. JAegeR, All ABOUT HeDge fUNDS, AT X (2003) (PeRHAPS IN A BIT Of HIS OWN HeDgINg, JAegeR CAllS HIS DefINITION "PROVISIONAl."). KeY CHARACTeRISTICS Of HeDge fUNDS • Hedge funds utilize a variety of financial instruments to reduce risk, enhance returns and minimize the correlation with equity and bond markets. Many hedge funds are flexible in their investment options (can use short selling, leverage, derivatives such as puts, calls, options, futures, etc.). • Hedge funds vary enormously in terms of investment returns, volatility and risk. Many, but not all, hedge fund strategies tend to hedge against downturns in the markets being traded. • Many hedge funds have the ability to deliver non-market correlated returns. • Many hedge funds have as an objective consistency of returns and capital preservation rather than magnitude of returns. • Most hedge funds are managed by experienced investment professionals who are generally disciplined and diligent. Hemant Palav / MBA / Semester II 8.

- 9. “Hedging Fund & Its Impact On Capital Market” • Pension funds, endowments, insurance companies, private banks and high net worth individuals and families invest in hedge funds to minimize overall portfolio volatility and enhance returns. • Most hedge fund managers are highly specialized and trade only within their area of expertise and competitive advantage. • Hedge funds benefit by heavily weighting hedge fund managers’ remuneration towards performance incentives, thus attracting the best brains in the investment business. In addition, hedge fund managers usually have their own money invested in their fund. fACTS ABOUT THe HeDge fUND INDUSTRY • Estimated to be a $1 trillion industry and growing at about 20% per year with approximately 8350 active hedge funds. • Includes a variety of investment strategies, some of which use leverage and derivatives while others are more conservative and employ little or no leverage. Many hedge fund strategies seek to reduce market risk specifically by shorting equities or through the use of derivatives. • Most hedge funds are highly specialized, relying on the specific expertise of the manager or management team. • Performance of many hedge fund strategies, particularly relative value strategies, is not dependent on the direction of the bond or equity markets -- unlike conventional equity or mutual funds (unit trusts), which are generally 100% exposed to market risk. • Many hedge fund strategies, particularly arbitrage strategies, are limited as to how much capital they can successfully employ before returns diminish. As a result, many successful hedge fund managers limit the amount of capital they will accept. • Hedge fund managers are generally highly professional, disciplined and diligent. • Their returns over a sustained period of time have outperformed standard equity and bond indexes with less volatility and less risk of loss than equities. • Beyond the averages, there are some truly outstanding performers. Hemant Palav / MBA / Semester II 9.

- 10. “Hedging Fund & Its Impact On Capital Market” • Investing in hedge funds tends to be favored by more sophisticated investors, including many Swiss and other private banks that have lived through, and understand the consequences of, major stock market corrections. • An increasing number of endowments and pension funds allocate assets to hedge funds. THe gROWTH Of HeDge fUNDS In the entire financial services area, the sector showing the most growth is clearly the area of hedge funds. While brokerage commissions continue to decline, investment banking fees start to come under pressure and the entire financial services industry worries about intensified regulatory scrutiny, the hedge fund industry with its rapid growth stands out from the crowd. New funds are starting up every week and many are beginning with an excess of a billion dollars under management from day one. The amount of money under management with hedge funds has gone up four times between 1996 and 2004 and is expected to further triple between now and 2010 to over $2.7 trillion. Public funds, endowments, and corporate sponsors have all increased their allocations to hedge funds within the context of an increased allocation towards alternative investments more generally. This move towards increased investments in real estate/private equity/hedge funds (alternative investments) is driven by the need for a higher return to compensate for the expected lower returns from more conventional investment strategies focused on US bonds and equities. There is also a clear desire among this investor base to be more focused on absolute-return strategies rather than relative return. Given the current level of allocations most of these large long-term investors have towards alternative investments, and their professed long-term target allocation, the flow of funds to these asset classes will remain strong. One of the intriguing developments in the hedge fund world is the clear desire and ability of the newer funds to charge higher fees and impose more stringent terms on investors. No longer are funds charging a 1 per cent management fee and 20 per cent of profits -- the norm for the first generation of funds set up in the early to mid 1990s. As per an interesting study done by Hemant Palav / MBA / Semester II 10.

- 11. “Hedging Fund & Its Impact On Capital Market” Morgan Stanley's prime brokerage unit, about a third of the funds opening in the past six months are charging a 2 per cent management fee and 20 per cent of profits or higher, while the majority are charging a 1.5 per cent management fee and 20 per cent of profits. Many of the new funds have more stringent lock-ups and stiff penalties if you redeem early, as well as modified high- water marks. The hedge fund business thus seems to have the unique characteristic of being possibly the only business that I know of wherein new players (most of whom are unproven) have the ability to charge more and get better terms than the established operators. This implies a negative franchise value for the established large fund complexes which have survived and prospered through the years. Given that most of the best hedge fund complexes are closed to new investors, the new guys seem to be taking advantage of the huge demand-supply mismatch for quality money managers. There is a feeding frenzy currently under way in the world of alternative investments and clients are paying up the higher fees for fear of being locked out from these funds at a later date, if they actually survive and grow. One reason why the new boys are focusing more on fees and lock-ups could be the difficulty all hedge funds are having in generating adequate alpha (excess return) to ensure an adequate payout for themselves. In a study done by Morgan Stanley on the excess returns generated by hedge funds over the last decade, this trend of declining returns was very apparent. In the study they defined excess returns as the return of the Hedge Fund research composite over one month LIBOR (a proxy for cash returns). In the 1995-97 period, excess returns were 14 per cent; these returns have consistently declined dropping to as low as 5 per cent in 2001-03 and have dropped further since. The current huge inflows into funds focused on emerging markets make sense if you look at performance numbers over the past three years. Hedge funds focused on the emerging markets had the best returns with an 18 per cent annual return during 2001-04, closely followed by distressed debt focused funds at 17 per cent. Hemant Palav / MBA / Semester II 11.

- 12. “Hedging Fund & Its Impact On Capital Market” More conventional hedge fund strategies of tech at 0 per cent and risk arbitrage at 3 per cent annual return lagged far behind. Given the constant inflows into new hedge funds, clients do not yet seem to be bothered about paying higher and higher fees for lower returns, but this is a discussion that I am sure will come up at some stage in most investment committees. At some stage if the hedge fund community continues to show declining alpha (excess returns), clients will need to question whether the proliferation of hedgies has reduced returns because the field has become too competitive. The beauty of the hedge fund business and the reason why the upward drift in fee structure is even more surprising is the ease of entry of new players into the game. The average long short hedge fund needs only about six back office staff per billion dollars, while a global macro fund needs about 11 people for a fund of similar size (Morgan Stanley survey). The typical long short US equity manager has only nine investment professionals and three in the back office. These funds are also not really regulated and have very limited disclosure requirements, if any. The start-up costs of these vehicles are also minimal and most funds will be able to break even at sub $100 million in assets under management. There is no other industry that I am aware of where exit and entry are as simple. Hedge funds till date in 2005 have had a tough year; there have been few strong trends to capitalise on and most funds are struggling to show a positive return. If the hedge fund industry ends the year flat or even (god forbid) negative after disappointing relative performance in 2003 and just about average numbers in 2004, some of the more sophisticated clients may migrate back to more conventional forms of investing with lower fee structures. Hedge funds are clearly here to stay, and continue to attract the best talent because of their payout structures; however, their ability to continue to command a premium fee structure will eventually be limited by their ability to differentiate themselves from their long-only brethren on the performance front. Hemant Palav / MBA / Semester II 12.

- 13. “Hedging Fund & Its Impact On Capital Market” HeDge fUND DATA Top performing funds The top 50 performing hedge funds, based on average annual return over the previous three years, were ranked by Barron's Online in October 2007 (Hedge Fund 50). The top 10 are as follows: • 1. RAB Special Situations Fund (RAB Capital, London) - 47.69% • 2. The Children's Investment Fund (The Children's Investment Fund Management, London) - 44.27% • 3. Highland CDO Opportunity Fund (Highland Capital Management, Dallas) - 43.98% • 4. BTR Global Opportunity Fund, Class D (Salida Capital, Toronto) - 43.42% • 5. SR Phoenicia Fund (Sloane Robinson, London) - 43.10% • 6. Atticus European Fund (Atticus Management, New York) - 40.76% • 7. Gradient European Fund A (Gradient Capital Partners, London) - 39.18% • 8. Polar Capital Paragon Absolute Return Fund (Polar Capital Partners, London) - 38.00% • 9. Paulson Enhanced Partners Fund (Paulson & Co., New York) - 37.97% • 10. Firebird Global Fund (Firebird Management, New York) - 37.18% Because of the unavailability of reliable figures, the top 50 list excludes funds such as Renaissance Technologies' Renaissance Medallion Fund and ESL Investments' ESL Partners (each thought to have returned an average of over 35% in the previous 3 years) and funds by SAC Capital and Appaloosa Management, which might otherwise have made the list. The list also excludes funds with a net asset value of less than $250 million. The returns are net of fees. Hemant Palav / MBA / Semester II 13.

- 14. “Hedging Fund & Its Impact On Capital Market” TOP eARNeRS Institutional Investor magazine annually ranks top-earning hedge fund managers. Earnings from a hedge fund are simply 100% of the capital gains on the manager's own equity stake in the fund plus the manager's share of the performance fee (usually 20% to 50% (depending on policy) of the gains on the other investors' capital). The 2004 top earner was Edward Lampert of ESL Investments Inc. who earned $1.02 billion during the year (PR Newswire link). The 2005 top earner was James Harris Simons with an earning of $1.6 billion according to Alpha magazine.[18] However, Trader Monthly reported that Simons only earned about $1 billion and that the top earner was instead T. Boone Pickens with an estimated earning of over $1.5 billion during the year.[19] The full top 10 list of hedge fund earners according to Trader Monthly Magazine. includes: • 1. T. Boone Pickens - estimated 2005 earnings $1.5bn + • 2. Steven A. Cohen, SAC Capital Advisers - $1bn + • 3. James H. Simons, Renaissance Technologies Corp. - $900m - $1bn • 4. Paul Tudor Jones, Tudor Investment Corp. - $800m - $900m • 5. Stephen Feinberg, Cerberus Capital Management - $500 - $600m • 6. Bruce Kovner, Caxton Associates - $500m - $600m • 7. Eddie Lampert, ESL Investments - $500m - $600m • 8. David E. Shaw, D. E. Shaw & Co. - $400m - $500m • 9. Jeffrey Gendell, Tontine Partners - $300m - $400m • 10. Louis Bacon, Moore Capital Management - $300m - $350m Hemant Palav / MBA / Semester II 14.

- 15. “Hedging Fund & Its Impact On Capital Market” The 2006 top earner was John Arnold according to Trader Monthly Magazine. The list includes: • 1. John D. Arnold, Houston, Texas- of Centauras Energy- $1.5-2B • 2. James Simons, East Setauket, New York- of Renaissance Technologies Corp.- $1.5-2B • 3. Eddie Lampert, Greenwich, Connecticut- of ESL Investments- $1-1.5B NOTABle HeDge fUND MANAgeMeNT COMPANIeS Sometimes also known as alternative investment management companies. • Amaranth Advisors • Bridgewater Associates • Caxton Associates • Centaurus Energy • Citadel Investment Group • D. E. Shaw & Co. • Fortress Investment Group • Goldman Sachs Asset Management • Long Term Capital Management • Man Group • Pirate Capital LLC • Renaissance Technologies • SAC Capital Advisors • Soros Fund Management • Marshall Wace Hemant Palav / MBA / Semester II 15.

- 16. “Hedging Fund & Its Impact On Capital Market” WHY HeDge fUNDS ARe ATTRACTIVe? There are a large number of investment vehicles that offer you good and stable returns. Products like diversified mutual funds, blue chip stocks and property are some of them. But for high net worth individuals (HNIs), there are more routes, especially in the international markets. Here we look at one such vehicle, namely hedge funds. A hedge fund is a common term used to describe private unregistered investment partnerships. Since most of them are not registered with financial regulators in their countries of origin, they do not need to meet the eligibility requirements to register as institutional investors. This is good in a way but could turn sour as well because there are no guidelines binding them. At present, there are no hedge funds operating out of India. But internationally, there are a large number of such funds. These funds are very manager-centric as the entire onus of their success or failure falls on the fund manager's ability to exploit existing market conditions. No wonder then that they charge a fixed fee of around 2 per cent a year of assets under management, along with a very high profit sharing percentage, which is mostly 20 per cent. Of course, they have to assure returns as well. Thus, profit sharing may start on the returns over and above say, the first 10 per cent returns. The fee is also based on a high watermarking concept, which means that the fund manager is entitled to a share of profits the first time. Thereafter, if the fund incurs losses and then recoups, the fund manager will not be entitled to any share of the recouped losses. The next time he will be entitled is when he beats his earlier performance. However, given the plethora of opportunities worldwide, the fund manager has the luxury of making investment decisions in stocks, bonds, commodities, currencies etc. The basic idea is to generate aggressive returns. The most important feature of hedge funds is that they seek to deliver absolute, rather than benchmarked returns. For example, equity mutual funds are benchmarked against an index like the Nifty or BSE 200, or a banking sector mutual fund could benchmark its returns against the banking index on a stock exchange and can show the investors how much better/worse he has performed. However, hedge funds managers do not have any such luxuries. Hemant Palav / MBA / Semester II 16.

- 17. “Hedging Fund & Its Impact On Capital Market” Since they are not regulated, most countries do not allow them to raise money from the general public through a prospectus or advertisements. A few are registered with the regulators in their countries because their main investors are universities, pension funds and insurance companies. Most of the marketing is done through investment advisors or personal contacts, with their main investors being restricted to sophisticated HNIs. With the Reserve Bank of India [Get Quote] (RBI) allowing Indian residents to invest up to $200,000 abroad per head a year, it is another opportunity for HNIs to tap these funds as the minimum limit of many of them start from $100,000. But you need to remember that the amount invested is not very liquid and may be subject to a lock-in period, with quarterly, half-yearly or yearly exit windows. Those seeking to invest in hedge funds can approach a wealth manager, securities broker or investment consultant abroad, who can advise them on the available options and select the hedge fund they wish to invest in, based on its track record and management style. After that they can approach their bank in India to arrange for the foreign remittance to the hedge fund. Whenever they wish to redeem their investment, as permitted by the hedge fund, they can repatriate the proceeds to India into their bank account. Hemant Palav / MBA / Semester II 17.

- 18. “Hedging Fund & Its Impact On Capital Market” WHAT INfORMATION SHOUlD I SeeK If I AM CONSIDeRINg INVeSTINg IN A HeDge fUND OR A fUND Of HeDge fUNDS? • Read a fund's prospectus or offering memorandum and related materials. Make sure you understand the level of risk involved in the fund's investment strategies and ensure that they are suitable to your personal investing goals, time horizons, and risk tolerance. As with any investment, the higher the potential returns, the higher the risks you must assume. • Understand how a fund's assets are valued. Funds of hedge funds and hedge funds may invest in highly illiquid securities that may be difficult to value. Moreover, many hedge funds give themselves significant discretion in valuing securities. You should understand a fund's valuation process and know the extent to which a fund's securities are valued by independent sources. • Ask questions about fees. Fees impact your return on investment. Hedge funds typically charge an asset management fee of 1-2% of assets, plus a "performance fee" of 20% of a hedge fund's profits. A performance fee could motivate a hedge fund manager to take greater risks in the hope of generating a larger return. Funds of hedge funds typically charge a fee for managing your assets, and some may also include a performance fee based on profits. These fees are charged in addition to any fees paid to the underlying hedge funds. • Understand any limitations on your right to redeem your shares. Hedge funds typically limit opportunities to redeem, or cash in, your shares (e.g., to four times a year), and often impose a "lock-up" period of one year or more, during which you cannot cash in your shares. Hemant Palav / MBA / Semester II 18.

- 19. “Hedging Fund & Its Impact On Capital Market” • Research the backgrounds of hedge fund managers. Know with whom you are investing. Make sure hedge fund managers are qualified to manage your money, and find out whether they have a disciplinary history within the securities industry. You can get this information (and more) by reviewing the adviser’s Form ADV. You can search for and view a firm’s Form ADV using the SEC’s Investment Adviser Public Disclosure (IAPD) website. You also can get copies of Form ADV for individual advisers and firms from the investment adviser, the SEC’s Public Reference Room, or (for advisers with less than $25 million in assets under management) the state securities regulator where the adviser's principal place of business is located. If you don’t find the investment adviser firm in the SEC’s IAPD database, be sure to call your state securities regulator or search the NASD's BrokerCheck database for any information they may have. • Don't be afraid to ask questions. You are entrusting your money to someone else. You should know where your money is going, who is managing it, how it is being invested, how you can get it back, what protections are placed on your investment and what your rights are as an investor. In addition, you may wish to read NASD’s investor alert, which describes some of the high costs and risks of investing in funds of hedge funds. Hemant Palav / MBA / Semester II 19.

- 20. “Hedging Fund & Its Impact On Capital Market” What protections do i have if i purchase a hedge fund? Hedge fund investors do not receive all of the federal and state law protections that commonly apply to most registered investments. For example, you won't get the same level of disclosures from a hedge fund that you'll get from registered investments. Without the disclosures that the securities laws require for most registered investments, it can be quite difficult to verify representations you may receive from a hedge fund. You should also be aware that, while the SEC may conduct examinations of any hedge fund manager that is registered as an investment adviser under the Investment Advisers Act, the SEC and other securities regulators generally have limited ability to check routinely on hedge fund activities. The SEC can take action against a hedge fund that defrauds investors, and we have brought a number of fraud cases involving hedge funds. Commonly in these cases, hedge fund advisers misrepresented their experience and the fund's track record. Other cases were classic "Ponzi schemes," where early investors were paid off to make the scheme look legitimate. In some of the cases we have brought, the hedge funds sent phony account statements to investors to camouflage the fact that their money had been stolen. That's why it is extremely important to thoroughly check out every aspect of any hedge fund you might consider as an investment. Hemant Palav / MBA / Semester II 20.

- 21. “Hedging Fund & Its Impact On Capital Market” hedging strategies Wide ranges of hedging strategies are available to hedge funds. For example: • Selling short - selling shares without owning them, hoping to buy them back at a future date at a lower price in the expectation that their price will drop. • Using arbitrage - seeking to exploit pricing inefficiencies between related securities - for example, can be long convertible bonds and short the underlying issuer’s equity. • Trading options or derivatives - contracts whose values are based on the performance of any underlying financial asset, index or other investment. • Investing in anticipation of a specific event - merger transaction, hostile takeover, spin- off, exiting of bankruptcy proceedings, etc. • Investing in deeply discounted securities - of companies about to enter or exit financial distress or bankruptcy, often below liquidation value. • Many of the strategies used by hedge funds benefit from being non-correlated to the direction of equity markets popular Misconception The popular misconception is that all hedge funds are volatile -- that they all use global macro strategies and place large directional bets on stocks, currencies, bonds, commodities, and gold, while using lots of leverage. In reality, less than 5% of hedge funds are global macro funds. Most hedge funds use derivatives only for hedging or don't use derivatives at all, and many use no leverage. Hemant Palav / MBA / Semester II 21.

- 22. “Hedging Fund & Its Impact On Capital Market” Benefits of hedge funds • Many hedge fund strategies have the ability to generate positive returns in both rising and falling equity and bond markets. • Inclusion of hedge funds in a balanced portfolio reduces overall portfolio risk and volatility and increases returns. • Huge variety of hedge fund investment styles – many uncorrelated with each other – provides investors with a wide choice of hedge fund strategies to meet their investment objectives. • Academic research proves hedge funds have higher returns and lower overall risk than traditional investment funds. • Hedge funds provide an ideal long-term investment solution, eliminating the need to correctly time entry and exit from markets. • Adding hedge funds to an investment portfolio provides diversification not otherwise available in traditional investing. hedge fund styles The predictability of future results shows a strong correlation with the volatility of each strategy. Future performance of strategies with high volatility is far less predictable than future performance from strategies experiencing low or moderate volatility. Aggressive Growth: Invests in equities expected to experience acceleration in growth of earnings per share. Generally high P/E ratios, low or no dividends; often smaller and micro cap stocks which are expected to experience rapid growth. Includes sector specialist funds such as technology, banking, or biotechnology. Hedges by shorting equities where earnings disappointment is expected or by shorting stock indexes. Tends to be "long-biased." Expected Volatility: High Distressed Securities: Buys equity, debt, or trade claims at deep discounts of companies in or facing bankruptcy or reorganization. Profits from the market's lack of understanding Hemant Palav / MBA / Semester II 22.

- 23. “Hedging Fund & Its Impact On Capital Market” of the true value of the deeply discounted securities and because the majority of institutional investors cannot own below investment grade securities. (This selling pressure creates the deep discount.) Results generally not dependent on the direction of the markets. Expected Volatility: Low - Moderate Emerging Markets: Invests in equity or debt of emerging (less mature) markets that tend to have higher inflation and volatile growth. Short selling is not permitted in many emerging markets, and, therefore, effective hedging is often not available, although Brady debt can be partially hedged via U.S. Treasury futures and currency markets. Expected Volatility: Very High Funds of Hedge Funds: Mix and match hedge funds and other pooled investment vehicles. This blending of different strategies and asset classes aims to provide a more stable long-term investment return than any of the individual funds. Returns, risk, and volatility can be controlled by the mix of underlying strategies and funds. Capital preservation is generally an important consideration. Volatility depends on the mix and ratio of strategies employed. Expected Volatility: Low - Moderate - High Income: Invests with primary focus on yield or current income rather than solely on capital gains. May utilize leverage to buy bonds and sometimes fixed income derivatives in order to profit from principal appreciation and interest income. Expected Volatility: Low Macro: Aims to profit from changes in global economies, typically brought about by shifts in government policy that impact interest rates, in turn affecting currency, stock, and bond markets. Participates in all major markets -- equities, bonds, currencies and commodities -- though not always at the same time. Uses leverage and derivatives to accentuate the impact of market moves. Utilizes hedging, but the leveraged directional investments tend to make the largest impact on performance. Expected Volatility: Very High Hemant Palav / MBA / Semester II 23.

- 24. “Hedging Fund & Its Impact On Capital Market” Market Neutral - Arbitrage: Attempts to hedge out most market risk by taking offsetting positions, often in different securities of the same issuer. For example, can be long convertible bonds and short the underlying issuers equity. May also use futures to hedge out interest rate risk. Focuses on obtaining returns with low or no correlation to both the equity and bond markets. These relative value strategies include fixed income arbitrage, mortgage backed securities, capital structure arbitrage, and closed-end fund arbitrage. Expected Volatility: Low Market Neutral - Securities Hedging: Invests equally in long and short equity portfolios generally in the same sectors of the market. Market risk is greatly reduced, but effective stock analysis and stock picking is essential to obtaining meaningful results. Leverage may be used to enhance returns. Usually low or no correlation to the market. Sometimes uses market index futures to hedge out systematic (market) risk. Relative benchmark index usually T-bills. Expected Volatility: Low Market Timing: Allocates assets among different asset classes depending on the manager's view of the economic or market outlook. Portfolio emphasis may swing widely between asset classes. Unpredictability of market movements and the difficulty of timing entry and exit from markets add to the volatility of this strategy. Expected Volatility: High Opportunistic: Investment theme changes from strategy to strategy as opportunities arise to profit from events such as IPOs, sudden price changes often caused by an interim earnings disappointment, hostile bids, and other event-driven opportunities. May utilize several of these investing styles at a given time and is not restricted to any particular investment approach or asset class. Expected Volatility: Variable Multi Strategy: Investment approach is diversified by employing various strategies simultaneously to realize short- and long-term gains. Other strategies may include systems trading such as trend following and various diversified technical strategies. This style of investing allows the manager to overweight or underweight different strategies to best capitalize on current investment opportunities. Expected Volatility: Variable Hemant Palav / MBA / Semester II 24.

- 25. “Hedging Fund & Its Impact On Capital Market” Short Selling: Sells securities short in anticipation of being able to rebuy them at a future date at a lower price due to the manager's assessment of the overvaluation of the securities, or the market, or in anticipation of earnings disappointments often due to accounting irregularities, new competition, change of management, etc. Often used as a hedge to offset long-only portfolios and by those who feel the market is approaching a bearish cycle. High risk. Expected Volatility: Very High Special Situations: Invests in event-driven situations such as mergers, hostile takeovers, reorganizations, or leveraged buyouts. May involve simultaneous purchase of stock in companies being acquired, and the sale of stock in its acquirer, hoping to profit from the spread between the current market price and the ultimate purchase price of the company. May also utilize derivatives to leverage returns and to hedge out interest rate and/or market risk. Results generally not dependent on direction of market. Expected Volatility: Moderate Value: Invests in securities perceived to be selling at deep discounts to their intrinsic or potential worth. Such securities may be out of favor or under followed by analysts. Long- term holding, patience, and strong discipline are often required until the ultimate value is recognized by the market. Expected Volatility: Low - Moderate Hemant Palav / MBA / Semester II 25.

- 26. “Hedging Fund & Its Impact On Capital Market” advantages of hedge funds over Mutual funds Hedge funds are extremely flexible in their investment options because they use financial instruments generally beyond the reach of mutual funds, which have SEC regulations and disclosure requirements that largely prevent them from using short selling, leverage, concentrated investments, and derivatives. This flexibility, which includes use of hedging strategies to protect downside risk, gives hedge funds the ability to best manage investment risks. The strong results can be linked to performance incentives in addition to investment flexibility. Unlike many mutual fund managers, hedge fund managers are usually heavily invested in a significant portion of the funds they run and shares the rewards as well as risks with the investors. "Incentive fees" remunerate hedge fund managers only when returns are positive, whereas mutual funds pay their financial managers according to the volume of assets managed, regardless of performance. This incentive fee structure tends to attract many of Wall Street’s best practitioners and other financial experts to the hedge fund industry. In the last nine years, the number of hedge funds has risen by about 20 percent per year and the rate of growth in hedge fund assets has been even more rapid. Currently, there are estimated to be approximately 8350 hedge funds managing $1 trillion. While the number and size of hedge funds are small relative to mutual funds, their growth reflects the importance of this alternative investment category for institutional investors and wealthy individual investors. Hemant Palav / MBA / Semester II 26.

- 27. “Hedging Fund & Its Impact On Capital Market” Hedge Funds Outperform Mutual Funds in Falling Equity Markets S&P 500 VAN U.S. Hedge Fund Index Morningstar Average Equity Mutual Fund 1Q90 -3% 2.20% -2.80% 3Q90 -13.70% -3.70% -15.40% 2Q91 -0.20% 2.30% -0.90% 1Q92 -2.50% 5.00% -0.70% 1Q94 -3.80% -0.80% -3.20% 4Q94 -0.02% -1.20% -2.60% 3Q98 -9.90% -6.10% -15.00% 3Q99 -6.20% 2.10% -3.20% 2Q00 -2.70% 0.30% -3.60% 3Q00 -1.00% 3.00% 0.60% 4Q00 -7.80% -2.40% -7.80% 1Q01 -11.90% -1.10% -12.70% 3Q01 -14.70% -3.80% -17.20% 2Q02 -13.40% -1.40% -10.70% 3Q02 -17.30% -3.60% -16.60% 3Q04 -2.30% 1.40% -1.70% 1Q05 -2.59% .10% -2.20% Total -113.01% -10.30% -115.70% During the last 18 years, the S&P 500 Index has had 17 negative quarters, totaling a negative return of 113.01%. During those negative quarters, the average U.S. equity mutual fund had a total negative return of 115.7%, while the average hedge fund had a total negative return of only 10.3%, displaying the ability of hedge funds to preserve capital in falling equity markets. Hemant Palav / MBA / Semester II 27.

- 28. “Hedging Fund & Its Impact On Capital Market” aBout WorKings of hedge funds A hedge fund is a private investment fund charging a performance fee and typically open to only a limited range of qualified investors. In the United States, hedge funds are open to accredited investors only. Because of this restriction, they are usually exempt from any direct regulation by regulatory bodies. Alfred Winslow Jones is credited with inventing hedge funds in 1949. [1] Hemant Palav / MBA / Semester II 28.

- 29. “Hedging Fund & Its Impact On Capital Market” As a hedge fund's investment activities are limited only by the contracts governing the particular fund, it can make greater use of complex investment strategies such as short selling, entering into futures, swaps and other derivative contracts and leverage. As their name implies, hedge funds often seek to offset potential losses in the principal markets they invest in by hedging via any number of methods. However, the term "hedge fund" has come in modern parlance to be overused and inappropriately applied to any absolute-return fund – many of these so-called "hedge funds" do not actually hedge their investments. Hedge funds have acquired a reputation for secrecy. Unlike open-to-the-public "retail" funds (e.g., U.S. mutual funds) which market freely to the public, in most countries, hedge funds are specifically prohibited from marketing to investors who are not professional investors or individuals with sufficient private wealth. This limits the information a hedge fund can legally release. Additionally, divulging a hedge fund's methods could unreasonably compromise their business interests; this limits the information a hedge fund would want to release. Since hedge fund assets can run into many billions of dollars and will usually be multiplied by leverage, their sway over markets, whether they succeed or fail, is potentially substantial and there is a continuing debate over whether they should be more thoroughly regulated. Industry In 2005, Absolute Return magazine found there were 196 hedge funds with $1 billion or more in assets, with a combined $743 billion under management - the vast majority of the industry's estimated $1 trillion in assets.[2] However, according to hedge fund advisory group Hennessee, total hedge fund industry assets increased by $215 billion in 2006 to $1.442 trillion, up 17.5% on a year earlier, an estimate for 2005 seemingly at odds with Absolute Return. As large institutional investors have entered the hedge fund industry the total asset levels continue to rise. The 2008 Hedge Fund Asset Flows & Trends Report [4] published by HedgeFund.net and Institutional Investor News estimates total industry assets reached $2.68 trillion in Q3 2007. Hemant Palav / MBA / Semester II 29.

- 30. “Hedging Fund & Its Impact On Capital Market” Fees Usually the hedge fund manager will receive both a management fee and a performance fee (also known as an incentive fee). Performance fees are closely associated with hedge funds, and are intended to incentivize the investment manager to produce the largest returns possible. Management fees As with other investment funds, the management fee is calculated as a percentage of the net asset value of the fund at the time when the fee becomes payable. Management fees typically range from 1% to 4% per annum, with 2% being the standard figure. Therefore, if a fund has $1 billion of assets at the year end and charges a 2% management fee, the management fee will be $20 million in total. Management fees are usually calculated annually and paid monthly. Performance fees Performance fees, which give a share of positive returns to the manager, are one of the defining characteristics of hedge funds. In contrast to retail investment firms, performance fees are prohibited in the U.S. for stock brokers.[citation needed] A hedge fund's performance fee is calculated as a percentage of the fund's profits, counting both unrealized profits and actual realized trading profits. Performance fees exist because investors are usually willing to pay managers more generously when the investors have themselves made money. For managers who perform well the performance fee is extremely lucrative. Typically, hedge funds charge 20% of gross returns as a performance fee, but again the range is wide, with highly regarded managers demanding higher fees. In particular, Steven Cohen's SAC Capital Partners charges a 50% incentive fee (but no management fee) and Jim Simons' Renaissance Technologies Corp. charged a 5% management fee and a 44% incentive fee in its flagship Medallion Fund before returning all investors' capital and running solely on its employees' money.[citations needed] Managers argue that performance fees help to align the interests of manager and investor better than flat fees that are payable even when performance is poor. However, performance fees have been criticized by many people, including notable investor Warren Buffett, for giving managers Hemant Palav / MBA / Semester II 30.

- 31. “Hedging Fund & Its Impact On Capital Market” an incentive to take excessive risk rather than targeting high long-term returns. In an attempt to control this problem, fees are usually limited by a high water mark and sometimes by a hurdle rate. Alternatively, the investment manager might be required to return performance fees when the value of the fund drops. This provision is sometimes called a ‘claw-back.’ High water marks A "High water mark" is often applied to a performance fee calculation.[5] This means that the manager does not receive performance fees unless the value of the fund exceeds the highest net asset value it has previously achieved. For example, if a fund was launched at a net asset value (NAV) per share of $100, which then rose to $130 in its first year, a performance fee would be payable on the $30 return for each share. If the next year it dropped to $120, no fee is payable. If in the third year the NAV per share rises to $143, a performance fee will be payable only on the extra $13 return from $130 to $143 rather than on the full return from $120 to $143. This measure is intended to link the manager's interests more closely to those of investors and to reduce the incentive for managers to seek volatile trades. If a high water mark is not used, a fund that ends alternate years at $100 and $110 would generate performance fee every other year, enriching the manager but not the investors. However, this mechanism does not provide complete protection to investors: a manager who has lost money may simply decide to close the fund and start again with a clean slate -- provided that he can persuade investors to trust him with their money. A high water mark is sometimes referred to as a "Loss Carryforward Provision." Poorly performing funds frequently close down rather than work without fees, as would be required by their high water mark policies. [6] Hurdle rates Some funds also specify a hurdle rate, which signifies that the fund will not charge a performance fee until its annualized performance exceeds a benchmark rate, such as T-bills or a Hemant Palav / MBA / Semester II 31.

- 32. “Hedging Fund & Its Impact On Capital Market” fixed percentage, over some period. This links performance fees to the ability of the manager to do better than the investor would have done if he had put the money elsewhere. Funds which specify a soft hurdle rate charge a performance fee based on the entire annualized return. Funds which use a hard hurdle rate only charge a performance fee on returns above the hurdle rate. Though logically appealing, this practice has diminished as demand for hedge funds has outstripped supply and hurdles are now rare.[citations needed] Strategies Hedge funds are no longer a homogeneous class. Under certain circumstances, an investor or hedge fund can completely hedge the risks of an investment, leaving pure profit.[citation needed] For example, at one time it was possible for exchange traders to buy shares of, say, IBM on one exchange and simultaneously sell them on another exchange, leaving pure profit.[citation needed] Competition among investors has leached away such profits, leaving hedge fund managers with trades that are partially hedged, at best. These trades still contain residual risks which can be considerable. Some styles of hedge fund investing, such as global macro investing, may involve no hedging at all. Strictly speaking, it is not accurate to call such funds hedge funds, but that is current usage. The bulk of hedge funds describe themselves as long / short equity, but many different approaches are used taking different exposures, exploiting different market opportunities, using different techniques and different instruments: • Global macro – seeking related assets that have deviated from some anticipated relationship. • Arbitrage – seeking assets that are mispriced relative to related assets. o Convertible arbitrage – between a convertible bond and the same company's equity. o Fixed income arbitrage – between related bonds. Hemant Palav / MBA / Semester II 32.

- 33. “Hedging Fund & Its Impact On Capital Market” o Risk arbitrage – between securities whose prices appear to imply different probabilities for one event. o Statistical arbitrage (or StatArb) – between securities that have deviated from some statistically estimated relationship. o Derivative arbitrage – between a derivative and its security. • Long / short equity – generic term covering all hedged investment in equities. o Short bias – emphasizing or solely using short positions. o Equity market neutral – maintaining a close balance between long and short positions. • Event driven – specialized in the analysis of a particular kind of event. o Distressed securities – companies that are or may become bankrupt. o Regulation D – distressed companies issuing securities. o Merger arbitrage - arbitrage between an acquiring public company and a target public company. • Other – the strategies below are sometimes considered hedge strategies, although in several cases usage of the term is debatable. o Emerging markets- this usually means unhedged, long positions in small overseas markets. o Fund of hedge funds - unhedged, long only positions in hedge funds (though the underlying funds, of course, may be hedged). Additional leverage is sometimes used.[citation needed] o Quantitative o 130-30 funds - Through leveraging, 130% of the money invested in the fund is used to buy stocks. 30% of the money invested in the fund is used to short stock. hedge fund risK Investing in a hedge fund is considered to be a riskier proposition than investing in a regulated fund, despite the traditional notion of a "hedge" being a means of reducing the risk of a bet or investment. The following are some of the primary reasons for the increased risk: Hemant Palav / MBA / Semester II 33.

- 34. “Hedging Fund & Its Impact On Capital Market” Leverage - in addition to putting money into the fund by investors, a hedge fund will typically borrow money, with certain funds borrowing sums many times greater than the initial investment. Where a hedge fund has borrowed $9 for every $1 invested, a loss of only 10% of the value of the investments of the hedge fund will wipe out 100% of the value of the investor's stake in the fund, once the creditors have called in their loans. At the beginning of 1998, shortly before its collapse, Long Term Capital Management had borrowed over $26 for each $1 invested. Short selling - due to the nature of short selling, the losses that can be incurred on a losing bet are theoretically limitless, unless the short position directly hedges a corresponding long position. Therefore, where a hedge fund uses short selling as an investment strategy rather than as a hedging strategy it can suffer very high losses if the market turns against it. Appetite for risk - hedge funds are culturally more likely than other types of funds to take on underlying investments that carry high degrees of risk, such as high yield bonds, distressed securities and collateralised debt obligations based on sub-prime mortgages. Lack of transparency - hedge funds are secretive entities. It can therefore be difficult for an investor to assess trading strategies, diversification of the portfolio and other factors relevant to an investment decision. Lack of regulation - hedge funds are not subject to as much oversight from financial regulators, and therefore some may carry undisclosed structural risks. Investors in hedge funds are willing to take these risks because of the corresponding rewards. Leverage amplifies profits as well as losses; short selling opens up new investment opportunities; riskier investments typically provide higher returns; secrecy helps to prevent imitation by competitors; and being unregulated reduces costs and allows the investment manager more freedom to make decisions on a purely commercial basis. Hemant Palav / MBA / Semester II 34.

- 35. “Hedging Fund & Its Impact On Capital Market” legal structure A hedge fund is a vehicle for holding and investing the funds of its investors. The fund itself is not a genuine business, having no employees and no assets other than its investment portfolio and a small amount of cash, and its investors being its clients. The portfolio is managed by the investment manager, which has employees and property and which is the actual business. An investment manager is commonly termed a “hedge fund” (e.g. a person may be said to “work at a hedge fund”) but this is not technically correct. An investment manager may have a large number of hedge funds under its management. Domicile The specific legal structure of a hedge fund – in particular its domicile and the type of entity used – is usually determined by the tax environment of the fund’s expected investors. Regulatory considerations will also play a role. Many hedge funds are established in offshore tax havens so that the fund can avoid paying tax on the increase in the value of its portfolio. An investor will still pay tax on any profit it makes when it realises its investment, and the investment manager, usually based in a major financial centre, will pay tax on the fees that it receives for managing the fund. At the end of 2004 55% of the world’s hedge funds, accounting for nearly two-thirds of total hedge fund assets, were established offshore. The most popular offshore location was the Cayman Islands, followed by the British Virgin Islands, Bermuda and the Bahamas. The US was the most popular onshore location, accounting for 34% of funds and 24% of assets. EU countries were the next most popular location with 9% of funds and 11% of assets. Asia accounted for the majority of the remaining assets.[citations needed] the legal entity Limited partnerships are principally used for hedge funds aimed at US-based investors who pay tax, as the investors will receive relatively favorable tax treatment in the US. The general partner of the limited partnership is typically the investment manager (though is sometimes an offshore Hemant Palav / MBA / Semester II 35.

- 36. “Hedging Fund & Its Impact On Capital Market” corporation) and the investors are the limited partners. Offshore corporate funds are used for non-US investors and US entities that do not pay tax (such as pension funds), as such investors do not receive the same tax benefits from investing in a limited partnership. Unit trusts are typically marketed to Japanese investors. Other than taxation, the type of entity used does not have a significant bearing on the nature of the fund.[7] Many hedge funds are structured as master/feeder funds. In such a structure the investors will invest into a feeder fund which will in turn invest all of its assets into the master fund. The assets of the master fund will then be managed by the investment manager in the usual way. This allows several feeder funds (e.g. an offshore corporate fund, a US limited partnership and a unit trust) to invest into the same master fund, allowing an investment manager the benefit of managing the assets of a single entity while giving all investors the best possible tax treatment. The investment manager, which will have organized the establishment of the hedge fund, may retain an interest in the hedge fund, either as the general partner of a limited partnership or as the holder of “founder shares” in a corporate fund. Founder shares typically have no economic rights, and voting rights over only a limited range of issues, such as selection of the investment manager – most of the fund’s decisions are taken by the board of directors of the fund, which is self-appointing and independent but invariably loyal to the investment manager. Open-ended nature Hedge funds are typically open-ended, in that the fund will periodically issue additional partnership interests or shares directly to new investors, the price of each being the net asset value (“NAV”) per interest/share. To realise the investment, the investor will redeem the interests or shares at the NAV per interest/share prevailing at that time. Therefore, if the value of the underlying investments has increased (and the NAV per interest/share has therefore also increased) then the investor will receive a larger sum on redemption than it paid on investment. Investors do not typically trade shares between themselves and hedge funds do not typically Hemant Palav / MBA / Semester II 36.

- 37. “Hedging Fund & Its Impact On Capital Market” distribute profits to investors before redemption. This contrasts with a closed-ended fund, which has a limited number of shares which are traded between investors, and which distributes its profits. Listed funds Corporate hedge funds often list their shares on smaller stock exchanges, such as the Irish Stock Exchange, in the hope that the low level of quasi-regulatory oversight will give comfort to investors and to attract certain funds, such as some pension funds, that have bars or caps on investing in unlisted shares. Shares in the listed hedge fund are not traded on the exchange, but the fund’s monthly net asset value and certain other events must be publicly announced there. A fund listing is distinct from the listing or initial public offering (“IPO”) of shares in an investment manager. Although widely reported as a "hedge-fund IPO"[8] , the IPO of Fortress Investment Group LLC was for the sale of the investment manager, not of the hedge funds that it managed. Hedge fund management worldwide In contrast to the funds themselves, hedge fund managers are primarily located onshore in order to draw on larger pools of financial talent. The US East coast – principally New York City and the Gold Coast area of Connecticut (particularly Stamford and Greenwich) – is the world's leading location for hedge fund managers with approximately double the hedge fund managers of the next largest centre, London. With the bulk of hedge fund investment coming from the US, this distribution is natural. London is Europe’s leading centre for the management of hedge funds. At the end of 2006, three-quarters of European hedge fund investments, totalling $400bn (£200bn), were managed from London, having grown from $61bn in 2002. Australia was the most important centre for the management of Asia-Pacific hedge funds, with managers located there accounting for Hemant Palav / MBA / Semester II 37.

- 38. “Hedging Fund & Its Impact On Capital Market” approximately a quarter of the $140bn of hedge fund assets managed in the Asia-Pacific region in 2006.[10] regulatory issues Part of what gives hedge funds their competitive edge, and their cachet in the public imagination, is that they straddle multiple definitions and categories; some aspects of their dealings are well- regulated, others are unregulated or at best quasi-regulated. US regulation The typical public investment company in the United States is required to be registered with the U.S. Securities and Exchange Commission (SEC). Mutual funds are the most common type of registered investment companies. Aside from registration and reporting requirements, investment companies are subject to strict limitations on short-selling and the use of leverage. There are Hemant Palav / MBA / Semester II 38.

- 39. “Hedging Fund & Its Impact On Capital Market” other limitations and restrictions placed on public investment company managers, including the prohibition on charging incentive or performance fees. Although hedge funds fall within the statutory definition of an investment company, the limited- access, private nature of hedge funds permits them to operate pursuant to exemptions from the registration requirements. The two major exemptions are set forth in Sections 3(c)1 and 3(c)7 of the Investment Company Act of 1940. Those exemptions are for funds with 100 or fewer investors (a "3(c) 1 Fund") and funds where the investors are "qualified purchasers" (a "3(c) 7 Fund"). [6] A qualified purchaser is an individual with over US$5,000,000 in investment assets. (Some institutional investors also qualify as accredited investors or qualified purchasers.) [7] A 3(c)1 Fund cannot have more than 100 investors, while a 3(c)7 Fund can have an unlimited number of investors. Both types of funds can charge performance or incentive fees. In order to comply with 3(c)(1) or 3(c)(7), hedge funds are sold via private placement under the Securities Act of 1933. Thus interests in a hedge fund cannot be offered or advertised to the general public, and are normally offered under Regulation D. Although it is possible to have non-accredited investors in a hedge fund, the exemptions under the Investment Company Act, combined with the restrictions contained in Regulation D, effectively require hedge funds to be offered solely to accredited investors. An accredited investor is an individual with a minimum net worth of US $5,000,000 or, alternatively, a minimum income of US$200,000 in each of the last two years and a reasonable expectation of reaching the same income level in the current year. The regulatory landscape for Investment Advisors is changing, and there have been attempts to register hedge fund investment managers. There are numerous issues surrounding these proposed requirements. One issue of importance to hedge fund managers is the requirement that a client who is charged an incentive fee must be a "qualified client" under Advisers Act Rule 205-3. To be a qualified client, an individual must have US$750,000 in assets invested with the adviser or a net worth in excess of US$1.5 million, or be one of certain high-level employees of the investment adviser. Hemant Palav / MBA / Semester II 39.

- 40. “Hedging Fund & Its Impact On Capital Market” For the funds, the tradeoff of operating under these exemptions is that they have fewer investors to sell to, but they have few government-imposed restrictions on their investment strategies. The presumption is that hedge funds are pursuing more risky strategies, which may or may not be true depending on the fund, and that the ability to invest in these funds should be restricted to wealthier investors who are presumed to be more sophisticated and who have the financial reserves to absorb a possible loss. In December 2004, the SEC issued a rule change that required most hedge fund advisers to register with the SEC by February 1, 2006, as investment advisers under the Investment Advisers Act. The requirement, with minor exceptions, applied to firms managing in excess of US$25,000,000 with over 15 investors. The SEC stated that it was adopting a "risk-based approach" to monitoring hedge funds as part of its evolving regulatory regimen for the burgeoning industry. The rule change was challenged in court by a hedge fund manager, and in June 2006, the U.S. Court of Appeals for the District of Columbia overturned it and sent it back to the agency to be reviewed. See Goldstein v. SEC. Although the SEC is currently examining how it can address the Goldstein decision, commentators have stated that the SEC currently has neither the staff nor expertise to comprehensively monitor the estimated 8,000 U.S. and international hedge funds. See New Hedge Fund Advisor Rule. One of the Commissioners, Roel Campos, has said that the SEC is forming internal teams that will identify and evaluate irregular trading patterns or other phenomena that may threaten individual investors, the stability of the industry, or the financial world. "It's pretty clear that we will not be knocking on [hedge fund] doors very often," Campos told several hundred hedge fund managers, industry lawyers and others. And even if it did, "the SEC will never have the degree of knowledge or background that you do. In February 2007, the President's Working Group on Financial Markets rejected further regulation of hedge funds and said that the industry should instead follow voluntary guidelines. Hemant Palav / MBA / Semester II 40.

- 41. “Hedging Fund & Its Impact On Capital Market” Comparison to private equity funds Hedge funds are similar to private equity funds in many respects. Both are lightly regulated, private pools of capital that invest in securities and compensate their managers with a share of the fund's profits. Most hedge funds invest in relatively liquid assets, and permit investors to enter or leave the fund, perhaps requiring some months notice. Private equity funds invest primarily in very illiquid assets such as early-stage companies and so investors are "locked in" for the entire term of the fund. Hedge funds often invest in private equity companies' acquisition funds. Between 2004 and February 2006 some hedge funds adopted 25 month lock-up rules expressly to exempt themselves from the SEC's new registration requirements and cause them to fall under the registration exemption that had been intended to exempt private equity funds. Comparison to u.s. mutual funds Like hedge funds, mutual funds are pools of investment capital (i.e., money people want to invest). However, there are many differences between the two, including: • Mutual funds are regulated by the SEC, while hedge funds are not • A hedge fund investor must be an accredited investor with certain exceptions (employees, etc.) Hemant Palav / MBA / Semester II 41.

- 42. “Hedging Fund & Its Impact On Capital Market” • Mutual funds must price and be liquid on a daily basis Some hedge funds that are based offshore report their prices to the Financial Times, but for most there is no method of ascertaining pricing on a regular basis. Additionally, mutual funds must have a prospectus available to anyone that requests them (either electronically or via US postal mail), and must disclose their asset allocation quarterly, while hedge funds do not have to abide by these terms. Hedge funds also ordinarily do not have daily liquidity, but rather "lock up" periods of time where the total returns are generated (net of fees) for their investors and then returned when the term ends, through a passthrough requiring CPAs and US Tax W-forms. Hedge fund investors tolerate these policies because hedge funds are expected to generate higher total returns for their investors versus mutual funds. Recently, however, the mutual fund industry has created products with features that have traditionally only been found in hedge funds. Mutual funds have appeared which utilize some of the trading strategies noted above. Grizzly Short Fund (GRZZX), for example, is always net short, while Arbitrage Fund (ARBFX) specializes in merger arbitrage. Such funds are SEC regulated, but they offer hedge fund strategies and protection for mutual fund investors. Also, a few mutual funds have introduced performance-based fees, where the compensation to the manager is based on the performance of the fund. However, under Section 205(b) of the Investment Advisers Act of 1940, such compensation is limited to so-called "fulcrum fees".[15] Under these arrangements, fees can be performance-based so long as they increase and decrease symmetrically. For example, the TFS Capital Small Cap Fund (TFSSX) has a management fee that behaves, within limits and symmetrically, similarly to a hedge fund "0 and 50" fee: A 0% management fee coupled with a 50% performance fee if the fund outperforms its benchmark index. However, the 125 bp base fee is reduced (but not below zero) by 50% of underperformance and increased (but not to more than 250 bp) by 50% of outperformance. Hemant Palav / MBA / Semester II 42.

- 43. “Hedging Fund & Its Impact On Capital Market” Offshore regulation Many offshore centers are keen to encourage the establishment of hedge funds. To do this they offer some combination of professional services, a favorable tax environment, and business- friendly regulation. Major centers include Cayman Islands, Dublin, Luxembourg, British Virgin Islands and Bermuda. The Cayman Islands have been estimated to be home to about 75% of world’s hedge funds, with nearly half the industry's estimated $1.225 trillion AUM[11] . Hedge funds have to file accounts and conduct their business in compliance with the requirements of these offshore centres. Typical rules concern restrictions on the availability of funds to retail investors (Dublin), protection of client confidentiality (Luxembourg) and the requirement for the fund to be independent of the fund manager. Many offshore hedge funds, such as the Soros funds, are structured as mutual funds rather than as limited partnerships. Hedge Fund Indices There are a number of indices that track the hedge fund industry. These indices come in two types, Investable and Non-investable, both with substantial problems. There are also new types of tracking product launched by Goldman Sachs and Merrill Lynch, "clone indices" that aim to replicate the returns of hedge fund indices without actually holding hedge funds at all. Investable indices are created from funds that can be bought and sold, and only Hedge Funds that agree to accept investments on terms acceptable to the constructor of the index are included. Investability is an attractive property for an index because it makes the index more relevant to the choices available to investors in practice, and is taken for granted in traditional equity indices such as the S&P500 or FTSE100. However, such indices do not represent the total universe of hedge funds and may under-represent the more successful managers, who may not find the index terms attractive. Fund indexes include BarclayHedge, Hedge Fund Research, Eurekahedge Indices, Credit Suisse Tremont and FTSE Hedge. Hemant Palav / MBA / Semester II 43.

- 44. “Hedging Fund & Its Impact On Capital Market” The index provider selects funds and develops structured products or derivative instruments that deliver the performance of the index, making investable indices similar in some ways to fund of hedge funds portfolios. Non-investable benchmarks are indicative in nature, and aim to represent the performance of the universe of hedgefunds using some measure such as mean, median or weighted mean from a hedge fund database. There are diverse selection criteria and methods of construction, and no single database captures all funds. This leads to significant differences in reported performance between different databases. Non-investable indices inherit the databases' shortcomings, or strengths, in terms of scope and quality of data. Funds’ participation in a database is voluntary, leading to “self reporting bias” because those funds that choose to report may not be typical of funds as a whole. For example, some do not report because of poor results or because they have already reached their target size and do not wish to raise further money. This tends to lead to a clustering of returns around the mean rather than representing the full diversity existing in the hedge fund universe. Examples of non-investable indices include an equal weighted benchmark series known as the HFN Averages, and a revolutionary rules based set known as the Lehman Brothers/HFN Global Index Series which leverages an Enhanced Strategy Classification System. The short lifetimes of many hedge funds means that there are many new entrants and many departures each year, which raises the problem of “survivorship bias”. If we examine only funds that have survived to the present, we will overestimate past returns because many of the worst- performing funds have not survived, and the observed association between fund youth and fund performance suggests that this bias may be substantial. As the HFR and CISDM databases began in 1994, it is likely that they will be more accurate over the period 1994/2000 than the Credit Suisse database, which only began in 2000. When a fund is added to a database for the first time, all or part of its historical data is recorded ex-post in the database. It is likely that funds only publish their results when they are favourable, so that the average performances displayed by the funds during their incubation period are inflated. This is known as "instant history bias” or “backfill bias”. Hemant Palav / MBA / Semester II 44.