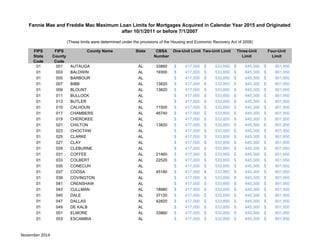

Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages in Calendar Year 2015

- 1. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit 01 001 AUTAUGA AL 33860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 003 BALDWIN AL 19300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 005 BARBOUR AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 007 BIBB AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 009 BLOUNT AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 011 BULLOCK AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 013 BUTLER AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 015 CALHOUN AL 11500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 017 CHAMBERS AL 46740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 019 CHEROKEE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 021 CHILTON AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 023 CHOCTAW AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 025 CLARKE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 027 CLAY AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 029 CLEBURNE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 031 COFFEE AL 21460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 033 COLBERT AL 22520 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 035 CONECUH AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 037 COOSA AL 45180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 039 COVINGTON AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 041 CRENSHAW AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 043 CULLMAN AL 18980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 045 DALE AL 37120 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 047 DALLAS AL 42820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 049 DE KALB AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 051 ELMORE AL 33860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 053 ESCAMBIA AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 2. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 01 055 ETOWAH AL 23460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 057 FAYETTE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 059 FRANKLIN AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 061 GENEVA AL 20020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 063 GREENE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 065 HALE AL 46220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 067 HENRY AL 20020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 069 HOUSTON AL 20020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 071 JACKSON AL 42460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 073 JEFFERSON AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 075 LAMAR AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 077 LAUDERDALE AL 22520 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 079 LAWRENCE AL 19460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 081 LEE AL 12220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 083 LIMESTONE AL 26620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 085 LOWNDES AL 33860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 087 MACON AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 089 MADISON AL 26620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 091 MARENGO AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 093 MARION AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 095 MARSHALL AL 10700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 097 MOBILE AL 33660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 099 MONROE AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 101 MONTGOMERY AL 33860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 103 MORGAN AL 19460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 105 PERRY AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 107 PICKENS AL 46220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 3. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 01 109 PIKE AL 45980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 111 RANDOLPH AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 113 RUSSELL AL 17980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 115 ST. CLAIR AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 117 SHELBY AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 119 SUMTER AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 121 TALLADEGA AL 45180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 123 TALLAPOOSA AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 125 TUSCALOOSA AL 46220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 127 WALKER AL 13820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 129 WASHINGTON AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 131 WILCOX AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 01 133 WINSTON AL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 02 013 ALEUTIANS EAST AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 016 ALEUTIANS WEST AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 020 ANCHORAGE AK 11260 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 050 BETHEL AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 060 BRISTOL BAY AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 068 DENALI AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 070 DILLINGHAM AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 090 FAIRBANKS NORTH AK 21820 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 100 HAINES AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 105 HOONAH-ANGOON C AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 110 JUNEAU AK 27940 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 122 KENAI PENINSULA AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 130 KETCHIKAN GATEW AK 28540 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 150 KODIAK ISLAND AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 November 2014

- 4. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 02 164 LAKE AND PENINS AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 170 MATANUSKA-SUSIT AK 11260 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 180 NOME AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 185 NORTH SLOPE AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 188 NORTHWEST ARCTI AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 195 PETERSBURG CENS AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 198 PRINCE OF WALES AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 220 SITKA AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 230 SKAGWAY MUNICIP AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 240 SOUTHEAST FAIRB AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 261 VALDEZ-CORDOVA AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 270 WADE HAMPTON AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 275 WRANGELL CITY A AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 282 YAKUTAT CITY AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 02 290 YUKON-KOYUKUK AK $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 04 001 APACHE AZ $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 003 COCHISE AZ 43420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 005 COCONINO AZ 22380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 007 GILA AZ 37740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 009 GRAHAM AZ 40940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 011 GREENLEE AZ $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 012 LA PAZ AZ $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 013 MARICOPA AZ 38060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 015 MOHAVE AZ 29420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 017 NAVAJO AZ 43320 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 019 PIMA AZ 46060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 021 PINAL AZ 38060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 5. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 04 023 SANTA CRUZ AZ 35700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 025 YAVAPAI AZ 39140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 04 027 YUMA AZ 49740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 001 ARKANSAS AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 003 ASHLEY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 005 BAXTER AR 34260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 007 BENTON AR 22220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 009 BOONE AR 25460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 011 BRADLEY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 013 CALHOUN AR 15780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 015 CARROLL AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 017 CHICOT AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 019 CLARK AR 11660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 021 CLAY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 023 CLEBURNE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 025 CLEVELAND AR 38220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 027 COLUMBIA AR 31620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 029 CONWAY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 031 CRAIGHEAD AR 27860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 033 CRAWFORD AR 22900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 035 CRITTENDEN AR 32820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 037 CROSS AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 039 DALLAS AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 041 DESHA AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 043 DREW AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 045 FAULKNER AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 047 FRANKLIN AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 6. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 05 049 FULTON AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 051 GARLAND AR 26300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 053 GRANT AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 055 GREENE AR 37500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 057 HEMPSTEAD AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 059 HOT SPRING AR 31680 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 061 HOWARD AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 063 INDEPENDENCE AR 12900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 065 IZARD AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 067 JACKSON AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 069 JEFFERSON AR 38220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 071 JOHNSON AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 073 LAFAYETTE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 075 LAWRENCE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 077 LEE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 079 LINCOLN AR 38220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 081 LITTLE RIVER AR 45500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 083 LOGAN AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 085 LONOKE AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 087 MADISON AR 22220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 089 MARION AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 091 MILLER AR 45500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 093 MISSISSIPPI AR 14180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 095 MONROE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 097 MONTGOMERY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 099 NEVADA AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 101 NEWTON AR 25460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 7. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 05 103 OUACHITA AR 15780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 105 PERRY AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 107 PHILLIPS AR 25760 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 109 PIKE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 111 POINSETT AR 27860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 113 POLK AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 115 POPE AR 40780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 117 PRAIRIE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 119 PULASKI AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 121 RANDOLPH AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 123 ST. FRANCIS AR 22620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 125 SALINE AR 30780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 127 SCOTT AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 129 SEARCY AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 131 SEBASTIAN AR 22900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 133 SEVIER AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 135 SHARP AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 137 STONE AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 139 UNION AR 20980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 141 VAN BUREN AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 143 WASHINGTON AR 22220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 145 WHITE AR 42620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 147 WOODRUFF AR $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 05 149 YELL AR 40780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 001 ALAMEDA CA 41860 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 003 ALPINE CA $ 4 63,450 $ 5 93,300 $ 7 17,150 $ 8 91,250 06 005 AMADOR CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 8. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 06 007 BUTTE CA 17020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 009 CALAVERAS CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 011 COLUSA CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 013 CONTRA COSTA CA 41860 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 015 DEL NORTE CA 18860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 017 EL DORADO CA 40900 $ 4 74,950 $ 6 08,000 $ 7 34,950 $ 9 13,350 06 019 FRESNO CA 23420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 021 GLENN CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 023 HUMBOLDT CA 21700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 025 IMPERIAL CA 20940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 027 INYO CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 029 KERN CA 12540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 031 KINGS CA 25260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 033 LAKE CA 17340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 035 LASSEN CA 45000 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 037 LOS ANGELES CA 31080 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 039 MADERA CA 31460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 041 MARIN CA 41860 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 043 MARIPOSA CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 045 MENDOCINO CA 46380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 047 MERCED CA 32900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 049 MODOC CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 051 MONO CA $ 5 29,000 $ 6 77,200 $ 8 18,600 $ 1 ,017,300 06 053 MONTEREY CA 41500 $ 5 02,550 $ 6 43,350 $ 7 77,650 $ 9 66,450 06 055 NAPA CA 34900 $ 6 15,250 $ 7 87,650 $ 9 52,050 $ 1 ,183,200 06 057 NEVADA CA 46020 $ 4 77,250 $ 6 10,950 $ 7 38,500 $ 9 17,800 06 059 ORANGE CA 31080 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 November 2014

- 9. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 06 061 PLACER CA 40900 $ 4 74,950 $ 6 08,000 $ 7 34,950 $ 9 13,350 06 063 PLUMAS CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 065 RIVERSIDE CA 40140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 067 SACRAMENTO CA 40900 $ 4 74,950 $ 6 08,000 $ 7 34,950 $ 9 13,350 06 069 SAN BENITO CA 41940 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 071 SAN BERNARDINO CA 40140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 073 SAN DIEGO CA 41740 $ 5 62,350 $ 7 19,900 $ 8 70,200 $ 1 ,081,450 06 075 SAN FRANCISCO CA 41860 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 077 SAN JOAQUIN CA 44700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 079 SAN LUIS OBISPO CA 42020 $ 5 61,200 $ 7 18,450 $ 8 68,400 $ 1 ,079,250 06 081 SAN MATEO CA 41860 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 083 SANTA BARBARA CA 42200 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 085 SANTA CLARA CA 41940 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 087 SANTA CRUZ CA 42100 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 06 089 SHASTA CA 39820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 091 SIERRA CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 093 SISKIYOU CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 095 SOLANO CA 46700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 097 SONOMA CA 42220 $ 5 20,950 $ 6 66,900 $ 8 06,150 $ 1 ,001,850 06 099 STANISLAUS CA 33700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 101 SUTTER CA 49700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 103 TEHAMA CA 39780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 105 TRINITY CA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 107 TULARE CA 47300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 109 TUOLUMNE CA 43760 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 06 111 VENTURA CA 37100 $ 6 03,750 $ 7 72,900 $ 9 34,250 $ 1 ,161,050 06 113 YOLO CA 40900 $ 4 74,950 $ 6 08,000 $ 7 34,950 $ 9 13,350 November 2014

- 10. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 06 115 YUBA CA 49700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 001 ADAMS CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 003 ALAMOSA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 005 ARAPAHOE CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 007 ARCHULETA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 009 BACA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 011 BENT CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 013 BOULDER CO 14500 $ 4 56,550 $ 5 84,450 $ 7 06,500 $ 8 78,000 08 014 BROOMFIELD CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 015 CHAFFEE CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 017 CHEYENNE CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 019 CLEAR CREEK CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 021 CONEJOS CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 023 COSTILLA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 025 CROWLEY CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 027 CUSTER CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 029 DELTA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 031 DENVER CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 033 DOLORES CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 035 DOUGLAS CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 037 EAGLE CO 20780 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 039 ELBERT CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 041 EL PASO CO 17820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 043 FREMONT CO 15860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 045 GARFIELD CO 24060 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 047 GILPIN CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 049 GRAND CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 11. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 08 051 GUNNISON CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 053 HINSDALE CO $ 4 27,800 $ 5 47,650 $ 6 62,000 $ 8 22,700 08 055 HUERFANO CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 057 JACKSON CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 059 JEFFERSON CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 061 KIOWA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 063 KIT CARSON CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 065 LAKE CO $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 067 LA PLATA CO 20420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 069 LARIMER CO 22660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 071 LAS ANIMAS CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 073 LINCOLN CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 075 LOGAN CO 44540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 077 MESA CO 24300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 079 MINERAL CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 081 MOFFAT CO 18780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 083 MONTEZUMA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 085 MONTROSE CO 33940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 087 MORGAN CO 22820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 089 OTERO CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 091 OURAY CO $ 4 25,500 $ 5 44,700 $ 6 58,450 $ 8 18,250 08 093 PARK CO 19740 $ 4 24,350 $ 5 43,250 $ 6 56,650 $ 8 16,050 08 095 PHILLIPS CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 097 PITKIN CO 24060 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 099 PROWERS CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 101 PUEBLO CO 39380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 103 RIO BLANCO CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 12. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 08 105 RIO GRANDE CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 107 ROUTT CO 44460 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 109 SAGUACHE CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 111 SAN JUAN CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 113 SAN MIGUEL CO $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 115 SEDGWICK CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 117 SUMMIT CO 14720 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 08 119 TELLER CO 17820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 121 WASHINGTON CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 123 WELD CO 24540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 08 125 YUMA CO $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 001 FAIRFIELD CT 14860 $ 6 01,450 $ 7 69,950 $ 9 30,700 $ 1 ,156,650 09 003 HARTFORD CT 25540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 005 LITCHFIELD CT 45860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 007 MIDDLESEX CT 25540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 009 NEW HAVEN CT 35300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 011 NEW LONDON CT 35980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 013 TOLLAND CT 25540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 09 015 WINDHAM CT 49340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 10 001 KENT DE 20100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 10 003 NEW CASTLE DE 37980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 10 005 SUSSEX DE 41540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 11 001 DISTRICT OF COL DC 47900 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 12 001 ALACHUA FL 23540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 003 BAKER FL 27260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 005 BAY FL 37460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 007 BRADFORD FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 13. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 12 009 BREVARD FL 37340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 011 BROWARD FL 33100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 013 CALHOUN FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 015 CHARLOTTE FL 39460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 017 CITRUS FL 26140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 019 CLAY FL 27260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 021 COLLIER FL 34940 $ 4 48,500 $ 5 74,150 $ 6 94,000 $ 8 62,500 12 023 COLUMBIA FL 29380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 027 DE SOTO FL 11580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 029 DIXIE FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 031 DUVAL FL 27260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 033 ESCAMBIA FL 37860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 035 FLAGLER FL 19660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 037 FRANKLIN FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 039 GADSDEN FL 45220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 041 GILCHRIST FL 23540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 043 GLADES FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 045 GULF FL 37460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 047 HAMILTON FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 049 HARDEE FL 48100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 051 HENDRY FL 17500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 053 HERNANDO FL 45300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 055 HIGHLANDS FL 42700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 057 HILLSBOROUGH FL 45300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 059 HOLMES FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 061 INDIAN RIVER FL 42680 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 063 JACKSON FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 14. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 12 065 JEFFERSON FL 45220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 067 LAFAYETTE FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 069 LAKE FL 36740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 071 LEE FL 15980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 073 LEON FL 45220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 075 LEVY FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 077 LIBERTY FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 079 MADISON FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 081 MANATEE FL 35840 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 083 MARION FL 36100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 085 MARTIN FL 38940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 086 MIAMI-DADE FL 33100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 087 MONROE FL 28580 $ 5 29,000 $ 6 77,200 $ 8 18,600 $ 1 ,017,300 12 089 NASSAU FL 27260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 091 OKALOOSA FL 18880 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 093 OKEECHOBEE FL 36380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 095 ORANGE FL 36740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 097 OSCEOLA FL 36740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 099 PALM BEACH FL 33100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 101 PASCO FL 45300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 103 PINELLAS FL 45300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 105 POLK FL 29460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 107 PUTNAM FL 37260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 109 ST. JOHNS FL 27260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 111 ST. LUCIE FL 38940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 113 SANTA ROSA FL 37860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 115 SARASOTA FL 35840 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 15. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 12 117 SEMINOLE FL 36740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 119 SUMTER FL 45540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 121 SUWANNEE FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 123 TAYLOR FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 125 UNION FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 127 VOLUSIA FL 19660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 129 WAKULLA FL 45220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 131 WALTON FL 18880 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 12 133 WASHINGTON FL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 001 APPLING GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 003 ATKINSON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 005 BACON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 007 BAKER GA 10500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 009 BALDWIN GA 33300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 011 BANKS GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 013 BARROW GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 015 BARTOW GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 017 BEN HILL GA 22340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 019 BERRIEN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 021 BIBB GA 31420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 023 BLECKLEY GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 025 BRANTLEY GA 15260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 027 BROOKS GA 46660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 029 BRYAN GA 42340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 031 BULLOCH GA 44340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 033 BURKE GA 12260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 035 BUTTS GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 16. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 037 CALHOUN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 039 CAMDEN GA 41220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 043 CANDLER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 045 CARROLL GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 047 CATOOSA GA 16860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 049 CHARLTON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 051 CHATHAM GA 42340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 053 CHATTAHOOCHEE GA 17980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 055 CHATTOOGA GA 44900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 057 CHEROKEE GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 059 CLARKE GA 12020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 061 CLAY GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 063 CLAYTON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 065 CLINCH GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 067 COBB GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 069 COFFEE GA 20060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 071 COLQUITT GA 34220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 073 COLUMBIA GA 12260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 075 COOK GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 077 COWETA GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 079 CRAWFORD GA 31420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 081 CRISP GA 18380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 083 DADE GA 16860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 085 DAWSON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 087 DECATUR GA 12460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 089 DEKALB GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 091 DODGE GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 17. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 093 DOOLY GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 095 DOUGHERTY GA 10500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 097 DOUGLAS GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 099 EARLY GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 101 ECHOLS GA 46660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 103 EFFINGHAM GA 42340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 105 ELBERT GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 107 EMANUEL GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 109 EVANS GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 111 FANNIN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 113 FAYETTE GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 115 FLOYD GA 40660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 117 FORSYTH GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 119 FRANKLIN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 121 FULTON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 123 GILMER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 125 GLASCOCK GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 127 GLYNN GA 15260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 129 GORDON GA 15660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 131 GRADY GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 133 GREENE GA $ 5 15,200 $ 6 59,550 $ 7 97,250 $ 9 90,800 13 135 GWINNETT GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 137 HABERSHAM GA 18460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 139 HALL GA 23580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 141 HANCOCK GA 33300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 143 HARALSON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 145 HARRIS GA 17980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 18. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 147 HART GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 149 HEARD GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 151 HENRY GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 153 HOUSTON GA 47580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 155 IRWIN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 157 JACKSON GA 27600 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 159 JASPER GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 161 JEFF DAVIS GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 163 JEFFERSON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 165 JENKINS GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 167 JOHNSON GA 20140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 169 JONES GA 31420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 171 LAMAR GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 173 LANIER GA 46660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 175 LAURENS GA 20140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 177 LEE GA 10500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 179 LIBERTY GA 25980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 181 LINCOLN GA 12260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 183 LONG GA 25980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 185 LOWNDES GA 46660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 187 LUMPKIN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 189 MCDUFFIE GA 12260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 191 MCINTOSH GA 15260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 193 MACON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 195 MADISON GA 12020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 197 MARION GA 17980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 199 MERIWETHER GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 19. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 201 MILLER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 205 MITCHELL GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 207 MONROE GA 31420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 209 MONTGOMERY GA 47080 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 211 MORGAN GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 213 MURRAY GA 19140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 215 MUSCOGEE GA 17980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 217 NEWTON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 219 OCONEE GA 12020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 221 OGLETHORPE GA 12020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 223 PAULDING GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 225 PEACH GA 47580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 227 PICKENS GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 229 PIERCE GA 48180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 231 PIKE GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 233 POLK GA 16340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 235 PULASKI GA 47580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 237 PUTNAM GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 239 QUITMAN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 241 RABUN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 243 RANDOLPH GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 245 RICHMOND GA 12260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 247 ROCKDALE GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 249 SCHLEY GA 11140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 251 SCREVEN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 253 SEMINOLE GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 255 SPALDING GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 20. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 257 STEPHENS GA 45740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 259 STEWART GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 261 SUMTER GA 11140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 263 TALBOT GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 265 TALIAFERRO GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 267 TATTNALL GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 269 TAYLOR GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 271 TELFAIR GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 273 TERRELL GA 10500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 275 THOMAS GA 45620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 277 TIFT GA 45700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 279 TOOMBS GA 47080 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 281 TOWNS GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 283 TREUTLEN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 285 TROUP GA 29300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 287 TURNER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 289 TWIGGS GA 31420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 291 UNION GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 293 UPSON GA 45580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 295 WALKER GA 16860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 297 WALTON GA 12060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 299 WARE GA 48180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 301 WARREN GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 303 WASHINGTON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 305 WAYNE GA 27700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 307 WEBSTER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 309 WHEELER GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 21. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 13 311 WHITE GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 313 WHITFIELD GA 19140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 315 WILCOX GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 317 WILKES GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 319 WILKINSON GA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 13 321 WORTH GA 10500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 15 001 HAWAII HI 25900 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 15 003 HONOLULU HI 46520 $ 7 21,050 $ 9 23,050 $ 1 ,115,800 $ 1 ,386,650 15 005 KALAWAO HI 27980 $ 6 57,800 $ 8 42,100 $ 1 ,017,900 $ 1 ,265,000 15 007 KAUAI HI 28180 $ 7 13,000 $ 9 12,750 $ 1 ,103,350 $ 1 ,371,150 15 009 MAUI HI 27980 $ 6 57,800 $ 8 42,100 $ 1 ,017,900 $ 1 ,265,000 16 001 ADA ID 14260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 003 ADAMS ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 005 BANNOCK ID 38540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 007 BEAR LAKE ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 009 BENEWAH ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 011 BINGHAM ID 13940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 013 BLAINE ID 25200 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 16 015 BOISE ID 14260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 017 BONNER ID 41760 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 019 BONNEVILLE ID 26820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 021 BOUNDARY ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 023 BUTTE ID 26820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 025 CAMAS ID 25200 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 16 027 CANYON ID 14260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 029 CARIBOU ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 031 CASSIA ID 15420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 22. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 16 033 CLARK ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 035 CLEARWATER ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 037 CUSTER ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 039 ELMORE ID 34300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 041 FRANKLIN ID 30860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 043 FREMONT ID 39940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 045 GEM ID 14260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 047 GOODING ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 049 IDAHO ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 051 JEFFERSON ID 26820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 053 JEROME ID 46300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 055 KOOTENAI ID 17660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 057 LATAH ID 34140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 059 LEMHI ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 061 LEWIS ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 063 LINCOLN ID 25200 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 16 065 MADISON ID 39940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 067 MINIDOKA ID 15420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 069 NEZ PERCE ID 30300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 071 ONEIDA ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 073 OWYHEE ID 14260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 075 PAYETTE ID 36620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 077 POWER ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 079 SHOSHONE ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 081 TETON ID 27220 $ 6 25,500 $ 8 00,775 $ 9 67,950 $ 1 ,202,925 16 083 TWIN FALLS ID 46300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 16 085 VALLEY ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 23. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 16 087 WASHINGTON ID $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 001 ADAMS IL 39500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 003 ALEXANDER IL 16020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 005 BOND IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 007 BOONE IL 40420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 009 BROWN IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 011 BUREAU IL 36860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 013 CALHOUN IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 015 CARROLL IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 017 CASS IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 019 CHAMPAIGN IL 16580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 021 CHRISTIAN IL 45380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 023 CLARK IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 025 CLAY IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 027 CLINTON IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 029 COLES IL 16660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 031 COOK IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 033 CRAWFORD IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 035 CUMBERLAND IL 16660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 037 DEKALB IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 039 DE WITT IL 14010 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 041 DOUGLAS IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 043 DUPAGE IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 045 EDGAR IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 047 EDWARDS IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 049 EFFINGHAM IL 20820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 051 FAYETTE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 24. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 17 053 FORD IL 16580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 055 FRANKLIN IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 057 FULTON IL 15900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 059 GALLATIN IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 061 GREENE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 063 GRUNDY IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 065 HAMILTON IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 067 HANCOCK IL 22800 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 069 HARDIN IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 071 HENDERSON IL 15460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 073 HENRY IL 19340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 075 IROQUOIS IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 077 JACKSON IL 16060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 079 JASPER IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 081 JEFFERSON IL 34500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 083 JERSEY IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 085 JO DAVIESS IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 087 JOHNSON IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 089 KANE IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 091 KANKAKEE IL 28100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 093 KENDALL IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 095 KNOX IL 23660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 097 LAKE IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 099 LA SALLE IL 36860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 101 LAWRENCE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 103 LEE IL 19940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 105 LIVINGSTON IL 38700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 25. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 17 107 LOGAN IL 30660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 109 MCDONOUGH IL 31380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 111 MCHENRY IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 113 MCLEAN IL 14010 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 115 MACON IL 19500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 117 MACOUPIN IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 119 MADISON IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 121 MARION IL 16460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 123 MARSHALL IL 37900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 125 MASON IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 127 MASSAC IL 37140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 129 MENARD IL 44100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 131 MERCER IL 19340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 133 MONROE IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 135 MONTGOMERY IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 137 MORGAN IL 27300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 139 MOULTRIE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 141 OGLE IL 40300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 143 PEORIA IL 37900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 145 PERRY IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 147 PIATT IL 16580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 149 PIKE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 151 POPE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 153 PULASKI IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 155 PUTNAM IL 36860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 157 RANDOLPH IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 159 RICHLAND IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 26. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 17 161 ROCK ISLAND IL 19340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 163 ST. CLAIR IL 41180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 165 SALINE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 167 SANGAMON IL 44100 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 169 SCHUYLER IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 171 SCOTT IL 27300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 173 SHELBY IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 175 STARK IL 37900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 177 STEPHENSON IL 23300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 179 TAZEWELL IL 37900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 181 UNION IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 183 VERMILION IL 19180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 185 WABASH IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 187 WARREN IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 189 WASHINGTON IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 191 WAYNE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 193 WHITE IL $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 195 WHITESIDE IL 44580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 197 WILL IL 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 199 WILLIAMSON IL 16060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 201 WINNEBAGO IL 40420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 17 203 WOODFORD IL 37900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 001 ADAMS IN 19540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 003 ALLEN IN 23060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 005 BARTHOLOMEW IN 18020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 007 BENTON IN 29200 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 009 BLACKFORD IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 27. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 18 011 BOONE IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 013 BROWN IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 015 CARROLL IN 29200 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 017 CASS IN 30900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 019 CLARK IN 31140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 021 CLAY IN 45460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 023 CLINTON IN 23140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 025 CRAWFORD IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 027 DAVIESS IN 47780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 029 DEARBORN IN 17140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 031 DECATUR IN 24700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 033 DE KALB IN 12140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 035 DELAWARE IN 34620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 037 DUBOIS IN 27540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 039 ELKHART IN 21140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 041 FAYETTE IN 18220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 043 FLOYD IN 31140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 045 FOUNTAIN IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 047 FRANKLIN IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 049 FULTON IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 051 GIBSON IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 053 GRANT IN 31980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 055 GREENE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 057 HAMILTON IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 059 HANCOCK IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 061 HARRISON IN 31140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 063 HENDRICKS IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 28. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 18 065 HENRY IN 35220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 067 HOWARD IN 29020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 069 HUNTINGTON IN 26540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 071 JACKSON IN 42980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 073 JASPER IN 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 075 JAY IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 077 JEFFERSON IN 31500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 079 JENNINGS IN 35860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 081 JOHNSON IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 083 KNOX IN 47180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 085 KOSCIUSKO IN 47700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 087 LAGRANGE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 089 LAKE IN 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 091 LA PORTE IN 33140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 093 LAWRENCE IN 13260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 095 MADISON IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 097 MARION IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 099 MARSHALL IN 38500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 101 MARTIN IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 103 MIAMI IN 37940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 105 MONROE IN 14020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 107 MONTGOMERY IN 18820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 109 MORGAN IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 111 NEWTON IN 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 113 NOBLE IN 28340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 115 OHIO IN 17140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 117 ORANGE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 29. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 18 119 OWEN IN 14020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 121 PARKE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 123 PERRY IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 125 PIKE IN 27540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 127 PORTER IN 16980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 129 POSEY IN 21780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 131 PULASKI IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 133 PUTNAM IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 135 RANDOLPH IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 137 RIPLEY IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 139 RUSH IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 141 ST. JOSEPH IN 43780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 143 SCOTT IN 31140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 145 SHELBY IN 26900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 147 SPENCER IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 149 STARKE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 151 STEUBEN IN 11420 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 153 SULLIVAN IN 45460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 155 SWITZERLAND IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 157 TIPPECANOE IN 29200 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 159 TIPTON IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 161 UNION IN 17140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 163 VANDERBURGH IN 21780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 165 VERMILLION IN 45460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 167 VIGO IN 45460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 169 WABASH IN 47340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 171 WARREN IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 30. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 18 173 WARRICK IN 21780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 175 WASHINGTON IN 31140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 177 WAYNE IN 39980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 179 WELLS IN 23060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 181 WHITE IN $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 18 183 WHITLEY IN 23060 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 001 ADAIR IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 003 ADAMS IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 005 ALLAMAKEE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 007 APPANOOSE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 009 AUDUBON IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 011 BENTON IA 16300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 013 BLACK HAWK IA 47940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 015 BOONE IA 14340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 017 BREMER IA 47940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 019 BUCHANAN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 021 BUENA VISTA IA 44740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 023 BUTLER IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 025 CALHOUN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 027 CARROLL IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 029 CASS IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 031 CEDAR IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 033 CERRO GORDO IA 32380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 035 CHEROKEE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 037 CHICKASAW IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 039 CLARKE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 041 CLAY IA 43980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 31. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 19 043 CLAYTON IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 045 CLINTON IA 17540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 047 CRAWFORD IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 049 DALLAS IA 19780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 051 DAVIS IA 36900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 053 DECATUR IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 055 DELAWARE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 057 DES MOINES IA 15460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 059 DICKINSON IA 44020 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 061 DUBUQUE IA 20220 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 063 EMMET IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 065 FAYETTE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 067 FLOYD IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 069 FRANKLIN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 071 FREMONT IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 073 GREENE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 075 GRUNDY IA 47940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 077 GUTHRIE IA 19780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 079 HAMILTON IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 081 HANCOCK IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 083 HARDIN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 085 HARRISON IA 36540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 087 HENRY IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 089 HOWARD IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 091 HUMBOLDT IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 093 IDA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 095 IOWA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 32. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 19 097 JACKSON IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 099 JASPER IA 35500 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 101 JEFFERSON IA 21840 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 103 JOHNSON IA 26980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 105 JONES IA 16300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 107 KEOKUK IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 109 KOSSUTH IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 111 LEE IA 22800 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 113 LINN IA 16300 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 115 LOUISA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 117 LUCAS IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 119 LYON IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 121 MADISON IA 19780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 123 MAHASKA IA 36820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 125 MARION IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 127 MARSHALL IA 32260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 129 MILLS IA 36540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 131 MITCHELL IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 133 MONONA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 135 MONROE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 137 MONTGOMERY IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 139 MUSCATINE IA 34700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 141 O'BRIEN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 143 OSCEOLA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 145 PAGE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 147 PALO ALTO IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 149 PLYMOUTH IA 43580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 33. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 19 151 POCAHONTAS IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 153 POLK IA 19780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 155 POTTAWATTAMIE IA 36540 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 157 POWESHIEK IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 159 RINGGOLD IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 161 SAC IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 163 SCOTT IA 19340 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 165 SHELBY IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 167 SIOUX IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 169 STORY IA 11180 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 171 TAMA IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 173 TAYLOR IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 175 UNION IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 177 VAN BUREN IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 179 WAPELLO IA 36900 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 181 WARREN IA 19780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 183 WASHINGTON IA 26980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 185 WAYNE IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 187 WEBSTER IA 22700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 189 WINNEBAGO IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 191 WINNESHIEK IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 193 WOODBURY IA 43580 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 195 WORTH IA 32380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 19 197 WRIGHT IA $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 001 ALLEN KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 003 ANDERSON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 005 ATCHISON KS 11860 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 34. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 20 007 BARBER KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 009 BARTON KS 24460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 011 BOURBON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 013 BROWN KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 015 BUTLER KS 48620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 017 CHASE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 019 CHAUTAUQUA KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 021 CHEROKEE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 023 CHEYENNE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 025 CLARK KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 027 CLAY KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 029 CLOUD KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 031 COFFEY KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 033 COMANCHE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 035 COWLEY KS 11680 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 037 CRAWFORD KS 38260 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 039 DECATUR KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 041 DICKINSON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 043 DONIPHAN KS 41140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 045 DOUGLAS KS 29940 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 047 EDWARDS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 049 ELK KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 051 ELLIS KS 25700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 053 ELLSWORTH KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 055 FINNEY KS 23780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 057 FORD KS 19980 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 059 FRANKLIN KS 36840 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 35. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 20 061 GEARY KS 27920 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 063 GOVE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 065 GRAHAM KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 067 GRANT KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 069 GRAY KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 071 GREELEY KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 073 GREENWOOD KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 075 HAMILTON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 077 HARPER KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 079 HARVEY KS 48620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 081 HASKELL KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 083 HODGEMAN KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 085 JACKSON KS 45820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 087 JEFFERSON KS 45820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 089 JEWELL KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 091 JOHNSON KS 28140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 093 KEARNY KS 23780 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 095 KINGMAN KS 48620 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 097 KIOWA KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 099 LABETTE KS 37660 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 101 LANE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 103 LEAVENWORTH KS 28140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 105 LINCOLN KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 107 LINN KS 28140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 109 LOGAN KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 111 LYON KS 21380 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 113 MCPHERSON KS 32700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014

- 36. Fannie Mae and Freddie Mac Maximum Loan Limits for Mortgages Acquired in Calendar Year 2015 and Originated FIPS State Code FIPS County Code County Name State CBSA Number One-Unit Limit Two-Unit Limit Three-Unit Limit Four-Unit Limit after 10/1/2011 or before 7/1/2007 (These limits were determined under the provisions of the Housing and Economic Recovery Act of 2008) 20 115 MARION KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 117 MARSHALL KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 119 MEADE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 121 MIAMI KS 28140 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 123 MITCHELL KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 125 MONTGOMERY KS 17700 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 127 MORRIS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 129 MORTON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 131 NEMAHA KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 133 NEOSHO KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 135 NESS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 137 NORTON KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 139 OSAGE KS 45820 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 141 OSBORNE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 143 OTTAWA KS 41460 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 145 PAWNEE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 147 PHILLIPS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 149 POTTAWATOMIE KS 31740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 151 PRATT KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 153 RAWLINS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 155 RENO KS 26740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 157 REPUBLIC KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 159 RICE KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 161 RILEY KS 31740 $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 163 ROOKS KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 165 RUSH KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 20 167 RUSSELL KS $ 4 17,000 $ 5 33,850 $ 6 45,300 $ 8 01,950 November 2014